Article current as of: May 2021

Pensioners with dependent minor children receive a pension supplement. An additional payment is also due for a child student under 23 years of age if he is studying full-time and does not work anywhere. The amount of the supplement to the pension for a dependent is determined as one third of the fixed payment to the insurance pension (IF).

- The amount of the pension fund in 2021 is 5334.20 rubles, so for one dependent the pensioner is paid an additional 1778.07 rubles.

- You can receive an increase for no more than three people, so the maximum additional payment is 5334.20 rubles (for three family members).

The cost of a fixed payment increases annually, therefore the amount of additional payment for disabled family members will increase every year. During the discussion of pension reform in 2021, a law was adopted that fixed the size of the pension fund for subsequent years. Therefore, it is already known how much the additional payment for dependents will be from 2021 to 2024.

In order to receive an increased pension, you must contact the Pension Fund with an application for recalculation. If a positive decision is made, the pension will be increased from the 1st of the next month . If the increase is refused, a written notification will be received from the Pension Fund (we remind you that not all pensioners are entitled to such an increase).

Amount of supplement to the pension for a dependent in 2019

The amount of payment for dependents is determined as a third of the amount of the fixed payment to the insurance pension (that is, its basic part). This norm is enshrined in law in Part 3 of Art. 17 of Law No. 400-FZ of December 28, 2013. Let us recall that from January 1, 2019, the cost of the PV was indexed by 7.05%, so its size was 5334.20 rubles.

Depending on the number of family members supported by the pensioner, the amount of the additional payment will be:

Articles on the topic (click to view)

- Federal Law 138 on State support for large families

- Refinancing mortgages for large families in 2021

- Expanding housing conditions for large families in 2021

- Rights and labor benefits for mothers of many children at work

- The right to early retirement for mothers of many children

- State assistance in repaying mortgages for large families in 2021.

- State assistance to large families when purchasing an apartment

- 1778.06 rubles – for 1 dependent (that is, 1/3 of the financial allowance);

- 3556.12 rubles – for 2 dependents (that is, 2/3 of the financial allowance);

- 5334.19 rubles – for 3 dependents (that is, the full amount of the financial allowance).

The increase can be received for no more than three family members. That is, the maximum additional payment will be 5334.19 rubles.

An additional payment to the pension for a dependent in 2021 is also due to working pensioners. The “freeze” of indexation for citizens who continue to work did not affect the increase for disabled family members. Therefore, the amount of the bonus for them will be the same as for non-workers.

Pension supplement for minor children in 2021-2024

Every year, the amount of additional payment for minor children, students and other dependents increases from February 1. This is due to the indexation of the fixed payment amount in accordance with the price growth index. But starting from 2021, this increase procedure has been changed - now the payment amount is indexed from January 1 , and the indexation coefficient is set above the inflation rate. For example, in 2021, indexation was carried out at 7.05%, although according to Rosstat, inflation in 2021 was 4.3%. As a result, the value of the FI became equal to 5334.19 rubles, and for each dependent they began to pay an additional 1778.06 rubles. (i.e. 117 rubles more than in 2018).

This pace will be maintained for the next periods. In Part 8 of Art. 10 of Law No. 350-FZ of October 3, 2018 approved the size of the PV until 2024. That is, it is now possible to determine what additional payment for dependents will be paid in subsequent years (see table below).

| Year | Amount of PV, in rub. | Additional payment depending on the number of dependents, in rubles. | ||

| for 1st | for 2 | for 3 | ||

| 2020 | 5686,26 | 1895,42 | 3790,84 | 5686,26 |

| 2021 | 6044,50 | 2014,83 | 4029,67 | 6044,50 |

| 2022 | 6401,12 | 2133,71 | 4267,41 | 6401,12 |

| 2023 | 6759,58 | 2253,19 | 4506,39 | 6759,58 |

| 2024 | 7131,36 | 2377,12 | 4754,24 | 7131,36 |

How is the pension increase for children calculated?

According to the current legislative acts in force in the field of calculating pension payments in favor of persons supporting a dependent, the current amount of allowances for the type of accrual we are interested in is:

- cannot be less than the current living wage in Russia;

- is subject to annual indexation, after which its size will be increased;

- subject to regulation by legislative acts in force in the required area in the territory of a specific region of the country;

- is calculated according to the specific category to which the pensioners applying for payment belong.

How is the pension increase for children calculated?

When calculating the amount due to a particular pensioner, Pension Fund employees take into account the following factors:

- the number of children dependent on the pensioner: minors, students, disabled people;

- current age of a person of retirement age;

- family place of residence;

- whether the pensioner has employment;

- belonging to the category of military personnel, athletes, etc.

Now let's look at the specific amounts discussed in this article.

Additional payment for mothers of many children

Pensioners who are mothers of many children have the right to:

- early payment of pension;

- obtaining pensioner status upon reaching 50 years of age, provided that the total length of service as a citizen is 15 years or more.

The amount of additional payments for mothers with many children is determined according to:

- region of residence of the family;

- the current demographic situation in a specific subject of the Russian Federation.

Supplement to pension for a child born in the USSR before 1990

Starting from 2021, women pensioners have the right to receive an additional payment to their pension for the birth of children before 1990, provided that they reached retirement age before the year the law on this pension payment was adopted.

In the image below you can see the number of points that will be awarded to female pensioners in this category.

How many points are awarded to pensioners of the required category?

Read more detailed information about this surcharge in a special article.

Video - Supplement to pension for children born before 1990

Additional payment per student

So, for example, when calculating an additional payment for a dependent student, the amount of payment will also be determined by many additional circumstances. If a person provides support for a full-time student, then the amount of the fixed allowance for one child will be 1 thousand 607 rubles and 7 kopecks. Accordingly, in order to calculate the allowance for two dependent students, it is necessary to multiply the specified fixed amount by half.

A pension supplement can be received for a dependent student

Additional payment for a minor

In addition, various circumstances affecting payments will also be taken into account when determining the amount of payment for minor children.

Provided that the pensioner is not disabled and does not have the right to receive other types of social category payments, or to receive any benefits other than pension insurance, he may qualify for payments in the following amounts.

1.

Provided that a person of retirement age is not yet 80 years old, he/she applies for the following benefits:

- 3 thousand 416 Russian rubles per child;

- 4 thousand 270 rubles for two children;

- 5 thousand 124 rubles for three.

2. Citizens whose age has reached or exceeded 80 years have the right to receive support from the state for a dependent in the amount of:

- 5 thousand 978 rubles per child;

- 6 thousand 832 rubles for two;

- 7 thousand 686 rubles for three children.

Additional payment for disabled people and residents of certain areas

Pensioners who are disabled and receive an appropriate benefit, or live in the Far North, or in other regions, under conditions equivalent to it, receive bonuses in amounts varying:

- from 4 thousand 4 rubles 26 kopecks;

- up to 21 thousand 623 rubles.

You can see the payout amounts in more detail in the image below.

Allowances due to pensioners of a certain category

What additional payment for children is due for a military pensioner?

Military pensioners receive a pension for their length of service, which is calculated in accordance with the relevant legislative acts. They are also expected to receive additional pension payments, which, however, can only be received if dependent persons do not receive:

- other insurance category security;

- other provision for the pension category.

What kind of child benefit can a military pensioner receive?

The amount of the required payment for military pensioners is determined according to the percentage relative to the pension already accrued to him. It can be:

- 32% of the pension for one dependent;

- for two people the percentage rises to 64 units;

- for three dependents, 100% of the pension amount is subject to addition.

In one of the special articles, we will look at what pension supplements pensioners are entitled to for serving in the Soviet army.

Calculator for calculating military pension with dependents

Go to calculations

Supplement for working pensioners for children

For working pensioners, the amount of payment is also determined separately. So, provided that they support minors, they are entitled to a payment, the amount of which will correspond to 1/3 of the old-age payment due to them per child.

At the same time, according to the law, working pensioners cannot receive payments for more than three children.

You may be interested in information on how to get additional leave for a working pensioner. In the material presented we will tell you how to write an application for a well-deserved rest.

Cash bonuses for pensioners of the Ministry of Internal Affairs

At the Federal level, payments are also determined for another separate category of pensioners - persons who served in the Ministry of Internal Affairs.

The amount of payment for representatives of this category will be 32% of the pension already accrued to them for one minor child, or adult child studying full-time at a university. Accordingly, for two children this percentage will be equal to 64 units, for three – 100%.

Please note: even if there are two pensioners in the family, and both of them belong to the Ministry of Internal Affairs of our country, only one of them can qualify for the additional payment.

Who gets paid extra for dependents?

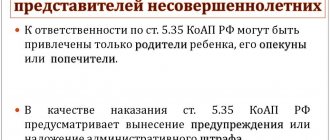

According to Part 3 of Art. 17 of Law No. 400-FZ, not all pensioners are entitled to additional payment for children - the increase applies only to citizens receiving old-age and disability insurance pensions . The bonus is assigned if the pensioner is supported by disabled, that is, non-working family members. You can get an increase for:

- children, brothers, sisters and grandchildren under 18 years of age;

- for them, but up to 23 years of age, if they are full-time students.

Several pensioners can receive additional payment for the same dependent. For example, for a full-time student, an increase will be assigned to his two parents if they are pensioners.

- For recipients of social pensions (those who have not accumulated the required length of service or IPC), such an increase is not allowed. Their pension benefits are calculated differently and regulated by different legislation.

- Military pensioners (Ministry of Internal Affairs, Russian National Guard, Federal Penitentiary Service, FSB, Ministry of Emergency Situations and other departments) are also given bonuses for children. However, their size and payment procedure are regulated by another law - No. 4468-1 of February 12, 1993. According to Art. 17 of this law, the additional payment is defined as: 32% of the calculated pension for one dependent;

- 64% - for two;

- 100% - for three.

How to get a raise for disabled family members

The Pension Fund is responsible for assigning additional payments to pensions for minor children or student children. To do this, you must submit an application for recalculation of the pension amount and indicate the reason for the recalculation - the presence of disabled family members dependent on the pensioner. The following documents must be attached along with the application:

- Confirming the relationship between the pensioner and the child (for example, a birth certificate);

- Confirming the fact of dependency:

- certificate of family composition or cohabitation (from the housing department or local government);

- certificates, checks or other documents confirming expenses for food, child accommodation, etc.;

- certificates of income of family members;

This is important to know: Can a mother of many children or a father of many children quit their job without working?

The fact of dependency can also be confirmed with the help of witness testimony (for example, other relatives, neighbors, etc. can confirm this). In case of a positive decision on the application, the increase in pension will be assigned from the first day of the next month. The bonus will be paid until the child turns 18 years old .

Supplement to pension for dependent student

If children are studying full-time , the payment can be extended until they reach 23 years of age . To do this, you will need to contact the Pension Fund again and confirm that the child continues to be supported by the pensioner. As a supporting document, you must submit a certificate from the educational institution containing the following information:

- Full name of the student, date of birth;

- Name of the educational institution, form of education and educational program;

- Date and number of the enrollment order, duration of study;

- Date of issue of the certificate, registration number, corner stamp of the institution, seal and signature of the head with a transcript.

However, if the child stopped full-time education (for example, was transferred to correspondence, expelled or drafted into the army), the pensioner must report this to the Pension Fund . If this is not done, then the Pension Fund will return all unjustifiably paid amounts in court. 2019-09-17

What documents are needed to receive additional payment to the pension for children?

As we have already said, in order to receive a cash supplement, you need to collect a package of documents confirming your right to possess the funds you are looking for. We are talking about the following papers.

1. An application with a request to recalculate your pension, adding an increase for children to its amount.

2. Documents for dependents:

- passports;

- birth certificates.

3. The pensioner’s work book in the form of an original and a notarized copy.

Employment history

4. A certificate stating that other specialized additional payments do not receive:

- dependents;

- pensioner;

- spouse of a pensioner.

5. Provided that the pensioner is an individual entrepreneur, he must provide a certificate of registration of the individual entrepreneur with the tax service.

6. A paper confirming the fact that specific individuals are dependent on a pensioner - usually this is a certificate of joint residence of persons.

7. A certificate from the university, which will indicate:

- dependent's form of education;

- date of enrollment at the university;

- date of expected completion of training.

8. An extract from a person's pension account.

9. Provided that you have already applied for an allowance, you will have to renew it every year. In this case, each time you will need to submit for consideration to the Pension Fund:

- work book;

- a certificate indicating that the dependent and the pensioner are registered at the same address;

- documents for the student.

Concepts of pension and pensioner

Pensioners are people who legally receive pension payments from the state or are entitled to receive them. The pension can be paid on the following grounds:

The retirement age is set for ordinary citizens at 55 years for women and 60 years for men, respectively. In connection with recent legislative changes, the retirement age is planned to be increased for male officials to 65 years old, for female officials to 63 years old.

Some professions, due to difficult physical working conditions, require earlier retirement.

Working pensioners include people who have reached retirement age but continue to officially work. In this case, the employer continues to make contributions for the working pensioner to the Pension Fund, Social Security and Tax authorities.

Based on the law, working pensioners can claim an additional payment to their pension if they have dependent children under 18 years of age or children studying full-time. The law also applies to children of disabled people who have reached the age of majority.

Dependency refers to the official full financial support of a child.

The following children may be dependent:

- relatives or adopted;

- younger brothers and sisters;

- grandchildren.

If all conditions are met, the pensioner has the right to receive additional payment.

Legislation

The possibility of receiving an additional payment to the insurance part of the pension is prescribed in Federal Law No. 400 “On Insurance Pensions”.

Additional payments for pensioners carrying out their labor activities in the police, criminal-executive punishment agencies are regulated by Federal Law No. 4468-1.

Additional payment to pensioners for minor children

Based on the provisions of the article, we can conclude that disabled relatives, namely children, brothers, sisters, spouse, and grandparents, can act as dependents of a pensioner. The determination of the fact of disability and the need for maintenance is determined in the following order:

You may be interested in:: Altai Territory one-time cash payment to mothers from 18 to 25 years old

The right to additional payment to the pension for dependents

The timing for recalculating the amount of fixed payments to pensioners is related to the submission of the application and the necessary documents. If all documents meet existing requirements, then recalculation is performed for the next month, after the month in which the corresponding application was submitted.

So, there are many recipients of social benefits in our country. However, not every citizen who reaches retirement age is entitled by law to additional payments for dependents. Only the following categories of citizens can count on additional assistance from the state:

- persons who have reached retirement age;

- ex-military personnel receiving preferential pension payments;

- WWII veterans;

- disabled people who support minor children.

Who counts as dependents in 2021 in Russia?

Starting in 2021, the volume of payments and the amount of social benefits for each disabled family member who is in the care of a person of retirement age has changed. Dependent's allowance for pensioners under 80 years of age without disability:

It is not uncommon for a pensioner to be forced to support disabled persons. Usually these are minor family members or close relatives with a disability group. In such cases, an elderly person can count on government support. But to obtain it you will have to meet a number of conditions, so it is important to study the requirements.

Eligible: students and dependent minors

All Russian citizens who receive an old-age or disability pension, as well as long service, have the right to receive additional payment. If they are dependent on:

- minor children;

- adult non-working children – students studying full-time;

- disabled children over 18 years of age.

And also with the mandatory official employment of a pensioner and official contributions from the employer to the Pension Fund, Social Security and Tax Inspectorate.

Accrual conditions

To accrue additional payments to the pension, a working pensioner must meet the conditions established by law. These include:

- the person must have the right to receive pension benefits or receive it;

- the pensioner must have an official place of work;

- The pensioner must be dependent on minor children, or disabled people, or adult children studying full-time.

- the citizen must submit all the necessary documents and submit an application to process the payment.

These are the basic conditions under which any Russian citizen has the right to apply for this additional payment.

How much is due - the amount of additional payments to the pension

The amount of additional payments when they are calculated will depend on several factors. The meaning is as follows:

- age of the pensioner;

- the region of Russia in which he lives;

- whether he has a disability and is given the appropriate status;

- number of dependents.

How much do they pay extra? The amount of additional payment for disabled people also depends on the group assigned to them. If a pensioner has a disability and has reached 80 years of age, then he can count on a payment in the amount of:

When pensioners reach 80 years of age and have official work, they are entitled to the following additional payments and benefits:

- if you have one child, 5970 rubles;

- with two 6832 rubles;

- with three children 7680 rubles.

If a pensioner has not reached such an advanced age as 80 years, then he has the right to receive an allowance:

- for one baby 3416 rubles;

- two 4270 rubles;

- for three 5124 rubles.

In all cases, when the child has become an adult and is studying full-time, the additional payment is reduced and amounts to 1,500 rubles.

This is due to the fact that teenagers at this age have the right to receive scholarships, and can also find part-time work for a few hours a day, if they want and need to earn money.

The calculation is carried out by the Pension Fund. In order to find out the amount of the surcharge in each specific case, you must contact the Pension Fund office at your place of residence and ask them to make a preliminary calculation.

Who is entitled to a pension supplement for children?

Pensioners who have dependent children under the age of majority have the right to count on an additional payment to their pension, because an elderly person is obliged to provide the child with a certain standard of living. Usually the size of pension payments does not allow this.

Moreover, he has the right to receive a bonus not only for his own children, but also for brothers, sisters, and grandchildren, provided that they meet the following criteria:

- are under age;

- have reached the age of majority, but are studying full-time at colleges or universities and are no more than 23 years old;

- recognized as disabled, in this case there are no age restrictions.

The categories are established by Federal Law No. 400-FZ.

How much is the surcharge?

For 2021, pensioners are paid a fixed supplement to their insurance pension. Its value is 5686.25 rubles according to Art. 10 Federal Law No. 350. This regulatory act amends Federal Law No. 400. The additional payment for dependents is calculated from this amount, it is one third of it (Article 17 of Federal Law No. 400).

Pensioners - former military personnel or employees of the Ministry of Internal Affairs - receive a bonus provided that they were not assigned other benefits, and they did not continue to work or serve. The amount of the surcharge depends on the number of children in care: one – 32% of the pension, two – 64%, three or more – 100%.

What documents are needed

To apply for benefits for minor children for ordinary and military pensioners, it is necessary to prepare a number of documents:

- an application requesting a benefit;

- applicant's passport;

- child's birth certificate;

- pensioner's certificate;

- SNILS;

- a certificate proving that the second parent was not assigned additional payment;

- a document indicating the number of family members.

If some of the original papers are lost, this does not mean that the benefit will have to be abandoned.

Documents can be restored in the authorities where they were received. For example, a child's birth certificate can be obtained from the registry office. The average time for issuing a duplicate is a month.

Registration procedure

To apply for benefits, you need to visit the Pension Fund of the Russian Federation. You can do this in person or send an application through the post office. Employees of the government agency will consider the application within 10 working days from the moment it was received.

If the decision is positive, increased pension payments will begin next month.

Renewal of the surcharge is made annually. If you do not submit your application on time, your pension payment will automatically be reduced.

Procedure for processing payments and allowances

The legislation establishes that additional payments to pensions are made by the Pension Fund and a certain procedure has been established. The algorithm of actions will be as follows:

This is important to know: Benefits for large families in Tver

- collection of necessary documentation;

- writing an application and submitting duplicates and originals of documents;

- obtaining a decision on the assignment of additional payments.

Thus, the first stage will be collecting documents.

Documents for receiving additional payment for dependents and minor children

A complete list of required documents can be found on the Pension Fund website or at its nearest branch.

The following will be mandatory:

- applicant's personal passport;

- a copy of the work record book certified by the employer with a confirmation note that the pensioner is currently employed;

- a certificate stating that the second spouse did not apply for this payment;

- children's testimonies;

- documents confirming that the child is a full-time student;

- certificates and conclusions of a medical commission confirming the presence of disability of a dependent and/or pensioner;

- a certificate from the passport office confirming the quantitative composition of the family.

In individual cases, the Pension Fund has the right to request any other additional documents.

After collecting all the documents, it is important to correctly fill out the application for benefits. It has a form prescribed by law. This form can be found on the Pension Fund website or obtained by visiting a Pension Fund office in person.

When filling out the application, you must provide the following information:

- Name of the Pension Fund branch to which this application is sent.

- Personal and passport information about the applicant.

- The name of the document indicating what kind of additional payment the applicant is applying for.

- Personal information about dependents and second spouse.

- List of attached documents.

- Signature of the applicant and date of submission of the document.

All documents and the application are submitted to the Pension Fund, after which a decision will be made within the time established by law. The Pension Fund is obliged to notify the pensioner of this decision in writing. If the decision is positive, the monthly payment of additional payment will begin along with the pension.

Where to apply for pension benefits for working pensioners if they have children

Due to the fact that this additional payment is carried out by the Pension Fund, you must therefore contact the Pension Fund branch at your place of residence. You can submit documents in the following ways:

- personal visit to the Pension Fund;

- in person through the multifunctional center;

- through a representative with the issuance of a notarized power of attorney to represent interests in the Pension Fund of Russia;

- send documents via mail to the Pension Fund;

- apply using the government services portal.

When submitting documents via mail, you must have all copies of documents certified by a notary.

When registering using the government services website (https://www.gosuslugi.ru/), you must go through the following procedure:

- Log in to your personal account; if you don’t have one, you need to register.

- If passport data is not officially confirmed on the portal, it will not be possible to access this service. Therefore, it is necessary to request confirmation of passport data, receive a special code upon presentation of the passport and enter it into the system. After this, all government services will become available.

- Next you need to select.

- The site will display the fields required to be filled out.

- After this, you will need to upload scans of the required documents and submit your application.

When submitted via an electronic service, the application will be reviewed within no more than 30 days; if submitted in person, no more than 10 days.

Peculiarities of accrual for non-working mothers with many children

For mothers of many children, it is possible to receive an additional payment to their pension before reaching retirement age. The legislation defines the following conditions under which a mother of many children (as well as a father of many children) can make an additional payment in advance:

- her age must be over 50 years;

- work experience must be at least 15 years;

- presence of 5 or more children.

If all the established conditions are met, a mother of many children can apply for additional payment.

conclusions

Summing up, we can conclude that working pensioners really need state support, since having dependent children and fully supporting them costs money. But their health in this case may no longer allow them to work fully.

In connection with this, the state has established additional payments if there is at least one dependent child. The main conditions are reaching retirement age and mandatory employment.

Documents for pension recalculation: how to submit for a pensioner, where to apply

Survivor's pension

Registration of a survivor's pension: where and how to obtain documents

Registration of a disability insurance pension

Basic concept of pension supplements

A pension supplement for a citizen who has reached retirement age is a certain amount of money that is reimbursed to the pensioner if certain conditions are met. In most cases, a pensioner's supplement is provided if he has minor children or disabled children as his dependents.

Important. The pension supplement for children born after and before 1990 is not an automatic additional payment to the monthly pension amount, but is calculated based on certain conditions.

Types of additional payments for dependents to pension

Payments on this basis are provided until the child completes the educational institution’s program. If he was expelled, drafted into the army or transferred to absenteeism, the pensioner is obliged to notify the Pension Fund of the Russian Federation about this circumstance within 5 days, because the basis for additional payment also ceases.

Payment amount

In addition, additional documents may be required. For example, if a pensioner acts through a representative, you will need a notarized power of attorney. If he is disabled, appropriate confirmation must be provided.

Citizens who have reached retirement age and have other citizens dependent on them are entitled to a dependent supplement to their pension. Let us consider in more detail the conditions and procedure for its appointment, as well as the amount of this type of financial assistance.

Basic conditions for receiving an allowance for minor children

A pension supplement is possible for both working and non-working pensioners. An important condition remains that the pensioner be a citizen of the Russian Federation. The Pension Fund of the Russian Federation puts forward the basic requirements for receiving a pension supplement:

- The pensioner must retire no earlier than 01/01/2015;

- The pensioner retired after this date, but did not report his existing children to the Pension Fund.

According to the old procedure for calculating pensions, maternity leave was not included in a woman’s total length of service, but was subtracted from it. Today, pensioners can recalculate their length of service taking into account points for maternity leave; this will also be a certain bonus to their pension.

Key points in receiving a pension supplement for minor children.

- Those pensioners who retired after January 1, 2015 do not need to apply for recalculation, since the most profitable option has already been calculated for them and assigned for payment. Recalculation is required only if the woman has non-insurance periods that were not taken into account when assigning a pension before January 1, 2015 or taken into account according to the old rules, for which pension points are now awarded in accordance with the new law of December 28, 2013 No. 400-FZ.

- There is no time limit for submitting an application for recalculation of women's pensions for children.

- The pension supplement for children obtained as a result of recalculation is individual and is not guaranteed for all pensioners, since replacing work experience with a period of child care will not always be beneficial.

This is important to know: Payment to orphans during the Second World War

According to statistics, only in 20-30% of cases the amount of paid pension benefits can be increased, and the amount of the increase can range from several rubles to several hundred or, in some cases, can even exceed a thousand rubles.

Important. If the recalculation is obtained “with a minus sign,” then the current pension amount will not decrease (since the deterioration of pension provision is not allowed by current law), and the Pension Fund employees will make a decision on refusal.

New rules for calculating pensions for people with children

Previously, the maternity period was not included in the calculation of the insurance part of the pension, i.e. this time was equated to non-working time. Then, amendments were made to the Federal Law “On Insurance Pensions in the Russian Federation” No. 400-FZ, according to which points are awarded for maternity leave; they will be taken into account when calculating the pension.

There are a number of nuances:

- the maximum period of maternity leave is 6 years;

- allowances are made for a maximum of 4 children;

- with each subsequent child the size of the points increases;

- Additional payments are due to persons who retired before January 1, 2015.

The volume of points, according to Art. 15 Federal Law No. 400-FZ is as follows:

- for the first child - 1.8;

- for the second child - 3.6;

- for the third and fourth children - 5.4.

Attention. When calculating your pension, points are converted into rubles: 1 point is equal to 93 rubles.

Who is entitled to additional payments?

Points are awarded only to one of the parents - the one who looked after the child on maternity leave until he was one and a half years old.

The supplement is due:

parents of 2 or more children born before 1990;

parents on leave to care for children under 1.5 years of age in Soviet times;

people who can document their right to receive additional points.

Moreover, receiving a bonus is not always beneficial for pensioners.

In what cases is it beneficial to apply for an allowance, and in what cases is it not?

The supplement sometimes increases the pension significantly, sometimes it is too small, and in some cases even leads to a reduction in the pension.

It is profitable to make an additional payment:

- parents of 2 or more children;

- those who were unofficially employed during parental leave;

- those who, by the time of retirement, had only a minimum amount of experience;

- the salary level for the entire period of employment was below average;

- the pension amount does not reach the subsistence minimum.

It is not profitable to recalculate pension payments if:

- only one child was born before 1990;

- the person continued to work officially and did not go on maternity leave;

- the salary was above average;

- professional experience is more than the minimum.

The decision whether to recalculate or not is up to everyone to decide for themselves. According to the law, an application and a package of documents for calculating the allowance must be accepted from everyone.

Who is entitled to pension supplements for minor children?

According to Russian legislation, women of retirement age who have two or more children whose children were born after 1990 can receive a pension supplement. The earnings of these women were minimal and their work experience was not long. Also women who are dependent on minor children or children who are studying full-time. In order to receive a pension supplement, a woman must contact the pension fund of the Russian Federation at her place of registration with an application and a certain package of documents. This package of documents includes the following documents:

- Application for accrual of a pension supplement for minor children;

- A document confirming the presence of minor children;

- A copy of the work record book, certified by a notary;

- Certificates confirming the absence of allowances;

All bonuses and calculation of pensions are regulated by the legislation of the Russian Federation, therefore, in order to receive a bonus, a certain procedure must be followed.

| Submitting an application | The application can be submitted in two ways: · Through the Pension Fund, by contacting the Pension Fund employees with a package of documents and a written application; · Through the government services website, which requires registration, then you need to go to the “pension calculation” menu and follow all the prompts. |

| Review of submitted documents. | Pension fund employees accept the package of documents and the application; a period of no more than 10 days is allocated for consideration. |

| Decision making by PF employees. | After 10 days after submitting the application, PF employees are required to notify the applicant of the decision, positive - the amount of the bonus is calculated or negative - the bonus is denied. |

By following this procedure and having all the necessary documents, the pensioner is required to provide a pension supplement.

The main category of citizens who are entitled to a pension supplement:

- Maintenance of minor children;

- If the child is a full-time student at an educational institution;

- Caring for a disabled child.

That is, if a woman who retired upon reaching retirement age and at the same time has minor children to support, she has every right to apply to the Pension Fund to receive an increase to the available amount of the pension payment.

How to apply for a supplement to the pension for children

As you know, pensioners are a category of citizens who, in general, have a greater number of benefits than other residents of our country. The thing is that pensions rarely provide them with a really decent standard of living, and they cannot work at the same pace. Therefore, Russian state policy involves various types of support for the desired category of persons.

In particular, in this case we are talking about a pension supplement for minor children. It is needed by pensioners who, for example, were able to have a child shortly before reaching retirement age, and at the time of filing an application for recalculation of payments from the state, he is still a minor, that is, a dependent requiring:

- full provision of his existing needs;

- constant assistance from parents, who are the only source of funds necessary for his existence.

In this case, the dependent must have:

- biological connection with a pensioner;

- other legalized family relationship with the person applying for an increased pension.

Thus, we can conclude that the supplement to the pension for children is due only to those pensioners who fully support their own children, providing them with:

- housing;

- food;

- clothes;

- education and other needs;

It should be understood that in addition to minor children, dependents may also be the offspring of pensioners who:

- are disabled for any reason;

- may be adults, but are studying at higher educational institutions or other organizations.

The required pension supplement is established at the following two state levels:

- federal;

- local.

This means that the budget for the payment of pensions and their amount will be formed not only through government regulations, but also taking into account the capabilities of each specific subject of the Russian Federation.

The amount of pension that will be added to each pensioner will be determined according to the number of dependents living with him

Supplement to pension payments at the local and federal levels

Let's look at one very important issue: which payments are allocated from the federal budget and which from the regional budgets. Let's look at the information we are interested in in the table below.

Table 1. To whom are pension payments allocated from the federal and regional budgets intended?

| Federal budget | Regional budget |

Thus, the funds that go to pensioners from the federal budget of our state are aimed directly at supporting children who:

| As for the money allocated by the regions, it must be said that in each municipality the authorities are developing specialized programs to support pensioners. In the required case, persons of retirement age who are:

|

Conditions for granting the allowance

The presented type of pension supplement for persons of retirement age who have assumed the responsibility to provide for dependents who are related to them is carried out only if the following conditions are met:

- Persons receiving pension payments who are not employed elsewhere receive additional payment without the need to provide evidence of their entitlement, in the case where the children are minors.

- If we are talking about receiving an allowance for children who are adults, but are unable to work independently, it will be necessary to submit documents for consideration to the Pension Fund that will prove the required condition of these dependents.

- To apply for a supplement for children studying at higher educational institutions and who are adults, you must provide a certificate from the educational institution.

Certificate of training

Procedure for applying for an allowance

Today, receiving the payment we are interested in is possible, provided that it is carried out in accordance with certain rules. We present a list of stages that you will need to go through to get the desired bonus.

- Writing an application and submitting it, complete with documents confirming your eligibility, to the Pension Fund of our country.

- Receipt by the desired government agency of the papers you submitted and consideration of the application.

- Representatives of the Pension Fund of the Russian Federation make a decision and notify the pensioner about it.

The period for reviewing documents on your application will be no more than 10 working days. After their expiration, and possibly earlier, you will receive official notification regarding the results of the review.

If your application is approved, your first pension increase will come to you as early as next month

You can submit your application for consideration not only directly to the Pension Fund specialists, but also through:

- state portal "State Services";

- Multifunctional Center.

However, in this case, you should understand that if you do not hand over the documents directly to the PF specialist, the waiting period increases to 30 days.

Additional payment for minor children

Russian legislation provides for the receipt of a supplement to the basic pension for pensioners who retired upon reaching retirement age and do not have other benefits and who have minor children as their dependents.

Basic bonus amounts.

| The pensioner has not reached 80 years of age. | Pensioner over 80 years old. | ||

| For one child | 3416 rubles | For one child | 5978 rubles |

| For the second child | 4270 rubles | For the second child | 6832 rubles |

| For three or more minor children | 5124 rubles | For three or more minor children | 7686 rubles. |

Important. If a pensioner is officially employed, according to Russian law, he is entitled to a supplement to the basic pension in the amount of one third of the fixed pension amount.

Based on this article, we can conclude that the state provides financial support in every possible way to citizens who need it; the main condition for receiving a pension supplement for a minor child in 2021 is having citizenship of the Russian Federation.

Supplement for children

It is very difficult to live on one pension, so you need to take advantage of all the opportunities provided by law to increase it. In most cases, a pensioner can count on additional payments to their pension thanks to relatives. Moreover, in 2021 such surcharges will become higher.

Spouse supplement

If a pensioner has two children, then the amount increases by 2 times, and the maximum amount you can receive is additional payment for three dependents. The fact of being a dependent does not need to be proven. You can also keep the additional payment after 18 years of age, if the child is admitted to full-time study, then the payment is due until the age of 23. If a child becomes disabled before the age of 18, the additional payment is due for life.

The application with the attached set of documents will be considered by the Pension Fund, and if a positive decision is made on the application, then an additional payment to the pension will be assigned from the 1st day of the month following the submission of the application. In this case, funds will be paid until the child reaches 18 years of age. If the additional payment is refused, a written notification will be received from the Pension Fund.

Who is entitled to an additional payment for a dependent in 2021, which pensioners who have disabled family members in their care and financial support are provided with additional payments, what their new amounts are, we will describe later in this article.

Who and when is entitled to an additional payment to the pension for disabled family members?

According to current legislation, a pensioner receiving an old-age or disability insurance pension and who has disabled family members as dependents is entitled to an increased pension.

You may be interested in :: Benefits and allowances for single mothers in Irkutsk

The main condition for additional payment is that the potential dependent has not reached the age of 18. As an exception to extending this period, every pension lawyer considers:

Contrary to popular belief, it is not an obstacle that either both pensioners or one of them works. The right to receive an appropriate additional payment arises after the guardians have completed all the necessary documents.

It should be noted that in addition to providing all the listed documents, sometimes there is a need to resolve all necessary disputes exclusively in court. In this case, various calculations are used as the main supporting documents, which can be used in favor of dependents (for example, checks that reflect expenses associated with the maintenance and education of a minor). Receiving a decision from a court serves as the main confirmation that the dependency process is actually taking place. This is explained by the fact that the proceedings are carried out in accordance with the procedure established by the judicial authorities.

Thus, pensioners have the right to receive bonuses to payments for dependents who are supported by them, as well as to recalculate their insurance period if they retired before 2015. Registration of both privileges is carried out in the Pension Fund of the Russian Federation.

Necessary! Within three days after the child’s status as a student at an educational institution or in relation to the form of his education changes, this information should be provided to the local branch of the Pension Fund in order to avoid overpayments and subsequent deductions from the parents’ pensions.

Verification of information by Pension Fund employees

Disability benefits are usually assigned together with a pension; just contact the Pension Fund, where they will calculate the specific amount of the benefit, tell you what papers you need to provide, and how payments are received. You will also need to open a bank account or take your card details where the money will be transferred. In addition to payments, there are also additional benefits and various services for the disabled - you shouldn’t refuse a little help.

It is worth noting that upon expulsion from an educational institution or transfer to another form of education, the additional payment to the pension ceases . Therefore, within 5 days it is necessary to notify the Pension Fund authorities of any changes in order to avoid overpayments , which will then need to be reimbursed.

- Parents of two or more children born before 1990;

- Parents who were on parental leave to care for children under 1.5 years old in Soviet times;

- Persons who have documentary evidence of the right to receive additional points.

Fixed supplement to pension: for dependents, disabled people, northerners

Every year, funds are allocated to the Pension Fund budget to increase payments and provide benefits to pensioners. Thus, for those who have completed their working career, indexation of the insurance part is provided. The question of how much percent it will grow remained acute until the end of the year. Initially, it was planned to increase by the amount of official inflation, which, according to preliminary calculations, ranged from 3.7 to 4.9%.

- if there is one dependent - 7581.67 rubles. (surcharge 1895.42 rubles);

- two dependents - 9477.09 rubles. (additional payment RUB 3,790.84);

- three dependents - 11372.5 rubles. (increase in the amount of 100% of the fixed payment).