Home/Alimony payments/From the state

Every child of the Russian Federation is under special protection of the state. In this regard, the mother and father of the offspring, regardless of whether they are married or not, have the responsibility to support and financially provide for the children. One of the forms of support is the registration of child support obligations, within the framework of which one of the parents monthly transfers funds to the minor citizen. Often the payer evades the conscientious fulfillment of established duties, then the money for alimony is collected forcibly. However, practice shows that even in such a situation it is difficult to obtain funds. In order to organize support for minor children, the Russian Federation is initiating a policy of processing alimony payments from the state. All the subtleties and procedure for establishing compensation will be discussed in this article.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

What is alimony from the state?

Attention

Issues related to alimony obligations are regulated in detail by the norms of the Family Code of the Russian Federation. The possibility of establishing state alimony is currently not provided for by the RF IC. The initiative under consideration exists only in the form of bill No. 680786-7, which is planned to be adopted. Deputies propose to form a separate state fund from which funds will be paid for the maintenance of children. The corresponding expenses will be offset by income from the sale of the debtor's property at public auction.

State alimony is payments established by authorities and aimed at supporting minor citizens. It is assumed that the source is a specially formed monetary fund. The state pays off the child support debt.

Who can receive government payments?

A parent (most often a mother) or another person who is supporting a minor child may have the right to receive state alimony. At the same time, potential purchasers must have a court decision on the basis of which alimony obligations were assigned. Considering that the deputies did not specify the circle of recipients of maintenance, we can conclude that state alimony will apply to all citizens in need of support:

- Adult disabled children - Art. 85 RF IC.

- Former or actual spouses who, due to objective circumstances, cannot support themselves - Art. 90 RF IC.

- Incapacitated needy parents - Art. 87 RF IC.

- Brothers and sisters who need help - Art. 93 RF IC.

- Grandsons and granddaughters - Art. 94 RF IC.

- Grandparents who are unable to bear expenses on their own - Art. 95 RF IC.

- Educators who previously supported a pupil and live with him - Art. 96 RF IC.

- Stepfathers and stepdaughters in need of support - Art. 97 RF IC.

Attention:

In modern conditions, the bill is at the discussion stage, so it may be adopted in a slightly different version. This means that the circle of recipients of alimony from the state may change or be specified.

Grounds for receiving child benefits

As with all payments that are due from the state, it is necessary to confirm that the child has the right to receive benefits. The following conditions are distinguished:

| Type of benefit | Conditions |

| up to 1.5 years | to all mothers or any family members |

| from 1.5 to 3 years | |

| up to 16 years old (up to 18 if studying full-time) | upon confirmation that the family is low-income |

In what cases does the state pay child support?

The basis for the appointment of state alimony is the presence of a debt for alimony (money for the maintenance of a disabled citizen has not been transferred for 6 months or more) on the part of the payer. The most common reasons for the formation of debt are the following situations:

- Military service upon conscription, when the serviceman is not paid funds from which child support can be transferred.

- Recognition of a citizen as incompetent, as a result of which the income of the alimony provider is significantly reduced. In most cases, state benefits are barely enough to support one’s own existence, so there is no opportunity to spend money on providing child support payments.

- A sentence passed with a sentence of imprisonment. In the current situation, the convicted person also does not receive any benefits from which alimony is withheld.

- Compulsory treatment - the court declares a person insane, which means it is necessary to undergo a rehabilitation course. During the period of stay in the hospital, a person does not receive any income.

- The location of the payer is unknown.

IMPORTANT

If one of the reasons listed above arises, the representative of the recipient in need of financial support must contact the bailiffs. Employees determine whether the payer has bank accounts that could be used to pay off the alimony debt. The source of income is also determined. If the payer has regular salary payments, payments are deducted from earnings, which means you won’t have to count on state alimony.

Features of alimony collection

In all cases, the relationship between the alimony provider and the alimony recipient regarding the collection of alimony can be resolved by concluding an alimony agreement with a notary. This is a convenient and flexible way to independently regulate alimony obligations, in particular, establish the frequency of payments, the duration of the contract and the amount of payments.

Below we will describe the features of judicial collection of alimony payments for various categories of alimony recipients.

For minor children

Minor children are the only category of dependents for whom 2 principles are applied for calculating the amount of monthly child support. The application of these principles depends on the presence or absence of “white” earnings.

| Type of earnings | Calculation principle |

| "White" | It's called a percentage of income. An additional criterion is the number of young children the child support payer has. As the law indicates, the alimony pays:

|

| Absent; in foreign currency; irregular; actually; periodically changing | It's called a fixed amount. Alimony is calculated either from the amount of the child's subsistence level established in the region of residence of the minor, or on the basis of documented expenses for it. In addition, when assigning alimony, the judge is obliged to take into account the presence of other dependents supported by the alimony payer, as well as his level of income. If, during a divorce, children remain with each parent, then alimony can only be awarded in a fixed amount. The key criterion when establishing the amount of alimony benefits is the material security (salary, business income, property) of each parent. In other words, child support is paid by the more affluent parent in favor of the less affluent parent. |

For a mother with a child under 3 years old

Here are the following features of recovery:

- The mother can be either the legal wife or the ex-wife of the alimony payer.

- Alimony can only be calculated in a fixed amount and must be paid monthly.

- The right to alimony is undeniable, i.e. the husband or ex-husband cannot be released from this obligation due to the unworthy behavior of the spouse or ex-wife or the short duration of the marital relationship.

- The spouse is obliged to have at his disposal the necessary means, i.e. earn more than 1 subsistence minimum per adult.

For disabled spouses

Russian legislation understands the following as disability:

- Reaching retirement age.

- Disability of any group. It must be confirmed by the conclusion of a medical commission.

The right to demand alimony from disabled spouses is strictly limited by time frame, namely the period of marriage or 1 year after divorce. In addition, if a person wishing to receive alimony is observed to have the actions described below, and the potential alimony provider proves their validity, the judge has the right to either limit the period of alimony payments or completely release the defendant from the burden of alimony obligations:

- A person wishing to receive alimony has become disabled as a result of committing an intentional crime or due to excessive use of alcohol or drugs.

- The person wishing to receive alimony behaved unworthily in the marital relationship, for example, he was aggressive, insulted other family members, did not want to work or study, frivolously spent money on gambling or his own fleeting hobbies.

- The marriage between the spouses was short-lived, i.e. less than 1 year.

For children over 18 years old

The obligation to pay child support in this case rests with the parents and is unconditional. Children must be:

- Disabled (retired or disabled).

- Those in need of help, for example, money to buy medicines, pay for the services of doctors or caregivers.

Payments are made only in a fixed amount and monthly.

Law on payment of alimony by the state

The law establishing state alimony has not yet been adopted. Representatives of the LDPR party submitted draft law No. 680786-7 to the State Duma of the Russian Federation for consideration. Until now, it is being considered and discussed by a specialized Committee.

For your information

If the project is adopted, there will be no separate law on the payment of alimony from the state. It is proposed to amend Article 112 of the RF IC, adding Part 3 to it. Thus, the grounds for establishing alimony from the government of the country will be reflected in Art. 112 RF IC.

While the draft on the payment of state alimony has not been adopted, you can familiarize yourself with it in the public domain through the automated system of the State Automated System “Lawmaking”. On the page you can see not only the text of the document, but also the order of its movement and the deadline for acceptance.

Amount of alimony obligations

It is proposed to set payment indicators in a strict amount, while the share method of determining the amount of alimony from the state cannot be used. This is due to the fact that interest is established on wages and other income that is unique to individuals.

The proposed bill does not establish the amount of transfers; however, it is assumed that the amounts will be fixed as a fixed indicator based on the subsistence level established in the recipient’s region. Employees of the social assistance service for citizens and the courts consider each situation individually and calculate the amount of alimony based on the financial situation of the family and the minimum wage.

Methodology for calculating alimony based on the subsistence level

This technique is used only when the court assigns alimony in a fixed amount. The judge acts according to the following algorithm:

- The judge finds out whether the subject of the Russian Federation where the plaintiff is registered has a law providing for the establishment of a subsistence minimum for certain categories of potential alimony recipients (minor children, able-bodied adults, pensioners). If the cost of living was fixed at the level of a constituent entity of the Russian Federation, the judge uses it to calculate alimony.

- If the subsistence minimum at the level of a constituent entity of the Russian Federation has not been established by law, the judge uses the federal subsistence minimum for certain categories of potential alimony recipients (minor children, able-bodied adults, pensioners) for calculations. For minors it is equal to 9,603 rubles. for 1 month, for able-bodied adults – 10,573 rubles. for 1 month, for pensioners – 8,078 rubles. in 1 month.

- Next, the judge examines facts indicating the family or financial status of both the defendant and the plaintiff, for example, their level of income, ability to work (absence of disability), and the presence of other dependents of the defendant. Depending on these facts, the judge assigns an amount of alimony, usually ranging from 50 percent to 100 percent of the minimum subsistence level.

Child support from the state

The general principles and provisions of the RF IC allow us to establish two categories of children for whose maintenance funds may be recovered:

- Minor offspring - in accordance with Art. 80 of the RF IC, parents undertake to support their children up to 18 years of age.

- Children who have reached the age of majority and who, due to disability, are unable to support themselves after the age of 18, as reflected in Art. 85 RF IC.

Due to the fact that the amendment on state alimony is being introduced into Art. 112 of the RF IC, the circle of recipients includes both categories of children.

Responsibility of parents to support minor children

The obligation to support their minor children is assigned to parents by law (Article 80 of the Family Code). This norm is unchanged and is not tied to moral requirements, public opinion, etc.

Spouses may enter into an agreement on the maintenance of their minor children. Such an agreement is called an alimony payment agreement . The document is drawn up in writing and is subject to mandatory notarization (Article 100 of the SK). An agreement drawn up in accordance with all the rules has the force of a writ of execution (Part 2 of Article 100 of the Criminal Code).

Termination or modification of the terms of this document is permitted only by mutual agreement of the parties (Article 101 of the Insurance Code).

Alimony can also be collected in court . By court decision, alimony for minor children is collected on a monthly basis in the amount of 1/4 (for one child), 1/3 (for two children) or 1/2 (for three or more) of the parent’s salary and/or other income ( Article 81 SK). The standard sizes of shares can be increased or decreased by the court depending on the financial condition of the parents, their marital status at the time of consideration of the issue and other circumstances worthy of attention (illness, change of job, unemployment, etc.).

State payments to single mothers

The concept of a single mother is not established by law. The determination of the status is reflected in the Reviews of legislation and practice of the Supreme Court of the Russian Federation. In 2010, judges determined that a single mother is an unmarried woman with children. At the same time, there is no record of the father in the birth certificates of the children.

Currently, there is no comprehensive law on state alimony for single mothers. A similar bill was submitted for consideration by deputies of A Just Russia. The legislator proposes to assign alimony from the state to children of single mothers, in the absence of information about the father in the birth certificates of the children. The amount of payments is fixed and will be equal to the subsistence level.

While the bill has not been adopted, a number of benefits and government payments have been established in the Russian Federation for single mothers:

- A benefit for the birth of a baby, which is assigned once, is about 8,000 rubles. The right to receive state payments is regulated by Art. and the Federal Law “On state benefits for citizens with children.”

- Monthly allowance, the right to receive which is reflected in Art. 13 Federal Law “On state benefits for citizens with children” - depends on the level of wages. For an unemployed mother, about 3,000 rubles are accrued monthly for the first child, and 5,200 rubles for the second and third children.

- Maternity capital, the right to assign which is noted in Art. and Federal Law “On additional measures of state support for families with children.” For one child, the amount of capital is 466,617 rubles, for two or more children - 616,617 rubles.

- Secondary compensations, which are fixed by regional governors at the local level.

Regulatory framework

| Laws | Articles |

| Family code | Chapter 14 – alimony for spouses or former spouses. Article 81 – alimony for minors in the form of a percentage of income. Article 83 – alimony for minors in the form of a fixed fixed amount. Article 85 – alimony for adult children. Article 113 – the obligation of the alimony provider to return to the state the money spent in the form of benefits for his child. |

| Code of Administrative Offenses | Article 5.35.1 is a list of administrative penalties for an alimony provider who does not want to voluntarily pay alimony. |

| Tax Code (Part 2) | Article 333.36 establishes a list of cases in which plaintiffs are provided with benefits when paying court fees. |

| Criminal Code | Article 157 is a list of criminal penalties for an alimony provider who does not want to voluntarily pay alimony. |

| Federal Law “On state benefits for citizens with children” | Article 16 – allowance for a minor child instead of alimony. |

What does the state do if a parent does not pay child support?

In the event that one of the parents ceases to conscientiously fulfill obligations to support needy minors and does not pay child support, then the following benefits can be issued:

- Compensation accrued monthly related to reimbursement of expenses for children - assigned to single mothers; large families; women whose ex-husbands do not pay alimony; military personnel; disabled people Established by regional laws.

- Monthly allowance to compensate for the increase in the cost of products - assigned to the same categories of persons as listed in the previous paragraph. Regulated by the provisions of regional legislation.

- If a family receives the status of needy, an additional payment in the amount of the subsistence minimum is assigned. The right to receive such assistance is fixed in Art. 5 Federal Law “On State Social Assistance” and regional legislation.

In order to receive compensation from the state instead of parental alimony, you must contact the social protection authorities, or one of them. In this case, the applicant must submit the following documents:

- Application for granting benefits.

- Passport.

- Baby's birth certificate.

- Divorce certificate - if available.

- Certificate from the bailiffs about the presence of debt and non-payment of alimony.

- Death certificate of the second spouse – if available.

- Certificate of conscription of a young man for service - if available.

Social protection employees may request additional documents if necessary.

Who is eligible to receive

The parent supporting the child has the right to receive alimony from the state.

Provided that there is a court decision in which the other parent is obligated to pay child support. At the same time, he has not paid alimony for more than six months, which may result in calls to the bailiff service. If the bailiffs cannot collect alimony because the debtor is hiding or does not have any property or funds, the parent supporting the child will receive alimony from the state. As soon as the debtor is found, all amounts due will be collected from him. The reasons for a debtor's evasion from paying alimony may be different. He may be unable to pay his debts due to:

- military service;

- recognition by the court as incompetent;

- criminal case;

- compulsory treatment.

Important. The measure of alimony from the state is temporary compensatory. She is subject to the procedure for paying alimony. It will be suspended as soon as the debtor is found and costs are collected from him, or in the event of death. Child support from the state cannot be awarded after the child reaches the age of majority.

A parent can pay child support after the age of 18, until the child reaches the age of 23.

Alimony from the state

What does the state do if a parent does not pay child support?

The state cannot fully compensate for the debts of a parent who evades child support. It can provide temporary assistance to a parent left without child support. This will be expressed in the assignment of a monthly allowance. Its size depends on the region and the capabilities of the local budget.

Please remember that this is temporary help. To receive it, you need to provide:

- Alimony agreement.

- The court's decision.

- Performance list.

You must contact the social security authorities with these documents. Having confirmed the right to receive alimony, as well as the impossibility of receiving it from the debtor, the parent will have the opportunity to assign state payments. The costs incurred by the state for compensation, as well as for the work of government employees, will be borne by the debtor.

Important. Even if a parent has been deprived of parental rights, he remains obligated to pay child support.

Compensation for child support from the state if the parent is wanted

If a parent who has an obligation to pay child support has been wanted for at least a year, the parent raising the child has the right to sue. The parent is notified by the bailiff service that the search has not been successful. She also gives explanations about the right to go to court.

This is done in order to recognize the missing person as missing. This will allow the child to become a recipient of state financial assistance, as a lost breadwinner.

On a note! Payment is made until the child reaches the age of majority. Payment is allowed up to 23 years of age if the child is a full-time student at the university.

The bailiff service may call the child's parent to an appointment to explain the procedure for going to court. Or notify him of this opportunity by letter. If no information has been received, you need to come to the service or call to obtain information about the progress of enforcement proceedings.

Read also: Child support for two children in 2021

Along with the statement of claim to the court, you must attach the following documents:

- Passport.

- A court decision on alimony.

- Certificate about the amount of debt.

- Resolution of the bailiffs to search for the debtor.

After the court accepts the documents, you need to wait for the hearing date to be set. The plaintiff must be notified of this. If the court sided with the defendant and made a positive decision, you need to contact the pension fund with a copy of the decision. Next, follow the instructions of the fund’s employees to apply for survivor’s pension payments.

Important. If, after all these actions, the debtor is still found, the costs of paying pension benefits will be collected from him. In addition, he will remain obligated to pay alimony.

How long does government support last?

Payment of state alimony is equivalent to the fulfillment of obligations. In this regard, transfers are terminated upon the occurrence of one of the following circumstances established by Art. 120 IC RF:

- The recipient has reached the age of 18. This also includes the acquisition of legal capacity at 16 years of age through emancipation.

- Adoption of a child to whom alimony payments were assigned.

- The court established the recipient's lack of need or restoration of ability to work.

- Entry of an incapacitated former spouse into a new marriage.

- Death of a person obligated to pay alimony in accordance with the established procedure.

In the case of state alimony, deductions to needy citizens also cease at the moment when the payer appears and resumes payments.

The mechanism for the occurrence of alimony obligations

The criteria that contribute to the emergence of alimony obligations for an individual are described in the table below.

| Criteria | Detailed description |

| Presence of family or related connections | This is the main criterion, in the absence of which the interested person has no right to demand alimony. The existence of a connection must be confirmed through the state registry office, for example:

Thus, we can conclude that a biological father who is not listed as a parent on the birth certificate is not required to provide monetary or other assistance to the child. The same applies to cohabitants who do not live in a registered marriage and therefore are not legally obligated to help each other. |

| Additional criteria for various categories of individuals |

|

| Availability of necessary funds | This criterion means that alimony cannot be demanded from every alimony provider, but only from such alimony provider who earns enough so that after fulfilling all obligations to the state and other persons, he will have money left in an amount exceeding the subsistence level. However, this criterion has exceptions: it does not apply to cases of payment of alimony from parents in favor of minors or adult children, as well as to cases of payment of alimony from adult children in favor of parents. |

How to apply for alimony from the state?

Since the bill on state alimony has not been adopted, it is impossible to talk about an exact list of documents. Presumably, in order to obtain the right to state alimony, the applicant must adhere to the following algorithm of actions:

- Contact the bailiffs to obtain a writ of execution and calculate the debt.

- Collect a package of documents.

- Send an application with documents to the magistrates to receive the appropriate order.

- A decision will be made within 10 days, of which the applicant will be notified.

- Receive a court order within the prescribed period and send it to the social welfare service.

- Receive alimony on a card or in another way specified in the application.

In order to form an appeal to the magistrate, it is necessary to collect the following documents:

- Statement.

- Marriage or divorce certificate.

- Baby's birth certificate.

- Applicant's passport.

- A court decision or agreement establishing alimony.

- A writ of execution indicating the assignment of alimony.

At present, the mechanism for assigning state alimony has not been clearly established, therefore the presented algorithm is for informational and approximate purposes only and may be changed in the future.

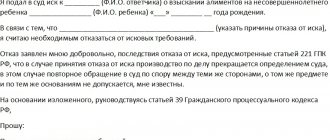

Application for alimony from the state

An application for alimony from the state is supposed to be sent to a magistrate in the order of writ proceedings. The rules for drawing up an appeal are reflected in Art. 124 Code of Civil Procedure of the Russian Federation. The petition must include the following information:

- Name of the court.

- Full name, place of registration of the claimant.

- Information about the debtor.

- The requirement is a request to collect state alimony.

- List of applications.

The application does not indicate the specifics of the purpose of state alimony.

IMPORTANT

It is worth noting that exact samples of applications for alimony from the state can only be published after the bill is adopted.

Child support for adult children

Contrary to popular belief, alimony can be collected not only for the maintenance of minor children. After reaching the age of 18, some categories of citizens also retain the right to receive alimony from their parents.

Conditions for assigning child support for an adult child

Adult children recognized as disabled and in need of assistance have the right to receive alimony payments from their parents (Article 85 of the Family Code). As we can see, it follows from the norm that the conditions for obtaining the right to alimony for adult children are:

- official recognition of disability;

- needy situation.

In accordance with the law, disabled people are recognized as incapable of work, i.e. persons with health problems accompanied by a persistent disorder of the vital functions of the body, resulting from various injuries, diseases, birth defects, leading to limitation of normal life activities, as well as the need for social protection of such people (Article 1 of the Federal Law No. 181-FZ “On Social protection of disabled people in the Russian Federation").

Amount and procedure for collecting alimony for adult children

Alimony for the maintenance of adult disabled children is collected by the court in a fixed sum of money and must be paid monthly.

The court determines the amount of payments based on the following criteria:

- financial situation of the parties;

- marital status of the parties;

- other circumstances worthy of attention.

Financial situation refers to the level of security of parents and children applying for alimony. Here the court evaluates the entire totality of the parties’ income, property, and the availability of mandatory payments.

Assessing the marital status of the parties, the court establishes whether they have dependents, and in relation to children, also the presence of persons obligated to take part in their maintenance.

Those worthy of attention and those that can be taken into account when making a decision by the court include such circumstances as loss of ability to work by a parent from whom alimony must be collected, the need of an adult disabled child for outside care, etc.

How to receive government payments?

Due to the fact that the bill has not been adopted, it is impossible to talk about the exact algorithm of actions for receiving alimony from the state. We can only imagine the approximate order of steps:

- Contact the bailiffs to obtain a writ of execution.

- Form an appeal, collect documents and write an application to receive alimony from the state.

- Get a court order.

- Send the document to the social protection service.

- Receive funds to your card at the appointed time.

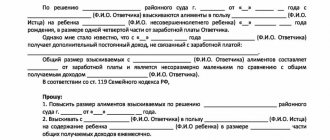

Child support from the state if the father does not pay

In the event that the father does not pay child support for 6 months or more, the baby’s mother will have the right to apply for state payments; in a sense, they can be equated to state alimony. In order to take advantage of this opportunity, you must first go to court. After the judge makes the order, you should go to the social security service. The sequence of actions will be as follows:

- Write an application to receive payments from the state. As a rule, social security employees provide a prescribed form or sample to write during the admission process, but you can prepare an application in advance yourself.

- Prepare a list of documents: judge’s order or decision, passport, child’s birth certificate, details for transferring funds. If necessary, specialists will ask for additional official documents.

- During reception hours, contact social security employees and submit documents.

- Hand over the collected documents, sign the required copies (in the documentation receipt log).

- Within 5 working days, social security employees review the documents and make a decision, of which they notify the applicant at the specified telephone number.

- Within the prescribed period, it is necessary to receive so-called state alimony.

The procedure for applying to court to obtain an order has been described previously. This is a general procedure for writ proceedings, which is characterized by a shorter deadline for making a decision on the payment of alimony.

List of documents for filing a claim for alimony collection

The collection of alimony at the first instance is carried out exclusively by magistrate judges. The choice of judge is the prerogative of the plaintiff, i.e. he can file a claim at his own place of residence or at the place of residence of the other party to the process (the defendant).

Along with the statement of claim, samples of which can be downloaded from here (alimony as a percentage of income) or from here (alimony in a fixed amount), the plaintiff must submit additional documents to the court. The number of their copies depends on the number of participants in the process. The list of documents includes:

- Certificate of family composition. It is necessary if the child support recipient is a minor child.

- Marriage certificate or divorce certificate.

- Information about the defendant's income.

- Conclusion of a medical commission on disability (for disabled spouses or disabled former spouses).

- Birth certificate of the minor to prove his age and the child's relationship with the defendant.

- Pension certificate (for disabled pensioners).

- Medical certificate of pregnancy.

- Calculation of the amount of alimony required by the plaintiff.

- Evidence of need (for needy ex-spouses, needy adult children), for example, a 2-NDFL certificate indicating income below the subsistence level or the presence of a disease requiring expensive treatment.

Documents are submitted to the magistrate in person or by mail. After receiving the documents, the judge examines the received materials within 5 days. As a rule, the study ends with the acceptance of the application for production.

Cases regarding claims for alimony are resolved in most cases within 1 month. It is advisable to prepare thoroughly before filing a claim, clearly formulate your requirements, and collect all the necessary documents and evidence. This will make it easier for the plaintiff to substantiate his claims and reduce the judge’s doubts about the legality of the plaintiff’s claims.

The magistrate concludes the proceedings by issuing a decision. By law, it does not come into force on the day it is issued. This is done so that a party to the process who is dissatisfied with the decision can appeal it to a higher court. 1 month is allocated for appeal from the date of its production in final form. In the absence of complaints from the parties, the decision receives legal force and is transferred to the bailiffs for execution.

Compensation for alimony payments from the state

Compensation for alimony from the state refers to payments assigned by government authorities and paid from the federal budget. One of the grounds for establishing such obligations is the fact that the payer is wanted.

In order to support children left without the care of one of their parents, it is planned to form an alimony fund. It must operate at the regional level. Income to the fund will be divided into two categories: public and private. The public part should be regularly replenished from the municipal budget, and the private part from the money received from the sale of debtors' property at auction.

How to get a pension instead of alimony?

In accordance with paragraph 16 of Art. 65 of the Federal Law “On Enforcement Proceedings”, if enforcement-search actions have not brought results and within 1 year the debtor and his property have not been found, the citizen is recognized as missing. According to the rules of Art. 42 of the Civil Code of the Russian Federation, the recipient of alimony payments has the right to file an appeal to the court to declare the debtor absent. The rendered court decision is the basis for assigning a survivor's pension instead of alimony.

In order to register the right to receive a pension payment from the state instead of alimony, you must do the following:

- Contact the district or city court to recognize the debtor as missing. You must first write an application and collect applications. To apply, you must provide the following documents: an application drawn up according to the rules of Art. 131 Code of Civil Procedure of the Russian Federation; applicant's passport; an agreement to pay alimony or a corresponding court decision; the writ of execution on the basis of which the collection was made; a resolution on the amount of debt with settlement - issued by the bailiff; resolution of a FSSP officer to place the debtor on the wanted list.

- At the appointed time, receive a decision from the court office.

- Submit an application for alimony from the state to the territorial branch of the Pension Fund of the Russian Federation and the documents collected for it: the applicant’s passport; a court decision recognizing the debtor as missing; divorce certificate; child's birth certificate.

- Within 3-5 days, employees will inform you about the decision made.

The survivor's pension is assigned from the 1st day of the month in which the applicant applied for a financial payment.

Legal consequences of evading payment of alimony

Keep in mind that the following legal consequences can occur only when the bailiffs have opened enforcement proceedings against the alimony provider based on a writ of execution for a court decision to claim alimony or on the basis of an agreement on alimony transferred by the claimant.

There are 4 groups of negative consequences.

| Categories of consequences | Description of legal consequences |

| Restrictions imposed by bailiffs | This category includes:

|

| Civil law | This category includes:

|

| Administrative | This liability arises when the alimony provider fails to fulfill his legal obligations to support the alimony recipient (minor children, adult disabled children or disabled parents) for more than 2 months in a row due to personal fault. Guilt in this case means that the obligated person deliberately avoids paying alimony or specifically takes measures to evade alimony payments. 1 of 3 penalties is applied to the alimony payer:

|

| Criminal | If the alimony holder has not completed the execution of one of the types of administrative punishment imposed on him as a result of refusal to pay alimony, or within 1 year after the imposition of the punishment he has again committed an administrative offense expressed in non-payment of alimony, then the bailiffs have the right to begin criminal prosecution of the culprit. The alimony payer may be charged with 1 of the 4 penalties described below:

|

Does the state pay alimony for the debtor?

The bill establishing state alimony has not been adopted, which means that the state is not yet paying funds for the debtor. At the moment, various types of liability are provided for non-payment of child support obligations (administrative, civil criminal), which the violator should not forget about.

For your information

The parent left with the child has the right to receive the status of a low-income needy family. In this case, the state will pay monthly benefits and provide financial support. In addition, it is worth noting that at the regional level, various support mechanisms are being established for women left with children and single fathers. It is recommended to contact the social protection authorities and clarify the types and amounts of government payments in relation to a socially vulnerable group of the population.

To receive 260,000 rubles from the state you need to contact the tax office

First of all, you need to contact the tax office at the place of registration after registering the right to own the apartment. If the housing is still under construction, you need to apply after receiving the transfer and acceptance certificate. Before submitting an application, you first need to obtain a certificate of form 2-NDFL. It is prepared by the accounting department of the tax agent enterprise.

Then you need to make copies of the package of documents:

- real estate purchase agreements;

- document certifying payment;

- document of ownership;

- in the case of a mortgage - a loan agreement;

- agreements of all apartment owners;

- bank account where compensation will be transferred.

Next, fill out the declaration form 3-NDFL.

The payment of one-time compensation will be carried out by the state not at once, but in several installments. An exception may be the payment of the full amount of compensation to those citizens whose salary is 2,000,000 rubles per year. Then the personal income tax received from them to the treasury was 260,000 rubles.

In cases where there are several owners of one apartment, then each of them has the right to a tax deduction

.

True, only recently they began to give permission for the so-called re-crediting. What does it mean? For example, a person learned about profitable mortgage offers from another bank. But it’s too late - he already took out the loan a long time ago. It's OK. He can take out a loan there and pay off the mortgage with these funds. After which you can repay the debt on more favorable terms to this bank. What does this have to do with financial assistance from the state? Despite the fact that it can also be used to pay interest.

Based on the above information, we can conclude that the process of receiving 260,000 rubles from the state once in a lifetime is not as complicated as many residents of the Russian Federation think.

What else is worth knowing?

It is also worth noting that 13% can be returned as compensation for paid treatment (an expensive operation, for example) or for studying. True, you will need to provide a lot of paperwork. In addition to acts for the purchase of housing and other things, you will need to collect an agreement on paid treatment/training, a license of the institution (clinic or university), payment receipts and personal income tax. Then everything is the same. Submission of documents to the tax office and a long wait.

If you believe the reviews, the application can be considered for up to three months. After making a decision, money will be sent to the person’s account within 30 days. If a person is employed and monthly pays 13% to the state treasury, he can take advantage of this opportunity.

By the way, there are better offers. For example, “young family”. This program also provides money for the purchase of housing. There is a lot of paperwork and red tape, but you can get not 13, but 30 percent or even 35% (if you have a child).

Read also: Payments to families with children were announced on May 11, 2021

Arbitrage practice

It is impossible to cite cases related to the assignment of state alimony, but you can see other examples related to the assignment of a survivor’s pension:

- In 2021, citizen P. appealed to the Central District Court of Barnaul to recognize her ex-husband as missing. The citizens lived together, a daughter was born in the marriage, and in 2014 the man left to work and disappeared. The search activities of the bailiffs did not give the desired result. The paternity of citizen S. and his minor daughter was confirmed in court. Inquiries to the Office of the Civil Registry Office, the branch of the Pension Fund of the Russian Federation, the Office of the Federal Tax Service of the Russian Federation, and the Military Commissariat did not give the desired result. The location of citizen S. has not been established. The court declared the man missing, and citizen P. was granted the right to apply for a survivor's pension on behalf of her 6-year-old daughter (Decision of the Central District Court of Barnaul, Altai Territory No. 2-5618/2019 of September 26, 2021).

- Citizen R. applied to the court to declare her ex-husband D. missing. The bailiff department is handling proceedings to collect alimony in favor of two minor children. Considering the case, the court found that enforcement proceedings had been initiated against D. In 2021, a search case was initiated, the operational activities carried out made it possible to identify the place of actual residence of D. Employees of the Migration Department called D. and interviewed him, establishing his location. Based on the above, the judge refused to satisfy the demands and did not recognize D. as missing (Decision of the Leninsky District Court of Orenburg No. 2-6004/2019 of September 26, 2019).

Alimony for an adopted child

Adoption is a legal procedure that legitimizes the placement of children left without parental care. Art. 124 of the IC says that adoption is allowed only in relation to minor children and only on the basis of their interests.

Children can be adopted by citizens of the Russian Federation, foreigners or stateless persons who are not relatives of the children, after a one-year period has passed from the date of receipt of information about children left without parental care in the state data bank.

Legal status of adopted children

The legal status of adopted children implies a complex of their rights and responsibilities. It should be noted that from the moment of adoption the child loses the status of an orphan or a child deprived of parental care that he had before. Having become a member of a new family, he is equated to a full-blood relative and has the same rights and obligations as full-blood family members by origin (Article 137 of the Family Code).

By acquiring new rights and obligations in relation to the adoptive family, the adopted child loses non-property and property rights and is released from obligations towards his actual parents and relatives.

If a child is adopted by one person , then the rights and obligations in relation to the second parent of the opposite sex to the adoptive parent (father or mother) can be preserved at the request of the adoptive father/mother. If one of the child’s parents has died, then, at the request of the parents of the deceased, the rights and obligations of the adopted child in relation to them can be preserved, provided that this is in the interests of the child. The above facts must be consolidated in the court decision on adoption.

Example

The K. spouses divorced in 2001. From the marriage they had a child together, who, by court decision, after the parents’ divorce, remained to live with his mother. In 2003, the child's father died. In 2006, citizen K. married citizen S. for the second time. The spouses decided that the child of citizen K. would be adopted by citizen S. At the same time, on the basis of Art. 137 of the Family Code, the rights and obligations of the child in relation to the relatives of the child’s biological father were preserved at the request of the parents of the deceased father (grandfather and grandmother) and with the consent of the adoptive parent.

Who and how much should pay child support to an adopted child?

Payment of child support for an adopted child by his biological parents ceases from the moment of adoption. This provision is expressly provided for in Part 2 of Art. 120 SK. In this case, all responsibilities for maintaining the child pass to the adoptive parent. However, there is an exception to the general rule.

When a child is adopted by one person, and not a married couple, then, on the basis of his expressed desire, rights and responsibilities (including property) can be preserved to one of the biological parents according to the following principle: if the adoptive parent is a woman, the rights and responsibilities are retained by the man ( father), if the adoptive parent is a man - to the woman (mother) (Article 137 of the Family Code).

This state of affairs must necessarily be reflected in the court decision on adoption, otherwise any legal consequences (it will be impossible to formalize inheritance, alimony, etc.).

In this case, alimony is collected from the father or mother on one of the following grounds:

- under a notarized agreement on the payment of alimony;

- at the request of the adoptive parent - in court.

The size and procedure of payments are determined according to the general rule. Situations often arise when the marriage of spouses who have adopted children breaks up. In this case, the question of who should pay alimony for the adopted child and in what amount must be resolved. It should be remembered that an adopted child is equated by the legislator to a only-begotten child, and therefore has all the rights and responsibilities of a natural child. Thus, the issue of awarding alimony to a child adopted by a married couple after a divorce is decided according to the general rules provided for in Art. Art. 81 - SK.

Collection of alimony for an adopted child

The procedure for collecting alimony for an adopted child is no different from the general procedure for alimony penalties. If alimony is paid by a parent or adoptive parent on the basis of an agreement on the payment of alimony, then the procedure and amount of payments are established by the document itself.

If a judicial procedure for collecting alimony is expected, the following algorithm is provided:

- Filing a claim in court (by one of the adoptive parents or the biological parent of the child).

- The court makes a decision to collect alimony.

- Drawing up a writ of execution by the court.

- Transfer of a writ of execution or court order to a bailiff.

- Collection of alimony.

Alimony can be assigned in shares of monthly earnings, in a fixed sum of money, or simultaneously in shares and in a fixed sum of money (if earnings are unstable - Article 83 of the Family Code).

If the situation requires it (at the discretion of the court), even before making a decision on the merits, the court may make an interim order to collect alimony from the defendant (Article 108 of the Criminal Code). Alimony is awarded from the moment the claim is filed.

Problems and nuances

Due to the fact that the bill under consideration on receiving alimony from the state by needy citizens has not been adopted, it is impossible to talk about any real problems. Legal experts note the following possible difficulties:

- The workload of justices of the peace - officials will not be able to quickly issue an order if the flow of applications is large.

- The alimony fund is formed unevenly. For example, a huge number of payments have been made, but the fund is not being replenished. In such a situation, reserves will quickly run out.

- A mechanism for collecting funds has not been developed.

- The amount of alimony paid from the state is not stipulated.

Additional information

The state creates many mechanisms to protect the rights and freedoms of children and other social groups in need of help. To this end, in April 2021, a bill establishing state alimony was introduced. Its essence is to provide material support to recipients who are left without a livelihood if payers do not fulfill their obligations. As of the beginning of 2021, the bill under consideration has not been adopted, so it is impossible to talk about an established algorithm for collecting alimony payments from the state budget. However, it is necessary to first understand the essence of the initiative and its features.

Comments Showing 0 of 0