Is severance pay subject to insurance contributions?

Severance pay, unlike compensation for unused vacation, is not subject to insurance contributions . In order to understand this issue, it is recommended to study the following articles of the Labor Code of the Russian Federation: 84, 178, 181, 279, 296 and 318. If you pay an employee an amount within the limits established in the Labor Code of the Russian Federation, then insurance premiums, including for traumatism are not accrued. In addition to the listed articles of the Labor Code of the Russian Federation, you can read the letter of the Ministry of Health and Social Development No. 1145-19.

- in connection with changes in the employment contract, for example, when there is a change in management;

- relocation of a company or transfer of an employee if the latter does not agree;

- for health reasons, if the employee can no longer perform his work duties;

- liquidation of an enterprise (institution or organization);

- reduction or mismatch of qualifications of employees;

- reinstatement of the worker who previously performed these duties, etc. The full list can be found in 178 Labor Code of the Russian Federation

Withholding personal income tax

Severance pay always refers to compensation associated with dismissal. Therefore, according to Article 217 of the Tax Code, income tax contributions on this amount are not paid . But one of the paragraphs sets some restrictions related to the amount. The rule is the same as in the previous case. An amount equal to three or six times the monthly salary of a particular employee is exempt from fees.

Retirement or agreement between the parties are situations when the employer may have problems with what type of payment to classify. If such payments are described in an employment or collective agreement, then they can be regarded as provided in accordance with the law.

Severance pay: subject to insurance contributions or not

But as soon as the employee’s payments exceed the established limit, insurance premiums must be calculated. The standardization of compensation and severance pay is established by Law No. 212-FZ in paragraphs. “d” clause 2, part 1, art. 9. Similar provisions are contained in Art. 20.2 of Law No. 125-FZ of July 24, 1998 on social insurance against occupational diseases and NS at work:

- if the employee does not want to move to another job recommended to him by the conclusion of doctors, or if the employer does not have such a job (clause 8, part 1, article 77 of the Labor Code of the Russian Federation),

- if the employee is completely disabled, and this conclusion is made on the basis of a medical report (clause 5, part 1, article 83 of the Labor Code of the Russian Federation),

- if an employee who previously worked in this position is reinstated (clause 2, part 1, article 83 of the Labor Code of the Russian Federation),

- if the employer has changed his location to another location, and the employee does not agree to move after him (clause 9, part 1, article 77 of the Labor Code of the Russian Federation),

- if the employee refused to work further because the terms of his employment contract changed (clause 7, part 1, article 77 of the Labor Code of the Russian Federation),

- if the employee joined the army due to conscription (clause 1, part 1, article 83 of the Labor Code of the Russian Federation).

We recommend reading: List of diseases that cause disability

Is severance pay subject to insurance contributions?

In addition, a collective or labor agreement, in accordance with Part 4 of Art. 178, part 2 art. 307 of the Labor Code of the Russian Federation, may contain other motives for paying severance pay, as well as establish higher amounts. However, in order to limit the initiative of employers, Art. 181.1 of the Labor Code of the Russian Federation introduces exceptions that must be taken into account.

The circumstances preceding payments can be very different: the organization has gone bankrupt or is being liquidated by decision of the founders, it is reducing its staff, and finally, the employee resigns of his own free will due to the impossibility of continuing work. Similar circumstances are given in Art. 178, 180 and 181 of the Labor Code of the Russian Federation.

Severance pay upon dismissal of an employee: personal income tax and insurance contributions

Payments made on the basis of agreements to terminate an employment contract can perform both the function of severance pay (earnings saved for a relatively short period of time before the employee is hired) and essentially act as payment for the employee’s consent to renounce the employment contract (determined by the Supreme Court of the Russian Federation dated September 23, 2019 No. 305-KG16-5939).

If an employment contract is terminated for certain reasons, the employee has the right to severance pay by virtue of law. These compensations are provided for in Article 178 of the Labor Code of the Russian Federation. Namely, severance pay to an employee dismissed due to the liquidation of an organization or a reduction in headcount or staff is calculated in the amount of average monthly earnings. In a number of other directly named cases, severance pay is paid in the amount of two weeks' average earnings - for example, if an employee refuses to continue working due to a change in the terms of the employment contract determined by the parties.

Other payment features

There is a type of severance pay in the amount of average earnings for two weeks. This is usually due to the situation if the initiative does not come from the parties to the employment agreement. For example, if an employee is called up to serve in the army. There are other similar justifications listed in the legislation.

An employee can also be fired if he refuses to accept changes to the employment agreement.

Typically, contradictions arise if the document initially indicates conditions that directly violate current legislation. You need to carefully study the dismissal process itself and look at what articles are used . It is recommended, if possible, to seek help from lawyers; they will point out the specifics of a particular situation.

The employer is obliged to transfer severance pay no later than the next day on which wages are paid. The date from which various benefits are assigned, including for registration at the employment center, depends on the time of termination of the employment relationship.

If managers violate the specified deadlines, they are required to pay certain fines. The minimum amount is 1/150 of the Central Bank rate of the unpaid amounts. Interest is charged for each day while there is a delay. The prosecutor's office or the court, the state labor inspectorate considers applications from employees if previous actions and disputes have not led to any result.

The amount of severance payments is usually increased only if the condition was initially specified in the regulations adopted by the organization. When making payments, it is necessary to take into account all the days when the employee performed his immediate duties.

It is also useful to read: Details for paying individual entrepreneurs’ insurance premiums

Severance pay insurance premiums

According to the position of the Ministry of Labor of the Russian Federation, the basis on which the employer pays severance pay does not matter: insurance premiums will in any case be charged in a situation where the amount specified above is exceeded. Thus, the situation in which the employer has an obligation to pay insurance premiums is unimportant.

Most often this happens when a company is liquidated or employees are laid off. It should be understood that in some cases, severance pay is subject to insurance contributions. However, not all employers know exactly which ones and in what order this happens, which gives rise to certain difficulties. We wrote this article to make it easier for you to navigate the legislation.

Is it subject to taxation?

If the employee quit by agreement of the parties, then insurance premiums are not applied to the part that does not exceed three times the average monthly salary. The amount is increased to six times the average monthly earnings when it comes to the Far North and other territories of equal importance. The opinion from the Supreme Court presented similar conclusions.

Reference! Contributions for “injuries” are not subject to severance pay under the same conditions as already described above.

Severance benefits are not subject to contributions

Guarantees and compensation to employees related to termination of an employment contract are established in Chapter 27 of the Labor Code of the Russian Federation. So, according to Art. 178 of the Labor Code of the Russian Federation, upon termination of an employment contract due to a reduction in the number or staff of employees (Clause 2, Part 1, Article 81 of the Labor Code of the Russian Federation), the dismissed employee is paid severance pay in the amount of average monthly earnings, and he is also retained the average monthly earnings for the period of employment , but not more than two months from the date of dismissal (including severance pay). In exceptional cases, the average monthly salary is retained by the dismissed employee for the third month from the date of dismissal by decision of the employment service body, provided that within two weeks after the dismissal the employee applied to this body and was not employed by it. In this case, an employment contract or collective agreement may establish increased amounts of severance pay.

We recommend reading: How to draw up a gift deed through a notary

An individual entrepreneur who is on a simplified taxation system has laid off several employees due to layoffs. They were paid benefits provided by labor legislation for cases of layoffs. Should the amount of such benefits be subject to contributions to the Pension Fund?

What does the payment mean and how much is the amount?

Severance pay is awarded in case of layoffs, regardless of most reasons. Article 178 of the Labor Code of the Russian Federation establishes the grounds for issuing funds and the specific amounts of compensation in a given case. The legislation specifies only a number of cases where such payments are higher. Such conditions are written down in the contract or collective labor agreements without fail.

The amount of benefits for some categories of specialists has some restrictions. An example is senior managers. Three times the average monthly salary will be the maximum compensation provided for such situations.

Dismissal by agreement of the parties is a popular situation that also deserves separate consideration. At the same time, the payment is considered both remuneration for the agreement to terminate the agreements and compensation. Such accruals are prohibited only for managers and their deputies and chief accountants.

Attention! The only reason when a refusal to pay benefits is fair is if it was the employer who initiated the dismissal. The Supreme Court of Russia issued an explanation that confirms this.

When determining sizes, managers need to take into account some nuances:

- During the first two months after termination of the contract, citizens must receive the average salary.

- For the third month, employees receive compensation if problems arise with employment, even if the person is registered with the employment service.

The amount of payment often also has a direct connection with the reason for which the dismissal occurred. The amount of remuneration for labor also matters. Managers have the right to draw up employment contracts that stipulate in advance not only the financial assistance itself, but also the situations in which it is paid. It is allowed to increase the amount of severance pay.

It is also useful to read: Do I need to pay insurance premiums from vacation pay?

Amounts not subject to insurance premiums

Material assistance is a socio-economic service consisting of the provision of cash, food, sanitation and hygiene products, child care products, clothing, shoes and other essential items, fuel, as well as special vehicles, technical means for the rehabilitation of disabled people and persons in need of outside care (GOST R 52495-2005 “Social services to the population. Terms and definitions”, approved by Order of the Federal Agency for Technical Regulation and Metrology dated December 30, 2005 N 532-st). In other words, financial assistance is given to an employee of an organization for personal needs and is not remuneration for time actually worked. If the name of the payment does not correspond to its content, you will not be able to take advantage of the benefit.

Professional retraining is also carried out to improve the skills of specialists in order to adapt them to new economic and social conditions and conduct new professional activities, incl. taking into account international requirements and standards. As a result of professional retraining, a specialist may be assigned additional qualifications based on the acquired specialty. Professional retraining to obtain additional qualifications is carried out through the development of additional professional educational programs. Students who have fulfilled all the requirements of the curriculum, by decision of the certification commission, receive a diploma of professional retraining.

Is severance pay subject to insurance contributions?

The Labor Code of the Russian Federation provides several examples when, upon dismissal of an employee, not only a salary, but also additional payments should be given. In this article we will tell you whether severance pay is subject to insurance contributions and what nuances there are in this regard that an accountant should know about.

If a company goes bankrupt and the number of employees is reduced, the organization pays employees severance pay in the amount of the average salary. For the period of employment for no more than eight weeks from the date of removal from position, the employee retains his salary, calculated on the average for the month. This issue is regulated by the Labor Code of the Russian Federation in Art. 178.

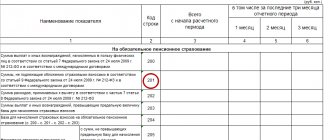

How calculations are displayed in RSV

Such payments fall into the RSV in full. To do this, fill out sections 1, 2 and 3. After this, a database is formed, which is used in the future.

It is necessary to take into account additional payments for which the employer is responsible:

- Upon dismissal of directors and chief accountants.

- Average earnings for employment within three months.

- Due to early dismissal.

- Regular severance pay.

Passing the DAM is mandatory for employers representing the following categories:

- Individuals who do not have individual entrepreneur status.

- Heads of peasant farms.

- IP.

- Separate divisions of foreign organizations operating on the territory of the Russian Federation.

- Separate divisions of Russian organizations that independently pay income to employees transfer all necessary funds to the budget.

Sometimes there is a need to register a zero RSV:

- Heads of peasant farms, if there are no employees, do not conduct business.

- Organizations or individual entrepreneurs subject to the same conditions.

- The only founders who also serve as CEOs.

Important! If the number of employees does not exceed 10 people, then reporting is submitted in paper form. Otherwise, registration takes place only electronically.

Calculation of severance pay - we compensate for “moral damage” upon dismissal

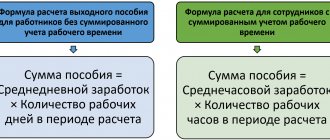

However, for some reasons for dismissal, an employee has the right to receive additional payments (severance pay and payments for the period of employment), for example, in case of staff reduction or liquidation of the organization. The amount of such payments depends on average earnings, which are calculated in a special way.

When an employee leaves the organization, he has the right to receive everything that. Usually this is wages for the last month of work and, if there are unused vacation days, compensation for unused vacation. If an employee resigns of his own free will, then usually the amount of payments is limited to this.

Are taxes withheld upon dismissal or not?

Now, from the general approach regarding personal income tax and insurance contributions, let’s move directly to the relationship of these payments to the dismissal process. Articles of the Tax Code state that:

- The salary provided for by legislative acts, which an individual receives on the day of dismissal, is subject to personal income tax withholding (Article 210, paragraph 1).

- Those severance payments that are adopted and approved by legislative acts are not subject to personal income tax (Article 217).

- In situations where an employee did not take the required vacation, he receives material compensation from the employer upon dismissal from the enterprise, from which personal income tax must also be deducted (Article 127 of the Labor Code, part one).

Severance pay – what is it? Read our article.

The list of responsibilities of a person who is an employer includes the transfer of insurance premiums to a number of different organizations (relying on the requirements of Federal Law No. 212-FZ):

- Pension Fund.

- Social Insurance Fund.

- The federal fund, which is responsible for mandatory health insurance.

- It is also necessary to pay a social contribution, which insures in the event of accidents, deterioration of health at work, as well as the occurrence of occupational illnesses.