Business lawyer > Labor law > Dismissal > Advance leave upon dismissal: who can count on what compensation and what kind of compensation

Annual paid leave is a right that accrues to anyone who has worked at an enterprise for at least six months. Our country has adopted an international convention according to which paid leave can be provided from the first day of work. But not all employers use this system; most prefer to rely on the Labor Code of the Russian Federation.

Article 122 of the Labor Legislation also gives the right to take a vacation before six months of continuous work, if the manager gives his consent. It is not necessary that such leave be issued in proportion to the time worked. Registration in full is acceptable, that is, the advance vacation can be equal to 28 days, like a regular one.

We arrange your next vacation in advance

The Labor Code of the Russian Federation regulates any relationship that arises between employees and managers. According to standard rules, any employee can receive leave every year after at least six months of continuous service.

Vacation

During subsequent periods, rest is provided at any time that is considered most convenient. The order of the procedure is established depending on the order in which rest time is provided in a particular organization. The employee uses standard rules to calculate vacation pay; the basis is specified in Article 139 of the Labor Code of the Russian Federation.

The billing period is now equal to 12 calendar months that precede the vacation. Over the course of every 30 days, the average number of working days is 29.6. 1 calendar year is counted before the 1st day of the month when the vacation is taken out.

This means that it becomes possible to arrange a vacation in advance, and not in time with actual work. Then the function of advance payment in connection with the upcoming performance of duties is transferred to the part of the vacation pay that was paid.

General rules for granting vacations

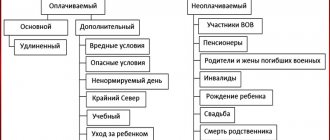

In general, the duration of annual paid leave is 28 calendar days (Article 115 of the Labor Code of the Russian Federation). This period increases for certain categories of specialists designated by the Code and federal legislation, for example, persons employed in hazardous industries or working in the Far North.

According to the law, rest is provided after a specialist has worked for the employer for six months (Article 122 of the Labor Code of the Russian Federation). However, the parties are not prohibited from agreeing to other terms that improve the employee's position. The article states that the company does not have the right to refuse to provide “premature” leave to the following categories of citizens:

- women “in position”;

- minor employees;

- adoptive parents of children under 3 months;

- other categories of persons named in federal laws.

Providing “premature” leave occurs in accordance with the general procedure. The specialist is paid vacation pay three days before the start of the vacation, and a personnel order is issued, which is endorsed by the head of the company and the employee himself.

Does the manager have the right to withhold debt for unearned vacations?

Management solves the issue

Dismissal means that on the last day the employee is given all the amounts due to him. This also applies to vacation time that remains unfulfilled.

If a debt arises, the manager will have the right to withhold:

- Amounts agreed to by the employee himself.

- That part that can be retained only on the basis of legislative norms.

When registering a dismissal in the year of receiving leave, but not fully worked, the employer can withhold amounts that are not compensated for labor, but received as an advance. There are only a few acceptable exceptions to this rule.

Recovery of part of the amount is unacceptable when certain grounds specified in the Labor Code of the Russian Federation are used.

The purpose for any deduction is to pay off the debt incurred to the employer because the amounts were not actually worked out. They were issued to the employee on the condition that they would be compensated in the future. But before dismissal, one of the parties violates this condition. As a result, one party receives unjust enrichment, and the other suffers losses.

An employee took a vacation in advance and quits - example of calculation

Before informing the employee of the fact of deduction for days of unearned vacation, the number of days and the amount of vacation pay received in advance are correctly determined. To do this, the personnel service provides the accounting department with accurate data on the continuous work experience of the outgoing specialist and on the vacations actually used. Method for determining the number of earnings and time off in advance for the unworked period:

The number of days stipulated by the Labor Code of the Russian Federation or the collective agreement is divided by 12 and multiplied by the number of full months worked.

If an employee is dismissed in the middle of the month, the number of vacation days for this period will be counted in full if more than 15 days were worked. Less than a month will not be included in the calculation.

Example:

The employee was employed on April 15, 2021. I took a full vacation of 28 days, the date of dismissal was January 25, 2021. Vacation pay amounted to 15,000 rubles. There are nine full months, the remainder is 11 days of an incomplete month; rest days for this period are not counted. The amount of withholding of vacation pay received in advance before dismissal is as follows:

- 12/28*9= 21 days;

- 28-21=7 days advance;

- 15000/28*7=3750 rub.

If this amount is less than 20% of all payments on the date of dismissal, then the deduction for the days provided in advance will be 3,750 rubles.

How should we proceed?

Article 138 of the Labor Code of the Russian Federation contains general provisions that prohibit deductions from the only means of subsistence. In addition, it is stated that deductions cannot be more than 20% of earnings. But only wages are subject to restrictions. It does not apply to other payments that are in no way tied to the main activity at work.

Many experts believe that such rules should not be applied when it comes to unworked vacations and deductions in connection with them. Debt repayment is possible using any means. Except for those that cannot be used according to certain legal regulations.

For a manager, it is worth pointing out three main rules that it is recommended to rely on:

Vacation time

- An employee receives the right to 28 days of rest if he works at the enterprise for a whole year, in total or continuously. If the vacation is taken out ahead of schedule, then part of the vacation pay is considered an advance, which involves a refund procedure if the dismissal occurs in a year not fully worked.

- It is acceptable when the amount is obtained voluntarily. This is easy to solve even if the employee’s own funds are insufficient. Employees cannot be forced to deposit money into the company's cash register. Including by delaying final settlements. Such actions may be considered illegal, and management will be held liable for material assets.

- If the employee refuses, then the manager himself can refuse, or organize recovery through the courts.

In each specific case, the manager must justify his decision. This is what will allow you to protect yourself if additional questions arise from the inspection authorities.

Deductions upon dismissal for vacation in advance in 2021

Vacation taken in advance is not grounds for retaining an employee if he or she expresses a desire to quit.

Dismissal at will is not the only reason for premature separation from an employee who took his vacation in advance.

Making collections is not as simple as it seems at first glance. This procedure requires knowledge of the law and the correct approach.

What to do if an employee takes a vacation in advance and quits?

The end of the employment relationship implies a full settlement with the resigning employee. The calculated payments include wages for the period worked, as well as compensation for vacation.

In cases where vacation payments were made in advance, it is necessary to make a deduction from the accruals made to the employee.

The employer acquires this right on the basis of the law enshrined in Article 137 of the Labor Code of the Russian Federation.

This list includes the following cases:

- Liquidation of the organization;

- Reductions made at the enterprise;

- When the management team changes due to a change in the owner of the company;

- As a result of the death of an employee;

- Conscription into the army;

- Obtaining a non-working disability group.

This list is not final; it includes only the most common reasons.

Refund of vacation pay upon dismissal of an employee who took a vacation in advance in 2018

Upon dismissal, the employer has the right to withhold only a small part of the accrued payment - a fifth.

In some cases, you can deduct half of the accrued amount.

The employee has the right to voluntarily return the difference in amounts to the organization’s account. The accountant should not forget that a voluntary return entails a full recalculation of personal income tax,

Order to withhold vacation pay for vacation issued in advance upon dismissal

Leave used in advance is subject to withholding only with written approval from management. The director of the company signs an order on deductions from the resigning employee.

To do this, the accounting department submits a memo with exact calculations for:

- The number of vacation days that were not worked;

- The amount of compensation paid in advance.

Based on it, the director issues an order, covering a list of the following issues:

- Justification for deductions. The reason is indicated here - the dismissal of the employee and the days received in advance, indicating their number;

- An order to the chief accountant to withhold amounts;

- Clarifications regarding the amount of the amount with reference to Article 138;

- Assignment of control over the execution of orders.

The order is subject to mandatory written familiarization with all persons specified in it.

Calculation of compensation for used vacation in advance upon dismissal

To calculate the recovery of previously paid compensation, the accountant must have the following data on hand:

- The start and end dates of the resigning person’s vacation period;

- The number of days of rest required for this employee;

- Number of days off;

- Calculated average daily income for the last two years.

Having these indicators, it is not difficult to calculate the compensation required to be paid. To do this, we carry out the following calculations:

- We find out the difference between the number of days off and the days allotted for the period worked;

- We multiply the resulting difference by the daily average.

The calculated amount is compared with the amount of accrued payments. One thing to keep in mind is the legal barrier to computing.

Deduction for vacation used in advance upon dismissal - personal income tax for deductions

In cases where an employee voluntarily returns the money overpaid to him for a vacation, the accountant is required to perform a number of actions.

Money returned to the company's account automatically ceases to be accrued income to the employee. Accordingly, all taxes taken from him for this amount should be returned. The organization also has the right to return the funds paid for personal income tax.

To do this, payments are recalculated and documents are sent to the tax authorities, which subsequently return these funds.

About tax issues

This question causes the most difficulties in accounting work. Especially when it comes to recalculating taxes from one type to another. Let's begin to consider the issue in more detail.

With personal income tax, the object for taxation is the income received by the payer, in any variety.

According to Tax Legislation, a tax base is the name of a characteristic for taxation, with a cost or physical content. When this base is determined, all sources from which funds come are taken into account. The fee base is not reduced due to withholdings, even if they are imposed by a court decision.

Subtleties of taxes

A negative answer will be given to the question of whether it is necessary to recalculate the income portion for the same period as vacation pay received in the form of an advance. When receiving labor remuneration, it is considered that the income was actually received on the last day of the month during which income accruals occur. When vacation pay was determined, the organization had already carried out all the necessary tax transactions.

It turns out that in any situation, personal income tax is already withheld from the employee in advance, using a cumulative total.

Will retention lead to a natural result in the form of a reduction in the unified social tax base? For enterprises in this case, the base is payments and any other transfers related to the labor-type agreement. Article 238 of the Tax Code of the Russian Federation is devoted to a description of the current exceptions to the rule. Of all the points, compensation for vacations that remained unrealized deserves a separate discussion.

Experts express two views. According to one, retention promotes reduction. The second is strictly opposite to the first. Many are inclined towards the first option. In this group, it is generally accepted that the portion of holiday pay retained by employers cannot be considered as payment to employees.

If the unified social tax has already been determined for the money received earlier, it is recommended to recalculate it. The same applies to pension contributions. Initially, UST is paid for the entire amount due to the employee.

What to do with the unified social tax?

If adjustments need to be made, this is done like this:

- First, you need to understand the difference between the tax amount calculated on the basis, using the total and the accrual in the reporting period before the dismissal occurred. And the amount of monthly advance payments already transferred.

- The appearance of a positive difference leads to the need to transfer the corresponding tax amount on time.

- If it is negative, then current payments are offset against the future.

It is this version that most experts lean toward.

About prohibitions on withholding vacation pay

When a manager withholds vacation pay, he must take into account the restrictions introduced by Article 138 of the Labor Code of the Russian Federation. According to the first part, 20% of wages is the maximum total amount. The rule continues even if the employee himself has no objection to the fact that the money is withheld.

The amount of debt can be repaid voluntarily if the amount of overpayment of vacation pay upon final settlement exceeds the maximum allowable amount. Cash can be deposited through the company's cash desk, and transfers to bank accounts are also allowed.

If the employee does not take such steps, then the amount can only be claimed through legal proceedings. But judicial practice in this area has developed very contradictory.

It is known for sure that deductions are unacceptable if one of the following reasons is indicated for dismissal:

Joining the army

- Death of an individual entrepreneur.

- The onset of force majeure, the characteristics of which comply with Russian legislation.

- Recognition of an employee as incapacitated for work based on medical indications.

- Conscription for military service. This also applies to the alternative option.

- Reinstatement of the person who previously held the position. This usually happens after the relevant court decision has been issued.

- Refusal to transfer.

Is it possible to withhold overpaid vacation pay?

As established by Article 122 of the Labor Code of the Russian Federation, an employee must be provided with paid leave annually. Moreover, during the first year of work, a citizen has the right to take out such leave only if he has continuously worked for a specific employer for at least 6 months.

Annual leave with pay can be provided to an employee before the end of the six-month period if the parties - employer and employee - reach an appropriate agreement.

Certain categories of employees, stipulated by Article 122 of the Labor Code of the Russian Federation, are necessarily granted paid leave ahead of schedule - before the end of a six-month period of continuous work - if the employee has asked (declared) about it.

For subsequent years of employment (second year and so on), paid leave can be issued to the employee at any time during the working year. In this case, the sequence of annual vacations regulated by the employer must be taken into account.

In other words, after working for six months for a specific employer, a citizen can take an annual paid vacation, the duration of which does not exceed 28 calendar days. He has this right, despite the fact that during a six-month period of continuous work he earned only 14 calendar days of paid leave.

It turns out that an additional 2 (two) weeks are provided to the hired employee in advance - he is obliged to work them over the next 6 (six) months of the working year.

If, before the end of a specific working year, a citizen who has used his annual leave time in advance wishes to resign, the employer will be able to withhold from him proper compensation for overpaid vacation pay.

The management of the organization has the right to do this, since an employee who wishes to terminate the employment relationship will not work off the vacation pay received until the end of the working year.

If you follow the norms of Article 138 of the Labor Code of the Russian Federation, upon dismissal, the employer can withhold a maximum of 20% of the full payment amount paid to the employee.

The employer is not required to withhold compensation for overpaid vacation pay from payments due to the resigning employee. However, he has such a right.

If the director of the company wants to use this opportunity, he will not need the consent of the employee who received the vacation pay in advance. He can independently make a deduction of 20% upon the calculation of the calculation upon dismissal.

If this employee does not have a sufficient settlement amount to return the entire overpayment of vacation pay (either there is none, or the withheld amount turned out to be more than 20% of payments), then the employee has the right to pay off the missing amount voluntarily.

An employer cannot force an employee to return an excessive overpayment of vacation pay, in excess of the 20% that can be withheld upon dismissal. You can only suggest to the employee that he himself returns to the organization’s cash desk that part of the vacation pay paid in advance for the vacation, which cannot be retained upon termination of the employment contract.

When is deduction from an employee not allowed?

A citizen must not reimburse the employer for overpaid vacation pay for vacation provided in advance if he resigns before the end of the relevant working year on the grounds mentioned in Article 137 of the Labor Code of the Russian Federation.

When it is impossible to withhold vacation pay issued in advance upon dismissal:

| Grounds for dismissal | Article of the Labor Code of the Russian Federation |

| The employee refused to be transferred to another job if the need for such a transfer is due to the requirements of a medical report. | Clause 8 Article 77 |

| The enterprise has finally closed (alternatively, a private entrepreneur has officially ceased operations). | Clause 1 Article 81 |

| The number of hired employees has been reduced. | Clause 2 Article 81 |

| The owner of the employing organization has changed. | Clause 4 Article 81 |

| The employee was called up for compulsory military service. | Clause 1 Article 83 |

| The previous employee was reinstated to the position held by the citizen. | Clause 2 Article 83 |

| The employee was declared incapacitated according to a medical report. | Clause 5 Article 83 |

| Death of an individual employer or employee. | Clause 6 Article 83 |

| Emergency circumstances arose that prevented further work activities (catastrophe, war, serious accident, natural disaster). It is noteworthy that such circumstances must have official confirmation. | Clause 7 Article 83 |

If the circumstances listed above do not exist when the employee is dismissed, the employer has the right to withhold compensation from him for vacation pay paid in advance.

The first option is for the employee to voluntarily return the funds.

The second option is for the employer to withhold 20% of the settlement and recover the remaining amount through the court (if the employee refuses to repay voluntarily).

How can an employer return money for days used in advance?

Vacation pay compensation for vacation in advance is collected from the resigning employee directly on the day of his dismissal.

Such deduction is carried out by the employer when carrying out proper mutual settlements.

To clarify an employee’s debt for overpaid vacation pay for an unfinished annual period, you need to get answers to the following questions:

- how many days and months did a citizen actually work in a given organization for a specific working year - calculate the vacation period;

- how many days a citizen did not work for a specific working year (that is, he still owed money) - excessive days off.

To determine, as of the date of dismissal, the number of unworked calendar days of vacation, excessive time off, for which the employee received vacation pay in advance, you need to use the following algorithm:

- The number of vacation days granted to this employee is divided by 12 (twelve) months, and the resulting value is multiplied by the number of months worked for this employer.

- The value obtained as a result of the previous arithmetic operation is subtracted from the number of vacation days granted to the employee during his time working for this employer.

Rounding of the numerical value of the number of months is allowed. The last month, which the employee worked less than 50%, is not taken into account. If the last month is worked at least 50%, it is counted as a month worked by the citizen in full.

The number of unworked days resulting from the calculation can also be rounded to the nearest whole number (this rounding should be done in favor of the employee).

The amount of overpaid vacation pay that must be withheld upon dismissal of an employee is determined as follows: the number of unworked days is multiplied by the average earnings of this employee paid during the paid vacation.

Step-by-step instructions for withholding overpaid vacation pay upon dismissal:

| Step 1 | Calculate the length of service that gives you the right to vacation. |

⇓

| Step 2 | Calculate the duration of vacation for the vacation period. |

⇓

| Step 3 | Determine the number of vacation days used. |

⇓

| Step 4 | Calculate the number of vacation days provided in advance. |

⇓

| Step 5 | Determine the average daily earnings on the date of granting leave in advance. |

⇓

| Step 6 | Calculate overpayment for vacation pay (multiply average earnings by the number of days in advance). |

Do I need to submit an order for a refund?

To protect itself in case of possible litigation and disputes with a former employee, the employer must properly formalize the withholding of overpayment of vacation pay. To do this, an order is issued providing for the deduction of overpaid funds from the resigning employee. Such an administrative act is drawn up in free form.

An important condition is that an order to withhold overpayment of vacation pay in advance is issued by the head of the company within a month, counting from the end of the period allotted to the employee for the voluntary repayment of this debt.

The order must contain the following information:

- Information about the employee (position, full name).

- Number of unworked days.

- The amount of debt - vacation pay issued by the employee in advance - for vacation days that the citizen did not work.

- Signature of the resigning employee confirming familiarization with this order.

Procedure for deducting overpaid vacation pay

The deduction, as stated, is made in the same period when the vacation pay itself is paid. The whole process should not take very much time. And the stages can be described as follows:

- It all starts with a calculation of the excess amount that was paid towards vacation pay.

- Issuance of an order confirming the completion of all settlements

- Familiarization with the employee’s order, under personal signature

- The retention procedure itself

It is important to follow the rules related to turn-taking. At the first stage, we remove personal income tax from wages. After this, they move on to the debt determined on the basis of the executive documentation. Only after this is the rest of the debt calculated. Usually the accounting department is responsible for this function.

Forgive debt

The manager has the right to simply forget about the existing debt. Usually the basis for such a conclusion is a small amount. For example, if the debt is measured in kopecks. If there are other reasons, the manager must provide compelling reasons for his decision.

If management itself does not take exacting measures, then the debt hangs with the employee until the statute of limitations expires. According to general rules, it is at least three years. It can be counted from the date of receipt of information regarding violated rights. But it is acceptable to use the immediate day of dismissal. The next day after the court’s decision that the penalty is canceled is also used.

Taxes and insurance premiums: accounting rules

Specific actions depend on how the manager behaves in relation to receivables. The situation may develop according to the following scenario:

- Full repayment on the last day of work.

- Refusal to repay the debt by the employer.

- The debt was forgiven and was not taken into account in the final calculation.

- Expiration of the statute of limitations for filing a claim.

Repayment situation

There is no need to fix anything during the presentation period. The adjustment is carried out during the period when the dismissal itself is organized.

- Income tax. The returned amount is taken into account as part of non-operating income. After all, they had already been taken into account when forming the base.

- Personal income tax. When wages were issued, personal income tax was already taken into account by management.

If the period of dismissal and retention coincides, the manager has the right to offset the personal income tax withheld in excess of existing standards.

Payment of taxes

When calculating, a total is used, accompanied by an increase. The tax amount is the difference between personal income tax, which is calculated and paid from the beginning of the reporting period. If an error is made, the personal income tax may be reduced depending on the calculations made earlier.

Income received by the taxpayer involves the performance of actions consisting of calculation and payment. In the case of a tax agent as a source, and offsetting the amounts discussed earlier. The rule is not without exceptions, but they do not include situations with advance payments.

The refund procedure is carried out if an employee is dismissed for a different tax period.

A situation where payments for the current reporting period are withheld from an employee, but they are unduly withheld for previous periods in time, will not be perceived as an error. Indeed, in each period the amount was determined separately, as the addition of all factors operating at that particular moment. Therefore, there is no need to make changes to documents for previous periods.

Summarize:

- A typical decrease in the base for insurance contributions is based on the amounts of vacation pay that were withheld or returned, and are also related to wages.

- But this decision will be erroneous when calculating the base level for indicators in connection with the previous reporting period, for which the advance payment was made.

But the employer will have to adjust the following forms if the final calculation results in a negative amount for additional accruals:

- SZV-6-2.

- SZV-6-1.

These reporting forms are submitted to the Pension Fund, along with other information for the reporting period in which the unworked days were withheld. The main requirement is consistency between the data in the form ADV-6-2 and RSV-1.

If the debt cannot be collected

If it is impossible to collect the amount, it cannot be taken into account when determining the basic part of the profit tax that is subject to levies. After all, this procedure will not meet the requirements for economic justification of costs.

There is no need to adjust personal income tax or insurance premium data. Their accrual per month of payment will not be considered legal.

When debt is forgiven

- Calculation rules

Income tax. Expenses are not taken into account when it comes to the taxable base. But a reasonable step would be to include vacation pay that was paid at the time the vacation was taken into account as expenses. In this case, there is no need to recalculate previous periods.

- Tax accounting has been completed in full. When the debt is forgiven, the employee does not have additional income that can be subject to personal income tax.

- Insurance type contributions. This situation also does not imply their adjustments.

When does the statute of limitations expire?

Vacation expenses are initially recognized as part of labor costs. Therefore, managers do not have the right to repeat transactions with funds. This implies the impossibility of taking into account the debt itself if the statute of limitations on claims has already expired. You can only write it off at the expense of the net profit of the enterprise.

What if the employee took time off in advance and decided to terminate the employment contract?

A common situation: if an employee takes a vacation in advance and quits of his own free will.

Important! Almost always, vacations are provided to employees for the unworked year, because the right to vacation begins six months after the start of work in the organization.

Starting from the 2nd year of work, the employee is allowed to rest according to the schedule, that is, at any time, and often employees go on such leave for the next working year.

This situation is called “advance” vacation.

Consider the following example. Korshansky N.A. According to the schedule, he used 28 days of vacation per working year from 04/03/2019 - 04/02/2020. He went on vacation in June 2021, and in July, upon returning to work, he submitted his resignation.

Thus, the following signs of advance leave can be distinguished:

- the employee goes on vacation after the new working year begins for him;

- the working year is not over yet.

Registration of deduction from salary

The employer decides not to require the employee to pay the full amount, but plans to make a withholding. There are no problems if the amount of debt does not exceed the legal limit (20% of wages).

Before settlement is made with the dismissed employee and he himself leaves the organization, the following steps must be completed.

- Calculate the amount of debt.

The organization's accounting department makes this calculation. How to do this correctly was discussed above.

- Issue an act on withholding part of the salary.

Most significant actions within the organization are formalized by an Order issued by the head.

Unlike the Order on the dismissal of an employee, this act does not have a unified form and is drawn up arbitrarily. The head of the organization must reflect the following information:

date and place of drawing up the act;- information about the employee (full name, position);

- reason for retention (due to dismissal before the end of the working year, during which the employee went on annual leave);

- the number of days not worked and the amount withheld;

- retention period;

- Full name and position of the responsible person (accounting employee).

- Place a hold.

Deduction is made from that part of the salary that is paid on the last working day (or the day of dismissal if the employee submits an application while on vacation or sick leave). From the amount, in addition to the deduction of 13% tax and other payments, debt is deducted, but only if it does not exceed 20% of the full salary. If it exceeds, then it is permissible to withhold only the specified part of the amount.

- Fill out tax reports and adjust insurance premiums.

Vacation pay paid to a dismissed employee was subject to personal income tax. Since the amount withheld is not due to an error, but because the employee decided to leave or was fired for wrongdoing, no adjustments need to be made.

However, the fact of deduction must be reflected in 2NDFL and the tax register in the month of dismissal of the employee.

In addition, the employer must, within 10 days from the date of withholding the amount, inform the dismissed employee that a larger tax has been withheld from the vacation amount that is collected from him. In accordance with Part 1 of Art. 231 of the Tax Code of the Russian Federation, an employee must submit an application to the tax office for excessive withholding of the amount.

The tax refund can be used to reduce the amount owed.

But insurance reports need to be adjusted. This applies only to contributions to the Pension Fund.

- Formalize your resignation.

Termination of employment relations is carried out in the usual manner specified in Art. 84.1 Labor Code of the Russian Federation:

- the employee’s statement is registered (or an act confirming the employee’s guilt on the basis of which he is fired);

- The Order and personnel documents are drawn up;

- calculation is made.

Voluntary return of the amount by the employee

Often employees agree to reimburse the amount, especially if it is small (or, on the contrary, more than the legal 20%), voluntarily, without penalty. This procedure is also carried out in several steps.

- Make a statement.

The document is drawn up in any form and must reflect:

in the header of the document - to whom the application is being submitted (full name and position of the head of the organization);- the main part is a voluntary agreement to pay the amount for unworked vacation (you must indicate the exact amount of money);

- date of application and employee signature with transcript.

- Issue an Order for the return of the amount of money.

As a rule, this act is not issued, since the voluntary return of the amount is the will of the employee himself, and not an order from his superiors. However, for accounting purposes, you can draw up an Order by ordering the chief accountant to accept from the employee the amount specified in his application.

Debt forgiveness by employer

In order not to burden themselves and the accounting department with unnecessary work, the organization’s management can forgive an employee’s debt , especially if it is a small amount. In addition, the tax authorities, in accordance with Art. 252 of the Tax Code of the Russian Federation, consider unearned vacation as unreasonable expenses.

Reference. An organization can reduce the tax base by the amount of an employee’s debt that was forgiven. There is no need to adjust the reporting.

Collection of the full amount of debt through legal proceedings

The amount turned out to exceed 20% of the salary, and the employee himself does not want to return it. The employer decides to file a lawsuit in the hope that the former employee will be allowed to collect the entire debt.

Alas, in this matter, judicial practice does not side with organizations , although before 2013 there were precedents when the courts allowed the full amount to be recovered from an employee who had already resigned.

In accordance with the Determination of the Supreme Court of the Russian Federation dated October 25, 2013 No. 69-KG 13-6, debt for unworked vacation is not subject to collection in court, because labor legislation does not contain any direct reference to this possibility. This Definition was included in the Review of Judicial Practice, and is currently actively used by the courts.

Thus, the employer can only recover an amount not exceeding 20% of the salary, agree with the employee on a voluntary payment, or even forgive him this debt.

Additional rules. Going to court

Through the court

The official position of the court on such issues is described as follows. There is no basis in the legislation for turning to the courts to recover amounts in connection with days of vacation without work. The exception is situations where a counting error was made, or when the regulatory authorities themselves recognized that the reason for exceeding the standards was precisely the behavior of the employee associated with a violation of the current rules.

Both the salary itself and other payments that have a similar purpose are not subject to recovery. This provision must be taken into account by courts that have only general jurisdiction. It will be difficult to prove your position, even if the employee himself agreed in writing to pay compensation, but never fulfilled his obligation.

Refund of vacation pay upon dismissal of an employee who took vacation in advance

If the employee agrees that the days received in advance need to be compensated, then the accounting department must provide him with a document listing in detail which amounts have been accrued and which will be withheld on the date of dismissal. The next stage is to obtain written confirmation from the employee himself; it can be presented in any form. The main thing is that it should be clear from the statement that the person does not object to the very fact of the withholding and its amount.

The amount of the estimated payments is so small that it is not enough to compensate for the advance payment for vacation pay. Option: the employee can independently deposit the missing amount into the cash register. Such an operation cannot be called a deduction from earnings, so the 20% limit will not apply.

Drawing up and issuing an order

Without it, it is impossible to demand an amount for the rest period, for which there is no actual work. A note on the employee’s consent does not apply to mandatory requirements. If there are not enough funds for a refund, then the excess is offered to be returned directly, through the company’s cash desk. If you refuse to cooperate, you can contact the courts.

In this case, a number of requirements are imposed on the content of the document. Compliance with them will allow the procedure to be carried out without violating the law:

- In the body of the document you need to clearly and clearly explain why exactly there was a need to withhold

- As already mentioned, a consent mark is not required. Because you don’t need to ask the employee himself anything

- It is necessary to indicate the exact amount to be withheld

- For calculations, standard schemes are used, according to which the amount of vacation pay is determined

In addition, there are details that are mandatory for any documents of this kind:

Drawing up an order

- Date of signing.

- Name and position, full name of the responsible person.

- Provide links to articles in the current law.

- Reason for retention and magnitude. It is acceptable to use brief descriptions of the situation.

- Name.

- The address at which the document was drawn up, along with the date.

- Serial number.

- Name of the organization in full form.

Upon dismissal

An employee can be dismissed for various reasons. For example, on his own initiative, due to a reduction in position, by agreement of the parties, or for misconduct - on the initiative of the employer.

However, the basis for termination of the employment relationship does not in any way affect the employer’s obligation to compensate for unused vacation periods. In simple words, even if an employee is fired for absenteeism or theft, compensation for missed rest will have to be made in any case.

If an employee resigns of his own free will, then it is necessary to prepare a corresponding statement. But it is not necessary to indicate in the application a requirement for a compensation payment. But it is worth noting that it is permissible to indicate this requirement if the employee has several periods without compensatory leave. Use the sample: resignation letter with vacation compensation.

Application for compensation

Order for compensation

Order to replace vacation with compensation

When you are fired due to downsizing

If the main reason for dismissal is liquidation or reorganization of the enterprise, then compensation in full is paid to all employees who have worked for more than five and a half months. Recalculation and deduction are carried out taking into account this fact.

The main document for resolving this issue was adopted more than 70 years ago, but its provisions largely remain relevant to this day. This applies to provisions that do not contradict the current version of the law.

To ensure that the employee is aware of what is happening with his finances, the other party is given a special pay slip containing detailed information. The document states the type of operation and the exact amount.

Currently, the deduction of overpaid compensation itself is possible only in certain situations described in the legislation. Before carrying out the procedure, you must familiarize yourself in detail with existing regulations. Then there is less chance that mistakes will be made or other conflict situations will arise.

The best option is when the parties agree amicably to reimburse the amounts. For example, when an employee voluntarily returns everything to the cash register. But no one has the right to coercion in such situations. If the employee does not consent, the manager can forgive the debt or go to court to demand its repayment. But not everyone agrees to this, since the procedure is always associated with additional expenses.

The court may decide that the withholding is more than 50 or even 70% of the total salary. Such situations are described in legislative norms and will not be considered a deduction for excess amounts in vacation pay. It must be remembered that such actions relate to the rights of the employer, but not to his direct responsibilities.

Top

Write your question in the form below

Deduction for vacation provided in advance upon dismissal

Vacation is the expected time for employees. Freedom of movement and the prospect of rest have an intoxicating effect on the mind, and few people would think about whether the employee has worked the full calendar year for which he plans to take time off. However, upon dismissal, it is these details that can spoil the mood and affect the final amount of payments upon settlement.

Deduction for used vacation in advance upon dismissal

Any employee receives the right to full vacation six months after employment, Art. 122 Labor Code of the Russian Federation. The same article also lists those categories of workers who may not wait for the expiration of this period:

- pregnant women before maternity leave or after maternity leave;

- adoptive parents;

- minors.

Whether they will work until the end of the year is a big question, but the amount of vacation pay is paid three days before the vacation in full. What an employer should do in the event of sudden dismissal of a rested employee is described in Art. 137 Labor Code of the Russian Federation.

In it, the law allows excess vacation pay to be withheld from the last salary. Article 138 of the Labor Code limits the amount of such withholding to 20% of paid earnings.

Even the written consent of the resigning employee will not help increase the percentage.

Under no circumstances is an enterprise allowed to claim a refund of vacation pay received in advance if the employee is dismissed at the initiative of management and through no fault of his own, as well as due to circumstances beyond his control. Even if the leave is taken in advance, no one will make a decision in favor of the employer. Moreover, the employer does not have the right to force the employee to work until the end of the working year and postpone the date of dismissal.

Refund of vacation pay upon dismissal of an employee who took vacation in advance

If the employee agrees that the days received in advance need to be compensated, then the accounting department must provide him with a document listing in detail which amounts have been accrued and which will be withheld on the date of dismissal.

The next stage is to obtain written confirmation from the employee himself; it can be presented in any form.

The main thing is that it should be clear from the statement that the person does not object to the very fact of the withholding and its amount.

The amount of the estimated payments is so small that it is not enough to compensate for the advance payment for vacation pay. Option: the employee can independently deposit the missing amount into the cash register. Such an operation cannot be called a deduction from earnings, so the 20% limit will not apply.

An employee took a vacation in advance and quits - example of calculation

Before informing the employee of the fact of deduction for days of unearned vacation, the number of days and the amount of vacation pay received in advance are correctly determined.

To do this, the personnel service provides the accounting department with accurate data on the continuous work experience of the outgoing specialist and on the vacations actually used.

Method for determining the number of earnings and time off in advance for the unworked period:

If an employee is dismissed in the middle of the month, the number of vacation days for this period will be counted in full if more than 15 days were worked. Less than a month will not be included in the calculation.

Example:

The employee was employed on April 15, 2021. I took a full vacation of 28 days, the date of dismissal was January 25, 2021. Vacation pay amounted to 15,000 rubles. Nine full months, the remainder is 11 days of an incomplete month, days of rest for this period are not counted. The amount of withholding of vacation pay received in advance before dismissal is as follows:

- 12/28*9= 21 days;

- 28-21=7 days advance;

- 15000/28*7=3750 rub.

If this amount is less than 20% of all payments on the date of dismissal, then the deduction for the days provided in advance will be 3,750 rubles.

Sample order to withhold for vacation used in advance

When all the formalities with calculating the amount of deductions and agreement with the employee are resolved, it is better to formalize the deduction upon dismissal by order of the enterprise.

There is no standardized form of the document; it describes the situation, what became the basis for the withholding, and how compensation will occur.

As an attachment, enter the employee’s statement of agreement with the amount of deduction or obtain the employee’s signature on the order.

order

If the separation is amicable or the amount of retention is insignificant for the company, then management may consider it irrational to start unnecessary paperwork.

This way out of a dismissal situation is the optimal solution for both the employee and the employer.

If you have questions, consult a lawyer. You can ask your question in the form below, in the online consultant window at the bottom right of the screen, or call the numbers (24 hours a day, 7 days a week):