The husband borrowed a large sum of money. I couldn't deliver it on time. Now the lender is demanding in court to return the debt with interest (he filed a lawsuit). Moreover, the defendant is not only my husband, but also me. The plaintiff claims that the husband spent his money on the needs of the family, which means that we, as spouses, are both debtors. Is such a requirement legal? After all, I’m not a co-borrower, I didn’t sign the loan agreement?

Answer:

There are two positions on this issue. Let's consider the options

The debtor's spouse is not liable for his obligations. This is a general rule

In accordance with Article 307 of the Civil Code of the Russian Federation, the debtor is liable to the creditor by virtue of the obligation.

According to paragraph 3 of Article 308 of the Civil Code of the Russian Federation, an obligation does not create obligations for persons not participating in it as parties.

If we proceed from the position on the legality of collecting a debt from both spouses in court, while only one of them is a party to the obligation, then it should be recognized that the court, by its decision, actually changes the terms of the agreement in terms of the number of parties - in a loan agreement, for example, it adds another person on the borrower’s side, which can hardly be considered based on the law.

In addition, the Family Code of the Russian Federation does not provide for the possibility of collecting debt from both spouses for the obligations of one of them. Let us give some examples from judicial practice.

Example 1: the court indicated that “each of the spouses is responsible for its obligations independently. In accordance with the Family Code of the Russian Federation, the joint obligation of the spouses in this case can arise only when foreclosure is applied to the property (Article 45 of the RF IC), that is, during the execution of a court decision on the present dispute” (see for more details the definition of the Leningrad Regional Court dated 01.04. 2015 N 33-1805/2015).

Example 2: In another case, the court, having considered the case on the claim to recognize the debt on the receipt as a joint debt of the spouses, to collect it jointly and severally from the spouses, also indicated that “the loan agreement was concluded only by one of the spouses, Ya.D.N. on its own behalf, and as a general rule, an obligation does not create obligations for persons not participating in it as parties (clause 3 of Article 308 of the Civil Code of the Russian Federation), a loan agreement cannot be considered a general obligation of the spouses" (see the appeal ruling of the Voronezh Regional Court for more details dated April 22, 2014 N 33-2087).

Article 45 of the RF IC - a basis for collecting debt from both spouses?

You can often hear the following question: “But what about Article 45 of the Family Code of the Russian Federation, which talks about the possibility of foreclosure on the common property of spouses if what one of the spouses received was spent on the needs of the family?”

The answer is simple: even the title of Article 45 of the RF IC speaks for itself (“foreclosure on the property of spouses”). The provisions of this article are devoted to the conditions for foreclosure on the property of spouses and do not regulate the procedure for debt collection.

Just in case, let us recall the definitions of the concepts “debt collection” and “property foreclosure”.

Debt collection – forced collection of debt from the debtor at the request of the creditor (judicial or extrajudicial)

Foreclosure of property is the sale of the property of a debtor who has not repaid the debt in order to transfer the proceeds from the sale to the creditor who filed the claim.

Thus, foreclosure on the debtor’s property is possible at the stage of executing a court decision on collection, but not at the stage of considering a dispute about collection from the debtor under a contractual obligation.

In light of the above definitions of concepts, the statement that Article 45 of the RF IC is the basis for collecting debt from both spouses for the obligations of one of them seems quite strange.

The algorithm for collecting debt from the debtor and his spouse should look like this:

1) the claim is brought against the debtor. The court makes a decision to collect the amount of debt from the debtor;

2) in the event of failure to comply with a court decision by the debtor (the debtor does not have enough property), the creditor, on the basis of clause 1 of Article 45 of the RF IC, has the right to demand the allocation of the share of the debtor's spouse in the common property of the spouses.

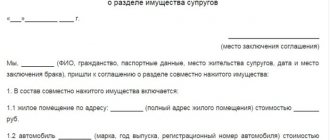

For example, the debtor did not have any property, while his spouse has a vehicle, a plot of land, real estate, and so on. This situation in practice is not a rare occurrence (the debtor has nothing, but his spouse has everything!). Most often, spouses enter into an agreement on the division of common marital property. In this case, you should go to court with a claim for the allocation of the spouse’s share in the common property, and if there is an agreement on the division of property, for the recognition of such an agreement as invalid (see, for example, the statement of claim for the recognition of the agreement on the division of property of the spouses as invalid, the determination and allocation of the share debtor's spouse).

3) in the case where it is proven that everything received under obligations by one of the spouses was used for the needs of the family, then the court, at the claim of the creditor, forecloses on the common property of the spouses.

From judicial practice of debt collection from both spouses

Example 1 . Canceling court decisions on recovery from both spouses and foreclosure on their property, the Supreme Court of the Russian Federation in 2012 indicated:

The demand for the allocation of the debtor's share, which belongs to him by right of common ownership, for the allocation of the debtor's share in the common property of the spouses, for foreclosure on the common property of the spouses, the creditor has the right to submit in court for the purpose of executing a court decision to collect the amount of debt from the debtor, taking into account the provisions of the current legislation on enforcement proceedings (see for more details the ruling of the Supreme Court of the Russian Federation dated April 24, 2012 N 5-B11-135).

Example 2 . In another case, refusing to satisfy the claims of OJSC for the collection of debt under the loan agreement jointly and severally with S.A.V., as the borrower’s spouse, the court stated:

the plaintiff demands that the obligations to repay the debt under the loan agreement be assigned to the spouse who is not a party to the obligations, which is actually aimed at changing the terms of the loan agreement.

Arguments of OJSC that S.A.V. knew about the terms of the loan agreement that the funds were invested in the construction of the house during the marriage of the spouses, and therefore are their joint property, therefore, she must bear joint liability in accordance with Art. 45 of the RF IC are insolvent, since this article establishes the basic rules for foreclosure by creditors on the property of spouses (see for more details the appeal ruling of the Orenburg Regional Court dated 08/19/2014 in case No. 33-4749/2014).

Objections to a claim for debt collection from spouses

The creditor applied to the court with a demand to collect the debt from both spouses, while only one of the spouses is the debtor? We recommend: “Objections to a claim for debt collection from the debtor and his spouse”

How to divide spouses' debts through court?

Terminology plays a very important role here. In procedural documents you can often see wording such as “division of spouses’ debts”, “division of debt obligations”, “division of common debts”, “division of mortgage / loan debt”, etc.

But did you know that from a legal point of view it is impossible to divide the debts of spouses? In the sense that if you come to court with such a demand, it will refuse you, even if in fact the truth is on your side.

The fact is that the court does not have the right to interfere with other people’s contractual obligations and declare to the creditor that now not only Petya, but also Masha owes him. Or, conversely, that now only Masha owes him, and Petya is free.

Therefore, in everyday life it is, of course, possible to use the expression “division of debts,” but in the framework of a judicial process it is appropriate to demand:

1) transfer to the borrower-spouse of the ownership of the corresponding part of the property in excess of the legally required share in the jointly acquired property or

2) compensation for the corresponding share of payments actually made under the loan agreement (other debt of the spouse).

The first option is convenient if the division of debts occurs simultaneously with the division of property. A spouse who claims that the debt is shared may request that the defendant's share be reduced by the amount of compensation owed to him.

Let's look at it with an example. The husband filed a lawsuit against his wife demanding to divide the apartment and the furniture in it. The wife, in turn, presented a counterclaim to recognize the debt under the loan agreement, where she is the borrower, as general. Let’s leave the apartment aside, and for the rest we’ll indicate the amounts. Let’s assume that the furniture in the apartment is worth 500,000 rubles, and the loan obligations repaid by the wife after the termination of the actual marriage relationship are worth 150,000 rubles. The shares of the spouses are equal. Thus, the wife can ask the court to award her furniture worth 325,000 rubles (250,000 + 75,000). For more information on the role of de facto marital relations, see below.

An example for the second option: the actual marital relationship between the spouses ceased in March, the decision to divorce came into force in August, and the loan must be paid before December. The dispute over the division of debts came to court in October. Therefore, the plaintiff in this case can claim monetary compensation equivalent to half the amount paid for the period from March to October. In the future, he will be able to go to court again - this time with a demand for payment for November and December.

And here we would like to draw your attention to one very important point - the statute of limitations. In cases of division of debt obligations, it is three years. The only catch is from what moment to count it. From the moment of making the corresponding payment or full repayment? If we are guided by a literal interpretation of paragraphs. 1 item 2 art. 325 of the Civil Code of the Russian Federation: a debtor who has fulfilled a joint and several obligation has the right of recourse against the remaining debtors in equal shares minus the share falling on himself, it turns out that only after full repayment of the debt. And there is a logical explanation for this. At least until the volume of payments exceeded half of the total debt of the spouses. Let's look at it with an example.

Let’s assume that the spouses have a mortgage debt of 5,000,000 rubles. The husband paid a million and goes to court to demand compensation for half of this amount from his wife. But why suddenly? If we evaluate his obligation to the bank as a whole, taking into account the equality of shares of the spouses, then it amounts to 2,500,000 rubles. It turns out that this million fully fits into the amount that the husband had to pay the bank one way or another. Thus, at the current stage, it is unjustified to demand the division of debt between spouses.

It can be considered purely by periods when the debt is tied to a specific month. For example, for utility costs. Receipts are issued for the amount of resources consumed in a certain month. If 3 years have passed since that moment, then the statute of limitations has expired. But the loan repayment obligation is more important than the total amount. Although a payment schedule is also established there and, as a rule, at monthly intervals.

There is no unity in law enforcement practice on the issue of dividing spouses' debts in case of partial repayment. As part of the consultation, we tell clients how likely it is that such a requirement will be satisfied in their particular case. The cost of assessing the prospects for cases of division of spouses’ debts at Maya Sablina’s Law Laboratory is 5,000 rubles.

Article 39 of the Family Code - Determination of shares when dividing the common property of spouses

1 . When dividing the common property of the spouses and determining the shares in this property, the shares of the spouses are recognized as equal, unless otherwise provided by the agreement between the spouses. 2 . The court has the right to deviate from the beginning of equality of shares of spouses in their common property based on the interests of minor children and (or) based on the noteworthy interests of one of the spouses, in particular, in cases where the other spouse did not receive income for unjustified reasons or spent the common property of the spouses to the detriment of the interests of the family. 3 . When dividing the common property of the spouses, the common debts of the spouses are distributed between the spouses in proportion to the shares awarded to them.

Lawyer in the area of Art. Akademicheskaya m. If you are interested in legal support regarding the division of common debts of spouses, you can contact us, as this is one of our areas of activity. By contacting us you will receive detailed advice! Tel: Lawyer Yurchenko Sergei Yurievich, 8 (965) 221-14-89

Source www.garant.ru

Debt section: summing up

1) Until proven otherwise, the debtor is considered to be the spouse in whose name the obligation is registered.

2) The debt of the spouses can be recognized as common if it arose on the initiative of both spouses or if everything received by one spouse under obligations was spent by him on the needs of the family.

3) If the debt of the former spouses is recognized as common, one can demand either a reduction in the share of the second spouse in the common property, or the payment of monetary compensation equivalent to the corresponding share of the repaid part of the debt.

4) If the debt is large and it will take several years to pay it off, we recommend that you go to court every three years to avoid problems with the statute of limitations. It is better to try and be denied than to receive compensation only for the last three years instead of the nine during which payments were made.

5) Consult with a lawyer on at least part of the requirements that you are going to include in the claim for the division of debts, and the evidence with which you want to confirm your position.

The article was prepared taking into account the edition of regulatory documents valid as of December 6, 2017. Author of the article: Maya Sablina, Director of the Law Laboratory

The cost of services to support cases of division of debts of spouses in the Maya Sablina Law Laboratory:

| № | Request | Cost, rub.) |

| 2. | Consultation on the division of spouses' debts | 5 000 |

| 2. | Drawing up a claim for division of debt obligations | 10 000 – 15 000 |

| 3. | Representation in the court of 1st instance in cases of division of debts of spouses | 30 000 – 50 000 |

| 4. | Representation in cases of division of spouses' debts at the appeal stage | 30 000 – 40 000 |

General rules for division of property

Loans have become a part of our everyday life: we borrow to improve our living conditions, large and small purchases, for recreation, education - for any needs when we do not have enough funds to pay.

Therefore, the average family is “secured” with debt obligations no less than with equipment for a comfortable life.

Large loans in most cases are taken out either by both spouses - they sign up as co-borrowers, or by one of the spouses with the other as a guarantor.

In this way, the bank insures the risk of non-payment of debt, including from a decrease in the client’s solvency and other factors arising during a divorce (for example, from fraud, when one of the spouses under a marriage contract after a divorce is left with a loan obligation and no property to satisfy it, and the other - everything rest).

Loans for a small amount are issued to one person. But in any case, when the issue of divorce and division of property is on the agenda, most often the spouse, whose name is not included in the “borrower” column, insists on the position: “Whoever took it pays.”

This position will not be supported by the court. Judicial practice in such cases has developed quite unambiguously.

Loans received and spent on family needs are considered common debt obligations, regardless of which spouse signed the loan agreement.

The criteria for community of debt can be formulated as follows:

- obtaining a loan by mutual consent;

- the second spouse’s awareness of the loan application;

- directing the money received to meet general family needs.

Therefore, a loan that one of the spouses took out for personal needs without the knowledge of the other spouse or about which he provided the spouse with incorrect information (underestimated the amount of borrowing or softened the terms of the agreement) will only be paid by the direct borrower.

In controversial situations, this will have to be proven in court, even if the spouses have not actually lived together for a long time, but maintain a legally registered marriage. In practice, it will be very difficult to prove your ignorance that your spouse took out a car on credit.

Is a loan taken by one of the spouses during a marriage divided?

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The legal status of family property assets and the procedure for their division during divorce are known to everyone. Each of the partners has equal rights to the common property, except in cases where a different division procedure is not established by agreement of the parties or by a court decision.

However, few people know how debt obligations are divided between spouses if they are not repaid at the time of termination of the marriage relationship.

To find out how the total debt is divided, we will determine possible loan options that will affect the subsequent division of loan obligations.

| Reasons for originating a loan | Will the debt be subject to division? |

| The loan is issued to one of the spouses, and the funds received are spent on family needs | Yes |

| Both partners enter into an agreement with the bank | Yes, if the funds were spent on family needs |

| The loan was issued to one spouse, and the funds received were spent by him on his own needs and contrary to the interests of the family | No, the debt will be considered a personal obligation of the spouse |

| Credit obligations arose for one of the newlyweds before marriage. | No, the debt is a personal obligation unless at the time of marriage there is some money left over from the loan that was spent on the general needs of the family. |

Important! The Family Code of the Russian Federation provides that the total debt of spouses when dividing property assets is divided in proportion to the shares awarded to each of the partners. However, in an out-of-court distribution of common assets, the parties have the right to determine any conditions for the division of debts.

If there are children

If there is one child or several children in the family, this may affect the size of the shares when distributing property assets.

The court takes into account the interests of the child and departs from the principle of equality of parties - the spouse with whom the child remains to live may be awarded a larger share in the total property.

As a general rule, a similar principle applies to the distribution of loan obligations. However, courts can also use the provisions of Art. 39 RF IC.

According to this rule, the interests of a minor child are taken into account when distributing debt obligations, and the court can reduce the amount of debt in the share awarded to the spouse who is dependent on the child.

If the loan was taken out before marriage

If at the time of registration of the marriage relationship one of the newlyweds had a loan, a demand for distribution of debts cannot be made after the registration of the marriage or during a divorce.

An exception may be cases when the borrowed funds were formally taken before marriage, but were intended for the needs of the future family and were actually spent on them.

Such circumstances must be proven by the plaintiff who filed a demand for division of debt obligations, as stated above with reference to the explanations of the Supreme Court.