If the buyer decides to return the goods to the supplier, a special document will be required - a return invoice. In case of return of goods already accepted for accounting, an invoice in the TORG-12 form is used. Such a document is used only when resolving issues between legal entities and individual entrepreneurs; in case of returning goods in retail trade, this return invoice is not used. In the article we will consider in what cases and how the TORG-12 consignment note is drawn up, and we will also provide a sample of how to fill it out.

Registration of goods return to the supplier

If the customer, upon acceptance of the goods, even before registering it, discovers discrepancies, then the parties must sign a statement of discrepancies. This act is the return invoice TORG-12. If the customer has already accepted the goods for accounting, and only then discovered discrepancies, then a return invoice is drawn up, to which the grounds for return are indicated (inconsistency in quantity, inadequate quality or hidden defects). The return invoice is accompanied by supporting documents, which are acts, claims and letters. All information about discrepancies must be indicated in the return documentation (

What form can be used?

The invoice form, which can be used by all organizations, was developed by the State Statistics Committee of the Russian Federation. A sample with explanations for filling out the TORG-12 form can be found in departmental resolution No. 132 of December 25, 1998.

It follows from the regulatory document that the invoice can be filled out in free form, guided by current circumstances. The law only requires the mandatory presence of a second copy.

Why do you need a bill of lading and whether it can replace a sales receipt? You can find out here.

When can a product be returned?

In accordance with current legislation, the customer has the right to return the goods to the supplier if:

- the goods received do not comply with the terms of the contract, for example, their quality, quantity, configuration or packaging;

- the delivered product has expired;

- the product cannot be used and sold;

- the assortment is being updated;

- the goods are not accompanied by accompanying documents;

- delivery deadlines for goods were violated;

- there was a delay in payment;

- defective products were discovered;

- other reasons.

Important! The customer checks the compliance of the characteristics specified in the contract with the supplier during the acceptance of the goods, or upon acceptance within the period established by the contract or legislation.

Deadlines for submitting a return invoice

You can return the goods to the supplier using the TORG-12 invoice at any time corresponding to the periods indicated below:

- The expiration date indicated on the packaging or accompanying documentation.

- Two years from the date of purchase in the absence of warranty from the manufacturer.

- Warranty period officially confirmed by the seller.

Retail outlets are allowed to return low-quality goods to suppliers, starting from the date of sale.

Return processing times

When accepting the goods, the buyer checks its quality, compliance of the supplied quantity with that specified in the documents, as well as the packaging. If any discrepancies are identified, then a return certificate is drawn up even before the goods are received. You can return low-quality goods within the established time frame (Article 477 of the Civil Code of the Russian Federation):

- no later than 2 years – if the manufacturer has not provided a guarantee for the product;

- during the shelf life of the product, if available;

- during the product warranty period.

In the case of retail trade, the date indicated in the official document upon sale will be the beginning of the period for returning the goods.

When processing a product return, the supplier must prepare certain documents:

- acceptance certificate, which indicates the registration number;

- a claim made in writing in free form;

- return note.

Return note TORG-12

Important! The return invoice (form TORG-12) is a special document drawn up with the necessary details and in accordance with the regulations established by law. In the event of a special audit, the tax authority may request invoices from the organization.

A return invoice is issued if the product is found to be defective or does not meet quality standards. This document is a confirmation of the shipment of the goods from the supplier and its receipt by the buyer. Based on the consignment note, goods in the warehouse are taken into account, and the resulting final information is entered into the financial statements (

Filling out the return invoice (procedure, sample)

The procedure for filling out a return invoice is no different from the procedure for drawing up a regular delivery note, issued when the supplier transfers products to the buyer. The document can be drawn up according to the unified form TORG-12, established by the Decree of the State Statistics Committee “On approval...” dated December 25, 1998 No. 132, or using a form developed for the needs of a specific enterprise. Since 01/01/2013, organizations and entrepreneurs have the right to choose: they can either continue to use existing unified forms of documentation or use their own internal forms, provided that all mandatory details are included in them.

The invoice must indicate:

- details of the company returning the goods;

- details of the consignee company;

- basis for issuing the invoice;

- document number and date of its preparation;

- information about the product being returned to the supplier (name, unit of measurement, quantity, price including and excluding VAT);

- the total cost of the cargo released under the invoice;

- signatures of representatives of the sending company and the consignee;

- date of transfer of goods.

You can fill out the delivery note issued when returning goods on our website:

How to prepare a return invoice TORG-12

The procedure for issuing a return invoice TORG-12 will be as follows:

- the document must contain the name “Invoice”, as well as the serial number and date of preparation;

- further, the Supplier’s details are indicated (its name, INN and KPP, legal address and bank details);

- information on the Shipper is indicated (the details of the shipper are filled in by analogy with the Supplier);

- information is entered (company details and bank details) for the Payer;

- information about the Consignee is filled in (as a rule, the Consignee and the Payer are the same, in this case you can indicate “he”);

- the basis for returning the goods is indicated (this may be a supply agreement or other agreement), the number and date of the document;

- further describe the product that the buyer returns to the seller (indicate its name, quantity, price, as well as the total cost in accordance with the quantity and price);

- the document is signed by the heads of the consignee and the consignor (the finished TORG-12 is stamped and the date of drawing up the return document).

Important! The return invoice must be issued in two copies, one of which remains with the buyer, and the second is given to the seller.

TORG-12 can be filled out by hand, without errors, typos or corrections. You can also create an invoice in 1C or in the VLSI program.

SAMPLE TORG-12

Basic document details

- Line “Consignor”:

- when sending goods through a third party, fill in the field with the full name of the company that is engaged in delivery, its contact details, bank account and other bank details.

- in case of shipment to the structural departments of the importer, the address of the department is indicated in the line;

- if the sale is made from the seller’s warehouse, in the field you need to indicate the name of the selling company, legal address, current account number, tax identification number, telephone number.

- The line “Structural Unit” is filled in if the supply is carried out from the warehouse of a company branch.

- The line “Consignee” - implies filling in the name of the addressee, his contacts, address and account number.

- “Supplier” is the selling company, its full name, bank account details and other contacts.

- “Payer” is a line where the name of the organization that pays for the cargo and details similar to the column “Supplier” are written down.

- In the “Bases” , fill in the name, contract number, and its date. When delivery occurs through a third party, fill in the number and date of the consignment note, which is issued to the organization involved in transportation.

Form TORG-12.

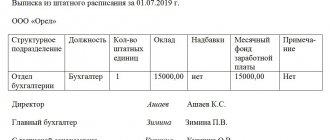

Calculation part: Bargaining-12 is presented in the form of a table. According to the accounting, indicate the number and date of the invoice.

Do you want to open a business from scratch, but don’t know how to get a loan? This article will help you.

In the “Total” line, the total values of each column are calculated on separate pages. The line “Total on invoice” shows the total amount for absolutely all pages of the invoice.

In the last part they indicate: how many sheets the TN has and the total number of recorded goods.

- total number of seats;

- weight of cargo;

- who authorized the shipment (his position, signature and full name);

- who made the delivery (signature, full name and position);

- date and number of issue of the power of attorney;

- who accepted the cargo;

- which consignee received it;

- invoice date;

Invoice for return note

The return of defective products is a business transaction that must be reflected in the accounting accounts. Moreover, each operation must be accompanied by a supporting document.

In addition to the return label, a return invoice may also be issued. When registering a return, the product is returned to the supplier either of proper or inadequate quality. In this case, the return occurs either before the invoice is signed or after it is signed.

When registering the return of goods between organizations on OSNO, quality products can be returned only if there is mutual agreement of all parties, and this condition must be provided for in the agreement. If ownership of the goods has passed to the buyer, and the goods have already been accepted for accounting, then the return will be processed as a reverse sale. In this case, the buyer will have to issue an invoice to the counterparty for the cost of the returned goods. This invoice must be recorded in the sales ledger.

Important! Reverse sales must be made for the same amount as the purchase of the goods.

When registering the return of low-quality goods not accepted for accounting between organizations on the OSN, the buyer does not have to issue an invoice for the return, nor do they have to calculate VAT. The supplier issues an adjustment invoice on its own behalf, which is not entered into the sales book by the buyer. This is due to the fact that there is no input VAT on this purchase. If it turns out that the goods are defective after they have been accepted for accounting, the buyer unilaterally terminates the contract and formalizes this with special documents. An adjustment invoice is issued by the supplier and such a return is not recognized by the sale. In case of a partial return, the buyer does not need to issue an invoice on his own, since part of the goods has already been accepted for accounting. An adjustment invoice is issued by the seller for the balance of the goods that remains after the return. The seller enters the invoice into the purchase book, after which he makes a VAT adjustment to the budget. The buyer, in turn, registers in the purchase book that part of the goods that he accepts for accounting.

How to fill out a return TORG-12

Instructions on how to fill out the TORG-12 sample for returning goods were compiled in the form of a table:

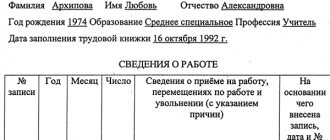

We disclose information about the buyer of goods and materials, who initiates a return in favor of the supplier. We list the following details:

- Name;

- address;

- telephone;

- Bank details.

In a separate line we indicate the name of the structural unit of the company from which the goods and materials are returned.

This is the supplier to whom products that do not meet specifications are returned. We disclose similar information and details (name, address, payment details and telephone).

By analogy with the “Shipping Organization” field.

If there were no transfers, then do not fill in the field.

Here, disclose the following information about the operation being performed:

Date and document number

Expert opinion

Romanov Denis Konstantinovich

Practicing lawyer with 10 years of experience. Specializes in the field of civil law. Has experience in document examination.

We reflect the details of the document itself, in accordance with accounting registers and journals. Include the details of the delivery note in the sample invoice for returning goods to the supplier, but only if available.

The tabular part is filled out on a general basis. Here you will have to describe the details and characteristics of inventory items returned to suppliers. Please indicate in order:

- line number;

- name of goods and materials;

- units of change;

- type of packaging;

- quantity and mass;

- price and cost;

- Select VAT separately and then add it to the total cost.

Write the totals below the table. Certify the finished sample invoice with the signature of the head and chief accountant of the organization.

Seal your signatures. Draw up the document in at least two copies, one copy for each of the parties to the transaction.

The financially responsible persons of the supplier must check the returned products and make the appropriate notes in TORG-12.

December 25, 2019

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

Most often, low-quality goods are returned, but the reasons for the return may be different:

- expiration date has expired

- it is impossible to sell the goods,

- delay of payment,

- the product packaging is damaged or missing altogether,

- the supplier did not transfer the products completely,

- the assortment conditions were violated, for example, some of the goods were delivered in a different color.

All return conditions must be specified in the goods delivery agreement.

Let's look at how to issue a return invoice to the supplier.

Returning goods under special conditions

Companies that are on the simplified tax system and UTII are exempt from paying VAT. They do not have to issue an invoice, and the procedure for document flow will depend on whether the entire shipment is returned to the seller or only a part.

If the goods are returned in full, the seller enters the invoice into the purchase book. The document is registered in the tax period when the goods are returned.

In the case of returning only part of the goods, the seller issues an adjustment invoice for the total cost, and also adjusts the amount of tax to the budget. In this case, the cost in the adjustment invoice must match the amount for which the goods were returned from the buyer.

How to issue a return invoice to a supplier

A separate organization must act as a supplier or shipper during the procedure for returning goods. This will make a difference in completing each item on the return invoice.

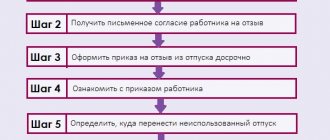

Operation sequence:

1. The name of the supplier or shipper is entered on the form.

2. The company address and bank transfer details are indicated in the paragraphs below.

3. When filling out the “Consignee” item, you must indicate the name and details of the supplier itself, which were previously stated under the contract. (Since he does not act as the person paying for all procedures for taxes and duties, because the buyer returns the previously paid products and all invested funds will be returned to him).

4. If the payment is not made, the “Payer” column does not need to be filled in.

5. Next comes the “Bases” column. It will be the basis and the most important point. Here it is necessary to describe in detail the reasons for returning the products, indicating all the accompanying documentation for the batch or individual products:

- numbers and dates of invoices, specifically returned goods and materials;

- number and date of the contract drawn up for this product or batch;

- a list of details of acts, defective statements, relevant letters and other documentation, taking into account the legislation or the existing contract.

For the compiled return invoice, a number is set, taking into account the existing numbering of this type of document in the company that compiled the acts. Additionally, if the return shipment is made by road, it is necessary to indicate the number and required date of the accompanying invoice. After which an invoice will be issued for transportation costs for the return transportation of the products.

It is also worth noting that:

- The specified product section is filled out taking into account the data on the invoices, which indicate defective consignments of goods that are already included in the buyer’s records. (Thus, the invoice should allow you to make up the percentage of previously delivered products and those that will be returned. All units of measurement and price for the product must be identical to what is in the invoice. Since the product will be returned under the same conditions as it was sent to the buyer ).

- After which the company representative and chief. accountant checks shipment. Recording compliance with signatures. There is also a need to record the process of receiving products by representatives of the transport organization.