How to collect alimony from an ex-husband who receives a salary unofficially?

There are several legal acts that provide for the need to support common children, regardless of the civil status of the parents and their financial status:

- The Family Code of the Russian Federation allows the collection of alimony in a fixed sum of money on the basis of Article 83;

- Federal Law No. 223 dated October 2, 2007 regulates the procedure for collecting alimony payments;

- Federal Law No. 229 of October 2, 2007 regulates the principles of enforcement proceedings and establishes the rights of the bailiff to collect debts.

There are two ways to solve the problem:

- the plaintiff proves in court that the defendant has unofficial income from which alimony must be paid;

- the court sets payment in a fixed amount regardless of whether the defendant has a salary.

It is necessary to prove the presence of an unofficial source of income if it is large enough. If the salary is small, then it is more profitable to demand a fixed payment, which will be indexed in accordance with the inflation rate.

If the claim does not indicate the need to adjust the amount annually, then the judge, as a rule, does not include this item in the decision. Thus, the assigned amount of alimony will be relevant for the entire time until the child reaches 18 years of age.

How to identify hidden income from child support?

In order not to pay child support or to pay it as little as possible, some fathers resort to various tricks.

In this article I will tell you how to identify the real income of the child’s father in order to receive normal alimony, and what the mother should do to make the amount of alimony higher.

The advice will be useful to all women who are just planning to go to court with a claim for alimony, as well as to those whose case is already being considered in court or is at the stage of enforcement proceedings with bailiffs.

Let me remind you that alimony can be collected as a share of earnings or as a fixed sum of money. In both cases, fathers may be interested in hiding their income:

- as for alimony as a percentage of earnings, it is obvious here - the lower the income, the lower the alimony,

— and as for shares of earnings, the logic is this: the higher the income, the larger the fixed amount of alimony the court can establish (other circumstances, of course, also matter).

So, what do fathers do to hide their real income and pay tiny child support:

1. They formally change their place of work - even while performing the same functionality, they begin to receive a significantly lower salary;

2. Remaining at the same place of work, they negotiate with the employer and arrange a meager salary for themselves. Moreover, often the size of their “white” salary theoretically becomes insufficient even to support themselves - i.e. in the amount of 7-10 thousand rubles. Circumstances such as being hired by a relative, and for a salary that is significantly lower than the industry average, may deserve special attention;

3. Quit all jobs. To be more convincing, they can even register with the employment center. But in fact they continue to work and receive “black” wages;

4. They sell their property at a reduced price to relatives and friends.

But everything secret can become clear, and the concealment of income can be detected if the right actions are taken.

Unfortunately, in response to mothers’ requests, neither the Pension Fund, nor the tax service, nor any bodies or organizations will give an official answer about the state of the alimony worker’s income. But the judge and bailiffs are another matter.

Therefore, it is possible to identify the necessary information if, at the stage of judicial proceedings, you file a motion to obtain evidence or, at the stage of enforcement proceedings, “pull” the bailiff so that he makes the necessary requests.

What information will help identify hidden income?

As practice shows, the following circumstances will help to establish the real income of the child’s father:

1. The child’s father can work in several places, but provide an income certificate only from one of them. You can find out about all places of work, employment contracts and civil process agreements by sending a request to the Federal Tax Service and the Pension Fund of the Russian Federation.

The Federal Tax Service and the Pension Fund can provide information not only about sources of income, but also the specific amount of income. Moreover, this information can be obtained over a fairly long period of time - several years prior to sending the request.

2. The child’s father may have bank accounts that receive not only wages, but also other funds. You can send a request about the movement of accounts in order to further identify what kind of money it is and where it came from.

3. The child’s father may have loans for which payments are significantly higher than his official salary. You can make a request to the Credit History Bureau to obtain information about all loans of the alimony provider, on the basis of which you can draw conclusions.

Sometimes the situation looks very strange when the father of a child tries to prove in court how poorly he lives, receives a salary of 8-10 thousand rubles, but at the same time pays 15-20 thousand rubles monthly on a car loan. He cannot provide a reasonable explanation for this, except that his parents help pay the loan, and usually the judge makes the corresponding conclusion clearly not in favor of such a negligent father.

4. The child’s father can receive, for example, a car or an apartment as a gift. It happens that in order to hide their income, alimony recipients buy an apartment or a car for relatives, and then register the donation of these objects to themselves. But they do not take into account that with a salary of 10 thousand rubles it is impossible to maintain a BMW or Mercedes or pay for housing and communal services in a 3-room apartment in Moscow.

In one of the recent alimony cases that I handled, there was just a similar situation. The court agreed with my conclusions that the presence of an expensive car is proof of the debtor’s relevant income, and collected alimony from him in the amount stated in the claim.

As you can see, if you look hard enough, you can find traces of concealment of income, correctly substantiate your position in court and get the desired result.

Of course, fathers can claim that they are not hiding anything, make big and honest eyes, but the court must make a decision based on evidence. However, without the presence of appropriate petitions, the court itself usually does not simply send such important requests anywhere. Therefore, your task is to correctly formulate and submit your petitions to the court, and after receiving answers to them, state your position on the case.

And if a court decision has already been made, but you believe that, in connection with all the circumstances stated above, you can claim a significantly larger amount of alimony, then you can go to court again. Or you can try to influence through bailiffs.

But in such a situation, I would still recommend acting first through the court - i.e. establish alimony in a fixed amount, and only then influence the execution of the court decision through the bailiffs - control that the debtor does not evade paying the collected amount. As practice shows, this is a more convenient option.

For more information about collecting alimony in a fixed amount, read the article “Child support in multiples of the subsistence level - when can it be collected?”

You may also be interested in finding out what the minimum amount of child support is in 2021 when collected as a share of earnings and in a fixed amount.

Do you have any questions or need help collecting decent child support?

You can call me or email me.

How to prove your ex-husband's income for alimony?

There are several ways to prove the fact of concealment of income:

- witness statements and bank statements, if funds are transferred in this way;

- contact the territorial body of state statistics (Rosstat) if the official salary is significantly lower than the salary in a particular industry.

Any citizen can submit an application to Rosstat; to do this, they must write a request to provide the necessary information, indicating the following:

- legal address of the organization in which the payer works;

- describe the current problem;

- request data on the average salary from specialists in this sector of the economy for a certain position.

It is best to contact us not by email, but by sending a registered letter. The answer will come in the same way by mail. It will need to be presented to the judge as evidence.

A sample application to Rosstat can be downloaded on the Internet or you can compose a letter in free form. You can find out the address of the statistics department in online directories.

Where does the “bag of money” come from: how to prove a legal source of income

It is not always possible to get by with a simple explanation with the bank manager - banks are increasingly blocking the account and offering to “confirm the origin of the funds.”

But what does this mean and why does this happen? The reason is simple: governments are fighting illegal money laundering and terrorist financing.

In the last decade, this struggle has gained significant momentum, and there is a trend in the world towards tightening the requirements of financial legislation. Now banks and other financial institutions, before opening an account for individuals or companies, are required to verify information about the source of funds.

As of July 2021, the fifth EU Directive on preventing the use of financial systems for the purposes of money laundering and terrorist financing (AML-5 Directive) came into force.

EU states must adjust their laws by 2021 - in January, the requirements of the directive will become mandatory for use by all EU banks. This move will provide a safer environment for legitimate businesses and significantly reduce illegal activities that exploit financial systems for the purpose of money laundering.

When answering the question about the origin of funds, it is necessary to take into account other important changes.

For example, the creation of databases in which banks, as well as other financial institutions, will check information about you - not only when opening, but also during the further use of the account (for example, a global register of ultimate beneficiaries and their assets).

Banks are also introducing risk-based verification of all your transactions (which relate not only to opening accounts, but also to carrying out current transactions).

This article is a must-read if you plan to work with foreign banks, open personal or corporate accounts, make large purchases, and also if you are applying for a license (including a financial license), or are thinking about changing your country of residence. In all these cases, you must answer the question about the origin of your funds.

Origin of funds for CIS citizens

What does this mean and why is it important for CIS citizens to worry about confirming the origin of their income?

Until recently, for CIS citizens there was rarely a question of opening an account in foreign banks. The legislative framework inherited from the USSR significantly complicated the process, since it contained many restrictions on working with foreign banks, and the low welfare of the majority of citizens made contacting European banks impractical.

Now the trends have changed, and CIS citizens are increasingly carrying out international transactions and opening accounts in foreign banks. By coincidence, these processes coincided with the tightening of the rules of operation of international financial institutions against the backdrop of the fight against terrorism and money laundering.

In foreign banks, CIS citizens have always been and remain a high-risk customer, since on the world stage former Soviet countries are associated with a high level of corruption and a low level of general welfare. This means that the answer to the question about the origin of funds needs to be prepared both by the CIS citizens themselves and their companies (even foreign ones), since banks will pay special attention to them.

A characteristic feature of people from post-Soviet countries is the habit of storing money in “suitcases” and also ignoring the need to pay taxes on all their income.

This leads to the fact that even honestly earned money from the “suitcase” itself will not be able to answer the question of its origin (especially if all taxes have not been paid on it).

Moreover, all over the world (and the CIS countries are no exception) they are introducing limits on cash transactions, which makes it even more difficult to use money from the treasured “suitcase”.

Taking into account all of the above factors, we do not recommend trying to answer the questions on your own and advise you to immediately contact a specialist.

Will they be asked about the origin of funds in the CIS countries?

Global trends in the fight against money laundering are already reflected in the legislation of the CIS countries. Below we will look at the most obvious signs of this influence using the examples of Ukraine and Russia.

Over the past year in Russia, almost every 10th citizen has faced blocking of a bank card. Most often, cards are blocked after purchases abroad or in online stores.

Why is this happening? Since September 2021, amendments have been made to the law “On the National Payment Card System”, which allows cards to be blocked for up to 30 business days if they are suspected of being credited with illegally obtained funds.

The fact is that even the most harmless at first glance transactions can arouse suspicion on the part of banks. Those at risk are those who make a large purchase, transfer or withdraw funds for a large amount, and also pay with a card abroad.

You can unblock a bank card (and the money on it) only after the bank accepts evidence of the legal origin of your funds.

As for Ukraine, previously, in order to provide banking services, it was enough for banks to identify clients, but since 2017, National Bank Resolution No. 42 has been in effect, according to which banks must check the sources of origin of funds from their clients.

The biggest problems in this situation arise for citizens who receive almost their entire salary in envelopes, but officially have only a minimal income (or no income at all). To confirm their income, they will have to show some documents other than a salary certificate.

If you are planning to open a deposit, transfer or deposit money into an account in Ukraine in an amount over UAH 150,000, you should now think about how to confirm your legal source of income and be prepared for questions from banks!

When asked about the origin of funds?

Let’s imagine a situation where you were able to save up a large amount of money in advance to buy the house or car of your dreams, and planned to move to another country for permanent residence. And now your dream is a couple of steps away from you, all that remains is to open the gate.

But, in order to do this, you first have to explain where you got the money to buy your dream.

And if your explanations are insufficient and without the appropriate documents, then the gate will never open, and you will be forced to give up your house, car, or change your place of residence.

Therefore, if any transaction you conduct raises doubts with the bank, you must confirm the source of funds for a particular transaction so that the bank can determine whether the transaction corresponds to your actual income.

What could be the source and how to confirm the origin of funds?

Unfortunately, there is no single correct answer to the question “how to confirm the origin of funds.”

Confirmation of the origin of funds can be a salary certificate, income statements, income from sales of products, sales of property, statements or receipts from other banks, gift agreements, receipt of an inheritance, winning a lottery, etc. It is worth considering that a loan agreement is extremely rarely accepted as confirmation of funds, since in this case, proof of the origin of the funds will be asked from the person who provided the loan.

Obviously, it will be easiest for those entrepreneurs who are careful about accounting issues, including personal finance, to confirm the origin of funds in a bank.

If everything is in order with your documents and the amount involved is small, then there will be no problems answering the question about the origin of the funds.

But if we are talking about large sums, and you cannot provide the appropriate documents about the origin of the funds, then the bank will be forced to refuse to carry out financial transactions.

We recommend that you do simple but permanent things, namely collect and store documents confirming your receipt of funds.

However, before you take on the answer to the question of the origin of funds, think about the consequences of an error.

The cost can be high - from canceling your transaction and blocking your account, to reporting your suspicious transactions to government authorities, who will begin an official investigation.

Therefore, it is better to immediately contact professionals who will advise and help you correctly confirm the origin of your funds.

Read more on our website: https://sb-sb.com

Source: https://spark.ru/startup/sbsb-legal-services/blog/53319/otkuda-meshok-s-dengami-kak-dokazat-legalnij-istochnik-dohodov

Calculation of the amount of alimony payments from black wages

The calculation procedure depends on whether the defendant has a stable income.

If the debtor is officially employed and receives part of the money on the card, part in cash, and the plaintiff managed to prove the fact of concealment of income, then the court sets the payment as follows:

- 25% of income - for one child;

- 33% of income - for 2 children;

- 50% of salary - for 3 or more children.

However, these figures are approximate and may be adjusted up or down in a particular case. In exceptional situations, if the defendant’s salary is large enough, payment may be ordered in favor of common minor children up to 70% of all income.

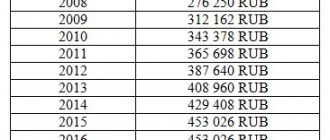

Judges set a fixed sum of money if the ex-husband does not officially work. The law is based on the minimum subsistence level. So, this amount is multiplied by 0.25, 0.33 or 0.5 (depending on the number of children) to calculate the minimum payment.

Regardless of whether you have a job, money must be transferred. Therefore, it is necessary to immediately establish work with a bailiff to prevent the arrest of accounts.

If the debtor does not plan to make payments on his own, then the bailiff has the right:

- seize bank accounts;

- seize the alimony provider’s property and sell it through an auction to pay off the debt.

Also, alimony debts are a reason not to let a person go abroad. Debt can accumulate and penalties may accrue. Thus, ignoring the demands of the bailiff only aggravates the situation.

You can refuse payment only for objective reasons. These include incapacity, disability, sudden deterioration in health, and so on. During the treatment period, debts will not accumulate, but after the problem is resolved, payments will need to be resumed.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Collection of evidence

Before we talk about collecting evidence that can confirm that the ex-spouse is hiding real income, we need to point out that this is a very difficult process. The vast majority of legal proceedings of this type are of a waiver nature. But if the mother decides to achieve her goal, believes that the payment of alimony is carried out unfairly and there is concealment of income, then it is recommended to use the following methods of collecting evidence:

- if, when contacting the bailiff, it was possible to obtain any information about the financial situation of the payer, then it is necessary to ask the FSSP employee to issue certified copies of the documents received during the proceedings;

- if the defaulter works unofficially, then first you need to contact the management of the organization in which he is employed and try to describe the situation to the manager. If nothing comes of this, then you should file a complaint with the labor inspectorate. Its representatives will record the fact of employment without official registration, and the results of the audit will serve as evidence of concealment of income;

- A fairly common situation is when one salary is issued according to the statement, but its actual amount is much larger. The deduction for alimony comes from the official part of the salary. If there are good reasons to believe that the alimony payer receives a salary “in an envelope,” then you need to contact the tax office. The Federal Tax Service will conduct an audit, and if the fact of receiving a gray salary is confirmed, this will also become evidence in court;

- if the ex-husband purchases an expensive item, for example, a car or an apartment, but registers it in the name of relatives, then you can try to prove to the court that the latter’s income would not be enough for such a purchase, and that the hidden income of the alimony payer was used for this;

- The ex-husband may have loans, the monthly payments for which significantly exceed the amount of alimony, however, the alimony payer regularly fulfills his obligations, despite the fact that his official income is clearly not enough for this. To confirm this, you need to provide the court with evidence of the existence of such loans, the amount of payments and the absence of late payments. Similar information can be obtained from a bank, but as a rule, a financial organization gives such answers only to bailiffs, and not to individuals;

- the alimony payer is the founder of a legal entity or manages one of them. However, according to the documentation, the company's income is very low. In such a situation, you can try to prove that a sharp decrease in the organization’s profit occurred at the time the alimony worker began paying child support;

- if the alimony recipient receives a salary the size of which is not comparable with the position he occupies, then it is possible to provide the court with information about the average salary of similar specialists in the region where he is employed. Such data can be obtained from the regional chamber of commerce and industry;

- Another proof is that the payer owns commercial property, such as trucks or warehouses. Obviously, such property is used to make a profit, but the alimony payer simply conceals it.

Read more: Can bailiffs seize a credit car?

From the above, it becomes clear that there are a huge number of ways to obtain evidence that will become a powerful argument for the court. But you need to understand that the defendant can provide counterarguments, for example, the property has 3 trucks, but they are in disrepair and cannot be a way to generate income, etc.

To obtain the evidence described above, you will need to send requests to various organizations that have the necessary information.

But it is worth understanding that most of them simply cannot give an answer to an individual, since this is a disclosure of personal data, which is prohibited by law. Partially, a lawyer will help solve the existing problem. His status allows us to get a little more information. If you need to obtain data that even a lawyer cannot request, then you need to ask the court to make a corresponding request. Any organization will provide the court with the necessary data, but the problem is that the court does not have the right to disclose it. Thus, the plaintiff and his lawyer will not be able to analyze the information received.

How to get funds to support a child from a gray salary?

A mother can receive money from the unofficial salary of the father of a common child by signing an agreement with him.

It must be certified by a notary. The document itself is drawn up in free form, but it must contain information about the parties, their place of registration, date of birth and the amount that the father undertakes to transfer to the mother for the maintenance of the minor.

The contract must indicate how often payments will be made and what method of transferring funds is provided . You can also indicate what you cannot spend the money you receive on.

If there is an agreement, the parties must comply with its provisions. Otherwise, you can go to court to claim alimony. If the costs of maintaining a child/children have increased sharply for objective reasons, the mother has the right to demand an increase in the amount of alimony.

How to get the child's father to pay more?

The alimony holder is not obliged to make payments in excess of the established amount. The amount can only be changed in court.

The reasons for changing the amount of payments may be:

- requiring urgent treatment as a result of deteriorating health conditions;

- the need for sanatorium-resort treatment;

- receipt of paid education by a child;

- registration of disability.

Each case must be considered separately.

Also, the amount of alimony can be increased in the event of a sharp change in the level of inflation, as a result of which the amount received will not be enough for the normal maintenance of minors.

To claim a larger amount, you must file a corresponding claim and provide a complete package of documents, which includes:

- evidence base showing the increase in child costs;

- a court decision on alimony or an agreement between spouses;

- receipt of payment of state duty;

- certificate of divorce and birth of a child;

- copy of the passport.

The more evidence provided, the higher the likelihood of a favorable outcome for the plaintiff.