Testamentary disposition of the deposit

If the owner of the account passes away, then his heir needs to collect all the papers and submit them to the bank - the money will be issued without any questions asked. If the order was made after 2002, then you will first need to contact a notary and officially enter into inheritance.

One of the frequently asked questions from Sberbank depositors

A testamentary disposition partly duplicates the function of a standard will. It is convenient to use if a bank client has several accounts, and he wants to bequeath each one to different people. It can be executed not only in connection with the death of the deposit owner, but also under other circumstances specified in the document.

To make it more clear what a testamentary disposition for a deposit in Sberbank is, it makes sense to indicate its features:

- the document is kept by the deposit holder and in the bank;

- drafting by a notary is preferable, as there is less chance that the document will be lost;

- the owner of the deposit can be any person, and not necessarily a relative;

- it is impossible to challenge the order except through the court;

- funds taken into account within the framework of this document are not included in the general inheritance pool;

- there is no order of inheritance holders;

- the funds can be transferred to the heir directly on the date of death (i.e., there is no need to wait 6 months for inheritance, but only if the order was executed before 2002), or within an agreed period.

- The depositor's dependents, as well as the spouse, have the right to half of his funds, despite the order, and therefore can claim their rights when opening an inheritance.

- When inheriting funds from a minor, the money is transferred to an account opened in his name, but he cannot dispose of it without the permission of his parents and guardianship authorities.

A testamentary document can be drawn up for absolutely any type of account - deposit, fixed-term, savings, etc. If a person has several accounts, then he will need to create an order for each of them separately.

Important: with the help of this document you can only manage funds on deposit in a specific bank. Other property, including the contents of a bank safe in Sberbank, cannot be transferred on the basis of this paper - here you will need a regular will.

How does the inheritance of money deposited in bank accounts occur?

According to the Civil Code, a deposit in a bank is an inheritance and is transferred to the owner’s legal successors by law or in accordance with a will. The owner of the account has the right to bequeath it to one or more persons, citizens, organizations, or the state. The rules for inheriting deposits in any bank are determined by the following rules:

In law. The first applicants will be close relatives of the owner - parents, spouses, children. All relatives and dependents can present their rights;

According to a will, certified by a notary. Please note that a drawn up will does not always guarantee receipt of an inheritance. The rights of heirs can be challenged by other applicants: dependents, minor children, disabled people. As a rule, they are awarded half the amount of the portion distributed by law;

By order issued by the bank. The peculiarity of the document is that it applies to a specific account (deposit). An order is drawn up to transfer the deposit to the heirs in Sberbank free of charge, without a notary. It is possible to challenge such a will, but this will require compelling reasons. Typically, courts satisfy the claims of persons who have been dependent on the testator for a year or more.

Contents of the order to Sberbank

This paper must indicate the following items:

- day and place of drawing up the order;

- passport details of the testator;

- an indication under what circumstances the transfer of ownership occurs (usually upon the death of the owner);

- details of the deposit that is bequeathed;

- data of the heir (or a number of heirs);

- the number of valid copies of the order and their location.

At the end, the signature of the testator, the bank employee who accepted the order, and the seal of the banking department are affixed.

Sample testamentary disposition for deposit

When you contact a bank or a notary, you will be given forms and they may differ from those presented on the website, the main thing is to carefully check that they contain all the necessary items (see above).

The order form can be downloaded here:

Testamentary disposition - form.doc

Filling example:

This order is drawn up in at least 2 copies, one of which remains in the bank, and the other is taken by the testator.

The document is not subject to correction. If the account owner changes his mind and decides to change it, then a new order is drawn up and the previous order is canceled. You can make any changes - composition of heirs, distribution of shares.

If there are several planned heirs, then it is better to indicate in what ratio the contribution is divided between them. If there is no indication of the share, then the funds will be distributed between them proportionally.

The validity period of a testamentary disposition for a deposit in Sberbank is not limited. There is no point in updating it. The order will be valid as long as the deposit is active. If the applicant closes the deposit and withdraws money, then, accordingly, it expires.

An important point: if the testator has several accounts in different banks, and not just in Sberbank, then he needs to visit all the institutions and draw up a separate document in each. You cannot leave a one-time order for all bank assets.

Types of orders

There are two conditional types of orders:

- ordinary - the money is transferred to the heir mentioned in the document in the event of the death of the account owner;

- special – funds are transferred to the specified person only when he performs special actions.

The list of actions is formally unlimited; these could be:

- reaching adulthood;

- marriage;

- admission to a higher educational institution;

- apartment purchase;

- acquisition of a disease, etc.

The specific list of situations is determined by the submitter of the order to Sberbank. The money will be transferred to the person indicated in the papers, even if the owner himself turns out to be alive.

Registration process

According to the Civil Code of the Russian Federation (Chapter 62, Article 1128), a testamentary disposition for a deposit can be drawn up at a notary or at a bank branch.

Through a notary office

Like a regular will, the form of a testamentary disposition for a deposit in Sberbank can be certified by a notary. The procedure is as follows:

- fill out the form according to the provided sample;

- together with the order, identification card and passbook, go to the notary;

- pay for his certification services;

- receive a certified order;

- take the document to the Sberbank office.

The cost of the procedure will be 700-1000 rubles per order.

But keep in mind that when drawing up a document independently, the testator may make a mistake, in which case Sberbank may refuse to accept it. Therefore, it is better to contact the department directly and perform the operation there.

Through the bank office

You will need a standard set of documents:

- passport;

- data of the heir (or several heirs);

- account (deposit) details.

The owner of the deposit just needs to come to Sberbank and declare that he wants to leave a testamentary disposition. The specialist will provide a ready-made form and help you compose the text on the spot.

Then the order is signed and endorsed by a bank specialist and remains in the branch. From a legal point of view, a Sberbank employee visa is equivalent to a notarization.

The entire operation is completely free.

Notarized will

How to draw up a will for a deposit with a notary? You need to identify a notary office at your place of registration. In addition to identification, it is necessary to provide a legal basis for the use of the property subject to the will. A bank deposit agreement or savings book is provided. It is mandatory to indicate the bank account number and the number of the Sber branch where it is serviced.

How to draw up a will for a deposit without the help of a notary?

How to bequeath a deposit if there are unavoidable circumstances? Art. 1127 of the Civil Code of the Russian Federation provides for the possibility of drawing up such a document without contacting a notary office. Moreover, such wills are equivalent to notarial ones if they are certified:

- Chief doctors or their deputies, heads of medical institutions where citizens are being treated or maintained.

- Captains of ships when sailing under the flag of the Russian Federation.

- Heads of expeditions when citizens are part of Arctic and Antarctic reconnaissance groups.

- Commanders of military units at whose disposal military personnel and their families serve and live.

- Heads of colonies when persons are in places of imprisonment or restriction of freedom.

The will order is signed in the personal presence of the above persons, as well as in the presence of a witness. At the first opportunity, such a document must be sent to a notary or other authorized person, taking into account the place of permanent residence of the person who made the order.

Receiving a bank deposit under a notarized will

The procedure is no different from those described above. The only thing is that bank employees will need more time to check such a document. The account numbers and bank branches in which they are located must be correctly indicated. The heir must present a passport.

How to receive money by testamentary order

If an accident happened and the testator died, then the procedure for how to receive money to the heir with a testamentary disposition for the deposit will depend on when the document was generated in Sberbank. In 2002, the legislation in the field of inheritance changed, so the process of obtaining funds is somewhat more complicated.

Package of documents for receipt

In March 2002, the civil code changed. According to Art. 1128, funds left by testamentary disposition and placed in a bank are inherited in the general manner after 6 months from the date of opening of the inheritance. In this case, the bank is provided with:

- Certificate of right to inheritance - issued by a notary. In order for the contribution to be included in the estate, the notary must be presented with the original testamentary disposition or a copy certified by the bank.

- Passport;

- Death certificate;

- Details of the account to which the funds should be transferred.

Based on the notary’s decree, the heir who actually paid for the organization of the wires can receive from the testator’s accounts an amount of up to 100 thousand rubles. for reimbursement of expenses (“a decent funeral”) immediately after the opening of the inheritance.

For deposits before 2002

If the testamentary disposition was executed before 2002, the contribution is not included in the inheritance estate, so there is no need to contact a notary. At the branch where the deposit was opened, present:

- Death certificate;

- Passport;

- Original testamentary disposition;

- Details of the account to which the funds should be transferred.

When prolonging the deposit

Receipt ahead of schedule

Upon presentation of a notary, you can receive an amount from the account to organize the burial procedure without a long wait

Receiving an inheritance in court

Making a testamentary disposition for a bank deposit significantly simplifies the receipt of money by relatives. If it is drawn up correctly and taking into account intra-family interests, then conflicts can often be avoided or at least reduced to a minimum.

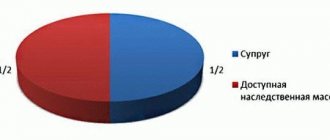

However, litigation between relatives is not uncommon, because every heir wants to receive the contribution of a deceased relative without a will, and everyone believes that he was deprived. For example, if the testator was twice married and has two adult children from different marriages, then after death, half of his contribution belongs to the widow with whom he was married at the time of death. However, it happens that a child from his first marriage files a claim to recognize his rights to this inheritance.

According to the court's decision, in this case, the widow will still receive half the amount from the bank account, and the second half will be equally divided between the children from both marriages. Based on a court decision, relatives can contact the bank to receive these funds. You can challenge a court decision in higher-level courts.

What to do if a testamentary disposition is lost

If the document is lost by the testator/heir:

- A notary can solve the problem. According to paragraph 13 of Government Decree No. 351 of 2002, the notary sends a request to the bank with a request to confirm the existence of a specific testamentary disposition or to provide a copy of it.

Please note that the bank’s refusal to provide a copy with a link to electronic document management is illegal! According to paragraph 12 of the said Resolution, a testamentary disposition is created in two copies, one of which is issued to the testator, and the second is registered in a special book, a testamentary folder is filed and stored in a fireproof cabinet.

If the bank refuses to provide a copy, obtain an official refusal to issue an inheritance certificate from the notary. Apply to the court with a claim for recognition of the inheritance of the deposit, and within the framework of the case, request evidence - a copy of the testamentary disposition or a bank certificate about the testamentary disposition. If there are mandatory heirs other than you, indicate them as interested parties. If the court decision is positive, the bank will be obliged to pay your deposit.

If the document is lost both at your place and at the bank, go to court to establish a legally significant fact (drawing up a testamentary disposition). In this situation, any evidence will be very helpful, especially written evidence (for example, a receipt for payment for a service from Sberbank).

Unfortunately, practice shows that plaintiffs rarely win cases against Sberbank when a testamentary disposition is lost. If the court refuses, you will inherit the contribution according to the general rule - in order of priority.