There is no new news this year regarding payments for child support. There have been no significant innovations regarding this issue. Despite this, there are still some minor changes.

Depending on the situation and conditions, the minimum amount of child support may be increased and the payment deadlines extended. What is meant here is that it is possible that payments will be collected even after the “child” turns 18 years old. The same goes for government. payments as child benefits. Such assistance is guaranteed and is paid in the amount of minimum alimony when the debtor parent avoids paying the due money.

Grounds for paying alimony

In Russia, the basis for paying alimony is various documents. It is clear that the obligation to support children is established a priori. But you can demand its execution only on the basis of the following documents:

- alimony agreement;

- court order or writ of execution.

The list of documents is exhaustive. Thus, no verbal agreements matter. Consequently, there is no point in talking about such a concept as the minimum amount of child support based on an oral agreement.

How to apply for alimony?

First of all, if an agreement is not reached between the parents on the voluntary maintenance of their common children, then a demand for an agreement on payment is being prepared to the second party, who is evading their obligations to support the child. The demand is sent by registered mail with notification, or delivered against signature, or a receipt of disagreement with the terms of the demand is requested. These actions will subsequently serve as the basis for filing a lawsuit in court.

Further, based on the stated claims, the court issues a court order for the forced collection of alimony established by the court. The order establishes both the amount and procedure for payment of alimony - either in a fixed payment or depending on a share of earnings. In addition to the order, you need to obtain a writ of execution and submit it to the bailiff service.

List of documents for registration of alimony

In order for the court to make a decision to collect alimony from the father in favor of his minor child, the following documents must be prepared and submitted to the court in accordance with Article 132 of the Civil Procedure Code of the Russian Federation: a claim with claims, a certificate of family composition, a birth certificate, a certificate of income from work or from social security, certificates of civil status (divorce, marriage), notice of an attempt to conclude an agreement, passport, petitions to attract witnesses and request documents from the plaintiff.

If payments occur on the basis of an agreement

In an alimony agreement certified by a notary, the parties can set the amount of payments at their discretion. This will be the minimum child support.

It must be taken into account that the level of alimony in 2021, paid on a voluntary basis, must correspond to the amount of funds that the minor would receive by court decision.

Thus, the mother and father cannot agree on monthly payments in the amount of, for example, 500 rubles. Judicial practice shows that more money should be recovered.

So, if the minimum payment of alimony on a voluntary basis must correspond to payment in a judicial manner, then it is worth considering in more detail the amount of funds that can be collected on the basis of a court decision.

Amount of alimony in 2017

This year it is planned to submit bills regarding payments to deputies for consideration. There are no guarantees that the alimony amendments will be adopted, but there is still hope. They will touch on issues such as:

- tightening sanctions for defaulters;

- establishing minimum alimony payments in 2017;

- increasing the age of the child to whom money must be paid.

In 2014, the Concept of Family Policy of the Russian Federation was adopted, which establishes in Section VII the need to absolutely eliminate the situation when children do not receive or do not receive enough maintenance from their father or mother. The peak implementation of the document falls in 2021.

Many deputies propose to amend the concept in terms of creating an Alimony Fund, identical in structure to the Pension Fund. The association must accumulate subsidies received from the state and other payments paid to persons who do not receive child benefits.

Minimum by court

A working parent is usually obligated by the court to pay for the maintenance of a minor in shares of his or her income. How much will be the minimum amount of alimony in 2021 with this procedure for withholding funds? Everything will, of course, depend on the salary of the alimony provider. It is different for everyone, therefore, the deductions are also different.

Let us remind you that you are supposed to give ¼ share of your income for one child. for two – 1/3, for three – ½. Percentage: 25, 33, 50.

If payments are made in shares, then the minimum amount of alimony per child cannot be less than 1,875 rubles.

Where did this amount come from? Calculations were made based on the minimum wage established in the country. At the time of writing this article, this amount for which it is permissible to work is 7,500 rubles. We divide it by 4 and get the above result, showing the minimum payments for 1 child.

Respectively:

- for 2 children they will withhold 2,500 rubles;

- for 3 – 3750 rubles.

We can say that the minimum amount of alimony collected from a working person is exactly 1875 rubles. But this, as should be understood, does not mean that the payment of alimony by a person receiving, say, 100 thousand rubles monthly can be equal to the specified amount. No, such a payer will be required to pay, at a minimum, if he has one child, a quarter of his income. However, Russian law provides for such a mechanism as reducing the amount of payments. We will touch on that too.

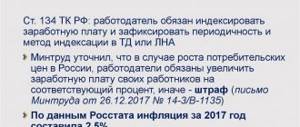

Indexation of payments

According to statistics from last year, more than 2 million children did not receive child support due to evasion of payers. Moreover, more than 1/5 of these children live in large families that are in poverty. The Government of the Russian Federation has strengthened measures to protect the rights of minor children:

- toughen the punishment in case of non-payment of alimony by the direct debtor;

- significantly reduce the number of minors who do not receive child support in full.

Currently, there is a social program in which minor children receive financial assistance from regional budgets. This assistance is provided in the amount of the minimum subsistence level.

According to the RF IC, it is necessary to recalculate child support payments in accordance with changes in the economic situation; for this purpose, alimony is indexed in a fixed amount. Recalculation occurs based on changes in the minimum subsistence level.

The minimum subsistence level in the Russian Federation is:

- for the working population 8885 rubles;

- citizens retiring RUB 6,785;

- minor citizens – 7899 rubles;

- The average minimum subsistence level is RUB 8,192.

These figures may vary depending on the region.

Minimum fixed amount

The current law provides that some individuals may be charged a fixed fee for alimony, that is, not a percentage of income, but a fixed amount of money.

This option for paying alimony is established for persons who:

- have unstable earnings;

- receive income in the currency of foreign countries or some other things.

What will be the minimum in this case? Judges usually focus on the cost of living. This social indicator is also being developed for children. Based on the following:

- both parents must support their sons and daughters;

- parents may have unequal financial situations;

- parents may have different marital status.

Other factors are also taken into account.

A typical situation is when the alimony payment is an amount equal to half the minimum wage provided for the normal existence of a minor. Half is given by the father, half by the mother. Everything is fair.

But there are situations when the fixed amount is less than ½ the cost of living. For example, if the father’s income is so low that it does not even reach 1 minimum wage. For example, the payer is engaged in entrepreneurial activity, but is not very successful.

Thus, it is quite difficult to say what the minimum alimony payment will be if the funds are withheld in a fixed amount. We can only say unequivocally that this amount will be proportional to the cost of living.

Methods for calculating alimony payments

Since the cost of living differs in each region of the state, the minimum payment for child support may vary. The judge has the right to increase or decrease this payment, guided by the arguments of each party. The living conditions of both parents are also taken into account.

In principle, there are three ways to calculate payments for children. These include :

- a fixed amount of money;

- property option;

- interest collected from wages.

Regarding recovery options, they remain the same as always. That is, either the parent pays the required amount on a voluntary basis, or the money is collected forcibly.

Exactly how much a parent who abandoned his child must pay depends on his salary. Additionally, this amount should include a percentage of bonuses, additional payments and other allowances received in addition to the salary. The same rules apply to the salary a person receives for part-time work.

Payments may be collected from scholarships and pensions.

There are a number of payments for which child support is not charged, such as payment for the loss of a breadwinner. The same applies to people who receive:

- unemployment benefits, disability benefits;

- income from business activities;

- royalties for author's works;

- income from GPC agreements, including the sale of real estate.

In addition, alimony is not paid:

- from humanitarian aid;

- from survivor assistance;

- from one-time compensation.

Before filing a child support claim against a working person, parents are always strongly advised to find a compromise on the amount to be paid.

This makes it much easier to argue about this in the future.

It is worth noting that this amount cannot in any way be lower than 25–50% of a person’s income according to Article 81 of the Family Code of the Russian Federation.

Minimum wage for an unemployed person

The minimum amount of alimony in 2021 will depend on the level of average salary established in the country. This is due to the mechanism for calculating the amount of alimony from the unemployed. The mechanism is quite interesting. You need to know the following about it:

- Child support payments are not made to the unemployed. It's logical. If a person has no income, then he has no reason to allocate money to support anyone.

- Debt is accumulating. The parent cannot pay now, but this does not mean that he can be exempted from payments in the future. The rights of the child must be respected.

- Debt calculation is calculated based on the average salary in the country or region. At the moment, the average wage in the country is more than 30 thousand rubles. If we take the average income by region, then in Moscow and St. Petersburg you will have to pay more money, because the salary is higher.

Thus, we can name the approximate amount of minimum alimony for the unemployed. If we start from the amount of 30 thousand rubles, it turns out that 7.5 thousand rubles will need to be paid for 1 child. An amount of money that is equal to the minimum wage rate. In general, if there is an obligation to pay alimony, then it is better to work somewhere, otherwise you will have to pay 1 minimum wage, and the lack of income will not be a valid reason.

Who is obliged to pay alimony in the Russian Federation?

Financial assistance is funds that must be collected from a parent who cannot pay for his maintenance. Compulsory payment is imposed on the parent from whom child support is not voluntarily received. He will not spend money on supporting his own child. It doesn’t matter whether he works only occasionally or is unemployed. An unemployed person has even more payment obligations.

Payment of funds sometimes has nothing to do with the children. There are situations when adult citizens are ordered to pay funds for the maintenance of their adult relatives who have currently lost their ability to work. They can also apply for alimony in order to support their former or current spouse in difficult times for them.

Child support will be collected from almost everyone, including the unemployed. The main thing is that there is a correct evidence base, according to which some family member needs financial support, and the second has obligations to him. And the status of unemployed will not help to avoid liability if a claim is filed.

Should we wait for a new law?

The minimum amount of child support in 2021, apparently, will not be prescribed in any legislative act. At the beginning of the article it was stated that attempts were made to amend the legislation by establishing a certain minimum amount of child support, but the new law was not adopted. Most likely, minimum child support in 2021 will also not be enshrined in law.

The reason is simple: significant social stratification of society. First, there is a huge gap between the incomes of the richest and the poorest. Let's take, for example, into account the proposed minimum payment rate - 15 thousand rubles. People with high incomes will try to qualify for minimum payments. For a person receiving 1.5-2 minimum wages, 15 thousand rubles is an unaffordable amount. You will have to give away your last earned money in order to satisfy the interests of the child. If you place a lower rate, there is a risk that the interests of the minor will be violated.

There is also a territorial stratification. In Moscow and St. Petersburg, however, in general, the incomes of residents are higher than in the regions. It is easier for a resident of the capital to pay 15 thousand per month than for a resident of the Urals, for example.

Comments from family law experts are similar. Now is not the time to make such changes. This is why the new 2021 law on alimony was not adopted. Bills were rejected in previous years as well.

The question was also raised about having the state, to some extent, albeit minimal, fulfill obligations for the defaulter. However, this proposal was rejected by legislators. The maximum that was done was to establish an increased amount of benefits.

Categories of relatives applying for alimony

The following categories of citizens have the right to receive alimony:

- children, until they reach 18 , or, if the child is studying full-time at a university, then until they reach the of 23 . Both “natural” children and adopted children have the right to alimony, regardless of whether the parents/adoptive parents are divorced or not;

- spouse, regardless of whether a divorce has been filed or not;

- parents, guardians or adoptive parents in case of loss of ability to work.

Below the lowest limit

Above, an attempt was made to determine the minimum amount of alimony payments in various cases. But the RF IC contains a rule that once again emphasizes that it is important to say exactly what the minimum amount of payments will be. The last thing is about Art. 119 RF IC. It is she who establishes the grounds for reducing the amount of payments. And they are as follows: a change in the position of the parties. First of all, financial and family.

For example, if a parent pays, as it seems, minimal alimony, then its amount can be reduced further if the following grounds exist:

- the occurrence of a serious illness requiring expensive treatment;

- the appearance of new dependents, for example, a son or daughter in a second marriage;

- opening a business activity for minors entitled to alimony payments;

- transition of a minor to state support;

- increase in the income of the recipient of funds, etc.

In each specific case, the court carefully examines the factual circumstances of the case, analyzes the evidence and decides whether the amount of payments can be reduced or not.

That is, a certain minimum amount of child support can be designated based on a specific case, but without generalizing all situations together. Changes to legislation are not expected in the near future.

From what funds is alimony deducted?

Withholding of alimony is not recorded from all the money available to the defendant. There is a special list for 1996, which can become the basis for withdrawing alimony if it is not paid. A more modern document that lists the sources from which alimony will be collected is the Federal Law “On Enforcement Proceedings”. Also in the text of this document they say which incomes are inviolable when alimony will be collected.

Knowing what income is considered taxable is important, because if the money is deducted incorrectly, there will be a risk of debt due to non-payment. And for late payment, a penalty may be charged. Then the alimony payer will find himself in an unpleasant position.

Collection from the debtor

Every year, the Government takes a number of measures that tighten the consequences for alimony defaulters. But the number of willful defaulters is decreasing quite slowly.

In 2021, the following amendments were made to the Civil Code of the Russian Federation, the Investigative Committee of the Russian Federation and the Criminal Code of the Russian Federation:

- information about the presence of alimony debt is now sent not only to airports and international railway and bus stations, but also to traffic police officers;

Since January 16, 2016, they have new powers - now they can confiscate rights if the total amount of alimony debt from the driver is more than 10 thousand rubles .

- there are certain restrictions in the provision of some public services;

For example , it is quite difficult for a debtor to obtain a foreign passport.

- the amount of penalties for each day of delay in alimony has increased significantly;

Now the debtor will have to pay 0.5% of the debt amount for each day of delay.

- the movement of the debtor's funds may be seized, as well as his property;

- the defaulter may be subject to criminal prosecution;

Based on Art. 157 of the Criminal Code of the Russian Federation , for failure to pay alimony he may be sentenced to forced labor for 1 year .

- the defaulter may be deprived of parental rights under a simplified procedure.

If alimony arrears arose not as a result of malicious intent, but due to a coincidence of circumstances, the defaulter will have to prove this fact in court. He won’t even be able to get his rights back without a court decision!

Do you know if there is a risk of criminal liability for non-payment of alimony? See about this in the article: can they be sent to prison for non-payment of alimony. What is malicious evasion of alimony payment is written here.

Do you want to understand how to pay child support if a person does not work officially? Read here.

Bill on a fixed amount of alimony

Article 83 of the Family Code provides for a situation where alimony is paid in a fixed amount. This option is possible if:

- the parent does not have an official place of work;

- wages are paid in foreign currency or in kind;

- earnings are not stable and depend on the scope of work performed (piecework).

In simple terms, making alimony payments is difficult due to the lack of a stable financial situation.

If one of the parents is not officially employed and does not have a stable income, and cannot provide the child with normal payments for subsistence, the court, based on the article, decides to assign a fixed amount.