VAT mechanism

Tax is calculated on all transactions within the framework of core and non-operating activities (entry D/t 90 K/t 68), the accountant records the amount of tax payable to the budget, and the entry D/t 91 K/t 68 reflects the VAT that the company must pay when performing other income-generating transactions.

When purchasing goods, the purchasing company has the right to reimburse from the budget the amount of tax indicated in the invoice by making the following entries:

D/t 19 K/t 60 — VAT on the purchased goods;

D/t 68 K/t 19 - tax is presented for deduction after the values are accepted for accounting. This algorithm allows you to reduce the amount of accrued VAT due to the “input” tax.

Thus, the accrued VAT is accumulated in the credit account. 68, and the reimbursable one is in debit. The difference between debit and credit turnover, calculated at the end of the reporting quarter, is the result that the accountant focuses on when filling out a tax return. If prevails:

- credit turnover - it is necessary to transfer the difference to the budget;

- debit - the amount of the difference is subject to reimbursement from the budget.

VAT recovery

Sometimes VAT previously accepted for deduction needs to be restored. This happens in situations where, for example, goods purchased for resale are sold in a VAT-free activity. Also, the obligation to restore the tax arises when switching to a special tax. regime, when receiving subsidies from the budget, using a 0% rate, etc.

VAT recovery:

- Debit 19 Credit 68 VAT – recovery of VAT on inventory items

- Debit Credit 68 VAT – restoration of VAT on goods, materials and fixed assets in case of deviation from the norms of natural loss

- Debit 91.2 Credit 68 VAT – restoration of VAT on sold fixed assets

Accounting entries for VAT: valuables purchased

Tax on purchases is taken into account using the following entries:

| Operations | D/t | K/t | Base |

| Reflects the “input” VAT on purchased goods and materials, fixed assets, intangible assets, capital investments, services | 19 | 60 | Invoice |

| Write off VAT on production costs for acquired assets that will be used in non-taxable transactions. | 20, 23, 29 | 19 | Accounting certificate-calculation |

| Write-off of VAT on other expenses if it is impossible to deduct the tax, for example, if the supplier fills out the invoice incorrectly, or if it is lost or not received. | 91 | 19 | |

| VAT previously claimed for reimbursement on inventory items and services used in non-taxable transactions has been restored | 20, 23, 29 | 68 | |

| VAT deductible on assets | 68 | 19 |

So, VAT can be reimbursed from the budget only when purchasing assets/services that will be used in transactions subject to VAT. Otherwise (when the property will be used in non-taxable transactions), the amount of tax on these assets is written off as production costs (by analogy with accounting for companies that do not pay VAT).

Attribution of VAT to other expenses, in common usage - write-off of VAT (entry D/t 91 K/t 19) is carried out both in cases of impossibility of obtaining an invoice, and in case of non-production expenses incurred on business trips (for example, for additional services specified in railway tickets), writing off accounts payable, gratuitous transfer of property, expiration of the three-year period allotted for tax refund, etc.

VAT: postings for accrual and payment

With only one formal difference to Accrue VAT on transactions: It follows that, just like in the previous scheme, when reflecting these transactions according to the scheme just shown, we will not see a tax credit on the balance sheet if the date of compilation of the report occurs in that period of time, when the first payment event has already taken place, but the second posting has not yet taken place.

As a result, the reporting information turns out to be untrue, if not distorted. And all because we have not made it a rule to distinguish between two types of tax credits, as well as two types of tax obligations. Two types of tax credit 1.

https://www.youtube.com/watch?v=9GqFofQ7-4U

Accounted for by the debit of the subaccount This is a tax credit that Accrue VAT on transactions arises along with the capitalization of the receipt of goods and materials from the supplier or with the acceptance of work performed by the contractor. Moreover, regardless of what event in the “tax queue” this posting was: This is a tax credit that arises in accordance with taxation rules if the first event is the payment of orders for gastroenterology to the contractor, receipts.

This tax credit must remain in the subaccount until the advances issued are counted towards payment.

As these advances are counted into payment, in the same way, in parallel, a tax credit from the subaccount should be counted to the debit of the subaccount. Two types of tax obligations 1.

It can hardly be said that this entry reflects any unreal transaction, which, by the way, cannot be said about the reflections of the tax credit in the schemes just criticized.

Output VAT, formally documented in documents, is provided to the customer of work, services or the buyer of goods.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 90.03 | 76 | Accrual of VAT on the sale of goods, works or services upon payment | VAT amount | Invoice |

| 90.03 | 68 | Accrual of VAT on the sale of goods, works or services upon shipment | VAT amount | Invoice |

| 68.02 | 51 | Repayment of debt to the budget for payment of VAT | Debt amount | Bank statement |

Input VAT for any enterprise is usually considered to be the amount of tax reflected in expenditure documents when purchasing any assets.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 19.01 | 60 | Reflection of the amount of VAT on the acquisition of fixed assets (raw materials, goods and services for production) | VAT amount | Invoice |

| 19.02 | 60 | Reflection of the amount of VAT on the acquisition of intangible assets necessary for production | VAT amount | Invoice |

| 19.03 | 60 | Reflection of the amount of VAT when purchasing inventories necessary for production | VAT amount | Invoice |

| 68.02 | 19.01, 19.02, 19.03 | Presented for deduction of amounts for paid and capitalized goods and services (fixed assets, intangible assets and inventories) | Total VAT amount | Invoice |

| 90.03 | 68.02 | VAT accrued on sales of products and provision of services and works | Total VAT amount | Invoice |

The tax is levied on receipts from the sale of goods and materials, services, transfer of rights, production and construction work, as well as import operations. All of them must be carried out on the territory of the Russian Federation, i.e. Inventory and materials are stored or shipped in the Russian Federation, services provided by the company are performed there, and all points of departure are located in the country or territories under its jurisdiction.

If a company applies several rates, then accounting is kept separately, and when reporting, the data is summarized. VAT calculations are made using a declaration.

| Actions | D/t | K/t |

| VAT is accrued for payment to the budget in revenue. The entry is made on the date of sale. | 90/3 | 68 |

| VAT on other income | 91/2 | 68 |

| VAT paid | 68 | 51 |

| Actions | D/t | K/t |

| Advance received | 51 | 62(advances received (AP)) |

| VAT is charged on it | 76 | 68 |

| Upon shipment of goods, VAT can be deducted | ||

| Offset of advance payment for goods and materials under a transaction | 62(AP) | 62 (settlements under executed agreements (RIA)) |

| VAT offset on received advance payment | 68 | 76 |

If a company has made an advance payment to the supplier, then it can deduct input VAT provided that the advance payment is stipulated in the agreement and is fully documented - an invoice and payment slip for the advance amount.

| Actions | D/t | K/t |

| Advance transferred | 60(advances issued (AB)) | 51 |

| VAT deduction from the advance amount | 68 | 60 |

| Entries as of the date of capitalization of inventory items: | ||

| Received MC | 41 | 60 |

| VAT included | 19 | 60 |

| Offset of the transferred advance payment in full payment for the transaction | 60(RID) | 60(AB) |

| The VAT previously accepted for deduction has been restored | 60(AB) | 68 |

| Accepted for deduction of input VAT on supplied goods and materials | 68 | 19 |

When selling goods (works, services) subject to VAT, the accrual of this tax must be reflected in the accounting records.

Debit of account 19 - Credit of account 60 “Settlements with suppliers and contractors” (Credit of account 76 “Settlements with various debtors and creditors”)

VAT on purchased goods is included in the price of these goods

Debit of account 41 “Goods” - Credit of account 19 Also, depending on the situation, account 19 may correspond with accounts 10 “Materials”, 08 “Investments in non-current assets”, etc.

In this article, we will look at how VAT is accounted for in accounting and VAT entries reflected in accounting. Also here you will find an example of accounting for VAT on purchased and sold goods with transactions (calculation and reimbursement of value added tax).

To record calculations for value added tax, account 68 “Calculations for taxes and fees” is used. To account for VAT, a separate subaccount 68.VAT is opened, on the credit of which tax is accrued for payment to the budget, the debit reflects the payment of the tax, as well as the amount of tax sent for reimbursement from the budget.

How is VAT accounted for on account 68? What VAT accounting entries should an accountant make?

| Postings | Contents of operation |

| Dt 90 Kt 68 | VAT accrued on sales (postings) |

| Dt 51 Kt 62.2 | Advance credited |

| Dt 76 Kt 68 | Crediting the deposit to the DS from the received prepayment |

| Dt 68 Kt 76 | VAT offset, posting for prepayment received from the supply of goods, works, services |

| Dt 91 Kt 68 | VAT on gratuitous transfer of goods and materials |

| Dt 68 Kt 51 | Debt payment |

| Postings | Accountant's actions |

| Dt 60.1 Kt 51 | Transfer of advance payment to the seller |

| Dt 68 Kt 76 | VAT on prepayment is deductible |

| Dt 19 Kt 60.1 | Accounting for input tax on DS |

| Dt 76 Kt 68 | Restoration of tax amounts under DS from advance payment |

| Dt 68 Kt 19 | Deduction upon supply of goods and materials |

VAT is subject to:

- Sale of goods, services, works in Russia.

- Transfer of property rights.

- Production for own consumption.

- Construction and installation works for own consumption.

- Import operations.

In any case, the place of sale must be the territory of the Russian Federation. This means that the goods must be stored or located at the time of shipment in the Russian Federation, the services provided by the company must be performed in the Russian Federation or territories under its jurisdiction, the points of departure are the Russian Federation, etc.

To find the tax base for VAT, it is determined at the time of the day of transfer of goods to the buyer (provision of services, etc.), or at the time of receipt of funds for this sale. If the contract provides for advances, then the base will need to be calculated several times. In this case, estimated tax rates must be applied.

For transactions subject to VAT, it is necessary to prepare invoices or UTD. Documents are drawn up in two copies. They are recorded by the supplier and buyer in the sales and purchases ledger. Intermediaries performing transactions subject to VAT must keep a journal of invoices.

The tax is calculated separately for each rate if the company applies several. They are then added up to arrive at the total tax amount. VAT is calculated by filling out a declaration.

VAT on sales is accrued in the debit of account 90.3. For non-operating income – 91.2. The loan corresponds to account 68.

- Debit 90.3 Credit 68 – VAT on sales upon shipment

- Debit 90.3 Credit 76 – VAT on sales upon payment

- Debit 91.2 Credit 68 – VAT on non-operating income shipped

- Debit 91.2 Credit 68 – VAT on non-operating income paid

VAT on sales: postings

The sale of assets is accompanied by the accrual of VAT on the debit of account 90/3, on receipts from non-operating transactions - 91/2. Typical transactions for the sale of goods and other transactions with VAT will be as follows:

| Operations | D/t | K/t | Base |

| VAT charged: | |||

| — on sales (upon shipment) | 90/3 | 68 | invoice |

| — upon sale (upon payment) | 76 | 68 | |

| - for non-operating income (shipped or paid) | 91/2 | 68 | |

| — for construction and installation work carried out on a self-propelled basis | 08 | 68 | Accounting certificate |

| - for a gratuitously transferred asset | 91 | 68 | Invoice |

| - for the advance received from the buyer | 76 | 68 | Invoice for advance payment |

| VAT is credited from the advance payment (upon shipment) | 68 | 76 | Issued invoice |

| VAT paid | 68 | 51 | Bank statement |

VAT on advances issued

An organization has the right to receive a VAT deduction from advances transferred towards future deliveries if there is an SF and the contract specifies the condition for advance payment.

against the upcoming receipt of equipment, transfers an advance in the amount of 95,000 rubles.

VAT on advances issued by transactions:

| Dt | CT | Operation description | Amount, rub | Document |

| 60 | 51 | Advance transferred | 95 000 | Payment order ref. |

| 68 | 76(advances) | VAT is deductible | 14 492 | Book of purchases |

| 08 | 60 | Equipment accepted for registration | 77 900 | Invoice |

| 19 | 60 | VAT on delivery allocated | 17 100 | SF supplier |

| 68 | 19 | VAT is deductible | 17 100 | Book of purchases |

| 76(advances) | 68 | Recovered VAT from advance payment | 14 492 | Sales book |

VAT on reduction of sales value: postings

Often, disputes arise between counterparties after the shipment of goods regarding the value of the assets being sold. Any party can be vulnerable in such a situation, but more often this applies to the supplier. If he agrees to the price change, a sales adjustment is made. Let's consider the option of reducing the price of a product due to additional delivery.

Example:

An agreement was concluded between the two companies for the supply of products in the amount of 100 units for the amount of 500,000 rubles. + VAT 90,000 rub. The price of one product is 5000 rubles. + VAT 900 rub., cost price 3000 rub. After shipment, the supplier additionally supplied 8 products under the additional agreement. The sales adjustment in supplier accounting will be as follows:

Operations D/t K/t Sum Sales proceeds 62 90/1 500 000 VAT on revenue 90/3 68 90 000 The cost of goods sold is written off (3000 x 100) 90/2 43 300 000 The cost of products shipped additionally has been written off (3000 x 44 43 24 000 VAT charged on additional supply (5000 x 8 / 118 x 18) 44 68 6102 Payment received 51 62 500 000 A permanent income tax liability has been created (6102 x 20%)

99 68 1220

VAT penalties

In case of late payment of tax, the organization is obliged to calculate and transfer penalties for the delay. Penalties are calculated at 1/300 of the Central Bank refinancing rate independently, or as a result of a tax audit.

The calculated amounts of VAT penalties in accounting are displayed by postings:

| Dt | CT | Operation description | Document |

| 99 | 68 | The amount of the penalty is reflected | Accounting information |

VAT accounting when returning goods

Failed acquisitions are also reflected in accounting, but they are recorded depending on the reasons for the return.

- If the goods turned out to be defective, and this was discovered after posting, VAT is reflected by postings like this:

| Operations | D/t | K/t |

| From the buyer | ||

| REVERSAL VAT on marriage | 19 | 60 |

| REVERSE previously accepted for deduction of VAT on the amount of marriage | 68 | 19 |

| From the seller | ||

| VAT REVERSE upon acceptance of defects (if shipments and acceptance occur in the same tax period) | 90 | 68 |

| VAT REVERSE upon receipt of a defect in the next period | 91 | 68 |

- if the product is of appropriate quality:

| Operations | D/t | K/t |

| From the buyer | ||

| VAT accrual on returned goods | 90 | 68 |

| From the seller | ||

| Input VAT on return of inventory items | 19 | 60 |

| VAT is deductible on returned goods | 68 | 19 |

Accounting for input VAT and accepting it for deduction: posting

Organizations and individual entrepreneurs have the right to make the tax payable lower by reducing it by input VAT. This means that when purchasing, for example, goods that are used in the main activity, subject to value added tax, VAT, which is included in the price by the supplier, reduces the tax base. Also included in deductions are the amounts of taxes previously paid from prepayment from the buyer,

To receive a VAT deduction, purchased goods and materials (services, etc.) must be accepted for accounting, have supporting documents (invoice) and be used in activities with the main taxation system, which involves paying VAT.

Input VAT is reflected in the debit of accounts 19 and 68:

- Debit 19 Credit 60 – reflection of VAT upon purchase

- Debit 68 VAT Credit 19 – VAT deductible.

Dt 19 Kt 60.

Dt 68 Kt 19.

See also the material “What are VAT tax deductions?”

At the end of the reporting period, the balance on account 68 reflects the amount of the organization's debt for the corresponding tax to the budget.

In order to make an accounting entry for deducting VAT, the conditions for such a deduction must be met.

In accordance with the provisions of Art. 171 and 172 of the Tax Code of the Russian Federation, the right to deduct “input” VAT appears when several conditions are simultaneously met:

- Purchased goods (services or works) and property rights are intended for participation in transactions that are subject to VAT (Article 171 of the Tax Code of the Russian Federation).

- Goods (services or work) that were purchased by the taxpayer were registered by him (Article 172 of the Tax Code of the Russian Federation).

- There is a correctly executed invoice.

An invoice is issued by the supplier (seller) of the goods or the person who provided the service/performed the work. The counterparty issues such an invoice in accordance with the requirements of Art. 169 of the Tax Code of the Russian Federation.

Dt 68 Kt 19.

Such an entry is legal regardless of whether the “input” VAT was transferred to the supplier/performer or not. After all, according to the general rules, paying tax is not a condition for accepting it as a deduction.

| Postings | Operation description |

| Dt 19 Kt 60 | Accounting for input VAT on purchased goods, works and services |

| Dt 20 Kt 19 | Write-off of input VAT for those assets that, when used in production processes, are not subject to tax contributions. Such a record is made using a calculation certificate drawn up by an accountant. |

| Dt 91 Kt 19 | VAT on purchased assets was written off as other expenses due to a missing or incorrectly drawn up invoice |

| Dt 20, 23, 29 Kt 68 | VAT recovery - entries for inventories and services that are used for production procedures and are not subject to taxation |

| Dt 68 Kt 19 | For tax deduction |

Subaccounts taken into account for the loan These are tax obligations that actually arise along with the registration of the fact of sale, i.e., regardless of what event in the “tax queue” this transfer was: These are tax obligations that arise in accordance with the Accrue VAT transactions rules taxation if the first event is receipt of payment from the buyer or transaction.

These tax liabilities must be listed in the subaccount until the advances received are offset against payment. As these advances are counted towards payment, tax liabilities from the subaccount to the credit of the subaccount must also be counted in parallel. The latter is very important, because the reporting information must be truthful, complete and unbiased, otherwise the purpose of accounting will not be achieved.

The importance of hiring a temporary worker should not be downplayed by the requirements set forth by the Law of Ukraine “On Accounting and Financial Reporting.”

Even if this were not specifically mentioned in the Law, the accountant would still be obliged to fulfill this condition of completeness, truthfulness, etc. To charge VAT on the transaction credit So that accounting and reporting information regarding the reflection of the tax credit is truthful, complete and unbiased, and the information indicated in the VAT return, corresponded to the Rules for the sale of a share in an apartment only to the entries in the tax books of purchases and sales, but also to the entries in the accounting registers, and the Accrual of VAT transactions would have been more clear, i.e.

Of all the wiring shown in the diagram, perhaps one requires additional explanation: Meanwhile, this wiring in this situation can be considered as correct as possible.

| Actions | D/t | K/t |

| Receipt of goods (amount excluding VAT) | 41 | 60 |

| VAT included in the cost of goods and materials is taken into account | 19 | 60 |

| Action | D/t | K/t |

| VAT on the purchase of goods and materials | 19 | 60 |

| VAT deductible | 68 | 19 |

Briefly about the tax itself

VAT is an indirect fee, since it is not withheld directly from the taxpayer’s income, but from the amount of its purchase. Often, when purchasing equipment or other goods in a store, each of us saw the very bottom line indicating the amount of VAT.

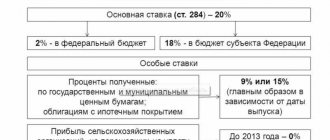

Most often it is equal to 18% of the cost of the product. This amount is added to the direct purchase of the product, therefore, in the end, the fee is paid out of the pocket of the end consumer. There are also preferential categories of taxpayers for whom the rate will be reduced - 10% or 0%.

Why do enterprises willingly work with partners and suppliers who are subject to the same tax system? The fact is that any manufacturing or trading company is obliged to transfer VAT on the amount of goods sold - this is called output VAT. In this case, the company issues a full package of documents:

- invoice,

- delivery note,

- tax invoice, where the amount of VAT will be indicated.

Read more: Personal property tax where to apply

But at the same time, any enterprise also purchases raw materials, materials or works, services. By purchasing all this from the same VAT payer, he receives his tax amount, that is, input VAT, which will be included in cost items.

When determining the tax base for calculating the amount of VAT, the payment amount can be reduced by the amount of input tax that was purchased as goods or work. In other words, the tax base will be:

Output VAT – Input VAT = Tax Base for calculating the tax amount.

Therefore, each enterprise strives to purchase as much goods as possible during the reporting period or order work with VAT.

Pension Fund

It is necessary to report on payments due for transfer and actually transferred for the purposes of compulsory pension insurance before the 30th day of the month following the quarter for which the report was prepared. The document is called “Calculation of insurance premiums” and is submitted to the inspectorate at the place of registration of the taxpayer.

Read more: Agreement using a safe deposit box sample

Payment deadlines – monthly, before the 15th day, you must pay off the obligations calculated for the previous month.

The amount of obligations to the budget for pension contributions is reflected in the credit of account 69.02 “Calculations for pension provision”, the following entries are made:

- Dt 20 (23, 25, 26, 44) Kt 69.02 - arrears on pension contributions are reflected;

- Dt 69.02 Kt 51 - debt to the pension fund has been repaid.