How long after approval is maternity capital transferred?

Changes in 2021 In 2021, no official statements are yet planned regarding the planned one-time payments from maternity capital funds.

The last payments from the MSK were made in 2021. Everyone who submitted an application to the Pension Fund on time has already received an amount of 20,000 rubles in their bank account. Similar measures were taken in 2015, 2009, 2007.

A bill from LDPR deputies was discussed on the Internet for a long time, which proposed introducing the possibility of annual mandatory payments from maternity capital funds. However, such a draft normative act did not even make it to the first reading according to formal criteria.

Important!

Important! Currently, there is no legislative opportunity to receive money from maternity capital funds solely at your own request. This requires legal grounds in the form of a separate legislative act. Changes for 2018 will be announced later.

The first amount is paid after the application is approved - after about 1.5-2 months. The second - after six months from the date of filing the application, subject to confirmation of the fact of construction and reconstruction work.

Attention! The law does not provide for other cases of transferring money specifically to the applicant’s bank account and not to a third-party organization.

Terms of use of MSC Maternity capital can be used immediately only in one case: repayment of a loan (credit) taken out for the purchase of housing with the participation of MSC funds.

It could be:

- making a down payment;

- interest repayment;

- payment of the principal debt.

Important! Such services are provided only by banks and some licensed credit organizations. In other situations, an application for disposal of MSC funds is submitted no earlier than the second or subsequent child turns 2.5 years old.

- Contact PF.

- Provide correct payment details.

Reducing the time limit for paying maternity capital is aimed solely at the speed of the purchase and sale transaction. In order to avoid any problems when completing a transaction, you need to accurately check whether it is possible in a particular case to use MSK as a partial payment.

There are options that cannot serve as a good example, for example, if you want to purchase an unfinished house or apartment in a new building that is not yet ready or the object does not meet the PF requirements, then most likely you will be refused payment. Many banks have their own requirements for MSC or do not accept it at all as loan repayment. These subtleties must be clarified at the stage of preliminary preparation for the registration of a transaction for the purchase of housing.

This requires the presence of unfavorable economic factors:

- crisis, stagnation in the economy;

- high inflationary growth;

- sharp jumps in prices for food products, housing and communal services tariffs, and the like.

Information about planned and already established opportunities to withdraw maternity capital funds is posted in official Russian periodicals and on the Pension Fund website. You can always read the latest news on your own in the web version of the Rossiyskaya Gazeta or in the section of the PF website “For MSC Recipients”.

How can you receive money into your account? You can also transfer money to your PF account when you submit an application for disposal of MSC funds in the usual manner.

Before this, the total period for receiving compensation was two calendar months:

- of which, one month is the period for raising a positive issue on the decision, but here it is worth noting the clarification that this period cannot exceed one calendar month, and less is possible;

- the second month was allotted for transferring funds to the seller or representative of paid services.

Now, starting from March 3, 2017, based on Resolution No. 253, we can say that the total period for receiving maternity capital has been reduced by half a month. What does this mean? In general, only the period for payment of compensation has been shortened.

This means that the period for making a decision on the payment of maternity capital intended for the purchase of housing is the same as before - no more than one calendar month, and the time for transferring funds is reduced to two weeks.

How to transfer money from funds allocated for children: the procedure for transferring maternity capital to the seller But in order to take advantage of the payment received, a number of certain conditions must be met. In this article we will tell you what the maternity capital transfer procedure is and for what purposes it can be used.

When will the money be transferred from maternity capital? The norms of Russian legislation in the field of social security of the population contain a comprehensive answer to the question posed - the seventh article of the Federal Law “On additional measures to support families with children” contains a list of what funds allocated by the state can be used for.

Thus, the receipt of maternity capital funds will now not exceed a month and ten days from the date of filing the application for disposal of the certificate.

This innovation is associated with changes in federal legislation, according to which state registration of the emergence and transfer of rights to real estate is certified not by a certificate of state registration of property rights, but by an extract from the Unified State Register of Real Estate.

The transfer of maternity capital to the seller of the apartment is carried out with the participation of the Pension Fund of the Russian Federation. The procedure for completing such a transaction is very specific and is often unfamiliar to the average citizen. Features are largely related to the need for targeted use of maternity capital.

Selling an apartment to people with maternity capital is not uncommon today. After the birth of their second child, many receive support from the state in the form of a family certificate. True, you won’t be able to just go and use it at will. This is due to two features:

- Maternity capital can be used strictly for the purposes specified by Russian legislation;

- all transfers of maternity capital funds are made with the consent of the Pension Fund, and it is he who transfers funds to the recipient, regardless of the purpose of spending.

The procedure for transferring maternity capital is quite labor-intensive; it is much easier to transfer your own money to the apartment seller. But after spending some time going to the Pension Fund and collecting documents, a person will be able to save his own money and acquire residential real estate.

Remember that no one will give you money from maternity capital. The Pension Fund of the Russian Federation does not have such powers, and such transfers are illegal and contrary to legal regulations.

We suggest you read: How to correctly write an explanatory note at work

A complete list of purposes and features of the use of maternity capital are prescribed in Federal Law No. 256-FZ of December 29, 2006. It is important to pay attention to one more nuance: there are certain deadlines after which you can use the allocated public funds. When purchasing an apartment, the following restrictions apply:

- when buying an apartment with a mortgage - immediately after the birth of the child;

- without borrowing funds – when the child reaches 3 years of age.

If the child is not yet 3 years old, then it is more logical to contact the bank for borrowed funds. Then the maternity capital money will be transferred not to the seller of the apartment, but to a financial institution.

But when purchasing real estate without borrowed funds, the Pension Fund will transfer the money directly to the seller, however, recipients of the certificate will have to wait until the child for whom the capital was received turns 3 years old.

Initially, the money in physical form is received not by the owner of the certificate, but by the Pension Fund. A special account is opened for the recipient of the subsidy where the allocated funds are stored. Pension Fund employees are responsible for their targeted spending and checking documents related to the use of maternity capital. They also recalculate funds during indexation.

In the second case, the certificate holder does not spend the entire subsidy amount, but only part of it. He can subsequently spend the remaining money on any of the purposes specified by law.

When purchasing an apartment from its owner, the funds are transferred to a bank account. The recipient of the money can be not only an individual, but also a legal entity. The basis for the payment will be the real estate purchase and sale agreement.

The Pension Fund will not issue cash to the seller. Therefore, in the agreement and application for the use of maternity capital, it is necessary to specify the details of the recipient’s current account.

When conducting an apartment purchase transaction, the owner of maternity capital may have a question: what documents are needed to use the subsidy? The list of required papers in this case will include:

- maternity capital itself;

- the applicant’s passport (note: the applicant must be the owner of the certificate, that is, if the maternity capital is registered in the name of the mother, then she, and not the child’s father, should apply to the Pension Fund);

- real estate purchase and sale agreement;

- certificate of state registration of the right to an apartment.

If the interests of the applicant in the Pension Fund are represented by another person, then the entire package of documents can be accepted from him only by power of attorney. You can also contact the MFC or send all papers by mail. There is another option - to use the EPGU, but you will have to register there first if the applicant does not yet have a personal account.

After submitting all documents, Pension Fund employees check them very carefully to ensure the legality of the use of maternity capital and eliminate the possibility of fraud.

Advice!

By the way, if a family uses its own funds as an advance payment under the contract, and after transferring the maternity capital money there is a surplus, then the seller must return the difference not to the buyer of the apartment, but to the Pension Fund. It will be credited back to the individual account of the family certificate owner. It can be used in the future.

- deadline for transfer of maternity capital

- maternal capital

- maternal capital. How long after approval was the money transferred?

Key points: what you need to know

The timing of document verification may vary. After reading the forums, a young family learns that in a number of situations government agencies can transfer money in 3 weeks, and in other cases they have to wait up to 2.5 months. For this reason, a person should be prepared in advance for the fact that they will have to wait longer. The deadline for collecting documents for transferring money is individual for each family.

The deadline for transferring maternity capital funds in 2021 has been shortened

It is very important to approach the choice of a loan product with the utmost care. The largest banks can offer a lending option in which a down payment is made out with a separate loan. In the future, this loan is closed with maternity capital (it is important to correctly calculate the total amount of principal and interest, which should be equal to the amount of capital). This method allows you to profitably increase the down payment, thereby reducing the principal debt, and, accordingly, the interest on the main loan, without spending your own funds.

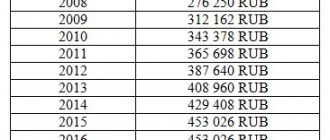

This year, maternity capital was indexed by 3.7% , respectively, the amount of compensation for the first child was 483,882 rubles, for the second – 639,432 rubles. Calculated additional payment = 155,550 rubles .

In 2021, the amount of maternity capital for the first child is 483,882 rubles. For the second child, an additional payment of 155,550 rubles is required. That is, if the mother has not yet received a certificate at the birth of her first child, then at the birth of her second child she will immediately receive 639,432 rubles (483,882 + 155,550). The same applies to the birth of the 3rd and subsequent children.

Key changes in legislation

Determining the amount of maternity capital is only part of the new reform; in addition, the general terms have been revised. The main goal of the Russian Government was their compression. Changes in timing were planned in two stages - for 2021 and for 2021. Let's look at them in the table:

When building a house on your own, first only half of the amount is transferred within one month (the total amount is indicated in the certificate). The second part can be received six months after providing documentary evidence of the work performed.

A certificate confirming your right to appropriate financial assistance can be issued in advance. Immediately after the birth of the second or subsequent child, an application is submitted to the Pension Fund with the mother’s passport and birth certificate (birth certificate).

You might be interested ==> What they give for a third child in 2021 in Udmurtia

How and where does the pension fund transfer money to MSK?

The actual time for transferring maternity capital when purchasing an apartment or other housing depends not only on the norms of the current legislation (Federal Law No. 256 of December 20, 2006, Art. 8). The timing of the transfer of maternal capital is affected by the correct preparation and submission of documents to the Pension Fund.

- The certificate will be issued 5 working days after the application. Now - in 15 days.

- An application for disposal of maternal capital will be considered within 10 working days. For now, a month is allotted for this.

- The decision regarding the disposal of maternity capital will be announced within a day. As long as the notification is sent within 5 days.

Features of the use of maternity capital

Maternity capital is a type of assistance provided to families for certain purposes upon the birth of a second child.

The nuances of using funds are regulated by the Pension Fund, which checks the recipient of the money and regulates the process of transferring it.

What is the procedure for transferring maternity capital to the seller? Who plays the role of the addressee, and in what time frame is the transfer carried out? We will consider these and other points in relation to the situation for 2021.

The Pension Fund is responsible for the distribution of maternity capital and the decision to issue it. It is this structure that accepts applications from the population, analyzes them and transfers funds for certain purposes (subject to legal requirements).

At the same time, issuing the amount in cash (in whole or in part) is excluded, because this payment option is illegal. The legislation of the Russian Federation clearly states that the purpose of maternity capital is to support families with a large number of children.

This means that the funds are spent taking into account certain rules, which will be discussed below.

State aid is allowed to be used for the following purposes:

- Improving living conditions (expanding living space).

- Using maternity capital money to form a mother's pension.

- Buying an apartment or cottage for family living.

- Transferring money for a child's education.

- Purchasing necessary products for a minor with a disability.

The last option for using funds (purchasing goods for the needs of a disabled child) has appeared recently. But practice has shown its importance for many families raising such children.

If we consider the most common way of using maternity capital, the purchase of an apartment stands out here. After the birth of their second child, many families decide to improve their living conditions or get their own living space. But here it is important to consider two points:

- The use of maternity capital is possible taking into account the purposes specified by law (this was mentioned above).

- The decision to transfer funds is made by the Pension Fund of the Russian Federation. It is this structure that is responsible for sending money.

The process of transferring funds is a labor-intensive procedure. It’s easier to transfer personal funds to the seller and thereby complete the transaction. On the other hand, after spending a little time, the recipient of maternal capital saves money and uses government assistance to purchase living space.

The laws of the Russian Federation indicate that the recipient of maternity capital is the Pension Fund of the Russian Federation.

In this case, the funds are transferred to the body that is located as close as possible to the place of residence of the family (the one that has received the right to state support).

Subsequently, the Pension Fund transfers funds to a third party, taking into account the goals pursued by the recipient of financial assistance. To activate the process, a person comes to the Pension Fund and writes a statement indicating the future use of the money.

Our lawyers know the answer to your question. If you want to find out how to solve your particular problem, then ask our duty lawyer online.

It's fast, convenient and free!

- Moscow and region

- St. Petersburg and region

- Federal ext. 386

If the recipient of maternity capital plans to use the funds for training, they are transferred to an organization (commercial, government) that provides the relevant services. In this case, a person has the right to send 100% of the maternity capital or part of the funds.

If we are talking about buying real estate (improving living conditions), the capital money is sent to the seller’s account. This role can be played by an individual (ordinary citizen) or a company (developer). It all depends on who the buyer of the property and the recipient of the capital entered into an agreement with.

When purchasing real estate from a private person (when transferring the full amount of capital in the contract), you must indicate the details of the banking institution. This requirement applies to construction companies that enter into share participation agreements with clients.

We invite you to read: What is included in title documents

If maternity capital funds are paid to repay a mortgage debt, public funds are sent to the account of the owner of the certificate in a banking institution. In this case, employees of the credit institution write off the required amount towards the loan.

When using a subsidy to purchase equipment or medications for a disabled child, the money is sent to the account of the company (the one that acts as the seller).

To transfer maternity capital to the seller, the recipient must collect and transfer a certain package of papers. It includes:

- Certificate for receiving financial assistance.

- A paper confirming the existence of an agreement between the recipient of the capital and the seller of the property. Such a document may be an agreement with an educational institution, a purchase and sale transaction, or other papers.

As noted, a person submits an application and the specified package of papers to the Pension Fund, after which the organization begins to verify the documentation.

This is done in order to eliminate fraud and eliminate the waste of money for extraneous purposes. In addition, the possibility of using maternity capital by a person who submitted an application to the Pension Fund is checked.

Attention!

The verification period for a citizen may take up to 30 days from the date of submission of the application and package of papers.

If the family has decided to make an advance payment to the seller’s account, and in the future, after transferring maternity capital from the Pension Fund account, an overpayment appears, the excess funds must be returned. In this case, the money is sent to an account in the Pension Fund of the Russian Federation. In this case, the recipient of the maternal capital has the right to use the remaining amount in the future (if necessary).

In practice, the timing of transferring money to the seller’s account depends on many aspects. The purposes of using maternal capital play an important role. Most often, the period for transferring funds to the seller’s account is carried out within about 2-3 months. The reason for this delay is easy to explain:

- Maternity capital money is located in the main body of the Pension Fund. This means that the funds are first sent to the regional body of the Pension Fund. This also takes some time. At the same time, employees of the regional Pension Fund of the Russian Federation periodically formulate an application and send it to the main office, taking into account current needs (requests from owners of maternal capital).

- A certain time period is also allocated for checking the application of the submitted documentation. Pension Fund employees must study the information provided and make sure it is correct.

- Time is also wasted on transferring money from the regional Pension Fund to the account of the seller (company or individual).

Time costs also apply to the applicant himself. We are talking about drawing up an agreement, registering it and collecting papers for the Pension Fund. That is why you should not count on instant transfer of maternity capital.

As noted, maternity capital money comes to the regional office from the head office. In this case, the transfer occurs once a quarter, and the application itself is sent within 3 days from the start of the quarterly period.

It is worth noting one more important point.

If we are talking about payment for real estate under construction, the process takes no more than 15 days.

Law enforcement practice and legislation of the Russian Federation changes quite quickly and the information in the articles may not have time to be updated. The latest and most relevant legal information, taking into account the individual nuances of your problem, can be obtained by calling toll-free 24/7 or by filling out the form below.

Is it possible to speed up the payment?

The total payment period has been reduced to 10 working days; it cannot be shortened further; it is important not to extend it, since there are cases when a positive decision is not made on your decision due to some reasons.

Reducing the time limit for paying maternity capital is aimed solely at the speed of the purchase and sale transaction.

In order to avoid any problems when completing a transaction, you need to accurately check whether it is possible in a particular case to use MSK as a partial payment. There are options that cannot serve as a good example, for example, if you want to purchase an unfinished house or apartment in a new building that is not yet ready or the object does not meet the PF requirements, then most likely you will be refused payment.

Many banks have their own requirements for MSC or do not accept it at all as loan repayment.

These subtleties must be clarified at the stage of preliminary preparation for the registration of a transaction for the purchase of housing.

The total period for receiving maternity capital as payment is one and a half months, this is the maximum period allotted for receiving payment if the decision is positive. In order not to waste time, make sure that your transaction is legal and meets all the requirements of the Pension Fund.

After a positive decision is made, you need to wait some more time for the money to arrive in the specified account. The total period for transferring maternity capital will be 1.5 months, this includes:

- 1 month to make a decision;

- 14 calendar days to transfer money.

It must be remembered that if the house is built independently or by a contractor, then payment is made in two payments. The time that can separate these payments is 6 months. In this case, the amount of payments is divided as follows:

- the first payment should be no more than half of the declared amount. If the declared amount exceeds the amount of maternity capital, then the payment will be no more than 50% of it;

- The second payment pays the remaining amount of the declared amount.

The question of how long it takes to transfer maternity capital is very relevant. In general, for any of the permitted purposes, except for paying the down payment, a period of one and a half months may suit the recipient of the funds. Therefore, it is enough to prepare the necessary documents, submit them to the Pension Fund and wait for the decision.

Why is the question posed this way?

Such questions make sense - after all, money received with the help of maternity capital cannot be used at any time and not for any need.

After all, the program was initially conceived to solve major family problems - first of all, to improve living conditions.

It’s worth taking a closer look at the time frame, because they are of considerable importance, which means you should plan in advance how and when to turn to these means.

Below are brief answers to extremely common questions regarding the timing of use of these funds.

ATTENTION: Focusing on 2021, we can assume that in 2017 a decision will be made on a one-time payment of twenty-five thousand rubles from maternity capital funds.

This money can be spent on any needs without reporting to the Pension Fund. Presumably, a decision on this matter will be made in the fall.

Speaking about the timing of payments, one cannot help but dwell on the time of registration of the certificate for receiving maternity capital.

After completing the application, it will be considered within thirty days (in accordance with Part 1, Article 8 of the Federal Law-256), after which a notification of the decision should be sent to your mailing address.

If the decision was made in your favor, you will be able to receive a paper or electronic version of the certificate.

If we consider the terms of payments themselves, then funds are transferred to the account within two months following the acceptance of the application.

It is worth remembering that there is a restriction according to which it is impossible to receive funds earlier than three years after the birth of the second child. There are exceptions to this rule, but more on them below.

What is the validity period of maternity capital? The program itself to help families with two or more children has been in effect for more than ten years, since the beginning of 2007. Rumors circulated several times about its termination, but they remained only rumors.

At the moment, it is known that the program will definitely operate until the end of 2021.

However, recent reports in the news allow us to hope that there will be an extension until 2021. However, you should not count too much on such an outcome, since, for now, these are just rumors.

The dates given above do not mean that from January 1, 2019, the program will completely close and payments will stop. The specified time frame means that those whose second child was born between 2007 and the end of 2021 can count on payment of this benefit.

Attention! The certificate itself, based on

Part 1 Art. 5 FZ-256

, you can get it immediately after the second child is born.

By themselves, the time frame for accessing the funds of this benefit is not limited in any way - you can apply for them at any time, with the exception of the three-year wait, which was mentioned earlier.

At the moment, according to Federal Law 256, the period for transferring funds to the seller, regardless of what exactly you buy, is a little less than two months. This is due to the fact that the application submitted to the pension fund will be considered within thirty days.

Another thirty working days are allotted to complete the transfer of funds. However, a decision is now being considered to shorten this period. Dmitry Medvedev proposed to set the maximum period for transferring funds to ten working days.

This means that if the offer is accepted, the time for transferring funds to the seller will be already one and a half months - thirty days for processing the application and two weeks (10 days, plus weekends) for the transfer itself.

As mentioned above, use a mat. capital is possible only after a period of three years, after the birth of the child. However, an exception has been made for mortgage repayments.

Reference! You can make payments on your mortgage loan immediately after receiving the certificate.

The same applies to mortgage interest payments. Of course, it is worth remembering the two-month period required for consideration of your application.

Among other things, maternity capital can also be used to pay for a child’s education. As with other expenses, the use of funds for these purposes is permitted only after three years have passed from the birth of the child. However, there is another temporary restriction - payment of tuition is possible only if the child’s age has not exceeded twenty-four years.

The application, along with the relevant documents, should be submitted in advance, due to the same two-month waiting period. Subsequent payments will be made in accordance with the deadlines specified in the application. Documents vary from case to case. For example, to pay for education, you must provide a copy of the service agreement certified by the educational organization.

It would not be superfluous to mention that it is permissible to use maternity capital to pay for the education of any of the children or their stay in kindergarten. At the same time, no one forbids spending these funds on all your children at once.

IMPORTANT: Tuition fees may be suspended.

For example, if a child went on academic leave, then you can draw up a corresponding request for a temporary suspension of payment.

Required documents: what is included in the application

Today, the total time for consideration of an application for the disposal of maternal capital is 40 days . Previously, this period was 60 days (2 calendar months), but after the signing of the corresponding Resolution No. 253 dated March 3, 2017, the waiting time was reduced. Of all 40 days:

The deadline for transferring mat capital to the seller’s account is 2020

An application for disposal of maternal capital must be accompanied by supporting materials. Otherwise, Pension Fund employees will make a negative decision, citing the lack of grounds for using the money.

May 09, 2021 semeiadvo 414

Share this post

- Related Posts

- List of free medications for diabetes in 2021

- Certificates for young families in 2021 Orenburg

- Well, what kind of money will a single mother receive after the birth of twins?

- Why don’t they pay an airborne pensioner with a certificate who left the zone of residence with the right to resettle? Advice from a lawyer forum

What happens if you don’t meet the established limits?

According to federal law, number 256, if the terms or conditions for using this benefit were violated and fraud was proven, then a fine will be imposed on the violator and a criminal case will be opened, in accordance with Article 159.2 of the Criminal Code of the Russian Federation - fraud in receiving payments.

This situation is possible when trying to receive and use this benefit early, for example, when trying to fictitiously take out a mortgage. In such cases, a fine of up to five hundred thousand rubles and restriction of freedom from one to ten years are provided.

In some cases, the fault may lie with the Pension Fund itself. Then, it makes sense to try to prove in court that the violator, in this case, is the PF itself. However, it will be quite difficult to prove the guilt of this organization, since the mechanisms of the PF’s work are opaque.

Maternity capital fraud.

When is the certificate issued?

Along with a positive response, the letter will indicate the address at which the applicant receives a personalized certificate for the provision of funds. If parents filled out an application through the website, the certificate will be sent electronically to the user’s personal account along with a paper containing the necessary information. This method, since the time spent on document production is minimal.

Read also: Who has the right to maternity capital