07.07.2019

0

334

5 minutes.

To account for the inventory of an organization, it is necessary to regularly carry out an inventory. Inspection allows you to identify surpluses or shortages in production. The period and rules for appointing an audit are determined by federal legislation and local regulatory documents of the company. If discrepancies are identified between actual and accounting information, in order to minimize financial losses, damages are recovered from the official or goods are written off, depending on the reasons for the shortage.

Natural decline

The concept and size of natural loss are related to the technological conditions at the enterprise. They depend on the following factors:

- storage methods;

- transportation sequences and technologies;

- climatic conditions;

- seasonal fluctuations.

For example, if an enterprise purchases bulk materials, then a change in their total weight due to transportation is quite understandable. Registration of shortages during inventory in this case is associated with writing off discrepancies as natural loss.

But there is a certain rate of natural loss. It is determined at the legislative level and revised every 5 years. Now the indicators set out in the letter of the Ministry of Finance No. 03-03-06/1/783, which came into force on November 8, 2007, are in force. If a shortage is identified as a result of the inventory, its size is compared with current standards. Shortages above the norm cannot be attributed to natural decline.

Most Frequently Asked Questions

Question No. 1 : Upon dismissal, an employee is accrued compensation for unused vacation, while he is credited with a shortage of a similar amount. Is it possible to retain the amount of debt through offset, and formalize such an operation with a purchase and sale agreement for lost property?

Answer : According to the rules of accounting workflow, this can be done as follows. Pay compensation according to the pay slip, and then arrange for the deposit of funds to the cash desk or bank as payment for the purchased property.

Question No. 2 : Is it possible to withhold the amount of damage caused from employees with collective liability without their signed consent?

Answer : Reductions in an employee’s accrued income are made only in those cases provided for in Article 137 of the Labor Code of the Russian Federation. All other accruals can be made only on the basis of the employee’s consent or by court order.

Question No. 3 : Are amounts accrued on sick leave included in the calculation of average earnings used when deducting material damage?

Answer : The rules for calculating average earnings are reflected in Art. 139 Labor Code of the Russian Federation. Based on this document, all monetary payments provided for by the remuneration system can be included in the average monthly salary. In turn, sick leave accruals are a compensation payment for the employee’s illness; therefore, such amounts do not participate in calculating the amount of the shortfall.

Question No. 4 : Is there a deadline for paying the shortfall?

Answer : No, the period of partial payment of material damage must last until the debt is fully repaid, regardless of time.

Re-grading

The shortage of available inventories is reflected in accounting only after offsets by re-grading. If after this there is still a shortage, then it is written off as a natural decline, but only for those items where the shortage was identified.

It is not always possible to use re-grading. If a shortage of goods was identified based on the results of the inventory, then mutual offset of shortages and surpluses is possible in exceptional cases, if they were identified in the same reporting period. Moreover, one person must be responsible for both names, and their number and names must be the same.

Even before the regrading is carried out, the responsible person draws up an explanatory note about the shortage during the inventory, a sample of which will allow the document to be drawn up correctly. In this case, the MOL explains the misgrading.

You can read more about the re-grading of goods in the article.

When does financial responsibility arise?

A company employee becomes a financially responsible person only after signing the relevant agreement. This norm is regulated by the Labor Code of the Russian Federation, Article 233. Full or partial responsibility is assigned to the employee who, due to the specifics of performing his job duties, comes into contact with cash and commodity valuables. The job list, which requires mandatory financial responsibility, was approved by a resolution of the Russian Ministry of Labor.

It is worth noting that in the course of financial and economic activities, situations arise when an employee has temporary responsibility. For example, an employee was entrusted with documented valuables, which he lost due to his carelessness.

Technological losses

During production, some materials may be lost. In this case we are talking about technological losses. Part of the shortage can be attributed to them. The legislation does not create standards for technological losses, so they are established individually at each enterprise. But this does not mean that if a shortage is identified during inventory, it can be completely attributed to technological losses.

An organization can set limits on irrevocable waste at its enterprise for each type of materials and raw materials used. But these limits must be confirmed by calculations made based on the methods of transporting raw materials and the organization’s production cycles.

In this case, the question may arise of how to conduct an inventory in the event of a shortage. It is necessary to be guided by technological maps and estimates. They are created by supervisory employees, and the limits are approved by managers.

Common mistakes

When assigning the responsibility to pay the amount of damage to the responsible person, some mistakes may be made, as a result of which the recovery will be considered unjustified:

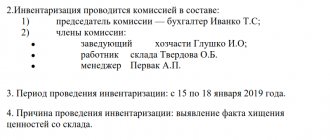

- During the inventory check, the results of which revealed violations, not all members of the appointed commission were present. Violation of paragraph 2.3 of the Methodological Instructions serves as grounds for canceling the results of the inventory check.

- The reduction of wages due to the discovery of a shortage occurs without taking into account other obligatory payments under writs of execution. As a result, the amount of all deductions may exceed 50%, and this is a violation of the law (Articles 107, 108, 109 of the Labor Code of the Russian Federation).

- When concluding an employment contract, the employee was not familiar with the job description, which means he was not warned of responsibility. In this regard, if the employment relationship has not been properly formalized, the employer does not have the right to reduce the employee’s income by the amount of damage caused.

Theft as a cause of shortage

Not all employees perform their duties conscientiously. Due to the negligence of those responsible, the question may arise of how to compensate for shortages during inventory.

The Labor Code (Article 22) states that the head of an organization can compensate his employees for damage caused to the enterprise after holding them financially liable. In this case, you need to act as follows:

- an inventory commission is assembled;

- inventory is carried out;

- the reasons that led to the occurrence of shortages are determined;

- the employee writes an explanatory note (if the employee refuses to draw up an explanatory note and does not sign the order about the shortage during the inventory, then the commission draws up an act);

- the amount of losses incurred and the procedure for withholding part of the employee’s salary to repay the damage caused are determined.

Much depends on what financial responsibility the employee bears. There are several types of liability:

- limited and complete;

- collective and individual.

To collect funds from an employee, an order regarding shortage during inventory is drawn up (the sample will help you enter all the data correctly). This procedure is used if the damage caused does not exceed the monthly salary. If the amount is greater, and the employee himself refuses to pay it, then the head of the organization must go to court. This must be done no later than 1 year after the shortage is identified.

If we are talking about collective responsibility, then after inventorying the shortage, deductions from workers are carried out in accordance with the degree of guilt of each of them. Other factors are also taken into account:

- monthly salary amount;

- length of service in the position held.

All this affects the amount paid to employees.

What to do if it is not the designated employee who is at fault?

If a special agreement was not concluded with the employee, which stipulated his financial responsibility, this does not mean that the person cannot be asked for compensation for the damage caused. Within the framework of domestic legislation, mat. All officially employed employees of the enterprise bear responsibility. However, the degree of financial responsibility and its amount are completely different.

For example, complete swearing. responsibility is specified in the contract concluded with the employer. But everyone, without exception, bears the partial. In addition, complete swearing. responsibility may be indicated in the general list of mat. responsible employees. The employee must be notified of inclusion in this list.

Consequently, if the employee through whose fault the shortage occurred is not considered a financially responsible person under the contract, then he bears partial financial responsibility. This means that the shortfall will be recovered from him according to the general rule, which we mentioned above. But the amount of recovery will differ significantly.

However, if the face is not considered mat. responsible and this is enshrined in the company’s special organizational documents, then full damages can be recovered in the following cases:

- the person knowingly and intentionally caused damage;

- the shortage occurred when the employee worked while under the influence of alcohol or drugs;

- the damage was caused by the employee at the workplace, but not in the performance of his direct job duties;

- if the damage was caused as a result of an administrative violation. However, the fact of this offense must be established by authorized government agencies.

In addition, the head of the enterprise, according to his position, is included in the list of persons carrying a full mat. responsibility (more information about the financial responsibility of the head of an organization can be found here, and here we talked about cases when the manager is responsible to the employee). If the shortage is considered to be his fault, he must compensate the damage in full. All cases in which it is possible to recover the full amount of damage from an immaterially responsible person are indicated in Art. 243 Labor Code of the Russian Federation.

The culprits were not found

If none of the forms of write-off are suitable for the organization, and the manager was unable to find the culprits, then the reflection of the shortage during the inventory is associated with the financial results. In this case, losses are written off to them.

In situations where the shortage of goods is related to the main activity of the enterprise, the issue of VAT already paid may arise. Not all accountants know what to do with taxes in this case. If the enterprise has a shortage during inventory, VAT is subject to restoration. This must be done in the tax period when it was identified.

Amount of penalty

establishes restrictions on deductions from wages.

Without the consent of the employee, the shortfall from the salary is withheld in an amount not exceeding his average daily earnings.

It should be taken into account that the amount of all deductions should not exceed 20% of wages per month.

If compensation for the shortfall occurs by court decision, and there are other writs of execution, then the amount of deductions can be increased to 50%.

If the amount of damage is related to a committed and proven crime, then the amount of deductions cannot exceed 70%.

Inventory shortage: postings

Establishing the reasons for the shortage is not the only issue facing the accountant and the head of the organization. Understanding the root of the problem can answer the question of how to write off inventory shortages.

If we are talking about shortfalls in the amount of permissible natural loss, then they are written off as enterprise costs. In this case, one of the following entries can be used:

- D 20 (23, 25, 26, 44) – K 94.

In this case, the amount within the limits of natural loss is included. If, during transportation or storage of inventory items, damage occurs or a shortage occurs, then the shortage of goods during inventory (the debit entries are the same, but account 80 is used for credit) is written off as material expenses.

If the responsible persons are to blame for the shortage, then the following entries are used:

- D 73-2 – K 94 – attributes the shortage to the guilty person;

- D 73.2 – K 98 – determines the difference between the amount to be recovered and the book value of the lost goods;

- D 98 - K 91-1 - displays the difference between the collected money and the cost of goods on the balance sheet.

In this case, taking into account the shortage during inventory allows us to consider the compensated damage as non-operating income. When the employee admits his guilt and undertakes to compensate for the damage, this non-operating income arises.

If during the inspection the responsible persons were not identified, and the shortage cannot be written off as natural loss (it exceeds it), then the following entry for writing off the shortage during inventory is used:

- D 91-2 – K 94.

It is also applicable if the court has refused to collect the deficiency from the guilty party.

Any situation requires separate consideration. After all, not only the methods of compensation for damage caused differ, but also how this damage is reflected in accounting. All major postings of shortages during inventory counting were considered.

Is it possible to deduct from the salary of a financially responsible person?

The document is numbered, recorded in the order journal, a note is made about the employee’s familiarization, and there must be a signature to confirm familiarization. If you are interested in what types of strict reporting forms there are, read this material. Still have questions?

In the absence of at least one member of the commission, the inventory results may be considered invalid. Financially responsible persons of the inventory commission give receipts stating that by the beginning of the inventory, all expenditure and receipt documents for property were submitted to the accounting department or transferred to the commission and all valuables received under their responsibility were capitalized, and those disposed of were written off as expenses.

One of the most common ways to compensate for this harm is to withhold the shortfall from wages.

Sample order for shortage during inventory count

A sample order for shortage during inventory looks like this:

Similar articles

- Write-off of goods based on inventory results

- Act on shortage of goods during inventory (sample)

- Act on shortage of goods during inventory (sample)

- Re-grading of goods

- Re-grading during inventory

Collection of shortfalls from the guilty parties

After registration, the statement is signed by all members of the inventory commission. After this, all reports are sent to the accounting department, which already carries out the final reconciliation of accounting and actual data.

The order approving the inventory results is signed by the manager, as well as the chief accountant and all employees named in this order, for review purposes. All materials are transferred to the accounting department for execution.

As a gift for registration, we will send you our most popular book: “Calculation of average earnings from vacation pay to donor pay” from the “Glavbukh Magazine Library” series.