Through the MFC you can apply for a one-time benefit at the birth of a child, monthly payments for child care up to 3 years, and assistance to low-income citizens for children under 18 years of age.

Table 1. Receiving child benefits at the MFC

| Description | |

| Who can receive | Parent, guardian, adoptive parent |

| Price | For free |

| Required documents | The list depends on the type of benefit being issued. |

| Deadline for receiving the service | 10 days |

| The result of receiving government services | Payment of child benefit |

| Algorithm of actions |

|

Monthly child care allowance through State Services

Through the EPGU it is possible to apply for care benefits. Step-by-step instructions on how to apply for child benefits via the Internet, namely the State Services portal:

- Log in to the system using your username and password.

- Go to the section “Pensions, benefits” - “Benefits and benefits for families with children.”

- Next, read the information and proceed to filling out the application.

- In the first paragraph, select the “Monthly child benefit” option.

- Fill out the application (the lines for which information was entered during registration on the portal will be automatically filled in).

- The department where you will need to go to submit the original application will be displayed automatically.

- Next, you need to select a date and time for a personal visit to a government agency and submit an application.

Note! The service is not available in all regions. If there is no “Get service” button, you must contact the MFC or social security.

Normative base

The procedure for the provision of public services by multifunctional centers is carried out in accordance with the Rules for organizing the activities of multifunctional centers for the provision of state and municipal services, approved by Decree of the Government of the Russian Federation of December 22, 2012 No. 1376.

The procedure for assigning and ensuring payments to citizens with children is established by Federal Law No. 81-FZ of May 19, 1995.

Types of state assistance to large and low-income families are established in accordance with Decree of the President of Russia No. 431 “On measures of social support for large families”

Payments up to 18 years of age

Child benefit under eighteen years of age is a financial payment to families with children with low income. The benefit is awarded to those children whose parents' average monthly income is less than the subsistence level. Single mothers and families in which only one parent works can also apply for financial support.

How to apply for child benefits under 18 years of age through State Services? Unfortunately, there is no such service on the portal. In order to receive benefits, parents must submit an application to the social protection department. But before applying, you should prepare a certain package of documents:

- Help 2-NDFL.

- Child's birth certificate or passport (upon reaching 14 years of age).

- Copies of both parents' passports.

- Help in form 9.

- Details for crediting funds.

The authority must make a decision within 10 days. If a child benefit is assigned, then after 2-3 months money should be credited to your personal account.

Accrual may be denied for several reasons, namely, if the parent:

- Is legally capable, but is not employed and is not on parental leave.

- Not recognized as unemployed, but not looking for work.

- Not a student of a state educational institution.

- Not on social leave to care for an incapacitated relative.

In what cases is an income certificate issued for social security?

A form that confirms a citizen’s official earnings is requested from an individual by the social security service in the following typical situations:

- Assigning appropriate pension supplements to citizens.

- Registration of targeted subsidies for persons classified as low-income.

- Providing certain benefits to low-income people (for example, for utility bills).

- Registration of social financial assistance by an individual.

- Opening of payments related to maternity leave.

- Assigning social benefits to a person in need (for example, “children’s benefits”).

- Other situations of this kind, in which citizen applicants contact the social protection service to obtain appropriate social assistance.

In all of the above cases, an applicant applying for certain benefits (subsidies, benefits, additional payments) must send documentary evidence of his earnings to the social security service, that is, a certificate of accrued income.

A citizen will need this document to officially prove that he belongs to the group of people in need. In addition, based on the information specified in this certificate, the amount of the assigned benefit is calculated. The amount of official income of an individual may affect the amount of social benefits issued.

For what period is it provided?

If a citizen applies for a subsidy or other social payment, he may be required to provide a certificate of earnings for the last 6 (six) months .

Sometimes social security asks the applicant to confirm the income received for 3 (three) months - this is practiced when it comes to receiving so-called “children’s” benefits. A salary document for the past three-month interval may be required by the employment service when determining the average salary to calculate unemployment benefits. Students and pensioners, who are considered socially vulnerable groups, often confirm their income (scholarships, pensions) for the last three-month period by requesting the necessary documents through the administration of their university and the Pension Fund of the Russian Federation, respectively.

In some cases, a certificate of income received for the last 12 (twelve) months .

One way or another, a document on an individual’s earnings can be issued for any necessary period of time. The citizen indicates the required number of months or specific periods in the application for a certificate addressed to his employer or other source (payer) of confirmed income.

A document that proves a citizen’s official earnings and paid (withheld) taxes for a specific period of time must be sent to social security no later than 30 (thirty) days counted from the date of receipt of this document.

If the thirty-day submission period is overdue, the issued certificate may be considered invalid - it will need to be received again, since a new last month will appear in the reporting interval.

Design rules

To receive a document confirming income for the required period of time, a citizen submits an application of the appropriate content to his employer or other source of income.

The employer does not have the right to refuse this request; he must prepare and provide the appropriate certificate within three days from the date of receipt of the said application.

As a rule, a certificate of earnings is issued to the applicant on paper (it can also be duplicated electronically by sending it by e-mail). In some situations - by agreement of the parties - the document is drawn up exclusively as an electronic file.

If the applicant proves his earnings for the period 2021, a supporting document is issued for him using the 2-NDFL template.

If you need to prove the income of an individual for any period of 2021, from 01/01/2021 you should issue a supporting certificate in the form introduced by Order of the Federal Tax Service of the Russian Federation No. ED-7-11 / [email protected] dated 10/15/2020:

- Appendix 1 to the said Order regulates the new template for the 6-NDFL report submitted by the employer.

- Appendix 4 to the same Order establishes a new form of confirmation document issued to the applicant employee. This form is used for the 2021 periods. In other words, this certificate proves the income received by an individual from January 2021 onwards.

more about filling out the new form 2-NDFL in this article.

The structure of the new supporting document has not changed much. As before, the help includes the following information:

- Information about the payer (source) of income - the employer.

- Information about the recipient - the employee.

- Information about taxable income of an individual.

- Information about personal income tax deductions provided to individuals.

- General amounts of charges and taxes.

The procedure for drawing up a supporting document is regulated by the content of Order of the Federal Tax Service of the Russian Federation No. ED-7-11 / [email protected] dated 10/15/2020. If a citizen needs to receive such certificates from several income payers, he applies to each of them with the appropriate application.

.

.

Sample form for 2021 for 12 months.

.

Free form sample.

Types of benefits

There are several types of child benefits:

- One-time, at the birth of a child.

- Child care up to 1.5 years old.

- Benefit up to 18 years of age.

There is also an additional measure of support for parents, which is popularly called “Putin payments.” They do not apply to maternity and child care benefits. Not everyone can apply for “Putin” payments. How to apply for Putin payments through State Services? You can fill out an application on the Unified Portal. You need to go to the “Pensions, benefits” section, select the “Assignment and payment of child benefits” item, then read the information, and if there is a “Get a service” button, proceed to filling out the application. But this is not possible in all regions; if there is no button, you should personally contact social security.

Families whose income is no more than 2 subsistence minimums per person per month are eligible to receive presidential payments.

What is required for payment

First of all, a reason is required - pregnancy and childbirth. This applies to maternity benefits, lump sum payments at birth and monthly care benefits.

Monthly payments to low-income families are provided only if certain conditions are met. For example, Putin’s subsidies are paid for children born after 01/01/2018 and only on the condition that the average per capita income per family does not exceed two times the regional subsistence level. The base value is the cost of living of the working population for the second quarter of the previous year.

For benefits from 3 to 7 years, similar rules apply: money in the amount of 50% of the subsistence level is transferred to those families whose average per capita income does not exceed the subsistence level in the region.

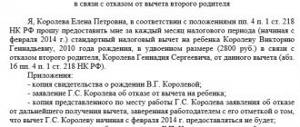

Another important condition: financial assistance is transferred only to one of the parents. Spouses have the right to choose which of them will receive a one-time social benefit at birth and a monthly benefit for up to 1.5 years from the employer. The second parent provides a certificate of non-receipt. Submit documents for obtaining child benefits from 3 to 7 years, if the mother does not work, to the MFC or social protection authorities. Sick leave for pregnancy and childbirth will be paid only by mothers.

IMPORTANT!

Social benefits are intended for children who are citizens of the Russian Federation.

What documents are needed for registration?

To apply for child benefits through the State Services portal, the following package of documents is required:

- Passport of the applicant (parent or legal representative).

- Child's birth certificate or passport (upon reaching 14 years of age).

- Certificate of family composition and income.

- Document on alimony (if available).

- Certificate of recognition of a low-income family.

- Copies of work records of each parent.

- Certificate from an educational institution.

- Document confirming that the child has no independent income.

- Details for calculating payments.

Note! To apply for certain types of benefits, an extract from the maternity hospital may be required.

Before applying for child benefits through State Services, you must check all entered data, otherwise the issuance of funds may be refused.

What to provide for social benefits at birth

In 2021, the size of the one-time subsidy is 18,004.12 rubles. Indexation is planned for February 2021. Employed parents receive money from the employer, unemployed and unemployed parents receive money from the Social Insurance Fund office. Here is a list of required papers for the appointment of financial assistance:

- statement;

- birth certificate in form 24;

- a letter from the employer about the non-receipt of benefits by the second spouse.

In special cases, authorities request a divorce certificate and a statement of last place of employment for unemployed applicants.

Who can apply for the service

Parents who are recognized as low-income and have a minor child have the right to receive financial support.

Price

There is no need to pay a state fee to receive the service.

Deadlines

You can complete and submit an application for child benefits under 18 years of age through the website in 15-20 minutes. The authority must register the application within 1 business day. After 10 days, parents will receive a decision on the service: positive or refusal to provide the service.

What to submit for payment up to 1.5 years

This is a monthly compensation of 40% of average earnings. From June 1, 2020, the minimum social payment is 6,752 rubles, the maximum is 27,984.66 rubles.

The money is received by one of the close relatives chosen by the family - mother or father, grandmother or grandfather. Papers for registration:

- statement;

- birth certificates of all children;

- certificate of non-receipt of monthly compensation by the second spouse.

The employer has the right to request a salary certificate from the previous place of work. As soon as the child turns 1.5 years old, the applicant is no longer paid monthly social benefits. He continues to receive a compensation payment of 50 rubles. Check with your employer what certificates are needed to apply for child benefits under 3 years of age: they usually require an application and a letter from the spouse’s place of work about non-receipt of money.

One-time benefit for the birth of a child

It is impossible to apply for a one-time benefit for the birth of a child through State Services. There are 2 solutions:

- Write an application at the place of work - if both parents work or one of the parents is officially employed, and the other is a student at a state educational institution.

- Contact social security if both parents are unemployed.

If the parents are divorced, the parent with whom the child lives has the right to receive benefits.

The benefit is assigned within 10 days after submitting the application and will be paid until the 26th of each month.

You can receive child benefits through the State Services portal; to do this, you need to fill out an application according to the established template. There is no need to fill out all the lines in the application; the system will automatically fill in the information that was specified when registering on the information resource. It should be noted that not all regions have the opportunity to fill out an application electronically. In this case, you must contact the territorial social protection unit.

The procedure for applying for child benefits through the MFC

Note! Before submitting an application, you must register your child at your place of residence!

Registration of child benefits at the MFC occurs in the following order:

- Pre-registration for an appointment or electronic queue. You can make an appointment by phone, online or by contacting the hall administrator in person.

- Collection of necessary documents.

- Filling out the application. You can fill out the application at home or at the multifunctional center with the help of a center employee.

- Submission of documents. At the appointed time, you must come to the multifunctional center, go to the reception window and submit documents.

- Receiving a receipt from an MFC employee about the acceptance of documents.

- Receiving the result of the service.

Who can receive

One of the parents, an adoptive parent or guardian, or a single mother can receive child benefits.

Material on the topic: Procedure for applying for alimony through the MFC.

Deadlines

An application for payment of child benefit is reviewed within 10 days.

In case of incomplete submission of the document, the period for consideration of the application increases to 30 days.

What will you need for Putin's manual?

Social benefits will be transferred starting from 2021. Low-income Russian citizens with children born after 01/01/2018 apply for it. One of the applicant parents is paid for each recipient from birth until the age of 3 an amount equal to the minimum subsistence level in a particular region. Rights to financial assistance must be confirmed annually.

IMPORTANT!

If you are applying for monetary compensation for your first child, contact the social protection authorities; for the second, contact the Pension Fund (payments are made from maternity capital).

Here are the documents needed for child benefits from 1.5 to 3 years (from birth to 1.5 the same):

- statement;

- birth certificate for each dependent;

- parents' passports;

- confirmation of citizenship;

- income certificates for all family members 3 months prior to application;

- bank account details;

- father's draft certificate (if he was drafted at the military registration and enlistment office).