Taxes

Home Help Insurance premiums Every officially employed person has the right to annual leave. He

The amount of financial assistance for a child by court decision is regulated in accordance with Article 81 of the Family Code

Answered by professional private accountant, independent expert Alena Klikina: You can only return the tax paid earlier

Application for personal income tax deduction for children in 2021: form of the Unified Standard Form

07/17/2019 0 355 3 min. The professional activities of a large number of people are associated with daily work on a computer.

Information on the income of individuals from whom personal income tax is withheld is transmitted to the Federal Tax Service on a quarterly basis by organizations and

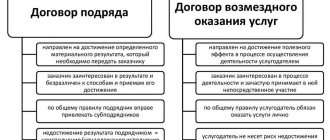

The difference between a service agreement and a work contract The main problem in drawing up a service agreement

Issues discussed in the material: Duration of vacation for workers in the Far North Calculation of length of service for

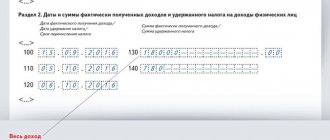

Why was personal income tax-6 invented? The taxpayer is obliged to submit to the Federal Tax Service a calculation of the accrued and transferred

When sending an employee on a business trip, the company’s accounting department employees have a question: what is the correct way to