Taking out a mortgage loan is necessarily accompanied by the purchase of an insurance policy. Accordingly, the loan amount becomes higher.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Accordingly, the question immediately arises: is insurance required for a mortgage at VTB, what conditions to choose in order to save on loan repayments? We will discuss how to choose the optimal mortgage insurance conditions below in the article.

Mortgage insurance at VTB

Mortgage loan insurance provides a guarantee of protection of the client’s health and property from possible insured events.

When taking out a home loan, VTB offers three types of insurance:

- real estate;

- life and health of the borrower;

- title.

The best option would be to take out comprehensive mortgage insurance from VTB. In case of early repayment of the loan, the unspent amount is returned by the bank to the client’s account.

Note! The policy is issued by organizations that are partners of the bank, there are more than 30 of them and confirms the rights and obligations existing between the parties. During the conclusion of the contract, the client is provided with a list of partners so that the client can make a choice of organization for himself.

VTB: apartment mortgage insurance

Apartment mortgage insurance at VTB involves:

- a full guarantee of return to the bank of loan funds invested in real estate;

- apartment appraisal;

- full compliance of the conditions with the requirements of the bank that issued the loan;

- prompt settlement of losses;

- free pre-contractual examination of previous transactions with the purchased real estate.

How to apply for a policy?

In order to obtain a mortgage policy from VTB, you must:

- Contact the VTB Bank office and fill out an application for a mortgage loan. The application form can be downloaded in advance on the bank’s website.

- Then you need to decide on an insurance company by selecting it from the list of bank partners.

- Get acquainted with the conditions and offers offered by insurance companies and choose the most optimal ones.

- Provide all the necessary documents for drawing up the contract;

- Insurance must be paid. This can be done in two ways: immediately and in parts.

- Give the bank specialists the documents prepared in advance for processing.

- Employees will calculate the cost of the policy and announce it to you.

Let's celebrate! When you take out a policy with VTB Insurance, you can pay for it online. After which the document will be sent by email, all you have to do is print it.

The required package of documents for issuing a policy includes:

- copies of passports of the borrower and all guarantors;

- certificate of ownership;

- passport for the object;

- certificate of absence of debts for housing and communal services;

- extract from the house register;

- information about the owner’s personal account;

- certified property valuation report;

- copies of documents of former owners.

How to calculate the cost using a calculator?

Online on the bank’s official website you can use a special service completely free of charge - the VTB 24 mortgage calculator.

To find out the preliminary cost using the VTB calculator, you need to enter in the calculation form:

- type of payments (annuity or differentiated). The annuity type involves calculating the same amount of monthly payments for the entire period. A differentiated payment is formed by adding part of the loan + interest accrued on the remaining debt.

- cost of the apartment;

- an initial fee

- interest rate

- credit term.

Let's celebrate! After entering the data, the site automatically calculates the cost of the policy. It is important to know that this amount can be changed during the review of documents and assessment of the condition of the property and health of the borrower.

What affects the cost of mortgage insurance at VTB?

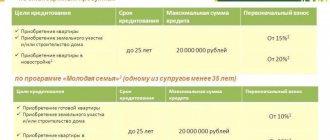

The price of mortgage insurance at VTB usually does not exceed 1% and depends on the following important factors:

- mortgage loan size;

- an initial fee;

- location, condition and cost of the purchased property;

- the number of risks included in the insurance;

- the condition of the property being purchased;

- material for building a house.

Note! The price is also affected by a number of features that are inherent to the insurance object.

Types of services for mortgage insurance

Mortgage insurance at VTB offers the following types of services:

Real estate protection.

Provides payments only when the insured property suffers significant damage in the event of:

- fire;

- natural disaster;

- flooding as a result of an accident in the water supply or sewerage system;

- household gas explosion;

- illegal actions of third parties.

In order to increase the insurance compensation and the list of insured events included in it, it is necessary to take out comprehensive insurance, but it will be more expensive.

The next type is life and health insurance of the borrower.

The policy guarantees payment in the event of:

- death of the borrower due to illness or accident;

- receiving disability of 1st or 2nd group due to illness or accident.

Title insurance. Designed to protect rights to real estate purchased with a mortgage.

The insurer will pay compensation to the bank client if:

- the purchase and sale agreement is declared invalid;

- recovery from the buyer of housing by persons who retain ownership of the property.

Can you refuse such policies?

You can only refuse voluntary types of mortgage insurance (life, disability, title). The ability to refuse insurance is provided for in most mortgage agreements. But this entails an increase in the interest rate on the loan.

What risks will have to be insured?

There is a certain list of risks that online mortgage insurance offered by VTB allows you to cover in whole or in part. You can choose:

- protection against specific problems;

- a comprehensive package of measures to prevent any unusual situations.

Important to know: Refusal of comprehensive insurance automatically entails an increase in the rate under the loan agreement by 1%. How profitable this is is up to the borrower to decide, but if in doubt, it is better to reduce the rate and take care of concluding an insurance agreement.

It is not necessary to protect against all risks at once. Usually you can simply insure for damage or total loss of real estate. In this case, the borrower saves a substantial amount and does not have to worry about losing the purchased apartment due to the elements or human factor. If we are talking about an object still under construction, the contract is drawn up after the ownership has been registered. The insurance contract covers damage to property (flooding from neighbors, gas explosion, destruction from an earthquake, terrorist attack), vandalism, and criminal incidents (robbery, theft, arson).

Recommended article: Gazprombank mortgage insurance

For those who purchase real estate on the secondary market or apply for refinancing, a special type of insurance is issued - title insurance. It protects against restrictions on property rights or their loss if the concluded purchase and sale transaction is contested.

Another important component of comprehensive insurance is issuing a policy in case of death or disability. If the borrower becomes unable to work or dies, the loan obligations are automatically repaid. To complete the paperwork, you must undergo a medical examination. The presence of excess weight in life-threatening amounts and chronic diseases will significantly increase the cost of insurance. In addition, representatives of dangerous professions or owners of extreme hobbies will also pay at a completely different rate.

Advantages of insurance when opening a mortgage at VTB

The advantages of cooperation with VTB are:

- financial protection of life, health and property in difficult situations;

- a huge selection of insurance companies;

- flexible insurance conditions taking into account the individual conditions of each client;

- simple and clear rules of action in the event of an insured event;

- favorable conditions for early loan repayment;

- availability of comprehensive mortgage insurance;

- The contract is valid for 12 months, after which you can change the insurer.

- the policy covers all possible risks of termination of ownership;

- quick execution of an insurance contract.

Refusal of insurance in Sberbank and VTB24

The growing demand of citizens for mortgage lending allows some banks to apply more flexible conditions to mortgage insurance requirements.

Sberbank and VTB24 are no exception in this matter. If previously a client’s refusal to accept a policy would inevitably lead to a refusal to issue a loan, then in today’s realities many financial institutions consider such refusals loyally, but put forward specific requirements.

Your loan has been approved!

Banks allow the abolition of insurance (even mandatory insurance for real estate), but in return they charge an increased interest rate on payments. Of course, each case is considered individually. For example, title insurance cannot be avoided if the purchased home has been owned by the seller for no more than three years. A down payment of less than 20% will also force the bank to require insurance against the possible risk of not fulfilling payment obligations.

The above facts indicate that when applying for a loan and disagreeing on the issue of insurance, the borrower is either denied a mortgage loan or is assigned an increased interest rate.

Reviews about mortgage insurance at VTB

Good afternoon I always spoke positively about VTB Bank, but this time they were very disappointing. I submitted an application to reduce the interest rate on 2 mortgages, the office said that the application would be considered in 60 days. As a result, three months have passed and there is still silence. I decided to call the hotline, the specialist replied, “You will be answered within a few days,” without asking for your first or last name... In the end, I even transferred my salary to another bank, since such a disregard for clients really disappointed me.

Grade:

Sergey, 35 years old.

Due to a decrease in mortgage rates in the market, I decided to contact the bank office about reducing the rate on my existing mortgage loan. After submitting the application, 2 months passed, after which I again came to the office where the employee told me that the rate reduction was denied to me without explanation. I meet all the criteria, but neither the hotline nor the office can explain why they are refusing me. Not a normal attitude towards your clients.

Grade:

Sergey, 29 years old.

Dissatisfied with the attitude of bank employees towards clients. I applied for a reduction in the interest rate on my mortgage loan. I indicated there all my coordinates where you can contact me. The application was supposed to be reviewed within 60 days, 71 days have already passed, and no one has contacted me from the bank. I called myself, to which I was told that the rate reduction program is not yet in effect and it is not known when it will start.

The other day I found out that everything is working and many people have already had their percentage reduced. It turns out that all this time the bank was deceiving me, feeding me with promises. I have lost all trust in the bank!

Grade:

Olga, 37 years old.

Hello. After the addition to the family, they started thinking about expanding their living space. The available funds after the sale of the apartment were not enough for a new one, so we decided to take out a loan. We contacted VTB because, compared to other banks, they had a fairly low interest rate. All documents were completed quite quickly. I would like to thank the bank employees for their work. Grade:

Alexander, 29 years old.

VTB insurance is a guarantee of protecting your health and your family from various unforeseen situations.

Note! If you need an inexpensive option, then pay attention to the individual insurance option. Complex, on the other hand, includes a greater number of risks and is a reliable protection of the borrower’s solvency.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

Life and health insurance at VTB 24

VTB company provides personal insurance, which provides financial assistance in the event of unforeseen circumstances.

These include:

- injuries and serious illnesses;

- natural disasters and accidents, such as fires or floods;

- violent and criminal acts;

- terrorist attacks;

- all other situations in which life is at risk.

An application for an insurance policy is submitted at one of the VTB branches. You must provide a package of documents. The next step is to choose one of the programs and agree on its cost. After full familiarization with the services offered, an agreement is concluded with the client. At the end of the operation he is provided with an insurance policy. The client has every right to terminate the contract with the insurance company at any time by writing a statement. The termination process will last about a month.

One of the services offered by VTB is endowment insurance. Such a program allows you to save a financial amount, and in an emergency, receive monetary compensation for its loss. The advantage of endowment insurance is the opportunity not only to maintain, but also to increase your financial income.

The most popular type of insurance from VTB is investment insurance. The client agrees to the company using his savings, and the company, in turn, invests the amount in some reliable endeavor. Result: the initial amount doubles or even triples.

The investment insurance program has the following nuances:

- the client is obliged to make payments systematically;

- the client can withdraw his funds only after several years;

- the client independently chooses the projects in which he wants to invest his money.

The price for this type of insurance policy varies. Depending on the services provided by the company and individual conditions, prices for the same type of insurance may differ radically.

How to obtain mortgage insurance from VTB Bank?

To conclude an insurance contract with the client must:

- Come to VTB Bank for a consultation with a specialist with identification documents (passport, TIN).

- Fill out an application for insurance, selecting the appropriate policy option.

- Give the application to the employee.

- Provide a package of documents (if insurance is issued for property owned by the mortgage borrower): a questionnaire, a registration certificate of the property, an extract from the house register, a real estate appraisal report, a certificate of absence of debts on utility bills. Additionally, the insurer may request other documents: an act of acceptance and transfer of property, an extract from the Unified State Register, a certificate of absence of debt, etc.

- Having received the necessary documents, the specialist calculates the amount of future insurance and announces the final figure to the client.

- A person pays for insurance. If he has chosen, then he has the opportunity to pay for insurance directly through the site. A receipt for payment will be sent to him by email.

Documents required to purchase insurance

In order for the insurance company to enter into an agreement with the client, the client needs to bring a passport, a medical certificate confirming the absence of serious illnesses, a mortgage agreement, and real estate documents.

VTB Bank works with several insurance companies, including: Alfa Insurance, VSK, etc.

Why do you need mortgage insurance?

Mortgage insurance is provided by joining the client to the comprehensive VTB program. It includes a number of main risks:

- Loss of ability to work.

- Death.

- Damage to purchased property.

- Restriction/complete loss of the right to own real estate for three years after the conclusion of the contract.

Joining the comprehensive program is a prerequisite for VTB Bank when applying for a mortgage loan. In addition, this leads to a reduction in the final percentage by one point. If the borrower purchases a VTB policy that includes only one type of insurance, its rate will remain the maximum.

Note! If a mortgage is taken out with the participation of third parties acting as co-borrowers or guarantors, VTB will ask you to insure their life and health.

Sberbank Insurance and VTB Mortgage Insurance agreements

A mortgage insurance agreement is drawn up when receiving a bank loan for the purchase of real estate.

Sberbank Insurance and VTB Insurance are Russian leaders in the mortgage insurance market . The complex products of these companies are quite similar in basic parameters.

Let's consider the key points of a comprehensive mortgage insurance agreement:

- Insurance of the purchased property against damage or loss. Covers such insured events as losses from fire, damage by lightning, water, gas or steam boiler explosion, damage caused by natural disasters, groundwater flooding and soil subsidence, illegal acts of third parties and other factors.

- Title insurance against the risk of losing your home due to restrictions or loss of rights to own real estate.

- Life and health insurance of the client. Includes risks such as death as a result of illness or accident, disability or temporarily lost ability to work, arising as a result of unforeseen circumstances.

The occurrence of an insured event gives grounds for insurers to pay compensation to the banking organization in the amount of actual damage not exceeding the agreed amount.

The amount of the contribution in accordance with the contract depends on the length of the insurance period, the age of the borrower, his state of health, the technical condition of the property, and how many transactions with this property have taken place in the past. The average premium paid once a year under a comprehensive insurance contract corresponds to 1% of the insurance amount. The duration of the contract is influenced by the length of the mortgage loan payment period.