Taxes

Contrary to the popular opinion of some citizens, establishing a disability group does not impose a ban on employment. Behind

Intermediary agreements - general principles When concluding an agency agreement, the principal (principal) instructs for a fee

07/01/2019 0 319 4 min. Paying taxes is an obligation that applies to every employed person.

Home / CHILDREN'S BENEFITS AND BENEFITS Back Published: 03/27/2020 Reading time: 2 min

Tax Is personal income tax withheld from vacation pay? According to current legislation, any income that an individual receives

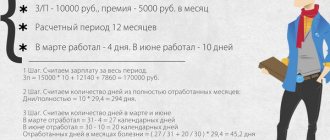

Home Accounting and HR Accounting Since salary is a separate type of remuneration

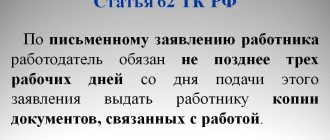

What payments are due upon dismissal? The Labor Code of the Russian Federation establishes three ways to terminate employment contracts: by

Obtaining reports on a citizen’s income for a certain period is possible by submitting an application for a certificate

Financial assistance in 6 personal income tax up to 4000 Also, financial assistance can be provided in the form

07/01/2019 0 317 4 min. Paying taxes is an obligation that applies to every employed person.