How much does an adoptive parent get paid?

Adoption is a procedure in which a court decision gives the rights and responsibilities of a son and parent to a stranger, a boy and an adult. A similar procedure for a girl is called adoption.

When a court decision on adoption enters into legal force, the child and adult become legal relatives. Therefore, the responsibility to provide for the child becomes entirely the responsibility of the adoptive parent. This is one of the main differences between adoption and other forms of family arrangement.

There are few special benefits and payments for adoptive parents. But they receive the right to all the benefits and allowances provided for blood families. Social support measures are provided at the federal and regional levels.

Let's take a closer look.

General terms

This year, adoptive parents will receive additional payments that are due to the biological parents of children. There are additional benefits intended to be paid to caregivers. The policy of the Russian Federation is purposefully moving towards improving the conditions for adoption. Innovations help minimize the number of children in orphanages waiting to be placed in a new foster family. The legislation is aimed at strengthening family ties and making the desire to go to an orphanage more justified. If the adoption concerns brothers, sisters, or two or three children belong to one family at the same time, the appropriate funds are paid.

Children dreaming of a family

The current year shows a decreasing trend in the return of adopted children to social institutions. At the same time, you can count on the help of psychologists, teachers and lawyers. What kind of work can a lawyer do, how much do they pay for it and who is suitable for this work during the preparation of this issue.

Federal payments

Federal payments are due to all adoptive parents who are citizens of the Russian Federation. However, some can only be applied for by citizens who have a certain level of income.

List of federal payments that an adoptive parent can receive:

- lump sum adoption benefit;

- maternal capital;

- monthly allowance for child care up to 1.5 years;

- monthly allowance for a child under 3 years of age;

- monthly allowance for a child from 3 to 7 years old;

- pensions and benefits assigned to the child before adoption.

Let's take a closer look at them.

One-time benefit

Payout Features:

- The benefit amount in 2021 is 18,004.12 rubles.

- The amount may be increased due to the regional coefficient.

- When adopting brothers and sisters, a disabled child or a child over 7 years old, the amount is 137,566.14 rubles.

- It must be taken into account that the adoption of 2 or more children under 7 years of age who are not siblings does not give the right to receive increased benefits.

- The payment is based on each of the adopted children.

- Can only be issued within 6 months from the date the court decision enters into legal force. If the deadline is missed for a good reason, it can be restored in court.

- The payment can be transferred only to one of the adoptive parents.

To receive the payment, you must contact the social benefits department at your place of registration or the accounting department at your place of work (service). In this case you need to prepare:

- passport;

- child’s birth certificate (new) and its copy;

- a certificate from the place of work (social protection department - for the unemployed, service - for military personnel and civil servants) stating that benefits were not assigned or paid to them;

- account details for transferring funds (when applying to social security);

- application for benefits;

- a copy of the court decision on adoption that has entered into legal force;

- documents confirming the relationship of children (in case of adoption of brothers and sisters);

- a copy of the ITU certificate (for adoption of a disabled person).

Funds are transferred within 10 days from the date of application.

Maternal capital

Adoptive parents can claim maternity capital if they have not used this right before. Starting from 2021, you no longer need to issue a maternity capital certificate yourself.

Upon receipt of a new birth certificate and adoption certificate from the Civil Registry Office, the information will automatically be transferred to the Pension Fund. The certificate is generated electronically, a notification about this is sent to your personal account on the State Services website.

If the adoptive parent does not have a personal account on the State Services website, then to clarify the information on the certificate, you need to contact the Pension Fund branch at the place of registration. If the information was not provided to them on time, then they will have to fill out the documents themselves.

The certificate amount in 2021 is:

- RUB 483,882 – if the person being adopted is the first born (adopted) child in the family;

- RUB 639,432 – if the family already had children, but the right to maternity capital was not used;

- RUB 155,000 – if the family already had children and the right to maternal capital was previously used.

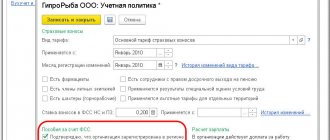

Monthly care allowance for up to one and a half years

When adopting a child under 1.5 years of age, the adoptive parent may qualify for benefits. The procedure for providing payments is regulated by Order of the Ministry of Labor and Social Protection of the Russian Federation dated September 29, 2020 No. 668n.

The payment has the following nuances:

- if the adoptive parent is employed, then the benefit will be 40% of the average monthly salary for the past 2 years, but not more than 29,600 rubles. 48 kopecks;

- if the adoptive parent is not employed, the payment will be 6,752 rubles;

- payment can be issued from the moment of adoption until the child reaches 2 years of age;

- if the deadline is missed for a good reason, it can be restored in court;

- if the payment is made after 1.5 years, then it is transferred in full for the entire period from the date of adoption until the child reaches 1.5 years.

Note! This benefit is not provided to citizens who receive unemployment benefits.

To apply for benefits you need to contact:

- to the accounting department at the place of work (for employed citizens);

- to the FSS branch (if the employing company is in the process of liquidation, bankruptcy, the employer does not have enough money or his location is unknown);

- to the social protection department (for the unemployed).

In this case you need to have the following documents:

- passport;

- child's birth certificate;

- child adoption certificate;

- birth certificate of the previous child (and adoption certificate for him - if adopted);

- a certificate from the place of work of the second adoptive parent stating that he was not assigned or paid benefits.

For the unemployed, you will additionally need a copy of your work record book. When applying to the Social Insurance Fund, you must attach an extract from your work record book.

Monthly benefit up to 3 years

The payment is provided for families in which the adopted child became the first or second child.

Payout Features:

- the payment amount is equal to 1 subsistence level in the region;

- family income should not exceed 2 subsistence minimums for each family member;

- for the first child, the payment is transferred from the federal budget, and documents are submitted to the social protection department;

- for the second child, the payment is transferred from maternity capital, and the documents are submitted to the Pension Fund;

- an application for payment can be submitted at any time before the child turns 3 years old;

- if the application is submitted within 6 months from the date of birth of the child, then the period from the birth of the child to the submission of the application is also paid;

- if the application is submitted 6 months after the birth of the child, then it is appointed from the moment the application is submitted;

- the right to payment must be confirmed annually (when the child reaches 1 year and when the child reaches 2 years).

Until March 1, 2021, you do not need to confirm your right to payment of child care benefits for children under 3 years of age.

Monthly benefit from 3 to 7 years

Monthly benefits for families with children aged 3 to 7 years are provided only to families whose average per capita income does not exceed 1 subsistence level in the region. And when adopting, a citizen must prove that his income exceeds the subsistence level for each family member and for the adopted child.

But the financial situation in the family may change. In the event of a decrease in income, the adoptive family has the right to apply for benefits for families with children aged 3 to 7 years. The procedure for paying benefits is regulated by Decree of the Government of the Russian Federation dated March 31, 2020 No. 384.

Payout Features:

- is 0.5 of the subsistence minimum established in the region;

- if 0.5 of the subsistence minimum is not enough for the family income to reach the subsistence minimum per person, then the amount of the payment is increased to the full subsistence minimum;

- family income is taken into account before taxes;

- income is taken into account for a period of 12 months before applying for benefits;

- the family includes the applicant, his spouse and minor natural and adopted children;

- You can arrange the payment through the social protection department, through the MFC or the State Services portal.

Tax benefits

When understanding what is required when adopting a child, do not forget about the procedure for reducing the tax burden for citizens with children.

It is the same for biological and adoptive mothers and fathers. The amount of taxable income is reduced:

- by 1.4 thousand rubles. upon adoption of the first and second baby;

- for 3 thousand rubles. - third and subsequent ones;

- by 12 thousand rubles. - for accepting a disabled child into the family (for each).

Attention! Preference is granted at the place of duty. To obtain it, you must contact the enterprise administration with the relevant documents:

- children's birth certificates;

- certificate of disability of a son or daughter.

Download for viewing and printing:

Tax Code of the Russian Federation (part two) dated 05.08.2000 N 117-FZ.doc

In the regions

Please note that payments for adoption in each region may differ. Here, their own rules are dictated - payment of payments, charges, depending on local authorities. Considering the capital's rate, we note that on average the regional capital per adoptive parent will be based on the amount of 100,000 rubles.

If a child is adopted by people living in Moscow, you can additionally expect the following payments:

- A one-time payment, the amount of which is 30,000 rubles. The address for transferring benefits is determined individually. The account of the adoptive parents is used, possibly the account of the adopted child.

10,000 rubles in the form of monthly assistance to parents for raising a child. By the way, the payment of 10,000 rubles is relevant for families who fully fulfill all the responsibilities of adoptive parents - they are involved in raising children, and can provide an annual report on the living conditions in which the adopted child lives.

Rights and obligations

After entering into a family relationship, certain responsibilities are imposed on the parents and the child. Thus, parents are obliged to :

- maintain the child in material prosperity;

- cultivate cultural, moral and physical qualities;

- provide secondary education;

- do not cause harm to health.

Children, in turn, should:

- grow and develop in the family;

- contact parents and all relatives.

We will not discuss pampering, pranks, running away from home, and other pranks.

Guardianship and adoption

Having found out what payments are due to guardians, it would not hurt to find out in what cases it is possible to obtain the right to adopt a baby from an orphanage. At first glance, the operation seems to be quite simple, because the state benefits when children are in families. But still the process itself is not so easy. So what is necessary to place a child in a new family?

The legislation of the Russian Federation gives the right to care:

- a specific baby;

- selected from specialized places of guardianship authorities.

Conditions that potential parents must meet:

- must not have a criminal record for committing serious acts (except for persons exonerated from criminal liability on rehabilitation grounds);

- must be of legal age and legal capacity;

- are not deprived of parental rights in relation to other children:

- do not have diseases that are contrary to the law;

- must not be of the same gender;

- mandatory possession of living space for registering a child.

But these are not all the conditions, since the last word still remains with the guardianship authorities. For proper upbringing and pedagogical approach, future parents must undergo a “school for adoptive parents.”

The next step will be collecting documents, namely:

- certificate of no criminal record - obtained from the police department;

- health certificate - issued after undergoing medical examination;

- Form 2-NDFL - issued at the place of work;

- extract from the house register;

- certificate of ownership of real estate;

- written consent of biological parents (if any);

- for children over 10 years old, their consent will be required.

Having collected the necessary documents and certificates, they are submitted to the guardianship authorities. Within 10 days, guardianship staff will come and inspect the standard of living and living conditions. After which an act is drawn up and a claim is filed in court, since the case is heard there. And the law comes into force only after 30 days from the date of the decision.

People with many children will not receive anything

Young families received the news more than joyfully - the new source of income can be used to pay off a mortgage or car loan, extend maternity leave and other needs. But upon a more careful reading of Law No. 418-FZ, which regulates the payment, the joy disappears - at least for parents of two or more children.

It turns out that only the parents of the first-born child will be paid from the budget. For families with a second child, the allowance will be deducted from maternity capital. And parents who have a third child (fourth and beyond) will receive nothing at all except standard payments.

The subsidy is also available to those parents who adopt a child in 2018, regardless of his age. But if this is the second child in the family, benefits will also be taken from maternity capital.

Per month

Until the age of one and a half years, his new parents receive monthly payments, in the same way as ordinary families. The amount of payments is 40% of the average salary for the last year. If the parent has not been officially employed for the last 12 months, a fixed benefit payment amount is applied. The minimum amount of this payment is currently 2576 rubles. For one, the base rate is 1,500 rubles.

Interesting to know: Jobs for retirees

If you adopt at least two children, the amount of the benefit will increase to 5,153 rubles. The base rate is 3000 rubles. Payments are made monthly on fixed dates. From the age of one and a half to three years, every month parents will receive approximately 50 rubles per child, taking into account the regional coefficient.