Let's try to figure out what legal force a handwritten receipt has, what the consequences of non-compliance with obligations under this document are, and how to force the debtor to pay the debt or provide the promised services.

It is enough to refer to the Civil Code to understand what a receipt is and whether such a document has legal force in court. According to the law, this paper, drawn up in writing, can act as evidence of a transaction. This point is regulated by paragraph 2 of Article 808 of the Civil Code. Thus, the law contains the concept of a receipt and unambiguously answers the following question: in what cases is a handwritten receipt acceptable, does this document have legal force? Such a paper, written by hand, is essentially a loan agreement. It can also act as a service agreement.

Is certification required by a notary?

The following types of receipts can be distinguished : notarized and executed without notarization. The second option raises doubts: is a handwritten receipt not certified by a notary valid, is it different from an uncertified document? We can safely say that both options are legitimate and have a right to exist.

An agreement drawn up by a notary is more reliable. In practice, the debtor often repudiates his obligations under the receipt. In this case, it is easier to prove in court the obligations of the defendant to the plaintiff. In the absence of notarization, the plaintiff can defend his rights in court. But this will require more time and money - there is a need to conduct a handwriting examination.

Rules for drawing up receipts

The person who lends money is interested in the proper fulfillment of debt obligations. Therefore, it is so important to know under what conditions a handwritten receipt has legal force and what the rules are for drawing up this paper. The following points can be identified that need to be taken into account when compiling:

- The one who receives the money or service should write. Handwriting must be legible. If a person subsequently refuses to fulfill his obligations, it will not be difficult to prove his authorship. It will be enough to conduct a handwriting examination.

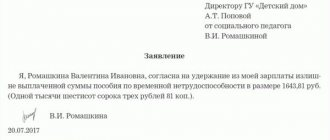

- The receipt must indicate the full names of the parties. Not indicating this data, writing instead a nickname, aunt, uncle and other options is wrong, this is a way to write a receipt so that it does not have legal force. Thus, it is impossible to count on receiving money through the court if the citizen’s full name is not indicated

- The receipt must contain the debtor's passport details. It is not uncommon for different people to have the same full name. Passport data will help prove the guilt of the debtor even if he has a full namesake. It is not necessary for the lender to provide passport details. The presence of a receipt from the debtor is sufficient evidence for the court.

- It is worth providing contact information and place of residence. This will help the creditor find the debtor, if necessary.

- All aspects of the transaction, conditions for the return of money or the provision of services must be described in detail in the receipt. Such a detailed description will help the parties protect their rights in court if the need arises. It is important to indicate the date of repayment of the debt or provision of the service.

- The receipt should be written carefully, without crossing out. This is due to the fact that possible blots and corrections may cause multiple interpretations of the paper.

- It is important to compare the debtor’s signature with the one in his passport. This precaution will help if it becomes necessary to prove the authenticity of the signature in court.

- It is better to use a ballpoint pen to write this document. Answering the question whether a handwritten receipt has legal force if it is written with a gel pen, capillary pen or other writing instruments, you can answer in the affirmative. However, papers written with such writing instruments are less durable. If a lot of time passes, the text may become unreadable. Then it will be difficult for the plaintiff to prove his position in court.

A correctly drawn up receipt will help the creditor defend his interests in court, and the debtor will not become a victim of fraud.

Receipt in the meaning - loan agreement

The loan agreement must contain the features of such an agreement. A promissory note and a loan agreement in this case are equivalent concepts.

The Civil Code stipulates that under a loan agreement, one party transfers funds or other property determined by generic characteristics to the other party, and that party, in turn, undertakes to return what was received.

The loan agreement is the real deal. It is considered concluded not from the moment of signing, but from the moment of transfer of money. Therefore, a money loan agreement cannot be concluded without transfer of money; it is considered not concluded.

You can do this as follows: conclude an agreement, and confirm the fact of transfer of money with a receipt for receipt of funds.

You can conclude an agreement and transfer funds by payment order to the debtor’s bank account. In this case, the confirmation of the transfer of funds will be a payment order.

The loan agreement may stipulate that the debtor received funds upon signing the agreement. This will also be a correct receipt of receipt of funds, contained directly in the text of the agreement. The debtor can write on the contract that he has received funds in a certain amount.

Any method will be correct if they reflect the essence of borrowed obligations: the creditor transferred funds or other property to the debtor, the debtor undertakes to return; the fact of transfer of money or property is confirmed by a separate document or written statement by the debtor.

If the receipt indicates that the debtor has received funds and does not indicate that he must return them, and also does not indicate why he received these funds, then in this case it cannot be considered that a relationship has arisen between the parties under a loan agreement. Similarly, if one party transferred funds to the other party, it is unknown why and it is not clear for how long. I believe that in this case a relationship may arise that is governed by the provisions of unjust enrichment.

At the same time, if it follows from the agreement (receipt) that the funds were transferred to the debtor on a repayable basis, but the period is not specified, then we are dealing with a loan agreement.

Interest for use on a promissory note

As a general rule, it is assumed that the contract is concluded with a provision for interest. If the interest rate is not specified in the agreement, it is determined by the bank rate. The contract can separately state that no interest will be charged. If the agreement is concluded for a certain period and the debtor is late in fulfilling the obligation to return the funds, then interest may be charged for the period following the interest-free period. But this will already be liability for use under Art. 395 of the Civil Code of the Russian Federation. To calculate interest for using someone else's money, you can use the interest calculator for using someone else's money.

Form of transaction, loan agreement

I draw your attention to the fact that the agreement, receipt or other supporting document must be executed in writing. Mandatory written form is provided for by law for concluding a loan agreement with the participation of a legal entity in all cases and with the participation of individuals, provided that the loan amount exceeds 1000 rubles.

If the written form of the transaction is not observed, the law provides for a consequence in the form of the inability to refer to the testimony of witnesses in support of the fact and circumstances of the conclusion of the contract. But the law does not prohibit otherwise proving the fact and circumstances of the transaction.

The loan agreement should look like this:

Lender – full name, passport details, registration address, telephone number; Borrower - full name, passport, registration address, telephone number, the Lender transferred, and the Borrower accepted funds in the amount of EE. The borrower received funds at the time of signing this agreement. The borrower undertakes to repay the money within three months, to NN.NN.YYYY. Funds are issued at interest. Interest is set at 5% per annum.

A loan obligation can take the form of a promissory note:

- “I, full name (passport details, registration address, telephone), took from the full name (passport details, registration address, telephone) funds in the amount of NN rubles at 10% per annum. I undertake to return by NN.NN.YYYY"

This will be the correct receipt. Both samples of the receipt (loan) contain all the essential terms of the loan obligation.

Receipt – write or print?

The receipt can be written by hand or printed on a printer. Many people prefer to use this method because they doubt whether a handwritten receipt has legal force and whether it will be possible to subsequently force the debtor to fulfill his obligations. However, if a document is drawn up without certification by a notary, it will be more profitable to write it by hand.

A document printed using technical means will contain only the signature of the debtor. Proving that he signed the printed text can be a difficult task. In the case where the paper is handwritten, an examination can be carried out and the authenticity of the handwriting can be easily confirmed.

Thus, the question of whether a handwritten receipt works can be answered in the affirmative. This option is even more preferable compared to a printed document.

The receipt must be notarized

Let's try to figure out what legal force a handwritten receipt has, what the consequences of non-compliance with obligations under this document are, and how to force the debtor to pay the debt or provide the promised services.

It is enough to refer to the Civil Code to understand what a receipt is and whether such a document has legal force in court. According to the law, this paper, drawn up in writing, can act as evidence of a transaction. This point is regulated by paragraph 2 of Article 808 of the Civil Code. Thus, the law contains the concept of a receipt and unambiguously answers the following question: in what cases is a handwritten receipt acceptable, does this document have legal force? Such a paper, written by hand, is essentially a loan agreement. It can also act as a service agreement.

In what cases can handwritten receipts be made?

It is convenient to draw up an agreement in the form of a receipt. When writing this paper, it is not necessary to spend money on notary services. And drawing up such an agreement takes little time.

Since we have already found out how to draw up a handwritten receipt and whether this paper has legal force, we will consider cases when it is possible to use such an agreement. Not all contracts between citizens can be concluded in this form. For example, purchase and sale agreements for real estate, gift agreements and many others must be certified by a notary. When drawing up such an agreement, it is important to know whether a handwritten receipt has legal force in each specific case. There are cases in which it is permissible to use this document:

- A loan for an amount greater than 10 times the minimum wage. However, the transfer of smaller amounts into debt should also be documented - this way there is a greater chance of getting your money back if necessary.

- Another option is a receipt for delivery of money. For example, in the case of transfer of collateral, it is important to know whether the receipt for receipt of money has legal force, and how to write it correctly.

- It will be relevant to draw up such a document in cases where the parties agree on the provision of services;

- Renting a home is another option for using receipts. In this way, tenants can protect themselves from unscrupulous landlords. In such cases, it is important to understand in what situations it is worth drawing up a receipt for receipt of money and whether each specific document has legal force. In order to ensure the transparency of such financial relations, it is worth documenting in writing all payments for a rented apartment, as well as the payment of a deposit. In such cases, you can safely draw up a document in writing, without doubting whether the receipt has legal force in court, and count on the protection of your rights.

We will answer all your questions and will definitely help! Call us right now on the Hotline (812) 425 31 40 and get legal advice!

How much does certification cost?

The form of a debt agreement is arbitrary. Its notarization is not required.

If, through the operation, a person wants to receive a 100% guarantee of productive cooperation with the borrower, then the price of giving legal force to the paper will depend on these factors:

- the subject contacts a public or private lawyer;

- what region the person lives in (prices may differ in different areas and regions);

- what object of the contract are we talking about;

- how quickly the client's request needs to be fulfilled.

To find out the approximate prices of the service, there is a free consultation with a lawyer, which will help you obtain complete, reliable information about the points of interest to a person.