Mortgage for a large family - in one article we have collected all the necessary information on mortgage programs and government support measures for families with children. Which is very important, given the lack of free time among mothers and fathers with many children. Enjoy reading!

Has your family welcomed a third child? Congratulations! After noisy meetings with relatives and friends about the arrival of mother and baby have passed, and family life returns to normal, you can think about what benefits you are now entitled to. After all, you are now a large family!

Particular attention should be paid to the housing issue - considerable funds are allocated from the state treasury to support families with three or more children, and banks lend to large families on special terms. All government support measures, be it lowering the interest rate, reducing the size of the down payment, writing off part of the principal debt, etc., are aimed at helping large families with housing problems.

Mortgage options

With the birth of the third child, the following mortgage programs become available to the newly-minted large family:

- social mortgage;

- subsidy of 450,000 rubles;

- interest-free mortgage from Sberbank;

- family mortgage at 6%;

- as well as mortgages on standard terms.

Let’s take a closer look at each of the options, and mortgage seekers with many children will be able to choose the most suitable and profitable program for themselves.

Social mortgage

What it is? This term refers to a preferential lending program in which a certain part of the housing loan will be returned to the bank by the state.

Who can count on receiving a social mortgage?

| 1. | Needy and large families | They live in cramped apartments or have no home of their own. |

| 2. | State employees, social workers and civil servants | Teachers, doctors, etc. |

| 3. | Young parents with one child, in which the spouses have not reached their 35th birthday | An important condition is the lack of your own housing. |

| 4. | Citizens who took part in hostilities on the part of the state. | |

| 5. | Social security participants, contract workers. |

It is important to consider compliance with a number of requirements for each category of borrower. For example, for public sector employees a certain length of service is required. If one of the conditions is not met, the social loan will be denied.

Conditions for participation in the program:

- The down payment is in the form of your own funds, you can use maternity capital.

- Officially confirmed status of a large family.

- Lack of housing ownership, or the existing property is not suitable for a large family.

- Cost limitation - in 2021, the price of an apartment on a preferential mortgage should not be more than 35 thousand rubles. per square meter.

Beneficiary borrowers can choose the type of monthly mortgage payments themselves - differentiated or annuity - and change them.

If all criteria are met, you can begin processing documents according to the standard mortgage scheme.

What documents are needed to apply for a social mortgage loan?

| Documentation | Notes |

| Statement | |

| Passport of a citizen of the Russian Federation | Provided by both spouses |

| Birth certificates for all children | under 14 years of age |

| Marriage certificate | |

| Certificate (certificate) confirming the status of a large family | |

| Extract from the house register | Need to get it from the local administration |

| Help 2-NDFL | Certificate from the place of official employment confirming receipt of monthly income |

| Copy of work book | Or an employment contract |

| Certificate for maternal capital | If available |

| Documents for the purchased apartment | Extract from the Unified State Register of Real Estate, title documents of the seller for the apartment, etc. |

| Bank account details | Open in the name of the real estate seller. |

You may be interested in: “Mortgage for an apartment and its use”

Social mortgage for a large family

Social mortgage is a credit program, under the terms of which part of the loan will be paid from the Federal budget. It was developed several years ago specifically for privileged categories of citizens. AHML is responsible for implementing the program and regulating all issues arising in connection with it.

Attention! In 2021, it is planned to subsidize in the amount of 35% of the cost of housing purchased with a mortgage. Applicants can receive assistance from the state in one of three ways: the interest rate will be reduced, part of the purchased property will be compensated, or the down payment will be reimbursed.

Conditions

You can take part in the program under the following conditions:

- The applicant must have the amount of funds for the down payment (you can use financial capital for these purposes).

- A large family must document its status.

- The agreement specifies an expanded list of options for repaying mortgages for large families.

- Clients are given the opportunity to change the form of monthly payments from differentiated to annuity and vice versa.

- You must not own any housing or have a property that does not meet the living standards for a large number of people (18 sq.m. are allocated per household member).

- When choosing an apartment in 2021, beneficiaries should remember that for them the cost of 1 sq.m. should not exceed 35,000 rubles.

Who can participate

The following categories of beneficiaries can apply for a social mortgage:

- Needy and large families who live in cramped apartments or do not have their own housing.

- State employees, social workers and government employees, for example, teachers, doctors, etc.

- Young social units with one child, in which the parents have not reached the age of 35, and do not have their own home.

- Citizens who took part in hostilities on the part of the state.

- Social security participants, contract workers.

How to apply

Each category of benefit recipients has a number of requirements that must be met (for example, state employees must have a certain length of service). Otherwise, they will be denied social mortgage lending. The social program is drawn up according to the standard scheme.

Documentation

To participate in the social mortgage program, applicants must prepare a large package of documentation:

- A statement is being written.

- Civil passports of spouses.

- Birth certificates for all children under fourteen years of age.

- Marriage certificate.

- Certificate (certificate) confirming your status.

- An extract obtained from the house register.

- A certificate from the place of official employment confirming receipt of monthly income (Form 2NDFL).

- A copy of the work book (employment contract).

- Certificate for mat. capital (if received).

- Documents for the purchased apartment (extract from the Unified State Register of Real Estate, title documents of the seller for the apartment).

- Details of a current account opened in a bank in the name of the real estate seller.

Attention! Each financial institution that issues mortgages for large families in 2021 under a social program can increase the list of documents.

Registration in banks and AHML

AHML lends to individuals on the following terms:

- The agency purchases debts from partner banks.

- The lender undertakes to issue mortgages on the terms determined by the agency.

- Interest rates for apartments on the secondary market do not exceed 11.00%, in new buildings up to 6.00%.

- The down payment amount is not higher than 10% of the loan amount.

- The monthly mortgage payment will not exceed 45% of the total family budget.

Banks independently determine interest rates for their loan products. In the case of the state program, they reduce them for a preferential category of clients, but do not lose income, since they receive compensation.

Social mortgages and the entire lending process are described in more detail in a separate post.

Interest-free mortgage from Sberbank

Can a mortgage be interest-free? For borrowers from preferential categories - yes! Of course, any loan is issued with interest, otherwise credit institutions would operate at a loss. In the case of an interest-free mortgage for beneficiaries, the state takes on the interest repayments.

Sberbank provides certain categories of citizens with the opportunity to receive an interest-free housing loan as part of a targeted state program. But only if the following conditions :

- the status of a large family has been confirmed;

- spouses have a stable income that allows them to make timely payments to the bank, while the amount of remaining income is sufficient to meet the necessary needs of a family with children;

- purchased housing - the first and only square meters owned by the spouses;

- if a family owns a property, but living conditions are unsatisfactory (for example, the living space is insufficient for a large family to live in) - the application for participation in the program can also be approved;

- the family is officially recognized as “In need of support.”

Is it possible to get an interest-free mortgage in practice and how to do it? The process of obtaining such a home loan differs from a regular mortgage loan, at least in that it requires a more thorough check of all submitted documents.

Basic steps to get an interest-free mortgage:

| 1. | Submit an application for participation in the state program to the local municipality body. Programs at regional levels may vary. |

| 2. | Obtain approval from the administration for a status with many children. |

| 3. | Apply for an interest-free mortgage from Sberbank for large families. |

| 4. |

|

| 5. | The credit institution selects a mortgage loan with the condition of repaying only part of the principal borrowed funds, all accrued interest is paid from the budget of the Russian Federation. |

| 6. |

|

A package of documents for obtaining a mortgage without interest from Sberbank

The list of required documents is identical to the list in the “Social Mortgage” section described above, and includes:

- Identity document of a citizen of the Russian Federation (passport);

- Notarized consent of the spouse to the transaction;

- Birth certificates of children;

- Confirmation of the right to participate in the state program;

- Certificate 2-NDFL confirming the applicant’s income level.

Important details! First, the conditions for obtaining an interest-free housing loan provide for the issuance of only a new loan. For example, interest on a previously issued mortgage will not be recalculated. Secondly, housing under the state program can only be purchased on the primary market; secondary housing is not suitable.

You may be interested in: “Mortgage for a young family”

Mortgage for a large family in 2019

Currently, there are no mortgage programs specifically for large families. But there are government support options that allow you to purchase an apartment on preferential terms. Part of the payments is borne by the state. This is either a reduced mortgage interest rate or a one-time subsidy from the federal budget (Resolution No. 1711 of December 30, 2017).

In general, applying for a mortgage for a large family does not differ from a similar procedure under general conditions. A bank is selected, a property is looked at and a package of documents is prepared. But there is still help from the state. Depending on the circumstances, parents with many children may qualify for state support under the “Mortgage at 6%” and “Young Family” programs.

The “Housing for Russian Family” program is also worth considering. Its goal is to provide housing for middle-class couples. Basic conditions: parents are raising at least two children and have maternity capital. The cost per square meter should not exceed 35 thousand rubles.

Note! In addition to federal ones, there are regional programs for large families. You need to find out about mortgage benefits from the competent organizations at your place of residence.

Mortgage terms

When participating in mortgage programs, a large family has a chance to acquire living space on more favorable terms. Features of preferential mortgage:

- Reduced interest rate - on average, large families can count on 10-12%. But it is important to remember that when buying a secondary home, the rate will be higher. And you can purchase a new apartment from the developer at 6-7% per annum. The bank will receive compensation for the difference in interest from the state budget (Resolution No. 220 of March 13, 2015).

- Using maternity capital - parents with many children have the right to spend funds on an entry fee or making monthly payments.

- Attracting guarantors - with a small income, close relatives can act as co-borrowers. But not all banks are loyal to guarantors.

- Some banks show loyalty and give the opportunity to defer payment for several months due to financial difficulties.

- Extension of the loan term.

Requirements for borrowers

Most banks put forward standard requirements for potential borrowers. First of all, this is the reliability and solvency of the client. To obtain a mortgage under the state support program, a large family must meet the following criteria:

- Both parents are citizens of the Russian Federation and are officially married.

- A couple has 3 or more minor offspring (depending on the region).

- A large family has at its disposal the amount required for a down payment. It differs in different banks, but on average it is 15-20% of the cost of the apartment.

- The couple is ready to document their status as a large family.

- Neither parent owns an apartment or house.

- Many banks are more willing to approve mortgages for parents with many children whose age does not exceed 35 years.

Required documents

Preparation of documents consists of providing the bank with complete information about the borrower and his income. The list may differ in different organizations; it should be clarified with the manager.

What you need to prepare to apply for a mortgage:

- TIN and passports of spouses with many children.

- Documents for each minor offspring (birth certificate, from 14 years old - passport).

- Marriage certificate.

- Certificate of a large family.

- Certificate about the need to improve living conditions.

- Spouse's military ID.

- Proof of income (certificate from place of employment or bank statement).

- Copies of work records.

- Certificate of family composition.

- Maternity capital certificate.

- Documents from the developer for the selected apartment.

The difference between registration in banks and AHML

Banks are commercial lending institutions, and for many families this is the only chance to acquire housing. However, not all parents with many children know about the opportunity to take advantage of a social mortgage with the help of AHML. This is a completely state-owned company, the abbreviation stands for Housing Mortgage Lending Agency.

The goal of the organization is to optimize lending conditions and provide housing for a large number of citizens (Resolution No. 373 of April 20, 2015). Due to the favorable conditions, this is the best option for a large family. The main difference between AHML and a bank is that a wide range of citizens can count on receiving a loan, regardless of income and social status. A commercial bank gives preference to clients with good income and property.

How else does a mortgage in AHML differ from a bank loan:

- Low interest rate - from 6 to 8%.

- Reduced down payment amount - to obtain a mortgage, it is enough to pay 10% of the cost of the apartment.

- Long loan term - the loan is provided for 30 years.

- Opportunity to buy an apartment on the secondary real estate market.

- The borrower does not need to be afraid of changes in mortgage conditions, unlike banks.

Mortgages with AHML also have some unpleasant features. The application is processed much longer, and you often have to pay for this procedure. Also, the issuance of a loan is sometimes delayed, and the borrower increases the risk of running into penalties for delaying the transaction. But against the backdrop of low interest rates and a minimum start-up contribution, this is nothing for some large families. You can learn more about mortgages in AHML from the video.

Family mortgage at 6%

This government support program has been in effect since 2021. Its essence is as follows: a family with two or more children takes out a conventional mortgage, the bank reduces the initial interest rate to 6% and, as a result, the monthly mortgage payment decreases. The state compensates for the credit institution's lost profit.

Basic conditions of a family mortgage at 6%:

| 1. | A prerequisite is that at least a second child was born in the family from 2021 to 2022. | |

| 2. | The rate for the entire mortgage term is 6%. |

|

| 3. | Primary market only. |

|

| 4. |

| |

| 5. | You can refinance! |

|

| 6. | Down payment - 20%. | It may consist entirely of maternity capital. |

| 7. | Maternal capital. |

|

| 8. | Residents of the Far East have special conditions. | At the birth of at least a second child from 2021 - a preferential rate of 5%. You can buy secondary housing, but only in the village. |

Important nuance! Life insurance of the borrower and the purchased property is mandatory! If the borrower refuses, the banking organization may increase the rate by up to four percentage points. And this is not the initiative of the creditor, but a condition provided for by government decree.

Funds for the family mortgage program are allocated from the federal budget.

Mortgage at 6% - family

For those families who have a child in 2021, the state offers to apply for a family mortgage on favorable terms - at only 6% per annum. Preferential mortgages are not available everywhere, these are only some banks.

How does the program work? The state takes on the difference in percentage (usually it ranges from 10 to 13% per annum) between the current and preferential rates. Based on this, it becomes clear that large families can save up to 4.00% annually, and this is a considerable amount if you take into account the full cost of the loan.

It is important to know. The executed agreement will include an interest rate of 6% per annum. The process of formalizing the signing of the agreement will be completed in a bank chosen (independently), but it is worth understanding that there is a certain list of financial organizations that work under the terms of the program. All banks must submit the necessary documents to the Ministry of Finance of the Russian Federation and an application for participation in the program within a month after the decree.

Conditions

The new state, preferential project, which is already active, actually has a number of criteria to take part in it:

- Children with a date of birth after January 1, 2021 and inclusive of December 31, 2022.

- Many people are interested in the duration of the subsidy. It is, of course, calculated based on the number of children the borrowers have. For example, if there are 2 children, then the subsidy period is 2 years, 3 children or more - 5 years.

- Under the terms of the special program, you can only buy housing in a new building. It is possible to use subsidies to refinance a previously obtained mortgage.

- If the borrowers met all the criteria for subsidization and their benefit was assigned for a period of three years, but later another baby appeared, the subsidy is automatically extended to five years.

- An important requirement is that the apartment must be purchased only from a legal entity.

- The program was introduced for a certain period and its current validity period is from January 1, 2021 to December 31, 2022. With favorable forecasts and high demand, the program will most likely continue to operate.

Attention! When implementing and developing a special preferential program, we took into account the fact that the demand for apartments in new buildings will decrease. And to help developers, a condition was included that the program is designed only for the primary real estate market.

Thus, a mortgage at 6% per annum was created both for large families and to help companies that build residential buildings. Secondary housing can only be refinanced, and only if it was purchased from a legal entity.

Subsidy of 450 thousand for mortgage repayment

Another tool for financial support for large families is a state subsidy in the amount of 450 thousand rubles. The corresponding federal law was adopted in July 2021, number 157. This assistance is allocated free of charge from the budget upon the birth of the third and subsequent children. The money can be spent on a mortgage loan - by paying it off in full or in part, by reducing the amount of monthly payments.

Basic conditions for receiving a subsidy:

- Time frame. Borrowers from 2021 to 2022 became parents or adoptive parents of a third or subsequent children.

- The date of concluding the mortgage agreement is until July 1, 2023. A housing loan received before this date is covered by the program; later, it is not.

- The object of purchase is residential real estate. The law does not prohibit the acquisition of land.

What documents need to be collected?

The first step is to draw up an application in the form of the bank that issued the housing loan. The following documents are attached to it:

| 1. | Passport (proof of citizenship) |

| 2. |

|

| 3. | Confirmation of maternity or paternity: birth certificate, adoption certificate, court decision on adoption. |

| 4. | Mortgage agreement (or refinancing, if any) |

| 5. |

|

The data obtained is subject to strict verification.

Important details!

The amount is 450 thousand rubles. – once and only within the framework of one mortgage agreement! That is, if the remaining debt to the bank is greater than this amount, then exactly 450 thousand rubles will be written off from the budget, and the remainder will continue to be paid by the recipient of the loan.

But if the unpaid mortgage is already less than 450 thousand rubles, then it makes sense for borrowers with many children to pay off this balance on their own, and use the state subsidy in full to purchase other real estate - unused funds cannot be transferred to other loan agreements, the money is burned.

You might be interested in information on how to get some of your mortgage interest back: “Tax Deduction for Mortgage Interest”

Mortgage conditions at 6%

Please note! In order to obtain a mortgage loan on special terms under the new rules for 2021, the following rules must be observed:

- birth of the second or 3rd child, starting from 01/01/2019,

- housing must be purchased from the developer (ready-made or under an equity participation agreement),

- a loan secured by real estate for a large family is issued in one of the Russian banks or in AHML, always in rubles and no earlier than the beginning of 2019,

- monthly payments - annuity (the same every month throughout the loan term),

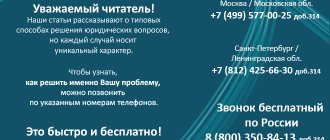

- minimum and maximum mortgage amounts have been established for each region. For example, for Moscow and the region - from 500,000 to 8,000,000 rubles. In St. Petersburg, the minimum threshold is similar, but the maximum is limited to 3 million rubles,

- registration of insurance (life and health of the borrower, as well as the apartment itself),

- to refinance a mortgage under new conditions, a loan from the current bank must be taken out at least 6 months ago in the absence of arrears and debt restructuring,

- mortgage loan terms range from 3 to 30 years, while the borrower must be at least 21 years old and not older than 65 years,

- standard package of documents. The only difference is that the birth certificate of the child is additionally attached, after the birth of which the right to obtain a loan on preferential terms arose.

Programs can be combined with each other

Can. To get the most out of the budget, parents can combine government support measures. But it is important to fulfill all the conditions stipulated by the programs. For example, how in practice can you combine a mortgage at 6% and a government subsidy of 450,000 for the birth of a third baby? The couple had a second baby in 2021, and the family purchased a new house or apartment with a mortgage. According to the terms of the family mortgage, the rate was reduced to 6%. And, for example, in 2021, a third son or daughter is born - in this case, an amount of 450,000 rubles is allocated from the budget to repay the existing loan, and the 2 programs are combined. Different regions have their own measures of social assistance and support, so spouses should definitely contact local administrations, bank branches and study the proposed financial assistance programs.

Let's sum it up

Supporting families with 3 or more children is a priority for the state. Families with several children are overwhelmingly experiencing housing difficulties. For them, Russia has special government and banking programs that facilitate the process of acquiring more spacious living space.

In this article, we examined the main measures of state support, including a family mortgage at 6%, a social mortgage, a subsidy of 450,000 rubles at the birth of the 3rd child, and others.