About the calculator for calculating payment for downtime

Downtime as a phenomenon is a purely production problem, manifested in a temporary suspension of the normal activities of the enterprise.

The Labor Code of the Russian Federation identifies four possible causes of downtime. The basis for differentiating the three of them is the principle of guilt, namely:

- employer's fault;

- employee's fault;

- the fault of third parties, such as a contractor, supplier, forwarding company, electricity supplier, etc.;

The fourth type of downtime is caused by events that do not depend on the will or desire of the employer and employee. As a rule, such events mean force majeure.

Whatever the reason for the downtime, it affects the employee’s wages. At the same time, he will be able to claim payment for downtime only if the fact of downtime is not his fault.

Declaring downtime is a way to maintain production and employees during a period of temporary suspension of work. However, its introduction raises many questions. When can you declare downtime? For how long? For how many employees? Can the lack of orders be considered the employer’s fault, and how can the temporary suspension of work be paid for in this case? Can idle time pay be less than the minimum wage (minimum wage)?

What is simple?

Downtime is a temporary suspension of work for reasons of an economic, technological, technical or organizational nature (Article 72_2 of the Labor Code of the Russian Federation, hereinafter referred to as the Labor Code of the Russian Federation). Thus, the reasons for downtime can be completely different: equipment breakdown, short supply of components, a drop in demand for goods produced by the organization, etc. During a crisis, as a rule, economic difficulties faced by the employer can lead to downtime.

What is the legal significance of the reasons why downtime is possible?

1. The employee may not agree that there is no work for him, i.e. challenge the very fact of the existence of reasons of an economic, technical, technological or organizational nature that entail a temporary suspension of work. In this case, the employee has the right to file a complaint with the labor inspectorate or the prosecutor's office, or go to court with a claim to recognize the order to send him to idle time as illegal, to oblige the employer to allow him to work, to recover the difference in payment for idle time up to the full average earnings on the basis of Art. 234 of the Labor Code of the Russian Federation, which provides for the employer’s obligation to compensate the employee for the earnings he did not receive in all cases of illegal deprivation of his opportunity to work. It should be borne in mind that when contacting the labor inspectorate and/or the prosecutor's office, most likely, these authorities will consider that there is a controversial situation that only the court can finally resolve and will also recommend that you file a lawsuit. What may be the factual basis of your claim? – You need to look at the situation. You can find out the amount of work of your colleagues who are not idle, compare your situation with those who are also not working, etc. This may not be easy, but there can only be one piece of advice here: stock up on evidence of the illegality of sending you to simple detention in advance, before the trial. Depending on the situation, you can also refer to the fact that you were sent to idle time for some fixed date: this can also be argued, arguing that at any time new contracts with suppliers and clients may appear or the negotiations that have begun may be completed and etc., i.e. that it is virtually impossible to foresee in advance how long the downtime will last. Having assessed the situation, or better yet, received specialist advice, weighing all the risks, you can go to court.

2. Downtime may occur in the normal course of events: the component supplier turned out to be dishonest and delayed delivery. On the other hand, emergency circumstances can also lead to downtime, namely: a natural or man-made disaster, industrial accident, industrial accident, fire, flood, famine, earthquake, epidemic or epizootic and any exceptional cases that threaten life or normal living conditions of the entire population or part of it (part 2 of article 72_2 of the Labor Code of the Russian Federation). If the downtime is caused by the specified emergency circumstances, then it is possible to temporarily transfer the employee without his consent for a period of up to one month to a job not stipulated by the employment contract with the same employer (for more information about this transfer, see below).

Temporarily no work during a crisis - what should an employee do?

So, during a crisis, economic reasons usually lead to downtime. However, since downtime entails providing employees with payment (as a general rule), as well as a number of guarantees, employers often resort to various violations of the law. In case of economic difficulties, the employer has several legal options:

1) carry out a reduction in numbers or staff; 2) issue an order for downtime; 3) if economic reasons lead to a change in organizational or technological working conditions (changes in equipment and production technology, structural reorganization of production, etc.), which, in turn, leads to the threat of mass layoffs of workers, the employer, in order to preserve jobs has the right in accordance with Art. 74 of the Labor Code of the Russian Federation to introduce a part-time working regime for up to six months. The third option is not considered in this article.

In the first case, the employer decides that it is impossible to retain employees; in this case, his right to reduce the number or staff is recognized by the legislator. The decision on the advisability of such actions is made by the employer’s body, which has such a right in accordance with the constituent documents; the validity of this decision cannot be challenged in court or when contacting government agencies (labor inspectorate, prosecutor's office). The trade union can influence this decision and its consequences to some extent: when making a decision to reduce the number or staff of employees and the possible termination of employment contracts with employees, the employer is obliged to notify the elected trade union body in writing no later than two months in advance (if possible). mass layoffs - no later than three months) before the start of the relevant activities. The indicated deadlines for warning the trade union committee, in fact, coincide with the deadlines for warning the employees themselves about their dismissal: the employer is obliged to notify the trade union committee no later than two months before the termination of employment contracts with employees. This was explained in the Determination of the Constitutional Court of the Russian Federation dated January 15, 2008 N 201-O-P. The employer can consult with the trade union and take into account its opinion regarding the need and procedure for the reduction.

In the second case, the employer decides to retain the employees. Russian labor legislation establishes special norms that allow the employee and employer to survive a period of temporary absence from work, while maintaining the employee’s job. In case of temporary absence from work, the employer is obliged to register the employee's idle time. However, in practice, a different approach is widely used when the employer draws up documents stating that the employee is on leave without pay - this makes it possible not to pay wages, and the period of such leave is not limited to the maximum duration. But for an employee, such leave is often an unacceptable option precisely because of the lack of payment. Being forced to go on leave without pay is illegal: according to Art. 128 of the Labor Code of the Russian Federation, leave without pay can be granted to an employee upon his written application for family circumstances and other valid reasons; The duration of the vacation is determined by agreement between the employee and the employer. For more information on vacations at your own expense, see here.

What awaits the employee in case of downtime?

Since downtime is a temporary suspension of work, this means that you are not doing your usual work. However, there is no rule allowing an employee to be absent from his workplace during downtime. After all, downtime can end at any moment: equipment repairs are completed, goods are unloaded, etc. A period of downtime is a special period; it is not a time of rest for an employee, that is, time during which the employee is free from performing work duties and which he can use as he sees fit. Therefore, during downtime, employees must be at their workplaces during working hours. This conclusion is confirmed by judicial practice (see, for example, the resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated February 28, 2006 No. A11-5850/2005-K2-27/257, the decision of the Arbitration Court of the Ryazan Region dated January 22, 2007 No. A54- 4926/2006C18). At the same time, a collective agreement, agreement, local regulation or your individual employment contract may stipulate that during the entire period of downtime or part of it, employees are exempt from the obligation to be present at work. Such a provision of a collective agreement or local regulatory act will be valid, since it improves the situation of workers in comparison with established labor legislation and other regulatory legal acts containing labor law norms (which is allowed by Article 8 and Article 9 of the Labor Code of the Russian Federation).

Temporary transfer to another job in case of downtime

During normal work, the employee is obliged to perform only the work for which he was hired; he has the right to refuse an offer or assignment to perform any other work not provided for in his employment contract.

In case of downtime caused by emergency situations, which were mentioned above, the situation changes: the employer has the right, without taking into account the consent of the employee, to transfer him for a period of up to one month to another job not provided for by the employment contract. The conditions for the legality of such a transfer are: - the downtime was caused by precisely those emergency circumstances that are specified in part two of Art. 72_2 Labor Code of the Russian Federation; — temporary nature of the transfer: for a period of up to one month; — transfer to a job requiring lower qualifications is permitted only with the written consent of the employee; — it is prohibited to transfer an employee to a job that is contraindicated for him for health reasons (Article 72_1 of the Labor Code of the Russian Federation). The employee's remuneration during such a transfer should be based on the work performed, but in any case - not lower than the average earnings for the previous job, even if the work performed is of lower qualifications. A temporary transfer to another job due to downtime is formalized by an order (instruction) of the manager, which must indicate the job to which the employee is transferred (position, profession, specialty, qualification or specific job responsibilities), the start and end date of the transfer to another job, specific reason for the transfer.

How should downtime be paid?

During the downtime period, your job remains yours, and this period, as a general rule, must be paid. The current Labor Code of the Russian Federation provides that downtime is paid differently depending on the presence or absence of fault in the downtime on one of the parties to the labor relationship (Article 157): downtime due to the fault of the employer is paid in the amount of at least two-thirds of the employee’s average salary; downtime due to reasons beyond the control of the employer and employee is paid in the amount of at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to downtime; Downtime caused by the employee is not paid.

Please note that the law only sets minimum limits for payment for downtime. If an employment contract, collective agreement or agreement provides for a higher amount of payment, then the rules of the employment contract, collective agreement or agreement respectively apply.

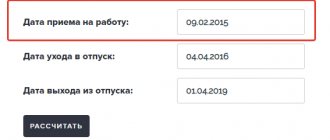

The average salary to pay for downtime due to the employer’s fault is determined in accordance with the general procedure in accordance with Art. 139 of the Labor Code of the Russian Federation, as well as the Decree of the Government of the Russian Federation “On the specifics of the procedure for calculating the average salary” dated December 24, 2007 No. 922. To calculate the average salary, all types of payments provided for by the remuneration system are taken into account, applied by the relevant employer, regardless of the sources of these payments. Billing period – i.e. the period for which these payments are taken into account is equal to 12 calendar months preceding the month in which the downtime occurred. In this case, a calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).

Average employee earnings = Average daily earnings x 2/3 x Number of working days during the idle period

Average daily earnings, as a general rule, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with the above-mentioned resolution of the Government of the Russian Federation, by the number of days actually worked during this period. When determining the average earnings of an employee with a summarized accounting of working hours, it is necessary to determine the average hourly earnings and multiply it by the number of working hours according to the employee’s schedule in the period subject to payment.

Payment for downtime for reasons beyond the control of the employee and the employer is determined depending on the form of remuneration established in the organization: time-based or piece-rate. In case of time-based wages, the wages of employees, depending on the conditions of payment established for you, are calculated based on: 1) or the hourly tariff rate; 2) or daily tariff rate; 3) or salary (official salary).

If the employee has an hourly wage rate, then payment for the downtime period is calculated by multiplying the hourly wage rate by 2/3 and by the standard working hours in a working day (shift) and by the number of working days in the downtime period:

Amount of payment for downtime for reasons beyond the control of the employee and the employer = Hourly tariff rate Standard working hours per working day (shift) x 2/3 x Number of working days during the downtime period

If the employee has a daily tariff rate, then payment for the idle period is calculated by multiplying the daily tariff rate by 2/3 and by the number of working days in the idle period:

Amount of payment for downtime for reasons beyond the control of the employee and the employer = Daily tariff rate x 2/3 x Number of working days during the downtime period

If the employee has a salary (official salary), i.e. fixed amount of remuneration for a calendar month, then idle time payment is calculated as follows:

Amount of payment for downtime for reasons beyond the control of the employee and the employer = Salary (official salary): total number of working days in the month x 2/3 x Number of working days during the downtime period

Payment for idle time to employees whose work is paid by the piece is calculated based on 2/3 of their hourly (daily) rate in the same manner as for employees whose work is paid on a time basis.

Downtime caused by the employee's fault is not subject to payment.

Thus, the employer has the right not to pay for downtime only in one case: if the employee’s fault in causing downtime is established, for example, the employee deliberately rendered the equipment unusable.

Is it the employer’s fault for downtime: how to establish this?

It is often difficult in practice to establish whether the employer is at fault or whether downtime arose for reasons beyond the control of either party to the employment contract. Often, employers themselves are in no hurry to admit their guilt, determining payment for downtime based on the employee’s tariff rate or his salary. This can be extremely unprofitable for the employee, since the tariff (constant) part of his earnings can be quite low, and the main part of his income is the so-called. variable parts: various allowances and additional payments, bonuses, as well as payment for overtime work, work on holidays and weekends, etc. All these payments are taken into account when calculating the average salary, but are not included in your salary or tariff rate.

In connection with this problem, in a dispute with an employer about the amount of payment for downtime, one can refer to the opinion of the Chamber of Commerce and Industry of the Russian Federation, according to which “negative financial and economic factors, the so-called “global financial crisis” <...> are not force majeure in relations business entities, but relate to financial risks. As a rule, force majeure circumstances include fires, floods, earthquakes, hurricanes, military actions, prohibitions on the export and import of goods, epidemics, strikes or other circumstances expressly provided for by the parties to the contract. However, according to paragraph 3 of Art. 401 [Civil Code of the Russian Federation], circumstances of force majeure do not include, in particular, violation of obligations on the part of the debtor’s counterparties, the absence on the market of goods necessary for performance, or the debtor’s lack of necessary funds” (letter dated November 25, 2008 No. 9/600 , not officially published). In other words, the circumstances specified in the last sentence do not relieve the organization from the obligation to fulfill the contracts concluded with its counterparties, and their failure to fulfill them for the specified reasons may result in the debtor being brought to civil liability (collection of interest, etc.), i.e. The court finds the debtor guilty of his behavior. The same logic can be used to justify labor disputes with the employer on the issue of payment for downtime.

This conclusion is confirmed by judicial practice. Thus, in the Third Issue of Judicial Practice (2009), prepared by the Central Council of the Mining and Metallurgical Trade Union of Russia, the following examples of successful judicial practice of collecting the difference in idle time payment up to 2/3 of the average wage are given. OJSC Zlatoust Metallurgical Plant (Chelyabinsk Region) filed a lawsuit to declare the order of the state labor inspector illegal. The applicant did not agree with the inspector’s demands: pay for downtime in the amount of at least two-thirds of the employee’s average salary and pay for shortfalls in part-time work as downtime. In court, the applicant's representative indicated that the order was issued without taking into account the current situation in the metallurgical industry. The lack of orders for the company's products is caused by the deterioration of the general economic situation in the country and abroad in the context of the global financial and economic crisis. In this regard, the reduction in production volumes of finished products and the suspension of production facilities should be considered as circumstances beyond the control of the employee and the employer. Consequently, payment for downtime must be made in the amount of two-thirds of the tariff rate (salary), calculated in proportion to the downtime. Having examined the circumstances of the case, the court recognized the order of the state labor inspector as legal and ordered the applicant to pay for downtime for economic reasons in the amount of at least two-thirds of the employee’s average salary.

A similar case on the claim of Magnezit Plant OJSC was considered by the Satkinsky City Court of the Chelyabinsk Region. However, in this case, the court of first instance considered that the downtime occurred for reasons beyond the fault of the employer and employee, and, therefore, payment for the period of downtime should be made based on two-thirds of the tariff rate. The judicial panel for civil cases of the Chelyabinsk Regional Court did not agree with the decision of the court of first instance and considered the requirement of the state labor inspector to pay for downtime in the amount of at least two-thirds of the average wage as legal. In both cases, the chief legal labor inspector for the Chelyabinsk region L. Meshcheryakova and legal labor inspector A. Goryunov took part in the court hearings.

OJSC Uralredmet filed a claim with the Kirovsky District Court of Yekaterinburg against the State Labor Inspectorate in the Sverdlovsk Region to declare the order illegal and cancel it. The essence of the dispute. The Chief State Labor Inspector issued an order to OJSC Uralredmet to eliminate violations of labor legislation: to pay for downtime in the amount of at least two-thirds of the employee’s average salary. The plaintiff, in support of his claims, indicated that the reasons for the downtime were non-payment by buyers for products manufactured by the enterprise, a decrease in orders and other reasons - the consequences of the financial and economic crisis. Consequently, downtime must be paid at least two-thirds of the tariff rate. The court did not agree with the plaintiff’s arguments and rejected the claim. The deputy head of the legal department of the Sverdlovsk regional trade union committee, O. Rakhimov, took part in the court hearing.

Can payment for downtime be less than the minimum wage?

Yes, it can be, since in any case you are paid either 2/3 of the average salary or 2/3 of the salary (official salary) / tariff rate, and not the full salary. Secondly, the minimum wage is set for a monthly period, and downtime can last only a few days.

Another question that is beyond the scope of this article is whether your salary can be less than the minimum wage? In our opinion, your salary (official salary) cannot be lower than the minimum wage (minimum wage). This conclusion is based on the following. On the one hand, according to Art. 133 of the Labor Code of the Russian Federation, the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage. In other words, in order to qualify for wages in the amount of the minimum wage, you need to fulfill only two conditions: 1) work out the standard working time (and not overwork it through overtime or work on holidays), and 2) fulfill labor standards (labor responsibilities). No other additional conditions are required.

If we compare this provision of the Labor Code of the Russian Federation with the concept of salary (official salary) given in Art. 129 of the Labor Code of the Russian Federation, then it becomes, in our opinion, obvious that it (salary) cannot be less than the minimum wage. Thus, salary (official salary) is a fixed amount of payment to an employee for the performance of labor (official) duties of a certain complexity for a calendar month without taking into account compensation, incentives and social payments. Those. In order to qualify for a full salary, you need to fulfill the same two conditions: 1) work a calendar month and 2) fulfill your job duties for this period. No other conditions are required.

Do I need to notify the employer about the start of downtime?

You are obliged to notify the employer, namely, inform your immediate supervisor, or another representative of the employer (for example, the head of the organization) about the beginning of downtime caused by equipment breakdown and other reasons that make it impossible for you to continue to perform your job function. The Labor Code of the Russian Federation does not link your right to receive payment for downtime with the fulfillment of this obligation, but, nevertheless, it is in your interests to report such reasons in writing. It is best to also get a mark of acceptance on your copy of the memo. This will allow you to pinpoint the exact start of the downtime, and therefore will affect the correctness of its payment. Moreover, you will also avoid the risk of being punished for failure to fulfill your work duties: if you report downtime on time, you are not responsible for the inability to perform your work duties.

What to do if there is no work, and the employer refuses to issue idle time?

The beginning and end of downtime must be recorded by the employer. The employer is obliged to issue an order to send the employee (workers) to idle time, indicating the reason for it and the procedure for paying for the time spent in idle time. Based on this document, entries are made in the working time sheet (forms N T-12 and T-13, approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 N 1). To indicate downtime due to reasons beyond the control of the employer and employee, a symbol is used: letter code - “NP” or numeric code - 32, and to indicate downtime due to the fault of the employer: letter code “RP” or numeric code - 31 If work is not provided according to the employment contract, and the employer does not issue an order to send you to idle time, you should write and submit to the employer a statement that you are on idle time and ask to be paid for this time in accordance with labor legislation. The application must indicate the reason for the downtime, since it affects the amount of payment due to the employee. You can also indicate that you are ready to start work at any time and ask to indicate the reason for the lack of work for you.

In case of a possible dispute, it makes sense to obtain evidence confirming the absence of work. If it is not possible to make copies of internal working documents or journals that indicate what work is entrusted to the employee (if such documents are maintained), you can contact the elected trade union body so that on behalf of the trade union an act of absence is drawn up in relation to one or more employees work. The report should indicate that the employee was at the workplace, but work was not provided or assigned to him. The act is signed by members of the commission created by the trade union committee, and can also be signed by witnesses (colleagues of the employee), or the employee himself. If there is no trade union committee, enlist the support of your colleagues and submit the application in the presence of witnesses.

There are cases when the employer does not register downtime due to his own fault, and immediate managers instead verbally inform employees that they do not have to go to work today. However, such unplanned “rest time” for workers can backfire on them: they are required to work it later on Saturday or Sunday. At the same time, all these manipulations may not be reflected in internal documentation, as well as accounting. You can either agree to such working conditions, understanding that you are making big concessions to the employer and giving him a real opportunity to save: firstly, not to pay for downtime, and secondly, not to pay at an increased rate for work on a day off.

If you do not agree to such a “work schedule,” then do not pay attention to verbal warnings and calls, show up at your workplace, write a statement about the beginning of the downtime, submitting it under the mark of acceptance. If you are not paid for this time, write a complaint to the labor inspectorate, prosecutor's office or go to court. If you are asked to appear to “work” downtime on your day off according to your schedule, request a written order to this effect. It is better to receive a copy of the shift schedule with your signature on it in advance in order to have evidence that the disputed day was a day off for you. To avoid the risk of dismissal for absenteeism, report to work on a day off, but record this fact: with your applications for an order to hire you to work on a day off, for increased payment for work on a day off, and testimony from colleagues.

Downtime and temporary disability, the impact of downtime on length of service

If you get sick during a period of downtime, then you have the right to pay for your sick leave. Issues of payment for temporary disability and maternity leave during downtime are regulated by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ). According to paragraph 7 of Art. 7 of Law No. 255, temporary disability benefits for a period of downtime are paid in the same amount as wages are maintained during this time, but not higher than the amount of benefits that a given worker or employee would receive according to the general rules for calculating benefits.

Downtime must be taken into account in the length of service, which gives the right to annual paid leave. So, according to Art. 121 of the Labor Code of the Russian Federation, such length of service includes the time when the employee did not actually work, but in accordance with labor legislation, his place of work (position) was retained, i.e. idle time is turned on at this time.

Downtime should be included in the insurance period to determine the amount of benefits for temporary disability, pregnancy and childbirth as part of a more general period: the period of work under an employment contract. Downtime is not subject to reflection in the work book, and the insurance period for sick leave is determined by the entries in the work book. In addition, amounts paid for downtime are subject to insurance contributions to the Social Insurance Fund of the Russian Federation.

As for the insurance period for the assignment of labor pensions, downtime must be included in the general insurance period as part of a more general period of work under an employment contract. In addition, amounts paid for downtime are subject to insurance contributions to the Pension Fund of the Russian Federation. As for early retirement pensions, the situation is different. According to clause 9 of the Rules for calculating periods of work giving the right to early assignment of old-age labor pensions in accordance with Articles 27 and 28 of the Federal Law “On Labor Pensions in the Russian Federation”, they are not included in periods of work giving the right to early assignment of old-age labor pension , periods of downtime (both due to the fault of the employer and the fault of the employee).

In Letter of the Federal Tax Service dated April 20, 2009 N 3-6-03/109, it is explained that the employer has the right to classify as expenses that reduce the tax base for income tax the entire amount of payment for downtime as economically justified expenses (Article 252 of the Tax Code). Code of the Russian Federation). Also in this letter it was explained (in relation to the previously levied unified social tax) that payments for downtime due to the fault of the employer and for reasons beyond the control of the employer and employee are subject to a unified social tax in accordance with paragraph 1 of Art. 236 of the Tax Code of the Russian Federation and insurance contributions in accordance with paragraph 2 of Article 10 of the Federal Law of December 15, 2001 No. 167-FZ “On compulsory pension insurance in the Russian Federation” in the generally established manner. If labor (collective) agreements or internal regulations on remuneration in an organization provide for payment for downtime in a larger amount than established in Art. 157 of the Labor Code of the Russian Federation, the excess amount is also subject to a single social tax and insurance contributions.

An analysis of the current legislation on the payment of insurance contributions to extra-budgetary funds also allows us to conclude that amounts of payment for downtime are subject to the specified insurance contributions.

What documents are required to introduce downtime?

An order to impose downtime can be created either on the basis of other documents evidencing downtime, or without supporting documents.

A basis document will not be required if the initiative to introduce downtime comes from the employer (for example, in the case of a difficult economic situation for him) or is a consequence of reasons beyond the control of either the employee or the employer (for example, due to changes in legislation).

If downtime occurs directly at the workplace, then no matter what causes it, the employee is obliged to inform his immediate supervisor or other representative of the employer about this situation (Article 157 of the Labor Code of the Russian Federation).

Sample memo about downtime

Information to the immediate manager can be both oral and written (in this case, a written message about downtime due to a strike is required - Article 414 of the Labor Code of the Russian Federation). But the message is still conveyed to the final authority - the employer's management - (if not by the employee himself, then by his immediate supervisor) in writing. And it is this document that most often becomes the basis for issuing an order to introduce downtime.

Employer's actions during downtime

When the moment of disruption to the work schedule occurs, the employer is obliged to perform a number of sequential actions:

- Find the culprit behind the production stop.

- Take measures to stop downtime.

- Draw up the relevant documentation and familiarize it with employees against signature.

- Accrue and pay wages in accordance with Art. 157 Labor Code of the Russian Federation.

It is sometimes quite difficult to identify those responsible for the suspension of production activities. For example, when equipment breaks down, it is possible that each party is at fault: the equipment broke down due to missed scheduled maintenance - the employer is to blame; due to the rules of violation of operation - the employee is guilty; due to marriage is a circumstance beyond the control of the parties.

When taking measures to restore production, the employer must ensure that there is evidence confirming its actions, for example, in the absence of materials, negotiations or correspondence with suppliers.

An employee who, for any reason, cannot perform the function assigned to him by the employment contract must notify the employer of the fact of downtime. After notification, the date and time of downtime must be documented in the prescribed form - by order, or some other document provided for by the organization’s office management rules.

During the entire period of downtime, a mark is made in the work time sheet with the letter designation “RP”, “NP” or “VP”.

Depending on who is to blame for the suspension of the production process, wages are calculated in different ways.

How long can downtime last at an enterprise?

Labor Code of the Russian Federation: in the event of a change in organizational or technological working conditions in order to prevent mass layoffs of workers and preserve jobs, he may introduce a part-time working day (shift) and (or) part-time working week in the organization.

This regime can be introduced by the employer for a period of up to six months.

Since the transfer of an employee to a part-time working day (shift) and (or) part-time working week at the initiative of the employer is regarded by the Labor Code of the Russian Federation as a change in the terms of the employment contract, the employer is obliged to notify the employee in writing about the upcoming introduction of such a regime and the reasons that caused the need for changes later than two months (part 2 of article 74 of the Labor Code of the Russian Federation). Remember that the order to introduce a part-time working day (shift) and (or) a part-time working week must be justified.

Attention

When the employee himself is to blame for downtime, he does not receive payment. So, if we are considering suspension of work for reasons that depend on the employer, then we should focus on the concept of “average earnings.”

It is he who will influence the amount of compensation for downtime due to the fault of the employer. The concept of “average wage” is given in Art. 139 Labor Code of the Russian Federation.

Important

How to calculate it? According to a single process approved by the Labor Code of the Russian Federation. When making calculations, all types of payments that apply to the relevant employer are taken into account.

Moreover, the source of their conduct is not taken into account. The calculation is made using the same formula regardless of the employee’s working mode. The average salary is determined for the last 12 months that preceded the downtime period. To make the calculation, all payments received by the employee are summed up and then divided by 12 (the number of months).

And this kind of circumstances, such as non-payment by counterparties, lack of orders, etc., belong to the category of business risks, and these risks lie entirely with the employer; shifting them to the employee is unacceptable.

But what’s interesting is that even if the employer declares downtime due to his own fault, he should still do this only if there are objective reasons.

After all, payment of 2/3 of the average salary and the inability to work are, in any case, negative consequences for the employee, which the employer does not have the right to create without objective reasons, only at his own discretion.

As for the procedural issues of introducing downtime due to the fault of the employer, there is also a gap in regulation. Obviously, the employee must be notified of the reasons, beginning and period of downtime, either before the start of downtime or directly on the start day.

The meager clarification that this is a temporary suspension of production for various reasons, most often of an objective and irresistible nature, does not make it possible to unambiguously attribute this period to either working time or rest time.

The amount of payment for downtime depends heavily on proof of fault for its occurrence. That is why almost all employers strive, if not to shift responsibility onto the employee, then at least to prove that nothing depended on management.

But judicial practice in this regard is inexorable. They include economic, technical, and organizational causes of production failure as the employer's fault.

Circumstances independent of the will of the parties, most often, are recognized only as force majeure in the form of catastrophes, disasters or military actions, the presence of which is confirmed by documents from the Chamber of Commerce and Industry.

Career

Thus, when deciding to introduce a downtime procedure due to the fault of the employer, the latter needs to take into account the following recommendations: 1) downtime can be introduced only if there are objective reasons not determined by the will of the employer that do not allow the employee to perform his labor function: suspension of business processes in which he is involved employee, liquidation, bankruptcy of a company, etc.; 2) if it is intended to transfer the duties of an idle employee to his colleagues or to another department, idle time cannot be introduced, since in this case the employer has the opportunity to provide the employee with work (which is by virtue of Art.

If you need to calculate the average daily earnings, then the additional amount received is divided by 29.4 (the average number of days in a month). From the obtained value, 2/3 is calculated - this is the amount of wages for the period of downtime due to the fault of the employer.

Please note that in Art. 139 of the Labor Code of the Russian Federation, the legislator allows for the possibility of a different procedure for carrying out calculations, including a different period for calculating wages. Such rules can be established in the local regulations of the organization.

They will operate if they do not worsen the worker’s situation in comparison with what is approved in the Labor Code of the Russian Federation.

How long can downtime last at an enterprise?

Dismissal during downtime: features, compensation Forced downtime due to the fault of the employer, lasting quite a long period, will invariably push team members to look for a new job.

If its results turn out to be positive, then the question will arise of how to properly part with the “old” employer. In this case, two options are most likely: one’s own desire (Article 80 of the Labor Code) and agreement of the parties (Article 78 of the Labor Code).

Most often, the management of an enterprise that finds itself in difficult economic circumstances is sympathetic to the attempts of employees to change their place of employment.

It is especially easy for an employer to agree to this if they do not expect the downtime to end soon or even foresee the possibility of liquidating the company. Then the parties sign a dismissal agreement and register the employee one day.

Forced downtime due to the fault of the employer is the suspension of an employee’s work for a certain period of time caused by a mistake by his boss. This measure is necessary to preserve the citizen’s job and establish production. At the same time, downtime raises many questions among workers, the answers to which can be found in this article. articles

- Regulations under the Labor Code of the Russian Federation

- Why could this happen?

- Registration process

- Employer Responsibilities

- Payment nuances

- What to do if the employer does not pay for the downtime period?

- What should an employee do during downtime?

- Is sick leave paid?

Regulations under the Labor Code of the Russian Federation In accordance with Art. 72, clause 2 of the Labor Code of the Russian Federation, the cause of downtime may be technological, technical, organizational or economic problems.

Administrative suspension of the functioning of an enterprise in cases approved in the Code of Administrative Offenses of the Russian Federation Failure of the enterprise to fulfill obligations under agreements with counterparties What caused a shortage of raw materials Lack of demand for goods - Business risks - Please note that the crisis, that is, negative economic processes, is also the fault of the employer. Workers must be compensated for downtime according to the rules of Art.

157

Labor Code of the Russian Federation. Often, enterprises require employees to write requests for unpaid leave. Please note that this is illegal. Providing this type of rest is allowed only by virtue of the will of the employee himself.

Issuing a notification We have already mentioned such a document as a notification of downtime, which is sent to the employment service. This obligation operates in accordance with the provisions of Art.

25 of Law No. 1032. Reduction of position as a reason for downtime The upcoming reduction of position is not a reason to declare downtime. This conclusion was reached by the Samara Regional Court in Determination No. 33-2390 dated March 15, 2011.

Thus, at the enterprise where the plaintiff worked, organizational changes occurred: the work that he performed was transferred to another division, where the same positions as his were introduced.

In relation to the plaintiff's position, a decision was made to reduce it, and vacancies were offered to him.

The plaintiff initially agreed to the transfer, but then refused. After which he was declared downtime, which the plaintiff contested.

The cassation court declared the removal of an employee in idle time illegal for the following reasons. As noted above, by virtue of Art.

Source: https://prodhelp.ru/skolko-vremeni-mozhet-dlitsya-prostoj-na-predpriyatii/

Proper registration of downtime

Proper registration of downtime is necessary, first of all, for the employer. This way he will protect himself from possible problems with the labor inspectorate and other government agencies. Registration involves the preparation of three main documents:

- An act indicating the employee’s fault for downtime.

- Papers of forms T-12 and T-13, in which you need to record the fact of suspension of work.

- Order on transfer of employees to idle time.

Registration is carried out in accordance with the following algorithm:

- Upon the fact of downtime, a report is drawn up. It requires a detailed description of all the circumstances that provoked the suspension. These circumstances must indicate the employee’s guilt. For example, you can indicate the fact of equipment breakdown that occurred as a result of an employee’s failure to comply with operating rules.

- The employee must be familiarized with the act upon signature. If the employee refuses to sign, the act should be sent by a valuable letter with a list of investments and a receipt. The letter is sent to the employee's home address.

- If the employer has concerns that the employee will dispute his guilt, an expert can be invited to draw up an opinion on the factors that provoked the downtime.

- Appropriate marks are placed on the time sheet.

- An order is being prepared to transfer the employee to idle time. The document is drawn up in any form. The Labor Code does not contain requirements for its execution, but it is advisable to reflect in the order all the circumstances of the suspension.

IMPORTANT! Usually, the employer cannot accurately predict the end of downtime, but it is advisable to indicate the approximate time frame for resuming the enterprise’s activities in the order. For example, it could be a week or a month.

Reflection of downtime in the timesheet

For suspension resulting from the fault of an employee, the letter code “VP” is relevant, as well as the numeric code “33”. If the reasons for downtime are different, the designations will change:

- Through the fault of the employer - “RP” and the code in numbers “31”.

- For reasons beyond the control of the employer and employee - “NP” and “32”.

Errors in recording downtime in the time sheet can become fatal when the enterprise is inspected by the labor inspectorate upon the appeal of the guilty employee.