General procedure for paying vacation pay upon dismissal

Labor legislation has established the procedure and timing for payment of compensation to an employee who quits his job.

According to these requirements, all payments due to the employee must be made by the head of the organization on the day the employee is dismissed by order.

However, it may happen that on the day of his dismissal the employee will not be at work. In this case, the calculation must be made either on the day the employee applies with a request for payment of this calculation or no later than the next day.

Delaying the deadline for paying a dismissed employee, under any pretext, is not acceptable.

- For delays in any payments, employees can demand from their boss not only these payments, but also compensation for not receiving their money on time.

- The law determines the amount of penalties for the employer - 1/150 of the amount of monetary payment due to the employee for daily delay.

- Moreover, the percentage of penalty payments can be increased by mutual agreement of the parties and must be specified in the employment contract.

- The manager will have to pay compensation to his employee, regardless of the reasons for the delays in payments.

- The head of the enterprise pays the required amount of money to his employee, and if the employee does not agree with this amount, he has the right to file a claim with the labor inspectorate, prosecutorial authorities or judicial authorities.

- Based on the norms of existing labor legislation, the resigning employee’s salary is paid either on the date of his dismissal from the company, or on the day (but not later than the next day) when he demanded that his manager pay such a salary.

- An employee can demand payment on a day other than the day of his dismissal if he was absent from his place of work on the date of his official dismissal.

- In turn, absence from the workplace on the last working day must be valid, for example, due to vacation, sick leave or a day off in accordance with the schedule.

- At the very beginning of the difficult path of resolving a controversial situation, the least painful and more rational thing would be to appeal to the conscience and common sense of the employer.

- In fact, in most cases, disagreements over employee benefits can be resolved this way.

- If the employee and the manager fail to come to an understanding, then it makes sense to file a complaint with the trade union organization, labor inspectorate, prosecutorial authorities, or the court.

There are situations when the employee and the employer do not come to a common opinion regarding the amount of payments due to the employee and the situation can develop into a conflict.

The legislation prudently stipulates such cases, and if they arise, the employee can apply for restoration of violated rights to the appropriate authorities.

- The Labor Inspectorate is perhaps the most effective government body in resolving problematic situations involving non-payment of wages.

- A written complaint is submitted to the inspectorate from an employee whose rights have been violated.

- The complaint must indicate the full name of the organization, full name of the head, the essence of the appeal, the amount of the settlement to be paid, the period of non-payment, the date and signature of the person who applied.

You can also send a complaint to the inspectorate by mail or via the Internet on the official website of the inspectorate. The employee's complaint will be considered within a month.

Based on the results of its consideration, if a violation of labor legislation is revealed, the inspectorate will issue an appropriate order to the head of the enterprise with a requirement to repay the settlement debt and the deadline within which this must be done.

In addition, such a manager will be subject to administrative punishment in the form of a fine.

Contacting the prosecutor's office is carried out in the same written manner, either by mail with a return receipt requested, or by email on the website of a law enforcement agency.

The requirements for the complaint in this case are similar, so there is no need to write anything else here.

The complaint must be accompanied by a written response from the employer, if the employee has previously contacted him in writing. Prosecutor's response measures will be similar.

That is, when it is established that the organization is in debt, a prosecutorial response will be issued to the employee, with a requirement to pay the amount due with interest for the delay. After which, the manager will also have to pay a fine to the state.

Any employee can file a complaint about unpaid severance pay in court. This can be either a district court located on the territory of the employing organization, or a magistrate’s court serving the given area.

When filing a claim in court, it is important to know that a dismissed employee has the right to go to court no later than three months after his dismissal.

The employee can contact the judicial authorities and write a statement asking for a court order to be issued to him. Based on the court order, a writ of execution is prepared, which he then presents to his organization and receives payments.

The employee can also file a lawsuit for payment of the settlement. Judicial practice shows that filing a claim is more effective.

An employee can contact all of the above authorities either step by step or simultaneously; there are no legal prohibitions in this procedure.

In this case, the employer will have to pay the state a more serious fine or go to prison for up to two years.

- Well, here we have looked at legal ways to resolve problems with non-payment of payments to dismissed employees.

- An important note here is that only those workers who were officially employed at their place of work and received an official salary can count on the protection of their rights.

- All other categories of workers with black and gray salaries will not be able to count on assistance from the state, since their earnings are partially or completely unofficial.

Each employer is obliged to calculate vacation pay, dismissal payments and other payments due to an employee in a timely manner, in accordance with Article 236 of the Labor Code of the Russian Federation.

When for some reason the deadlines are violated, the entire payment amount must be accrued and then compensation must be paid for each day of delay.

In this article we will tell you how compensation is paid for delayed vacation pay in 2021 and provide a sample application.

Even if the company is currently experiencing financial difficulties, this is not an exemption from paying compensation to the employee for delays in both vacation pay and other payments related to benefits, maternity pay, compensation for unused vacation upon dismissal, etc.

Based on the Law “On Compulsory Social Insurance”, the employer is obliged to accrue maternity benefits and child care benefits within 10 calendar days from the moment the employee provides the necessary documents for calculation. In this case, the payment of benefits must be made immediately after calculation on the nearest salary payment day in the organization.

According to Article 236 of the Labor Code of the Russian Federation, violation of the deadline for the payment of benefits, vacation pay and other payments entails the payment of compensation for each day of delay, starting from the one that follows the one established for payment.

We invite you to familiarize yourself with: the Labor Code of the Russian Federation on postponing vacation at the request of the employee and the reasons for refusing this from the initiative of the employer

Where to turn if payment is delayed upon dismissal? This issue is not uncommon in the Russian Federation, but it can be solved by delving into the essence of the problem. The solution to the problem is possible in a narrow circle of people, i.e. between employer and employee. When an agreement cannot be reached, it is necessary to involve authorities that have all the necessary tools to restore justice.

basic information

- To meet the needs of life and for a comfortable life, every person needs money.

- Cash can be earned by performing certain duties.

- The employer is obliged to pay wages; he can be either a private businessman or a government agency.

- A citizen of the Russian Federation must receive earned money on the dates specified in the contract or on the day of dismissal.

If the employer delays payments, then the employee, whose rights have been violated, has the right to sue the unscrupulous manager.

Definitions

Calculation is payments due to an employee on the days specified in the employment contract, or transfers assigned on the day of the employee’s dismissal.

Delay of wages or payment upon dismissal is an offense that is recognized as such the very next day after failure to pay on time.

Legislation

Labor legislation stipulates in what periods payments to employees should be made.

Wages are paid twice a month. The date of payment must be determined by the agreement concluded between the employee and the employer upon hiring.

Late payment of wages liability 2021

- Individual entrepreneurs and management will pay from 1000 to 5000, for the company and enterprise everything will cost more - from 30 to 50 thousand;

- repeated violation threatens an increase for the individual entrepreneur and the responsible person - from 10 to 20 thousand, respectively. Firms will pay from 50,000 to 70,000 rubles;

- a violation recognized as administrative will cost the entrepreneur and manager 30,000, the company will have to fork out 100 thousand rubles.

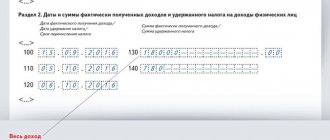

To calculate compensation, take the period from the date following the salary payment deadline established by the company until the date of actual payment, inclusive. As debt, take the amount that the employee should receive in hand, and not the accrued salary. Keep in mind: the company has the right to establish increased compensation for delayed wages in an internal personnel document or employment contract. Then focus on it, and not on the minimum size from the Labor Code. Production calendar Penalty for late payment of wages upon dismissal The final payment upon dismissal or termination of the employment contract is required by the former employer to be made on the same day as the issuance of the work book. Confirmed facts will lead to the sending of an order demanding immediate restoration of rights and payment of due funds. In addition, it is possible to contact tax and law enforcement authorities to take control of the matter. In the event of a temporary suspension of work, it does not hurt to independently contact the judicial authorities.

We recommend reading: Inspectors in the Migration Service

Payment period upon dismissal of an employee

Article 136 of the Labor Code of the Russian Federation clearly states that all required vacation payments must be made at least 3 days before the start of the vacation. If these days are weekends or holidays, then the payment period will need to be moved to a slightly earlier time. That is, vacation pay must be paid for exactly 3 working days.

The legislation does not limit management from making payments in advance - this can be done as many days earlier as desired. The main condition is no later than the stipulated date.

According to the same rule, money is paid if a person is going to go on vacation with subsequent dismissal. That is, vacation pay and pay pay can be paid to him at different times.

Example: An employee goes on vacation on Thursday (10/4). The vacation period lasts 15 days, after which the employee wishes to resign. In this case, the employer must pay vacation pay for 15 days of the upcoming vacation 1.10, but the final payment (salary and severance pay, if applicable) must be given to the employee 3.10 - on the last working day.

The situation is different if a person has not used part of the vacation and wants to receive compensation upon dismissal during this time. In this case, the funds will be issued along with all payments and documents, that is, on the last working day.

It is important not to confuse management’s guilt with a completely legitimate issue – the deadline for transferring funds. The point is that each bank reserves the right to transfer money from account to account for some time. Often this time is 3 banking (that is, working) days. For this reason, the company’s management could transfer money to the employee’s account on time, but transferred the funds a little later.

If the employee does not agree with the amount issued, then he must go to court to receive the balance. If he is proven right, then the management of the enterprise must also pay fines for late payment of funds.

According to the Labor Code of the Russian Federation, certain deductions may be made from an employee upon dismissal. For example, if he is a financially responsible person, then a shortage may arise during the inventory process. This amount may be deducted from the official final settlement. In this case, deductions are also made from vacation pay (the entire amount that must be paid upon dismissal).

Compensation for delayed payment of wages under the Labor Code of the Russian Federation

For example, according to the labor code, the employer must issue vacation pay no later than 3 days before the start of the vacation. If you are late by even a day, you will have to pay compensation.

The organization must pay compensation, even if it is not to blame for the delay. For example, an accountant transferred a salary to an employee’s bank card. There was a problem with the bank and the money arrived late. The employer has nothing to do with this, but he is still obliged to compensate the employee for the wait.

How to run a business without fines

Earn more without breaking the law. Once a month - in our newsletter for entrepreneurs

What to do if you didn’t transfer your vacation pay upon dismissal?

In case of complete or partial non-payment of wages, and the delay in vacation pay is fully consistent with this concept, the citizen has the right to demand elimination of the violation. The following list of ways to protect his interests is available to him:

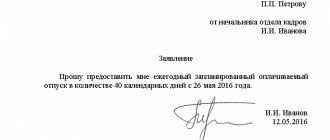

- A written application to the company with a demand to repay the vacation pay debt;

- Writing an application to the labor inspectorate outlining a list of violations committed by the employer;

- Submitting a claim against the employer to the prosecutor's office;

- Going to court.

The least effective in practice are attempts to collect compensation through communication with the employer. If he deliberately failed to pay vacation pay upon dismissal, it is unlikely that he will correct the violation.

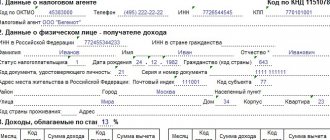

Rostrud bodies are responsible for monitoring compliance with labor legislation. If an employee’s rights are violated, he has the right to contact the labor inspectorate located in the territory where his employer operates. To do this, you need to write a statement in free form, in which you need to indicate (Article 7 of the Law of 02.05.2006 No. 59-FZ):

- The name of the Rostrud department to which the applicant is applying;

- Identification information of the applicant: full name, address, telephone, email;

- Information about the employer who committed the violations, including the name of the company, its address;

- Describe the violations committed in the employee’s opinion, as well as your requirements regarding their elimination.

The complaint can be submitted in person or by registered mail with acknowledgment of receipt. It is allowed to send a message through the appropriate section of the regional labor inspectorate website. After receiving the request, the State Tax Inspectorate must respond to it within 30 days. In some cases, it is possible to extend this period by another 30 days (clause 116 of the Administrative Regulations, approved by Order of the Ministry of Labor of Russia dated October 30, 2012 N 354 n).

During this period, the inspectorate must conduct an inspection of the employer on all the facts stated in the application. If the violations indicated in the appeal are confirmed, she issues an order against the employer with a requirement to eliminate them and pay the due compensation along with interest for the delay.

If the deadline for paying vacation pay for unused rest days upon termination of an employment contract is violated, the employee may contact the prosecutor's office. To do this, you also need to write an appeal indicating the details of the prosecutor, the applicant, the company and a list of violations committed and requirements for their elimination. The procedure will be similar to that used for GIT:

- Submitting an application;

- Initiation of an investigation by the prosecutor;

- Issuance of an order to eliminate violations if they are actually confirmed;

- Receiving a written response from the prosecutor's office based on the results of the inspection within 30 days from the date of registration of the application.

A citizen’s appeal to the State Tax Inspectorate or the prosecutor’s office does not prevent the simultaneous filing of a claim in court. The actual expediency of such actions is questionable, since when applying to all these authorities, the final decision will be made by the court. Therefore, it is better to either file a claim immediately or first contact one of the indicated supervisory authorities, and then, if the conflict is not resolved, go to court.

When filing a claim in connection with non-payment of compensation for vacation, a citizen has the right not to take into account the time that has passed since the end of the working year for which it was provided. The general period for going to court is one year from the date of dismissal (Resolution of the Constitutional Court of the Russian Federation of October 25, 2018 N 38-P). If the established period for filing a claim was missed for valid reasons, it can be restored by a judge (Part 2, 4 of Article 392 of the Labor Code of the Russian Federation).

Resolving a dispute over non-payment of compensation for vacation can occur in two ways:

- In the order of writ proceedings, if the amount of debt does not exceed 500,000 rubles. and is not disputed by the parties;

- In the procedure of claim proceedings, if the value of the claim is more than 500,000 rubles. or the company objects to its payment.

Applications for the issuance of a court order are considered by a magistrate. If the case must be resolved by law in the course of litigation, then you should contact the district court. Writing a statement of claim may require certain legal knowledge, as well as an understanding of the intricacies of procedural proceedings. Therefore, it is advisable to seek help in representing your interests from qualified and experienced lawyers.

Judicial procedures should take no more than 2 months from the moment the claim is accepted for consideration. They require great effort on the part of the plaintiff in collecting evidence and clearly justifying his position. In addition, hearings are often postponed for formal reasons and the total period for consideration of a claim can be up to 3-4 months.

We suggest you read: Where to take the exam to become a judge

Late payment of compensation upon dismissal

What do they pay for? What is the payment due upon dismissal? The timing of this action is a completely different question. First, each employee must become familiar with what they are entitled to money for.

Judicial practice shows that both employees and employers have a number of questions regarding the procedure and timing of payment of wages upon dismissal. Compensation to the employee in case of untimely final payment, statute of limitations for claims, liability of the employer - the main points that may force the employer not to violate the law. In the event of termination of the employment contract, for any of the reasons provided for by law, the employer must, all payments due to the employee , make on the day of dismissal (Article 140 of the Labor Code of the Russian Federation).

Complaint about non-payment of vacation pay

If a person quit and did not receive all or some part of the payment, then he has the right to contact:

- court;

- the prosecutor's office;

- Labor inspection.

There is no clear sequence here - the employee can choose any authority at his discretion. Also, employees of the organization can then petition to transfer the case further. For example, if the employer does not repay the debt voluntarily, the Labor Inspectorate may refer the case to the court in order to carry out forced collection by court order.

The same applies to the prosecutor's office. Sometimes people may go there initially for another matter, but then the fact of a violation becomes obvious during the investigation process.

Working personnel of companies have the right to basic and, in certain cases, additional leave (Articles 114, 116 of the Labor Code of the Russian Federation). The entire time an employee is on vacation is paid based on his average earnings. The need for an employer to pay vacation pay arises in the following cases:

- An employee going on vacation in accordance with the approved schedule or a statement written by him;

- When replacing part of an employee’s vacation over 28 calendar days with a monetary amount (Article 126 of the Labor Code of the Russian Federation);

- Compensation for unused rest days upon dismissal of an employee (Article 127 of the Labor Code of the Russian Federation).

Payment for vacation time is part of the employee’s guaranteed salary. Therefore, for violation of the deadlines for transferring funds, the employer will bear the same responsibility as for late payment for work. If an employee is not paid vacation pay or is delayed, the following types of punishment may be applied to the company:

- Material in the form of payment of interest on the amount of debt for each day of delay (Article 236 of the Labor Code of the Russian Federation);

- Administrative penalties for non-compliance with the requirements of labor legislation under Art. 5.27 Code of Administrative Offenses of the Russian Federation;

- Criminal punishment in case of delay of wages in full at the intention of the employer for a period of more than 2 months, or partial non-payment for a period of more than 3 months (Article 145.1 of the Criminal Code of the Russian Federation).

In addition, the employee can file a claim in court for compensation for moral damage. If his claim is satisfied, the employer will have to incur additional financial losses.

Failure to fulfill your obligations to pay the amounts due to the employee for vacation is a violation of the law. In this regard, the citizen is given the right to protect his interests, using all the opportunities provided to him by regulations. When an employee is not paid vacation pay, he can:

- Using the right given to him in Part 2 of Art. 142 of the Labor Code of the Russian Federation, suspend work if the delay period exceeds 15 days, stop work, warning the employer in writing;

- An employee may apply in writing to his employer with a demand to repay the debt;

- File a complaint with the labor inspectorate;

- Apply to the prosecutor's office to protect your rights;

- File a lawsuit.

Direct contact with the employer rarely leads to any result. However, the presence of such a written document can confirm the employee’s desire to resolve everything peacefully during subsequent legal proceedings.

The procedure for filing a complaint with the labor inspectorate in a situation where vacation pay is delayed is no different from other cases of complaints related to violations of labor laws. It includes the following steps:

- Writing an application and sending it to the State Tax Inspectorate by registered mail with notification or electronically;

- Consideration of the complaint by inspection staff and making a decision to inspect the employer within 10 days from the date of its receipt;

- Conducting verification of facts of violations contained in the appeal within 20 days; in complex cases, this period may be extended, but not more than by another 30 days;

- The inspectorate issues an order to eliminate violations, or, in their absence, provides a written response to the applicant within 15 days from the end of the inspection.

Currently, the powers of the State Tax Inspectorate in terms of collecting wage debts have been expanded and if the employer refuses to comply with the order within 30 days from the date of its issuance, then the money is collected forcibly. For this purpose, a separate decision is issued in 2 copies, one of which is sent to the employer, and the second to the bailiffs.

The process for filing an application with the prosecutor's office is similar. At the same time, the prosecutor's office also conducts an inspection within 30 days and, if violations are detected, also issues a mandatory order to the employer. Often the procedure for contacting supervisory authorities causes difficulties for citizens and to resolve them it is better to seek advice from a lawyer. The legislation does not prohibit filing complaints simultaneously with both supervisory authorities.

Currently, there is no requirement for mandatory attempts to pre-trial resolve a labor dispute before filing a claim. Although interaction with supervisory authorities may be useful in terms of obtaining additional evidence or collecting the resulting debt, the employee can immediately go to court.

Geographically, appeal to the judicial authorities is made at the choice of the plaintiff: at his place of residence, at the location of the employer, at the place of performance of work. For an employee whose rights have been violated, there are 2 options for resolving the conflict depending on the current circumstances:

- For debt amounts up to RUB 500,000. and there are no disputes regarding the amount of payments due, he can turn to the magistrate to collect it in the order of writ proceedings.

- If the amount of vacation pay debt exceeds 500,000 rubles. or the employer disputes the amount of unpaid wages, the employee should file a claim in the district court.

The order of debt collection is implemented as follows:

- Writing and submitting an application for the issuance of a court order;

- The judge accepts the application and issues an order within 5 days from the date of its receipt;

- Sending a copy of the court order to the defendant;

- Waiting within 10 days for possible objections from the employer to the issued order;

- The entry into force of the order and its issuance to the plaintiff or forwarding, at the request of the employee, to the bailiffs.

In cases related to labor disputes, citizens are exempt from paying state fees. At the same time, cases are considered by order without meetings or lengthy processes, which is beneficial for the employee whose rights have been violated.

If there is a debt of more than 500,000 rubles, or if there are disputes with the company regarding the amount due, the employee will have to solve the problem through full-fledged litigation. It will be very difficult for an unprepared person to achieve the desired result without the help of a lawyer. The trial procedure includes the following stages:

- Filing a claim to the district court;

- After the claim is accepted, the procedure for preparing for consideration of the case on the merits begins, and the judge must in every possible way facilitate the reconciliation of the parties. It is possible to schedule preliminary hearings;

- A date is set for consideration of the case on the merits;

- The required number of court hearings are held;

- Making a decision based on the results of the meetings.

The court decision takes legal force after the end of the one-month period allotted for the defendant to appeal it. In addition, decisions to collect wages for a period not exceeding 3 months are subject to immediate execution. According to Art. 154 of the Code of Civil Procedure of the Russian Federation, the consideration of the case should not last more than 2 months, and only in exceptional cases this period can be extended, but not more than for another 1 month.

It must be taken into account that a full-fledged trial is quite tedious for the plaintiff, in addition, without the help of a qualified lawyer, it is quite difficult to achieve the desired solution. Therefore, before filing a claim, you should consider other possibilities for resolving the conflict situation that has arisen and, if an opportunity arises to come to an acceptable agreement, use it.

An officially employed citizen can go on paid leave for 28 days once a year. Payments for this period are calculated based on the average salary for the previous twelve months. The employer is obliged to issue them to the employee at least three days before the start of the vacation. If these deadlines are missed, the employee is entitled to compensation.

The three-day period before the start of the vacation, during which the organization is obliged to pay vacation pay to the citizen, is determined by Article 136 of the Labor Code, and Articles 114 and 115 indicate that if these days fall on weekends or holidays, then the money is accrued in advance.

You may be interested in: How vacation pay is calculated

We suggest you read: Lawyer for administrative offenses

In practice, most employers tend to transfer them much earlier, since delays sometimes arise due to unforeseen circumstances: for example, a bank delay in a transaction.

In this case, the organization will be obliged to additionally pay the employee for each day of delay, regardless of the reason.

Since payment of annual leave is the responsibility of the employer, he cannot justify the delay in transferring finances by ignorance of the employee’s retirement, lack of funds, etc.

- Providing an employee with leave at his request followed by dismissal. In this case, he receives payment according to the usual rules, 3 days before the start of the vacation. The date of dismissal will be the last day of vacation;

- The employee receives money for all his remaining unused vacation days on the date of dismissal.

Possible consequences for the employer for non-payment of compensation

In case of violation of deadlines or complete non-payment of due compensation for vacation pay upon dismissal, the employer may incur liability under the law. As a punishment the following may be applied to him:

- Liability of a material nature in the form of 1/150 of the refinancing rate accrued from the amount of debt for each day of delay (Article 236 of the Labor Code of the Russian Federation);

- Administrative punishment in the form of a fine under Art. 5.27 Code of Administrative Offenses of the Russian Federation: for officials and individual entrepreneurs from 1000 to 5000 rubles, for companies from 30,000 to 50,000 rubles.

- If the transfer of part of the salary is delayed for more than 3 months or if the remuneration for work has not been received in full for more than 2 months, as well as if there is intent on the part of the official, criminal penalties may be applied.

In addition, a resigned employee may seek compensation for moral damage in court.

Responsibility of the employer for non-payment of payment upon dismissal

- employer in accordance with Art. 140 of the Labor Code of the Russian Federation pays the employee the unpaid part of the salary, compensation for unused vacation days, etc. To the manager dismissed by decision of the owner of the organization’s property, when the termination of the employment contract is not related to the actions of the head of the organization, under Art. 279 of the Labor Code of the Russian Federation, special compensation is paid;

- the employee compensates for real damage caused to the employer, but the amount of such compensation is limited to the average monthly earnings of the dismissed person (Article 241 of the Labor Code of the Russian Federation). If the employee is a financially responsible person, then for him the limitation on the amount of compensation is removed, and he compensates for all direct actual damage. The list of positions for which it is possible to conclude an agreement on full financial liability was approved by Resolution of the Ministry of Labor of the Russian Federation dated December 31, 2021 No. 85.

We recommend reading: Standards for subway placement for placement in the housing queue

Monetary compensation is recovered in favor of the employee along with unpaid wages and other payments. As the Arbitration Court of the Volga-Vyatka District indicated in its ruling dated October 16, 2021 in case No. A82-2306/2021, compensation is paid to an individual employee for the performance of his labor duties and is a way of protecting his labor rights.

Going to court

If you have not paid vacation pay upon dismissal on time, the best reliable way is to go to court. The reason for such a recommendation is that it is the court that has the right to forcefully collect something. It is important to first familiarize yourself with all the features of the statement of claim (its preparation and filing procedure).

You can submit a claim in one of the most convenient ways:

- personally deliver;

- send by registered mail with acknowledgment of receipt (an inventory of the attachment is also required);

- transfer through an official representative (a notarized power of attorney is required, even if the representative is a close relative).

When filing a claim, it is important to clarify how the response will be sent (if it is possible to conduct a hearing without the presence of the parties).

If vacation pay has not been paid and a person decides to go to court to protect his rights, then care must be taken to ensure that the application is drawn up correctly. It should include the following list of required sections:

- Indication of the parties. We are talking about the plaintiff, the defendant, as well as the details of the court where the statement of claim is filed.

- The essence of the dispute. It is necessary to state for what period of time the person worked, when he quit, and how much the employer did not pay.

- Specify the requirements (specify the amount you would like to receive).

- Provide a list of attached documents.

It should be noted right away that employees often additionally declare amounts of moral damage in claims. This is quite acceptable, but often it is not possible to collect it. If the judge seeks to satisfy the requirements, then mainly only for the immediate debt.

When drawing up a claim, it is also recommended to follow a number of general rules characteristic of any such document:

- information must be presented strictly in a business style, avoiding emotional statements and digressions;

- information should be presented in detail, with clarification of details, but in essence - only relevant to the case;

- It is better to type the claim on a computer rather than write it by hand;

- It is necessary to provide the most accurate calculation of vacation pay (down to kopecks). A detailed form of calculation is provided, and not just the final amount;

- you need to provide as many references as possible to regulatory documents that confirm the correctness of the stated requirements;

- a maximum of specific dates, registration numbers and other accurate information is indicated.

The Labor Code provides for the possibility of considering disputes in court.

Even if the employment contract initially states otherwise, you should not focus on this. The ban on going to court is completely illegal, so such a clause can easily be appealed. No one can prevent a person from going to court to protect his rights.

The plaintiff in a labor dispute may not always be an employee of the enterprise. This can be done by a representative of the prosecutor's office or the Labor Inspectorate. They often act as representatives of the employee’s interests (if he previously contacted them, but they were unable to obtain anything from the employer on their own).

In such hearings, witnesses can theoretically be heard so that they can be introduced in the case if it is appropriate to do so. It is also permissible to use a lawyer as a standard procedure.

The trial may take place at the place of registration:

- employee (plaintiff);

- enterprises (legal address of the head office);

- branch in which the plaintiff is directly employed.

The employee decides where exactly to file a claim at his own discretion.

The deadline for filing a lawsuit with any financial claims against the employer is one year. The period begins to be calculated from the moment the claim is accepted for consideration. The date should not be confused with the moment the letter was sent or, conversely, with the moment the decision was made in the case.

Calendar days are counted here, not working days.

Employer's liability

Art. 5 of the Code of Administrative Offenses of the Russian Federation stipulates that in connection with non-payment of vacation pay or their untimely issuance, liability arises in the form of a fine of 1-5 thousand for officials and 30-50 thousand for legal entities.

If management does not pay the debt for more than 2 months, then the court may consider applying criminal liability standards to the management of the enterprise. Art. 145 of the Criminal Code of the Russian Federation provides for a fine of up to 120 thousand rubles or imprisonment for up to 3 years.

The issue of temporary suspension of business activities by the enterprise may also be considered.

Responsibility for late payment of wages, vacation pay and “settlements” during dismissals will be tightened

The Ministry of Health and Social Development has prepared a bill that significantly increases the responsibility of employers for violating the rights of employees. Currently, the Code of Administrative Offenses of the Russian Federation has only one article, which concerns violations of labor legislation (Article 5.27, fine for legal entities from 30,000 to 50,000 rubles).

Officials propose to break it down into several articles, which will specify fines for various violations. In particular, for late payment of wages, vacation pay and “settlements” for dismissals - 25,000 rubles for officials and 100,000 rubles for companies. For failure to provide leave - half as much. If the law is adopted, it will come into force on the date of publication.

We recommend reading: Children's ticket at Swallow