Taxes

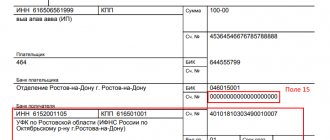

It is necessary to check payment orders in 2021. It is necessary to indicate new details of the Federal Treasury. Although

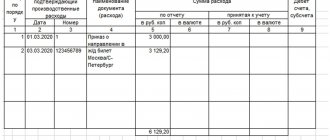

The company's advance reports are always of great interest to the inspection inspector. Tax officials on their visit

What needs to be paid to a resigning employee On the last day of work with the employee, payment must be made

In 2021, changes are planned to the Labor Code for Russians. And it's already known

UTII is an imputed tax “assigned by the authorities”, which does not depend on the income of the enterprise paying it,

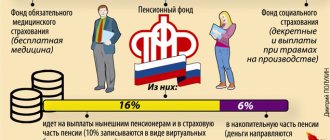

The maximum value of the base for calculating insurance premiums in 2021 Existing legal provisions that have

The amount of contributions depends on the employee's income. The standard rate for calculation is 22%. Maximum amount

The correction coefficient K2 affects the amount of the single tax on imputed income, taking into account various

Who needs to provide a 2-NDFL certificate? Certificate 2-NDFL will contain information about the income of individuals

What is a GPC agreement? The phrase “GPC agreement” stands for a civil law agreement. Usually he