Labor Code of the Russian Federation on the timing of receiving vacation benefits

Annual paid leave is provided to each employee. This right is enshrined in law by the corresponding article of the Labor Code of the Russian Federation.

The duration of annual paid leave usually does not exceed 28 calendar days. Longer vacations are established for certain categories of workers, for example, for workers of the Far North, employees of hazardous industries, etc.

The legislator provided for the preservation of the average earnings of the working person during the annual rest period allotted to him. Payment for this period is set according to a formula.

By multiplying the number of days of rest by average earnings, the amount of vacation pay is determined. To calculate average daily earnings, a calculation period of 12 months is taken and payments are made only for the time actually worked. Disability benefits and various social benefits are not taken into account.

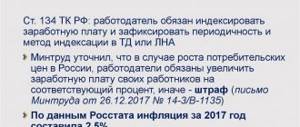

The period for which vacation pay is paid is established by Part 9 of Article 136 of the Labor Code of the Russian Federation. Vacation pay must be paid at least 3 days before the start date of the vacation. Earlier you can pay vacation pay, but later you can’t. In case of delay in payment of benefits due to the fault of the enterprise, the employee is entitled to compensation.

It is also not very convenient to make a payment earlier than three days in advance. Various circumstances may arise in which going on vacation will have to be postponed (for example, illness). Therefore, it is optimal to accrue and pay vacation pay 3 days before the start date of the vacation.

Despite the fact that the above-mentioned article of the law does not specify the status (calendar or working) of these three days, there is a special letter from Rostrud (No. 1693-6-1 dated July 30, 2014), according to which the counting must be carried out in calendar days. Three calendar days before the start of the vacation, benefits must be paid.

Results

Vacation pay in commercial companies is paid 3 calendar days before the vacation, in the civil service - 10 calendar days. If vacation pay is delayed, the employer may be subject to sanctions under the Code of Administrative Offenses of the Russian Federation (fines) and the Labor Code of the Russian Federation (interest on the amount of debt on vacation pay).

You can learn more about the specifics of calculating vacations in the following articles:

- “Calculating the number of vacation days in 2021 - an example”;

- “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation”.

Our online calculator will help you correctly calculate the amount of vacation pay.

Sources:

- Labor Code of the Russian Federation

- Law “On State Civil Service” dated July 27, 2004 No. 79-FZ

- Code of the Russian Federation on Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for granting leave

In order to understand how vacation pay is paid, it is necessary to pay attention to a certain procedure for granting leave from work.

As is known, leave cannot be granted to persons who have not worked a certain amount of time at a particular enterprise since receiving the job (usually this period is a year). However, not every citizen knows about the opportunity to get a few days of rest after six months of work. At the same time, for these days, according to the Labor Code of the Russian Federation, accrual and payment of vacation pay must be realized.

Annual paid leave must be included in a special vacation schedule and also agreed with the employee himself. It is also worth noting that the worker has the right to transfer vacation (however, this possibility exists for no more than two years in a row). Vacation can be divided; Moreover, each part of it should not be less than 14 days.

Vacation pay calculation

As a rule, the amount of vacation payments differs significantly from the amount of wages. The thing is that for many employers it is simply not profitable to pay vacation pay and wages in the same amount. Thus, cash payments for rest required by law are calculated according to a certain average. It is calculated based on average daily earnings.

All calculations are carried out in accordance with the period for which vacation payments are accrued. What period is this? As a rule, this is the time period from the very first day of work to the day of the first legal vacation. At the same time, it is worth paying attention to the average daily earnings. It is very easy to calculate. The entire amount that the employee received during the pay period is divided by the number of days worked. Average daily income received. How are vacation pay paid? 28 days of rest (or 14 if the rest is divided) are multiplied by the average daily income. This will generate the required amount.

Next, it is worth considering the issues of non-payment of money on time, as well as how many days before the vacation vacation pay is paid.

General accrual algorithm

Every employer is required by law to pay statutory holiday pay strictly in the prescribed amount. If this rule is not followed, the company or individual entrepreneur will be assessed a certain fine. Calculating the amount of holiday pay required by law is relatively simple. It is carried out as follows:

- The estimated time period is determined. By default, its standard value is 12 full months preceding the start of vacation or dismissal. If such a billing period is slightly different, you will need to set the year and month yourself;

- Time periods that are not used to calculate compensation are excluded. A detailed list of days is presented in the official government decree;

- In conclusion, the personnel employee multiplies the total number of days by the average daily earnings established in the organization. After this, personal income tax is calculated, the amount of which is subtracted from the final amount.

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

The amount received after calculations must be transferred to the employee within the period established by modern legislation.

The process of crediting vacation pay is carried out using the usual method - card, cash at the cash desk. The payment of the required amount is reflected in the accounting report. Failure to comply with this rule will automatically result in the appointment of an official desk audit. This situation, in turn, will lead to rather unpleasant consequences for the employer. These may include fines and other equally serious sanctions.

What amounts should be included in the calculation?

When calculating average earnings for a working year, it includes those payments that are approved by the organization. Such payments include: salary at the approved rate; compensation for overtime work; premium; other payments for labor performance. But there are payments that can be issued along with the salary, but will not be taken into account when calculating vacation pay. These are: travel payment; compensation for food and the use of personal transport; sick leave; other non-labor or social benefits.

When is it paid?

Every employee who is authorized to calculate and accrue funds is required to know when vacation pay is paid? The legislation has established a certain period for this - three days before the start of the holiday.

But this issue also has its own nuances. For example, what to do if the accrual date falls on a weekend and the accounting department is closed. In this situation, the money must be transferred on the last working day before the weekend. The same applies to holidays. According to the law, none of the holidays, especially long ones, can interfere with the payment of vacation pay.

Therefore, if vacation starts on Monday, when are vacation pay paid? Funds can be transferred on Friday. In addition, tax is also charged on vacation pay. This fact should not be forgotten when calculating funds.

Another fact that cannot but concern employees is whether vacation pay is paid along with their salary or not? The law does not provide for such a rule. Not a single legislative act speaks of this as an obligation, which means that the employer should not pay both wages and vacation pay at the same time. The employee must receive vacation pay three days before the rest, and the salary must be accrued on time.

If vacation is from Monday

It is a controversial issue when vacation pay should be paid if the vacation starts on Monday. Are weekends included in the calculation? There is no clear answer in the code, it only says that you need to pay in 3 days.

According to most lawyers, weekends are included in the calculation time, so it is acceptable to pay vacation pay on Friday or Thursday. Judicial practice also confirms this. But to avoid controversial situations, it is always better to take into account only working days, in which case the risk of error will be minimal.

If an employee receives payment for his vacation in advance, for example, a week or more in advance, there is nothing wrong with that. The employer is not responsible for where and on what vacation pay may be spent, since his task is only to pay it. It is especially important to consider transferring money on long holidays and take care of this in advance

Explanations from the Ministry of Labor - how to count 3 days?

The Ministry of Labor was forced to answer numerous questions from employer representatives regarding the period for payment of vacation pay.

- How to count 3 days?

- Do they include payday or not?

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

First, in an information letter dated June 16, 2014, the Ministry of Labor and Social Protection of Russia spoke in the spirit that the established period begins the next day after payment, that is, the day of payment is not included in the deadline (see explanations in the document “On the need for recalculation vacation amounts taking into account changes in the average monthly number of calendar days"). This position is consistent with the general procedure for calculating terms adopted in Russian legislation, however, such a rule is not enshrined in the Labor Code; on the contrary, in Art. 14 states that the period of time associated with the emergence of any rights of employees begins from a specific date that determines their beginning. The special procedure for calculating deadlines is always specified separately by the legislator.

It is not surprising that an explanatory letter No. 1693-6-1 dated July 30, 2014 followed, from the text of which it could be concluded that Rostrud (Federal Service for Labor and Employment, under the jurisdiction of the Ministry of Labor and Social Protection) is of the opinion that in widespread situations where an employee goes on vacation on Monday, payment can be made on Friday. Thus, Rostrud ambiguously spoke in favor of the position of calculating the three-day period directly from the date of payment.

However, not all courts supported Rostrud at that time; there was no uniformity in judicial practice. Perhaps the only provision that has not been questioned is that the law deals with calendar days, not working days. But how to count these 3 days, neither legislators nor law enforcement officials could give a clear answer.

Responsibility for violation of deadlines for payment of vacation pay

But, if such a violation did occur, or occurs at the enterprise, then you should remember that if the terms of payment of vacation pay are violated, the employer is subject to liability: financial, criminal and administrative.

The employer's financial liability is provided for in Article 236 of the Labor Code of the Russian Federation. It states that for delays in wages, vacation payments, dismissal payments, etc., the organization is obliged to pay monetary compensation to the employee. Such compensation may be provided for in labor or collective agreements, and can, in principle, be any amount agreed upon with the employees.

But there is one important “but”: compensation for delayed payments cannot be calculated less than 1/300 of the refinancing rate of the Central Bank of the Russian Federation on the day of actual payment of vacation pay for each day of delay. Delay in payment of vacation pay is considered from the next day after the due date and ends on the day of actual payment (including this day).

The timing of payment of vacation pay to the employee must be strictly observed, special attention must be paid to days falling on weekends and holidays, since the employer will bear financial responsibility in any case, regardless of whether he himself is to blame for the delay or some circumstances beyond his control.

Late payment of vacation pay

Administrative liability for an employer who has not notified an employee of the vacation entitled to him by law or who has committed such a violation of the Labor Code of the Russian Federation as failure to pay vacation pay on time is provided for in Art. 5.27 Code of Administrative Offenses of the Russian Federation:

- for officials, a warning or fine from 1 to 5 thousand rubles;

- for entrepreneurs a fine of 1 to 5 thousand rubles;

- for organizations a fine of 30 to 50 thousand rubles.

Find out at what time he can count on vacation, working the right from the vacation schedule, the preparation of which everyone is notified against signature. If there is no such schedule, the employee writes a statement.

Opinion of Rostrud: what is the period for payment of vacation pay?

It echoes the norms of Art. 136 of the Labor Code of the Russian Federation and letter of Rostrud dated July 30, 2014 No. 1693-6-1, defining a three-day minimum in calendar days counted before the start of vacation. The document also notes the need to take into account non-working days. If they exist, the period by which payments must be made increases, i.e. The required amounts will have to be paid out in 4, 5 or more days. For example, when providing leave from June 14, 2021, payment is made not on the 10th, but on the 9th of June on Saturday (it was a working day), since the 10th and 11th of June are weekends, and the 12th is a holiday day.

This is also important to know:

Paternity leave for fathers

However, letter No. 1693-6-1 does not clarify this circumstance: whether the day of payment should be counted within the three-day period. Only the possibility of issuing vacation pay on Thursday or Friday to an employee who goes on vacation on Monday is mentioned.

The absence of this clarification has given rise to differences in the interpretation of deadlines in different regional labor inspectorates. Thus, in the Irkutsk region, it is considered legal to pay vacation pay 2 days on the 3rd day before the vacation, and in the St. Petersburg GIT it is recommended to transfer or issue money for vacation 3 days on the 4th.

In practice, based on legal regulations, security considerations and simple everyday caution, accountants make payments exactly on the 4th day. In addition, there are many conflicting decisions of the Arbitration Court.

Calendar or vacation pay: calculating the payment period

The legislation clearly states that all pre-vacation payments must be made to the employee no later than 3 days before the start date of the annual vacation. If the third boundary day falls on a weekend or holiday, then all calculations are made the day before.

Ignoring this rule is fraught with serious consequences for the employer. In particular, a fine of up to 50 thousand rubles may be imposed on the company. An individual entrepreneur faces sanctions of 5,000 rubles.

All officially employed employees of the enterprise have the right to receive vacation with appropriate payments every year. Moreover, this right is reserved to them by the Labor Code of the Russian Federation.

The corresponding clause must be in the employment contract concluded with the employee and in other regulatory documents of the enterprise.

When to pay personal income tax on vacation pay in 2021

It is worth noting that in most cases it is not necessary to apply for annual paid leave. The fact is that enterprises draw up a vacation schedule, of which the employee is notified in advance, against signature. When the deadline established by the schedule approaches, the director issues an order to grant vacation, and the accounting department calculates vacation pay based on it. The employee, having read the order, puts his signature on it as a sign of consent.

If an employee requires paid leave, but not at the time established by the vacation schedule, he must write an application at least 4-14 days before the expected date of departure. About the timing of payment of vacation pay, see the video below: If the last of the three days before the issuance of vacation pay coincides with a weekend As mentioned above, vacation pay must be issued no less than three days before the first day of vacation.

What to do if you fail to pay on time?

All the necessary notes about late payments are in the law, the employer knows about them. The manager also knows how many days before the vacation vacation pay is paid. And yet the cash payments never come. Do not intimidate your boss either with possible consequences or with the Labor Code. The situation is painfully familiar to many Russian citizens. What to do in such moments? Some employees can't stand it and simply quit. However, such cases are usually associated with delayed salaries. Things are completely different with vacation payments.

If the manager does not pay the required amount for vacation, the employee can take note of two options for action. The first option involves postponing your vacation to another time. Sometimes managers themselves put pressure on employees, wanting to achieve changes in the vacation schedule. The second option is somewhat more radical. It consists of filing a complaint against the employer with the Prosecutor's Office or the Labor Inspectorate. This method is effective, but, alas, not the most optimal. Any such complaint significantly worsens the reputation and prestige of the employer. That is why further career growth for the employee who submitted the application will most likely be closed.

How is vacation calculated?

The payroll period can be worked by the employee completely or partially. Depending on this, different formulas are used to calculate average earnings for vacation.

If the period is worked out in full and leave is granted to the employee in calendar days, then the average daily earnings are determined as follows (Article 139 of the Labor Code of the Russian Federation, clause 10 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922):

29.3 is the average monthly number of calendar days in a year.

If the billing period is not fully worked out, another formula is used:

In turn, the last indicator - the number of days worked in months not fully worked - is determined taking into account the proportion separately for each such month.

A formula that takes into account months not fully worked is used if the employee’s pay period included excluded periods: vacations, business trips, periods of temporary disability, etc. (Clause 5 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Having determined the amount of the employee’s average daily earnings, you can calculate the amount of vacation pay (clause 9 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922):

Accrual of vacation in 2021: example

Example 1. Calculation of vacation pay for a fully worked pay period

Manager Safonov A.N. in accordance with the vacation schedule, from May 21, 2021, another paid vacation of 14 calendar days should be granted. The billing period is from May 1, 2021 to April 30, 2021. The amount of payments taken into account when calculating average earnings was 516,000 rubles.

Solution.

Average daily earnings: 1467.58 rubles. (RUB 516,000 / 12 months / 29.3)

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

Amount of vacation pay: 20,546.12 rubles. (RUB 1,467.58 x 14 days)

Example 2. Calculation of vacation pay when the billing period is not fully worked

Let's use the condition of the previous example and assume that Safonov A.N. from October 11 to October 13, 2021, he was on a business trip, and from March 19 to March 26, 2021, he was on sick leave. The amount of payments taken into account when calculating average earnings was 509,000 rubles.

Solution.

Average monthly number of days worked in October 2021: 26.5 days. (29.3 / 31 days x (31 days – 3 days)).

Average monthly number of days worked in March 2019: 21.7 days. (29.3 / 31 days x (31 days – 8 days)).

Average daily earnings: RUB 1,491.79. (RUB 509,000 / (29.3 x 10 months + 26.5 days + 21.7 days))

Amount of vacation pay: RUB 20,885.06. (RUB 1,491.79 x 14 days)

Calculation and accrual

The calculation and transfer of vacation pay is handled by the accounting department when it receives the appropriate order from the employer about the employee going on vacation.

The amount depends on:

- billing period;

- average daily earnings of an employee;

- duration of rest;

- increasing coefficients.

What does the amount depend on?

Before you find out how many days vacation pay is transferred, it is advisable to know the procedure for calculating the amount due for the vacation period.

General formula: Vacation pay = average employee earnings per day (ASD) * number of vacation days.

SDZ = salary / (12 months* 29.3), where:

- 12 months is considered a billing period, i.e. the last year that the employee worked in the organization before the required vacation;

- 29.3. – number of days in a month.

If an employee has worked in a company or institution for less than a year, then the average daily earnings are calculated using the following formula:

SDZ = salary / (KPM * 29.3+∑KNM)

KNM = 29.3/KD x OD, where:

- KPM – the sum of months worked;

- ∑КНМ – number of days not worked in a month;

- OD – totality of days worked;

- KD – number of days in a month.

The SDZ includes all payments that are included in the wage system, with the exception of maternity leave, benefits for leave to care for a small child, business trips and sick leave.

Changes in vacation pay payment terms from July 1, 2021

In such a situation, in the employment contract, the director of the company makes reference to a specific provision of the collective agreement. When paying an employee his salary, the accountant indicates the following information on the pay slip:

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

- the main part of the salary, which is accrued for a specific month;

- the size and basis of the deductions, if any;

- monetary compensation, vacation pay, severance pay, etc.

Deadlines for payment of advance payments in 2021 From October 3, 2021, the changes provided for by 272-FZ came into force. Some amendments to the law also apply to advance payments.

The employer prescribes salary accrual periods here. He can also prescribe the issuance periods, describe them in another act, and leave a link to the document in the contract;

- Rules of routine. The head of the company must indicate the periods for calculating wages in the rules of the schedule, and in other documents leave a reference to this provision. The fact is that the rules of the schedule are followed by all employees, and the employment contract is followed only by a specific employee. The company may not have a collective agreement;

- Collective agreement. In this document, the head of the enterprise indicates the point in which the periods for accrual of salary are entered.

However, the legislation does not indicate whether this should be 3 full days or whether rest can begin on the third day after payment of vacation pay. It is also not indicated which days we are talking about: working days or calendar days. Three days can be interpreted in different ways. In the situation that became the basis for the decision of the Perm Regional Court, the State Labor Inspectorate came to the organization with an unscheduled inspection of compliance with labor legislation and other regulatory legal acts containing labor law norms. The inspectors found a violation in the timing of payment of vacation pay.

They indicated that after payment of vacation pay, at least 3 full calendar days must pass before the start of the vacation. If this requirement is not met, the employee's rights are violated.

In the inspection report, GIT inspectors classified all situations where employees received vacation pay 3 days in advance as violations of deadlines, taking into account the day of going on vacation itself.

You can get a vacation after working a full six months. But this is a vacation “in advance”. Then leave will be granted every 11 months. At the end of each calendar year, a vacation schedule is drawn up, according to which all employees “walk” in the next calendar year.

Vacation can be divided into several parts, but one of them should not be less than 14 calendar days. Then you can “split” your vacation into at least 1 calendar day.

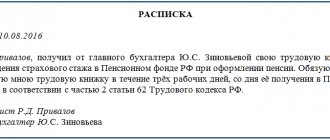

The procedure for “leaving” for a well-deserved work holiday is as follows:

- the HR department notifies the employee in writing 2 weeks before the scheduled leave date;

- the employee writes a leave application;

- the employer signs the application and an order is issued based on it;

- the employee receives “vacation pay” - compensation for the fact that he does not work on these days.

This is also important to know:

Can an employer refuse leave: how the right to rest is regulated, reasons for refusing leave

Vacation pay is paid based on the employee’s average earnings for 1 working day in the previous working year. To do this, you need to know the billing period - that is, the start and end date of the working year. For example, an employee goes on vacation in 2021 on July 8, and he got a job on March 23, 2021. The calculation period for vacation pay in 2021 is from March 23, 2021 to March 22, 2019.

To calculate average earnings, it is necessary to add up all labor payments to the employee and divide by the number of days he actually worked in the last working year. The result is the average employee's earnings per 1 working day. This number must be multiplied by the number of days of rest.

According to the law?

Ch. 19 of the Labor Code of the Russian Federation pays attention to the duration and the right of certain categories of employees to additional leave.

The employer is obliged to notify the employee about the leave no later than 2 weeks before the actual release from work duties.

Vacation can be divided into several periods, but, according to the Labor Code of the Russian Federation - Art. 125, one of the periods must not be less than two weeks. The employee, by agreement with the employer, can use the remaining days at any time.

In exceptional cases, due to production needs, an employee can postpone vacation until the next year, but it is forbidden not to take a vacation for 2 years in a row.

It is prohibited for minor workers and those who work in harmful and dangerous conditions not to take annual leave.

Vacation pay is calculated in accordance with Government Decree No. 922 of 2007. The employer's responsibility for untimely transfer of vacation pay arises in accordance with the Labor Code of the Russian Federation - Art. 236.

Administrative punishment is imposed in accordance with the Code of Administrative Offenses of the Russian Federation - Art. 5.27.

In case of malicious evasion by employers from paying the required vacation pay, criminal liability may follow according to the rules of the Criminal Code of the Russian Federation - Art. 145.1.

Financial assistance and health benefits

Financial assistance to an employee paid in the period for which vacation pay is calculated is not taken into account.

By decision of the management team, additional allowances may be applied to the vacation accruals of employees of this enterprise, in addition to the accrued money as basic ones. In particular, such additional payment can be financial assistance. It can act as a fixed equal amount for each employee, the best specialists of the enterprise who have shown high performance or have no penalties or comments for the period being calculated.

This kind of financial assistance can act as compensation for a trip to a sanatorium or dispensary (so-called health benefits).

But, one should take into account the fact that neither financial assistance nor health contributions should be taken into account when calculating vacation amounts.

Problems of calculating the period for payment of vacation pay

There are no special rules for calculating the period for payment of vacation pay. In this regard, in law enforcement practice there has not been a single position on the issue of calculating the period for paying leave. So, for example, from the Information of the Ministry of Labor and Social Protection of the Russian Federation dated June 16, 2014 “On the need to recalculate vacation amounts taking into account changes in the average monthly number of calendar days,” it follows that specialists from the Ministry of Labor and Social Protection believe that the three-day period begins the next day after payment for vacation.

And from the above letter dated July 30, 2014 No. 1693-6-1, in our opinion, it follows that Rostrud adheres to the position that the three-day period should be calculated directly from the day of payment of vacation (the letter states that payment of vacation pay can be made on Friday (three days before the start of the vacation), and within the meaning of the explanations contained therein, we are talking about a situation where the employee is granted vacation on Monday).

Judicial practice on this issue is also not uniform. Thus, some courts believe that the payment day is included in these three calendar days (decision of the Moscow City Court dated 02/18/2014 No. 7-764/14, decision of the Pavlovo-Posad City Court of the Moscow Region dated 09/03/2012 in case No. 2-1590/ 2012, ruling of the Investigative Committee for civil cases of the Moscow City Court dated 09/02/2010 No. 33-23757, decision of the Shilkinsky District Court of the Trans-Baikal Territory dated 10/19/2012 in case No. 2-843/12), others - that between the date of granting leave and the date of payment should be at least three full days (see, for example, the decision of the Bezhitsky District Court of Bryansk, Bryansk Region dated October 20, 2014 in case No. 2-2266/14, the decision of the Industrial District Court of Khabarovsk, Khabarovsk Territory dated November 13, 2012 in case No. 2 -5201/2012; decision of the Penza Regional Court of July 23, 2015 in case No. 7-288/2015).

Subscribe to the latest news