Legislative acts

The procedure for registering citizens in mortgaged housing is regulated by the following regulations:

- Civil Code of the Russian Federation;

- Federal Law “On Banks and Banking Activities”;

- Federal Law No. 5242-1 of June 25, 1993 “On the right of citizens of the Russian Federation to free movement, choice of place of stay and residence within the Russian Federation”;

- Housing Code of the Russian Federation;

- Federal Law No. 102 of July 16, 1998 “On Mortgage”.

Most people believe that the owner of housing purchased on credit is a financial institution. Actually it's not like that .

By law, the borrower is considered the owner of the mortgaged apartment. In this case, the bank has the right to control actions related to real estate, up to full repayment of the debt.

A careful analysis of the above documents shows that mortgaged housing is not subject to sale, gift or any other type of alienation. But there are no restrictions on registration, so to the question: “Is it possible to register a child in an apartment taken on a mortgage?” you should answer: “You can!” .

The procedure is absolutely free and cannot be subject to government fees.

The legislative framework

First you need to get at least a general idea of the regulatory framework. After all, banks are obliged to strictly comply with their requirements. So, the following official documents will be useful to us:

- Civil Code;

- Housing Code;

- basic banking law “On banks and banking activities”;

- Law “On the right of citizens of the Russian Federation to free movement, choice of place of stay and residence within the Russian Federation”;

- Law “On Mortgage”.

The law states that the owner of the mortgaged apartment is the borrower himself. The apartment is simply pledged to the bank, i.e. has a burden. Therefore, the lender has the right to control the actions of the borrower. Having studied the above documents, we come to the conclusion that the borrower does not have the right to perform a number of actions with the apartment, including:

- give it to someone;

- sell;

- alienate in another way.

Nothing is said about registration. Therefore, we can safely say that it is possible to register children in an apartment. Moreover, the procedure is free and not subject to state duties.

However, the mortgage agreement contains a clause limiting the borrower’s ability to register children in the mortgaged apartment. Therefore, although the bank does not have the right to refuse registration to a child, it can create obstacles to this. Therefore, it is initially better to choose a more loyal lender and clarify all controversial issues. For example, Sberbank does not create any obstacles to the registration of children.

Features of registering a child in a mortgaged apartment

According to the legislation in force in Russia in 2021, children under 14 years of age must have the same registration as their parents, guardians or other legal representatives. However, in the case of housing purchased on credit, several important features should be taken into account.

If newborn babies, as well as those born after their parents moved into mortgaged housing, are automatically registered at the place of residence of the mother and father, then with older children everything will be completely different.

So, if the possibility of registering a child is not initially indicated in the mortgage agreement, the borrower must contact the bank himself to obtain its written consent (to do this, write an application in free form).

You can also provide a notarized obligation to release children. If this is not done, the lender may prohibit the registration of minors at the mortgage address.

For a successful outcome of the case, both parents must be registered in the purchased apartment . In addition, there must be no fines in their credit history.

As for guardians and trustees planning to change the place of registration of the ward, they need to obtain permission not only from the bank, but also from the guardianship authorities. In this case, the reason for refusal may be the insufficiently large area of the new housing (smaller than where the minor currently lives).

Many borrowers are interested in whether they can take away an apartment for mortgage debts if a child is registered? The financial institution that provided the loan for the purchase of housing has the right to do so.

And in order to protect their interests and avoid lawsuits, banks may require a written commitment from the client to discharge the minor from the mortgaged apartment in the event of debt and subsequent seizure (Article 78 of the Law “On Mortgage”).

Is it possible to register a relative or another person in a mortgaged apartment? What is the reaction of banks

How to register for an apartment with a mortgage? Registration must begin with obtaining bank approval. If such approval is not received, then no further actions will bring the desired result. It is better to start collecting documents only after receiving such consent .

- applicant's passport;

- consent of the credit institution, if required in a particular case;

- photocopy of the title document;

- marriage certificate, if a spouse is registered, or birth certificate, if the borrower’s child;

- application in the prescribed form;

- power of attorney, if the person does not independently apply to the registration authority.

Documents for registration

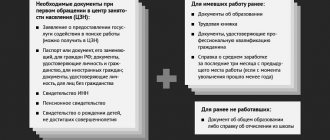

In order to register a minor in a mortgaged apartment, parents or legal guardians must prepare the following package of documents:

- Internal passports of owners of living space (originals and copies);

- Child's birth certificate (originals and copies);

- A mortgage agreement with a clearly stated clause on the possibility of registering minors or the written consent of the lender;

- Extract from the Unified State Register of Real Estate;

- Marriage certificate or other document confirming paternity;

- Extract from the financial and personal account (FLA);

- A written statement regarding the registration of the child at a specific address;

- Tear-off coupon or sheet of departure from the last place of registration (form No. 7);

- Military ID (for those liable for military service);

- Certificate of family composition (taken from the passport office).

If the parents live separately, then the one with whom the child will not live must give written permission to register their son or daughter in the mortgaged property.

Documents for obtaining registration

To register a child in an apartment purchased with a mortgage, you will need to collect the following package of documents:

- document confirming the birth of the child;

- marriage certificate (or paternity document) + copy;

- parent's application requesting permanent registration for the child + copy;

- an extract from the financial and personal account, which can be obtained from the EIRC;

- an extract from the house register, which is issued at the passport office itself;

- a certificate indicating that the child has not received registration at the place of residence of the other parent;

- a statement from the other parent about the absence of objections on his part regarding the child’s registration at a different address (if the parents live separately);

- parents' passports.

As a rule, the passport office asks you to bring only the first two documents from the list, as well as an extract from your personal account. It is better to check the exact package of documents at the passport office in your area. All documents must be submitted to the passport office.

Documents will be reviewed in approximately one week. You will be notified of their readiness by telephone. After this, the applicant must pick up the completed registration. Don't forget to put a registration stamp at the police station.

This algorithm of actions is relevant if the mortgage agreement does not contain a clause on the bank’s consent to registration.

If you need to obtain the lender’s consent to register a mortgaged apartment, then this must be taken care of even before going through the registration procedure.

Registration procedure

To register children in mortgaged housing, you must go through a procedure consisting of several stages:

- Step 1. Personal visit by the owner of the apartment to the local FMS (passport office). In addition, the borrower can submit an application to the MFC, whose employees will hand over the paper for its intended purpose. As a general rule, the applicant for registration must also appear at the FMS along with the owner of the property.

- Step 2. Filling out the registration application (form No. 6). Subsequently, it will become the basis for moving into the apartment.

- Step 3. Submission of documents.

- Step 4. Filling out a tear-off coupon - if the child is not deregistered at the previous place of registration.

- Step 5. Waiting for a response. It takes up to 3 working days to check the documents, after which employees of the Federal Migration Service or MFC are obliged to either put a stamp confirming the registration of the minor at the specified address, or refuse registration (if there are serious reasons).

Yulia Simanovskaya, Director of the Department of Legal Support of Transactions at Tekta Group, answers:

An apartment purchased using mortgage funds is pledged to the bank, so in order to carry out any transaction, it is necessary to obtain the consent of the mortgagee.

Since the new owner has obligations to pay mortgage payments, the bank will carefully check his solvency. Considering that a minor child cannot have his own income, much less sufficient to repay the mortgage, the bank has the right to refuse to approve such a transaction, even if the consent has been obtained and the solvency of his parents has been confirmed.

If the bank has agreed to donate the mortgaged apartment to the child, then it is necessary to conclude a gift agreement and, together with the bank’s consent, submit it for registration with Rosreestr to transfer ownership of the apartment. In this case, the mortgage on the apartment in favor of the bank will also be registered.

5 main facts about apartment donation agreements

Donating real estate in 5 questions and answers

Is it possible to register a child without the consent of the creditor?

Many parents are concerned about the question of whether the bank’s consent is needed to register children in mortgaged real estate and what to do if the financial institution does not give such permission? Unfortunately, such problems arise very often, because on the one hand, the presence in a loan agreement of a ban on registering the borrower’s children is legally void, and on the other hand, banks strongly recommend compliance with this recommendation.

If faced with such a situation, the borrower can use the following algorithm of actions:

- Contact the regional unit of the Main Directorate of Migration Affairs of the Ministry of Internal Affairs of the Russian Federation at your place of residence (passport office) with an application and all necessary documents.

- If the employees of the passport office begin to demand the written consent of the bank, remind them of the norms of the current legislation:

- Art. 20 of the Civil Code of the Russian Federation, according to which the child’s place of residence is the place of registration of his parents;

- Art. 3 of the Law of the Russian Federation No. 5242-I of June 25, 1993, obliging every citizen of Russia to obtain permanent or temporary registration;

- Decree of the Government of the Russian Federation No. 713 of July 17, 1995 (as amended on December 23, 2016) on the procedure for registering Russians at their place of residence;

- Art. 64-65 of the Family Code of the Russian Federation on the parental rights of Russian citizens.

- If you receive a refusal to register, file a complaint with the city or regional department of the Main Directorate for Migration Affairs of the Ministry of Internal Affairs and send it by registered mail with acknowledgment of receipt.

- If you receive a negative answer, file a statement of claim in court with a copy of the response letter attached.

Penalties imposed by the bank after successful registration of children at the place of residence of the parents should also be challenged through a lawsuit.

The only way to avoid conflicts with a financial institution is to carefully study all the clauses of the mortgage agreement and consult with a professional lawyer. If you are categorically not satisfied with the provisions regarding registration, look for a more loyal lender.

The nuances of registering a minor child in an apartment with a mortgage

However, in order to prevent a dispute with the creditor, it is recommended to contact the bank and ask for consent with a written statement drawn up in any form. If the credit institution knows and respects all the laws of the Russian Federation, and not just those that are beneficial to it, the borrower will give consent.

The law both gives the right and obliges the parent to register their children in the living space where he himself is registered. At the same time, a citizen is required to obtain someone else’s consent to implement the law - namely, the other parent - only if that parent lives separately and is registered at a different address.