There has always been a labor relationship and discipline between employee and employer.

Some people want to devote as much time as possible to relaxing, communicating with colleagues, drinking coffee and discussing the latest gossip. Others insist on working hard to achieve maximum productivity and efficiency. Labor legislation, which regulates work and rest standards, provides for all kinds of liability for non-compliance with them, allows maintaining the balance of power between these two parties.

Right to rest during the working day

Art. 108 of the Labor Code of the Russian Federation provides for the right to rest for all employees. It should be at least 30 minutes, but not exceed 2 hours in total. This time is not counted as work time.

Each company has the right to independently develop a schedule, which will include the time of work of an employee of a certain specialty, rest, and also reflect the interval for each of the breaks. The most common use of rest breaks is during lunch. At the discretion of the manager, he has the right to increase or reduce it.

When applying for a job, an employee must be familiar with the established labor regulations.

Separately, smoking breaks during working hours are not allocated under the Labor Code, but they have the right to spend the provided break at their own request, including on smoking breaks.

When hiring, many companies ask you to indicate bad habits in your application form, including smoking, how often and how many cigarettes a day the candidate smokes.

The company is required to create separate smoking areas for such employees. Large holdings have begun to pay more attention to this problem and are fighting in every possible way for a healthy lifestyle, motivating employees to give up the bad habit.

What breaks are included in working hours?

In Art. 91 of the Labor Code of the Russian Federation, working time is defined as the duration of the employee’s performance of his job functions, as well as other periods classified as working periods in accordance with the law. As the latter, in accordance with the provisions of Part 2 of Art. 109 of the Labor Code of the Russian Federation, additional breaks during the working day are recognized, which is obliged to provide in connection with the peculiarities of technology and labor organization. The procedure for their provision is necessarily fixed in the internal labor regulations.

The list and duration of regulated breaks are not clearly established . Their list is open , and for some of them only a minimum time is defined.

The main prerequisites for their provision are:

- Performing work in unfavorable temperature conditions (extreme cold or, conversely, exposure to high temperatures).

- Presence of unfavorable harmful and dangerous factors during work.

- Working under heavy physical exertion during the labor process.

- Monotonous work at the computer or when processing large amounts of data obtained through information networks.

- Other cases when it is necessary to maintain the normal performance of personnel and ensure uninterrupted production.

Most of them are defined as a technical or technological interruption in work. In addition, special time is allocated for working mothers to feed their babies.

Break for rest and food

Let us remind you that rest for meals is provided for by the legislation of the Russian Federation. Its exact beginning and end are determined by the head of the company by internal act.

Since this time is not working time, the employee can dispose of this break at his own discretion:

- go to lunch;

- go home;

- meet friends, etc.

It happens that an employee, due to the nature of his work, does not have the opportunity to have lunch at the allotted time. In such a situation, the employee has lunch during any other free time, this rest is credited to him and is subject to payment.

The legislator has established different labor regimes in regulations; also, the head of the company can approve several more options, depending on the category of employees.

The main thing to remember is that the lunch break should be at least half an hour.

Another feature is provided; it is as follows: the manager approves only the total time of the break, without indicating its beginning or end. The worker uses it at his own discretion, whether he spends it at once, divides it into several short periods, or maybe even uses this time for work activities.

04.02.2021Who and when can submit the “zero” RSV - Calculation of insurance premiums?

The organization does not conduct business activities and does not accrue or pay wages to individuals. The Ministry of Finance spoke about whether she needs to submit “zero” reporting on contributions and how to fill it out in a letter dated January 26, 2021 No. 03-15-05/4460.

04.02.2021When are funds received from a 100% owner included in income?

We all know that funds received from the owner are not subject to income tax if he owns 50% or more of the authorized capital of the company, not to mention all 100%. There shouldn't be any doubts here. But, as can be seen from a recent court decision, there is an exception if the owner turns out to be not entirely “suitable”.

04.02.2021How to track the completion of the electronic register in the Social Insurance Fund for the assignment of benefits?

From January 1, 2021, benefits are paid directly from the Social Insurance Fund. However, this does not mean that employers are relieved of the responsibilities associated with their appointment and payment. They must prepare and send to the Fund the documents necessary to pay benefits to the employee.

04.02.2021The situation in the Russian business environment in 2020

The self-isolation regime and the need to move business remotely blocked the activities of many entrepreneurs. They were not prepared for the need to rebuild business processes as quickly as possible and transfer employees to remote work. As a result, their revenue has decreased significantly.

04.02.2021Summing up the bankrupt results of the year

Data for 2021 showed a reduction in the number of company bankruptcies; the figure decreased by almost 20% compared to 2021. How many companies have closed, on whose initiative the enterprises were declared bankrupt, and will there be a jump in the number of insolvency filings after the restrictions are lifted, did Calculation magazine find out?

04.02.2021What to do if you do not agree with the tax amount from the inspectorate?

Soon we will all have to start putting into practice the innovations that have been introduced this year regarding the transport tax. We don’t submit a tax return, but we calculate it ourselves and pay it on the new deadline. And only then misunderstandings may begin when in the paper received from the tax office we see the amount of tax that it calculated. There could be several options for action.

04.02.2021When do you need to submit an updated RSV?

If you find an error in the submitted calculation of insurance premiums due to which the premiums were underpaid, be sure to submit an amendment. Several situations have been established when an employer is required to submit an updated DAM.

04.02.2021How much will the state fee be charged if the court reduced the penalty?

The price of the claim includes the penalties, fines, penalties and interest specified in the statement of claim. This leads to an increase in the amount of the state duty that must be paid to consider the case in court. But if the penalty is collected in a smaller amount, is it necessary to recalculate the legal costs in proportion to its reduced amount? The Supreme Court decided on this issue.

04.02.2021The company gives employees discounts on its products: what about personal income tax?

Employees can buy company products at a discount. Is this income subject to personal income tax?

04.02.2021The idea of a “four-day week” has gained popularity

The four-day working week proposed by former Prime Minister Dmitry Medvedev is popular with almost half of Russians. According to the survey, the number of supporters of the changes has increased by 8% since October. Many people think that they can handle their workload in four days instead of five.

03.02.2021The company has discovered a bad debt: how to account for it for income tax?

An organization has identified a bad debt that it had not previously taken into account by mistake and wants to include it in its income tax calculation. The error resulted in an overpayment of tax. The Federal Tax Service spoke about the period in which the organization can take into account the identified debt in a letter dated December 7, 2020 No. SD-4-3/ [email protected]

03.02.2021What and how is taken into account on the balance sheet?

Special business objects are registered in off-balance sheet accounts in accounting. These may be values that do not belong to the company, but are temporarily at its disposal and use, as well as those that serve as security for its obligations. Let's talk about this in more detail, since information about off-balance sheet items must be disclosed in the explanations to the annual financial statements.

03.02.2021Under what conditions can a preferential VAT rate of 10% be applied?

When selling products of its own production, the organization paid VAT at a preferential rate of 10%. But the tax authorities did not agree with this and added additional taxes. In their opinion, VAT should have been calculated based on a rate of 20%. The dispute went to court, but the judges took the side of the tax authorities.

03.02.2021The story of one case: why did the judges reduce the fine by 100 times?

The company was late with the transfer of personal income tax to the budget. For violating the deadline, the auditors fined the company one and a half million rubles. But the judges considered that the punishment was disproportionate to the offense, and reduced the size of the sanctions by 100 times. The editors of the magazine "Recalculation" read the resolution to understand the logic of the arbitrators.

03.02.2021Why do the income figures in the VAT and profit declarations not match?

The coincidence of taxable income figures in VAT and income tax returns is the exception rather than the rule. In practice, they most often do not coincide, and there are objective reasons for this. Let's find out why this happens.

03.02.2021When to take the SZV-TD in February and what will happen if you are late?

In February, an organization may need to submit several reports using the SZV-TD form. Let's figure out in what cases such a need arises.

03.02.2021Ministry of Labor: what should the order on transfer to remote work in 2021 contain?

On January 1, 2021, amendments to the Labor Code that relate to remote workers came into force. The Ministry of Labor of Russia, in letter dated December 24, 2021 No. 14-2/10/P-12663, explained how an employer can draw up an order to transfer employees to remote work.

03.02.2021How to get a standard personal income tax deduction for a child?

Every working parent has the right to a standard “children’s” deduction for personal income tax. Up to what age is it provided to the child and how to get it?

03.02.2021The Supreme Court ordered the authorities to sell the building to business

The company decided to exercise the pre-emptive right to purchase federal property provided for in the lease agreement. But neither the Federal Property Management Agency nor the courts allowed her to do this. The Supreme Court intervened (ruling dated 02/01/2021 No. 301-ES20-17874).

02.02.2021What the Federal Tax Service will not like about your partner and will lead to a refusal of VAT refund

The organization entered into several contracts for the supply of goods and declared VAT deductible on them. The Inspectorate considered the contracts fictitious and refused to refund VAT.

But the court considered all the circumstances of the transaction and sided with the company. 1 Next page >>

Types of breaks at work

Legislative acts provide for several types of possible break intervals at work. They depend on the specifics, severity of the work performed, as well as the conditions in which the workers find themselves, when such periods are considered working and must be paid.

Breaks are divided into the following categories:

- lunch and rest;

- rest and recuperation in bad weather conditions;

- time to be able to feed the baby;

- special types.

Break for warmth and rest

It is given to those employees whose working conditions involve heavy physical labor, as well as in adverse weather conditions. Such employees should be given a special work schedule and be provided with adequate space where workers can regain their strength and warm up. It is necessary to take into account that such break time must be counted as working time, entered into the time sheet, and subject to payment.

Workers who are entitled to rest for heating and food include:

- those performing labor functions in the cold or in buildings where there is no heating (builders, janitors);

- loaders with heavy physical exertion, etc.

Baby feeding break

For employees who decide to start working before the child is 1 year and 6 months old, the manager must allocate additional time so that she has the opportunity to feed the baby. The same opportunity should be given to single fathers or guardians.

Many employers are not very willing to agree to such breaks; the majority of them first try to find some reasons for refusal and not allocate another break; they ask questions about feeding, whether the child is fed breast milk or artificial formula.

If a woman for some reason cannot breastfeed her child and gives him artificial formula, on this basis the employer sometimes tries to refuse to allocate additional rest time; this is regarded as a direct violation of the labor legislation of the Russian Federation on the part of the employer.

The time to be able to feed the baby should be as follows:

- the family is raising a single newborn under the age of 1 year and 6 months, the opportunity to feed the child should be within 30 minutes after every three hours of labor;

- If there are two children or more under the age of 1.5 years in a family, then the opportunity to feed takes from one hour.

Such a break must be included in the time sheet and paid according to average earnings.

At the request of the worker, she can submit an application with clarifying points regarding the breaks provided:

- ask to combine an extra break and your lunch time;

- combine and assign breaks with the opportunity to feed the child to the beginning or end of the working day, shortening it.

To properly secure such a break, the employee must submit to the HR department:

- statement;

- a copy of the child's certificate.

An order must be issued for the employee to allocate time for the opportunity to feed the child, taking into account all additional nuances at the request of the employee.

Special breaks

Personal breaks

Breaks to go to the toilet, smoke, chat with a colleague over a cup of coffee or tea are not established by the legislator, but in all kinds of methodological recommendations, in order to reduce the level of employee fatigue and increase productivity, it is necessary to give such breaks for 10–20 minutes. Such rest time can be reflected in the company’s internal regulations. Some companies go further and equip a special room in the office space where their employees will fully rest and replenish their strength.

Technical break

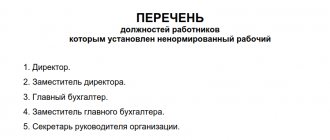

Necessary for workers working with all kinds of equipment. These can be either workers who perform duties at the computer for a long time, or employees who work in production, and most of the time they are behind the conveyor belt. The employer must allow a break of 10–15 minutes, and the total rest time per day should be 50–90 minutes.

A technical break is also necessary:

- air traffic controller, he must interrupt his activities for 20 minutes. after two hours of labor;

- for a driver on intercity flights, he must stop for 15 minutes en route. 3 hours from the starting point and after two hours on the road;

- workers involved in the production of alcohol, juice, yeast;

- workers working with fire-resistant coatings are given the opportunity to rest for a period of ten minutes every working hour;

- whose work involves transporting goods on railway tracks and using respiratory protection equipment, rest must be at least 15 minutes at a remote distance from a place where it is possible to remove the protective equipment;

- employees of postal offices and cadastral chambers who receive citizens and provide consultations.

The above list is not exhaustive; the manager has the right to establish by internal act other positions that provide for a mandatory break to maintain health, efficiency and uninterrupted performance of work functions.

Whether such rest time will be counted as working time and whether it will be paid is up to management to decide.

Other technological and technical breaks

In document MP 2.2.9.2311-07 2.2.9. “The health status of workers in connection with the state of the working environment. Prevention of stress in workers during various types of professional activities. Methodological recommendations” (approved by the Chief State Sanitary Doctor of the Russian Federation on December 18, 2007) provide other cases when it is recommended to provide a technical break to workers.

For example, it provides recommendations for manual workers :

- 2-3 breaks - for local physical activity lasting 15-20 minutes during the shift;

- 3 breaks - with regular physical activity lasting 20-25 minutes ;

- during general physical activity, it is also recommended to introduce at least 3 breaks with a total duration of 35 minutes .

For those working 12 hours with high work intensity, it is recommended to establish 4 regulated breaks with a total duration of at least 40 minutes .

When determining the time a work break takes, employers can be guided by these recommendations and, on their basis, develop their own rest standards, enshrining them in the internal labor regulations.