Help for low-income families in 2019

The legislation provides criteria that help exclude the possibility of accruing financial assistance to families for whom it is not intended.

For example, if the total family income does not reach the subsistence level, but able-bodied people do not want to work, they will be denied benefits. In order for a family whose able-bodied members do not work to be recognized as poor, it is necessary to prove that the difficult financial situation arose due to reasons beyond their control. Such reasons may include: serious illness, loss of property, the need to care for children or elderly relatives, etc. But in most cases, able-bodied and non-working family members are required to register with the employment center. Thus, a family whose adult able-bodied members either work but earn less than the subsistence level or are registered with an employment center can be recognized as low-income. The exception applies only to women on maternity leave. In cases where the location of a family member has not been established, and this does not allow determining the average per capita income, benefits to a low-income family can be accrued only if a criminal case is initiated by the police department regarding the missing person.

What income should a low-income family have?

Free legal consultation

To determine whether your family falls into the low-income category, you need to know what income should be in 2021. The calculation algorithm is simple: we add up the amount of official cash receipts to the budget from all members, and divide by the number of people including children.

The total income of a family is the sum of all income received into its budget over the last 3 months:

- salaries (official)

- accruals from bank deposits and deposits

- income from the rental of housing and other property

- pension

- scholarship

- fee

- child support

- other benefits and allowances

For 2021, the Government has established the average cost of living in the Russian Federation - 10,701 rubles ; if the amount received is less, then you have the right to apply to the MFC to obtain the status of a low-income family.

When making calculations, it is worth considering that a family, according to the law, is a person or group of persons who are permanently registered in the same living space and are engaged in a joint household, including parents, children, grandparents, single mothers and fathers, with adopted children, etc. .

An example of calculating the income of a low-income family:

- father salary - 10,000 rubles

- mother's salary - 8,000 thousand rubles

- grandfather's pension - 3,000 rubles

- daughter scholarship - 1,500 rubles

Read also: Step-by-step process for separating a personal account for municipal apartments

Total income for the last three months = (10,000 x 3) + (8000 x 3) + (3000 x 3) + (1500 x 3) = 67,500 rubles, hence the family income for one month is 67,500 : 3 = 22,500 rubles .

So, as 4 people live, the average income per person is 22,500: 4 = 5,625 rubles, which is less than the subsistence level.

Conclusion: such a family has the right to benefits and benefits provided to the poor.

It is worth considering that we carried out calculations based on the average minimum for Russia, a separate level is established for each region, the table below shows only some regions, check with an MFC specialist for more detailed information.

| City | Living wage |

| Moscow and Moscow region | 16426 rubles |

| Saint Petersburg | 10449 rubles |

| Republic of Crimea and Sevastopol | 9994 rubles |

| Vladivostok | 12456 rubles |

| Samara | 9964 rubles |

| Ekaterinburg | 9973 rubles |

| Rostov-on-Don | 9420 rubles |

| Arkhangelsk | 12011 rubles |

| Ulan-Ude | 9875 rubles |

| Voronezh | 8581 rubles |

How is total family income determined?

- Wage:

- average earnings maintained in cases provided for by labor legislation; payments made by bodies and organizations in whose interests the employee performs state or public duties;

- compensation paid by a government agency or public association for the period of performance of government or public duties;

- severance pay paid upon dismissal, compensation upon resignation, wages retained for the period of employment upon dismissal due to liquidation of the organization, reduction in the number or staff of employees;

- additional payments established by the employer in excess of the amounts accrued in accordance with federal legislation and the legislation of the constituent entities of the Russian Federation;

- wages for foster parents.

- Payments to military personnel and persons equivalent to them:

- monetary allowance and other payments;

- lump sum payment upon dismissal.

- Social payments:

- pensions, compensation payments (except for compensation payments to non-working able-bodied persons caring for disabled citizens) and additional monthly financial support for pensioners;

- monthly lifelong allowance for retired judges;

- scholarships paid to students in educational organizations providing secondary vocational education, higher education - bachelor's degree, higher education - specialty, master's degree, higher education - training of highly qualified personnel, graduate students and doctoral students studying off-the-job in graduate school and doctoral studies at educational organizations of higher education professional education and research organizations, students of religious educational institutions, as well as compensation payments to these categories of citizens while they are on academic leave for medical reasons; NEW! Since 2015

- unemployment benefits, financial assistance and other payments to unemployed citizens, as well as scholarships and financial assistance paid to citizens during the period of professional training, retraining and advanced training in the direction of the employment service, payments to unemployed citizens taking part in public works, and unemployed citizens, those especially in need of social protection during the period of their participation in temporary work;

- temporary disability benefits, maternity benefits;

- monthly child care allowance;

- monthly compensation payments to women with children under three years of age;

- monthly allowance to the spouses of military personnel serving under a contract during the period of their residence with their spouses in areas where they are forced not to work or cannot find a job due to the lack of employment opportunities in their specialty and were recognized as unemployed in the prescribed manner, as well as during the period when spouses of military personnel are forced not to work due to the health of their children related to the living conditions at the place of military service of the spouse, if, according to the conclusion of a health care institution, their children need outside care before reaching the age of 18;

- monthly compensation payment to non-working wives of ordinary and commanding officers of the internal affairs bodies of the Russian Federation and institutions of the penal system in remote garrisons and areas where there is no possibility of their employment;

- monthly insurance payments for compulsory social insurance against accidents at work and occupational diseases;

- monthly funds paid for a child (children) under guardianship or trusteeship; NEW!

- allowances and additional payments (except for those of a one-time nature) to all types of payments specified in this paragraph, established by state authorities of the constituent entities of the Russian Federation, local governments, enterprises, institutions and other organizations;

- cash payments paid to athletes and coaches NEW! Since 2015.

- Other payments:

- commissions for full-time insurance agents and full-time brokers;

- payment for work under contracts concluded in accordance with the civil legislation of the Russian Federation;

- the amount of royalties, including those paid to full-time employees of editorial offices of newspapers, magazines and other media;

- income received from election commissions by members of election commissions who carry out their activities in these commissions not on a permanent basis;

- income received by individuals from election commissions, as well as from the election funds of candidates for deputies and election funds of electoral associations for the performance by these persons of work directly related to the conduct of election campaigns;

- income of individuals engaged in mining activities;

- income from entrepreneurial activities (including income received as a result of the activities of a peasant (farm) enterprise), including those without the formation of a legal entity;

- income from shares and other income from participation in the management of the organization’s property (dividends, payments on equity shares);

- income from property owned by a family (its individual members), which includes income from the sale and rental (hire) of real estate (land plots, houses, apartments, dachas, garages), transport and other mechanical means, means food processing and storage;

- alimony received by family members.

We recommend reading: List of documents for apartment privatization 2019

Low-income family - a family (incomplete family) with an average per capita family income below one and a half times the subsistence level per capita established in St. Petersburg for the last quarter for which the specified subsistence level was determined, unless otherwise established by this Code.

Benefits for the poor

Benefits will be paid based on calculations made, in which the entire family's income for the previous three months is taken and divided by 3 . The result is divided by the number of people in the family. If the calculation determined by such calculations is less than the subsistence level, then you can contact the social protection authorities with a statement.

To support low-income families, many regions pay a targeted one-time benefit; it can be given to children who go to school at the beginning of the school year. Also, benefits for low-income families can be paid to pregnant women for adequate nutrition and more.

Help for low-income citizens of the Russian Federation in 2019

- The child is up to one and a half years old. One of the parents is paid monthly 40% of average earnings. Such payment cannot be less than 2,908 rubles for the first child and 5,817 rubles for the second and each subsequent child.

- Child under 3 years old. The amount of monthly payment was established for a child under 3 years old who was the third born in the family (and each subsequent one). In 2021 it is 9,396 rubles.

- A child under 5 years old from a military family. We are not talking about the family of a conscript - only children from the family of a contract serviceman are eligible for this type of benefits. The monthly benefit is 10,500 rubles.

- For the loss of a breadwinner for a military serviceman's family. It amounts to 2,117 rubles and is paid monthly.

- Benefit for low-income families. We are talking about a specific amount, but it is determined only by regional authorities and in many regions it simply does not exist.

When determining the status of a low-income family, not only the income of each family member is taken into account, although this is the most important point for making a decision. The commission must make sure that members of a family applying for low-income status live together and run a joint household.

Recognition of a family or citizen as low-income in St. Petersburg in 2021

Low-income families can receive from the state free trips to a camp for children or to a sanatorium if the child, for health reasons, needs treatment or recovery from illness.

Some regions in their budgets provide discounts for low-income people to pay utility bills, transport, and attend events with young children.

There are two main conditions for recognizing a family or a citizen living alone as low-income:

- average per capita income, which, for reasons beyond the control of citizens, is lower than the regional subsistence level;

- level of property security not exceeding the limit established in the region.

Moreover, the absence of one of these criteria is grounds for denial of recognition as low-income.

In other words, if the average per capita income is below the subsistence level, but property security exceeds the level established in the region, then a family or single citizen is not recognized as poor.

Therefore, to understand whether a family is low-income or not, it is necessary:

- calculate the average per capita family income and compare it with the regional subsistence level,

- compare property security with the level established in the region.

The procedure for calculating the average per capita family income is regulated in detail by Federal Law No. 44 of 2003.

To calculate the average per capita family income, you must use the following formula:

SDDS = OD: KM: KES, where SDDS is the average per capita income of the family; OD is the total family income for the 3 months that precede the month of filing the application to recognize the family (citizen) as low-income; KM is the number of months for which the total income was calculated (3 month);CCS – number of family members.

For example, a family of three received an income of 90,000 rubles in 3 months. The average per capita family income, based on the formula, is 10,000 rubles (90:3:3=10).

It is important to understand that the average per capita family income for assigning benefits for children aged 3 to 7 years is calculated not for three, but for the last 12 calendar months preceding the 6 calendar months before the month of filing the application for a monthly payment.

You can obtain the status of a low-income family (single citizen) if a number of conditions are met:

- the average per capita income of a family (citizen) is below the regional subsistence level;

- family members live together and run a common household (to recognize the family as low-income);

- able-bodied citizens of the family (able-bodied single citizen) have (have) a permanent place of work or are (are) registered with the employment center;

- lack of use of residential premises that meet established standards (for registering a family/citizen as needy/in need of residential premises).

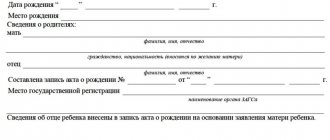

To recognize a family (single citizen) as low-income (low-income), the following documents must be prepared:

- statement;

- passports of family members;

- children's birth certificates;

- certificate of family composition;

- marriage certificate - if available;

- divorce certificate – if available;

- certificates of income of all family members for the last 3 months (for the last 12 months - for registration as those in need of residential premises);

- documents confirming income from owned property (from rent, sale) - if available;

- documents confirming income from the fruits and products of personal subsidiary plots - if available;

- Declaration 3-NDFL – for individual entrepreneurs;

- work book - for unemployed citizens;

- certificates from educational institutions about the issuance of scholarships - if available;

- a certificate from the Pension Fund about the amount of pension - if available;

- an extract from the results of a medical and social examination – for people with disabilities;

- adoption documents – if available;

- power of attorney certified by a notary (when applying through a representative):

- documents confirming ownership of movable and immovable property (if it is not registered in the Unified State Register of Real Estate) - for registration as those in need of residential premises;

- documents confirming the value of movable and immovable property owned - for registration as those in need of residential premises;

- consent to the processing of the applicant’s personal data.

Additionally, other documents may be required confirming the need to recognize a family (single citizen) as low-income (poor): certificates from medical institutions, court decisions, certificates of the amount of alimony/benefits, certificates of the provision of paid educational services, SNILS, etc.

Submitted documents may be subject to commission verification by the authorized body

Each document must be accompanied by a copy.

Help for low-income families in 2021: housing, payments, clothing

Low-income citizens are citizens recognized as such by the decision of local governments, taking into account the income that falls on each family member. Low-income status entitles you to receive social assistance from the state in the form of certain benefits and subsidies, the full list of which depends on the region of residence.

Help for low-income families is also provided in the form of tax benefits in relation to the amounts they receive from the state. In particular, one-time payments (including financial assistance) paid to low-income citizens as targeted social assistance are exempt from personal income tax.

Website about raising children

I collected my thoughts for a long time before setting off to conquer the paperwork. I prepared thoroughly so as not to travel twenty times: I called the MFC help desk, studied thematic websites. As a result, I can say the following: this is not real! Definitely! It feels like all kinds of barricades are specially set up for mothers on the way to the “cherished” pennies on some kind of “children’s” card, which, by the way, still needs to know where to pay. I’ll write everything in order, I hope my experience will help someone not to travel to these establishments several times.

- Payment for early registration with medical services. institution;

- Maternity benefit

- One-time payment at the birth of a child;

- Child care allowance up to 1.5 years;

- Payment at the birth of a child from St. Petersburg (children's card)

- Benefit for low-income families up to 1.5 years, from 1.5 to 7 years, from 7 to 16 years, or until graduation from a general education institution, but not older than 18 years

- New benefit (for those born in 2021) for low-income people from birth to 1.5 years

We recommend reading: Estimated number of spaces for cars on the site when designing an apartment building

Amounts of child benefits in St. Petersburg in 2021

It is legal. Since January 1, a new social code has been in effect in St. Petersburg. But now amendments are being adopted, thanks to which families where only 1 parent and child are registered in St. Petersburg will be able to receive benefits. Wait 1-2 months until the amendments are accepted and apply for benefits again

A child card can be issued up to 1.5 years of age. Other benefits - you can submit documents on any day convenient for you. Monthly benefits can be received for the previous period, provided that all certificates are provided. (but no more than for the previous 6 months)

How to obtain the status of a low-income family in St. Petersburg in 2021

- Maternal (family) capital:

- 483 881,83

- if the right to maternity capital arose before 01/01/2020 - 483 881,83

- for the first child in the event of his birth (adoption) starting from 01/01/2020. Maternity capital increases by 155,550 rubles in the case of the birth (adoption) of a second child starting from 01/01/2020, provided that the first child was born (adopted) no earlier than 01/01/2020 (total - 639,431.83 rubles) - 639 431,83

- for the second or third child or subsequent children in the event of his (their) birth (adoption) starting from 01/01/2020, provided that the right to maternity capital did not previously arise. - Monthly payment from maternity capital for the second child (up to 1.5 years) - 11,366.10

(Regional cost of living in St. Petersburg for children for the 2nd quarter of 2021)

For clarity, here is an example:

Calculation of income for benefits to the poor

| Family member | Income level for the last 3 months in total | Calculation |

| Woman | 30 000 | (30,000 + 60,000 + 30,000)/3/4 = 10,000 rubles per family member. The cost of living in the region for each family member is 11,680 rubles. You can apply for payments. |

| Man | 60 000 | |

| Pensioner | 30 000 | |

| Child | Does not receive income |

A family where its members deliberately do not work or engage in bad habits will not be able to apply for benefits. To keep your income to a minimum, you need to register with the Employment Center and actively look for work.

Until March 1, 2021, the authorities extended the automatic extension of benefits to 3 years for families whose income is below two subsistence levels in the region. What does it mean? Families who need to confirm their right to payment from October 1, 2021 do not need to visit social security authorities. All certificates will be collected without the participation of citizens.

What date do benefits arrive?

Money begins to be transferred no later than the 26th day of the month following the month in which the application for financial assistance was accepted. If a family receives regional payments, the accrual period is set by local authorities.

Support for families with children in 2021 will be provided from the regional budget. Conditions for receiving benefits may vary depending on the region. Payment is provided for the purchase of school uniforms and stationery.

You can also ask your employer for financial assistance, but it is worth remembering that the manager may refuse. If the situation is completely critical and there is confirmation of this, then you can count on significant help from the employer.

At the same time, we should not forget about other assistance to low-income families. Thus, from January 1, a new benefit for low-income families for children from 3 to 7 years old is in force in the amount of half the subsistence minimum per child for the 2nd quarter of 2021. A family with children where the parents have lost their jobs will also receive 3,000 rubles for each minor child in August. One of the parents receives such a payment, even if both parents are on the labor exchange.

An application for appropriate assistance must be submitted before September 1; this can be done at the MFC or social protection authorities.

What benefits are available to low-income families?

- for children under 1.5 years old. One of the parents receives a monthly payment for the child in the amount of 40% of the average official earnings. In this case, the minimum amount is 4465.2 rubles for the first and 6284.65 for the second;

- for children under 3 years old. This allowance is equal to 50 rubles;

- for children under 5 years of age from a low-income military family. It is worth noting that this benefit applies to those who have a family member who is a conscript. This benefit is paid to those who are military personnel on a contract basis. It is 12,569.33 rubles;

- other payments. In this case, we are talking about those provided by local governments in each individual region. The type of benefit and amount are determined at the regional level. It can be either in the form of an additional payment of any amount or in a separate form.

- free food (2 times a day);

- free school and sports uniforms (if necessary);

- discount on public transport – 50%;

- monthly free admission to exhibitions and museums. But there is a limitation - no more than 1 time per month;

- free sanatorium-resort treatment (if there are diseases) – at least once a year.

What documents and certificates are needed for a low-income family?

After waiting for your turn, you will get an appointment with a specialist, he will issue an application form, which must be filled out according to the sample, you also need to submit the following documents:

- Passport from the applicant and copies of all family members, birth certificate for children under 14 years old (copies can be made on site at the MFC).

- Certificate of marriage or divorce

- Certificates of income for the last three months (from work, extracts from the pension fund, scholarships from the place of study, for legal entities 3-NDFL and others)

- a certificate of family composition (form 9) or an extract from the house register (can be obtained through the MFC)

- copies of work books and certificates from employment centers for the unemployed but capable

- a copy of the property title document

- extracts from the Unified State Register for all family members indicating the cost and list of property (available at the MFC)

- if there are incapacitated persons living in the family, the original certificate of disability

- statement with the applicant’s bank account details

- in some cases, an individual taxpayer number may be required.

Read also: Environmental Protection Law

After the specialist accepts and checks all the documents, you will receive an extract with a number, which you can use to track the status of the application.

Rights and benefits of low-income families in 2019

- Tax: you don’t have to pay taxes on amounts received as preferential grants, pensions, etc.;

- The right to receive housing under a social tenancy agreement from the housing stock of the local municipality in order of priority, or when registering as those in need of improved housing conditions, a social mortgage can be issued;

- Housing: benefits for utilities for low-income people for tenants of municipal housing and owners of privatized housing (local adjustment factors are valid and applied);

- Material aid:

- Monthly - for minors, full-time students, in single-parent families - 2 times the amount, mothers on maternity leave are paid until the child is 2 years old.

- Emergency - a one-time payment in the event of a serious illness or death of a family member.

- Extraordinary enrollment in preschool educational institutions with a reduction in monthly payments by 20% for the 1st child, by 50% for the 2nd, by 70% for the 3rd and all subsequent ones;

- Legal - free legal advice, assistance in protecting interests in court.

To obtain the legal right to social assistance, low-income families must obtain low-income status. The application is submitted to the social support body (social security), where, if all conditions are met, an agreement will be concluded to provide financial support from the state. This document can then be used everywhere and provided as proof of social status.

Housing subsidy

The state provides assistance to low-income people to improve their living conditions. The subsidies apply to citizens of the Russian Federation. State programs are implemented by:

- Registration of those in need of improved housing conditions. Social housing for low-income people is provided from the state or municipal housing stock.

- Purchasing your own real estate or building a house using a social mortgage. It is distinguished by preferential interest rates, the presence of social guarantees, and the ability to pay the down payment or part of the loan using maternity capital. There are special programs that provide additional financing for repayment of a mortgage loan from budget funds. Thus, according to the “Young Family” program, up to 70% of the mortgage amount can be obtained from the state budget to pay for the cost of purchased housing. In 2021, low-income citizens will be issued mortgages for construction or finished housing at 6%, the rest of the interest will be covered from budget funds.

To register, you should contact local authorities, write an application and provide the following documents:

- passport of adult citizens;

- children's birth certificate;

- Marriage certificate;

- certificate of absence of residential property;

- certificate of family composition;

- income certificate.

The decision is made within a month, but before making it, the living conditions are examined by a commission. Mostly housing subsidies for low-income people are provided in the form of a certificate. To obtain housing in this way, you should follow the following algorithm:

- open a bank account for crediting certificate funds;

- choose residential real estate (when purchasing from a developer, its readiness must be more than 70%);

- draw up a purchase and sale agreement;

- provide an agreement to the bank to transfer funds to the seller;

- take a receipt from the seller about the receipt of money, draw up an act of acceptance and transfer of real estate;

- register property;

- provide a certificate of registration to the housing stock.

Conditions of receipt

Article 49 of the Housing Code of the Russian Federation states the right of low-income citizens to free priority housing. According to Article 51 of the Housing Code of the Russian Federation, citizens are recognized as in need of improved housing conditions and are registered for the allocation of social housing on the following grounds:

- There are no residential property owners or social housing tenants among family members.

- The premises in which low-income citizens live are unsuitable for habitation and are in disrepair.

- One of the family members is seriously ill.

- Several families live in one room (apartment, house).

- Owned or rented housing does not meet established standards. According to the law, 1 person is entitled to at least 18 square meters. m of living space.

- Leeches - benefits and harm, reviews. What are the benefits of leech treatment?

- Post an ad on Avito with registration for free

- How to treat burns at home

What does social assistance mean for low-income families in 2021?

The limit is determined using complex calculations. By applying for this subsidy, residents can expect to receive a subsidy for a period of six months if successful. It is interesting that this financial assistance is provided to both home owners and people renting it.

Since 2012, the poor have the right to receive free legal services provided by the state. These services include not only consultations, but also representation of clients’ interests in court and other government bodies. Such assistance increases the chances of the poor to receive more social assistance, and most importantly, gives them the opportunity to defend their rights.