What is the difference between the minimum wage and the living wage in 2021

In the regions, the cost of living is determined every quarter.

The basis for this is the consumer basket and statistical data from federal executive authorities (on consumer prices for products, costs of payments and services). The earnings of a company employee who has worked a full month (including additional payments, bonuses, compensation) cannot be less than the minimum wage that was established in the region (Article 133.1 Part 1 of the Labor Code), and less than the minimum wage provided for by federal legislation (Part 4 of Art. 133.1 TC).

Minimum wage - size and difference from the minimum wage

If the minimum wage in the Russian Federation is described in some detail in the Labor Code of the Russian Federation, then the legislator briefly mentioned about its maximum that “... they are not limited to the maximum amount, except for the cases provided for in the Labor Code of the Russian Federation” (Article 132 of the Labor Code of the Russian Federation).

For example, according to Art. 1 of the Agreement on the minimum wage in the Republic of Tatarstan dated 08.08.2016 for employees working on its territory, the minimum wage is established in the amount of 8,252 rubles. Employees of state and municipal institutions of the Republic of Tatarstan are not included in this number; in 2017, the minimum wage for them was set at 7,500 rubles.

Difference between minimum wage and salary

The minimum wage (minimum wage) is a monetary amount firmly established by the state, below which no salary can be for an employee who has fully worked the monthly standard hours and fulfilled all labor standards or job duties (part three of Article 133 of the Labor Code of the Russian Federation). Today it is 4611 rubles. What this amount includes is up to the employer to decide, but he is obliged to pay it in all cases. And overtime is already a deviation from normal working conditions, so it must be paid at an increased rate (Article 149 of the Labor Code of the Russian Federation)

The minimum wage includes all types of payments. Art. 129 of the Labor Code of the Russian Federation: Wages (employee remuneration) - remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Salary in the amount of minimum wage

If an employee’s salary is set based on the minimum wage, then if the minimum wage increases, it must be increased. This is important because Article 133 of the Labor Code establishes the rule: if an employee has fully worked his working hours and fulfilled the monthly work quota, then his monthly salary cannot be lower than the minimum wage.

Please note that an employee’s salary may be less than the minimum wage. After all, salary includes, in addition to salary, compensation payments, various bonuses and incentive payments (Article 129 of the Labor Code of the Russian Federation). Therefore, taking into account all salary increases or incentives, the employee receives an amount greater than or equal to the minimum wage.

If the employee’s salary is still less than the established minimum wage, the employer must make an additional payment up to the minimum wage.

What cannot be included in the minimum wage?

Read more…

There are two options to bring your salary up to the minimum wage: increase the salary or introduce bonuses. In the first case, issue an order to amend the staffing table and enter into additional agreements to employee employment contracts. In the second case, an order establishing a premium and additional agreements is sufficient.

Please note: the employer is obliged to calculate and withhold personal income tax from the employee’s salary. The employee is actually paid the amount minus personal income tax. Consequently, an employee can receive a salary below the minimum wage.

How does the minimum wage differ from the minimum wage (Moscow)

If we are talking specifically about the minimum wage (for example, when calculating sick leave), then, naturally, it is the minimum wage that needs to be applied, and not the minimum wage (even if one is established in the region). Because The minimum wage is applicable to all of Russia, and the minimum wage is only applicable to a specific region.

An employee can be given any salary. The main thing is that for a full month worked, the employee receives (salary with all compensation and incentive payments) no less than the minimum wage (5205), if there is no regional agreement on the establishment of a minimum wage in your region, and no less than the minimum wage, if one is established in Your region. As far as I understand, you are from Moscow, therefore, you should have at least 12200 for accrual, because... in Moscow there is an agreement on the minimum wage. You will find the difference between the minimum wage and the minimum wage in Articles 133 and 133.1 of the Labor Code of the Russian Federation.

The concepts of minimum wage and minimum wage in Russian labor legislation

Before considering the direct differences between the minimum wage and the minimum wage, it is necessary to familiarize yourself with the legal provisions of Russian legislation governing this issue. Since the issues of ensuring payment of wages to employees relate to the sphere of labor relations, the main legal norms in this context are considered in the provisions of the Labor Code of the Russian Federation. In general, in order to determine the main similarities and differences between the concepts of minimum wage and minimum wage, it is enough to familiarize yourself with the following two articles of the Labor Code of the Russian Federation:

- Article 133 considers the principles of establishing the minimum wage and the very concept of the minimum wage as an indicator of remuneration used at the federal level. Now the minimum wage cannot be lower than the subsistence level, or the minimum wage established in previous years.

- Article 133.1 is devoted to issues related to the establishment of the minimum wage in the regions of the Russian Federation and legal standards governing the use of this indicator in individual cases.

In practice, in everyday communication and informal documentation, the concepts of minimum wage and minimum wage are most often used as identical. At the same time, there is another designation for the minimum wage, which is used quite often - regional minimum wage.

What is the difference between minimum wage and salary

These indicators are components of one economic category related to the concept of wages. Two important terms are most directly related to the income of the organization’s employees and non-working citizens.

This economic value has a main function - providing the worker with an income capable of satisfying his most minimal needs . The indicator has a particular impact on workers receiving low wages.

We recommend reading: What pregnant women can get for free

How does the minimum wage differ from the minimum wage?

Dear labor law experts! I ask for help, since I am not a specialist in labor ((it is necessary to understand the question of whether there was a difference between the concepts of minimum wage (minimum wage) and “Minimum wage” in 2001 (or rather, in May 2001)? Before the introduction In force of the current Labor Code, there was Federal Law No. 82-FZ of June 19, 2000 “On the minimum wage.” In the Labor Code, which came into force on February 1, 2002, there was Article 133 “Establishment of the minimum wage,” and in the text The article dealt with the minimum wage. (So, it was believed that these were the same thing?) After changes were made in 2007, the title of the article was changed to “establishment of the minimum wage,” and Article 133.1 was introduced on the “minimum wage,” that is, they became clearly distinguish between the two concepts.

Thank you! I forgot about the Labor Code!)) In the Constitution, Art. 7 is also guaranteed by the minimum wage. Why is it not known what the Minimum Wage is? In the first edition of Art. 133 of the Labor Code of the Russian Federation was called “Establishment of the minimum wage.” Now this term is contained in the title of the article. 133.1 “Establishment of the minimum wage in a constituent entity of the Russian Federation.” It says in detail what it is. Something established by a regional agreement, taking into account socio-economic conditions and the cost of living of the working population in the subject. Well, in Moscow it was introduced by the Agreement on the minimum wage in the Moscow region between the Government of the Moscow region, the Moscow regional association of trade union organizations and associations of employers of the Moscow region for 2010 dated December 24, 2009 N 48.

How does the minimum wage differ from the subsistence minimum (LM)?

The concept of a living wage is often confused with the minimum wage, but the living wage is indirectly related to remuneration for work.

The cost of living is the conditional cost of the consumer basket, which includes a minimum set of food products (42 items, excluding tobacco, alcohol and delicacies), non-food goods and services, as well as personal income tax.

Since the beginning of 2021, the subsistence minimum established for the third quarter of 2021 has been in effect in the Krasnoyarsk Territory. New standards will be determined on January 21, 2021, which will be:

- per capita - 12,290 rubles;

- for the working population - 13,028 rubles;

- for pensioners - 9,642 rubles;

- for children - 12,725 rubles.

The subsistence minimum is established in general for the region and three natural and climatic zones. You can download a detailed document with all the data for districts and districts here.

The minimum wage in the Krasnoyarsk Territory is calculated based on the approved average Russian minimum wage, taking into account regional coefficients and percentage increases in wages for work in areas with special climatic conditions.

The cost of living is the conditional cost of the consumer basket, which includes a minimum set of food products, non-food products and services, as well as personal income tax.

How does the minimum wage differ from the subsistence minimum?

The minimum wage is the lowest wage limit for an employee, including those without qualifications. It is determined by the legislation of the Russian Federation. The employer does not have the right to set wages less than this amount if the employee has worked a full month (full time).

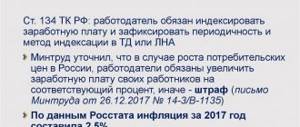

Note that formally the employer is obliged to set wages based only on the minimum wage. Previously, according to the law, he could not take into account the cost of living, which companies and individual entrepreneurs willingly took advantage of. Therefore, many people received income that did not correspond to the cost of the consumer basket, and were considered poor. However, now the minimum wage is strictly tied to the subsistence level. Therefore, in our opinion, such vicious practice should become a thing of the past.

Employer's liability

If, contrary to the law, an employee is charged and given a salary below the minimum payment, then the organization and its officials will be held accountable.

We invite you to read: How to apply for temporary registration through the MFC, documents and deadlines

Administrative

This kind of liability implies penalties from 10 to 50 thousand Russian rubles for officials, and for legal entities - from 30 to 50 thousand Russian rubles (Article 5.27 of the Code of Administrative Offenses of the Russian Federation). In addition, the activities of the enterprise may be temporarily suspended for up to 90 days.

Criminal

Criminal liability is provided for in Art. 145.1 Labor Code of the Russian Federation. This article applies to an employer when it has been established that there was a deliberate understatement of wages for 2 months or more, provided that the actions were carried out out of selfish or personal interest of the manager.

The responsible individual must be punished:

- arrest;

- fine from 100 to 500 thousand rubles;

- ban on the right to hold leadership positions for up to three years;

- work in places determined by the bodies of the penal system for a period of up to 3 years.

Attention: If the employer’s actions show signs of fraud, then he falls under Art. 159 of the Criminal Code of the Russian Federation.

Conclusion

Now every reader can confidently answer the question: can an employer pay an employee a salary less than the subsistence minimum? Of course, wages cannot be less than the minimum wage. Otherwise, management faces penalties, administrative or criminal liability.

If the monthly payment to an employee, taking into account salary, allowances, bonuses and compensation, exceeds the minimum amount established by the state, then there are no violations.

The main document for both parties to labor cooperation is the contract.

In it, the employer is obliged to specify what amount of payment he sets for the employee. Depending on whether a violation is discovered during documentation or whether the salary is actually reduced already at the stage of accrual and payment, punishment is applied to legal entities.

Responsibility may be:

- Administrative in the form of fines of various sizes.

- Criminal, in the form of detention and a ban on carrying out activities for a specified number of years. Criminal liability also does not cancel fines.

Punitive measures can be applied to the organization or to the responsible person whose guilt is established.

Administrative

Administrative penalties are applied on the basis of articles of the Code of Administrative Offences. As for the specific situation in which we are talking about a deliberate understatement of payments for work performed, the amount of fines is prescribed in Article 5.27 of the Code of Administrative Offenses.

Fines may be as follows:

- From one to five thousand rubles, if we are talking about individual entrepreneurs.

- From thirty to fifty thousand, when a legal entity is convicted of a violation.

Repeatedly detected violation entails the following consequences:

- Individual entrepreneurs receive from 10 to 20 thousand.

- Legal entity – from 50 to 70 thousand rubles.

The maximum permitted fine barrier is considered to be half a million rubles. It applies if the salary was not only underestimated, but was not paid at all. Partial non-payment may threaten the employer with an amount of 120 thousand.

Wanting to reduce salary costs, employers can hire workers under civil agreements, setting pay below the minimum wage. Such an action is also considered illegal and entails an administrative penalty of up to one hundred thousand rubles, and in case of a second violation, the amount doubles.

Criminal

Criminal liability, unlike administrative liability, is applied to responsible persons, and not to the organization.

In fact, an illegal reduction in payments below the established minimum threshold can be classified under Art. 145.1 of the Criminal Code of the Russian Federation - non-payment of wages or other mandatory benefits.

Several penalties may be applied simultaneously to responsible persons:

- Imprisonment for up to three years.

- The right to hold certain positions or engage in some type of activity.

- Fine.

In a situation where a company pays a citizen a salary in an amount less than the established minimum wage, this means that no nuances can be taken into account. Liability for violators is reflected in the provisions of administrative or criminal law. However, the first type of punishment is most often used, the second norm is used in rare cases.

Initially, you need to consider the provisions on administrative responsibility. When a situation arises that the company’s management pays wages in an amount less than the subsistence minimum, the sanction of Article 5.27 of the Code of Administrative Offenses is used. This article reflects several options for applicable measures:

- a fine in the amount of 10 to 20 thousand rubles is imposed on a citizen holding a certain position;

- for a company, liability increases to 30-50 thousand rubles;

- a person registered as an individual entrepreneur will have to pay a fine in the amount of one to five thousand rubles.

However, in practice, it often happens that the same violation is recorded in a company several times in a row. In this case, the legislator provides for tougher penalties that will be applied to violators. Including:

- the official will have to pay a fine in the amount of twenty to thirty thousand rubles or be subject to disqualification for a period of one to three years;

- the entrepreneur contributes from 10 to 20 thousand rubles to the treasury;

- Firms in this situation are subject to penalties ranging from 50 to one hundred thousand rubles.

Also in the situation under consideration, the provisions of criminal law may be applied. These measures are used on the condition that the organization’s management pays citizens wages in an amount not exceeding the subsistence level for more than a couple of months. To do this, it is necessary to prove that the director acts in this way based on selfish goals.

The sanction is reflected in Article 145.1 of the Criminal Code of the Russian Federation. This provision provides for the following penalties:

- a fine in the amount of one hundred to five hundred thousand rubles or the amount may be expressed in income calculated for the last three years;

- forced labor for three years, while the person loses the opportunity to engage in certain activities for a similar period;

- the person is deprived of freedom for three years and again deprived of the right to engage in certain activities (the period is set to the same).

When the violation in question resulted in serious consequences, for example, if the employee was driven to suicide or he begins to beg or engage in vagrancy, the sanction increases.

Including, the fine becomes equal to from two hundred thousand to half a million rubles. A citizen can also be imprisoned for a period of two to five years

Noticed a mistake? Select it and press Ctrl Enter to let us know.

What is included in the minimum wage: what it is, what it depends on and what the indicator affects

Hello. Here's what I think: Previously, it was that the minimum wage was the amount of the monthly wage for the work of an unskilled worker who had fully worked the standard working hours while performing simple work under normal working conditions, this was the starting point for me as a working person. That is, it was in other words, 1st category. Like the work of a janitor or a cleaner. According to this law, this article, and knowing the pay for work of the 1st category, that is, a payment equal to the minimum wage, I could somehow count and hope that for me a working person with a rank or qualification, the salary would be accordingly will increase every time the government raises the minimum wage level. After all, for any employer this is no longer a recommendation, it is already an obligation (Indexation, for example, of wages with an increase in consumer prices for the employer is a recommendation. Why do they write such ambiguous laws.) Why and who removed this article from the labor code. After all, it was precisely this formulation of the concept of minimum wage that was most accurate, it was the starting point. And so, according to the already amended articles, it turns out that the work of a qualified specialist or rank and the work of a janitor is equalized by legislation in the person of our elected deputies in the Duma. I would like to know the author of the idea about changing this particular article. So as not to vote for him in the future.

After increasing the minimum wage, all minimum wages must be increased to the established limit. The employer can increase both the salary and incentive parts by adjusting the amount of bonuses or compensation. The main thing is that together these parts reach the required size.

Can the salary be less than the minimum wage?

when establishing wages, he provided as a mandatory only condition: wages, including incentives and compensation payments, cannot be lower than the minimum wage established by federal law. In this case, it is allowed to establish a tariff rate and salary (official salary) below this amount.

Within the meaning of the above constitutional provisions, the institution of the minimum wage, by its constitutional and legal nature, is intended to establish the minimum amount of money that must be guaranteed to the employee as remuneration for the performance of labor duties, taking into account the subsistence level (Resolution of the Constitutional Court of the Russian Federation of November 27 2008 N 11-P).

We recommend reading: How to become a Norwegian citizen

Clarifications on the minimum wage (minimum wage) from January 1, 2021

The Ministry of Family, Labor and Social Protection of the Population of the Republic of Bashkortostan and the Ministry of Finance of the Republic of Bashkortostan, in agreement with the Federation of Trade Unions of the Republic of Bashkortostan, announce the following.

Federal Law No. 473-FZ of December 29, 2021 “On Amendments to the Federal Law “On the Living Wage in the Russian Federation” and Article 1 of the Federal Law “On the Minimum Wage””, from January 1, 2021, established the minimum wage in in the amount of 12,792 rubles per month.

Taking into account the regional coefficient, the amount of the minimum wage in the Republic of Bashkortostan is 14,710 rubles 80 kopecks .

Taking into account the legal positions of the Constitutional Court of the Russian Federation, the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) must not be lower than the minimum wage (including all elements of wages in accordance with Articles 129, 135 of the Labor Code of the Russian Federation established by the employment contract) without taking into account:

1. regional coefficients and percentage allowances in the regions of the Far North and equivalent areas (Resolution of the Constitutional Court of the Russian Federation dated December 7, 2021 No. 38-P);

2. payments for overtime work (resolution of the Constitutional Court of the Russian Federation dated April 11, 2021 No. 17-P);

3. payments for work at night (resolution of the Constitutional Court of the Russian Federation of April 11, 2021 No. 17-P);

4. payments for work on weekends and non-working holidays (Resolution of the Constitutional Court of the Russian Federation dated April 11, 2019 No. 17-P);

5. payments for combining professions (positions) (Resolution of the Constitutional Court of the Russian Federation of December 16, 2019 No. 40-P).

It is recommended to bring the wages of employees of organizations and institutions to the minimum wage by the decision of the employer by establishing an additional payment to the minimum wage.

In addition, it is recommended that the provisions on remuneration of employees of subordinate budgetary, government and (or) autonomous institutions and other types of economic activities include the following points:

- the monthly salary of a person who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage established by federal law, taking into account the legal positions of the Constitutional Court of the Russian Federation set out in the decisions of December 7, 2017 goal No. 38-P, dated 04/11/2019 No. 17-GG and dated 12/16/2019 No. 40-P;

- in the event that the salary of an employee who has fully worked the standard working hours and fulfilled the labor standards is below the minimum wage established by law (hereinafter referred to as the minimum wage), the employee is paid additionally up to the minimum wage within the established wage fund.

Minimal salary

It is impossible to calculate wages below the minimum wage, but there are situations when it is permissible to calculate wages below the specified indicator. If the employee has not worked a full month, it is permissible to set the salary based on the time actually worked. This category of workers may receive wages below the minimum.

The minimum wage is approved by federal law. From July 1, 2016, its amount was 7,500 rubles (Federal Law No. 164). However, in addition to the federal minimum wage, there is a regional one, which is approved by local authorities. Its size may differ significantly from that established by federal law.

What is the difference between minimum wage and minimum wage?

As can be understood from the regulatory documents that contain the basic principles of legislative regulation, the minimum wage and the minimum wage are not the same terms in meaning and have a number of differences.

First of all, the difference is that the minimum wage is an indicator that operates at the federal level and is mandatory for use within any business entity that operates on the territory of the Russian Federation.- The minimum wage, in turn, is a regional indicator and is under the exclusive control of the authorities of individual subjects of the federation. In particular, the size of this indicator cannot be influenced by the standards of federal bodies. However, it should be noted that the minimum wage at the regional level cannot be lower than the minimum wage.

- The principles for determining the minimum wage and minimum wage also differ. Now the minimum wage is determined based on the subsistence level adopted as a whole for the Russian Federation, and cannot be lower than it. The minimum wage is considered directly at the regional level and is calculated based on the cost of living in the region (which may be lower than the federal value). You can read more about the cost of living as a statistical and normative indicator in a separate article.

- Minimum wages and minimum wages also differ in the principles of obligation for business entities. Thus, the first indicator is necessarily applicable for any type of activity and any employer. At the same time, the minimum wage is mandatory only for employers operating in a certain region and employees from this region working for the specified employer. In addition, the legislation allows for the possibility of employers ignoring regional indicators in some cases.

The established general indicators of the minimum wage and minimum wage are applied directly to the total amount of wages, taking into account the normal working hours, which are identical to those for a five-day, forty-hour working week in general cases. That is, if an employee works part-time, he can receive a salary below the minimum wage and this will be legal.

Minimum wage, salary and wages

In addition to the minimum wage established by the regional agreement of the constituent entity of the Russian Federation, when calculating wages to employees, regional coefficients and allowances for work in special conditions that are not included in the minimum wage should be taken into account. The salary received by the employee should not be lower than the regional minimum wage with all increasing coefficients and allowances for the region.

But, in some cases, the accrued monthly salary may be lower than the minimum wage if the employee is hired part-time or on a part-time basis (Articles 284 and 93 of the Labor Code of the Russian Federation).

What is the difference between the minimum wage and the living wage?

If in any region the minimum wage is set higher than the federal value, then employers will have to make payments according to this indicator. In fact, regional authorities can thus express support for the citizens of their region.

The executor carries out indexation in proportion to the growth of the PM, if it is established in the specific region where the alimony recipient lives. In another case, the PM indicator established at the federal level is used for indexation. The amount of alimony must be a multiple of the monthly minimum, as stated in Federal Law No. 223 in Art. 117 (clause 1). It could even be a share of PM. The deadlines for calculating indexation are stipulated by the Insurance Code, Art. 109.

Minimum wage - size and difference from the minimum wage

The calculation of wages will directly depend, firstly, on what payment system is used by the employer. Somewhere there is a flexible system, implying bonuses, compensation and other additional payments, and somewhere only a salary. In many companies now, under capitalism, the interest rate prevails, which directly affects the amount of wages.

Regional coefficients and percentage bonuses for “northerners” are also not components of the minimum wage; they are added on top of it. Can the salary be less than the minimum wage? The legislation stipulates that the total salary, taking into account bonuses and compensations, cannot be less than the established minimum.

What is the minimum wage in the Krasnoyarsk Territory in 2021?

In general, in the Russian Federation, from January 1, 2021, the minimum wage increased to 12,130 rubles, which is 7.5% more than the 2021 level.

It is important to remember that in the Krasnoyarsk Territory the minimum wage is calculated taking into account regional coefficients and percentage increases in wages for work in areas with special climatic conditions, therefore the minimum salary level, taking into account allowances in the region from the beginning of 2020, is from 19,408 rubles - in the central and southern territories of the region, up to 31,538 rubles - in Norilsk and the Taimyr Dolgano-Nenets municipal district. Agree, it's not that bad?

Difference between minimum wage and salary

The employer in accordance with s. Minimum salary 2021 example of salary calculation according to the new minimum salary For example, a person went on vacation on December 28 and was supposed to go to work on January 11. Weekends and holidays from January 1 to January 8 are excluded from the calculation. In accordance with Art. 123 of the Labor Code of the Russian Federation, only 4 days that the employee worked in December are subject to payment. The amount of accrued vacation pay is calculated taking into account the old minimum wage. On January 1, the minimum wage increased to 9,489. The person went to work on the 9th and 10th. These days are subject to inclusion in vacation pay. They are calculated taking into account the new minimum wage. The minimum income level of a person working full time cannot be less than the minimum wage. In 2021, its level is 9,489 rubles. However, some employers are trying to save on labor.

Based on it, the accounting service calculates the additional payment up to the minimum wage. This is the generally accepted norm. Moreover, it is not necessary to issue a special document to justify additional charges to the level of the minimum wage. For these purposes, you can use a general order on the minimum wage at the enterprise.

What is the minimum wage?

Minimum wage is an abbreviation that stands for “minimum wage.” The concept is enshrined in the Labor Code - this is the minimum monthly wage of an employee established at the federal level, provided that he has fulfilled the required labor standard and worked the required working hours.

In other words, the salary cannot be less than the minimum wage, but there is one thing - the minimum wage is taken into account before deduction of income tax, so the employee receives an amount that is 13% less.

Minimum wage and minimum wage - what is the difference

The minimum wage is established locally in a particular subject of the Russian Federation. According to the law, the minimum wage cannot be lower than the minimum wage. The exception is cases when the employee has not fulfilled his job duties. In the Khabarovsk Territory, the minimum wage is established and regulated by an Agreement concluded between the Union “Khabarovsk Regional Association of Trade Union Organizations”, the regional association of employers “Union of Employers of the Khabarovsk Territory” and the Government of the Khabarovsk Territory.

The minimum wage is used to determine the minimum amount of benefits for temporary disability, pregnancy and childbirth, regulate wages, determine the amount of taxes, fines, and fees. At the beginning of 2021, the minimum wage amounted to 7,500 rubles; from July 1, 2021, it increased to 7,800 rubles.

Why is it important to equalize the monthly wage and minimum wage?

The minimum wage is established simultaneously throughout the Russian Federation and cannot be lower than the subsistence level of the working population.

The minimum wage must correspond to or be higher than the subsistence level so that a worker can provide himself with the necessary set of goods and services - this is one of the basic social standards by which the standard of living of citizens is assessed. A salary below the cost of living means that a person cannot afford to pay for the minimum monthly set of products and services. This is a guideline for the government when developing and implementing the social policy of the country and a specific region.