Every employee is entitled to leave, but in the vast majority of cases the company does not stop its activities during holidays. The absence of one employee should not affect the work of the entire organization, which means that his powers must be delegated to someone. At the same time, a colleague who has received additional duties, and with them additional responsibility, should have the right to compensation.

Question: The organization employs employees who receive additional payment for combining professions (positions). The established salaries for such workers are below the minimum wage, but the salary and additional payment for combining professions (positions) for a fully worked month are slightly higher than the minimum wage. Are payments made for combining professions (positions) included in wages in order to compare them with the minimum wage? View answer

How additional payments are made for combining positions during vacation, what the labor legislation of the Russian Federation says about such a situation, what are the nuances of registration, accounting and taxation of such a combination - let’s figure it out together.

The legislative framework

From the first day of employment, an employee has a certain range of responsibilities, which are assigned to him on the basis of an employment contract, as well as a job description, if any.

At the same time, by virtue of Article 60 of the Labor Code of the Russian Federation, the employer cannot demand the fulfillment of additional duties that are not enshrined in these acts, with the exception of certain cases.

Thus, within the framework of Article 60.2 of the Labor Code of the Russian Federation, in the absence of the main employee, who, for example, is on vacation, it is possible to assign additional responsibilities to another employee by combining two positions and expanding service areas.

This is relevant for identical vacancies or the imposition of additional responsibilities, if we are talking about different positions.

But only if certain mandatory conditions are met:

- employee consent;

- compensation for more intensive work in monetary terms.

The concept of part-time work

Mandatory leave is provided for by labor legislation, but it also requires maintaining the continuity of the process. In this case, an employee is selected from the existing staff to temporarily perform the duties of the absent employee, or another person is hired to work temporarily or part-time. Temporary replacement requires documentation and additional payment.

What is meant by the concept of combination? The employee must fulfill his immediate duties stipulated by the employment contract, as well as those assigned to the person temporarily absent from work. Powers are transferred on the basis of an order, which must indicate for what period this is being done and what the premium is.

The legislative framework

From the first day of taking up the position, the employee performs certain duties stipulated by the employment contract. The boss does not have the right to assign additional functions to him unless this is stipulated in the company order (Article 60 of the Labor Code of the Russian Federation). That is, based on this article, an employee can be involved in combining positions or expanding the area of responsibility only after the relevant regulatory act has been drawn up and an allowance has been assigned.

Attention! It is impossible to force an employee to do a combination of jobs; his consent and compensation for intensive work, expressed in money, are required.

Possible restrictions

By providing one employee with internal part-time leave, another person from the staff is hired to perform his work. The law contains practically no restrictions in this matter. Also, the positions must be related for the person to cope with the assigned tasks. For example, an accountant may be temporarily appointed to replace a personnel employee.

No additional responsibility is placed on preferential categories of citizens, since this violates their right to reduced production standards. In addition, they do not attract:

- Pregnant women.

- Minor citizens.

- Disabled people.

- People with serious chronic diseases.

When combining positions in one organization, after granting leave to an employee, it is mandatory to undergo training. Each workplace has its own rules for safe behavior, and even if the positions are similar, they may differ slightly.

In addition, there is a restriction on replacement if the place is vacant - this is confirmed by numerous judicial practice. It is impossible to involve workers with insufficient or higher qualifications in the performance of duties, only people of an equivalent category. An exception is the replacement of a manager by a deputy, since this often serves as a test of his ability to hold such a position in the future.

The concept of combination and substitution

The Labor Code makes a fundamental distinction between the concepts of substitution and combination, although many use them as identical. In fact, when replacing an employee, the employee must only perform someone else's duties. When combined, the responsibility of another person is only an addition to its main functions, that is, the load increases.

Temporary replacement is applied to the manager or with maximum responsibility. To fully perform the functions, the deputy must leave his main tasks. In some cases, appointment is used as a test of competency and the individual may subsequently be eligible for promotion. The maximum replacement period is 1 month.

Temporary sharing involves performing the duties of an absent employee. At the same time, one’s own labor function does not disappear and the person is not freed from performing basic tasks. If additional payment is not provided for replacement, with the exception of a number of cases, then combination obliges the employer to reward the person for his work. The same scheme is used in the absence of personnel during sick leave, business trips, or educational process.

Concept

Within the framework of the law, combination is the assignment of additional duties to another employee without relieving them of their own or increasing the workload due to the fulfillment of the workload of the vacationer, and for the same 8 hours as provided for by the work schedule in the company.

At the same time, taking into account that an employee may be assigned both similar tasks and ones completely different from his usual range of responsibilities, the combination can be done in two ways:

- Simultaneous performance of duties , but at a more intensive pace, given that we are talking about expanding service areas.

- Alternate execution of tasks in order of their importance for both positions or according to other criteria that are determined by the employee himself.

Are holiday pay paid to part-time employees?

Relations between a part-time worker and an employer are regulated by the Labor Code and other federal and local regulations. According to current legislation, employees who work in two positions have the right to vacation, just like other subordinates.

Part-time workers, like main employees, are entitled to the following types of leave:

- annual basic;

- maternity leave;

- educational;

- for pregnancy and childbirth;

- paid additional;

- caring for a minor child;

- benefits without pay.

Employees who work two jobs are interested in whether vacation pay is due when working part-time. A similar question is quite relevant for employers. It should be taken into account that part-time work is divided into two types: external and internal.

Part-time workers must be provided with all the guarantees provided for by labor legislation. In particular, we are talking about article No. 287 of the Labor Code of Russia.

Internal

An internal worker is a part-time worker who holds two positions at one enterprise. Most often, the initiative to work at two workplaces within the company comes from the employee himself.

An employee learns about a vacant position and proposes his candidacy. Management is willing to accept an internal part-time job. It is easier for a manager to collaborate with an employee he already knows than to select a candidate from outside.

An example of an internal part-time job: a man cleans a store from 8:00 to 10:00, and from 10:00 to 18:00 works as a security guard in the same establishment. Certain difficulties arise with the provision of vacations and payment of vacation pay to such employees. This is due to the fact that many people confuse part-time work with combination or substitution.

Leave for internal part-time workers is granted during the rest period required at their main place of work. Since such employees have equal rights with other employees, they are paid vacation pay for their main position and part-time position three days before the start of their vacation.

External

External part-time work should be understood as working in two positions at different enterprises.

An example is a woman who works from 8:00 to 10:00 as a cleaner in a store, and from 11:00 to 19:00 as a nurse in a children's hospital. Leave for an external part-time worker is granted during the period of rest at the main place of work.

Vacation pay is required to be compensated and paid three days before the start of the vacation. It should be noted that the duration of vacations may not be the same.

Expert opinion

Irina Vasilyeva

Civil law expert

If a part-time worker needs to take several days at his own expense in order for the duration of two vacations to be the same, then this period will not be paid.

Right or duty?

Within the framework of Article 60.2 of the Labor Code of the Russian Federation, combination can be carried out only with the written consent of the employee, and the deadline for fulfilling the additional load is also agreed upon.

The work schedule for the main position may be different during the month and, accordingly, at the beginning of the month the employee still has the opportunity to perform an additional amount of work, but at the end, if the same quarterly reports are to be submitted, he no longer has the opportunity.

And since, without the consent of the worker, the employer cannot oblige him to perform the amount of work of the vacationer, combination is a right, given that the worker can choose whether to agree to an increased amount of work or not.

Temporary combination

Is it possible to cancel or reduce the surcharge? The law specifies only one case when such an action by the employer will be lawful - a deterioration in the quality of work of the substitute compared to the one being replaced. If this occurs, the employer has the right to change the conditions of the combination, but he must warn the offending employee about this in writing.

Unused vacation, even in the event of dismissal, must be paid! In our article you will find out the details.

Who can be involved?

The law does not contain a list of restrictions on being involved in part-time work. However, this does not mean that they do not exist at all.

For example, it is prohibited to involve any employee in such types of work without his consent, and it is also undesirable to assign additional responsibilities to preferential categories, which, within the framework of the law, have the right to reduce production standards.

That is, it is possible to attract a pregnant woman or a minor employee, as well as a disabled person, to work in such a mode, but it is not advisable, given that they already work under conditions of reduced workload and shortened work shifts.

Replacing a temporarily absent employee

If one of the employees is absent for a while, due to illness, going on vacation, or similar reasons, his place may be taken by another employee, who is not released from his main job. That is, when another employee takes a vacation, the part-time employee has to take over his work too.

It often happens that the rights of workers are violated because they are burdened with responsibilities without official registration and payment.

To prevent this from happening, you need to be well aware of the rights you have and have the determination to defend them - and if necessary, even in the courtroom. If the labor code is violated, the employer must be held accountable.

It is also necessary to remember that an employee has the right to refuse to replace a colleague: working part-time when that colleague has gone on vacation is not at all an obligation. Moreover, in order for an employee to begin performing his duties, it is necessary to obtain his written consent; the document must detail the main parameters of the work and payment for it. A sample application is attached to the article. But the issue of payment should be considered separately.

Restrictions

Also, additional restrictions when combining are the following aspects:

- a ban on the assignment of duties for a vacant position, which is confirmed by judicial practice;

- the impossibility of being hired for a position with higher qualifications, given that an employee without proper education or clearance does not have the right to perform such duties; therefore, combinations are permissible only between equivalent categories of blue-collar professions or specialists;

- a ban on hiring without a medical examination, if the position requires the issuance of a medical record;

- the impossibility of assigning duties without undergoing training, given that the rules of safe behavior are established in all workplaces without exception.

Rights of the substitute employee and employer

Labor legislation protects the interests of workers. An employee has the right to refuse to perform the work duties of a colleague on vacation or to prematurely stop performing additional work.

When combining several positions, an additional agreement is not required; signing an order is sufficient.

The employer may cancel the assignment before the deadline. The reasons may be different: early return from vacation, transfer of job responsibilities to another person, etc.

For more information, see “Vacation Substitution: The Right Approach.”

Combination or replacement?

By virtue of the law, combination is the assignment of additional duties without exemption from one’s own, while replacement is a transfer to another position before the main employee leaves.

As a rule, replacement is used in the event of a long-term absence of a worker, for example, maternity leave, with the likelihood of remaining at the workplace permanently due to transfer. While the combination is used only for a very short time, that is, for the same period of annual rest.

Who is entitled to financial assistance for vacation and in what cases? Find out from our article. What are the penalties for non-payment of wages? Read here.

Normative base

Some organizations cannot shift the responsibilities of an employee who has gone on vacation to another person.

The reasons are different: high workload, lack of required experience, etc. When combining or filling a position is impossible, it is advisable to conclude a fixed-term employment contract with a third party. The advantages are obvious: The next stage of registration is the issuance of an order to fill a position during vacation in a form approved by the State Statistics Committee (T-5 or T-5a). The document form is available on our website here.

How is the additional payment for combining positions during vacation processed?

When performing labor duties in conditions deviating from the norm, the Labor Code of the Russian Federation contains not only clear standards for payment, but also a minimum fixed amount, but not in the case of combination.

Considering that the amount of additional work may vary, the parties to labor relations, that is, the worker and management, are given the right to independently determine the amount of additional payment depending on the nature of the work and its complexity.

However, given that the amount of work for each position is calculated in proportion to the standard hours per week, performing duties in two positions at the same time can be not only difficult, but also impossible.

That is why the law allows registration of a combination of jobs at once in relation to several employees, who will take on a certain part of the vacationer’s responsibilities.

Naturally, in such a situation, the amount of additional payment will naturally be different, given that the complexity and intensity of the work will vary.

Order

Within the framework of Article 151 of the Labor Code of the Russian Federation, the amount of additional payment is determined by agreement of the parties, which is reached both when issuing an order on combination, and, possibly, earlier, for example, under the terms of a collective agreement, in which a condition on the basic amount of additional payment in the event of replacing the main employee.

At the same time, regardless of whether the amount of the additional payment is stipulated in the agreement adopted collectively or not, the order indicating the amount of the additional payment is issued anyway, taking into account that several employees can be involved in the part-time mode, and with different workloads.

It should also be noted that, regardless of how many employees work part-time, within the framework of Article 149 of the Labor Code of the Russian Federation, the amount of additional payment cannot exceed the maximum salary for the position being filled, and based on the total payments for everyone.

That is, if the vacationer’s salary was 12 thousand, the additional payment, even based on three shift workers, cannot be higher than the specified amount, but it can be less.

Replacing an employee during vacation

Not all employees can be replaced on their own, using the services of internal workers. Some professions require the performance of labor activities in a volume that takes up the entire working time, which, of course, is impossible with internal part-time work. In addition, it happens that there is simply no specialist in the team who can perform the necessary actions skillfully and professionally. In these cases, you cannot do without substitutes.

An invited specialist can be hired full-time, for example, if he has no other job or is currently on vacation with a limited duration of the contract. He can also be accepted part-time, having another place of work. Both methods are completely legal, but require appropriate registration.

A separate item for external part-time jobs is the selection of a deputy. He must meet all the requirements of the vacationer position and have sufficient work experience and suitable qualifications. Selecting a replacement is a labor-intensive procedure, so it is often done in advance.

Decor

External part-time employees are registered using different methods than internal ones. They undergo a full-fledged hiring process, which depends only on whether the hired employee has another job or not. If there is no main job, then he is obliged to provide a complete list of documents specified in the Labor Code of the Russian Federation, including a work book. But those who have a main job may not provide a personal work record book and even have the right to decide whether to enter information about this temporary work into it or not.

In addition to the required documents, the employer may require a certificate from the main employer about the nature of the work performed. This rule is mandatory if the deputy will work in harmful or dangerous conditions. Sometimes you can’t do without medical certificates about your health status.

After the package of documents for admission has been submitted, an employment contract is concluded with the part-time worker, which states:

- Who hires a citizen?

- For how long it was accepted, the day of the beginning of work and its end should be indicated here.

- What payment will he receive?

The contract is drawn up according to the same rules as for main employees, only with a limitation on the terms of cooperation.

Payment upon replacement

External part-time work has its own rules for calculating payment amounts. Although they are not regulated by law, most often the deputy’s remuneration directly depends on the vacationer’s salary.

You can calculate the salary of a part-time worker based on:

- The rate is based on the salary of a temporarily absent employee. The full rate will be equal to one salary, and 0.5 to only half of it.

- Average salary level in the region for this position.

The main thing when setting wages is reaching an agreement between the temporary worker and the employer himself. If both parties are satisfied with the terms of the agreement, then the contract can be signed.

Please note that when combining, be it internal or external, you cannot count on all types of additional payments that were established for the main employee. Additional amounts, such as length of service, professional skills, and others, are assigned as incentives for permanent employees and most often are not included in the deputy’s salary.

Kinds

Of course, each company has different financial capabilities. And the parties may have their own opinion regarding the full remuneration, and therefore several options for calculating the additional payment are possible.

As a percentage of salary

In particular, the most common method is a percentage of the vacationer’s salary in an amount that is determined by agreement of the parties or based on the conditions enshrined in the same collective agreement.

For example, in most companies the additional payment is 50% of the salary, and in some it is 30%, but if we are talking about a management position, say, that of a line manager, the additional payment, as a rule, is made at the level of 100%.

In a flat amount

Also, remuneration for an additional amount of work can be made in a fixed amount, which implies a condition for payment, for example, of the same 12 thousand rubles for a full month one-time after the main employee returns from vacation.

Is it possible not to pay and is it legal?

But the lack of remuneration is completely unacceptable, given that both Article 60.2 of the Labor Code of the Russian Federation and Article 151 of the Labor Code of the Russian Federation stipulate the condition of mandatory additional payment for additional workload.

That is, if an order is issued to perform the duties of a temporarily absent employee, the condition for additional payment must be included. Otherwise, when inspected by regulatory authorities, the company will face penalties.

Accrual and types

There are several main types of surcharges:

- The amount accrued based on the actual products produced (piecework). For example, at an additional place of work, a milling machine operator checked finished parts, and for each of them a tariff of 4 rubles was set. For checking 2,000 products, this employee will receive an additional 8,000 rubles.

- The amount calculated based on the salary at the main place of work (in percentages established in the collective agreement). For example, a 25% surcharge was established. An economist earns 25,000 rubles in his main position. The salary of an additional workplace is 20,000 rubles, and the combined time is 20 days if there are 21 working days in the current month.

To calculate the surcharge you need:

- 20,000 multiplied by 25%;

- then multiply the resulting number again by 20 days worked;

- and divide the result by 21 working days;

- As a result, 4,761 rubles 91 kopecks will be charged for payment.

The accountant will add this amount to the basic salary, and the total payment will be 29,761 rubles 91 kopecks for the month worked in combination.

Also, the collective agreement may provide for a fixed amount of additional payment.

The state pension co-financing program is aimed at supporting the social level of the population of the Russian Federation. Indexation of pensions in 2016 is a topic of concern to many. Read more about this here. Unused vacation, even in the event of dismissal, must be paid! In our article you will find out the details.

Payment amount

In 1981, Resolution of the USSR Council of Ministers No. 1145 was adopted, which has now lost force, which does not prevent many companies from using it as a base.

That is, many employers to this day set an additional payment of no more than 50% for blue-collar workers, and up to 30% for specialists.

Meanwhile, Article 132 of the Labor Code of the Russian Federation states that remuneration should be made in direct proportion to the quality and quantity of work performed, as well as its complexity.

And since additional responsibilities are also labor, they should be rewarded accordingly, that is, in proportion to the effort expended.

What does it depend on?

Of course, ideally, the percentage of additional payment for performing additional work should depend on the complexity of the work and the number of tasks completed.

However, in practice, management prefers to set a small percentage in the form of an additional payment, thus fulfilling the provisions of Article 151 of the Labor Code of the Russian Federation and no more.

What percentage can be set?

As a rule, in most cases, the additional payment for combining positions during vacation is set at 50%, similar to Soviet times.

However, some employers, in order to save wages, prefer to pay no more than 30% of the vacationer’s salary, citing the fact that this amount of remuneration is specified in the collective agreement.

But it is possible to increase the surcharge, given that the law prohibits providing guarantees lower than those approved by local acts or federal regulations, but making payments in an increased amount is not prohibited.

Calculation features

Often, additional payment for combining positions is made as a percentage equivalent to the salary of the absent employee, but taking into account some features.

If the enterprise is located in the North, the surcharge increases by the corresponding coefficient. If the salary also includes some allowances, for example for secrecy or hazardous working conditions, they are also included.

What to do if an employee takes his vacation in advance and quits? Information on the issue is in the article. How is Chernobyl leave paid? Find out here.

How to understand a pay slip? See here.

Taxes and fees

Remuneration for part-time work is income.

Consequently, from the accrued amount not only personal income tax is charged under Article 208 of the Tax Code of the Russian Federation, but also other fees are transferred, such as insurance premiums in accordance with Article 425 of the Tax Code of the Russian Federation.

Example

Let’s say a vacationer’s salary is 12 thousand rubles. He is also entitled to a monthly bonus for hazardous working conditions of 10%. In accordance with the order, an employee who is employed part-time is given an additional payment of 50%. In this case, the vacationer will remain on vacation for 28 days.

Calculation: 12000 + 10% (1200): 168 (monthly hours) x 160 (hours for 28 days) x 50% = 6285.6 rubles.

Documenting

To avoid labor disputes arising in the process, the company is recommended to act in a strictly prescribed manner. The following algorithm is followed:

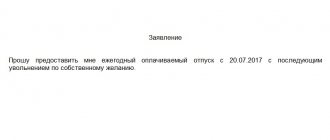

- Signing a person’s application for another unused vacation.

- Drawing up an order or additional agreement on part-time work, substitution or combination of positions during the employee’s vacation period.

- Signing of a document by an employee, which indicates job responsibilities, additional functions, and the amount of additional remuneration.

The additional payment will need to be calculated individually for each person, depending on whether he will combine positions or replace an employee. This is done by the accounting department and certified by the director. It is not necessary to indicate the amount in the order, but mention of compensation for labor must be present.

It is important to know! There is no need to reflect the combination on a personal card or time sheet.

Personnel registration

Both the performance of certain duties and the payment of remuneration for work performed are possible only on the basis of administrative documents - the same orders. Therefore, before an employee begins additional tasks, it is necessary to document his admission and the amount of additional payment.

Notification

That is, at the initial stage, the line manager draws up a memo or report stating that the main employee is going on vacation, therefore, in order to avoid downtime, it is necessary to assign his responsibilities to one or another worker.

After imposing a resolution on the specified document, the employee is sent a notification with a proposal to expand service areas during the vacation of the vacationer according to the following sample:

Is an application required?

As a rule, many workers seek to increase their income through even temporary part-time jobs.

Therefore, if one of them goes on vacation, the workers themselves can initiate the combination in the form of an application with a request to be assigned additional responsibilities.

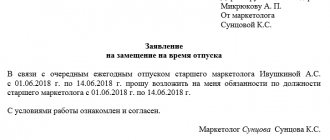

A sample application can be found below:

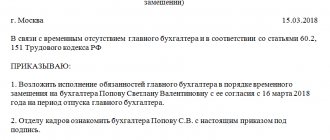

Order

Naturally, on the basis of an application or notification, which actually serves as the basis, an order is issued to assign responsibilities or expand service areas.

The standard form is presented on our website:

Additional agreement

Under Article 60 of the Labor Code of the Russian Federation, an employee cannot perform duties that are not covered by the employment contract.

Accordingly, in order for the worker to receive certain powers and to know what his new responsibilities are, even on a temporary basis, an additional agreement is drawn up.

A typical form looks like this:

Forms can be downloaded here:

Order form for combining positions

Additional agreement on combining positions

Application for combining positions

In what cases is sick leave not paid? This is discussed in our article. How to issue an order to postpone annual leave? Find out here.

Reflection in other personnel documents

As a rule, employment in one of the positions implies an indication in other personnel documents, in particular, in a report card or personal card, but not in the case of a combination.

The reason is that the employee performs duties in two positions simultaneously during the same shift and is not transferred to another vacancy.

Registration procedure

You can pay extra for the volume of combined work performed only on the basis of documents.

Consequently, any performance of someone else's duties must be officially documented. In order to apply for a replacement, you must:

- Have a reason to start the procedure. Most often, the immediate supervisor of the vacationer writes a report addressed to the director of the organization stating that for a certain period it is necessary to assign work obligations to another person.

- The director evaluates whether he can expand the service area and should attract an internal or external part-time employee.

- Once the decision on the required alternate has been made, a candidate is selected.

- The replacement, if known and registered in the organization, is sent a notification with a request to take on a certain block of work.

- The parties reach an agreement on the amount of payments and enter into a written agreement.

- The last step is to issue an order.

At large enterprises, to automate processes, issues of internal substitutions are resolved in advance. Usually, the employment contract and job description stipulate the need to replace a certain employee during vacation. This order allows you to skip all stages of registration, except the last one. The appropriate order is simply issued at the right time.

Conclusion of an agreement

If the need for replacement was not previously provided for in the employment contract, then the parties must draw up an additional agreement. It must contain all the points that are significant for the performance of duties.

A standard additional agreement contains:

- The number and date of the agreement to which it is written.

- Date of preparation of the document.

- Details of the employing organization and information about the manager - full name, position and on what basis he acts.

- Employee details – full name.

- Information about assigned responsibilities. If they are transferred to one person in full, then general information is written down, and if partially, then an updated list of them will have to be provided.

- Dates when you will have to combine work.

- The amount of the established bonus for performing work.

The agreement may also stipulate that the employee has the right to resign his part-time job early by notifying the employer no later than three days in advance.

Issuance of an order

An order is a mandatory administrative document that must be issued when making each individual decision.

It contains the following information:

- Date and document number.

- Link to Article 60.2 of the Labor Code of the Russian Federation, on the basis of which the decision on replacement is made.

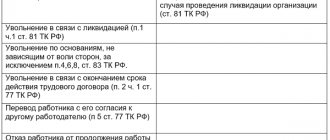

- The reason for the combination. They can be different, but in this case we are talking about providing leave to an employee.

- Substitution time, the deadlines for the beginning and end of the period are indicated, they coincide with the vacation of the person being replaced.

- The range of responsibilities assigned to the deputy.

- The amount of payment for the actions performed.

The order is signed by the director, after which both the vacationer himself, leaving his duties for a while, and the one who accepts responsibility for their implementation must be familiar with it.

In some cases, the basis for an order may be an application to assume obligations to combine oneself. Some workers, wanting to earn extra money, write counter-statements to their superiors.

Nuances

The procedure for registering a combination of several positions in ordinary organizations does not cause any particular difficulties, of course, if you follow the rules of the law.

But the need for combination also arises in other structures, which, due to their special specifics, carry out their activities not only on the basis of the Labor Code of the Russian Federation, but also other federal norms.

This leads to questions about how this type of legal relationship is formalized in the civil service or in relation to managers.

In the civil service

Federal Law No. 79-FZ of July 27, 2004 does not contain detailed explanations on how to formalize the combination of two positions during the vacation of one of the civil servants.

In this situation, we are guided by Article 73 of Federal Law No. 79, according to which, when combined, the norms of the Labor Code of the Russian Federation are applied, that is, Article 60.2 and Article 151 of the Labor Code of the Russian Federation.

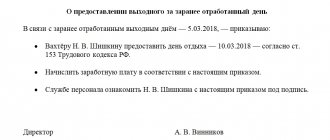

Combination during the director's vacation

As a rule, even at the stage of hiring the first deputy, the employment contract initially stipulates his powers in the absence of the director, which does not mean that the combination occurs automatically when an order is issued on the director’s leave.

Even in such a situation, an order is issued indicating the period of absence of management, the person who will replace him, as well as the amount of additional payment.

That is, neither a statement nor a memorandum is drawn up in these circumstances, given that the employment contract acts in their capacity, therefore only an order is sufficient.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Vacation

Second option: replacement

When it is impossible to combine two positions, it is permissible to temporarily release one of the employees from his permanent duties in order to perform the labor functions of the absentee.

Management does not have the right to force subordinates, therefore temporary transfer is possible only with a written agreement. It contains:

- signatures of both parties;

- the nature and extent of additional work;

- duration of performance of the colleague’s labor functions (can be specified in the charter, employment contract);

- the amount of due payments.

Written consent is not necessary in one case - when the working conditions do not change compared to those specified in the employment contract. There is no need to submit an application.

The next stage of registration is the issuance of an order to fill a position during vacation in a form approved by the State Statistics Committee (T-5 or T-5a). The document form is available on our website here.

Such an order must contain:

- reason for substitution;

- the amount of payment for performing labor duties;

- Kind of activity;

- replacement period.

Remuneration is provided in the amount established by the staffing schedule. Since a substitute employee is completely relieved of his permanent duties and performs labor functions for another person, there may be no additional payment. Exception: when the new job is more complex and highly paid.

Also see “How to register a replacement during sick leave.”

EXAMPLE Economist A.N. Rubtsova, who works at Release Build CJSC, goes on annual paid leave for 28 days. Absence period: 11/15/2016 – 12/12/2016. Her work responsibilities are transferred to accountant I.N. Orlov in order of filling the position. According to the charter, the employee is entitled to an additional payment of 40% of A.N.’s official salary. Rubtsova.

The sequence of registration for filling a position in Release Build:

- An agreement is drawn up indicating the reason for the decision (economist’s vacation), the date and signatures of the interested parties.

- An order is issued to fill the position of economist I.N. Orlov.

- Remuneration According to the accounting program, the salary of the absent employee is 23,700 rubles/month. As a result of filling the position during the vacation of I.N. Orlov is entitled to an accrual in the amount of: 23,700 × 40% = 9,480 rubles.

- In settlements with the budget, the employee is required to withhold income tax in the amount of:

9480 × 13% = 1232.4 rubles.The accrual to extra-budgetary funds is as follows:

9480 × 22% = 2085.6 rub.