Taxes

Home — Consultations of the Consensus on the taxation of payments made to an individual as compensation

VAT is an indirect federal tax, the calculation of which is carried out by the seller when selling goods to the buyer, i.e.

How to pay if the trip goes to the next month? Therefore, Article 167 of the Labor Code of Russia

In Form 6 Personal Income Tax, line 070 is intended to reflect the amount accumulated for the period under review.

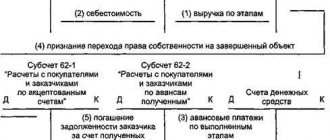

Application of invoice 46 The invoice Dt reflects the cost of completed and accepted by the customer according to approved

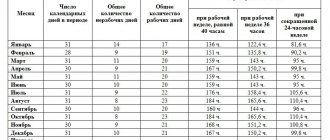

The standard working time for 2021 is the total number of days and hours subject to

Many enterprises and organizations send their employees on business trips. Often circumstances change and

09/11/2019 0 3937 5 min. The rights of single mothers under the Labor Code are given a certain priority, according to

Home / Family law / Benefits and benefits Back Published: 07/15/2018 Reading time:

A pension is money that a person receives in connection with reaching old age,