Sberbank insurance

Sberbank, for example, requires mandatory insurance of collateral property, and the property value limit is no more than 15 million rubles; you will be charged 0.25% of the loan amount, and every year this percentage will be accrued on the balance of the total debt.

Life and health insurance will cost you 1%, but it is at your request, however, if you refuse, this percentage is added to the interest rate on the mortgage, or rather, if you agree, it will be subtracted.

In practice, it looks like if the amount is approved at 14.9% per annum, then for life and health insurance, the rate will drop to 13.9%. Well, the wide range of insurance cases that are insured has not been canceled here either.

Also, if you take out a mortgage from Sberbank, then this is the only bank that does not require comprehensive insurance, i.e. title is an optional condition.

If you want to change insurance, there is a 40% discount for the first year for mortgages and for those who decide to change companies.

Which company to choose (by price and payments)

For example, when selecting an insurer, it is better to take into account the base rates. In this situation, the picture will be more objective. But from the list below, you should choose a specific company using an online apartment mortgage insurance calculator. You will find this program on the websites of these organizations.

- SOGAZ - offers favorable rates from 0.08% (title policy), several types of products (personal insurance, constructive, civil liability, title), but there are problems with payments.

- Apartment mortgage insurance in RESO starts at 0.10%. For the title and personal policy you will have to pay 0.26 and 0.25%. They offer discounts from 5 to 20%, and it is possible to purchase a comprehensive policy.

- In Ingosstrakh, apartment insurance for mortgages is carried out at a rate of 0.14%. The company works with most major banks. Reviews about payments vary. In case of fires and floods, the company regularly pays amounts. But for larger damages, you will have to work hard to get what you are owed under the policy.

- make an apartment mortgage insurance calculation with Alfa online. For a constructive policy you will have to pay 0.15% of the loan amount.

- Sberbank offers to purchase real estate protection for 0.25%, and a personal policy will cost 1% of the loan amount. This company pays regularly when insured events occur.

- It costs 0.17%. A personal policy costs 0.28% of the loan amount. If the borrower is female, this company provides lower rates. There are no special problems with payments.

- Tariffs in this company are higher than others. For a personal policy you will have to pay 0.55% of the loan amount. In VSK , apartment insurance with a mortgage will cost 0.43%. Feedback on payments here is mostly negative. They either pay less money or the application is rejected.

- The rate for all types of products at VTB starts at 0.33% . The company offers only a comprehensive policy, which includes several types of risks. If we take into account the reviews on payments, VTB apartment mortgage insurance is not the most profitable.

Recommended article: How not to lose your home with a mortgage in a civil marriage

As a result, if we consider the proposals of insurers taking into account not only basic tariffs, but also the chances of receiving payments, then the most suitable conditions are guaranteed by: Sberbank, RESO, Ingosstrakh and Rosgosstrakh. In this case, it is necessary to correctly and timely notify the company about the occurrence of an insured event. Otherwise, the likelihood of timely payments in full is reduced.

Alliance (Rosno)

In Alliance, life and health insurance will be 0.87% of the insured amount; property insurance – 0.16% and title insurance – from 0.18%. The company is currently running a mortgage insurance promotion, which means that when you sign up for a mortgage insurance policy, you can insure additional risks at discounted prices:

- interior decoration of the property (finishing walls, floors, ceilings);

- insurance of civil liability to third parties during the operation of residential premises;

- increase in the sum insured for life and health;

- increasing the insured amount for property to the market value of the property.

It should be noted that due to the closure of offices in the regions, services are provided by the Central Moscow office.

Rosgosstrakh

Life and health insurance for Sberbank – 0.6% (men), and 0.3% (women); property – from 0.2%.

For VTB and other banks - life - 0.56 (man), 0.28% (woman), this is respectively; constructive – 0.17%; Well, and title insurance – 0.15%. By agreement with the Central Office, discounts are possible, but the amount is determined individually in each case.

The insured amount decreases in proportion to the decrease in the loan amount. Early termination of the insurance contract on your initiative is also provided here only with full early repayment of the loan, in which case you are paid part of the premium paid for the remaining term minus 65% of the paid insurance premium. For other reasons, early termination on your initiative is possible, provided that the insurance premium is non-refundable.

Ingosstrakh

Here, you can choose to insure everything individually, or choose comprehensive mortgage insurance, which you already know includes property, life and title insurance. They do not provide approximate rates; you can only calculate the cost of insurance on your own terms.

Let's look at the example of a 38-year-old man, without bad habits, healthy, working in the prosecutor's office and a woman of the same age, but an estimator, the amount of their mortgage is 8,000,000 rubles, secondary housing on the 5th floor, they have owned it for more than 3 years . Insurance programs for Sberbank and other banks also differ here, so let’s move on to the numbers:

For Sberbank:

life insurance – 35,518 rubles (man) and 25,248 (woman);

Collateral property – 11,200 rubles (for each),

In total, we see that for a man – 46,718, and for a woman – 36,448. Contracts are issued for 1 year.

For VTB and other banks:

life insurance – 44,418 (for men) and 18,176 (for women);

Construct – 12,000 rubles (for both one and the other);

Title – 16,000 rubles (for each).

As a result, you see that for a man in this case comprehensive insurance will cost 72,418 rubles, and for a woman 46,176 rubles. For VTB, it is possible to conclude an agreement for the entire loan term with an annual extension.

You can terminate the contract early at your request on the same terms as most previous organizations; within 5 days after signing the contract, the insurance premium will be returned to you in full; beyond that, the premium will not be returned. Exceptions include, for example, the fact that you were not given a mortgage.

If you decide to change the insurance company to Ingosstrakh, then you will be provided with preferential conditions in the form of a discount from 5 to 15%, the exact amount of the discount is decided by the management: up to 3,000,000 rubles, the decision is made by the regional branch, above - by the central Moscow office.

The following promotion is currently in effect: if you have a mortgage insurance agreement concluded with this company, then there is a 20% discount on voluntary insurance (utility networks, finishing, property, etc.).

Where is it cheaper to get insurance?

There are 3 ways to purchase insurance:

- In the bank itself directly when applying for a mortgage loan. This option is for those who are not interested in saving and want to do everything at once in one place. Such insurance can cost 2 times more than in other companies. Therefore, it is better to refuse to take out insurance from a bank.

ADDITIONAL INFORMATION:

Sometimes banks put forward a condition that in the first year of the mortgage you need to take out insurance from them. In this case, there is nothing left to do but agree to this requirement, but after 1 year it is better to change the insurer.

- At the office of the insurance company. In order to find an insurer with the most favorable rates, you will have to spend a lot of time and effort. At the same time, you need to act quickly so that the calculations do not lose relevance, because prices in this segment are constantly changing.

- Through an insurance aggregator. These are special online platforms that contain all the relevant information about the largest insurance companies. Here you can quickly calculate the cost of insurance from different insurers, choose the best option and purchase a policy online. Moreover, such services not only do not add extra charges, but also provide discounts. Therefore, when looking for a place where it is cheaper and more convenient to purchase insurance, it is preferable to consider the option with an insurance aggregator.

Which insurance company should you choose?

When searching for the optimal insurance option, it is important to remember that the tariff policies and approaches to risk assessment are different for all insurers. Therefore, you cannot rely on the experience of friends and advice from Internet users when it comes to insurance. Everything is so individual that calculations should be made specifically for your situation.

The second point that needs to be taken into account is that the cost of insurance company services is constantly changing. If you are already a client of one or another insurer, it will likely be beneficial for you to purchase mortgage insurance from them. Regular customers are usually given good discounts. If you have to take out insurance for the first time, for a profitable deal you will need to monitor the promotions and special offers of insurers.

The cost of insurance is also affected by the bank where the mortgage is issued. This is due to the fact that an insurance company must be accredited by the bank in order to work with bank clients. Accordingly, banks often require a commission from insurers. In addition, the requirements for the insurance itself may differ: different content of risks, amount of insurance coverage, etc. An exception to this rule is Sberbank, which imposes strict contract conditions.

So, we offer a short overview of the largest insurance companies on the Russian market:

Alpha insurance

In Alfa Insurance, you can also choose comprehensive mortgage insurance, the term of which will be equal to the loan term and decrease every year as the debt is repaid. The contract is terminated early in accordance with the conditions of VSK Insurance House. When you change insurance company, here you get a simplified procedure for drawing up a contract and more favorable conditions. The contract is concluded for 1 year.

As with all companies, there are different programs for Sberbank and other banks. But today the organization in question does not have accreditation for life and health insurance for Sberbank, so you can only insure property, it will cost 0.18% of the mortgage amount.

For VTB and other banks, you can insure for the entire term of the mortgage, to see the cost of insurance, we will again turn to our example (man and woman 38 years old and 8,000,000 rubles):

Life – 46,900 (man) and 30,452 rubles (woman);

Constructive – 9,200 rubles;

Title – 12,000 rubles.

Now you can see that the exact cost of mortgage insurance depends on many components, so all the amounts given as an example are approximate.

The most common insurance that banks offer to buy when taking out a mortgage loan

According to Russian laws, banks have the right to introduce their own conditions when providing a mortgage loan. This means that the interest rate and, in principle, the bank’s consent to issue a loan may depend on the borrower’s willingness to take out additional types of insurance. Let's look at the most popular of them:

- Life and health insurance – guarantees that the insurance company will pay the remaining loan debt in the event of disability or death of the borrower.

- Title insurance – will protect the borrower from fraud by the seller when purchasing real estate on the secondary market. The insurance company will compensate for losses if the transaction is considered illegal.

- Liability insurance - involves shifting responsibility for repaying the loan to the insurance company in the event that the borrower is unable to repay the mortgage loan on his own. It is worth keeping in mind that the mortgaged apartment is for sale.

- Job loss insurance means that if the borrower is fired for any reason other than voluntary resignation, the insurance company will assume the obligation to pay the balance of the debt.

Most often, banks insist on taking out life and health insurance. There is a logical explanation for this - the mortality rate in our country is quite high, no one is insured against an accident, and banks thus strive to protect themselves. Therefore, we will dwell on life and health insurance in more detail and tell you where it is cheaper to buy this type of insurance.

SOGAZ

Insurance in Sogaz is one of the most affordable:

- Constructive - 0.1% if you additionally take out insurance for decoration, furniture, plumbing and civil liability for a minimum of 1,150 rubles.

- Life and health – 0.17%

- Title – 0.08%.

- Loan default insurance – 1.17%

If the client cancels insurance early (early repayment of the mortgage), part of the fee for the unexpired policy period is returned, reduced by the share of the load in the tariff rate structure. There are no returns for other reasons.

comparison table

Analyzing the above, we can summarize everything in a comparative table for all the insurance companies we are considering, using the example of the same men and women with the initial data we took at the beginning of the post.

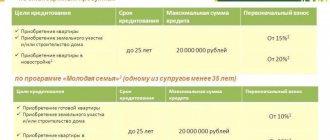

| Bank | Property (construct) | Life and health | Title |

| Sberbank | 0,25 | 1 | No |

| VTB | 0,33 | 0,33 | 0,33 |

| VSK | 0,43 | 0,55 | No |

| Alliance | 0,16 | 0,66 | 0,18 |

| RESO | 0,1 | 0,26 | 0,25 |

| Rosgosstrakh | 0,17 | 0,28 | 0,15 |

| Ingosstrakh | 0,14 | 0,23 | 0,2 |

| Alpha insurance | 0,15 | 0,38 | 0,15 |

| Sogaz | 0,1 | 0,17 | 0,08 |

Bottom line

To find out where mortgage insurance is cheaper you need to take several steps:

- Get a list of insurance companies from the bank or on our website.

- Analyze the list to find insurance companies where you have preferences.

- Analyze the list using our table.

- Find several of the most profitable options.

- Make the calculation using our online calculator.

- Call your insurance company and find out the final rate for you.

Summing up our post, we see that insurance significantly reduces the interest rate on a mortgage, and refusal to insure the collateral may result in the bank refusing the mortgage, which means it is better to insure yourself. And if you approach this issue with all responsibility, with the understanding that a mortgage is far from a short-term loan and anything can happen in our lives, you will, of course, eliminate possible risks that may affect your obligations in front of the Bank. Although, it’s up to you to decide and any decision you make will be right for you!

And we are waiting for your questions in the comments, which we will be happy to answer.

Subscribe to project updates and press the social media buttons!

Is it possible to get a policy from a company without accreditation?

Many borrowers, in an attempt to save money or for other reasons, turn to unaccredited companies. But even if the price of apartment fire or flood insurance here is lower, it is not worth taking out. Otherwise, the lender will refuse to issue the loan. And such a requirement of banks (to buy a policy only from approved insurers) is completely legal.

In 2021, the latest changes were made to the regulations regarding the admissibility of agreements between banks and insurers. The resolution legalizes such cooperation, despite discrepancies with antimonopoly legislation. Therefore, when deciding which insurance company is best to insure your apartment, be guided by the lists provided by the lender.

However, the compilation of such lists is legal subject to certain conditions stated in the Resolution. Although the borrower has the right to obtain a policy from a non-accredited company if:

- it meets the bank's requirements;

- will present a package of documents (charter, reporting, etc.);

- will not violate the deadline for submitting papers (no more than a month);

- the borrower will apply to be included in the list.

But not every client will agree to this. This means that life and apartment insurance for mortgages is carried out in the usual way - through organizations that have received the approval of the lender. Moreover, for each type of loan the bank has its own lists of insurers.

Why do financial institutions have such difficulties with such lists? There are two main reasons:

- Reducing the risk of non-repayment of the amount received for the purchase of housing.

- Commission from the insurer is additional income.

Recommended article: Mortgage insurance through Sberbank online: instructions

But there are advantages for the borrower in this situation. Title insurance when purchasing an apartment with a mortgage, as well as other types of policies, will help secure it in the future. Banks will not cooperate with unreliable companies, which means the client should not worry about payments.

Typically, the borrower chooses the cheapest option to save on the policy. But insurers offering such conditions often find themselves on the verge of bankruptcy. And working with such an organization is not beneficial for either party to the contract. Hence the strict requirements, as well as all these lists. Having determined where apartment mortgage insurance is cheaper, the bank client will be sure that:

- The accredited company will not close as long as he pays the loan.

- If an insured event occurs, he will be paid the required amount.

- He will not overpay for additional products.

Among the organizations that have received the approval of banks, there are their own lists with the most advantageous offers. From these, you need to choose the most suitable company.