Author of the article: Vladimir Danilevsky Last modified: January 2021 18477

Withholding for workwear upon dismissal is a legal practice of enterprises. The products are designed to protect workers from exposure to negative factors in the workplace. The completeness and properties of protective equipment may vary significantly depending on the field of human activity. At the same time, the current legislation clearly establishes the procedure for issuing items to subordinates and the process of returning them to the organization upon dismissal. The last procedure will be discussed in detail in the article.

Special protective equipment

Collective and individual protective equipment helps preserve the life and health of workers. A special category is given to workwear, which provides protection for the very vulnerable human body from the effects of external production factors.

In accordance with Article 209 of the Labor Code of the Russian Federation, special protective equipment makes it possible to protect a person from harmful and dangerous factors that affect them during the performance of work duties, as well as to avoid contamination. Personal protective equipment (PPE) helps prevent consequences that cannot be eliminated with collective protective equipment. In addition, they can be selected individually, which increases the level of security.

Personal protective equipment is produced in accordance with the rules of the technical regulations of the Customs Union “On the safety of personal protective equipment” TR CU 019/2011.

The procedure for issuing workwear

Each employer develops its own rules for PPE based on state regulations. The conditions established by law cannot be worsened, but if desired, they can be modified and improved.

The procedure for issuing personal protective equipment has an important and unshakable condition - the provision of special clothing and safety footwear must be made before the employee begins his immediate duties. An employer cannot allow an employee to work if he does not have PPE or if any of the equipment provided has become unusable.

Each personal protective equipment item has its own limited validity period, which is also regulated by law. You cannot increase them yourself. For the functioning of the system for providing PPE for new and existing employees, special records are kept. A special clothing card is issued for each employee, which states:

- Required completeness.

- Actual security.

- Date of issue.

- Initial cost.

- Lifetime.

Every month, the accounting department depreciates personal protective equipment, which reduces their cost. By the end of the wearing period, the price of PPE reaches zero, and the clothing or shoes themselves are replaced with new ones.

Reimbursement by the employee of the residual cost of workwear

In some industries, the obligation to use protective clothing depends on the specific type of activity, but if it is necessary to ensure the safety of workers or people contacting the organization, then employees must put it on every time before starting a working day or shift.

There are certain cases when PPE may be located outside the organization: for example, when carrying out emergency rescue operations or extinguishing fires, combat equipment is a necessary attribute of rescuers, and its absence is interpreted as a gross violation of safety regulations. This act is subject to administrative, and if it resulted in casualties or harm to the health of employees - to criminal punishment.

What applies to workwear

Not all areas of activity require mandatory provision of PPE. There are established lists of professions that cannot do without special clothing and shoes. When classifying positions in the following areas:

- Trading enterprises.

- Agricultural industries.

- Woodworking and logging organizations.

- Medical institutions.

- Fishing enterprises.

- Mining and mineral processing industries.

- Chemical and metallurgical industry.

- Construction organizations.

- Research areas.

Each industry has its own classifications of mandatory special protective equipment. They vary depending on what functions the employee performs. In most cases, engineering and technical personnel do not need special clothing if they do not enter the territory of the enterprise and carry out inspections.

PPE includes:

- Winter outerwear - warm jackets, sheepskin coats, cotton pants, short fur coats.

- Demi-season outerwear - raincoats, light jackets.

- Overalls for constant wear - overalls, suits.

- Robes.

- T-shirts.

- Caps, hats and other headwear.

- Mittens and gloves.

- Safety shoes by season.

Within the framework of this classification, PPE differs in the density of materials, as well as their quality characteristics. There are professions that require cotton products, while others, on the contrary, have a dense and waterproof structure. Non-flammable materials are a separate class.

Write-off procedure

Each issued unit of PPE has its own service life, which is indicated in the employee’s personal card.

When receiving clothes or shoes, he signs the date of issue, from which the countdown actually begins. When the wear time is up, the PPE must be written off. Typically this process looks like this:

- Worn work clothes or safety shoes must be handed over to the responsible employee. In the realities of modern economy and rational use of materials, worn-out PPE can be sent to rags or for further processing of recyclable materials.

- The employee responsible for the acceptance and issuance of personal protective equipment must register the accepted items and immediately issue new ones.

- The employee who delivers the workwear signs the acceptance certificate and the receipt form.

Sometimes the return of PPE occurs earlier than the specified period, when the issued funds were spoiled before the stated period. It is impossible to leave an employee without special clothing, so in any case he must be provided with a replacement. But if it is proven that the owner himself is to blame for the damage to the PPE, then the losses will be withheld from him.

Return of special clothing

Upon dismissal, the employee is required to sign a bypass sheet, which also states the obligation to hand over previously issued protective clothing and other protective equipment issued by the employer. This rule may not be observed only in one case, if the special protection was purchased with your own money. However, the legislation of the Russian Federation obliges employers to purchase PPE at their own expense and provide it to their employees in full.

To return special protective equipment, the resigning employee must first take an extract from his personal PPE card indicating which units are registered with him. Then, according to the list, collect all the items and hand them over to the storekeeper or other employee responsible for issuing them. If items were received recently, but have obvious signs of damage, then the employer must create an acceptance committee to assess the degree of wear.

After the protective clothing according to the list has been handed over, the receiver signs the bypass sheet. Return of PPE may be partial or not provided at all if the wear period has expired.

Reimbursement by the employee of the residual cost of workwear

The Employee has read before signing this Agreement; - at his own expense, promptly provide repairs and replacement of special clothing issued to the Employee. The Employee undertakes: - to take care of the workwear and personal protective equipment received from the Employer; - upon termination of the employment relationship or upon expiration of the period of wearing new workwear received instead, as well as when the Employee is transferred to another job for which wearing special clothing is not required, return it to the Employer received workwear and personal protective equipment;— in the event of loss through the fault of the Employee of the received workwear and personal protective equipment or non-return of workwear by the Employee in the cases specified in this employment contract, reimburse the Employer for the cost of clothing/protective equipment based on its actual cost, taking into account the degree of wear.

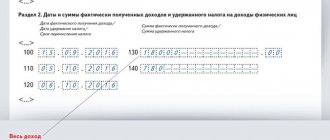

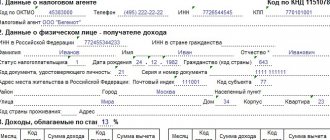

If the cost of clothing is written off as a total amount at once Debit 10/11 Credit 10/10 The clothes were given to the staff Debit 20,23,25 Credit 10/11 The entire amount is written off as company expenses If a partial cost is written off (in equal shares for the entire period of use of PPE) Debit 10/ 11 Credit 10/10 Clothes were handed over to the staff Debit 20,23,25 Credit 10/11 The cost of clothing is written off monthly in equal shares, which is distributed over the entire period of use Debit 91/1 Credit 10/11 The remainder of the cost of clothing is written off as other expenses in case of loss, damage, return if an employee is fired If protective equipment, sets of workwear, shoes, tools are purchased, the cost of which is more than 40,000 rubles apiece, then accounting is kept on the account simultaneously with the organization’s fixed assets.

Deduction of cost upon dismissal

A resigning person has every right to buy back the work clothes and shoes issued to him, partially or completely. Many employers welcome this, especially in cases where it was not made to standard sizes or has already served more than half its term. As a rule, it is no longer possible to issue them again and they must be written off with a loss of residual value.

Withholding for PPE is carried out in the following order:

- The accounting department prepares a certificate of the cost of the specified units. For this purpose, depreciation write-offs are made if they have not been made previously.

- The primary price of clothing must also be documented.

- The total amount is withheld from the dismissal person’s settlement funds.

Please note that retention can be done in two ways:

- Automatic deduction from the salary accrued to the dismissed person. Here it is important to comply with the norms of the Labor Code, which establish that no more than 20% can be withheld.

- On a voluntary basis, in which the employee himself writes a statement addressed to the manager with a request to deduct the residual cost of workwear from his accruals. In fact, in this case, PPE is sold to the citizen.

The second option is the most preferable, since it has no restrictions on the amount and allows the accounting department, without paying attention to the total amount of the estimated compensation, to make a deduction.

Certificate for write-off of workwear, sample

The act of writing off workwear that has become unusable, a sample of which we have prepared, is considered a strict reporting document. At the moment, it is not unified, but there is a standard inter-industry form No. MB-8 “Act for write-off of low-value and wear-and-tear items”, approved by the Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997. No. 71a, which can be used in its preparation.

PPE and uniforms are written off for various reasons (as a result of wear and tear, accidents, employee dismissal, etc.). Sometimes this occurs earlier than the manufacturer's failure date. In this case, the form of the act does not change.

According to paragraph 2 of Article 9 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ, the act must include the following sections:

position and full name manager, his signature with transcript;

composition of the commission indicating the names and positions of employees;

information about the recovery of material damage and its amount;

grounds for writing off property;

other sections that can be added if necessary.

This document can be used when various equipment and other property are worn out.

Damage compensation procedure

If there is no desire on the part of the employee to cooperate voluntarily, the employer has the right to compensate for the damage caused to him in other ways.

The practice of labor relations has many examples when, upon dismissal, an employee does not want to return the overalls or gives them back in a rather shabby form, despite the fact that they were issued relatively recently and should not look like that. In all controversial cases, the employer is obliged to document the damage. To prove the fact of damage, it would be legitimate to create a commission that will evaluate the accepted PPE. All information is documented in an acceptance certificate, which indicates the percentage of wear. Based on the act, a decision is made to deduct the cost of damaged property from the employee’s salary. Having such an act in hand, the accounting department has the right to make a deduction from the income of the dismissed person in an amount not exceeding one salary.

If for one reason or another the parties are unable to solve the problem on their own, then the management of the organization can initiate legal proceedings by filing a claim for compensation for the material damage caused.

Arbitrage practice

The Oktyabrsky City Court of the Republic of Bashkortostan accepted for consideration the claim from Oil-Service LLC. A representative of the organization applied to the court with a request to recover from the resigned employee the amount for unreturned personal protective equipment. On the merits of the case the following was reported:

- The organization employed an employee who acted as a lift operator.

- Due to the specifics of the profession, the employee was provided with special clothing in the form of an insulated men's suit and special footwear in the form of winter boots.

- The employee wrote a letter of resignation of his own free will and the contract with him was terminated within the legal time frame.

- However, upon settlement, he did not return the PPE issued to him.

The employer tried to resolve the issue peacefully and sent written requests to the dismissed person asking for the return of PPE or money, but no answers were received.

The defendant did not appear at the court hearing, so a default judgment was made.

Since the applicant argued the residual value of the issued protective clothing and confirmed it with documents, the judge fully satisfied the claims and ordered to recover from the defendant not only the damage caused, but also the amount of the state duty paid for the filed claim. Decision of September 12, 2021 in case No. 2-1763/2017

Reflection of workwear in accounting and tax accounting.

Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 No. 135n (effective as amended on December 24, 2010) approved the Guidelines for accounting of special tools, special devices, special equipment and special clothing (hereinafter referred to as the Guidelines).

In accounting, the purchase of workwear at the expense of the employer is reflected on the date of its acceptance for accounting:

| Contents of operation | Debit | Credit |

| The purchase of workwear is reflected | 10/10 | 60 |

| The amount of VAT presented by the seller of workwear is reflected | 19 | 68 |

| The debt to the workwear supplier was repaid | 60 | 51 |

| The amount of VAT presented by the seller is accepted for deduction | 68 | 19 |

If the workwear was purchased at the expense of the Social Insurance Fund, it is necessary to draw up correspondence accounts: Debit 69 Credit 10/10 - the cost of workwear is offset against the payment of insurance premiums.

However, in practice, reducing the amount of insurance premiums for the cost of purchasing workwear is possible only after submitting documents and approval from the Social Insurance Fund, which most often occurs not only after the purchase, but also after the transfer of workwear to employees.

In this case, you can make the following entries:

- Debit 20, 23, 25 Credit 10/10 – special clothing released for use (transferred to employees);

- Debit 69 Credit 20, 23, 25 – expenses were offset against the payment of insurance premiums (after approval by the Social Insurance Fund).

For your information:

In the case of the purchase of special clothing, special shoes and other personal protective equipment for workers at the expense of insurance premiums payable to the Social Insurance Fund, the VAT amounts presented by the sellers of these goods are not subject to deduction. The fact is that, according to clause 2.1 of Art. 170 of the Tax Code of the Russian Federation (as amended by Federal Law No. 335-FZ of November 27, 2017) when purchasing goods (work, services), including fixed assets and intangible assets, property rights, through subsidies and (or) budget investments received by the taxpayer from the budgets of the budgetary system of the Russian Federation, the amounts of VAT presented to the taxpayer or actually paid by him when importing goods into the territory of the Russian Federation and other territories under its jurisdiction are not subject to deduction. And in accordance with Art. 10 of the Budget Code of the Russian Federation, the budgets of the budget system of the Russian Federation include the budgets of state extra-budgetary funds (Letter of the Ministry of Finance of the Russian Federation dated June 20, 2018 No. 03-07-11/42124).

When transferring workwear to employees, an entry is made (in the case of a one-time write-off - on the date of issue to employees): Debit 20, 23, 25 Credit 10/10 - workwear was put into operation.

The accountant needs to organize documentary control of the availability and safety of protective clothing issued to employees. To do this, you can provide an additional off-balance sheet account 12 “Special clothing transferred to operation.” Then, after the work clothes are issued to the employees, the following entry should be made: Debit 012 Credit – – the cost of the written-off work clothes is reflected on the balance sheet.

When writing off expenses for the purchase of workwear evenly, the following entries are made:

- Debit 10/11 Credit 10/10 – special clothing issued to employees (as of the date of issue);

- Debit 20, 23, 25 Credit 10/11 – reflects the repayment of part of the cost of workwear (in equal monthly installments during the wear period).

As for tax accounting, according to paragraphs. 3 p. 1 art. 254 of the Tax Code of the Russian Federation, an organization has the right to independently determine and establish in its accounting policies the procedure for recognizing material expenses in the form of the cost of workwear. Consequently, in order to bring accounting and tax accounting closer together, workwear can be recognized either as an asset (in tax accounting - a material expense), the value of which is gradually written off, or as an expense recognized in the full assessment of an immediately written off asset.

Expenses for the purchase of workwear can be recognized when calculating income tax, provided that the expenses comply with the norms of Art. 252 of the Tax Code of the Russian Federation and the provisions of labor legislation (letters of the Federal Tax Service of the Russian Federation dated September 22, 2017 No. SD-4-3/19054, Ministry of Finance of the Russian Federation dated August 19, 2016 No. 03-03-06/1/48743, dated April 8, 2016 No. 03-03- 06/1/20165).

According to the rules of Art. 272 of the Tax Code of the Russian Federation, when applying the accrual method, the date of material expenses is the date of transfer into production of raw materials and materials related to goods (work, services), that is, material expenses in tax accounting are recognized at a time.

For your information:

If the expenses for the purchase of workwear were financed from the Social Insurance Fund (reduced in the amount of insurance premiums), these expenses are not taken into account when taxing profits, since they were made through targeted financing (clause 17 of Article 270 of the Tax Code of the Russian Federation).

Operational accounting of workwear. According to para. 1 clause 13 of the Intersectoral Rules, the employer is obliged to organize proper accounting and control of the issuance of PPE to employees within the established time frame.

In the Guidelines, the section of the same name is devoted to the operational accounting of special clothing. VII.

For your information:

Maintaining operational records means, first of all, reflecting in personal cards the fact of issuing and returning workwear to employees. The form of the personal card is given in the appendix to the Intersectoral Rules. Cards are issued for each employee individually; they indicate the wearing period and the percentage of validity of PPE at the time of issue.

The appendix to the Intersectoral Rules establishes the employer’s right to record the issuance of special clothing to employees using software (information and analytical databases). The electronic form of the registration card must correspond to the established form of the personal registration card for the issuance of personal protective equipment. In this case, in the electronic form of the personal card, instead of the employee’s personal signature, the number and date of the accounting document on the receipt of PPE, on which the employee’s personal signature is indicated, are indicated.

For your information:

The employer has the right to organize the issuance of personal protective equipment to employees and their replaceable elements of a simple design that do not require additional training, through automated issuance systems (vending equipment). This requires personification of the employee and automatic completion of data on the PPE issued to him in the electronic form of a card for recording the issuance of PPE (clause 13 of the Intersectoral Rules as amended by Order of the Ministry of Labor of the Russian Federation dated January 12, 2015 No. 2n).

In order to establish control over the duration of special clothing being in production (operation), a stamp can be placed on it indicating the date of issue to employees.

Is it possible to recover the cost of workwear from an employee upon dismissal?

Workwear is the property of the organization and must be returned. The employer has the right to recover the cost of workwear from the employee upon dismissal, but only if the employee does not return it himself.

The employee’s obligation to compensate the employer for direct actual damage caused to him is enshrined in Art. 238 Labor Code of the Russian Federation. Lost income (lost profits) cannot be recovered from the employee.

For your information:

For damage caused to the employer, the employee bears financial liability within the limits of his average monthly earnings, unless otherwise provided by the Labor Code or other federal laws (Article 241 of the Labor Code of the Russian Federation).

In accordance with Art. 246 of the Labor Code of the Russian Federation, the amount of damage caused to the employer in the event of loss and damage to property is determined by actual losses, calculated on the basis of market prices prevailing in a particular area on the day the damage was caused, but not lower than the value of the property according to accounting data, taking into account the degree of depreciation of this property.

Recovery from the guilty employee of the amount of damage caused, not exceeding his average monthly earnings, is carried out by order of the employer (Article 248 of the Labor Code of the Russian Federation). It is important to remember that the order can be made no later than one month from the date the employer finally establishes the amount of damage caused by the employee.

In the accounting records of the organization, compensation for workwear, which is withheld from an employee upon his dismissal due to the abandonment of his workwear, is reflected by the entry: Debit 73 Credit 91/1 - reflects the debt to reimburse the cost of workwear.

For your information:

If the one-month period has expired or the employee does not agree to voluntarily compensate for the damage caused to the employer, and the amount of damage to be recovered from the employee exceeds his average monthly earnings, recovery can only be carried out by the court.

It should be noted that a mandatory condition for collecting from an employee the amount of damage caused to the employer is to determine the amount thereof. In the Appeal ruling dated 02/09/2015 in case No. 33‑1150/15, A-12, the Krasnoyarsk Regional Court did not satisfy the demand of the employer, who wanted to compensate for the damage caused by the employee: the latter received special clothing, special shoes and other personal protective equipment during the period of work, which upon dismissal, did not return in full.

Considering the case, the court noted that the material damage was declared by the employer based on the total value of the property according to accounting data, while there was no information about the degree of its wear and tear. In this regard, the arbitrators pointed out that there was no reliable evidence of the fact that material damage was caused by the employee and the amount of damage, since in accordance with the procedure established by law, the employer did not determine the amount of direct actual damage based on the cost of personal protective equipment, taking into account the degree of wear and tear on the day the damage was caused (the date of dismissal of the defendant). In addition, the personal cards submitted by the plaintiff for recording the issuance of personal protective equipment did not contain information about the wearing period of the personal protective equipment issued to the employee, and the percentage of their validity at the time of issue was not indicated.

Taking into account these circumstances, the lack of proper control by the employer over the timely delivery of PPE at the end of the wearing period, the failure to properly notify the employee about the procedure for handing over (returning) worn out workwear to the employer, the court came to the conclusion that there are no legal grounds for collecting from the defendant the amount of material damage claimed by the plaintiff.

Is it possible to deduct the cost of workwear that was not returned by an employee upon dismissal from his salary? In the Review of Current Issues for June 2021, Rostrud explained: if an employee refuses to return workwear upon dismissal, its cost cannot be withheld from the payments due to him without the employee’s consent.

In this situation, you should go to court. The statute of limitations is one year. At the same time, the employer’s local act must specify the procedure for returning workwear or refunding its cost. In addition, the trial will require primary documentation confirming the date of issue of the workwear and its cost.

Are the actions of an employer legal when he wants to withhold the residual cost of work clothes from the income of a laid-off employee, although the employee is ready to return it? An employer cannot refuse an employee to accept worn-out workwear delivered to the warehouse. In addition, he does not have the right to deduct the cost of special clothing from the employee’s salary, since the current legislation does not include in the list of grounds for withholding funds from an employee’s salary such a basis as a severe degree of wear and tear of special clothing (Article 137 of the Labor Code of the Russian Federation).

Write-off of workwear upon dismissal of an employee. Based on clauses 30, 31 of the Methodological Instructions, write-off of workwear is possible, in particular, when it is morally and physically worn out. If the inventory commission determines that the workwear returned by the employee upon dismissal is worn out and unsuitable for further use, the cost of workwear not included in expenses can be written off at a time to account 94 “Shortages and losses from damage to valuables” or account 91, subaccount 2 “Other expenses” .

For your information:

Violation of the procedure for writing off protective clothing and personal protective equipment may be considered a gross violation of the requirements for accounting rules, for which administrative liability is provided under Art. 15.11 Code of Administrative Offenses of the Russian Federation.