Taxes

Prerequisites for dividend payments Dividends (part or the entire amount of net profit) are paid to shareholders (in a joint stock company)

Grounds for deregistration of an organization that pays UTII Removal of an organization from “imputed” registration

Author: Ivan Ivanov The purpose of account 68 is to display information about accrued and paid by the enterprise and

Clause 1 of Part 1 of Art. 333.36 of the Tax Code of the Russian Federation exempts employees from paying state duty

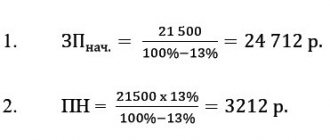

Last modified: January 2021 The employer not only accrues and pays the employee income for work performed

General rules for filling out form 6-NDFL Rules for filling out section 1 in 6-NDFL are prescribed in the order

Application Please transfer my salary and other payments to a bank card using the following

Calculation of the thirteenth salary calculator online Attention: To receive the bonus in full, you need to work

07/05/2019 0 86 5 min. Knowledge of the rights and obligations to the state saves the citizen some

Able-bodied citizens who are unable to work due to the need to constantly provide care for a disabled child can