Home/Alimony payments/With a small salary

Alimony obligations are a mechanism for supporting a needy family member. Needy mothers with babies and other citizens are protected by legal norms. At the same time, the payer may find himself in various situations, so all features should be taken into account. Recently, more and more often citizens receive unofficial wages, and therefore the deduction of alimony payments becomes impossible. In some situations, employees receive a “gray” salary, the amount of alimony from which becomes minimal. In these cases, the interests of the child are jeopardized. What a needy mother and child should do if alimony is paid on a small salary, where to go and what subtleties there are in the situation under consideration and many other questions are contained in this article.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

If the official salary is small, how is alimony paid?

As a general rule, alimony is assigned in the form of shares. At the same time, in Art. 81 of the RF IC states that interest is deducted from the payer’s salary. Only official salaries are taken into account, that is, those incomes that are subject to tax. In the event that the obligated person receives a “gray” salary, that is, part is received through official means, part is given “in person”, alimony is deducted only from the official component.

Attention

In cases of irregular income or receiving unofficial income, the legislator has provided for the possibility of assigning alimony from a small salary in hard form. This version of obligations is regulated by Art. 83 RF IC. Thus, if the official salary of the obligated person is at the minimum level, the parties are recommended to agree on alimony payments in a fixed amount.

If the salary is below the minimum wage, how much alimony will you have to pay?

In Art. 81 of the RF IC states that child support is paid from all types of earnings of the debtor: under employment, civil contracts, etc. The full list is established by Decree of the Government of the Russian Federation of July 18, 1996 N 841 “On the List of types of wages...”.

According to Art. 133 of the Labor Code of the Russian Federation, the employer does not have the right to pay wages below the minimum wage, which is equal to the minimum wage for the working population. Even if the debtor earns less than the minimum wage, this is only the responsibility of the organization.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

Can alimony be awarded more than official earnings?

Due to the fact that the modern Russian economy is characterized by a high percentage of citizens receiving piecework or unofficial wages, a judge may order alimony to be paid that will exceed the official part of the income. An increase in payments may be due to an increased level of expenses for a child, the ex-wife being on maternity leave, and other cases. The situation in which payments for the child exceed the official part of the father’s salary is relevant if the judge prescribes a fixed form of payments.

For your information

Despite the fact that family law is based on the principle of equality of positions for all parties, in practice, in most cases, the judge gives priority to the interests of a minor citizen and a woman on maternity leave. In such a situation, the payer has the right to provide evidence of the impossibility of paying alimony from a small payment, in the amount established by the court.

Is there a minimum amount of alimony?

There is no minimum amount of alimony, despite the fact that employers by law cannot pay less than the minimum wage. For example, if the debtor receives 10,000 rubles. and is obliged to transfer 1/4 of the income to the child; the claimant acting in the interests of the minor will receive only 2,500 rubles.

According to Rossiyskaya Gazeta, the Ministry of Justice previously proposed setting the minimum amount of alimony equal to the minimum wage. They even drafted a bill, but things didn’t go further than that. It has still not been accepted.

How can you prove that there is not enough alimony from a small salary?

In practice, quite often a situation arises in which the assigned alimony from the payer’s small salary is not enough to fully support the child. In this case, it is advisable to apply in court to change the amount of alimony payments, in accordance with Art. 119 RF IC. The grounds for increasing (as well as decreasing) the amount of financial support from the alimony provider are the following factors:

- Change in the financial situation of both parties or one of the citizens.

- Change of financial situation - marriage, birth of a baby.

- Other circumstances confirming the need to incur additional expenses. For example: a child’s illness, or the need to pay for educational institutions or additional training.

The first two grounds are regulated by Art. 119 RF IC, third – part 2 of Art. 81 IC RF.

To prove that there is not enough alimony from a small salary, the plaintiff has the right to provide the following documents:

- Receipts confirming the amount of expenses for the baby. These could be receipts for the purchase of hygiene supplies, office supplies, textbooks, medications or other necessary items.

- A certificate from a doctor confirming the need to refer the child for treatment or rehabilitation. The certificate can also confirm the need to purchase additional equipment.

- A certificate of income in the event that the parent left with the child was laid off or the mother’s or father’s salary became less for other reasons.

- Certificate of income of the second parent in the event that the citizen’s salary has increased.

- A birth certificate indicating that the woman has another baby, which undoubtedly increases the level of expenses.

The plaintiff must provide the maximum amount of evidence confirming the fact that the alimony paid from the payer’s small earnings is insufficient to support the child.

Is it possible to receive alimony payments from a gray salary if the official income is small?

In the Russian Federation, there are organizations whose employees can help identify the real income of the alimony payer. These include:

- The territorial department of state statistics is a structure that reveals the average salary in a certain industry, type of activity and region.

- The Federal Tax Service Inspectorate division is generally interested in identifying the real income of citizens, from which state taxes are deducted in favor of the state.

In order to contact the state statistics body to receive alimony from the payer’s gray salary, the child’s mother should do the following:

- Determine the correct name, as well as the address of the government agency in the region in which the citizen is employed.

- Submit your request in writing. The letter indicates the name of the employing company, the text of the request, a list of attachments as necessary, signature and date.

- Send a letter to the organization of state statistics.

- Within 30 days, department employees will send the applicant a response letter providing information. The specified period is reflected in Art. 12 Federal Law “On the procedure for considering citizens’ appeals in the Russian Federation.”

IMPORTANT

The State Statistics Authority provides only informational information, that is, indicative information. This structure does not hold the violator accountable for concealing the level of income and paying alimony from a small salary, does not arrange an audit and does not establish adverse consequences.

To contact the tax office regarding the calculation of alimony from a gray salary, you need to do the following:

- Determine the territorial tax office to which the appeal will be sent.

- Form a written request to conduct an audit of the employing enterprise in order to identify the real income of employees.

- Collect attachments to the application: the applicant’s passport, an extract from the Unified State Register of Legal Entities for the employer, information about the employee, a response from the statistical authority, other documents as necessary.

- Send a prepared appeal by letter or in person to the tax office.

- Within the meaning of Art. 12 of the Federal Law “On the procedure for considering appeals from citizens in the Russian Federation”, within 30 days the tax inspectorate will send the applicant a response based on the results of consideration of the submitted appeal.

Attention

When contacting the tax office regarding the deduction of alimony from a gray salary, you should understand that the outcome can be completely different. Federal Tax Service employees may decide to set the level of real wages and oblige the employer to increase the official wage. The consequences may also be negative factors, that is, the employee who caused the verification may be fired.

If the ex-husband has a small official salary, how to collect alimony?

If the ex-husband has a small official salary, but there are hidden incomes that are not reflected in official declarations, the mother taking care of the baby can sue to establish alimony in a fixed form. In order to initiate an appeal to the court, you should do the following:

- Determine jurisdiction, that is, the court to which the claim will be sent. According to the rule of Art. 24 of the Code of Civil Procedure of the Russian Federation, cases related to changes in the procedure for assigning payments and the amount of alimony are considered by district or city courts. According to the rules of Art. 29 of the Code of Civil Procedure of the Russian Federation, the application can be submitted at the place of residence of both the plaintiff and the defendant.

- Write a statement in accordance with Art. 131 Code of Civil Procedure of the Russian Federation.

- Prepare a package of necessary documents according to the rules of Art. 132 Code of Civil Procedure of the Russian Federation.

- Through the office or the portal of the State Automated System “Justice”, send the completed application with attachments to the court.

- Within 5 days from the date of receipt of the application to the court, obtain a ruling according to the rules of Art. 133 Code of Civil Procedure of the Russian Federation. This act specifies the time, date and place of the trial.

- At the appointed time, the parties appear in court, restating their claims and supporting them with evidence.

- In the event that there is no need to request additional documents, there are no controversial issues, the proceedings end at one meeting.

- Based on the results of the consideration of the case, the judge announces a decision, which is reflected in Art. 193 Code of Civil Procedure of the Russian Federation.

- Within 30 days from the announcement of the judicial act, you can file a complaint and change the decision according to the rules of Art. 321 Code of Civil Procedure of the Russian Federation.

In order to formulate a correct statement of claim, you can use an example sample of a petition for the collection of alimony in a fixed amount of money, which can be used.

How to change the form of alimony from shared to minimum wage payments

If the alimony shares are not enough for the children, you can file a claim with the district court at the defendant’s place of residence to change the method of payment to TDS. The plaintiff makes the calculation independently, taking into account the size of the monthly allowance per child in the region.

What the procedure looks like step by step:

- A statement of claim is drawn up, documents are prepared.

- One copy of the claim with documents that the defendant does not have is sent to him by registered mail with acknowledgment of receipt.

- Documents are submitted to the court.

- The judge accepts the application for proceedings, schedules and conducts a preliminary hearing.

- The case is set for trial. During it, the opinions and arguments of the parties are heard, documents and evidence are studied. Based on the results, a decision is made.

- Immediately after the decision is made, the plaintiff must receive a new writ of execution. A copy of the decision will be issued within five days (Article 214 of the Code of Civil Procedure of the Russian Federation), and it will come into force in a month.

Note: the decision in cases of collection of alimony is subject to immediate execution (Article 211 of the Code of Civil Procedure of the Russian Federation). There is no need to wait until it comes into force to present the writ of execution to the bailiff.

Contents and sample of the statement of claim

To change the procedure for collecting alimony with a share of TDS, you need to draw up a statement of claim in accordance with the rules of Art. 131 Code of Civil Procedure of the Russian Federation.

What it says:

- name, address of the court;

- Full name, address, telephone number of the plaintiff;

- Full name, address of the defendant;

- dates of marriage and divorce;

- information about the children for whom the money is paid;

- details of the order or decision, according to which payments were previously transferred in shares;

- old alimony amount in shares;

- claims: change the procedure for collection of TDS indicating the amount from pm;

- inventory of submitted documents;

- date and signature.

Sample claim

Consultation on document preparation

Documentation

What the plaintiff will need in addition to the application:

- passport;

- child's birth certificate;

- a copy of the order or decision (old);

- notice of service of documents to the defendant.

State duty

Plaintiffs acting in the interests of children are exempt from paying state duty (Article 333.36 of the Tax Code of the Russian Federation).

How to increase alimony from a small salary?

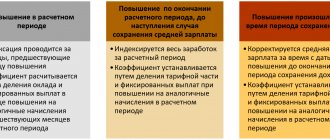

In a situation where financial support for a child has already been established and the allocated funds are not enough to provide for the child, you can increase the amount of alimony from a small salary by establishing a fixed form of payments. In Art. 83 of the RF IC provides for two options for increasing the amount of funds allocated for the needs of the child:

- Voluntary - development between the parents of children, an agreement on the assignment of alimony, in the manner prescribed by Art. 99 and art. 100 IC RF. The document must be drawn up in writing and also certified by a notary. A prepared agreement on the payment of alimony is equivalent to a court decision, that is, it has the force of a writ of execution, which means it can be sent to bailiffs to force the collection of funds from the payer.

- Compulsory – going to court. Cases related to the registration of alimony in a fixed form are considered by city or district courts. The final decision serves as the basis for the forced collection of funds through bailiffs. This option is distinguished by its duration and relative complexity.

Depending on the situation, the parents of a needy child have the right to choose absolutely any option to increase child support from the payer’s small salary. If citizens do not have insurmountable contradictions, an agreement can be drawn up; when there are disputes and difficulties, it is necessary to go to court. As a rule, cases of this nature are more often resolved in court.

Agreement to increase alimony payments

In a situation where the mother and father of the child have decided to draw up an agreement to increase child support, the parties must do the following:

- To determine the approximate monthly expenses for a child - it is advisable to calculate the price of products, necessary supplies, clothing, and other objects, without which the full existence of the offspring is impossible. The amount of spending includes all indicators that are relevant in the current conditions.

- Set the amount of monthly payments - the amount of alimony should not be less than half of the established subsistence level. If the amount of financial support from the parent is less, the rights and legitimate interests of the child are violated.

- Create a draft agreement both printed and in Word format.

- Collect a list of attachments: identification documents of the baby’s parents; offspring's birth certificate; marriage or divorce registration certificates; independently calculated expenses for the child and the amount of monthly payments. You can check in advance with a notary for a complete list of required papers for the agreement.

- Contact your chosen specialist and make an appointment.

- At the appointed time, the child’s parents should appear before the notary, with a prepared draft agreement and accompanying documents. The agreement is re-heard orally and signed by the parties in triplicate. The first option remains with the recipient, the second – with the payer, the third – in the notary’s archives.

Timing and cost

The duration, as well as the cost of the procedure, depends on the chosen option for changing the amount of alimony. The price of notary fees is regulated by Art. 22.1 Federal Law “Fundamentals of legislation on notaries”, as well as Art. 333.24 Tax Code of the Russian Federation. Clause 9, part 1, art. 333.24 of the Tax Code of the Russian Federation directly indicate the cost of an agreement to establish alimony - 250 rubles. This amount is paid only for certification of the document; if the child’s parents used the service of drawing up a draft agreement, the price increases. You can check the exact cost of notary services in advance. The duration of the procedure is not strictly regulated by law. In practice, the period does not exceed 5-7 days, it all depends on how busy the notary is.

Attention

The duration of the trial, in contrast to the certification of the agreement, is strictly regulated by the rules of the Code of Civil Procedure of the Russian Federation. Part 1 art. 154 of the Code of Civil Procedure of the Russian Federation indicates that cases within the jurisdiction of the district court are considered before the expiration of 2 months from the date of filing the claim. Part 6 art. 154 of the Code of Civil Procedure of the Russian Federation indicates that the duration can be increased by another 1 month if the case is complex. As a general rule, a state fee is paid for going to court. The amount of the fee is fixed in clause 14, part 1, art. 333.19 of the Tax Code of the Russian Federation, it is 150 rubles. At the same time, according to the rules of clause 2, part 1, art. 333.36 of the Tax Code of the Russian Federation, the plaintiff does not pay the funds. The responsibility to pay the funds rests with the defendant.

Changing the amount of alimony

The recipient may have reasons to increase the amount of child support. Their payer may have grounds to reduce its obligations. Any changes in the amount of maintenance are subject to official registration, which can be expressed: as notarization of a new agreement, when regulating parental relations in the form of voluntary agreements; in obtaining a new court decision based on a claim to change the level of alimony.

If it is necessary to go through a judicial procedure, the initiating party must prove the existence of the circumstances that become the basis for the claims specified in the claim.

Thus, the amount of alimony is subject to reduction in the following cases:

- a significant change in the financial capabilities of the payer, the composition of his family, or the establishment of disability;

- the child’s existence of other financial sources that allow him to meet his needs in full;

- the appearance at the recipient of payments of such property (including real estate), which is a stable income component, as well as a significant improvement in the financial situation;

- the emergence of new obligations to pay alimony;

- establishing full child support at the expense of the state;

- an increase in current prices, while maintaining the payer’s income at the same level;

- the presence of other circumstances.

The court may satisfy demands for an increase in maintenance if:

- significant deterioration in the financial condition of the recipient of payments;

- a sharp increase in prices, while the recipient retains the same income;

- the emergence of new obligations to pay alimony from the recipient, as well as the termination of previously established alimony obligations from the obligee;

- death of a third party who provided financial support;

- other extenuating circumstances.

Can the amount of alimony from wages be lower than the minimum wage?

The RF IC does not reflect the requirement that alimony depend on the minimum wage, but practice has developed in such a way that the relationship between these indicators can still be traced. Part 2 art. 83 of the RF IC indicates that the amount of monthly payments is determined based on the possibility of maximizing the preservation of favorable living conditions for the child. This rule applies to a fixed form of payments.

Attention

Thus, the amount of alimony is determined based on the needs of the child and the costs on the part of the parents, however, the court also takes into account the cost of living established in the region. So, part 2 of Art. 117 of the RF IC indicates that when determining the amount of payments in a fixed form, the judge can take into account the minimum wage and calculate the amount of payment as a share of the subsistence level. The size of the share is determined in each situation individually. For example, a judge can set alimony in the form of 1/2, 1/3, or 1/4 of the minimum wage, this depends on the income of the parents and the needs of the child.

Minimum amounts of alimony

The main interest of the recipient is to use the most profitable method of calculating them, which affects the final amount of content. The general legislative rule indicates that the funds paid by one of the parents as alimony, as well as those spent by the second parent in the process of cohabitation with the child, must provide the minor with at least a level of support that is defined as subsistence the minimum established for persons under the age of majority.

Arbitrage practice

To fully understand the procedure for collecting alimony from a small salary, you can refer to judicial practice:

- Citizen I. filed a lawsuit to assign alimony in a fixed amount from citizen R. for the maintenance of their joint child A. Officially, citizen R. is not employed anywhere, which means alimony is assigned from unemployment benefits. Having considered the case materials, the court came to the conclusion that it was necessary to assign payments in a fixed amount of 5,059.5 rubles, which is 50% of the minimum wage established in the region. In the future, the amount of payments should be indexed in proportion to the increase in the minimum wage in the region (Decision of the Kizlyar City Court No. 2-675/2019 of December 30, 2019).

- Citizen X. filed a lawsuit against citizen A. to change the form of collecting alimony for joint child C. A court order previously established that citizen A. must pay alimony obligations in the amount of 25% of wages. For 2 years, the amount of payments was no more than 3,800 rubles. At the same time, expenses for the child gradually increased, and therefore Citizen X. asked to change the form of alimony from shared to flat. Considering the case materials, the court came to the conclusion that it was necessary to establish alimony payments in a fixed amount - 5,000 rubles monthly.

Problems and nuances

The procedure associated with changing the option of assigning alimony from a small salary is characterized by a number of difficulties and features:

- When going to court, the plaintiff must prove not only the level of expenses for the child, but also, if possible, provide an indicator of the payer’s income.

- When preparing a claim, special attention should be paid to the evidence base; the more complete it is, the greater the likelihood of a positive resolution of the issue.

- In practice, when determining the amount of alimony in hard form, the court calculates 50% of the minimum wage.

- Unlike the share form, the fixed amount of payments is subject to regular indexation according to the rules reflected in Art. 117 RF IC.

- You can change the method of collecting alimony several times. For example, if the payer is officially employed, you can change back fixed payments to equity payments.

- If the child is under three years old, alimony can be collected for the maintenance of both the baby and the mother.

Is the amount of alimony determined by the minimum wage or by the subsistence level?

The norms of Federal Law No. 363 of November 30, 2011 became the basis for amending the provisions of Art. 117 SK. These changes led to the fact that the minimum wage was no longer used for calculating alimony. The cost of living data is now used both when determining the final amount of child support and when carrying out indexation.

Bailiffs use the cost of living indicator in the indexation process, which affects alimony assigned in a fixed value.

The cost of living is set separately for each subject of Russia. The absence of such an indicator indicates that the calculation is based on the indicator that is established by Government Decree and operates at the federal level.

EXAMPLE: Based on the subsistence level in force in the capital and region, equal to 14,009.00 rubles, the amount of alimony for one child, provided that alimony is paid in a fixed amount, will be a multiple of one subsistence minimum .