- Can debt collectors call a debtor?

- Can debt collectors call relatives?

- Can debt collectors sue?

- Can debt collectors sell debt?

- Can debt collectors come to your home?

- Can debt collectors collect debts?

- Can collectors seize accounts or cards?

- Can debt collectors call you at work?

- Can debt collectors describe property?

- What should you remember when dealing with debt collectors?

The history of the existence and activities of collection agencies in Russia is relatively short, just over 15 years.

They owe their existence to the rapid growth of consumer lending at the beginning of the 2000s. The presence of credits and loans also implies debts of borrowers to creditors (banks, microfinance organizations). Collectors are the connecting link in the “Credit institution – Borrower” formula, where funds are returned first, and convenient return conditions are provided second. Collection agencies are understood as organizations whose main activity is the collection of overdue debts from borrowers. Despite the fact that collection agencies began their activities 15 years ago, there was no regulatory framework for their activities in Russia. Accordingly, the methods and means of returning funds went beyond the legal field and were more similar to methods from the “nineties”: death threats, damage to property, psychological and physical violence.

A “breath of fresh air” for borrowers who are unable to repay their financial obligations was the adoption of Federal Law No. 230 in 2021. The law, popularly nicknamed the “Law on Collectors,” outlined the methods and methods of collecting overdue monetary obligations, as well as requirements for collection organizations.

The time has passed when the activities of collection agencies were perceived solely as “knocking out” debts. To create a civilized market for collection services in Russia, a professional association of collectors, NAPKA, began to operate in the country. The Federal Law included the requirements necessary for conducting collection activities. The law also imposes requirements on the identity of the collectors themselves. Persons with a criminal record are prohibited from interacting with borrowers.

Let's figure out what collectors have rights to and what they don't?

Can debt collectors call a debtor?

According to Russian federal law, creditors can contact debtors through personal meetings, telephone calls, as well as telephone, telegraphic, and postal messages. Collectors do not have the right to communicate via messages and calls with the following groups of people:

- with citizens declared bankrupt;

- with persons recognized as incompetent or partially capable;

- with persons undergoing treatment in inpatient facilities;

- with disabled people of group I;

- with minors (except for emancipated ones).

The law clearly defines how often and at what time the collector has the right to call the debtor. Debt collectors do not have the right to disturb with their calls at night. The permitted time period for such calls is strictly defined: from 8.00 to 22.00 on weekdays and from 9.00 to 20.00 on weekends and holidays

.

Quantitative criteria for calls to the debtor are established by law. For telephone calls – no more than 1 time per day, no more than 2 times per week and 8 times per month

.

Text messages asking to repay an overdue loan can be used no more than 2 per day, 4 per week and 16 per month

.

An important point: collectors can call and write to the debtor within 4 months from the moment the loan is overdue, after which the debtor has the right to refuse to communicate with collection agency employees.

To protect the rights of debtors who have not fulfilled their obligations on time, the legislator included in the law a list of unacceptable actions of debt collectors:

- methods of physical influence and psychological pressure;

- deception and misleading the debtor regarding the size of the unfulfilled obligation, terms, expected consequences, etc.

Stories often appear in the press when collectors pester not only the debtor with calls, but also his close relatives. The real question is, do they have the right to do this?

Get a free consultation

Should a debtor be afraid?

Can agency employees file a claim with a court and ensure that the debtor bears criminal liability for non-payment of the debt? This question is very popular, since such threats are considered the main technique. It is necessary to realize that the relationship between the debtor and the creditor is at the administrative level, but not at the criminal level.

IMPORTANT! In order for employees or the bank to be able to prove fraud (in this case the punishment is a real sentence), a large amount of work will be required.

The point is that if the client has made the minimum payment at least once, then according to the law there is no criminal intent in his actions. Therefore, there is no criminal liability for failure to pay an overdue debt. The only decision that can be made by the court is to repay the debt.

Can debt collectors call relatives?

There are often cases when, in the event of a loan being overdue, collectors contact not only the debtor himself, but also his relatives, employer, friends and even neighbors.

In 2021, rules were introduced into federal legislation according to which any interaction between debt collectors regarding the collection of overdue debts with members of the debtor’s family, as well as other third parties, is carried out only if the following conditions are met:

- there is the debtor’s consent to interact with third parties;

- there is no disagreement of third parties to interact with creditors.

- This norm is aimed at protecting the interests of the citizen and his private life.

Forgiveness promotions from the agency

According to the terms of each promotion, the agency can forgive up to 50% of the amount of the obligation, including interest, penalties and fines accrued by the bank on an overdue loan. Sometimes it turns out that the client, having taken advantage of the promotion, actually pays only part of the debt, without interest previously accrued by the bank. It all depends on the situation and repayment terms. For example, the EOS company regularly holds similar promotions. We treat people who find themselves in difficult situations with understanding. We always take an individual approach to solving a specific problem and strive to achieve a positive result in favor of the client. Therefore, if you want to repay your obligations on the most favorable terms, keep track of current offers on the website or just call the EOS contact center. We will be happy to offer you the best way to pay off your debt!

Can debt collectors sue?

An overdue loan debt may become the basis for filing a claim in court demanding collection of the debt not only by the bank, but also by a collection agency.

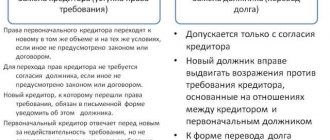

As a rule, collectors are involved in the pre-trial resolution of a financial dispute about loan repayment on the basis of an agency agreement, i.e. the creditor actually gives the debt collector the right to negotiate with the debtor on his own behalf. In this case, negotiations are conducted exclusively to repay the overdue debt through personal meetings, calls and messages. Without the right to file a claim in court. This right remains the right of the bank (MFI) that issued the loan (loan).

If the bank resells the debt to a collection agency under an assignment agreement (assignment of rights to claim the debt), the latter has the right to go to court to resolve the financial dispute. The trial takes place without the participation of the disputing parties. The court issues a writ of execution based on the documents attached to the statement of claim. The borrower is given 10 days from the moment the judge signs the writ of execution to contact the Federal Bailiff Service and repay the debt. If the defendant does not protest the order, the writ of execution comes into force.

If the defendant objects, the case is filed in court. However, the writ of execution does not cancel the legal consequences, but only suspends its effect until a new hearing is held, where the court decides whether to uphold the order to cancel the writ of execution or leave it unchanged.

There is a statute of limitations, after which legal recovery is considered impossible. It lasts 3 years and is counted from the date of termination of the agreement, or from the moment of making the last payment on the existing loan.

Why do debt collectors call you?

If a person has not paid his loan for a long time, it is not surprising that one fine day collectors may call him. As a rule, banks first try to contact an undisciplined borrower on their own, but if he does not make contact, they turn to collectors for help. There are two possible work schemes here:

- Agency contract. The agency represents the interests of the bank and acts on its behalf. The money needs to be returned to the bank.

- Assignment agreement. The bank assigns the right to claim your debt obligations to the collector, after which you must repay the loan to the collection agency to which the rights of claim were transferred.

Can debt collectors come to your home?

Yes they can. At least there is nothing illegal about it. One of the ways of interaction between the collector and the debtor is personal meetings.

Such “visits”, as a rule, are used as the highest measure of influence on persons for whom other methods of influence (telephone calls, messages) no longer work. Typically, such meetings take place in the form of a conversation between the collection agency employee and the debtor regarding the return of overdue debt. It is worth noting that the collector is an ordinary civilian who is not vested with special powers. In this case, an employee of a collection agency has no more rights than any other guest who comes to your doorstep. Therefore, he can even cross it only with the permission of the owner. The legislator also limited the number of personal meetings - no more than once a week.

Get a free consultation

What to do if you encounter unscrupulous debt collectors

Unfortunately, sometimes you can encounter company employees who violate the rules of law, ethics and morality. If strangers come to you and introduce themselves as collectors, but at the same time violate your rights with their actions, are rude and threatening, disclose personal information, and provide knowingly false information - these are unscrupulous employees or even scammers. Stop communicating with them immediately. Any self-respecting agency values its reputation and works exclusively within the law and in the interests of people. If you note violations of the law, you can fill out a complaint using the NAPCA “Welcome to Complain” service: https://zhaloba.napca.ru/ or contact law enforcement agencies.

Relations between collection agencies and clients must be respectful, mutually beneficial and within the bounds of the law. In case of reasonable behavior, the borrower has every chance to cope with a difficult financial situation if he deals with professional collectors. The EOS Agency is interested in solving your problem and is ready to help. We are committed to constructive dialogue! For advice, please call 8.

Can debt collectors collect debts?

Collectors can collect debts under an overdue monetary obligation only by a court decision. Collection agencies do not have the right to independently write off funds from accounts in order to pay off an existing debt.

If the court makes a decision on the forced collection of an overdue debt, a sum of money (equal to the amount of the obligation) may be written off from the debtor’s accounts.

If the debtor does not have enough funds to repay the debt, then the law provides for the withholding of part of the wages in favor of the creditor. The amount of such write-off cannot exceed 50% of the salary itself. However, there are categories of citizens with a “preferential” amount of wage deduction (for example, if there is a dependent in the family whom he provides, the amount of write-off should not exceed 30% of the salary).

What to do if collectors call after the trial

The optimal course of action depends on what exactly the court hearing decided. If, as a result, the judge left the issue in the hands of your former creditors or a change of party (procedural succession) occurred in the decision made, then the call from the collectors is completely legal.

If the calls are legitimate.

Hiding from agency employees is not a good idea. Fear is a natural reaction to what happened, but there is no point in giving in to it and panicking. The collection agency, operating in accordance with the law and the NAPCA code of ethics, does not aim to intimidate the borrower, but to help him and provide more favorable conditions than the original creditor. Working with agents such as EOS may be more beneficial than dealing with bailiffs, so such a court decision will ultimately work out in your favor. Reply to agents and try to negotiate terms that are optimal for you. In this case, a second court hearing will not be necessary, and you will be able to repay the loan on a schedule that is convenient for you.

If the calls are illegal.

If the court has denied the new creditor procedural succession (replacement of parties), and after that you should not receive calls from collectors, or if the agency uses illegal methods, you should not cooperate with collectors. You can file a complaint with NAPCA and report agents acting contrary to the law. The Association will take appropriate measures.

Summary

If the borrower does not pay the loan and the debt is transferred to a collection agency, remember:

- collectors have the right to file a claim as representatives of the bank or on their own behalf;

- when filing a claim, agency employees must follow the pre-trial procedure for resolving the dispute;

- the statute of limitations for loan collection is 3 years;

- if the debt is less than 500 thousand rubles, a court order may be issued;

- If collectors violate their powers, complain about them to the regulatory authorities.

More…

- Who are collectors, how do they act and what are they afraid of?

- What happens if you stop paying your loan?

- Is there a threat of criminal liability for non-payment of a loan?

- How debts on loans to individuals are written off

Why doesn't the bank sue, but sells the borrower's debt?

Litigation with the borrower to repay the debt involves large expenses for the financial institution. It may turn out that the client's outstanding balance is significantly less than the potential costs.

The bank does not sue, but sells the borrower’s debt to collectors not only because of large expenses, but also for other reasons:

- the proceedings may take a long time;

- the judge may side with the debtor and oblige the creditor to write off the debt, then the financial institution will suffer a double loss;

- the client does not have a real opportunity to repay the loan - a long illness, a large debt load, etc.;

- the judge may oblige the defaulter to repay the overdue loan in amounts acceptable to him, 500-1000 rubles per month. Then repayment of the total debt will take several years.

If the bank is not sure of the advisability of independently collecting the overdue loan, it decides to sell the debt.