Does an individual entrepreneur need ShR?

According to Art. 57 of the Labor Code of the Russian Federation, in the ShR document the employer must indicate the following information:

- Name of the structural unit.

- The employee's position.

- The number of staff positions corresponding to this position.

- Salary (tariff rate).

From the above it follows that if the employment contract specifies only the position of an employee, the organization must have a staffing table.

ShR streamlines the personnel structure of the organization and allows the entrepreneur to plan the costs associated with paying for the activities of employees. If necessary, such a document is proof that the refusal to employ a person is lawful.

The staffing table can be used to justify legal dismissal due to reduction in numbers or staffing levels by presenting it in court. Using this paper, the employer has the right to confirm the impossibility of employing the employee in another position.

Attention! The Labor Code of Russia speaks about the ShR in the institution, but does not mention the presence of the document at the individual entrepreneur. However, officials of the Labor Inspectorate may regard the absence of such paper as a gross non-compliance with the Labor Code, and bring the individual entrepreneur to responsibility under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Do you need a staffing table for an individual entrepreneur?

Mention of the staffing table (SH) can only be found in Article 57 of the Labor Code of the Russian Federation. It says that when concluding an employment agreement (contract), it is necessary to specify in its text the employee’s position, his specialty, his profession, which must correspond to the company’s staffing table. Otherwise, you should indicate in detail all the job responsibilities and functions that are assigned to the employee being hired.

From the above it follows that in cases where the TD (employment contract) indicates only the employee’s position (profession, specialty), then the organization a priori assumes the presence of a staffing table. And on the contrary, if the provisions of an employment agreement with an employee clearly, point by point, spell out all of his job responsibilities and indicate the specific types of work that he will have to perform, there is no need for a SR.

The same Article 57 of the Labor Code of the Russian Federation talks about the staffing table of organizations, while there is no mention of the need for entrepreneurs to have such a document. But this fact can be assessed in two ways, both by the individual entrepreneurs themselves and by officials of the Labor Inspectorate. And the absence of a ShR in an individual entrepreneur can be considered as a gross non-compliance with Labor legislation and entail punitive measures provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Therefore, individual entrepreneurs are advised to take care of preparing a staffing table if:

- the total number of employed persons is more than 3 people;

- the responsibilities of hired employees correspond to the generally accepted functions of standard positions (specialties, professions);

- The staff needs clear structuring and strict distribution of responsibilities.

There are often situations when a newly hired employee enters into an employment contract with the employer and is assigned to a specific position. At the same time, there is simply no current staffing table in which this position would be spelled out and assigned to the company. It is necessary to understand that even the fact that the employer does not have a work permit cannot serve as an obstacle to the employee’s employment, the performance of his job duties and the exercise of labor rights.

It happens that an employee is appointed to a position that is not provided for in the staffing table. The discrepancy between the information in the employment contract and the SR is not an obstacle to hiring, and disagreements that arise on the basis of Article 8 of the Labor Code of the Russian Federation, as a rule, are resolved in favor of the TD. And the employee is considered to be assigned to the position specified in the employment contract.

Neglecting to draw up and fill out the staffing table can create some difficulties, primarily for the employer himself. In particular, an organization or individual entrepreneur that does not have a valid HR will not be able to reduce staff. Of course, this can be done more precisely. But there is a possibility of running into a labor dispute with an employee and increased attention from the Labor Inspectorate. It is not possible to prove the legality of the reduction and formalize the procedure according to all the rules without an approved, valid staffing table.

Consequences of absence

When a person enters into a contract for employment with an individual entrepreneur, the employer provides in the paper for the employee’s work activity - his work in the corresponding position, taking into account the HR.

Article 8 of the Labor Code of the Russian Federation states that the employer is obliged to adopt a local regulatory act, which includes staffing . This means that in the absence of such a document, a violation of the law occurs. The employer may receive a warning or an administrative fine in the amount of 1000-5000 rubles.

In addition, when an individual entrepreneur neglects to draw up and fill out the SR, certain difficulties may arise for the employer himself. For example, an individual entrepreneur who does not have the specified document does not have the right to reduce staff. This may lead to a labor dispute between the employee and the employer, as well as increased attention from the Labor Inspectorate. Without approved paper, the employer is not authorized to formalize a staff reduction in accordance with all the rules.

Form and sample filling

Similar articles

- Part-time work: how to register correctly

- External part-time job: how to apply?

- Substitution during vacation

- Early termination of an employment contract due to staff reduction

- Sample job application form

Basic rules for maintaining documents for an entrepreneur

- SR is for the whole year. It begins to operate from the date of approval by order of the general director and on its basis personnel production in the organization is built.

- Hiring of new employees is carried out taking into account the existing units in the state. Moreover, the position and structural unit in the employment contract and the employment order are entered strictly as they were recorded in the ShR.

- The document is drawn up and filled out in form T-3. Despite the fact that it is recommended, many entrepreneurs use it. However, if desired, the employer has the right to issue his own form containing his own structure. This will only require the approval of the CEO.

- If it is necessary to make adjustments to the staffing table, the employer has the right to draw up a new schedule. If the changes are minor or non-existent, the document is not re-approved when the next calendar year begins.

On our portal you will find information about the rules for drawing up staffing for organizations such as a store, private security company, cafe and restaurant, construction company, hotel, motor transport company, LLC with one director, travel agency, beauty salon and some others.

Is it absolutely necessary?

Legislation sometimes allows you to do without such documentation. Moreover, if there are freelance specialists and their wages are calculated without being tied to a fixed rate, staffing is not required.

Despite the fact that the Russian Federation does not say that individual entrepreneurs must have such a schedule, it is advisable to have one. Otherwise, administrative fines will be imposed on the organization.

For individual entrepreneurs, having an internal staffing table means the opportunity to:

- carry out reductions;

- hire specialists, taking into account available labor units;

- regulate the ratio of positions held and wages;

- track staffing levels (even those who work part-time);

- if necessary, refuse to hire if, according to the regulations, there are no vacancies.

Individual entrepreneur with employees

If an individual entrepreneur has more than 3 employees, it is necessary to have a staffing arrangement. Working according to a simplified scheme also does not relieve the entrepreneur from drawing up administrative documentation, which will help:

- form a wage fund;

- prepare reports and submit applications to recruitment agencies and employment services;

- justify expenses for the tax office and provide the necessary extracts to the authorities.

No employees

An individual entrepreneur without employees can do without registering a full-time job. Also, if the organization has one manager or people work under civil contracts, this standard can be omitted.

How to fill out each item?

Important! As mentioned earlier, an individual entrepreneur has the right to use not only the unified T-3 form, but also to apply his own form.

The SR must be dated twice: by the date of registration and approval. It is necessary to indicate the period of time during which the document will be valid. For example, from January 10, 2018 to December 28, 2021.

Procedure for registration of ShR:

- The name of the organization corresponding to the registration papers is indicated (for example, IP Semakova).

- It is necessary to write down the name of the document, the date of preparation and its signing.

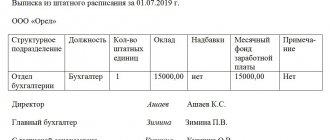

- Column No. 1 should indicate the name of the departments providing for a particular position. For example, the sales department.

- In column No. 2, enter the code corresponding to each division. For example, 03.

- In column No. 3, indicate the position assigned to the individual entrepreneur. For example, a cashier salesperson.

- Column No. 4 indicates the number of staff units for each position. An individual entrepreneur can indicate the full rate or a non-integer number, for example, 0.75 or 0.5.

- Column 5 indicates the tariff rate or salary. They must be written in rubles. For example, the salary is 20,000 rubles.

- In fields 6-8, information about salary allowances is entered. They are allowed to be indicated in rubles or percentages and coefficients.

- In column 9, management specifies the total amount of remuneration of the employee by position for 1 month.

- The following column is a note containing information about the availability of vacant positions.

Below are signatures with a transcript of the individual entrepreneur and the employee who compiled the document.

What it is

The term “staffing table” refers to an internal document of the enterprise that approves the structure, number of employees and salary rate in accordance with the position.

Through this document, it is possible to formulate the composition and determine the total number of the company.

Do you need a staffing table for an individual entrepreneur? The law does not oblige entrepreneurs to develop this document, but its presence facilitates the maintenance of personnel records and accounting documentation related to payroll.

The staffing schedule of an individual entrepreneur must include the following information:

- a complete list of professions and positions;

- breakdown of the list by structural divisions;

- an indication of the salary, all available allowances and the full salary of each position;

- a list of staff positions indicating the number of positions occupied.

Another reason why an individual entrepreneur should have a staffing table is the need to hire workers based on the number of staffing units. Proper maintenance of internal documentation allows you to track staffing levels, including employees working at 0.5 rate.

How to make changes?

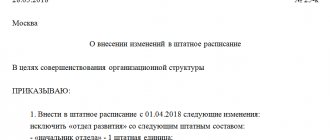

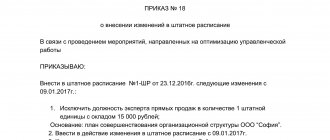

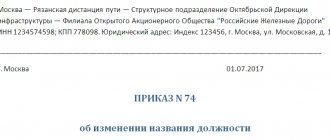

When divisions are opened and abolished, new positions are introduced or salaries increase, an individual entrepreneur can make appropriate changes in the ShR document . All of them must be fixed in 2 ways:

- creation of a new ShR with its subsequent approval;

- or by drawing up an order according to which amendments will be made to the paper.

In the latter case, you must indicate the reason for the adjustment:

- Changes that have taken place in the Labor Code of the Russian Federation.

- Expansion or reduction of production.

- Reorganization of the company.

- Optimization of personnel structure.

After the amendments are made, new entries are made in the documentation of the personnel department : work books, personal cards of employees. Often it is necessary to draw up an additional agreement to the TD, for example, in the event of a change in salary.

Who should approve it and how?

The head of the company or individual entrepreneur is who is responsible for resolving the issue in this case. To approve a document, it is necessary to issue an order containing the relevant information. It is not necessary to stamp the staffing table; this element is used if desired by an individual entrepreneur.

Important. Even when a document is drawn up and approved, it is not considered final. It is permissible to change information in the text; there are practically no restrictions in this direction. It is not necessary to seriously justify the changes made.

Changes to the document

Alteration

If there is a need to make any amendments, two options are used:

- The schedule is redone and re-established.

- An order for changes is signed. In this case, the reason for the adjustment is indicated (for example, personnel changes, changes in the number of labor units, salary amounts, names of structural departments, and so on).

Important! When changing the routine, it is important to comply with the deadlines correctly (especially when reducing the number of people or adjusting tariff rates). With such amendments, the document cannot be changed earlier, until 2 months have passed after the order has been drawn up and signed.

The staffing table is a standard that may not be drawn up for individual entrepreneurs if there are no hired employees or there is only one director. In other cases, a routine is necessary to properly regulate labor relations.

How to make a schedule

Is staffing required for individual entrepreneurs? It is desirable, because if an entrepreneur employs 2 or more people, then he will need to enter into an employment contract with them, which will indicate qualification requirements and salary.

How to draw up a staffing table for an individual entrepreneur? Difficulties arise with determining rates for staffing units. If an example of a staffing table for an individual entrepreneur and a sample filling can be found on websites for personnel document flow, then the need for specific work units must be determined independently. The Ministry of Labor website contains special methods and recommendations that establish an approximate plan for calculating the need for employees for each profession or position.

For example, do you need to develop a sample staffing table for an individual entrepreneur in a cafe? How do you know how many cooks, wardrobe attendants or janitors will be needed? A way to solve such a problem is to use calculation methods of labor qualimetry. They include calculation of the load on each employee, the number of operations performed, the class of working conditions, and the presence of harmful factors in the workplace.

Similar calculations can be found in old documents from the times of the Soviet Union, which still have valid status. In terms of methods, the Republic of Belarus (Belarus) compares favorably, where there are many clear and accessible documents regarding labor law and document management. The situation is similar in Kazakhstan.

Creating a Document Form

The drafting of this normative act follows certain rules. For individual entrepreneurs, regardless of what form of taxation they use, there are no specific requirements for this type of paper. Many people use their own templates to create a staffing table, but novice businessmen should take a closer look at the ready-made form, which is called UV T-3.

The document is drawn up taking into account the type of activity of the company. A sample of the filling can be seen in Fig. 1. Based on this, professions, positions are selected and the responsibilities of employees are described. However, for some types of work it is necessary to use qualification reference books, which outline the requirements for certain positions.

In most cases, the HR department is responsible for creating the staffing table. If the business is small and the number of hired employees is no more than a couple of dozen, the entrepreneur can develop the document independently. These responsibilities can be assigned to an accountant or, as a last resort, you can attract freelance specialists who, for a fee, will do the work quickly and efficiently.

The structure of the regulatory act necessarily provides for a complete list of company positions, the number of employees employed in the business, wages and the fund for its payment. The document must be certified by the head of the department that was involved in drawing up the staffing table, that is, the personnel department or accounting department, or confirmed by the signature and seal of the individual entrepreneur.

Sample schedule

The schedule is usually filled out using the T-3 form. However, the employer can take his own form, individually tailored to the structure of the enterprise. It just needs to be approved by the manager by signing the appropriate order.

XLS file

When drawing up internal regulations, you can use:

- All-Russian classifier of professions;

- qualification directory of positions.

Note! Different salaries cannot be set for the same positions. You may be fined for this.