Downloads: 299

(with the establishment of allowances, bonuses and additional payments; with the condition of salary indexation)

1. GENERAL PART

1.1. This Regulation on allowances has been developed in accordance with the Labor Code of the Russian Federation and other norms of the current labor legislation of the Russian Federation.

1.2. For the purposes of these Regulations, remuneration is understood as a system of relations associated with ensuring the establishment and implementation by the employer - ______ "________________" (name of the organization - employer) of payments to employees for their work in accordance with laws, other regulatory legal acts, this Regulation on bonuses and labor contracts.

1.3. The organization establishes the following payments to employees for their work (wages):

— official salary;

— allowances for professional skill, urgency of the work performed, complexity of the assigned task, due to the division of the working day (shift) into parts, for irregular working hours;

- additional payments when combining professions and performing the duties of a temporarily absent employee, for overtime work, for work on weekends, with a reduced working day;

- bonuses based on the results of work, for exceeding the task, for compliance with safety regulations, for the highest performance in work in the relevant profession, for an anniversary, for conscientious performance of job duties. The above allowances, additional payments and bonuses are paid to employees in the cases and in the manner provided for by these Regulations on allowances.

The employer has the right to establish new types of allowances, additional payments, bonuses by amending this Regulation on allowances.

1.4. Payment of wages in the organization is made in cash in rubles.

At the written request of the employee, remuneration may be made in other forms that do not contradict the law (by providing food, with the exception of alcoholic beverages, etc.). The share of wages paid in non-monetary form cannot exceed 20 percent of the total wages.

1.5. When paying wages, the employer is obliged to notify each employee in writing about the components of the wages due to him for the relevant period, the amounts and grounds for deductions made, as well as the total amount of money to be paid.

The form of the pay slip is approved by the employer.

1.6. Wages are paid directly to the employee at the place where he performs the work (transferred to the bank account specified by the employee) on the ____ and ____ days of the month. Non-monetary wages are paid in the same manner. If the payment day coincides with a weekend or non-working holiday, wages are paid on the eve of this day.

Payment for vacation is made no later than three days before it starts.

1.7. Deductions from an employee's salary are made only in cases provided for by the Labor Code of the Russian Federation and other federal laws.

1.8. The total amount of all deductions for each payment of wages cannot exceed 20 percent, and in cases provided for by federal laws, 50 percent of wages due to the employee.

In some cases established by the legislation of the Russian Federation, the amount of deductions from wages cannot exceed 70 percent.

Deductions from payments that are not subject to collection in accordance with federal law are not allowed.

1.9. Upon termination of the employment contract, payment of all amounts due to the employee from the employer is made on the day the employee is dismissed. If the employee did not work on the day of dismissal, then the corresponding amounts are paid no later than the next day after the dismissed employee submits a request for payment. In the event of a dispute about the amount of amounts due to the employee upon dismissal, the employer undertakes to pay the amount not disputed by him within the period specified above.

1.10. Wages not received by the day of the employee’s death are issued to members of his family or to a person who was dependent on the deceased on the day of his death. Payment of wages is made no later than a week from the date of submission of the relevant documents to the employer.

1.11. In case of failure to fulfill official duties due to the fault of the employer, payment is made for the time actually worked or work performed, but not lower than the average salary of the employee calculated for the same period of time or for work performed.

In case of failure to fulfill official duties for reasons beyond the control of the employer and the employee, the employee retains at least two-thirds of the salary. In case of failure to fulfill official duties due to the fault of the employee, payment of the normalized part of the salary is made in accordance with the volume of work performed.

1.12. Downtime caused by the employer, if the employee warned the employer in writing about the start of downtime, is paid in the amount of at least two-thirds of the employee’s average salary.

Downtime due to reasons beyond the control of the employer and employee, if the employee has warned the employer in writing about the start of downtime, is paid in the amount of at least two-thirds of the tariff rate (salary). Downtime caused by the employee is not paid.

What are incentive payments?

The employees of any enterprise are its most important resource, since the success of the company depends on how effectively a person works. The main task of the organization's management is the effective use of personnel, but for this a person must be interested in performing his duties at the highest level. For this purpose, various measures of labor incentives are used - establishing rewards for achieving certain results.

According to labor legislation, wages consist of several components:

- A basic part that has a strictly established meaning. It can be expressed in tariff rates, salaries, piecework payments.

- Compensatory payments, for example, such as for work in difficult climatic conditions.

- Incentive accruals, which are additional incentives for work performed.

Article 144 of the Labor Code states that the employer has the right to award bonuses to employees and assign them additional payments. The sizes and shapes are established taking into account the opinion of the representative body of workers, agreements, collective or labor contracts. Incentive payments in 2021, terms of appointment and procedure for application are established:

- The Government of the Russian Federation, if funding comes from the federal treasury;

- government bodies of a single entity when making payments from the regional budget;

- by local governments, if subsidies are provided from the local budget.

Difference from compensation payments

Remuneration for work under special conditions or conditions different from usual ones is called compensation payments. These include:

- surcharges for persons engaged in heavy, harmful or dangerous work;

- remuneration for work in areas with special climatic conditions;

- overtime work;

- work on weekends, non-working days, holidays;

- night work;

- bonus for mobile or traveling nature of work;

- remuneration for shift work;

- performing work of various qualifications;

- combination of professions.

Being one of the parts of remuneration, compensation has a number of differences from incentive measures:

- If incentive incentives are assigned at the request of the company’s management, then compensatory incentives are mandatory and are reflected in law.

- Incentive rewards have a strictly limited amount, which is prescribed in local regulations. The amount of compensatory additional payments is not tied to any figures and may vary.

- Compensations directly depend on the working conditions, while various reasons may be used for assigning additional incentive payments.

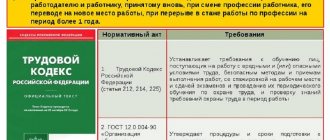

Regulatory framework

The main legislative act that prescribes the possibility of awarding incentives to a person for his work in 2021 still remains the Labor Code (Articles 129, 135, 144, 191). Particular attention should be paid to the Unified Recommendations for the establishment of remuneration systems for employees of state and municipal institutions at the federal, regional and local levels. They are approved annually by a decision of the Russian Tripartite Commission for the Regulation of Social and Labor Relations. It consists of the Government of the Russian Federation, trade unions and employers.

In addition, each industry has its own recommendations, for example:

- Order of the Ministry of Health and Social Development of the Russian Federation dated June 28, 2013 No. 421.

- Letter of the Ministry of Education and Science of the Russian Federation dated June 20, 2013 No. AP-1073/02.

- Appendix 3 to the Order of the Ministry of Emergency Situations No. 545 of September 22, 2009

Regulations on incentive payments

As before, incentive payments in 2021 are determined based on developed performance criteria. They are recorded in the Regulations, and must also be clear to all employees who have the right to apply for this type of additional payment. In addition to this, an individual map of key performance indicators, or KPIs for short, is developed for each employee. The indicators set there must be achievable so that there is a real possibility of motivating employees.

To objectively assess the abilities of each employee, analyze his professional growth, responsibility, organization, ability to plan his work activity and a number of other indicators, a point system of personnel incentives is used. When using it, each employee of the company receives marks for their work, which are used to calculate bonuses. Within the framework of the assessment company, its own scale is being developed, and each one is prescribed an exact characteristic for each point.

The points earned are recorded in special evaluation forms. Subsequently, when summing up the results, they are used by the balance commission to determine the exact amount of remuneration. An important point is that any employee has the right to familiarize himself with the assessment of his professional activities, and if he disagrees, he can always file an appeal.

The regulations do not have a set form and are developed at each enterprise individually. It can be part of a collective agreement, is developed with the participation of representatives of the workforce and cannot worsen the working conditions of employees. The main points reflected in the document include:

- information about employees who are eligible for bonuses;

- data on the composition of the award and its funding resources;

- scheme and criteria for calculating the allowance;

- what goals are achieved through the use of incentive measures;

- appeal procedure.

Incentive criteria for health workers

Recommended lists of indicators with criteria for their implementation and assessment in points for different positions are indicated in Order of the Ministry of Health of the Russian Federation dated June 28, 2013 No. 421. Examples of such indicators:

- participation in disease prevention;

- reduction in morbidity and mortality rates;

- number of diseases detected in time;

- the fact of timely hospitalization;

- compliance with sanitary norms and medical standards;

- the presence of incorrect diagnoses or complications as a result of prescribed treatment;

- presence of patient complaints;

- the total amount of time worked for the period.

Order No. 421 also describes the features of the performance assessment procedure, the coefficients applied depending on the position, and the maximum amounts of points awarded.

Read more about incentive payments to healthcare workers here.

What applies to incentive payments in 2021

In order to stimulate work, various types of additional payments are provided:

- Premium. There are one-time and regular bonuses. The first option has a personalized accrual nature and is set directly by the manager. Regular bonuses are part of the remuneration system. Their size is indicated as a percentage of the tariff rate or salary. The frequency of appointment is regulated by local regulations in agreement with employees and/or trade union organizations. Periodic bonuses are taken into account when calculating an employee's average earnings. If controversial issues arise, the problem is dealt with by a labor dispute commission or court.

- Additional payments and allowances. They can be established both by the employer himself, for example, for skill or professionalism, and at the legislative level - for title, academic degree, length of service. To calculate additional payments, an order or order is issued.

- Reward. It is set at the discretion of the employer and is fixed in local regulations. It can be timed to coincide with a specific event, for example, a professional holiday, or it can be paid to all employees at the end of the reporting period (thirteenth salary).

Results

The provision on incentive payments plays a very important role in the process of forming a remuneration system for any employer, influencing the employee’s direct interest in the results.

In relation to state unitary enterprises and municipal unitary enterprises, the creation of such a document is mandatory due to the existing legislative prerequisites for their application of a unified wage system, including additional incentive payments. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who sets incentive payments and how?

In most organizations, incentive salary bonuses are based on the quality of work performed, high professionalism and achievements, length of service and the presence of an academic degree. According to the Labor Code, in 2021, as in previous years, the employer has the right to assign additional payment. Through negotiations with employee representatives, the amount and procedure for payments is established. The incentive process is reflected in local regulations, which may be an Employment Contract, Regulations on Material Incentives, and Regulations on Remuneration.

Additional payments may also be assigned at the request of the immediate supervisor. To do this, an order is issued for the department and provided to the head of the company along with the justification. The latter can be a score sheet or other documents that can be used to determine the effectiveness of the person applying for the award.

OTHER PAYMENTS TO EMPLOYEES

6.1. The employer also undertakes to pay employees severance pay and other compensation payments in cases and in the manner established by the legislation of the Russian Federation.

7. EMPLOYER'S RESPONSIBILITY

7.1. For delays in payment of wages and other violations of wages, the employer is liable in accordance with the labor legislation of the Russian Federation.

7.2. In case of delay in payment of wages for a period of more than 15 days, the employee has the right, by notifying the employer in writing, to suspend work for the entire period until the delayed amount is paid.

Performance criteria

Certain incentive payment criteria are used to assign remuneration in 2021. They form the basis of uniform recommendations and are used to assess the quality of work performed:

| Principle | The essence |

| Objectivity | The amount of remuneration is assigned based on a fair, impartial assessment of the performance of the enterprise as a whole and each of its members individually, without infringing on anyone’s rights. |

| Predictability | Each person should be informed about how much he will receive for his work. |

| Adequacy | The amount of the incentive should correspond to the work done. |

| Timeliness | The reward must be paid after achieving the agreed results. |

| Transparency | The system for forming and calculating incentive measures should be clear to every applicant. |

Employee Scorecard

Based on the fulfillment of the performance criteria defined above, incentive payments are distributed among the company's employees. To record the degree of their implementation, a score sheet is used. The form of the document itself is not regulated by any legislative acts, but is necessarily prescribed in local regulatory documentation, for example, in the Regulations on incentive payments.

As practice shows, it is convenient to design a Sheet in a tabular form. Here the serial number and name of the criterion itself, its description are recorded. The following indicates the rating scale that is used by the employee to evaluate his performance according to each of the criteria. The document is personally signed by the employee and his supervisor. After this, the Sheet is transferred to a specially created commission, which makes its mark on the quality and effectiveness of the specialist’s work. Depending on the assigned point, a reward is awarded.

The role of incentive provisions in salary calculation

The Regulations on Incentive Payments is a document, the presence of which is necessary to include in the employee’s salary that part of it that is defined as incentive in the Labor Code of the Russian Federation.

According to Art. 129 and 135 of the Labor Code of the Russian Federation, wages consist of:

- from the salary itself (salary or rate), determined by the qualifications of the employee and the characteristics of the work he performs;

- compensatory additional payments for special working conditions;

- incentive additional payments aimed at encouraging employees to work more efficiently;

- social benefits, in certain situations compensating for loss of income.

Stimulating in accordance with Art. 129 of the Labor Code of the Russian Federation can become:

- additional payments;

- allowances;

- bonuses;

- other payments.

They are divided into established ones:

- legislatively - for title, degree, category;

- independently - annual bonus, additional payments for length of service, quality, intensity of work or specific achievements.

For information about what payments form the composition of labor costs for the purposes of calculating income tax, read the article “Art. 255 of the Tax Code of the Russian Federation (2017): questions and answers.”

Each employer bases its incentive mechanisms on its own methodology, outlining both the main criteria for which the employee should be rewarded and formulas for determining the amount of remuneration depending on the quantitative or qualitative characteristics of this criterion. A document such as the regulation on incentives is devoted to defining these criteria and the methodology for their application.

Incentive payments to public sector employees in 2018

Compensation and incentive payments to public sector employees differ in each specific organization. Everyone without exception has the right to receive remuneration. This applies to those who are permanently on staff and to those who work part-time. When calculating remuneration, economic standards and indicators of a budget organization are taken as a basis. Not the least place in the range of incentive measures is given to one-time bonuses, for example, for a professional holiday or due to the achievement of any special results.

The amount of remuneration is individual depending on the institution. Mostly, an independent scale of criteria is developed and a certain amount of the bonus is indicated, which depends on the fund of the budgetary organization. All incentive measures are reflected in the Regulations adopted by each individual institution. The document is drawn up by the employer in accordance with labor legislation. It must be agreed upon with trade unions. When forming an incentive system, they are guided by the orders of relevant ministries and departments.

Who is entitled to

There is no clear formulation in the legislation of who is considered a public sector employee in Russia, but in a number of legal acts that relate to remuneration and labor incentives, this concept is used. For a more precise determination, the main criterion is the sources of funding, that is, the allocation of money from the budget (federal, regional, local). It is customary to include the following employees as state employees:

- federal government agencies (customs service, tax authorities, treasury employees, etc.);

- education systems at all levels (teaching staff of universities, teachers, kindergarten teachers, their assistants);

- citizens involved in healthcare (doctors, nurses, medical and social experts);

- sanatoriums and holiday homes;

- social services;

- scientists and cultural figures;

- civilian personnel of military units;

- some executive branch employees.

Types of incentive payments to public sector employees

The management of public sector organizations independently determines the types of incentives for their employees. Conventionally, they can be divided into several groups:

| Group | Incentive options |

| Intensity |

|

| Quality |

|

| Experience |

|

| Awards |

|

Features of the appointment in 2021

Depending on the specifics of the institution’s functioning, its own criteria are developed to determine whether incentive payments can be accrued in 2021 to a specific employee or the team as a whole. Along with this, we should not forget that the amounts of the allowance provided for by the collective agreement or other local acts may be reduced or even canceled. These issues are discussed, and the minimum and maximum thresholds for deprivation of bonuses must be indicated (usually in percentage terms).

Conditions leading to partial or complete non-payment of remuneration are:

- violation of production discipline;

- failure to fulfill official duties;

- failure to comply with safety regulations and internal regulations;

- reduction in the quality of services provided;

- the presence of complaints from third parties;

- damage to the organization's property.

Incentive payments for middle and senior level teachers

Providing bonuses to education workers helps motivate them to work productively and helps increase the staffing level of educational institutions, preventing staff turnover. Incentive measures give the employer the opportunity to attract more qualified teachers to educational activities who are not afraid of innovation, introduce their own methods, and use a non-standard approach to teaching. Until 2008, teachers were not accrued incentive payments at all, whereas now, in 2021, their value can reach 30–35% of wages.

The procedure for calculating additional payments is reflected in internal regulations, and in order to receive remuneration, teachers are subject to certain requirements, for example, such as:

- regular professional development by taking relevant courses at least once every three years;

- self-education, development and improvement of professional qualities;

- participation and speaking at seminars, teacher councils, conferences;

- additional classes for talented students and children from disadvantaged families;

- organizing student employment by creating exhibitions of achievements;

- selection of young people to participate in olympiads, competitions and competitions;

- conducting excursions, visits to recreational, educational and creative events outside the walls of the educational institution;

- conducting electives and clubs;

- working with parents and involving them in the lives of students;

- holding meetings and cooperation with the parent committee;

- monitoring the progress of students.

- How to make mustard from dry powder

- Bilirubin in the blood - normal table for children and adults. Causes of increased bilirubin in the blood and how to reduce it

- Medicine for sinusitis

For preschool teachers

Working with young children is a responsible job, so the state is trying in every possible way to attract talented and creative citizens to this. Since raising children is a socially significant activity, the incentive system for preschool employees consists of various payments:

- one-time and regular bonuses;

- remuneration for length of service;

- allowances for qualification category;

- additional payments for merit and work done.

The incentive process, the amount and frequency of funds accrual are reflected in local documents. In 2018, educators who not only conscientiously perform their duties, but also:

- apply new, innovative pedagogical developments in working with children, which lead to positive results;

- encourage parents to participate in the life of the team;

- carry out additional work with children and their parents who find themselves in difficult situations.

Medical workers

According to labor legislation, in 2021, remuneration for employees of medical institutions consists of several parts:

- basic (salary, tariff);

- compensation;

- incentive reward;

- social benefits.

Of the above-mentioned accruals, only incentive payments are regulated by the administration of the medical institution (head of the clinic, head physician of the hospital). All the rest are under the jurisdiction of federal and regional authorities. When determining the procedure for calculating incentive measures, and they are enshrined in local regulations, each employee is individually provided with all the information regarding the possibility of receiving bonuses.

The amount of additional payments does not have fixed values and depends on the volume of services provided. To do this, an order is issued monthly, indicating the employees and the amount of incentives. The amount of incentive additional payments is established by the administration of the institution independently, but with an eye to the Regulations and methods developed by the Ministry of Health. The following are taken into account:

- assessing the effectiveness of a health worker;

- compliance with standards in the field of medicine and healthcare;

- actual time worked.

Particular attention is paid to work efficiency, which is difficult to determine. For this reason, medical institutions use a special technique that helps determine the reliable results of the work of employees of medical organizations. To sum up, take into account:

- presence of patient complaints;

- making inaccurate diagnoses;

- untimely hospitalization;

- identification of complications resulting from drug treatment or surgery;

- number of identified diseases, etc.

Civil servant

In 2021, the amount of incentives for civil servants will vary depending on the department. So, for example, for employees of the Ministry of Labor they will be approximately 30% lower than for employees of the Ministry of Finance. The amount of remuneration in the central office will be greater than that of their colleagues in the regions. If funds from local budgets are used to pay bonuses, then the amount of bonuses will directly depend on the capabilities of the treasury of each subject.

Other incentive measures are based on length of service, when performing complex or important tasks, or for special conditions of service. They can be paid monthly or at other intervals, or they can be accrued as a one-time payment. All this information is reflected in the regulations of a particular department. The amount of additional payments in 2021 depends on various factors and can vary within different limits, for example:

- for length of service - from 10 to 30%;

- for special conditions of service – 60–200%;

- when working with classified information – from 5 to 75%.

Employee bonuses

2.1. This Regulation provides for monthly bonuses, bonuses based on the results of work for the year, as well as a one-time bonus, which can be given for specific successes or achievements in the work of a particular employee, and can also be timed to coincide with significant events - public holidays, anniversaries of an industry or an autonomous institution.

2.2. Bonuses are paid to employees of the autonomous institution [name of institution] if the following conditions are met:

— high-quality and timely performance of functional duties defined by approved regulations and job descriptions; high-quality preparation of documents;

— high-quality and timely implementation of work plans, resolutions, orders and instructions of the head of a departmental higher organization, director of an institution, immediate supervisor on issues within the competence of the employee.

— proper preparation and execution of reporting, financial and other documents in a timely manner;

— demonstrated initiative in performing job duties and making proposals for better and more complete resolution of issues;

— observance of labor discipline, ability to organize work, emotional endurance.

2.3. The amount of the monthly bonus for employees of institutions is [value]% of the established official salary, taking into account allowances and additional payments to it, subject to the fulfillment of the conditions specified in clause 2.2. of this provision.

2.4. The amount of the bonus paid at the end of the year is [value]% of the established official salary, taking into account allowances and additional payments to it, subject to the fulfillment of the conditions specified in clause 2.2. of this provision.

2.5. For employees whose labor results can be assessed by objective indicators (quantitative, qualitative, volume), the amount of bonus payments is established in accordance with such indicators.

2.6. For employees whose work cannot be assessed at each stage, the amount of bonus payments is established depending on their personal contribution to the overall result of the work of the autonomous institution “[name of institution]”.

2.7. Managers and specialists of the main divisions are rewarded for the performance of these divisions.

2.8. Managers and specialists of auxiliary sections are rewarded for the results of the work of the main divisions in which they belong.

2.9. Payments of one-time bonuses and their size are determined on the basis of the order of [name of the manager's position] at the expense of the wage fund, within the approved allocations to employees who are on staff as of the date of publication of the order or order, with the exception of employees on leave without pay, including child care.

2.10. A one-time bonus is not paid to employees working in a position for less than one month, with the exception of employees hired by transfer from another structural unit of the institution.

2.11. If the bonus indicators provided for in paragraphs 2.2 - 2.4 of these Regulations are not met in full, the bonus to employees is reduced or not paid in full.

2.12. The basis for calculating the bonus is the data of accounting and statistical reporting, operational accounting. Bonuses are awarded for actual time worked.

2.13. When calculating bonuses to employees, in addition to tariff rates and salaries, additional payments provided for in Section 4 of these regulations are taken into account.

2.14. Bonuses are awarded to employees on the staff of the autonomous institution [name of institution].

2.15. Bonuses can also be paid to employees with whom a fixed-term employment contract has been concluded to perform certain work.

2.16. The decision on bonuses for employees who are not on staff is made by [name of manager's position].

2.17. For employees holding full-time positions with part-time work, including part-time work, the amount of bonus payments is established on a general basis and depends on their personal contribution to the overall results of the work of the team of the structural unit of the institution.

2.18. For persons newly hired at the autonomous institution “[name of institution],” a monthly bonus may be paid for less than a full month at the discretion of the head of the relevant structural unit.

2.19. For persons hired at the autonomous institution “[name of institution]” during the year, the bonus paid based on the results of the year’s work may be paid for an incomplete year at the discretion of the head of the relevant structural unit.

2.20. For persons who have worked for less than a month or a year due to admission to an educational institution, retirement, dismissal due to staff reduction and other valid reasons, bonuses are paid for the time actually worked.

2.21. Prizes are not paid:

- employees who have committed absenteeism;

- employees who show up to work in a drunken state;

- employees who were absent from work without good reason for more than 3 hours continuously or cumulatively during the working day;

— employees brought to disciplinary or financial liability during the billing period.

back to contents

Accrual procedure

Since, unlike compensation, incentive measures directly depend on the employer, their size and calculation procedure are under his control. The algorithm of actions has been perfected over the years and consists of several successive stages:

- To begin with, a special commission is created, which includes representatives of the team - from the administration to ordinary workers.

- Next, the commission considers the case of each employee individually.

- After a detailed analysis, a decision is made to reward the employee in a certain amount for the results he has achieved.

- An order is issued.

- Remuneration is paid based on the approved order.

How is the commission formed?

Before the commission begins to act, a general production meeting is held, which decides by voting who will be part of its composition. Mandatory members of the commission are:

- director/founder of the enterprise;

- Deputy Head;

- trade union representative;

- employees of the labor collective (at least 3 people).

After the final composition of the commission is formed, the first meeting is held, at which organizational issues are considered, and a chairman is elected. His responsibilities include:

- holding meetings;

- distribution of responsibilities between members;

- registration and storage of individual employee cards;

- studying the documentation and submitting it to the commission for consideration.

The commission itself is in charge of:

- counting employee points (if a point system is used);

- determining objectivity when assessing the quality of the applicant’s work;

- making a decision on charging a premium;

- determining the amount of remuneration;

- registration of the protocol.

Drawing up a protocol

In order to make payments, an order is issued for the enterprise. The basis for this is the protocol adopted by the commission. It is signed by all members of the commission without exception. The document must contain the following information:

- name of the institution;

- date of the meeting;

- the names and initials of members who voted and representatives who were absent;

- personal data of each employee to whom remuneration is accrued;

- method of decision making (voting, by counting points, etc.);

- amount of funds to be accrued.

Order for the enterprise

After holding a meeting of the commission, summing up the results and signing the protocol, an order is issued for the enterprise. It is approved by the manager, after which the accounting department calculates the remuneration. The document contains the following information:

- full name of the organization whose employees receive remuneration;

- employee data (last name, first name, patronymic, position);

- amount of incentive paid;

- date of signing the order;

- signature of the manager and its transcript;

- company seal.

Regulations on non-material incentives (example of development)

The regulation on non-material incentives establishes the rules for non-material incentives for employees and the procedure for forming the part of the compensation package consisting of non-material incentives.

The regulations are approved by the head of the organization and put into effect by order.

1. General Provisions

* In the “General Provisions” section, indicate the main goals and objectives of its development, as well as from which fund the cost of non-material incentive measures is paid.

1.1. This provision describes the principles and rules for the distribution of non-material remuneration and the procedure for forming a compensation package in the part consisting of non-material incentives for employees of the organization “……….”.

1.2. All employees can be rewarded for conscientious work and achieved economic, material, financial and other results.

1.3. The allocation of funds to reward employees is provided for during the distribution of profits by directing part of the profits to a special fund for non-material incentives for employees. The non-material motivation fund is formed based on the results of each financial year and is approved by the general meeting of shareholders and managers of the organization. If there is no profit in the Company, a non-material incentive fund is not formed.

2. Structure of the non-material incentive system

2.1. The non-material incentive system is formed from the following main types of non-material incentives:

2.1.1. Employee incentives:

– public recognition – public recognition of the results of employees’ work in the form of gratitude (clause 3.1.); – awarding – issuance of status insignia, certificates, diplomas (clause 3.2.); – valuable gifts – presentation of souvenirs, coupons for the purchase of valuable items, etc. (clauses 3.3. and 3.4.);

2.1.2. Change in the status of an employee - promotion, rotation or other change of position or activity desired by the employee (clause 3.5.).

2.1.3. Employee training – internship, participation in seminars, trainings, advanced training (clause 3.6.).

2.1.4. Organization of corporate leisure activities - field trips and other events, competitions with the participation of close relatives, exhibitions and competitions for children of employees (clause 3.7.);

2.1.5. Benefits not provided for by the Labor Code of the Russian Federation - providing employees with non-state pension fund programs, benefits on loans, life insurance, financial assistance, etc. (clause 4.)

2.2. Additional measures include a variety of low-budget employee incentive programs (clause 5.).

3. The procedure for applying the main non-material incentives

* In the section “Procedure for applying the main non-material incentives”, describe:

– procedure and rules for conducting incentive events; – terms and conditions for the use of one or another type of incentive; – a list of documents describing the rules and regulations for the use of non-material incentives (if the organization has them).

3.1. The following types of public recognition can be applied to all groups of employees:

– declaration of gratitude for the conscientious performance of labor duties, namely: for saving the organization’s funds, innovation, and rationalization activities. – inclusion on the Board of Honor for conscientious performance of labor duties, namely overfulfillment of the production plan, early implementation of the production plan, improvement of the quality of products (services provided, work performed). – awarding a Letter of Gratitude for long and impeccable work, conscientious performance of job duties for three years. – awarding a Certificate of Honor for long and impeccable work, for conscientious performance of labor duties for five years. – awarding the title “Best Professional of the Year” for conscientious performance of work duties, professional excellence, achievement of high professional results and indicators.

3.2. Employees are awarded insignia (organization badge “……”, cups, certificates and diplomas) in case of participation and winning places in corporate professional and sports competitions or other competitions.

3.3. Employees are awarded with valuable gifts on their anniversaries (45, 50, 55, 60, 65 years). The cost of gifts for all anniversaries is the same and is determined depending on the size of the non-material reward fund.

3.4. Employees are awarded valuable gifts for conscientious performance of work duties, high performance results and creative achievements.

3.5. Changes in the status and position of an employee are made in accordance with the rules and regulations approved in the Regulations on the personnel reserve of the organization “……..”.

3.6. Personnel training is used as a method of non-material incentives in accordance with the rules and regulations approved in the Regulations on the training of personnel of the organization “………”.

3.7. In order to unite the interests of employees and the organization, to express gratitude to employees for their work, the organization carries out:

– events in honor of annual public holidays (New Year, Defender of the Fatherland Day, International Women’s Day); – events to honor the organization (Birthday of the organization, Anniversary of the organization); – events to honor employees (Award Ceremony “Best Professional”); – events for entertainment and uniting the interests of employees (offsite events, sports and professional competitions, professional competitions); – events with the participation of family members (drawing competition for children of employees).

4. The procedure for applying benefits not provided for by the Labor Code of the Russian Federation

* In the section “Procedure for applying benefits not provided for by the Labor Code of the Russian Federation” describe:

– list and composition of basic benefits not provided for by the Labor Code of the Russian Federation; – list and composition of additional benefits that apply only to certain categories of employees; – rules and conditions for the distribution and application of benefits

4.1. The basic compensation package for all categories of employees of the organization who have completed the probationary period, in addition to material remuneration, includes the following benefits not provided for by the Labor Code of the Russian Federation:

– corporate transport services from metro stations; – gym membership; – the opportunity to purchase products produced by the organization at a discount (the amount of the discount for employees is established by local regulations of the organization); – connection to corporate cellular communications with preferential rates. The categories of employees who are provided with preferential terms for paying for cellular communications are established by local documents based on the order of the General Director; – voluntary health insurance (VHI); – free food in the canteen; – free use of hot drinks vending machines (tea, coffee).

4.2. For some categories of employees, the basic compensation package may be expanded with the following additional benefits:

4.2.1. Rental compensation

The organization compensates 100% of the cost of renting housing for the general director and his deputies, as well as 30% of the monthly cost of renting housing for department heads.

For other categories of employees, housing rental compensation is possible by order of the general director, if the hired employee is from out of town and is not able to come to the office by transport every day.

4.2.2. Payment for taxis and provision of official transport

Payment for taxi services or provision of official transport for delivering employees to the airport, train stations when sent on a business trip is made for the list of employees in accordance with Appendix 1.

For other categories of employees, these services can be provided by written order of the General Director based on a request from the immediate supervisor.

4.2.3. Employee insurance

The organization provides insurance for individual employees against accidents. In this case, the insurance risks against which insurance is carried out in accordance with the insurance contract are:

– partial loss of ability to work as a result of an accident; – permanent total disability as a result of an accident; – death of the insured person as a result of an accident.

Insurance amounts are established depending on groups of employees in accordance with Appendix 2.

4.2.4. Lending to employees.

Employees whose salary is at least 40,000 rubles are provided with loans from the organization “………” for the purchase of housing and other movable property.

The terms of the loan, the interest rate and other requirements are established by local regulations of the organization and are provided on the basis of an order from the general director.

If an employee leaves the organization before the final loan payment is due, his obligations to the organization remain regardless of the reason for the dismissal.

4.2.5. Issuance of financial assistance

Financial assistance is provided to employees of the organization “……..” whose monthly remuneration does not exceed 30,000 rubles, in the following cases:

– death of a close relative (parent, spouse, child, brother/sister) in the amount of 10,000 rubles; – upon the death of the employee, the employee’s family is paid financial assistance in the amount of 20,000 rubles.

The basis for payment of financial assistance is the provision of a death certificate of a relative/employee to the personnel department.

4.2.6. Additional benefits upon retirement:

The organization pays an additional pension to employees whose work experience in the organization is more than 20 years. The amount of the preferential pension is calculated in accordance with the local acts of the organization on the basis of the order of the general director. An employee retiring is awarded a personal certificate of honor and a corporate medal. After finishing work in an organization due to retirement, an employee can be invited as an expert or mentor to train interns and young professionals as a freelance employee. The procedure for concluding an employment agreement with retired employees is carried out in accordance with the norms of the labor legislation of the Russian Federation. 4.2.7. Separate parking space for vehicles

Parking on the office premises is provided only for company cars of employees holding positions from group leader and above.

The reserve of free and vacated parking spaces is reserved for new employees hired for corresponding positions or for those employees who received a promotion based on the results of the final annual personnel evaluation.

After dismissal, demotion, moving to another city to work in a division of the organization, or for other reasons of absence from work at the central office for more than three months, the coupon for a parking space on the territory of the organization is canceled.

4.3. These benefits are distributed among employees based on the Table of distribution of additional benefits not provided for by the Labor Code of the Russian Federation (Appendix 3) depending on:

– labor achievements; – work experience in the organization; – positions.

5. The procedure for applying additional non-material incentives

* In the section “Procedure for applying additional non-material incentives”, describe:

– composition of additional incentives, rules and conditions for their application; – persons to whom additional incentives apply; – rules for using additional incentives.

5.1. The list of non-material incentives, which are developed to diversify the system of non-material incentives for employees and meet the individual needs of, if possible, all categories of employees, includes:

– championship challenge cup for the achievements of the week; – photo session with a professional photographer in the studio; – tickets to the cinema, theater, concert; – rare professional books; – corporate car for everyday use; – corporate car with driver; – voucher to the sanatorium; – personalized work chair and custom-made furniture; – publication of an article about an employee in a corporate publication; – coupons for the purchase of valuables; - a dream come true; – special birthday.

5.2. This list is used by the heads of departments and the personnel department in addition to the main compensation package, as auxiliary means for stimulating employees to perform and exceed work, work outside working hours, as compensation to employees if they used their own equipment, tools, cars to perform work tasks.

5.3. When choosing non-material incentives from the list given, department heads and personnel department employees select from one to several incentives, without exceeding the limit established for each category of positions in accordance with Appendix 4.

5.4. The selected non-material incentives are approved by the HR director and transferred to the HR department employees for implementation.

5.5. The list of non-material incentives can be supplemented by decision of the General Director based on certain requests and wishes of the organization’s personnel, identified during a survey and questionnaire of personnel.

6. Requirements for the design and implementation of events

* In the “Requirements for registration and implementation of events” section, please indicate:

– basic requirements and procedure for filing a submission (petition) when applying certain types of incentives, benefits and additional incentives; – rules and terms for approval of submissions (petitions); - the method of their approval.

6.1. Incentive measures are not applied to employees who have committed at least one disciplinary offense during the assessed period and have received a disciplinary sanction in connection with this, since the indispensable basis for the application of incentive measures is the conscientious performance by the employee of his work duties.

6.2. Conscientiousness is the performance of labor duties by an employee in accordance with the requirements for the performance of his work, in compliance with the rules and regulations established by the employment contract, job description, internal labor regulations, instructions and requirements for labor protection and other documents.

6.3. A proposal for all types of incentives and a request for the inclusion of additional benefits in the basic compensation package are drawn up by the employee’s immediate supervisor and submitted to the HR director for approval. After that, the HR department submits the agreed submission (petition) to the General Director for approval.

6.4. The idea of applying incentive measures that require monetary investment is agreed upon with the accounting department of the organization.

6.5. During approval, the personnel department and accounting department have the right to require the compiler to provide additional documents and explanations confirming the existence of grounds (motives) for rewarding the employee.

6.6. Based on the agreed submission, the personnel department prepares a draft order to reward the employee (or employees) and submits it to the general director together with the submission.

6.7. Based on the agreed petition for the inclusion of additional benefits in the employee’s basic compensation package, the personnel department prepares a draft order for the inclusion of additional benefits in the compensation package and submits it to the general director together with the petition.

6.8. The application for non-financial incentive measures is submitted by an authorized person for approval no later than two weeks before the incentive is applied to the employee.

6.9. The period for approval by the accounting department is five days from the date of receipt of the submission. The accounting department forwards the agreed upon submission to the HR department.

6.10. Terms of approval with the personnel department:

– three days from the date of receipt of a proposal agreed with the accounting department on the application of measures of material incentives for the employee (employees); – six days from the date of receipt of the notification on the application of moral incentive measures to the employee (employees).

6.11. The General Director, within five days from the date of receipt of the proposal for incentives and the draft order to reward the employee (or employees), and if there are grounds, reviews and issues an order to reward the employee (or employees).

6.12. The General Director, within five days from the date of receipt of the request for the inclusion of additional benefits in the basic compensation package of the employee (or employees) and the draft order and if there are grounds, considers and issues an order for the inclusion of additional benefits in the basic compensation package of the employee (or employees).

6.13. The order to encourage the employee (employees) is presented against signature within three days from the moment the order is signed by the General Director. The contents of the order are brought to the attention of the workforce at a general meeting of employees or by posting a corresponding announcement on the Information Board and the organization’s corporate website.

6.14. The employee’s work book and personal card contain information about awards and other incentive measures provided for by the legislation of the Russian Federation, as well as collective agreements, internal labor regulations of the organization, the charter and regulations on the discipline of the organization “………..”.

7. The procedure for implementing the norms and rules of the Regulations

* In the section “Procedure for implementing the norms and rules of the Regulations”, indicate the person responsible for planning, organizing and implementing measures for non-material incentives for employees. Describe the rules and terms for planning, organizing and implementing non-material incentives for employees

7.1. The heads of departments, in agreement with the HR director, plan a monthly package of non-material incentives for subordinate employees based on the results for the month and submit it to the HR department for approval.

7.2. The HR department plans, organizes and conducts all activities provided for in these Regulations.

7.3. In some cases, provided for by the budget, the HR department may engage third-party organizations to provide services for organizing corporate events.

7.4. A plan of activities and regulations for their implementation is drawn up by the personnel department and approved by the director of personnel one year after summing up and reporting for the past financial year.

Methodology for calculating the value of reward points

In 2021, a special fund is being formed at each enterprise (department) to accrue incentive payments. Its size is determined individually by the management of each institution and depends directly on the wage fund. Provided that the organization uses a point system to determine incentive compensation, the value of one point is used to calculate the exact amount of the additional payment.

The amount of 1 point is calculated in this way:

- the amount of funds from the payroll to be paid is determined;

- all points that were awarded to all employees of the organization are summed up to calculate bonuses;

- the amount of planned money is divided by the number of points.

The amount obtained as a result of mathematical operations is the price of one point. After that, it is multiplied by the number that a particular person earned. The total amount will be considered a material incentive reward. So, for example, if the cost of 1 point is 235 rubles, and their total number, determined based on the results of the commission’s work, was 120, then the total amount of accruals will be equal to 28,200 rubles. (235 x 120 = 28200).

POST SALARY

2.1. The monthly official salary of an employee of an organization is determined in the employment contract with him and cannot be lower than the minimum wage established by federal law.

The amount of an employee’s monthly official salary depends on his qualifications, the complexity of the work performed, the quantity and quality of labor expended, and is not limited to the maximum amount.

The monthly official salary does not include additional payments, allowances and bonuses, other compensation and social payments.

2.2. Due to the increase in consumer prices for goods and services, the monthly official salary of the organization’s employees is indexed quarterly (every six months) by increasing by ___ percent.