In a situation of conflict with the employer, it often becomes necessary to submit an application for work-related documents. What kind of documents are these, how to draw up a document and achieve results - we will tell you.

Work-related documents must be submitted when filing employment claims. These are cases about reinstatement at work, about the recovery of wages, about establishing the fact of work. The need to present such documents may also arise outside of court proceedings. To the bank, to obtain a visa, power of attorney from a legal entity, etc.

:

Application for work-related documents

What documents should be given to an employee upon leaving?

Article 84.1 of the Labor Code of the Russian Federation approves the conditions for termination of labor relations. On the last working day, the employer must give the dismissal a work book and finally pay it in accordance with Art. 140 Labor Code of the Russian Federation. In addition, subject to written request, he must provide signed copies of papers relating to the former employee. Thus, the Labor Code of the Russian Federation speaks of the unconditional issuance to the worker of all documents requested by him.

Article 140 of the Labor Code of the Russian Federation. Payment terms upon dismissal

Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the day the employee is dismissed. If the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed employee submits a request for payment.

In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer is obliged to pay the amount not disputed by him within the period specified in this article.

In case of dismissal, the company:

- Returns work and medical records.

- Issues a payslip, a salary certificate for the last two calendar years, extracts from the reports SZV-STAZH and SZV-M, a copy of section 3 of the calculation of insurance premiums for the employee, information from the register of insured persons in the form DSV-3 (in case of payment of additional contributions to the funded part of the pension).

- Issues documents at the request of the employee: 2NDFL, copies of orders for employment, transfer, dismissal, promotion, salary certificate for the employment service.

Certificate of salary form 182Н for the last two years

Starting from 2013, a certificate in form 182H can be replaced by form 4H - it confirms the income received by the employee, on which social insurance contributions were calculated.

At the same time, it also indicates periods when contributions were not accrued: the employee was on leave due to pregnancy (childbirth) or due to child care.

The certificate will be needed to calculate the amounts paid for sick leave, maternity leave, child care when assigning pensions and various types of social benefits issued as part of the social protection of the population.

How to make a request for certificates?

The application for the provision of the necessary papers and certificates is written with your own hand or printed on an A4 size sheet. You can borrow a company letterhead from the organization to fill out an application. Traditionally, a statement consists of 5 blocks:

- information about the addressee and applicant;

- Title of the document;

- formulation of a request or proposal;

- date of application;

- signature (what papers does the employee sign upon dismissal?).

In the upper right corner it is reflected to whom this statement is intended and, accordingly, from whom it is made. The official document is submitted to the official representative of the company, therefore, you need to indicate:

- the addressee's position;

- name of the enterprise;

- Full name of the head.

The addressee's position and name should be written in the dative case (for example, director Smirnov, vice-rector Semyonov).

In the message about the applicant, you must indicate your last and first name, and it is also worth indicating the position of the employee in the genitive case (for example, accountant Zolotareva). It makes no difference how you write: “accountant” or “from an accountant.” The second option is correct from the point of view of the Russian language, but the application will be accepted in any case. Writing without a preposition is already an established practice in business correspondence.

The same applies to writing the word “statement” - with a capital letter or a lowercase letter; you can compose a statement in different ways. Three versions of the spelling are common:

- The line begins with a lowercase letter and a period is placed after the word “statement”. This is a generally accepted design method. In this case, the name of the document, information about the addressee and the applicant are considered one sentence.

- A capital letter without a dot at the end. If the word “statement” is written in the center of the sheet, it becomes the name of the entire document. It follows the same rules as other headings.

- Without a period at the end and in capital letters. This type of editing is traditionally found when typing text on a computer rather than writing it by hand.

The text of the statement itself begins with a red line. You are writing a statement with a clear purpose, and you should convey here why you are contacting the addressee. State:

- grounds for appeal: “in connection with dismissal”;

- their demands: “to issue documents related to work”;

- evidence - provide a link to Art. 62 and 84.1 of the Labor Code of the Russian Federation.

You should adhere to a formal business style and write concisely.

The date of the application is indicated after its contents and is aligned to the left. You can indicate the number immediately after the word statement, this will not be a mistake.

The signature must be put in your own hand, even if the rest of the text is printed. Without the employee’s signature, any application may be considered invalid, since it is an important requisite.

Issuance of educational documents

The same applies to educational documents, if they are stored at the place of work. Diplomas confirming professional education are kept by the employee. All that is allowed is for the employer to familiarize himself with them and provide him with copies.

As for certificates certifying that a specialist has completed various types of advanced training courses, trainings, additional education programs, etc., especially if they are paid for by the employer, the documents can be kept by the employer in the original. As soon as an employee resigns, they are required to issue them to him.

There are situations in which an employee was denied the issuance of certain documents if the organization paid for them. We are talking about documents indicating completion of courses for forklift drivers, instructors in the field of tourism, etc.

Please note! This practice has no legal basis, so the employee can defend his rights by contacting the judicial authorities, the Prosecutor's Office, and the Labor Inspectorate.

Who to contact, in what form?

The Labor Code establishes quite a few cases in which an employee is obliged or has the right to contact the employer with an appeal. The law does not always determine whether communication should be oral or written, or whether a formal form is required.

An application for the issuance of documents must be submitted in writing. A verbal request will not allow the employee’s demands to be confirmed in the event of a conflict. The application must be registered with the clerk or the human resources department. If the organization has few employees, this can be done personally by the director or accountant. It makes sense to keep 2 copies with a note of acceptance.

The employer can use his right to receive documents at any time: both on vacation and during a period of temporary incapacity for work. In this case, he can send the application by mail. In this case, the application should be sent to the company by registered mail with notification. It is recommended that the applicant fill out an inventory of the attachment in order to avoid disagreements regarding the contents of the letter.

The procedure for receiving, processing and delivering registered letters is determined by Order 234 of the Ministry of Telecom and Mass Communications of the Russian Federation dated July 31, 2014. The fact that an employee has the right to fill out an application remotely is confirmed not only by the absence of a direct prohibition in the legislation, but also by the content of Rostrud’s letter dated September 5, 2006 1551-6, and also judicial practice.

You can submit your application along with your resignation letter or on your last day of work. You can apply for work-related documents even after dismissal - the employer will have to provide copies of documents related to the employee.

We recommend that you look at our other articles on the procedure for preparing documents such as a work permit and a letter of recommendation upon dismissal.

Employment history

The employee receives a work book with a notice of dismissal entered on it on the last day on which he performs his work duties.

Upon receipt of this document, the employee is required to sign in the reporting documentation - the Labor Code logbook and in the personal card.

If the employee was not at work on this last day (he was sick or there is another reason), then the work report should be sent to his home address.

In this case, the employee is notified in advance that he needs to pick up the Labor Code from the employer. An alternative should be immediately offered in the form of sending the book by mail.

If the book is sent by the postal service, then only a separate document can confirm the sending of the document - an inventory included in the shipment.

Deadlines for issuing documentation

According to Art. 62 of the Labor Code of the Russian Federation, the organization must issue the requested documents to the employee within 3 working days from the date of application. Copies must be properly certified and issued to the employee free of charge.

In Art. 84.1 of the Labor Code of the Russian Federation talks about the obligation of the manager, when dismissing an employee, to give him copies of documents at his request. The article does not specify a specific period. In any case, the employer does not have the right to prepare and certify copies of documents for more than three days.

If the employee is not given the necessary documents on time, the Labor Inspectorate may impose penalties on both the organization and the head of the enterprise. Fine under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation will be:

- from 30,000 to 50,000 rubles for an organization;

- from 1000 to 5000 for officials and individual entrepreneurs.

If the violation is repeated, the amount of the fine increases.

Let us give an example of how an employer in Khabarovsk was brought to administrative responsibility for late issuance of documents to a resigning employee.

The head of the company was found guilty of violating labor laws, since, contrary to the requirements of Art. 62 of the Labor Code of the Russian Federation, he did not issue copies of documents related to the work of the former employee within the established three-day period. In fact, the documents on the application for dismissal were transferred, but later.

The manager explained the non-compliance with the deadline for issuing the requested copies of documents by the fact that the employees authorized to carry out the relevant actions were temporarily absent. The court did not agree with this. Compliance with labor legislation cannot be made dependent on the presence at the workplace of an employee responsible for carrying out the instructions of the manager.

The head of the organization was sentenced to the minimum sanction under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation for officials - 1000 rubles.

Help on form 2-NDFL

Tax agents (which include employers) can issue a 2-NDFL certificate. The certificate is needed to confirm the income of the tax payer (if he is employed) and the amount of tax payment that is paid from the income received.

This document is needed under the following circumstances:

- tax service, when tax deductions are issued (they are provided exclusively through the inspectorate);

- to confirm income when submitting an application for a bank loan;

- in order to certify the profit (and amounts withheld from it) received in the new organization.

At a new place of work, a certificate will be needed if the employee needs:

- calculate paid sick leave;

- complete a regular tax deduction (including for a child);

- calculate other amounts of compensation or benefits provided.

There are other circumstances when it will be necessary to prepare this certificate. Therefore, the dismissed employee must immediately take care of receiving it.

It will definitely be needed. For example, a new employer, the Tax Inspectorate. Therefore, it is better to take several copies of documents for different payment periods.

Important! It should be borne in mind that if we are talking about an employer, then he will need data on income (paid taxes) for the last year, but if the certificate is being prepared for a bank, information for the last three months or six months is enough for him.

When preparing documentation for a deduction, the tax office needs data for the calendar year for which the deduction is issued.

If an employee was employed several times during a given year or received other income subject to personal income tax, then certificates will need to be collected for each tax agent.

A separate situation is when a taxpayer exercises his right through an employer to receive a deduction when purchasing residential real estate. In this case, income is accrued to the employee without levying tax payments.

If the employee resigns, he needs to obtain a document from the Tax Service in order to confirm his right to receive a deduction. With this document, he goes to the accountants of the new employer to receive a deduction for the new place of employment.

The entire package of documentation is sent to the Federal Tax Service, including the 2-NDFL certificate issued by each employer (tax agent).

Watch the video. The employer is obliged to provide the employee with copies of work-related documents free of charge:

How to submit a request?

- In the upper right corner of the sheet you need to indicate who the application is intended for (in the dative case): full name, position of the manager and name of the organization.

- Next, you should indicate who is submitting the application: full name, position, address and contact information.

- The title of the application is “Application for the issuance of work-related documents.”

- The text of the statement may be something like this: “In connection with the dismissal and on the basis of Art. 62 and 84.1 of the Labor Code of the Russian Federation, I ask you to give me documents related to my work, namely (indicate an approximate list of documents):

- a copy of the employment order;

a copy of the dismissal order;

- a copy of the promotion order;

- a copy of the employment contract;

- certificate of salary for the employment center;

- certificate in form 2NDFL;

- a certified extract from the work record book (read about what a copy of the work record book is and when a dismissed employee needs it here).

Date of application, signature.

What documents can be requested from the employer?

The list of documentation that directly relates to the work is listed in Art. 62 of the Labor Code of the Russian Federation, however, it does not provide for the names of all documents.

Here are just a few:

- order according to which the employee was hired (copy);

- an order on the basis of which a transfer to another position is carried out, where the employee will be assigned other responsibilities (copy);

- order by which the employee is dismissed from his position (copy);

- extracting data from TD;

- various certificates reflecting data on wages, insurance premiums (those accrued and paid in fact), duration of work in the company.

Each of these documents must be properly certified. Documents are required to be submitted free of charge.

A completed sample certificate of average earnings in free form

We apply for a loan

To obtain borrowed capital from a bank, for example, a loan to buy a car or a mortgage for a new home, you will also need to confirm your income level. Most banks and credit institutions have their own forms for certificates of earnings. However, they can be replaced by one unified form - 2-NDFL.

Please note that Form 2-NDFL will have to be requested from all places of work. If you receive income from other sources, for example, renting out living space, then it is more profitable for you to fill out a form from a banking organization, in which you indicate all types of income, and not just wages. Below is a salary certificate, a sample to the bank.

We confirm earnings in court

If the courts request information about your income, then prepare a document without fail. For example, such information may be necessary when calculating the amount of alimony or determining the amount of damage caused.

If you do not provide such information, the court may independently request information about average earnings or award payments based on standard costs, that is, based on the size of the minimum wage.

To submit information to the court, you can use the following sample certificate of average earnings:

Unified certificate form

For information on accrued wages for the previous two years, a unified form for a certificate of average wages is provided, which is approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. Let's look at how to fill out certificate 182n; you can download the form for free below.

IMPORTANT! Until July 2, 2013, for information about wages, a different form was used - certificate 4n. Therefore, if an employee provided information on average earnings for 2011, 2012 and 2013 on such a form, then there is no reason not to accept the information. During these periods, the form in Form No. 4n is considered valid. The employer also has the right to provide similar information for the specified periods in a free-form salary certificate (sample below).

What to do if the employer does not respond to the request

The organization has 3 working days to prepare the requested documents or a reasoned refusal to provide them. If an employee believes that he was given the wrong documents or not in full, he has the right to complain to the labor inspectorate or immediately go to court. You should also contact them if the employer ignores the appeal. He will be punished at least under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (the minimum fine under it for legal entities is 30,000 rubles).

Read more: Sample statement of claim for labor disputes in 2020

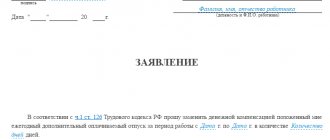

Application for provision of certificates upon dismissal sample

An employee’s application for the issuance of copies of work-related documents.

Upon a written application from the employee, the employer is obliged, no later than three working days from the date of filing this application, to provide the employee with copies of documents related to work (copies of an order for employment, orders for transfers to another job, an order for dismissal from work; extracts from the work record book; certificates of wages, accrued and actually paid insurance contributions for compulsory pension insurance, period of work with a given employer, etc.). Copies of work-related documents must be properly certified and provided to the employee free of charge.

Upon termination of an employment contract, the employer is obliged to provide the employee with a work book on the day of dismissal (the last day of work) and, upon the employee’s written application, copies of documents related to the work.

If it is impossible to issue a work book on the day of the employee’s dismissal due to the employee’s absence or his refusal to receive the work book in hand, the employer sends the employee a notice of the need to appear for the work book or agree to send it by mail.

From the date of sending the notification, the employer is released from liability for the delay in issuing the work book.

Information: - The last two paragraphs are excluded from Article 62 of the Labor Code of the Russian Federation.

Employee's application for issuance of copies of work-related documents

To the manager __________________________________ (name of employer) __________________________________ (full name of the manager) from Artem Aleksandrovich Rusinov Administrator of the legal blog RAA Law

(position, full name of employee)

APPLICATION for issuance of copies of documents related to work

In accordance with Art.

62 of the Labor Code of the Russian Federation, I ask you to give me duly certified copies of the following documents related to work: - employment order; — certificate of period of work; — orders for transfers to another job; — order of dismissal from work; and also: - an extract from the work book; - salary certificate; — a certificate of accrued and actually paid insurance contributions for compulsory pension insurance; — a certificate of the period of work with this employer; — explanatory notes on the basis of which the penalty was imposed.

(other)

___________________/________________________________ (signature) (full name)

In the event of termination of the employment relationship between the employer and the working citizen, the management side is obliged to issue the resigning person with all the necessary documents relating to the implementation of his professional activities in this company.

This obligation is regulated by Article 62 of the Labor Code of the Russian Federation. Also, upon dismissal, the employer must pay the employee all amounts of money due for payment.

To obtain employment papers, the employee must prepare an appropriate written appeal to the manager.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

What documents must be given to an employee upon leaving?

Information on the list of certificates and other documents that an employee has the right to demand from an employer upon dismissal is present in Article 62 of the Labor Code of the Russian Federation.

The Labor Code obliges the employer to issue the following documents to the worker upon dismissal:

- photocopy of the employment order;

- a photocopy of orders on the transfer of an employee to other positions (if any);

- photocopy of the dismissal order (executed in form T-8 );

- an extract from the work book of the person who resigned;

- various certificates about a citizen’s income for certain periods of time, about the transfer of funds to insurance organizations, the duration of professional activity with a given employer. Examples of such certificates can be documents of this nature - 2-NDFL, 182n .

Do I need to write?

In order to receive certificates (182n and 2-NDFL) in the event of dismissal, a citizen must draw up and submit a special application to the manager.

The employer, in turn, is obliged to provide the requested papers no later than 3 days after receiving a written request from the employee.

When submitting an application, an employee must pay attention to several factors:

- The application received by the employer must be recorded in the register of such papers.

- The employer must provide photocopies of the requested documents if issuing originals is not possible.

- The maximum period for providing papers is 3 days . Failure to comply with this condition is contrary to legal regulations.

- Indicating the purpose of issuing certificates is not a necessary condition that must be present in the application.

- Copies of papers must bear the company seal of the company and the signature of its chief executive.

- Providing certificates is free of charge . The employee does not have to pay for the issuance of papers.

After this, you should seek help from higher authorities involved in resolving such issues. Such institutions are the Labor Inspectorate and the Prosecutor's Office.

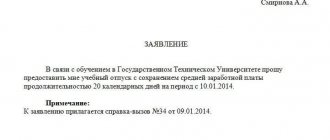

How to apply to receive 182 n and 2-personal income tax?

An application for the issuance of certificates is drawn up in any form. Be sure to include the following information:

- Company name;

- initials and position of the main manager;

- information about the applicant - full name, residential address and contact telephone number;

- Title of the document;

- main part. Description of the request. List of documents or copies that need to be obtained - certificate 182n (on income for 2 years for the assignment of sick leave benefits) and 2-NDFL (for correct accounting of deductions when calculating income tax from a new employer in the current year);

- reference to a regulatory act , according to which the employer is obliged to provide documents within the prescribed period. In this case, reference is made to Article 62 of the Labor Code of the Russian Federation;

- paper submission date;

- applicant's signature.