About the general conditions and procedure for accepting work

Acceptance of work under a construction contract must be carried out in accordance with the provisions of the Civil Code of the Russian Federation (Civil Code of the Russian Federation), namely, Articles 720 and 753. In accordance with Article 720 of the Civil Code of the Russian Federation, the customer is obliged, within the time frame and in the manner prescribed by the contract, with the participation of the contractor, inspect and accept the work performed (its result), and if deviations from the contract are discovered that worsen the result of the work, or other shortcomings in the work, immediately report this to the contractor.

According to paragraphs 1 and 2 of Article 753 of the Civil Code of the Russian Federation, the customer, having received the contractor’s message about the readiness to deliver the results of the construction work performed under the construction contract, is obliged to immediately begin accepting it. The customer organizes and carries out acceptance of work at his own expense, unless otherwise provided by the contract.

Clause 4 of Article 753 of the Civil Code of the Russian Federation provides for the registration of delivery and acceptance of work performed under a construction contract, signed by both parties. If one of the parties refuses to sign the act, then a mark to this effect is put in it, and the act is signed by the other party.

What are the stages of acceptance of work under a construction contract?

- notification of the customer by the contractor about the readiness of the work result for acceptance;

- direct acceptance of work, i.e. inspection of their results by representatives of the parties;

- execution of an acceptance document (signing by the parties of a work acceptance certificate or execution of a unilateral act in the event of an unreasonable refusal by the customer to sign it).

It follows from the provisions of Article 711 of the Civil Code of the Russian Federation that the acceptance certificate is the basis for their payment.

The practice of applying Article 753 of the Civil Code of the Russian Federation by the courts is based on the fact that the contractor, when filing a claim to recover the price of work performed, must prove the fact that it was completed and delivered to the customer. In particular, paragraph 8 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 No. 51 (hereinafter referred to as the Review dated January 24, 2000) states that the basis for the obligation to pay for work performed is the delivery of the result of the work to the customer. In this case, the contractor does not have the right to refer to a unilateral work acceptance certificate if it is established that he did not notify the customer about the completion of the work under the contract and did not call him to participate in the acceptance of the work result.

A similar conclusion is contained in the Ruling of the Supreme Court of the Russian Federation dated August 24, 2015 No. 302-ES15-8288, according to which the contractor, in confirmation of the fact of completion and delivery of the work, must provide the court with evidence of the plaintiff’s notification of readiness to hand over the result of the work, as well as the acceptance certificate.

At the same time, the courts, based on the circumstances of the case, may accept other documents as adequate evidence of the completion of work. In particular, in Determination No. 305-ES15-3990 dated July 30, 2015, the Supreme Court of the Russian Federation indicated that certificates of completion of work are not the only means of proving relevant circumstances, and accepted as evidence of the completion of work an acceptance certificate signed by the customer and the general contractor, which reflected the work performed by the plaintiff.

You can develop the necessary forms yourself

There are no separate standard forms for intermediate delivery and acceptance of work and for delivery and acceptance of the final result of work (or the result of a stage of work provided for in the contract). In civil legislation, the form of the act of delivery of the work result by the contractor and its acceptance by the customer is not regulated.

Read more: Refund of personal income tax upon notification of property deduction

It follows from this that the parties to a construction contract have the right not only to establish the procedure for transferring the result of work by the contractor to the customer, but also to agree on the forms of documents with which they will formalize the transfer of the result of the work performed. As a rule, in practice, forms No. KS-2 and No. KS-3 are used for these purposes.

But if necessary, “final” forms of documents reflecting the full cost of the work can be developed independently and their use agreed upon in the contract. At the same time, we recommend using wording for the act that makes it possible to unambiguously determine that it confirms the customer’s acceptance of the result of work under the contract as a whole (or the stage provided for by the contract). For example, “Acceptance certificate of the result of work performed under the contract.”

This will allow you to correctly qualify transactions for tax accounting purposes.

September 2015

| Home » For entrepreneurs » Requirements for certificates of work completed in 2021 |

On registration of acceptance of work according to approved forms

As a rule, when registering the delivery and acceptance of work, the parties use unified forms approved by the State Statistics Committee of the Russian Federation (Resolution No. 100 dated November 11, 1999).

These forms include an act of acceptance of a completed construction facility ( form KS-11 ), which in its content is an act confirming the completion of work under the contract as a whole.

According to the above-mentioned resolution of the State Statistics Committee of the Russian Federation, the act of form KS-11 is the basis for the final payment of all work performed by the contractor in accordance with the contract.

Despite this form, most participants in contracting relations, when accepting work, are limited to the use of acts of the KS-2 form. This approach is quite understandable - in particular, the use of KS-2 acts is justified in the case of a separate contractor performing part of the work, upon completion of which the construction project as a whole is not accepted.

In addition, acts of form KS-2, as well as certificates of the cost of work performed and expenses (form KS-3), are often drawn up by the parties to the contract on a monthly basis in order to record the volume and cost of work performed for the corresponding period. Moreover, if the contract does not provide for the phased acceptance of work, the monthly execution of such acts is not evidence of the completion of the relevant work. This approach is confirmed, in particular, by paragraph 18 of the Review dated January 24, 2000, according to which intermediate acceptance certificates confirm only the completion of intermediate work for carrying out calculations. They are not an act of preliminary acceptance of the result of a separate stage of work, with which the law associates the transfer of risk to the customer.

At the same time, courts, as a rule, accept KS-2 forms precisely as acts of acceptance of work performed, i.e. as evidence of their completion and delivery to the customer.

Instructions for drawing up the acceptance certificate for completed work

- The first part of the act includes information about which document it is an appendix to (number of appendix, date, contract number). Then the word “act” is written in the middle and its essence is briefly indicated (in this case, “handover and acceptance of work”).

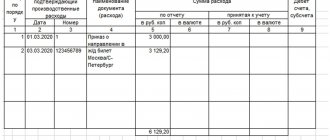

- The second part includes a table, but first the very fact of delivery and acceptance of work is recorded, as well as the document on the basis of which it took place (its name, for example, “Agreement”, number and date of its preparation).

- Then all types of work performed are entered into the table in order, indicating delivery dates, cost, quality, and customer comments.

The columns about the name of the work, quality and comments should be filled out especially carefully, since this information in the event of legal disputes will be the main arguments in court.

- Next, you need to add a clause stating that the work performed was checked and the customer has no complaints. If this is not the case, then in the paragraph below you need to describe in detail the identified shortcomings, as well as indicate the timing and procedure for eliminating them.

- At the bottom of the document you should indicate the name of the organizations party to the contract (in accordance with the constituent documents).

- And finally, the work acceptance certificate must be certified by the signatures of the heads of organizations or persons authorized to carry out this procedure.

- If necessary, the act can be certified with seals.

Read more: Documents required for registration of mat capital

After signing the acceptance certificate for the work performed, all claims can only be considered in court.

Record of acceptance

On unilateral acceptance of work

As stated above, paragraph 4 of Article 753 of the Civil Code of the Russian Federation provides for the possibility of issuing a unilateral act of acceptance of work in the event of the other party’s refusal to sign it.

In paragraph 8 of the Review dated January 24, 2000, also cited above, the Supreme Arbitration Court of the Russian Federation noted that the said norm protects the interests of the contractor if the customer unreasonably refused to properly prepare documents certifying acceptance. Accordingly, the contractor does not have the right to refer to a unilateral act in the absence of acceptance as such, i.e. in the absence of notification of the customer by the contractor about the readiness of the work result for acceptance.

According to paragraph 2 of Article 753 of the Civil Code of the Russian Federation, a unilateral act of delivery or acceptance of the result of work can be declared invalid by the court only if the reasons for refusing to sign the act are recognized by it as justified.

Commenting on this norm, the Supreme Arbitration Court of the Russian Federation in paragraph 14 of the Review dated January 24, 2000 indicated that the act drawn up in this manner is evidence of the contractor’s fulfillment of the obligation under the contract and if the customer refuses to pay, the court is obliged to consider the customer’s arguments justifying his refusal to sign act of acceptance of the work result.

At the same time, if there is evidence of the completion of the work and the actual acceptance of the result by the customer, failure to sign the work acceptance certificate in itself is not grounds for exempting the customer from paying the cost of the work performed (decision of the Supreme Court of the Russian Federation dated January 26, 2021 No. 70-KG15- 14).

On refusal of acceptance and challenging it

According to paragraph 6 of Article 753 of the Civil Code of the Russian Federation, the customer has the right to refuse to accept the result of work if deficiencies are discovered that exclude the possibility of its use for the purpose specified in the construction contract and cannot be eliminated by the contractor or the customer.

From this norm it follows that the very fact of the presence of some shortcomings in the work performed cannot be an unconditional basis for refusing to sign the acts and pay for the work. This conclusion is confirmed by Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 27, 2012 No. 12888/1, according to which the customer must provide evidence of a justified refusal to sign certificates of work performed.

In accordance with paragraphs 2 and 3 of Article 720 of the Civil Code of the Russian Federation, a customer who discovers deficiencies in the work upon its acceptance has the right to refer to them in cases where these deficiencies were specified in the act or in another document certifying acceptance or the possibility of subsequent presentation of a claim for them elimination. The customer who accepted the work without checking is deprived of the right to refer to its shortcomings that could have been established during the usual method of accepting it (obvious shortcomings), except in cases provided for by the contract.

Thus, the law establishes a general rule according to which the customer does not have the right to refer to obvious defects in the work if they were not declared upon acceptance and if they are not recorded in the relevant act.

At the same time, paragraph 13 of the Review dated January 24, 2000 provides for the possibility of the customer raising objections to the quality of the work, despite the presence of an acceptance certificate signed by the parties, if there is evidence of the validity of such objections. However, this paragraph concerns a case in which the contractor’s demands for payment for work were based on intermediate acceptance certificates of form KS-2 (the contract agreement provided for monthly payments on the basis of these acts).

Under these circumstances, the most correct position seems to be that the rules regarding the impossibility of reporting obvious deficiencies not recorded in the act are applied when accepting the result of the work as a whole. Deviation from such rules is permissible if the contractor presents demands for payment for work on the basis of interim acts of form KS-2, when the work as a whole is not completed and its result has not been transferred to the customer.

Requirements for certificates of work completed in 2018

Return to Certificate of Completion 2018

The certificate of completed work (services) is drawn up taking into account the requirements for the mandatory composition of details, the list of which does not contain requirements for mandatory reflection of the details of the work (services) performed.

Under a contract for the provision of paid services, the contractor undertakes to provide services (perform certain actions or carry out certain activities) on the instructions of the customer, who, in turn, undertakes to pay for them (Clause 1 of Article 779 of the Civil Code of the Russian Federation). According to Article 783 of the Civil Code of the Russian Federation, the general provisions on contracts, as a rule, apply to the said contract. They are given in articles 702-729 of the Civil Code of the Russian Federation. Thus, according to paragraph 1 of Article 720 of the Civil Code of the Russian Federation, the customer is obliged to accept the work performed (its result) within the time frame and in the manner prescribed by the contract. In this case, acceptance of services provided (work performed) is documented in the appropriate act.

According to the clarifications of the Russian Ministry of Finance in a published letter, in accordance with the current legislation, the act of completed work (services) is drawn up in any form, reflecting all the necessary details.

The required details of the primary accounting document are listed in paragraph 2 of Article 9 of Federal Law No. 402-FZ, these are:

• name of the document and date of its preparation;

• name of the economic entity that compiled the document;

• the content of a fact of economic life, the value of its natural and (or) monetary measurement, indicating the units of measurement;

• the names of the positions of the persons who made the transaction, operation and those responsible for its execution, or the names of the positions of the persons responsible for the execution of the accomplished event;

• signatures of the mentioned persons indicating their surnames and initials or other details necessary to identify these persons.

As we can see, this list does not contain requirements for mandatory reflection of the details of the work performed (services provided). This is what the financial department pointed out in the commented document.

However, in practice, tax services require more detailed clarification in the act of actions taken, including the availability of information about the period of their implementation.

The fact that tax authorities make complaints about insufficient detail of the types of services provided in the act is evidenced by extensive judicial practice. However, in most cases, arbitrators consider such claims to be unreasonable.

After all, the legal norms do not indicate with what degree of detail the content of the service should be reflected. This is evidenced, for example, by the decisions of the Ninth Arbitration Court of Appeal No. 09AP-22191, as well as the FAS Volga District in case No. A55-40076, the FAS Moscow District No. KA-A40/6672-10 and No. KA-A40/7049-09, FAS Volga district No. A55-9765.

Details of the services provided can confirm the economic justification of the costs incurred by the customer for its acquisition, as well as the connection of a specific service with activities aimed at generating income.

However, there are court decisions in favor of the tax authorities. Thus, in the resolution of the Federal Antimonopoly Service of the Volga Region No. A55-12359, the arbitrators came to the conclusion that the taxpayer did not submit all the necessary documents for a tax deduction.

The fact is that the presented report on the provision of consulting services is not detailed, does not contain data on the actual work performed (services provided), their volume and nature, the timing of their implementation and the results of the work performed.

And in the decisions of the Federal Antimonopoly Service of the Volga District in case No. A55-12359, the Eighth Arbitration Court of Appeal No. 08AP-7994, the courts noted the following. If the acceptance and transfer act does not disclose the content of the services provided, then the company, in confirmation of the fact of the actual performance of services, can submit documents indicating that the contractor has performed specific types of services and the result of each service in the form of a report, conclusion, etc.

Read more: EMERCOM battery operation card

Similar conclusions are given in the decisions of the Arkhangelsk Region Court in case No. A05-4792/, in case No. A05-7717, the Samara Region Court in case No. A55-17531, and the Yamalo-Nenets Autonomous District Court in case No. A81-2271.

Thus, the details of the services provided can confirm the economic justification of the costs incurred by the customer for its acquisition, as well as the connection of a specific service with activities aimed at generating income.