Due to self-isolation, many areas of the economy suffered, many workers were left without work, but the hardest hit financially were citizens who worked unofficially. The unemployment benefit offered by the state for such citizens is minimal and amounts to 1,500 rubles. The amount is not funny, this amount of benefits can only make you cry. But workers have children who want to eat, loans that also need to be paid.

Negative consequences of informal employment

“Black” wages and relationships without an employment contract have the following consequences for the employee:

- sick leave, maternity leave and vacation are not paid;

- processing is possible;

- If there is no work experience, the pension will be lower;

- may be fired without explanation or payment of wages;

- there is no financial compensation for injuries at work.

As you can see, there are a lot of negative consequences for the employee. By agreeing to informal employment, you become legally unprotected.

For absenteeism and alcohol - clause 6 of Art. 81 Labor Code of the Russian Federation

Violations of discipline can be serious. For one rude thing you can be fired immediately. This is also a disciplinary sanction. But there is no need to save the previous ones.

All gross violations are recorded in paragraph 6 of Art. 81 Labor Code of the Russian Federation. These include absenteeism and alcohol or drug intoxication at work.

A gross violation is documented in the same way as a simple violation. A memo or act, explanation, order of dismissal no later than a month from discovery.

Absenteeism

Absenteeism is when a person does not come to work or is absent for four hours in a row.

There is no good reason for absenteeism: illness, accident, death of a relative. Time off and vacations without the request of the manager are also considered absenteeism. This is explained in paragraph 39 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2.

Example of absenteeism:

A specialist at a bank on the eve of a working day at 11:30 pm asked the director for a day off via a WhatsApp message. Silence was considered consent. When she returned to work, she was given absenteeism and fired.

The specialist appealed the absenteeism, but the court did not return the job.

The time off was not approved, which means it’s absenteeism. There is an absence from work report and a memo from the director, an explanation, an order. We met the deadlines. Dismissal for absenteeism is fair and documented correctly - case 33-12011/2019.

Intoxication

Alcohol and drug intoxication must be proven.

The act with witnesses is suitable. The court believed the witnesses that the store clerk was drunk behind the counter - case No. 33-5383/10.

The stronger option is a breathalyzer or a doctor’s report. For example, a breathalyzer helped in a dispute about the dismissal of a trolleybus driver - case No. 2-3639/2018. There is a possibility - take a test or call a doctor.

In this case they will help you

1. Colleagues.

Talk to your colleagues - perhaps someone will agree to testify in court in your favor. But most likely, the company's employees are in the same precarious position, and any action against the boss threatens them with the same consequences.

2. Bank account statement

If the employer regularly transferred the same amount to your card, then a bank account statement will help in court to prove the fact of payment for the work performed.

3. Smartphone

The phone may contain correspondence with the manager, which will also serve as evidence in court.

Thus, in one of the disputes regarding the establishment of labor relations, “printouts on the social network “VKontakte” with notarized screenshots from an Internet page” were some of the evidence on the basis of which the court satisfied the employee’s demands (Appeal ruling of the Volgograd Regional Court dated May 24, 2018 to case No. 33-6786/2018).

The court may consider “screenshots from the social network Instagram”, “e-mail correspondence and audio recordings of voice messages in a group created by the employer in the WhatsApp messenger”, in which the parties discussed the schedule for receiving clients for the massage procedure, work schedule, order and the amount of wages paid for the massage sessions performed" (Appeal ruling of the Omsk Regional Court dated November 28, 2018 in case No. 33-7850/2018).

Currently, there is quite an extensive and diverse judicial practice in labor disputes, in which data from social networks or instant messengers is used as evidence.

Correspondence between an employee and an employer in disputes about establishing the fact of an employment relationship should indicate not only that such an employee was hired by this particular employer, but also that:

- the employee is allowed to perform a predetermined job function;

- the employee has become familiar with the internal labor regulations and obeyed them;

- The employee was given a specific amount of wages that he would receive for his work.

4. Company documents, waybills, goods and invoices, which you signed in your own hand, are also suitable.

If the evidence is collected in the form of screenshots, it is better to have it notarized. Otherwise, the judge may have doubts.

So, if the evidence has been collected, you can file a claim in court with the following requirements:

- establish the fact of labor relations;

- draw up an employment contract and make an entry in the work book;

- recover wages and compensation for delays;

- pay compensation for moral damage;

- recover the average salary for the period of inactivity - from the moment of dismissal until the court decision comes into force;

- recover legal costs when drawing up a claim by a lawyer.

You can prove the amount of your salary with a bank account statement, if the employer transferred the salary to the card, with an accountant’s testimony, or with a screenshot of a vacancy from the company.

If you cannot provide such evidence, provide statistics from websites about the salary of a specialist for the same position.

Remember, the fact of establishing (coordination) of wages in the amount declared by the plaintiff is subject to proof by the plaintiff in accordance with Art. 56 of the Code of Civil Procedure of the Russian Federation, however, if such evidence confirming the fact of setting the salary is not provided to the court, then the arrears of wages can be recovered based on the amount of the minimum wage.

Negative aspects and penalties for lack of contracts

An employee who has worked for a company for more than three days must be employed on the basis of Article 16 of the Labor Code of the Russian Federation. It also describes labor relations. The fact is that when an employee is allowed to work with the consent or at the request of the employer or deputy, they are already considered a working relationship, even if the document is not properly executed.

Based on Article 67, Part 2 of the Labor Code, a worker who has worked for more than three days should not work without a contract; the director is obliged to draw up a document with the formalities observed. Failure to comply with the law provides for liability for failure to conclude an employment contract with the employee and consequences for the employer in the form of penalties:

- Individuals face a penalty in accordance with Article 5.27 of the Code of Administrative Offences, from three to five thousand rubles.

- Officials will be fined from 10 to 20 thousand rubles for the lack of an employment contract.

- Legal entities will have to fork out from 50 to one hundred thousand rubles or suspend activities for up to three months.

If a worker is refused to draw up labor documentation or conclude documents in an unspecified form, a fine is provided:

- For an individual from 5 to 10 thousand rubles.

- Officials from 10 to 20 thousand.

An official who was previously prosecuted for the lack of an employment contract and who again finds himself guilty in this case, in addition to penalties, faces removal from office and prohibition from working in his specialty for a long time.

Responsibility for non-compliance with laws related to the conclusion of employment contracts, according to Article 2.1 of the Administrative Code, rests not only with the legal entity, but also with the employees. Based on Article 5.27 of the Code of Administrative Offenses, the number of offenders may be unlimited.

The above penalties are imposed only for formal documentation. For related violations related to non-payment of taxes and insurance contributions, stricter sanctions and liability of the employer are fraught.

For example, guided by Article 199 of the Criminal Code of the Russian Federation, a fine of one hundred to three hundred thousand rubles, or restriction of freedom for a period of two years is provided. If a larger amount of contributions is revealed to be transferred to the tax authorities, a fine of up to five hundred thousand rubles or 6 years of imprisonment may be imposed.

According to Federal Law No. 212, evasion of insurance contributions to the Pension Fund of the Russian Federation is fraught with repayment of the identified debt in the form of penalties, including fines in favor of the state:

- in case of unintentional concealment of income - 20%;

- when wet - 40%.

It's not just about fines

Properly formalized labor relations are needed not only by the employee, but also by the employer. Firstly, official labor relations give the employer not only responsibilities, but also rights: for example, the right to demand compliance with the work schedule, the opportunity to enter into an agreement on full financial responsibility when the employee is entrusted with material assets. In addition, a formal employment relationship gives employees confidence in their continuity, and when people are committed to long-term work, they are more motivated to work hard, which will ultimately positively impact the performance of your business.

What if you have already concluded a civil law contract instead of an employment contract, or if your assistant has started work without any formalities? The best option: draw up an employment contract without waiting for a conflict situation.

In the next article we will tell you step by step how to properly formalize labor relations and what personnel documentation is needed, in addition to the contract itself.

How to resign voluntarily

The procedure for terminating an employment contract involves a sequence of actions by all participants in the labor relationship.

Table: stages of voluntary dismissal

| Stages of dismissal | Characteristic |

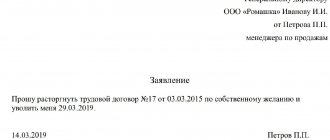

| An employee writing a resignation letter | The procedure for submitting an application for resignation at your own request involves drawing it up in two copies. The most common case is when an employee gives one copy personally to the employer or an authorized person, and keeps the second copy with a receipt stamp. On the second copy of the application, the employer must write something like the following: “One copy of the application has been received on (date). Signature and transcript of the recipient’s signature.” If an employee has a suspicion that the application will not be considered, he can send it by mail in a valuable letter with an inventory. It is not necessary to indicate the reason for dismissal in the application. However, if circumstances require dismissal without work, then the reason must be indicated. HR employees may ask you to confirm it with documents. |

| Formation of an order to dismiss an employee | Typically, a unified form of such an order is used (Form No. T-8), approved by Decree of the State Statistics Committee of January 5, 2004 No. 1. The details of the employee’s application must be reflected here. Familiarization of the employee with the dismissal order. If the order cannot be brought to the attention of the dismissed person (he is absent or refuses to familiarize himself with the order), then a corresponding entry is made on the document. |

| Dismissal | Upon expiration of the notice period for dismissal, the employee has the right to stop working. On the last day of work, the manager is obliged to give the employee a work book and other documents related to the work, upon the employee’s written application, and make a final payment to him. If on the day of termination of the employment contract it is impossible to issue a work book to an employee due to his absence or refusal to receive it, the employer is obliged to send the employee a notice of the need to appear for the work book or agree to send it by mail. |

The resignation letter reflects the following information:

- Full name and position of the person to whom the application is addressed.

- Reason for dismissal (at the initiative of the employee).

- Reference to the legislative right to voluntary care (Article 80 of the Labor Code of the Russian Federation).

- The exact date of the last day of return to work.

- Position held and initials of the applicant.

- Date of writing and personal signature.

An employee is not required to indicate the reason for such a decision in his resignation letter.

If the warning period has expired, but the employment contract has not been terminated, the employee (if desired) can continue to work in this organization (firm, enterprise, etc.).

An order to terminate employment relations with an employee is issued in form No. T-8

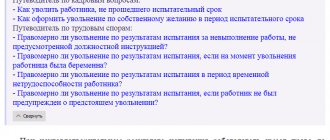

Premature termination of an employment contract by an employee without agreement with management may be classified as absenteeism. If an employee is undergoing a probationary period, then it is enough to inform management about his dismissal three days in advance. However, sometimes you can do without working out. This is true if the employee and employer agree to terminate the employment contract immediately.

According to the Labor Code of the Russian Federation, there are the following categories of workers who can leave the workplace without working:

- enrolled in educational institutions for full-time education;

- retired;

- those leaving with their spouse to his new place of service;

- caring for a disabled person.

Dismissal without service is also possible if the management of the organization (IP) violates labor legislation.

Upon dismissal, the employee is accrued:

- earnings for all days worked;

- compensation for unused vacation;

- severance pay (if specified in the employment contract).

Payments are made on the day the employee is dismissed. If a citizen did not work that day, then the money is given to him no later than the next day after the dismissed employee submits a request for payment.

If on the day of termination of the contract the manager has not made a full payment, he must compensate the leaving employee for his error in the amount of no less than 1/150 of the current Central Bank key rate of the amounts unpaid on time for each day of delay, starting from the next day after the established payment deadline and up to and including the day of actual calculation and issuance of the work book.

m.ppt.ru

Termination of employment during vacation or illness

Dismissal of an employee while he is on sick leave or on vacation is carried out only on the initiative of the employee himself. If management does not object, the employed person goes on vacation followed by dismissal. In this case, the last day of vacation will be the day of dismissal. However, the work book and all funds provided in this case must be issued to the citizen on the last day of work. If the date of dismissal indicated in the application falls during the employee’s illness, then the termination of the employment contract with all due payments is made on this day, and the work book can be collected after recovery.

Payments for sick leave will be calculated within 10 days after it is provided to the employer, and made on the nearest day of payroll in this organization (IP).

If instead of an employment contract there is a civil law one

The Labor Code directly prohibits replacing employment contracts with civil contracts (Article 59 of the Labor Code of the Russian Federation). If you are going to draw up a contract for a contract or for the provision of paid services in a case where it is necessary to conclude an employment contract, this will also be a violation for which a fine is imposed. And just as in the case of a complete lack of registration, most likely, all other personnel procedures required for labor relations will not be carried out, which is also considered separate violations.

Can an employer fire without cause?

Labor legislation contains many different guarantees of the labor rights of workers. Such guarantees include, among other things, a ban on dismissing employees without any reason. All grounds on which employees can be dismissed are directly provided for by the Labor Code of the Russian Federation.

In general, they can be divided into dismissals:

- At the request of the employee;

- At the request of the employer.

Any dismissal of an employee must be justified and legal.

The employer is obliged to comply with the dismissal procedure provided for by the current legislation of the country. Dismissal without reason, as well as dismissal in violation of the procedure established by law, can be appealed by the employee in court.

Unregistered workers

Working without an employment contract also entails administrative liability for the employer.

Failure to conclude an employment contract with an employee in order to evade the employer’s obligations under labor law is a gross violation that carries the worst consequences for the employee.

The latter is completely defenseless against such a fraudulent employer: he is not guaranteed either wages, compliance with labor safety requirements, or deductions of insurance premiums, etc.

Often, failure to register an employment relationship is accompanied by other serious violations of legislation (tax, etc.) by the employer.