Why are indicators needed?

The average headcount indicator is necessary for:

- filling out the report “Information on the average headcount for the past year” for the Federal Tax Service;

- determining the form for submitting reports to the tax office: according to paragraph. 3 p. 3 art. 80 of the Tax Code of the Russian Federation, taxpayers whose average number of employees in the previous calendar year exceeds 100 people submit reports electronically;

- determining the form for submitting calculations for insurance premiums: based on clause 10 of Art. 431 of the Tax Code of the Russian Federation, payers whose average number of individuals in whose favor payments and other remunerations are made for the previous billing period exceeds 25 people submit a report in electronic form;

- filling out the calculation in form 4-FSS (field “Average number of employees”) (clause 5.15 of the Procedure for filling out the calculation form for accrued paid insurance contributions for compulsory social insurance against industrial accidents and occupational diseases, as well as for the costs of paying insurance coverage, approved by Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381);

- calculating the amount of income tax paid at the location of a separate division, if the institution uses the average headcount indicator for the calculation (clause 2 of Article 288 of the Tax Code of the Russian Federation). Income and expenses of a government institution related to the performance of government functions, including the provision of public services, are not taken into account for profit tax purposes (clause 33.1, clause 1, article 251, clause 48.11, article 270 of the Tax Code of the Russian Federation). However, when a government institution sells goods and services, such income is subject to inclusion in the corporate income tax base (clause 1, clause 1, article 146, clause 1, article 249 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated July 13, 2015 No. 03-03 -03/40083, sent by Letter of the Federal Tax Service of the Russian Federation dated July 21, 2015 No. ED-4-3/12819).

The indicator of the average number of employees is used to determine the possibility of a government institution using the taxation system in the form of UTII, as well as to find out whether the institution has lost the right to use this taxation system (clause 1, clause 2.2, clause 2.3, article 346.26 of the Tax Code RF, Letter of the Ministry of Finance of the Russian Federation dated 04/07/2016 No. 03-11-06/3/19830).

How to calculate the average headcount in 1C: secrets, instructions

1C program helps calculate the MSS in automatic mode. Just enter all the data into the form and click “Calculate” and in a few seconds the result will be ready. But there are nuances that are not automated and have to be calculated manually. The secrets of the calculation are as follows:

- For example, as mentioned above, the number of employees on a weekend or holiday is equal to the list number of employees for the previous working day. If the worker did not come to work on January 31 (this is a Saturday), then the calculation is carried out according to the Friday preceding this day off.

- If an employee is sick and the sick leave has not yet been closed, then you can enter the data into the program and successfully generate a time sheet for the month.

- Just switch the button to o. See the picture below.

Calculation of the average headcount in 1C

Here are instructions on how to calculate the average headcount in 1C version 2 (8.2) :

- Go to "Menu" .

- Click "Salary calculation by company" .

- Click on "Reports" .

- Select "Regulations-reports" .

- Create a new report, click "Other reporting" .

- Then click on “SCH Data” and “Fill” .

After performing such manipulations, the data will be calculated automatically. See how it will look in your 1C report:

Calculation of the average number of employees in 1C

If you want to check whether you filled out the report correctly, go to the “Human Resources” and “Employee Accounts” :

Calculation of the average number of employees in 1C

Calculation of the SCH of employees in the 1C program version 3 (8.3) is performed through the “Personnel Accounting” . Then click:

- "SSCH."

- "Form" . Look like the picture below.

Calculation of the average headcount in 1C

default settings in this version of the 1C

Calculation of the average number of employees in 1C

Now you can take advantage of the capabilities of the 1C and create the necessary report.

Calculation procedure

To calculate the average headcount, you should be guided by the Instructions for filling out federal statistical observation forms No. P-1 “Information on the production and shipment of goods and , No. P-3 “Information on the financial condition of the organization”, No. P-4 “Information on the number and wages of employees ”, No. P-5 (m) “Basic information about the activities of the organization”, approved by Rosstat Order No. 772 dated November 22, 2017.

The concept of average headcount is not defined in the Tax Code of the Russian Federation.

The average headcount includes only employees for whom the institution is the main place of work.

The full list of persons who are included in the payroll is given in clause 77 of the Instructions, and the list of persons not included in the payroll is in clause 78 of the Instructions.

The average headcount differs from the average in that it does not include external part-time workers and employees under civil law contracts.

When calculating the average number of employees for a month, you need to add the average number of fully employed workers and the average number of part-time workers.

In this case, it is necessary to take into account the following nuances. Part-time workers include employees who work part-time by agreement with the employer. If part-time work is required by law, such employees are counted as fully employed (clause 79.3 of the Guidelines).

The average payroll number of full-time employees per month is calculated on the basis of their payroll number for each calendar day of the month (clause 76 of the Instructions). For example, if the payroll number from January 1 to January 20 is 89 people, and from January 21 to January 31 is 88, then the average payroll number for January is 88.6 people ((20 days x 89 people 11 days x 88 people) / 31 days). According to clause 79.4 of the Guidelines, the number is shown in whole units, that is, in the example under consideration it will be shown as 89 people.

The payroll includes all full-time employees who are listed in the institution on a specific day (including those who were on vacation or sick leave).

Employees who are on maternity leave, unpaid educational leave and do not work while on parental leave are not taken into account. If an employee works part-time while on parental leave, he is included in the calculation (clause 79.1 of the Guidelines).

The payroll number on weekends and holidays is equal to the number for the previous working day (clause 76 of the Instructions). For example, if an employee quit on Friday, he must be included in the payroll for Saturday and Sunday.

The average headcount for a year, quarter and other period of more than a month is calculated on the basis of the average headcount for each month of this period (clauses 79.6, 79.7 of the Instructions). For example, if the average headcount in January is 89 people, in February - 90, in March - 93, then the average headcount for the first quarter will be, taking into account rounding, 91 people = (89 90 93) / 3.

To calculate the average number of part-time workers per month, clause 79.3 of the Guidelines recommends the following formula:

Average number of part-time workers = KCHO/KCHM,

where KCHO is the number of hours worked by part-time workers per month, and KCHM is the number of working hours in a month.

The number of working hours in a month is determined according to the production calendar.

As a general rule, working days that fall on vacation and sick leave are also included in hours worked. For each such day, the same number of hours is taken into account as the employee worked on the last day before vacation or sick leave. In order to calculate the average number per month, the average number of external part-time workers and the average number of employees under civil contracts must be added to the average number of employees (clause 75 of the Instructions).

In accordance with clause 80 of the Guidelines, the average number of external part-time workers is calculated as follows:

Average number of external part-time workers = KChO/KChM,

where KCHO is the number of hours worked by external part-time workers, and KCHM is the number of working hours per month.

As a general rule, hours worked include working days on vacation and sick leave. The result obtained is rounded to tenths (clause 80 of the Instructions).

How to use the calculator

To use an online calculator for the average number of employees, you do not need to understand all the intricacies of legislation and personnel records. Therefore, absolutely anyone with access to the enterprise’s personnel documentation can accurately calculate the average number of employees using such a tool. To make the calculation process simple and understandable, we have prepared simple step-by-step instructions.

First step

First of all, to calculate the average headcount using an online calculator, you need to enter the number of full-time employees at the enterprise. To do this, enter on each day of the year the number of employees who were on staff as of that day. These include all employees with whom an employment contract was concluded for a specified period of time, with the exception of employees whose contract does not imply full-time employment.

At the same time, vacations, sick leave and other periods of absence of employees from the workplace do not reduce the average number of employees. However, there are certain exceptions. Thus, employees who:

- They are on maternity leave.

- They are on maternity leave.

- Are on unpaid leave to take exams or undergo training.

These persons are not included in the calculation of the average number of employees on a specific date.

Second step

After filling in the number of full-time employees, it is also necessary to calculate the number of part-time employees. At the same time, these include both external and internal part-time workers and, in general, employees whose employment contract stipulates that they work on a part-time basis.

It should be taken into account that such workers are included in the average payroll in a fractional format, depending on the ratio of their employment to full employment. That is, if an employee works part-time 20 hours a week instead of 40 full-time, then he is counted as 0.5 full-time employees.

In the same way as in the first step, you should fill out each working day of the enterprise, indicating the number of part-time employees.

If no one at the enterprise works part-time, then this step can simply be skipped.

Third step

The last step is to obtain data for calculating the average number of employees. To do this, there is no need to carry out any additional actions - the calculator calculates the average number of employees automatically. That is, you can always make changes to any of the fields and compare how the average number of employees of the enterprise changes depending on them.

Example

Three external part-time workers work two hours a day, five days a week.

According to the production calendar in January 2021, there are 17 working days and 136 hours (with a 40-hour working week). Let's calculate the average number of external part-time workers. The number of hours worked by external part-time workers in January 2019 is 102 hours = (2 hours x 17 days x 3 people).

The average number of external part-time workers is 0.75 people = 102 hours / 136 hours, rounded to the nearest tenth - 0.8 people.

The average number of employees under civil contracts is determined in the same way as the average number of employees under employment contracts. In this case, individual entrepreneurs do not participate in the calculation (clause “b”, clause 78, clause 81 of the Instructions).

The average number for a year, quarter and other period of more than a month is calculated based on the average number for each month of this period.

Calculation of average headcount per month (example)

Let's consider an example of calculating the average number of employees per month.

MAKS-info LLC needs to calculate the average number of employees for one calendar month - November. All employees work for the company full-time. The listed number of personnel in the period November 1–15 was 12 people, and in the period 16–30 – 17 people.

Thus, the average number of employees of MAKS-info LLC for November will be:

Average payroll number November = ((12 people * 15 days + 17 people * 15 days) / 30 calendar days = (180 + 255) / 30 = 14.5 workers. Let’s round the resulting value to 15 people in accordance with the rules of arithmetic.

The procedure for determining the average number of employees is not particularly complicated and rarely causes difficulties for accounting employees.

Similar articles

- Can the average number be zero?

- Formula for calculating the average number of employees per year

- How to calculate the average headcount for a quarter

- Average number of employees

- Calculation of average headcount

Submission of information to statistical authorities

In 2021, reports to Rosstat are submitted according to the forms approved by Rosstat Order No. 485 dated 06.08.2019. In particular, this order approved:

- annual forms (applied from the report for 2021) 1-T “Information on the number and wages of employees” 1-T (GMS) “Information on the number and wages of employees of state bodies and local governments by personnel categories”

- monthly form (applied from the report as of 02/01/2019) P-4 “Information on the number and wages of employees”

- quarterly form (applied from the report for the 1st quarter of 2021) P-4 (NZ) “Information on underemployment and movement of workers.”

The differences between the updated forms and the previous ones are insignificant; they are mainly of a technical nature.

For example, in the order of filling out Form P-4, the words “previous year” are replaced with “2017”. Similar amendments are provided for form P-4 (NZ). It has been clarified in the code parts of the title pages of both forms that separate units and the parent unit indicate an identification number. If there are no separate divisions, then, as before, OKPO must be indicated. As noted above, recommendations for filling out Form P-4 are given in the Guidelines. In this form, information is provided in general for the organization (line 01) and for actual types of economic activity (lines 02 to 11).

Information in form P-4 is distributed into 11 columns, which reflect information about the number, wages and hours worked as follows:

- average number of employees for the reporting month (columns 1, 2, 3, 4);

- number of man-hours worked since the beginning of the year (columns 5, 6);

- accrued wage fund for the reporting month (columns 7, 8, 9, 10);

- social payments to employees (column 11).

Please note: the data in Form P-4 cannot have a negative value (clause 74.6 of the Instructions).

Institutions must submit information in form P-4 to the statistical authorities no later than the 15th day after the reporting period:

- with an average number of employees of more than 15 people - monthly;

- with an average number of employees of less than 15 people - quarterly.

Failure to submit statistical reports is an administrative offense, liability for which is established by Art. 13.19 Code of Administrative Offenses of the Russian Federation. Thus, for failure to submit or untimely submission of this information or submission of unreliable primary statistical data, a fine is provided:

- for officials - in the amount of 10,000 to 20,000 rubles;

- for legal entities - in the amount of 20,000 to 70,000 rubles.

Institutions must provide information on the average number of employees to both the tax authorities and the statistical authorities. Since the Tax Code of the Russian Federation does not define the concept of average headcount, one should be guided by statistical tools. Late submission of reports may result in liability in the form of fines for the institution and its officials.

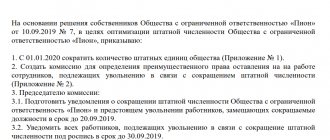

Calculation of the average value for a full month

The formula for calculating the average headcount for a month, given in the Rosstat Instructions, is as follows:

The number of employees on a weekend or holiday is recognized as the same as on the working day the day before.

IMPORTANT!

2 categories of employees are taken into account in the payroll, but are not included in the SSC. This:

- employees on maternity and child care leave;

- employees who took additional unpaid leave to enroll in educational institutions.

EXAMPLE

As of December 31, the payroll numbered 20 people. The New Year holidays lasted from January 1 to January 10. Since the 11th, 3 new employees started working. Since January 20, one employee went on maternity leave. What is the average headcount for January?

- from January 1 to January 10 (10 days) – payroll 20 people;

- from January 11 to January 19 (9 days) – 23 people;

- from January 20 to January 31 (11 days) – 22 people (on payroll 23 people, but to calculate the MHC we exclude the employee on maternity leave).

TSS for January = (10 (days) × 20 (persons) + 9 × 23 + 11 × 22)/31 = (200 + 207 + 242)/31 = 20.93 = 21 ( rounded to whole units).

We prepare a report for the Federal Tax Service

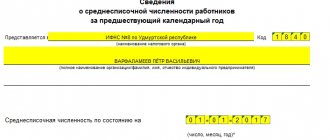

The form “Information on the average number of employees for the previous calendar year” was approved by Order of the Federal Tax Service of the Russian Federation dated March 29, 2007 No. MM-3-25/174.

Institutions can submit information in electronic form according to the format approved by Order of the Federal Tax Service of the Russian Federation dated July 10, 2007 No. MM-3-13/421. Recommendations for filling out the form are given in Letter of the Federal Tax Service of the Russian Federation dated April 26, 2007 No. CHD-6-25/353.

As a general rule, institutions are required to submit information on the average number of employees for the previous calendar year to the tax authority no later than January 20 of the current year (clause 3 of Article 80 of the Tax Code of the Russian Federation). However, the need to submit such a form may arise earlier - during reorganization. In this case, information is submitted no later than the 20th day of the month following the month in which the institution was reorganized. In this case, the institution is considered reorganized from the date of making the corresponding entry in the Unified State Register of Legal Entities.

If an institution has separate divisions, then there is no need to submit information about them separately.

Employees of such departments are taken into account when calculating the average headcount for the organization as a whole. According to the recommendations for filling out the form, taxpayers must fill out all lines and cells of the information form, except for the section “To be completed by a tax authority employee”:

- in the designated cells, indicate the taxpayer identification number and the reason code for registration at the location of the institution;

- in the “Submitted to” line, reflect the full name of the tax authority to which the information is being submitted, and enter its code in the provided cells;

- in the line “Organization (individual entrepreneur)” indicate the full name of the institution in accordance with its constituent documents;

- when filling out the indicators for 2021, in the cell specially designated for the date on the line “Average headcount as of”, enter the date 01/01/2019. Then, indicators about the average number of employees of the institution are entered in the appropriate fields.

When filling out the field “The accuracy and completeness of the information provided is confirmed”, indicate:

- surname, name, patronymic of the head of the institution in full, his signature, which is certified by the seal of the institution, and the date of signing;

- when confirming the accuracy and completeness of the indicators by a representative of the institution - the full name of the organization or the last name, first name and patronymic of the individual - the representative of the institution in accordance with the identity document;

- when confirming the accuracy and completeness of the indicators by an organization that is a representative of the institution, the date of signing and the signature of the head of the authorized organization, which is certified by the seal of the organization;

- when confirming the accuracy and completeness of the indicators by an individual - a representative of the institution - the date of signing and the signature of the individual;

- the name of the document confirming the authority of the representative (a copy of it is attached to the information).

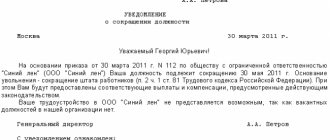

For untimely submission of information on the average number of employees, both tax and civil legislation provide for liability. In this case, the following fines may be imposed at the same time:

- per institution - in the amount of 200 rubles. (Clause 1 of Article 126 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated 06/07/2011 No. 03-02-07/179)

- per official - in the amount of 300 to 500 rubles. (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Calculation of the number of employees

In order to determine the value of the average number of full-time employees of a company, it is necessary to calculate the indicator of the payroll of employees.

The legislative basis will be orders and instructions from statistical bodies.

The documents regulating the calculation of the number of employees on the payroll are:

- Instructions adopted by the Decree of the USSR State Statistics Committee in 1987 (hereinafter referred to as the Instructions);

- Order of Rosstat No. 357 dated August 3, 2015;

- Rosstat Order No. 498 dated October 26, 2015;

- Order of Rosstat No. 536 of August 27, 2014.

The headcount is a significant indicator not only for the purposes of generating and submitting reporting forms to authorized bodies, but is also successfully used for analytical calculations. Thus, with its help, companies and entrepreneurs have the opportunity to calculate how effectively the attracted personnel work in the organization, what the dynamics of wages are.

When determining this value, it is important to know that not all employees can be taken into account in the calculations.

The instructions establish categories of working citizens who appear in determining the number of payrolls of a company, as well as those who cannot be involved in calculating this indicator.

In accordance with the Instructions, the calculation of the payroll includes:

- Workers performing their professional duties at their workplaces, including periods when workers were actually on site, but did not work due to downtime;

- Employees who are on official business trips by order of the manager while maintaining their salary and position;

- Personnel on sick leave for the entire period of validity of the sick leave until the day of actual recovery and return to the workplace or dismissal for health reasons;

- Employees who are hired by the organization on a part-time, part-time or half-time basis in accordance with the approved staffing schedule. In this case, each employee will be counted as a whole unit, regardless of whether the employee was at the workplace full time or not. This group does not include personnel who are required by law to have a reduced working day;

- Employees on an executive term in accordance with Art. 70 of the Labor Code of the Russian Federation, starting from the first day of being in the workplace;

- Remote employees;

- Citizens who were sent by the organization to improve their qualifications in educational institutions;

- Employees who are assigned to perform labor functions by the company outside the main location of the company, that is, shift workers;

- Personnel on one of the legally permitted types of leave: annual, additional or leave at their own expense;

- Employees who, in accordance with current legislation, are on maternity leave and parental leave for up to one and a half years. This category also includes employees who were hired by the organization temporarily to replace absent employees;

- Employees caught absenteeism;

- Employees who are under investigation in connection with search activities.

In accordance with the Instruction under consideration, a certain category of workers that should be excluded from the calculation. These include external part-time workers, employees, and employees who were hired to perform one-time work. The full list is presented in the Instructions approved by the Resolution of the USSR State Statistics Committee.