What is an administrative fine

Administrative fines are the most common type of punishment in judicial practice and they perform several functions at once: punitive, compensatory and preventive. There are a huge number of types of offenses for which material penalties are imposed on individuals or legal entities and they are listed in the Code of Administrative Offenses of the Russian Federation

.

The most common of them:

- breach of public order or public safety;

- violation of trade or business rules;

- violation of deadlines for filing tax reports;

- violation of traffic rules;

- violation of copyright and related rights;

- unauthorized use of someone else's territory or land plot;

- beatings that caused physical pain, but did not entail the consequences already provided for by the Criminal Code of the Russian Federation, etc.

What fines are administrative?

An administrative fine, as established by the Code of Administrative Offenses of the Russian Federation, is a measure of punishment for non-compliance with labor, antimonopoly, tax, customs, land, labor, and housing legislation. Sanctions also apply for violations of consumer rights law or other areas of law.

Since recovery is carried out in cash, the following are taken into account:

- what was the administrative offense and its consequences;

- the number of similar crimes committed by the accused;

- type of entity - for individuals and legal entities, amounts may differ significantly.

Important!

A fine may be imposed in conjunction with other sanctions. According to the Code of Administrative Offenses, the only citizens for whom monetary liability is not established are conscripts of the Armed Forces and cadets of military educational institutions until the moment of signing the contract.

By the way, there is also an article that describes ways to check administrative fines.

What fines are administrative?

Administrative fines include fines applied for violations of antimonopoly, labor, land, family, housing, customs, tax legislation, the law on consumer rights and other branches of law.

Administrative penalty

When determining the amount, the following factors are taken into account:

- the nature of the act and the consequences created by it;

- similar violations of the law, if the person was previously held accountable for them;

- the subject by whom the violation was committed (individual, official or legal entity). Depending on the subject, different penalties are imposed and the amounts collected differ significantly.

Important! A fine for a misdemeanor can be applied not only as a separate punishment, but also as part of other sanctions. For example, for driving a car while drunk (in 2021, the permissible level of alcohol in the blood is equal to 0.16 mg of ethyl alcohol per 1 liter of air exhaled by a person), the driver can not only be fined, but also have his license withdrawn. Another example: if an enterprise fails to comply with environmental standards and labor protection standards, a penalty may be imposed on it simultaneously with the suspension of activities.

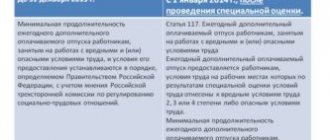

Imposition of an administrative fine below the lower limit

The Code of Administrative Offenses of the Russian Federation allows the authorized body to assign an amount of an administrative fine below the minimum limit, which is established by the sanction of the article of the Special Part of the Code of Administrative Offenses of the Russian Federation. In this case, Article 4.1. provides a list of circumstances that are taken into account. This is the exceptional nature of the circumstances associated with:

- the nature of the violation committed

- consequences of violation

- the identity of the offender

- property status of the offender

For a legal entity, these are the same circumstances, except for the individual. The property and financial position of the organization is taken into account.

So, a judge, body, official considering a case of administrative offenses or a complaint (when appealing a decision in a case) may impose an administrative fine in an amount less than the minimum amount of an administrative fine. But only if the minimum administrative fine is at least 10,000 rubles. for citizens. At least 50,000 rubles. - for officials. For legal entities – from 100,000 rubles.

However, in these cases, the amount of the administrative fine cannot be less than half that established by the sanction of the article of the Special Part of the Code of Administrative Offenses of the Russian Federation.

Minimum administrative fines in Russia in accordance with the Code of Administrative Offenses of the Russian Federation

- Fine for an individual - 500 (five hundred) rubles.

- Fine for a legal entity - 25,000 (twenty-five thousand) rubles.

- The fine for an official is 5,000 (five thousand) rubles.

In addition, Judges were allowed, in some cases, to reduce the minimum amount of administrative fines for legal entities and individuals within the framework of the federal and regional Code of Administrative Offences.

This possibility is provided in the presence of exceptional circumstances related to the nature of the offense committed and its consequences, the property and financial situation of the legal entity being held accountable.

Maximum fines

The maximum size is gradated depending on the subject of administrative responsibility:

- for citizens - no more than 5,000 (five thousand) rubles;

- for officials - no more than 50,000 (fifty thousand) rubles;

- for legal entities - no more than 1,000,000 (one million) rubles.

Establishing the minimum and maximum amounts of an administrative fine guarantees compensation not only for material damage caused by a citizen or legal entity to the state and society as a result of unlawful behavior (Part 1 of Article 3.5 of the Code of Administrative Offenses of the Russian Federation), which also corresponds to the public goals of guarantees of administrative liability and the goals of administrative punishment ( Article 3.1 of the Code of Administrative Offenses of the Russian Federation), but also allows the law enforcement officer to individualize the punishment, choosing exactly the one that corresponds to the committed illegal action (inaction).

In addition, depending on the form of calculation of the fine, it can be considered as a multiple of:

- the cost of the subject of the administrative offense at the time of completion or suppression of the administrative offense;

- the amount of unpaid taxes, fees payable at the time of completion or suppression of an administrative offense, or the amount of an illegal currency transaction;

- the amount of illegally obtained proceeds for a certain (established) period of time.

What determines the size of the administrative fine?

The choice of the amount of an administrative fine is made by the authority or court, which considers the case in accordance with the rules of jurisdiction of administrative cases. In this case, mitigating circumstances must be taken into account. As well as those that aggravate it.

The list of circumstances mitigating liability is enshrined in Art. 4.2. But at the same time, this list is open. That is, a court or an authorized body has the right to recognize one or another circumstance as a sufficient reason to reduce the amount of the fine. Article 4.2. The Code of Administrative Offenses of the Russian Federation indicates:

- offender's remorse;

- voluntary cessation of unlawful behavior;

- voluntary reporting by the offender to the authorized body about the administrative offense committed;

- assistance in establishing the circumstances of the case

- preventing harmful consequences of crime

- voluntary compensation for damage and harm

- voluntary execution of an order to eliminate a violation

- committing a violation in a state of passion (strong emotional excitement)

- the offense was committed due to difficult personal or family circumstances

- the offense was committed by a minor, a pregnant woman or a woman with a young child.

In practice, courts take into account the commission of an offense for the first time, and minor harm from the violation. Aggravating circumstances are established in Article 4.3. Code of Administrative Offenses of the Russian Federation. This is the repeated commission of a homogeneous offense, committed by a group of persons, in a state of intoxication, etc.

Minimum amounts of administrative fines in the Russian Federation for an administrative offense in 2021

The Russian Federation has adopted new minimum fines for administrative violations:

- For individuals – 500 rubles.

- For institutions and individual entrepreneurs – 25,000 rubles

- For persons holding responsible positions – 5,000 rubles.

Note. In some circumstances, judges have the right to reduce the minimum amount of penalties for individuals and institutions.

Maximum fine for an administrative offense in 2021

When carrying out more serious illegal actions, for example, in the foreign exchange sector, smuggling or other areas, the minimum threshold for penalties increases:

- For individuals, the amount of penalties increases to 200 minimum wages.

- For legal entities – up to 5000 minimum wage.

Note. When carrying out illegal actions in the field of taxation, the amount of the fine can reach the total amount of taxes not transferred to the Federal Tax Service.

Amount of fine for foreigners

The imposition and execution of an administrative fine for citizens of other states has several nuances:

- imposition of a fine as an additional penalty. Foreigners pay the sanction the next day after the decision. Failure to pay may result in an entry ban for 5 years;

- foreign carriers pay fines no later than the general deadline, but before the departure of their vehicles.

On a note! The court, federal (regional, municipal) officials, the Federal Tax Service, customs, and the Ministry of Internal Affairs have the right to impose penalties for an administrative offense.

Other ways to determine the amount of the fine

An administrative fine can be expressed as:

- in an amount that is a multiple of the cost of the subject of the administrative offense or the amount of unpaid and payable taxes, fees or customs duties (Article 9.17 of the Code of Administrative Offenses of the Russian Federation)

- the amount of the offender’s proceeds from the sale of goods (work, services), the initial (maximum) price of the civil contract,

- the amount of excess income, or the undeclared amount of cash or the amount of funds received from the budget of the budgetary system of the Russian Federation,

- the difference between the amount of the administrative fine that would be imposed for committing an administrative offense if reliable information necessary to calculate the amount of the administrative fine was provided, and the amount of the administrative fine imposed (Article 19.8 of the Administrative Code of the Russian Federation),

- cadastral value of a land plot (Article 7.1. Code of Administrative Offenses of the Russian Federation - unauthorized occupation of a land plot), etc.

These special rules for calculating the amount of a fine are also established by the article of the Special Part of the Code of Administrative Offenses of the Russian Federation. When drawing up a protocol on an administrative offense, the authorized body must indicate the article of the Code of Administrative Offenses of the Russian Federation. And the specific amount of punishment is chosen by the body (court) when considering the case in a resolution on an administrative offense.

Possibility of reducing the fine amount

The Code of Administrative Offenses in Article 28.6 of the Code of Administrative Offenses of the Russian Federation allows for the reduction of minimum fines, namely:

- Part 2.2. Code of Administrative Offenses of the Russian Federation. In the presence of exceptional circumstances related to the nature of the administrative offense committed and its consequences, the personality and property status of the individual brought to administrative responsibility, the judge, body, official considering cases of administrative offenses or complaints, protests against decisions and (or) decisions on cases of administrative offenses may impose a punishment in the form of an administrative fine in an amount less than the minimum amount of an administrative fine, if the minimum amount of an administrative fine for citizens is at least ten thousand rubles, and for officials - at least fifty thousand rubles.

- Part 2.3. Code of Administrative Offenses of the Russian Federation. When imposing an administrative penalty in accordance with Part 2.2 of the Code of Administrative Offenses of the Russian Federation, the amount of the administrative fine cannot be less than half the minimum amount of the administrative fine provided for citizens or officials.

- Part 3. Code of Administrative Offenses of the Russian Federation. When imposing an administrative penalty on a legal entity, the nature of the administrative offense committed by it, the property and financial position of the legal entity, circumstances mitigating administrative liability, and circumstances aggravating administrative liability are taken into account.

- Part 3.1. Code of Administrative Offenses of the Russian Federation. In cases provided for by Part 3 of the Administrative Code, administrative punishment is imposed in the form of an administrative fine. In this case, the amount of the imposed administrative fine must be the smallest within the sanction of the applicable article, and in cases where the sanction of the applied article or part of the article provides for an administrative penalty in the form of deprivation of the right to drive vehicles or administrative arrest and does not provide for an administrative penalty in the form of an administrative fine, administrative punishment is imposed in the form of an administrative fine in the amount of five thousand rubles.

Bodies considering administrative offenses cannot go beyond the maximum limits, but at their discretion, in exceptional cases, they can reduce the amount of fines by 50% of the lower limit.

Methods for checking fines

Punishment can be imposed for various offenses. The main percentage of decisions are in the field of traffic. As a rule, car owners are given 60 days to pay the fine, after which it is “transferred” to the bailiff service. Next, enforcement proceedings are initiated, and an enforcement fee is imposed on the citizen if he does not comply with the instructions of the bailiff.

You can check a person for fines using online services:

- State Services Portal.

After authorization, the user is taken to his personal account. If he filled out information about the presence of a car, then the system automatically provides information about the presence of fines by sending letters. If you need to check another car, then you need to use the “Check Fines” service.

After authorization, the “Get service” button will appear. Next, the system displays information about existing fines.

- Official website of the State Traffic Safety Inspectorate, service “Checking fines”.

To obtain information about fines, you must enter the vehicle number and series, and the vehicle registration certificate number. After analyzing the information in the database, the service produces the result.

- FSSP services.

Data Bank of Enforcement Proceedings

If the user enters the last name and first name, and also selects a territorial authority for the region, he will receive information about all enforcement proceedings initiated against him.

Where can I get the details?

The main document for paying a fine is a receipt. It is issued after the penalty has been imposed. The payment shall indicate:

- name of the financial and credit organization where the recipient has an account;

- account numbers for settlement and correspondence;

- TIN of the organization that issued the fine;

- amount to pay;

- type of administrative offense;

- Full name of the payer;

- registration address or place of residence of the offender.

Important! The receipt is proof of payment of the fine.

How to pay an administrative fine online?

You can consider the procedure for paying a fine online using the example of Yandex.Money services. The offender acts like this:

- Logs into your e-wallet.

- Selects the “Products and Services” section.

- Clicks on the “Fines” field.

- Indicates the TIN and the name of the recipient organization.

- Enter the amount of the fine.

- Confirms the transfer of funds.

How to pay an administrative fine through Sberbank Online?

You can pay fines through the bank app if the payer has a payment card or current account. To deposit funds you will need:

- Go through identification in your Personal Account - enter your login and password.

- Go to the “Payments” section.

- Select the subsection “Staff Police, duties, tax payments.”

- Select the institution that issued the fine.

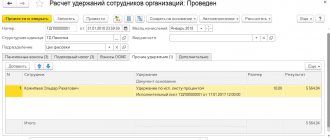

- Enter the details from the receipt or find the organization by TIN. Payment via Sberbank Online

Important! Money is transferred to the recipient only after the information is verified.

How to pay an administrative fine through State Services

On the State Services website, a registered user will need:

- After logging into the portal, select a section.

- Enter the operation parameters.

- Indicate in the columns information about the administrative violation and payment.

- Click on the “Search” field.

- Select a payment method - from a bank card or e-wallet.

- Enter the required details and click “Ok”. Payment of fines through State Services

Important! Information on liquidation of administrative liability debt will appear in the State Services database in 2 days.

How to pay an administrative fine through an ATM?

You can pay the fee for an offense at the terminal and ATM using one algorithm:

- Go to the device menu.

- Select the section “Taxes, fines, traffic police”.

- Select the desired organization.

- Specify the amount of the fine.

- Enter payer details.

- Insert money into the bill acceptor.

- Click “Ok” and pick up the receipt.

If you have a payment order, you can do the following:

- Find “Payments in my city” in the terminal menu. Select "Payments in my region"

- Click “Search recipient” and select “By QR code”.

- Bring the order to the scanner so that it reads the barcode.

- Confirm action.

- Deposit money and click OK.

On a note! Cardholders of a certain bank receive an SMS with a code that must be entered into an ATM or terminal.

How to pay an administrative fine without a receipt?

When the payer has lost or forgotten the receipt, you can contact the bank cash desk to pay the fine. You will need a passport, pension certificate and the name of the authority that issued the decision. The bank employee needs to be informed how much you need to pay.

On a note! If the protocol and receipt are lost, the violator can contact the institution that imposed the fine.

Features of checking fines on the official website of the traffic police

Advantages of the new method:

1. You do not need to undergo lengthy registration (as on the government services portal).

2. You can find out the traffic police fines for all drivers who drove the specified vehicle at different times.

3. The official website of the traffic police provides detailed information about the fine (including the article of the Code of Administrative Offenses under which the fine was issued).

Disadvantages of checking fines according to the state. number:

1. You cannot find out which driver of the car received a particular fine (if you drive the car alone, this is not critical).

2. You are required to enter the vehicle registration certificate number, but this is not a problem for the car owner.

3. If desired, other motorists can obtain information about your fines, and a little later I will tell you how.

How to find out traffic police fines by state. number

In order to find out the fines according to the state. car number, you will need only one document - a vehicle registration certificate. Prepare it before moving on to the next step.

In the window below, enter the data specified in the registration certificate of your car:

When all fields are filled in, click on the “Request” button.

Deadline for payment of an administrative fine

Regulatory acts of the Russian Federation allow 60 days to pay off an administrative penalty. In this case, after the announcement of the verdict, 10 days are given to appeal it. Thus, the violator has a total of 70 days to pay off the financial fine. If the debt repayment period is overdue, the bailiffs will be inactive for the first month. However, they will then take the following actions against the borrower:

- First, the debtor will be awarded another fine, usually in the same amount.

- The materials on the debtor will be re-sent to the judicial structure.

- Thus, a debt not paid on time may double in size already in the first overdue month.

- Repeated failure to repay the financial penalty may result in the offender being arrested for 15 days.

Methods of paying an administrative fine

Any person who is imposed an administrative penalty must pay it off on time, otherwise he faces additional punishment in a more severe form.

The most common type of administrative punishment is a traffic police fine for non-compliance with traffic rules. This penalty is applied to prevent similar actions by the motorist in the future. In case of such a violation, the traffic police inspector draws up a protocol in which the violator must sign.

The protocol should display the following information:

- Date and place of execution of the document.

- FULL NAME. and the position of traffic police inspector.

- FULL NAME. and contact information of the driver who committed the offense.

- FULL NAME. and contact information for witnesses and victims (if any).

After a court order is issued to impose a penalty, the violator has the right to appeal the court decision within 10 days.

Judicial structures have 3 months at their disposal to force the violator to pay the fine, otherwise more severe penalties will be applied to him, including arrest.

How to pay such a fine in order to prevent further troubles?

It should be noted that today there are many ways to pay off debts to government agencies, using various online resources that provide services for transferring debts on fines without leaving home. To do this, you need to have a computer or mobile application and an Internet connection.

Among the most common ways to pay off administrative fines are the following:

- Service "Government Services".

- Sberbank Online.

- A number of payment systems, for example, Yandex money, QIWI.

Service "Government Services"

This service belongs to the official government resource called electronic government.

The resource provides a search for outstanding fines and their payment. The advantage of this resource is that no commission is charged when transferring funds.

To use the Gosuslugi portal, you must first register on it. After registration, opening the site, you need to find the required tab, fill in the driver's document number and car number.

The user will see a page displaying information about outstanding penalties, indicating the order number, date and location of the traffic violation.

To make a transfer to pay off a fine, you need to click on the “Pay” button located next to the name of the resolution.

Sberbank Online

This resource provides payment of administrative penalties online. Sberbank clients registered on the website have a personal account where they can make payments from a plastic card via the Internet.

To transfer money to pay off a debt, you need to select the “traffic police fines” tab in the “payments” section. Then you need to fill out information about transport and details of the punishment order. You can make another payment online in the same way.

Payment of administrative penalties is carried out by debiting funds from the client’s Sberbank account. Therefore, users are required to have the required amount in their account. The transfer is completed within 24 hours; no commission is charged when paying a fine.

Yandex money

To pay penalties using the Yandex resource, the user is required to register an account in the system.

First, you need to use the search mode to check for any outstanding debt. To do this, enter the driver's document number or vehicle registration certificate in the form that opens. The user will see a page with outstanding debts.

To pay off the debt, you need to click on the “pay” column. Money is debited from the payment system account or from an attached bank plastic card. The money transfer operation is carried out within a few minutes, the transfer fee is 1%.

Wallet – QIWI

The procedure for paying off fines in this resource is similar to the resource on Yandex. There is also a function to check for fines and transfers.

A traffic violation violator will need to fill out a form with the number of the resolution, the amount of the fine and the date of the violation.

Among the named fine payment services, Qiwi is the least popular payment system, since the transfer fee is 3%. To close the debt, you can use a bank plastic card, a Qiwi wallet account, or Web Money.

Minimum amounts of administrative fines in the Russian Federation

Deadline for payment of an administrative fine

The Russian Federation has established new minimum fines for administrative offenses, which are:

- 500 rub. for individuals;

- 25 thousand rubles. for legal entities;

- 5 thousand rubles. for officials.

Note! In some cases, judges have the right to reduce the minimum amount of monetary penalties for individuals and companies.

Possibility of reducing fines

Courts and bodies considering administrative cases, in accordance with Article 4.1 of the Administrative Code, have the right, in the presence of exceptional circumstances, to reduce the amount of monetary penalties depending on the nature of the offense and its consequences for society, the financial situation and personality of an individual to less than the minimum, if, in accordance with The minimum sanction of the article is 10 thousand rubles or more. In this situation, the recovery cannot be less than 50% of the minimum (that is, at least 5 thousand rubles).

For an official, this limit can also be reduced by 50% of the minimum if he pays a fine of 50 thousand rubles. For legal entities, in exceptional cases, the court may accommodate and reduce the amount by 50% of the minimum, if the minimum penalty is 100 thousand rubles.

If a monetary punishment was imposed in accordance with Art. 28.3 of the Code of Administrative Offenses of the Russian Federation without drawing up a protocol, then it should be minimal.

Maximum fine

If a more serious offense has been committed in the currency, customs (smuggling) or other areas, then for individuals the maximum limit increases to 200 times the minimum wage, and for legal entities - 5000 times the minimum wage.

Note! If a violation of the law related to taxation has been committed, the amount of recovery may be equal to the total amount of taxes unpaid to the treasury.

Recovery to the maximum

Features of checking fines online

A fine is imposed for committing an administrative offense. After recording it and putting it on record, the official must bring the information to the guilty person. That is, the document is sent by mail or handed over against signature.

Those citizens who do not receive letters or do not live at the registration address need to check for debts using online services.

But if on the traffic police website and on the State Services portal you find out all the information in the latest data mode, then the bailiffs will have information about fines only after 60 days for voluntary payment have expired.

The second feature of online checking is that the data provided by the resource is for informational purposes only. In other words, if a citizen wants to appeal the decision, he will not find it. To do this, you need to contact the authority that issued the document.

Circumstances mitigating administrative liability

According to Article 4.2. The Code of Administrative Offenses of the Russian Federation recognizes the following as circumstances mitigating administrative liability:

- repentance of the person who committed the administrative offense;

- voluntary cessation of unlawful behavior by a person who has committed an administrative offense;

- voluntary reporting by a person who has committed an administrative offense to the body authorized to carry out proceedings in the case of an administrative offense, about an administrative offense committed;

- provision by a person who has committed an administrative offense of assistance to the body authorized to carry out proceedings in the case of an administrative offense in establishing the circumstances to be established in the case of an administrative offense;

- prevention by a person who has committed an administrative offense of the harmful consequences of an administrative offense;

- voluntary compensation by the person who committed the administrative offense for the damage caused or voluntary elimination of the damage caused;

- voluntary execution, before a decision is made in a case of an administrative offense, by a person who has committed an administrative offense, of an order to eliminate the violation issued to him by the body exercising state control (supervision) and municipal control;

- committing an administrative offense in a state of strong emotional excitement (affect) or due to a combination of difficult personal or family circumstances;

- commission of an administrative offense by a minor;

- commission of an administrative offense by a pregnant woman or a woman with a young child.

The advantage of checking fines through Cheklik

When you need objective information about an individual, which will be collected in one place, use the Cheklik online service.

To perform a search, you must enter the following information:

- Surname;

- Name;

- Reportable;

- Date of Birth;

- Search region.

After the user clicks the “Check” button, the system will process the request and display the result in the form of a report.

Our advantages:

- 24/7 online and telephone support;

- Refund if false information is found;

- Using only verified, official sources to search for information.

You will find out all the information about existing fines, including those that were transferred to the bailiffs, and will have the opportunity to pay off the debt before an enforcement fee is imposed on you.

You may also be interested