Hello, dear blog guests, today we will look at a topic such as replacing a Sberbank card when changing your last name, since this information may be useful to many clients of the credit institution in question. A life situation may develop in such a way that a client of the credit institution in question will have to change his last name or other personal data. In such a situation, Sberbank rules require that the client replace the bank card. This is necessary to ensure that the information indicated on the surface of the card matches the client’s passport data. Next, we will try to consider in detail the process of changing the card of the credit institution in question after changing the last name.

Do I need to change my bank card when changing my last name?

Changing the surname automatically invalidates the citizen's passport. When changing personal data, the bank card must be changed so that the data indicated on it matches the passport data. In this case, the card holder will receive not only updated plastic card, but also bank employees will update his account details and make changes to the agreement for the provision of banking services.

It is necessary to change the card if it is personal.

Personalized cards contain the holder's first and last name on the front side. If a citizen has an instant card that does not contain personal data, then there is no need to change it. Sberbank often issues such cards to repay loans or when issuing credit cards as part of a personal offer.

But if the card is not personal, then the citizen should apply to change the account details.

The bank itself can find out that its client has recently changed his last name and changed his passport from the information received in the database of the Ministry of Internal Affairs. After which he himself will invite the citizen to the bank branch to update the information.

The obligation of the card holder to notify the bank about changes in passport data is contained in the agreement for the provision of banking services.

What details are saved?

After the card is reissued, some details remain the same - card account number, plastic number (if planned replacement), BIC and name of the issuing bank.

A personal account is an account in which the user’s money is stored. It is required to make cashless transfers. Regardless of whether the credit card was reissued as planned or ahead of schedule, the account number remains unchanged. If you are participating in a salary project, you do not need to provide new details.

The exception is the Momentum credit card. The Sberbank instant card does not provide for re-issuance, so the account is automatically closed after the expiration date.

The plastic number does not change if the re-issuance was carried out due to the expiration of the credit card. However, there is an exception - Tinkoff Bank credit cards, which have the numbers 521324 or 437773 at the beginning of the number. They do not save details.

The payment system remains unchanged. If you had a Mastercard card, the new plastic will also belong to this payment system. Some banks give you the opportunity to choose a PS during registration - Visa or Mastercard. A visa is suitable for payments in dollars, and a MasterCard is suitable for payments in euros.

Details for transfers within Russia do not change: BIC, name of the organization, correspondent account remain the same. To find out the details, you can use an ATM, mobile application or visit a bank office.

If there was no change in last name and first name, personal data will remain the same.

Replacement procedure

Let's look at the procedure for replacing a plastic card using Sberbank as an example. After all, it is the cards issued by this bank that the majority of Russians use.

The procedure for replacing a card involves going through a number of stages:

- Initially, you need to re-issue your passport.

- With a set of documents, go to the bank branch and write an application to change the card. It is called “Application for Change of Personal Data”.

- A bank employee will make photocopies of documents and make changes to the database.

- At the appointed time, you will need to come to the bank branch and get a new card. An SMS will be sent to the client’s phone when the card is ready. You can also track the status of your statement through Sberbank Online.

- In this case, the person will be able to change the default PIN code on the card to any convenient one.

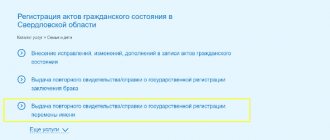

Users who have access to Internet banking can request card reissue online.

To do this, they need to log in to the system and find the reorder option in the “Cards” section. Then all that remains is to receive a new card on the appointed day.

It is worth considering that after changing the plastic, its details will change:

- card number;

- its validity period (it is automatically extended for a year or three);

- code indicated on the reverse side and used when paying online.

How to change plastic by visiting the office of the issuing bank

If a client who has changed his last name prefers to personally visit the office of a financial institution to update agreements and receive a new card, he should proceed as follows:

- Contact a competent employee of the issuing bank, providing the necessary paper from the registry office, your civil passport and plastic card.

- Create an application with appropriate content. As a rule, such an application is drawn up by the client by filling out a standard form regulated by the requirements of the institution.

- Specify the estimated production time for new plastic. It should be noted that banks are not always able to assign the applicant a specific day to receive a card after reissue.

- Pay the established fee for re-issuing the card due to a change in the holder's last name.

If an employee of the institution has assigned the client an exact date for issuing the updated plastic card, you should visit the bank on that day. If the reissue deadlines are not precisely established, you must wait for an SMS notification to the mobile phone number specified in the application.

When the ordered card is ready, the client visits the financial institution again and presents his own passport. An applicant who has changed his last name is issued a new certificate. Upon receipt of the updated card, the holder provides the issuing bank with a receipt certifying that there are no claims on his part.

Structure of an application to the bank for card reissue

A citizen can submit an application for re-issuance of plastic both at the office of the issuing bank and at home. A sample of such a statement can be found and copied from the Sberbank online resource. A request for re-issuance of a card due to a change in the last name of its holder must contain the following information:

- name (full name) of the financial institution issuing the plastic.

- personal information about the client (applicant’s name, patronymic and new surname).

- data from a civil passport, information about current registration.

- The designation of the paper being drawn up is indicated - “Application”.

- the purpose of the request is revealed and a justification is given: to replace plastic with a certain number due to a change in the surname of its holder, confirmed by a specific document.

- accurately indicate the basic details of the presented paper certifying the legality of the client’s change of personal information.

- certify the completed document with your own signature, indicate the date of filing this application.

Through Sberbank Online you can apply for a replacement card

List of required documents

To replace a bank card you will need the following documents:

- Application - usually filled out by a bank employee himself. The applicant only has to check all the specified data with his new passport and put his signature.

- Passport with updated information.

- A document that serves as the basis for changing the surname: marriage certificate, divorce certificate, etc.

- Bank card with old name.

- A notarized power of attorney for the representative and his passport, if the documents are transferred by an authorized person.

Need for replacement

Like any personal document, a bank card must be replaced when your last name changes.

Causes:

- The user will not be able to carry out payment transactions at a bank branch with the old last name.

- If you lose your card, it will be more difficult to restore it. The client will have to prove that he is its owner.

- Some financial transactions will not be able to be carried out. For example, transfers based on a receipt or other payment document issued in the same name.

- The citizen will not be able to take out a loan.

- Some companies (especially state-owned) check the consistency of the information in the passport and on the card before paying by cashless method. If they do not match, payment will be refused.

By the way, changing your last name does not affect your credit history.

Opportunities to use a card with an old surname:

- pay with it non-cash in places where identification confirmation is not required;

- withdraw cash and carry out banking transactions through an ATM;

- make online purchases;

- others.

Note. When using a card with the same data, it is worth considering that the transactions performed are considered illegal. For safe banking operations, you must reissue the card.

Replacement costs

Planned replacement of a bank card is free of charge. But re-issuing a card is perceived as a replacement at one’s own request. If you need to re-issue your card early, you will need to pay a fee. The current rates depend on the card category:

- 30-60 rub. for cards linked to a pension or social account;

- 150 rub. – for the reissue of classic bank cards;

- 500 rub. – for plastic with an individual design.

The specified amount will be automatically debited from the account to which the card is linked, or it will need to be paid at the cash desk.

Card reissue cost

Many clients are interested in the question of whether they need to pay money for re-issuing a card when changing their last name.

You should know that in this case, replacing the card will be paid, since it is an unscheduled operation.

If the card, for example, expires, the bank will reissue the card free of charge.

The cost of reissue depends on the status of the card. If we are talking about plastics of the lower level or with social status, then replacement will cost about 50 rubles.

An unscheduled replacement of international status cards will cost slightly more: from 200 rubles and more. The exact price can be clarified by phone or with a bank employee.

How long will the replacement take?

The time frame for replacing a bank card depends on the region in which the individual applies. They are about a week in large cities (such as Moscow and St. Petersburg). For small cities they reach 10-15 days . At this time, the applicant can use the old card to pay.

And if a person applies to a branch different from their residential address, then the time frame for re-issuing the card may take up to a month.

Some banks offer mortgage programs for young families. Are you dreaming of a free plot of land in Crimea? The conditions for obtaining it are described in detail in our article.

Do you need to draw up a deposit agreement when purchasing land? A sample of it can be downloaded from our thematic material.

Price

Sberbank has set a standard price for card reissue. The cost does not depend on the reason for the replacement, but only on the status of the card itself.

- For the reissue of a regular classic card, the client will pay 150 rubles (5 US dollars, 5 euros).

- Manufacturing products that support contactless payment technology will cost 250 rubles. (USD 10, EUR 10).

- Gold and premium products are reissued free of charge.

- Production of a MIR pension card with an updated last name will cost 30 rubles.

Quick application form

Fill out the application now and receive money in 30 minutes