Taxes

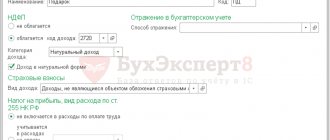

How are gifts made? To give gifts to employees, you need to draw up the appropriate administrative document - an order

What is financial assistance for treatment? Let's start with the concept of “material assistance”. You can go to her

Payment of wages is made in cash in the currency of the Russian Federation (in rubles). IN

Legislative framework The table below reflects the main documents that should be relied upon when making payments

Home / Labor Law / Dismissal and layoffs / Retrenchment Back Published: 12/23/2019 Time

The concept of material assistance is interpreted as a form of social support provided by an employer to an employee. Payment does not depend

Account 76. AB If it is necessary to calculate and withhold alimony amounts collected from employees, also

If you need assistance of a legal reference nature (you have a complex case and you don’t know

Home / Family law / Benefits and benefits Back Published: 07/29/2018 Reading time:

Taxi travel expenses for a posted employee An employee sent on a business trip can use the service