Business lawyer > Accounting > Remuneration > How are wages calculated at enterprises in the Russian Federation?

When looking through advertisements for available vacancies, the first thing everyone pays attention to is the salary. It is important for people to know what the rewards will be for their efforts and dedication. There are no queues for small salaries. Everyone agrees to a decent reward. But often expectations are not met, since the promised salary is not paid in the amount that was originally promised. And this is not deception or a violation of employee rights. Do not forget that part of your salary goes to social contributions and taxes.

Where do wages go?

We calculate salaries correctly

So, you've been hired. An order was issued in this regard and an employment contract was signed. A corresponding entry has been made in your work book. Based on the submitted documents, the company’s accounting department has opened a personal account in your name. You are working and full of expectations.

To avoid disappointment with the amount of earnings paid, every employee must understand that in most cases, when announcing vacancies, it is not the amount that a person will receive in hand that is indicated, but what will be initially accrued. Deductions are not shown, since from the point of view of the law, the basic amount is taken for the salary.

Salary is what you will receive when all legally required interest has been deducted from your salary. In Russia they are not as ruinous as in many other countries. In some states, the treasury takes away more than 50% of people's honestly earned money. This is needed to cover social needs, defense, maintenance of government agencies, etc.

What amounts will not be included in the salary that the employee receives at the end of the month. It can be:

- contributions to social services;

- unworked days for which no one is obliged to pay you;

- alimony;

- advances;

- taxes that the state levies on individuals, etc.

The salary will change every month. And there is nothing illegal about this.

Those who feel most comfortable are those who understand the question of “what’s what” and can calculate their pay themselves. This is useful, since accountants can make mistakes: knowing that you are savvy in this matter, they will be more attentive.

The salary is not the salary that the employee receives in person after the accounting department has made all the necessary deductions.

Payroll formula

In order to determine the amount of vacation pay, the average salary for the last 12 months is calculated.

Next, the average earnings per working day are calculated; for this, the resulting number is divided by 29.4 - this is the average number of days in a year. The resulting figure is multiplied by the number of days on vacation.

Example of vacation pay calculation:

| Full name | Number of vacation days | average salary | Earnings in one day | Amount to be paid |

| Petrov Ivan Ivanovich | 24 | 4500 rubles | 4500/29.4 = 153.06 rubles | 153.06×24 = 3673.44 rubles |

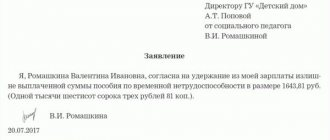

In order to calculate sick leave, you need to know your length of service, the payment for which is a certain percentage of average earnings:

- 100% - with work experience of 8 or more years;

- 80% - with work experience of 5-8 years;

- 60% - with less than 5 years of work experience.

When calculating payments for sick leave, calendar days are taken into account, not working days. Temporary disability benefits are calculated on the basis of the average salary, which is calculated over the last 2 years.

When calculating the daily allowance for one day, the total amount of income for two years is divided by 730 (the number of calendar days in two years).

An example of calculating disability payments:

| Full name | Number of days netru - capacity | Average salary for 2 years | Insurance experience | Earnings in one day | Amount to be paid |

| Petrov Ivan Ivanovich | 14 | 108,000 rubles | 10 years | 108000/730= 147.94 rubles | 147.94×14×100%= 2071.23 rubles |

When calculating alimony, the amounts specified in the writ of execution are withheld from wages. Alimony can be indicated as a percentage of available income, or in a set amount.

The maximum amount of alimony withholding should not exceed 70% after deduction of personal income tax.

In percentage terms, alimony amounts to:

- 1/4 of income if there is 1 child;

- 1/3 of income if there are 2 children;

- 1/2 of income if there are 3 or more children.

These percentages can be reduced or increased in court due to related valid circumstances, for example, financial situation.

For example , if the salary is 4,500 rubles, then the amount of alimony for one child will be: 4,500/4 = 1,125 rubles.

What is personal income tax?

Personal income tax is the taxes that all individuals are required to pay. In order to calculate it, the total income of a particular person is taken, from which all expenses established by law are subtracted (they must be supported by documents) and the required percentage is subtracted.

It is important to know exactly what percentage they should charge you. For different categories of persons, it may differ.

We understand what taxes individuals must pay

The tax will be maximum if you have not yet started a family, you have no dependents, and you have not participated in any military operations, etc. For those who suffered from large-scale disasters, fought or otherwise took part in hostilities, or have legal dependents, a tax break is provided.

Thus, a person representing a child under 18 years of age can expect that the tax base will be reduced by 1,400 rubles. If there are two such children, then the total amount will be 2,800 rubles. For the third child, the base will decrease by 3,000 rubles. Moreover, if the first two children become adults, the amount of 3,000 for the third offspring still remains relevant. For the fourth, fifth, etc. for children the amount of 3,000 rubles remains unchanged.

For disabled children, the base is always reduced by 3,000 rubles. If a child has entered and is studying at the institute, the base remains unchanged until he reaches the age of 24.

There are a lot of subtleties in relation to each category. Before calculating wages to employees, accountants must decide on what amount personal income tax should be calculated.

Other deductions from wages

Withholding refers to forced deductions from wages without the consent of the employee.

Read on - how to find out OKPO by TIN. Detailed instructions.

In the article (link) how to change OKVED.

Distribution of profits in an LLC between participants! https://urist.club/other/buhgalteriya/raspredelenie-pribyli-v-ooo.html

According to the law, the following deductions can be made from wages:

- personal income tax - personal income tax;

- compensation for material damage that the employee caused to the company;

- fines according to the law;

- according to executive documents;

- for defects in the production process and others.

The total amount of deductions should not exceed 20% of income, in some cases 50%. The amount of deduction is calculated from the net amount payable, which is formed after calculating deductions, personal income tax, and alimony.

It should be remembered that personal income tax is deducted from accrued wages (including deductions), then the amount of alimony, then other deductions in the amount of no more than 20%.

Video on the topic: “Training 1C 8.2 payroll for employees”

https://youtu.be/Vf3G7TES7jE

What is an advance?

Where is the advance and where is the salary?

The Labor Code of the Russian Federation has Article 136, which clearly states that the employer is obliged to pay his employees wages twice a month. Many people think that the advance is paid at the request of the employee; in fact, every employee has a legal right to this payment, made in the middle of the month. The only question is what the amount should be. What percentage should the accounting department calculate?

It turns out that the percentage of payments for the first half of the month is agreed upon by management and the trade union committee and is fixed by the collective agreement. That is, each enterprise has its own rules. There is only one single stipulation that the employee must receive no less than what he earned during the first half of the month or for the days for which the advance is calculated. This means that the amount should be at least 40-50%.

As for the timing, the advance is paid approximately 15 days after the previously received wages for the previous month. The interval should not be too small. It is also not allowed to pay an advance two or three times within a month.

Taxes are not deducted from the advance payment. Personal income tax, social payments and other calculations are calculated by the accounting department at the end of the month, when the employee receives the remaining amount.

Failure to pay the advance is considered a violation of the law. The employee has the right to demand it from the manager if the enterprise does not have such a tradition and, in case of refusal, go to court.

Types of wages

It will be useful to know how wages are calculated. There are two types of it: piecework and time-based. Your task is to decide which of the two types your type of income belongs to.

Time-based depends on the time you worked. That is, it is calculated depending on the hours worked. Each enterprise has a special employee who is obliged to keep records of how much each of the team members on the staffing table works. All information about the work is entered into the working time sheet. The time taken into account is divided into categories. There is night and holiday. Work at night and during holidays is paid differently. The timesheet contains all the information about what the employee did during working hours.

If you were sick or on vacation, the appropriate notes are made in the document.

The time-based salary is directly dependent on how much you worked and how you used the time taken into account in your timesheet, whether you were at your workplace or went on a business trip.

Piece payment depends on the amount of work performed. In this case, the basis for accrual is not time, but the prices agreed upon by management and employees.

If teams are involved in production, wages are calculated for everyone, and then the foreman decides who is entitled to what amount. Typically, the volume completed by each team member is taken into account. With piecework calculation, workers always know how much they should receive.

Enterprises use either piecework or time-based wages. The first can be paid directly to the brigade.

Calculation of employees' wages

Salaries are calculated in accordance with the tariffs, piece rates, and salaries in force at the enterprise. The time worked by the employee and the volume of products produced are also taken into account.

The following documents are used to calculate wages:

- staffing schedule;

- wage regulations;

- The order of acceptance to work;

- employment agreement or contract.

Based on these documents, the salary amount and form of payment for each employee are calculated. The salary amount can be changed upward or downward.

Correct calculation of compensation for unused vacation. Example and formula.

In the news (here) how long the staffing table is kept.

Sample of personal income tax certificate 2! https://urist.club/other/terminy-i-opredeleniya/spravka-2-ndfl.html

The basis for this are additional documents: orders for bonuses or punishment, memos. The Regulations on Remuneration regulate the procedure for calculating salaries for each category of employees, including the calculation of bonuses.

Salary calculation example

The easiest way to understand how to calculate the wages that will be paid to an employee is to rely on specific examples.

For example, an employee receives a salary of 30,000 rubles. There were 21 working days in a month, of which the person worked only 10. You need to decide how much salary is due for each day. To do this, 30,000 is divided by 21. It turns out that the employee earned 1,428 rubles every day.

If we multiply this amount by 10 days worked, we get the salary. It is equal to 14,280.

If an employee has, for example, two children, 2,800 must be subtracted from the amount received (1,400 for each child). What remains is 11,480 rubles, from which personal income tax is taken in the amount of 13%. That is, a citizen must pay 1,492 rubles to the state treasury. We subtract this amount from the salary and get the salary for the month worked 12,780.

Salary: calculation example

The previously paid advance is subtracted from the amount received.

There are several types of piecework wages. The most common is simple. When calculating it, the completed volume is multiplied by the tariff established at the enterprise.

Piece workers, like everyone else, are required to pay taxes. After the salary amount is calculated, deductions are made as provided for by the legislation of the Russian Federation. In addition to personal income tax and social payments, accounting has the right to deduct alimony and other things, which does not contradict the law.

Salary and tariffs are not a secret, therefore, when applying for a job, an employee has the right to contact the accounting department and find out exactly what will be deducted from his salary. Once you have this information, you can calculate the amount due to you at the end of the month.

What else is paid besides personal income tax?

The law provided for the amount of tax. In most cases, personal income tax should not take more than 20% of his salary out of an employee’s wallet. There are exceptions. In total, the tax should not be more than 50%.

There are other taxes, or deductions, that the law imposes on wages. However, their payment is not the responsibility of an ordinary employee. The employer bears this burden.

In addition to personal income tax, a social security contribution is made in the amount of 2.9%. Monthly amounts are also transferred to the Pension Fund. Their size is 22%. Compulsory health insurance takes 5.1%.

For everyone who is residents of the Russian Federation, the tax rate for labor activities does not exceed 13%. The same percentage is paid by non-residents classified as citizens of EAEU countries, visa-free immigrants, refugees and highly qualified specialists. All other persons who are not residents of our country pay personal income tax in the amount of 30%.

It is expected that in the near future the tax will be increased to 16%. However, the State Duma is postponing resolution of this issue for now. It is not yet known whether it will be considered.

Some categories of employees (notaries, lawyers, individual entrepreneurs, etc.) are themselves required to pay taxes on their activities.

By learning how to calculate your salary, you can plan your expenses and make plans for the future. Many enterprises have such concepts as progressives, bonuses, overtime, etc. The more savvy you are, the easier it is to change your life for the better. The ability to calculate salaries correctly will not hurt anyone.

Top

Write your question in the form below