Home / Labor Law / Payment and benefits / Vacation payments

Back

Published: 05/04/2016

Reading time: 6 min

2

10057

Every citizen who is officially employed, in accordance with the legislation of our country, has the right to annual paid leave.

But what if an employee needs a vacation earlier than expected, for example, in six months?

- Vacation after six months of work: is it possible?

- Calculation of vacation pay for six months

- Number of vacation days

- Calculating vacation pay manually

- Calculating vacation pay using a calculator

- Calculation examples Example 1

- Example 2

- Example 3

- Example 4

- Example 5

Legal leave

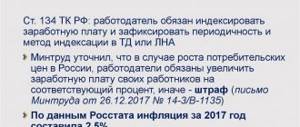

The Labor Code says: every officially working citizen has the right to request leave provided by his superiors every year. It often lasts 28 days, although many bosses ask their subordinates to take vacation in “pieces” of a week or a week and a half. All vacation days are paid by the company. This is stated in Article 115 of the Labor Code of the Russian Federation.

Article 115 of the Labor Code of the Russian Federation

A person should be allowed to rest every year from the moment he has worked for at least six months (Article 122 of the Labor Code of the Russian Federation). However, you can agree with your employer and ask for a break a little earlier, but there must be good reasons for this. For minor citizens, leave can be issued earlier, and management is obliged to satisfy the request (Article 267 of the Labor Code of the Russian Federation).

Important ! If an employer refuses to let an employee go, then he is violating his rights.

Article 122 of the Labor Code of the Russian Federation

Calculating the amount of money for an incomplete calculation period is not an easy task, and this issue is very acute for all participants in the employment contract.

Key points when calculating the leave of a dismissed person

The law states that an employee can take his first vacation at a new place of work if he has worked at the enterprise for at least six months. True, there are exceptions, including those established by law or vacations granted by the employer out of turn and ahead of schedule.

Attention! Each employee of an enterprise who decides to quit on the last day of work has the right to receive settlement funds, the amount of which must include compensation for unused vacation.

Moreover, if the organization, due to working conditions, is required to provide employees with additional leave, it must also be included in the final calculation. At the same time, the reasons that became the reason for the dismissal of an employee are not significant - all employees, according to the Labor Code of the Russian Federation, have the right to payment for unrealized vacation days.

The only exceptions are those employees of companies who were fired due to damage to property, theft, falsification of documents and other illegal actions towards their employer.

Important! If a person has worked for a company for less than 6 months, he is also entitled to compensation for vacation.

Some accountants, due to insufficient knowledge, believe that since the right to use leave arises for an employee only after six months of work at the enterprise, then he can receive compensation if he has worked in one place for more than six months. However, it is worth remembering that the right to vacation is not at all equivalent to the right to payment for unfulfilled vacation. It’s just that in this case the calculation must be made based on the number of months actually worked.

How are vacation pay calculated?

The law assumes that money is either given to the employee in person or transferred to a bank card. This happens three days before the vacation (this is specified in Article 136 of the Labor Code of the Russian Federation). Sometimes money is given out earlier, but if they do it later, they are breaking the law.

When a citizen has worked for the required period, the procedure for calculating vacation pay is as follows:

- the person must submit an application requesting leave;

- then an order for the enterprise is formed;

- in the settlement department the amount of money is calculated.

Example of a vacation application

You can take annual paid leave.

If you work for half a year and quit, you will be paid vacation pay

If I worked for 5 months and quit, do I get compensation for vacation? Attention In accordance with the Labor Code of the Russian Federation, all employees without exception have the right to annual paid leave - based on 28 calendar days per year. As labor law states, every employee has the right to receive paid annual leave. Vacation pay is a sum of money that is paid to an employee when taking a vacation.

But in practice, there are cases when an employee quits without having time to fully use his vacation. In such a situation, he can count on receiving compensation.

What do you need to know? First of all, you need to know that if an employee has the right to receive annual paid leave, then the employer is obliged to pay him vacation pay upon dismissal for unused vacation days. Accordingly, when terminating an employment contract, it is first necessary to calculate the number of days of unused vacation. But besides them, the employee must also know the size of the average daily earnings. It is on the basis of this indicator that the amount of vacation pay is calculated. In accordance with the Labor Code of the Russian Federation, all employees without exception have the right to annual paid leave - based on 28 calendar days per year. Moreover, this right does not depend on the category of the employee (permanent, seasonal or temporary, main or part-time), his profession or the working hours in which he works (full-time or part-time - for example, part-time). Upon dismissal, it is impossible to provide vacation in kind (i.e. in days), so the employer pays the employee monetary compensation (these are the provisions of Article 127 of the Labor Code of the Russian Federation). Accordingly, such compensation is due to all resigning employees without exception - regardless of the reasons for dismissal and duration of work. Simply, if an employee worked for less than a year before dismissal, the number of paid vacation days is calculated in proportion to the time worked - it will not be 28 days, but less. According to the Labor Code, the right to use vacation for an employee arises after he has worked for six months at a given enterprise, from the moment of his hiring. However, the right to use is not the same as the right to compensation for unused vacation. This idea is also adhered to by the Federal Service for Labor and Employment, which in its letter No. 944-6 clearly indicates that compensation in money for the unused vacation of a new employee should still be paid to him, even if he lasted less than six months. In this case, the calculation is made in proportion to the months worked. Since the calculation usually takes into account the partial month that the employee has worked in total, there is an opinion that the employee is supposedly not entitled to be paid compensation if he has worked at the company for only about 2 weeks. In practice, this is not always the case.

When is vacation pay not accrued?

This information is in the Labor Code: the time for calculating SDZ does not imply the calculation of the period (even when the employee received a salary) when the following occurred during this period:

- Vacation or business trip allowances.

- Organized strikes or downtime.

- Disability benefit.

- Maternity payments.

Important ! That is, they do not take into account the time period when you took vacation. This is indicated in the Decree of the Government of the Russian Federation dated December 24, 2007 N 922 (as amended on December 10, 2016) “On the specifics of the procedure for calculating average wages”

Excerpt from Decree of the Government of the Russian Federation dated December 24, 2007 N 922 (as amended on December 10, 2016) “On the specifics of the procedure for calculating average wages”

Cash taken into account when determining the average salary

Based on the Regulations, the average salary is calculated on the basis of payments made to a citizen by the company (Resolution of the Government of the Russian Federation of December 24, 2007 N 922 (as amended on December 10, 2016) “On the specifics of the procedure for calculating the average salary”) More details:

- earnings - salary, hourly payments, interest on revenue, commission plan awards, etc.;

- earnings given to a citizen in kind;

- material maintenance provided for the period worked by a state or municipal employee;

- payments to people working in the media and cultural workers;

- remuneration of teachers for extra time worked, less workload for a given academic year, accrual time is not an important factor;

- various types of additional payments - for secrecy, knowledge of foreign languages, extensive experience, class management (for educational institutions);

- compensation paid for unsuitable working conditions;

- other bonuses and payments.

Excerpt from Decree of the Government of the Russian Federation dated December 24, 2007 N 922 (as amended on December 10, 2016) “On the specifics of the procedure for calculating average wages”

Important ! It is worth noting that social compensation is not taken into account - this is material assistance, compensation for lunch, travel, education, etc.

Average daily earnings in 1919

To learn about the specifics of calculating the average salary, you need to read article number 139 presented in the Labor Code.

All rules taken into account when calculating vacation pay were approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

Important ! The average salary per day is calculated for the calendar year preceding the start of the vacation.

Any fully worked month involves recording 29.3 days. Average monthly number of days – 365 days – 14 holidays per year / 12 months.

When calculating vacation pay, a coefficient of 29.3 days is used

The same principle applies to calculations and payments for the period not used by the employee for vacation.

Rules for calculating average daily earnings

To clarify the question you are interested in, you must:

- First, find out information about the calculation period.

- Determine the amount of payments issued to the citizen during this time period.

The calculation includes the calendar year until the start of the vacation.

Accounting for months in the calendar is done like this:

- January: from 1st to 30th inclusive.

- February: from 1st to 28th inclusive.

- March: from 1st to 31st inclusive.

- The remaining months are calculated similarly.

When calculating vacation pay, the days worked by the employee before the vacation are taken into account.

Example one . How to find out the calculation period?

A citizen wants to go on vacation from 07/10/19.

How then is the calculation period calculated:

- time from July to December '18;

- time from January to June '19.

Are vacation pay paid upon dismissal?

Additional paid vacations must be taken into account even when an open-ended employment contract is concluded with an employee, and he leaves the company without working for even six months. For non-use of additional vacations, the company must also pay compensation in cash equivalent. General calculation procedure In order to determine how many vacation days an employee is entitled to, you should follow a simple formula. The number of employee vacation days provided for in the employment contract or collective agreement should be divided by the number of months in the year (there are 12 of them). After which, it will become clear how many days of rest the employee is entitled to per month of work. There is another way to achieve a more specific figure - divide the number of vacation days by 365 (the number of days in a year), and then multiply by the number of days worked by the employee during the pay period.

Calculation of vacation pay in 2021

Once we have found out what the calculation period includes, we can determine the money spent for a specific period of time.

All money received during the period when a person performed duties is taken into account, and it is necessary to take into account bonuses, additional payments, allowances, incentives, and the like.

Important ! The payments taken into account can be viewed in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922.

More specifically, this includes payments in various forms, allowances, additional payments of various kinds, compensation paid for working conditions and working conditions.

They take into account all the money received by an employee for a certain period

Example two . Calculation of the average salary taking into account the necessary payments

The person plans to go on vacation from 07/05/19.

The calculation involves taking into account the calendar year before the start of the holiday.

We take into account the following time periods:

- from July to December '18;

- from January to June '19.

Every month a person earns 20 thousand rubles.

In addition to salary, a person can be rewarded for fulfilling or exceeding work plans. More information is provided in the Regulations on Bonuses.

That is, if in March a person coped with the work plan and exceeded it, he was given a bonus of 8 thousand rubles.

In April, the situation repeated itself, but the overfulfillment was slightly different, so he was paid an incentive of 5 thousand rubles.

Various premiums are usually taken into account when calculating the SDZ

It was not possible to fulfill the work plans for the next month, but the citizen requested financial support amounting to 4 thousand rubles (due to the birth of a child).

Now let's calculate the average salary of a person:

- Let's calculate how much money he received in a year:

12*20.000=240.000

- We calculate the incentive payments that were given to him in March and April of 1919.

240.000+8.000+5.000=253.000

- Material support is not taken into account.

Material support is not taken into account when calculating SDZ

Formula for calculating vacation pay

So, this figure is calculated as follows:

Average daily earnings * vacation days = amount of vacation pay

Example three . Calculation of vacation pay for the 19th year

The citizen plans to start his vacation on 08/07/19, which is 2 weeks.

Every month a person receives 20 thousand rubles for his work. In April, he was awarded a bonus of 5 thousand rubles.

Calculation period = 12 months that passed before the moment of rest: from August to December of the 16th year and from January to July of the 17th year.

Average daily earnings are:

(20 thousand rubles * 12 months + 5 thousand rubles): 12 months: 29.3 calendar days = 696.81 rubles.

Amount of vacation pay:

696.81 rubles * 14 days of vacation = 9 thousand 755 rubles 34 kopecks.

You can take a vacation for two weeks

It will be similar when calculating vacation pay for six months, only in this case not 12, but 6 months will be taken into account.

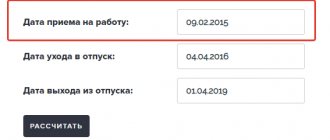

Vacation pay calculator

Go to calculations

How to calculate vacation pay when working part-time?

Today, many companies can establish part-time work for various categories of citizens. For example, a person does not work a full 8 hours, at 6, 7, 4, etc.

Important ! Calculation of vacation pay for such people is based on the same principles that are used for citizens working full time.

They take the money received by a person a year before the vacation, add all the allowances, bonuses and rewards. The resulting figure is divided by 12 and 29.3.

For part-time work, vacation pay is calculated in the same way

How are payments for unused vacation time calculated?

The employer is obliged to pay, upon dismissal of an employee at his own request, payment for time worked, as well as compensation for unused vacation. If everything is obvious with payment for time worked, then compensation for vacation pay for unused rest days needs to be dealt with in more detail.

So, according to Art. 114 of the Labor Code of the Russian Federation, during the vacation the employee retains his average salary . Accordingly, upon termination of an employment relationship, compensation for unused vacation is calculated based on the employee’s average salary.

In accordance with Art. 139 of the Labor Code of the Russian Federation, when calculating average earnings, wages for the last twelve months are taken into account. The amount of payments is divided by the number of months in a year - 12, and by the average number of calendar days in a month - 29.3 (read about how to calculate compensation for leave upon dismissal if an employee worked for 11 months or less).

To correctly calculate the amount of compensation, you first need to correctly calculate the employee’s labor income. The amount includes:

- wage;

- bonuses provided for in the employment contract;

- other payments, except for sick leave, maternity leave, and business trips.

To calculate vacation pay for unused rest days when leaving at your own request, you must multiply the number of unused vacation days by the average wage per day.

To calculate the number of unused vacation days, you need:

- Divide the number of days of annual leave by twelve months. This way we can find out how many days of vacation the employee is entitled to per month worked.

- We multiply the result by the number of months worked.

- Subtract the number of vacation days already used from the result obtained. The resulting figure is the number of days of unused vacation.

To calculate the vacation days to which an employee is entitled, the “Rules on regular and additional vacations” approved by the People's Commissariat of Labor of the USSR on April 30, 1930 are applied. They stipulate that if an employee worked less than half of the current month, then he is not included in the calculations, but if more than half or exactly half is included, he is included.

Moreover, if there are twenty-nine days in a month, fifteen days are considered half, and if there are thirty-one days, then half of such a month is sixteen days.

Thus, in order to calculate the amount of compensation for unpaid vacation upon voluntary dismissal, you must:

- Calculate the average wage per day. To do this, divide the amount of wages for the last 12 months by 12, and then divide by another 29.3.

- Calculate the number of unused vacation days. To do this, divide the required number of vacation days per year by 12 and multiply by the number of months actually worked. From the result obtained, subtract the number of days off.

- We multiply the numbers calculated in the first two paragraphs. The final value will be the amount of compensation due.

In addition to unused vacation time, an employee may have accrued unused vacation time. They appear to the employee due to:

- with overtime work;

- with going to work on holidays and weekends;

- on duty;

- with participation in donor events.

As a rule, such time off is accumulated in order to then use it to extend the next vacation.

But a situation may arise when an employee decides to resign of his own free will, but the accrued time off remains. The Labor Code of the Russian Federation does not contain provisions on compensation for time off in cash upon dismissal.

In this case , it is important that the right to time off is documented. That is, if this is time off due to participation in a donor event, then it will be confirmed by a doctor’s certificate. Otherwise, you may not receive payment for time off even through the court.

Therefore, if an employee decides to resign of his own free will, it is better to use all accumulated time off before writing an application to terminate the employment relationship.

How to understand which calendar days were taken into account if a person did not work for a whole month?

When an employee could not perform his job duties due to absence from the workplace, the following formula is used:

29.3 (average number of calendar days): number of calendar days of the month * number of calendar days during work = number of unworked calendar days.

Example four. Calculation of average wages for vacation pay with a full working month

The citizen is provided with rest from 10.23.17, vacation days - 14. Salary - 18 thousand rubles.

The calculation includes: the time period from October to December of the 16th year, from January to September of the 17th year.

In December 2016, a person took sick leave, as a result of which he performed his work duties for only 10 working days (equivalent to 14 calendar days).

December '16 consists of 22 working days.

Salary received in December - 18 thousand rubles: 22 working days * 10 working days = 8 thousand 181 rubles 82 kopecks.

During the time period when the citizen was on sick leave, he was paid an appropriate benefit. This money is not included in the calculation of vacation pay.

Sick leave is also not taken into account when calculating vacation pay.

Calculating vacation pay:

- We determine the number of calendar days that made up December to be included in the billing period:

29.3: 31 calendar days * 14 calendar days = 13.24 calendar days.

- Find out the average salary of a person.

(8181.82 rubles + (18,000 rubles * 11 months)): (13.24 calendar days * 11 months)) = 614.48 rubles.

- We count the money that makes up vacation pay.

614.48 rubles * 14 calendar days = 8602.72 rubles.

When an employer hires another employee for a new position, and he decides to take a vacation in six months (or 8 months), then the calculation time, consisting of 12 months, naturally does not work out. In this case, vacation pay is calculated as follows:

- payments received by a person for actual work duties performed;

- actual time the employee worked.

If the employee’s actual working time is less than 12 months, the calculation is based on the period that he worked

How to calculate the payment?

If we return our money correctly, then it is very important to know how to calculate the due amount. This is necessary primarily in order to indicate the correct price of the claims in the claim sent to the court. It should describe how the claimed amount was received.

The lawsuit provides calculations of the following indicators:

- number of unused vacation days;

- average daily earnings;

- due amount.

It is also very important to take into account the fact that compensation for unused vacation time refers to calculated payments. From this amount, the employer can deduct shortfalls or other damage caused by the actions of an employee of the organization.

If the employee does not agree with the amount given to him, then he must go to court or other authorities to protect his rights. If the employee proves that the deduction was made without reason, then not only compensation will be paid in favor of the person who quit, but also interest for the delay in issuing the amount.

How to calculate average earnings?

Vacation pay upon dismissal at one's own request is calculated based on the amount of average earnings for the last year. If an employee has worked at a given enterprise for less than a year, then the amount for the entire period is taken. This amount is divided by 12 (or the number of months worked) and also by 29.3 (the officially approved average showing the number of days in a month).

The resulting value is multiplied by the number of vacation days for which the employee is entitled to compensation.

It should be noted that for convenience, they do not calculate exactly how many working days there were during the period taken into account and how many of those fell during vacation.

Vacation pay itself is calculated according to a similar principle. The only difference is that usually the employment contract provides for additional bonuses and assistance when going on vacation, while this is excluded when receiving compensation.

It should also be taken into account that some payments are not taken into account when determining average earnings:

- travel allowances, compensation for travel, meals;

- one-time payments due to difficult financial situation;

- maternity benefits.

That is, even if this period is taken into account, the amounts paid will not affect the average earnings in any way.

How to calculate vacation days?

The number of vacation days must be noted in the employment contract that the employee enters into with the employer at the time of hiring.

The only condition is that the duration cannot be less than 28 days. Additional rest time may be provided - this is not prohibited by law. Additional vacation days are determined as follows:

- additional regulatory industry documents. For workers in the northern regions and civil servants (due to irregular working hours), an increase in the number of vacation days is provided. In each specific case, the duration varies;

- Many modern companies prefer to provide for additional social guarantees in a collective agreement (paid rest days for mothers of large families, parents of disabled people). If this is provided for in a previously signed agreement, then without approval of the changes it is impossible to deprive the employee of this right. But do not forget that in our case vacations are taken into account on a permanent basis - if the employee did not use the vacation days provided for during the wedding, then this time will not be taken into account here.

In this case, upon dismissal, a refund must be made or paid vacation days must be provided, taking into account additional paid time. When an employee quits, he must be paid the full amount for paid vacations. At the same time, you should not forget about the differences between paid and unpaid leave (the so-called at your own expense). If an employee was entitled to additional unpaid leave, which he did not use, then the employer is not obliged to pay anything to the resigning employee for this.

Clause 28 of the Rules for calculating the number of vacation days stipulates that after working for 12 months, the employee is already entitled to vacation in full (or compensation for all this time).

That is, to calculate vacation, you need to divide the number of allotted days by 12 and multiply by the number of months worked.

Simply put, the number of days of rest stated in the employment contract will need to be divided by 12 and multiplied by the number of months that have been accrued for vacation. If a month has not been fully worked (for example, 5 months and 16 days), then it is calculated according to the rounding rule: if the employee worked more than half of the month, then it is counted in full, if less than half is discarded and not taken into account.

Calculation of vacation pay for changed salaries

When in the company where the employee works, during the calculation period, at the end of this time, but before the start of the citizen’s vacation or during his vacation, the salary amount was changed, then the payment associated with the vacation will have to be recalculated.

This nuance is presented in detail in paragraph 16 of the Decree of the Government of the Russian Federation of December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages.”

Calculation of the vacation pay correction factor due to an increase in salary - formula:

Salary received by a person during an increase in the amount: salary received by employees for each point of calculation = increasing factor.

If the employee's salary has been changed, an increasing factor is calculated

Example five . Finding out the salary increase rate

A person earned 20 thousand rubles a month in September and October of 2016. In November, the salary increased, and it now amounts to 24 thousand rubles (that is, 4 thousand rubles more).

Let's calculate the increasing factor:

24,000 rubles: 20,000 rubles = 1.2.

When the salary was increased within the calculation time, the citizen’s working salary is multiplied by the increase factor.

Salaries are divided if you need to find out the increase rate

Example six . We determine vacation pay taking into account the increase factor

The employee will be given a vacation of 28 calendar days from 08/21/17.

The salary before 1.02 was 20 thousand. Then the amount increased to 22 thousand.

Let's find out what the vacation pay will be:

- Let's find out the increasing coefficient:

22,000 rubles: 20,000 rubles = 1.1.

- The time period from January to July of the 17th year is taken into account.

- Let's find out the number of payments required to be taken into account when calculating vacation pay:

We take into account the amount of salary before the increase for six months (that is, from August 16 to February 17), the increase coefficient is 1.1, and we take the amount of salary at the time after the increase and without the coefficient (that is, the period from February to July 17 year).

(20,000 rubles * 6 months * 1.1) + (22,000 rubles * 6 months) = 264,000 rubles.

- Let's find out what the average daily earnings are:

264,000 rubles: 29.3 calendar days: 12 months = 750.85 rubles.

- We calculate vacation pay:

750.85 rubles * 28 vacation days = 21,023.8 rubles.

If the salary was increased in a certain period, only this number of days is multiplied by the increase factor

It is also necessary to make adjustments to the average earnings figure when the salary was increased outside the calculation, before the time period when the employee received leave.

Example seven . Correction in the amount of vacation pay when the salary was increased after calculation, before the start of the vacation

The person will be given leave from 08/21/17 for 14 days. Until August 1, the salary is 18 thousand rubles.

From the 1st, wages were increased, then the employee’s salary became 21 thousand 600 rubles.

Let's calculate vacation pay:

- We determine the increase factor:

21,600 rubles: 18,000 rubles = 1.2

- Let's find out the scope of the calculation period.

It consists of the period from January to July of the 17th year.

This is provided that the employee was not sick, did not take time off at his own expense, that is, he worked everything he was supposed to.

- The average salary when calculating vacation pay is as follows:

(18,000 rubles * 6 months): 6 months: 29.3 calendar days = 614.33 rubles.

- We find out vacation pay accrued for 14 days:

614.33 rubles * 14 calendar days = 8,600 rubles.

- Let's make adjustments to the number of vacation pay when taking into account the coefficient. The salary increased after the end of the calculation, but when the vacation had not yet begun.

8,600 rubles * 1.2 = 10,320 rubles.

If the salary was increased after calculation, but before the start of the vacation, the increase factor is also taken into account

There are also cases when the salary increases during vacation (although this is rare), and then it is necessary to make adjustments to the amount of the average salary, which occurred from the day the salary was increased until the start of the vacation.

Example eight . Adjustments to the amount of vacation pay when the salary was increased during the vacation

A person goes on vacation from March 27, 2017, the number of vacation days is 14, that is, until April 9.

The employee's salary is 28 thousand rubles. He worked for six months, that is, 6 months.

The calculation time consists of: the time period from September 2016 to February 2021.

All the time before the vacation, the employee did not take sick leave, that is, he worked all that he was supposed to.

On April 3, the company increased workers' salaries. After this, the salary changed to 30 thousand rubles.

Let's find out what the vacation pay will be:

- Find out the average salary:

(28,000 rubles * 6 months): 6 months: 29.3 calendar days = 955.63 rubles.

- We calculate according to the general rule:

955.63 rubles * 14 calendar days = 13,378.82 rubles.

- While the employee was on vacation, the salary was increased. We find out the increase factor: 30,000 rubles: 28,000 rubles = 1.07.

Don't forget that the moment of promotion coincided with vacation. In other words, it is necessary to make corrections in the time period from April 3 to April 9, 17, this is a calendar week.

- Let's determine the amount of vacation payments for these 7 days.

The average salary before the holiday was 955.63 rubles.

Vacation pay per calendar week:

955.63 rubles * 7 calendar days = 6,689.41 rubles.

- Let's find out what the amount of vacation payments was during that time period when the salary was increased - this is 7 calendar days.

To do this, multiply the salary amount by the increasing factor:

955.63 rubles * 7 calendar days * 1.07 = 7,157.67 rubles.

- Let's find out what the total vacation pay figure is. To do this, we sum up the vacation pay before and after the increase.

6,689.41+7,157.67=13,847.08 rubles.

- Let's find out how much additional money a citizen should receive.

Since the money paid for vacation is provided before the start of the vacation, it is necessary to find out the difference obtained by adjusting the amount of vacation pay for 7 calendar days from the moment the salary is increased by the coefficient. This money is given to the employee.

Let's calculate the difference:

13,847.08-13,378.82 rubles = 468.26 rubles.

During vacation, salary increases are infrequent, but in this case the employee must receive an additional portion of vacation pay

The procedure for calculating vacation payments

According to the law, an employee going on vacation must receive money either in person or on a bank card at least three days before the start of the vacation. You can make the payment earlier, but later - this will be a violation of current legislation.

If an employee has worked for a year or six months, the procedure for calculating vacation pay remains the same:

- the employee signs an application for paid leave from the manager;

- based on the application, an order is issued for the enterprise;

- Based on the order, an accountant or an employee of the settlement department calculates payments.

The payments themselves, or more precisely, the total amount, depend on three parameters:

- billing period;

- average daily earnings;

- duration of vacation.

Back to contents

Billing period

From the first day when an employee officially begins to perform his work duties, the countdown of his work experience begins, which ultimately affects payments for temporary disability, retirement, as well as the right to take advantage of the opportunity of paid rest. The time from the first working day to the end of the calendar year is called the billing period. If the employee goes on vacation, for example, after six months, the calculation period will be from the first working day to the day before the first day of vacation.

For example, a person got a job at an enterprise on the twelfth of May 2011, and is going on vacation on the twenty-fifth of December 2011, the billing period will be seven full months and thirteen days. The same principle applies in how to calculate holiday pay for 6 months and for any other period.

At the same time, the billing period includes only days worked for which full earnings are due. That is, temporary disability, business trips, training, and the like are not included in this period.

Back to contents

Average earnings

Once the payroll period has been determined, it is necessary to calculate the employee’s average daily earnings. Of course, in an incomplete billing period this figure will be less.

For example, how to calculate vacation pay for six months if an employee receives 8,000 rubles per month. To this amount you need to add - if any - regional coefficients, all bonuses for length of service, scientific titles and works, and the like. That is, any payments that are issued on a regular basis and are included in the wage system. Let’s say it turns out to be 8,423 rubles for five months and 8,200 rubles for the first month, the billing period is exactly six months. Then the calculation of average daily earnings will look like this:

((8,423 x 5)+8,200)/6/29.4 = 285.23 rubles,

where 29.4 is the average number of days in a month, a coefficient established at the state level.

This is the amount the employee will receive for each day of his official vacation.

You should also not forget that if you quit, for example, 11 months or less after employment, you will have to pay back all the funds previously issued for vacation, since they were received, as it were, on credit.

Back to contents

Duration of vacation

Average daily earnings, as mentioned above, are paid for each day of rest. At the same time, public holidays and official non-working days are not taken into account in the duration of vacation and, accordingly, are not paid.

That is, an employee with an average daily earnings of 567 rubles, who will rest from December twenty-eighth to January third, will officially go on vacation for five days and receive 2,835 rubles for this time period.

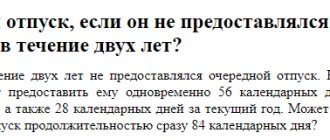

It must be remembered that rest after the first six months of work is due in full, established at the enterprise. That is, if it is supposed to be twenty-eight days, the employee can go for all of these twenty-eight days, if thirty-five days are due, for all thirty-five, and so on.

If a worker asks for leave before he has worked for six months, he can only claim the days he actually earned. That is, approximately two to three days for each month worked.

We hope this article has clarified how to calculate vacation for an incomplete year and make payments according to it.

Back to contents

Responsibility for violations

If an employer violates the regulations for making vacation payments, the state imposes sanctions on him. For a one-time offense:

- you must pay a fine of 30-50 thousand rubles (for organizations);

- For an entrepreneur, the fine is 1-5 thousand rubles.

For repeated violations, the sanctions increase:

- for legal entities – 50-70 thousand rubles;

- private entrepreneurs - 10-20 thousand.

If a manager violates the regulations on vacation pay, he will be punished financially by the state

Important ! Also, violating managers are sometimes banned from holding leadership positions for several years.

Calculating vacation pay for six months is no different from calculating vacation pay for a year worked - only you need to take into account not 12, but 6 months.