Last modified: February 2021

Dismissal of the alimony provider is a standard procedure for terminating the contract, characterized by the preparation of additional documents to the relevant authorities. Within the framework of labor law, alimony payers are equated to ordinary categories of citizens. Status is not a hindering factor for an employer when wanting to leave. The obligation to make payments to third parties does not protect against rupture and does not contribute to the preservation of the employment relationship.

Why don't alimony payments arrive on my card?

There are several reasons why alimony arrears may arise. They can be respectful or disrespectful.

The following are considered valid reasons:

- loss of official place of employment by the alimony payer;

- delay in payment of wages;

- serious diseases that require large financial expenses.

Unexcused reasons include:

- evasion of alimony payments due to the fault of the alimony payer;

- delay in alimony payments by the employer (unfair work of the accounting department);

- delay in bank transfers;

- taking another job or changing place of residence, but the alimony payer did not notify the new employer about this;

- the defendant is trying to hide his true income.

Other circumstances may also arise that affect the termination of alimony receipts on the card, for example, its validity period has expired, or the alimony recipient has changed his last name, which requires replacement with a new card.

The Department of Bailiffs collects evidence about malicious evasion of alimony obligations.

Features of dismissal

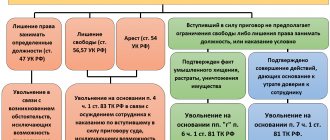

The fact that an employee is considered a child support worker does not at all protect the person from dismissal. The employer has the right to dismiss this employee, like any other. How to fire a child support worker:

- systematic absenteeism;

- avoidance of direct official duties;

- reduction of employees;

- insufficient qualifications.

All this is clearly stated in Art. 81 Labor Code of the Russian Federation. If there are compelling reasons, an employer can fire a child support payer in the same way as an employee who is not burdened with monthly payment obligations.

Is it possible to fire a child support worker?

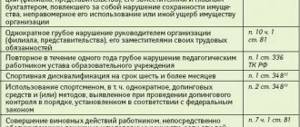

Responsibility of the employer The employer may be held administratively liable for failure to comply with the rules for dismissing the alimony payer. In particular, this includes:

- a fine of 3000-5000 rubles. from the enterprise, 300-500 rubles. from the manager - for untimely notification of executive authorities about the termination of the contract;

- fine 30,000-100,000 rubles. for the company and 10,000-20,000 rubles. for the manager for not sending a writ of execution on time with a note about withheld funds.

Bailiffs can analyze and check the work of the accounting department, as well as monitor the fulfillment of obligations to pay funds. Being aware of the rules for dismissing alimony payers and the deadlines for fulfilling obligations to provide documentation to executive authorities, you don’t have to worry about problems with the law.

Responsibility of the employer for failure to comply with the rules for dismissal of the alimony worker

The employer is required to act in strict accordance with the above rules. Otherwise, he is subject to liability in accordance with the Administrative Code.

If the deadline for informing the dismissed person about the termination of the contract is not met, a fine may be imposed on both the responsible person and the company. For the general director, its size will be from 300 to 500 rubles. Its value for the organization will be from 3,000 to 5,000 rubles.

Additionally

If the deadline for sending the writ of execution, which contains information about the amounts withheld from the employee, is missed, the company will face more significant penalties. The fine for the general director will range from 10 to 20 thousand rubles. At the same time, for the company its range will be from 30 to one hundred thousand.

Dismissal of an alimony worker: procedure and nuances.

- After delivering a letter of termination of the employment contract to the second parent, he has the right to control the situation by inquiring about the receipt of information about the new place of work from the bailiffs. But it often happens that for some reason you have to change your job.

- A notification letter must be sent to the parent on the day of termination. A natural question arises: is alimony paid upon dismissal?

- Timely information is clearly regulated by law. A delay of even one day may be grounds for filing a complaint. Here you should consider all possible situations in order to understand when you can count on payments and when not.

- Being aware of the rules for dismissing alimony payers and the deadlines for fulfilling obligations to provide documentation to executive authorities, you don’t have to worry about problems with the law. We had an employee for whom we paid alimony. We sent a letter to the bailiffs about his dismissal. It is immediately worth noting that alimony upon dismissal of a full-time employee is paid only for children under the age of majority.

- At the same time, after breaking the employment relationship with the employer, the employee may receive different options for compensation, differing in monetary amounts.

- When it comes to paying alimony upon dismissal by agreement of the parties, you should know that compensation to a former employee will consist of two parts: By the way, it is also possible to recover alimony from vacation pay. upon dismissal under this scenario, it comes from both amounts.

- The calculation of the fee due to the recipient is carried out using the usual method, taking into account the personal income tax, which is 13%.

- In this way, alimony is calculated from compensation upon dismissal, essentially alimony from the salary that a person managed to earn.

USEFUL INFORMATION: How to register a child without the consent of the father

Typically, severance pay is equal to three times the employee’s monthly salary.

Accordingly, according to the law, this amount is subject to deduction of payments. Alimony from severance pay upon dismissal is withheld in the usual manner.

There are no changes in the amount or rules for calculating it.

It is useful to know how to prove black wages for alimony and how to collect it?

This will allow you to quickly take the necessary measures, eliminating the situation of a prolonged absence of alimony payments.

When a person quits his job, the recipient of alimony and the bailiffs are immediately notified about this.

Typically, an enterprise takes the following actions: Bailiffs who have received the listed documents submit them to the alimony payer’s new place of work, if the documents indicate the company’s coordinates.

This allows the recipient to count on alimony after the payer’s dismissal.

Otherwise, service employees take active steps to search for the person and establish his current place of work.

It is useful to find out whether alimony is withheld from sick leave and how to receive payments?

If for some reason the company where the alimony worker worked did not transfer the necessary papers on time, as a result of which a debt arose to the recipient, the latter has the right to sue the organization and, in this manner, recover alimony payments from it.

To win the case, you must attach documents indicating the date of dismissal of the payer, as well as information from the bailiffs that they did not receive the necessary papers.

As for the child support worker himself, after dismissal he must independently notify the bailiffs and the mother of his child about the change of job.

This can be done orally, because no official documents from the previous place of employment are given to him. How is child support paid after leaving work?

Video on the topic:

Letter to the bailiffs

The main responsibility of the employer in this case is to prevent a situation where a person paying alimony amounts may evade the duties assigned to him. That is, the employer must promptly notify representatives of enforcement proceedings (bailiffs) about the termination of the employment contract with the alimony worker.

Also, an enterprise or organization is required to notify the recipient of alimony payments (the former spouse or spouse of the dismissed employee).

Read more: Guarantees and compensation for workers of the Far North

It should be noted that there are discrepancies . In the Family Code, this is a three-day period from the date of termination of the contract. But Federal Law number 229 states that the notification must be sent immediately. For this reason, it is better for HR department employees to send the document to the address of the recipient of alimony payments as early as possible in order to avoid administrative penalties.

If you want to find out how to solve your particular problem, please contact us through the online consultant form or call :

The Family Code states that responsibility for paying alimony (controlling the deduction of these funds from the employee’s salary) falls on employers - Article 111 of the code.

Therefore, when alimony provider changes position or workplace, bailiffs are notified within three days. The following is sent to this government body (according to Federal Law number 229):

- a special letter containing notice of termination of the employment contract and information about the new place of work, if it is known to the previous employer;

- an executive document that was previously transferred by bailiffs to this enterprise or organization (a note is made in the document about penalties that have already been withheld from the employee).

The legislation does not provide for a single or unified form of notification . However, the document sent to the bailiff service must contain the following points:

- The date of the document is written in the upper left corner. The name and address of the bailiff department (region, district and city), as well as the number of the court order that is being executed, and the date of its issue by the judicial authority are indicated.

- The reason for drawing up the document is stated below in free form. It is necessary to indicate the exact execution of the specified order by the management of the organization or enterprise (with a breakdown of information about the recipient of alimony amounts) and the return of this document in connection with the dismissal.

- Next, information is entered regarding the amount of deduction and the period during which it was made. For example: “The amounts indicated in the writ of execution in the amount of (interests are indicated) were withheld from the wages of Vasiliev A.P. monthly from January 2015 to May 2021 inclusive in a total amount of 150,000 rubles (the amount is again indicated in parentheses in words) and were transferred Vasilyeva O.N. according to the details she indicated.”

- Here you can insert a small table by month, reflecting the order of deduction of alimony amounts with the date of their transfer to the recipient.

- The notification letter is signed by the head of the organization or enterprise with his first and last name spelled out. The seal of the enterprise or organization is also affixed.

Sample letter to bailiffs:

When dismissing the alimony worker, do not forget about the writ of execution

Relevant as of: April 4 Notification of employee dismissal Sometimes organizations have employees from whose salaries the accounting department regularly makes deductions and transfers them to claimants. Alimony or other amounts are withheld from the employee’s income on the basis of a writ of execution. This may be part. Such a document reaches the organization either by mail from the bailiffs, or from the employee himself. It only says that the employer must immediately provide the relevant information to the bailiffs and return the writ of execution with a note on the penalties made. At the same time, specifically in the case of alimony, the Family Code instructs the employer to inform the bailiff and the recoverer about the dismissal of the debtor and his new place of work if it known within three days. At the same time, the norm does not say anything about the deadline for returning the writ of execution. A sample notice of dismissal is provided on the page.

Accounting responsibilities

After the accounting employee is relieved of his position, he needs to carry out the appropriate work - collect a personal file and send the documents to the organization’s archives. This document should contain the following acts:

- photocopy of the dismissal order;

- a photocopy of the writ of execution, which contains data about funds withheld from wages and the remaining amount of payments;

- a list of documents that are in the personal file;

- photocopies of notices that were sent to the recipient of alimony and the bailiffs.

If the organization has a documentation book, then an appropriate note must be made in it, indicating the date of sending the notice and dismissal.

If the alimony worker quit his job, how to pay alimony

You can apply for a division of this loan, and if it is proven that these funds (loans) went to the needs of the family... then it should be divided.

23. I pay child support. 50%+10% debt. A week ago I had to quit my job. Finding a new job takes time. What to do in such a situation? Can I pay alimony through bailiffs in a fixed amount during this period? And another question... I now live in another city. There is no opportunity to travel to my hometown. Can I contact the bailiffs here?

23.1. Good day to you, you can simply transfer a certain amount to the account of the child’s mother, indicating the purpose of the payment.

24. Got a job in the organization at the end of February 2018.

How to make payments if the contract is terminated?

How to pay child support if an employee quits his job? If it is impossible to get a job immediately after dismissal, many citizens turn to employment authorities , where they are registered, paid an allowance in the amount of a certain percentage of the average salary from their previous place of work, and helped to find a new way to earn money.

Important! In accordance with Government Decree No. 841 , alimony for minor children is collected from unemployment benefits (clause “c”, paragraph 2). At the same time, Art. 101 Federal Law No. 229 does not contain this benefit as a prohibition, therefore it can also be recovered from other relatives.

Other income of the dismissed alimony worker can also be used to collect:

- severance pay (if alimony is established for minor children);

- amounts received from renting out property;

- income received as a result of work performed or service provided under a civil contract.

Is it possible to fire a child support worker?

Alimony is money paid by one of the parents for the maintenance of a minor child or children after a divorce. Payments are due to a minor in accordance with this legislation of the Russian Federation and are deducted from the salary of the parent (father or mother).

The writ of execution for payment of alimony is transferred to the company where the parent works after the end of the divorce process. The document contains information about the average salary of the alimony worker, the position held, and the name of the organization itself. Funds are deducted from each employee's salary in a predetermined amount.

Despite the parent’s obligations to pay monthly child support, no one can oblige an employee to work in his position until the child comes of age. An employee can be dismissed under an article or at his own request. It is also possible to move from one place of work to another, transfer to another company or branch.

The dismissal of an alimony payer is not much different from the dismissal of other employees.

However, when the alimony worker is dismissed, the accounting department is faced with the question: what to do with the writ of execution provided by the executive authorities? After all, according to Art. 111 IC RF and Art. 5 No. 229-FZ, it is not the parent, but the employer, who is responsible for calculating child support. Failure to comply with formalities may result in administrative liability.

If the employer’s company does not take appropriate measures after the employee’s dismissal and does not submit a writ of execution to the relevant authorities on time, the consequences can be disastrous:

- the alimony automatically becomes a debtor;

- The employer's company, according to the law, is found guilty of failure to fulfill its obligations.

To avoid misunderstandings, after the dismissal of the alimony worker, the company accountant notifies the enforcement authorities about this. The notification is drawn up according to the sample and signed by the manager. The writ of execution is returned to the bailiffs.

Retroactive dismissal of an employee

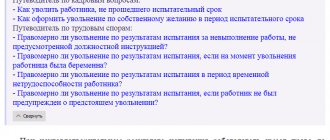

It often happens that the alimony payer introduces ambiguity into the issue of employment, dismissal or continuation of work in the same place.

For example, he repeatedly plans to submit his resignation and then changes his mind. A company manager may be faced with a difficult question regarding what to do if an employee is fired retroactively.

After all, in fact, we are dealing with a violation of the law in the form of delays.

For untimely submission of a writ of execution and some other inconsistencies, the employer may be punished with a fine.

Therefore, it is extremely important to correctly explain the reason for the untimely submission of documents to the executive bodies

In this case, the retroactive dismissal of the alimony payer cannot be considered a violation of the law.

Nuances

The dismissal of an alimony payer does not mean the termination of payments. After delivering a letter of termination of the employment contract to the second parent, he has the right to control the situation by inquiring about the receipt of information about the new place of work from the bailiffs.

USEFUL INFORMATION: Privatization of a cooperative apartment

A notification letter must be sent to the parent on the day of termination. Timely information is clearly regulated by law. A delay of even one day may be grounds for filing a complaint.

Employer's liability

The employer may be held administratively liable for failure to comply with the rules for dismissing the alimony payer. In particular, this includes:

- a fine of 3000-5000 rubles. from the enterprise, 300-500 rubles. from the manager - for untimely notification of executive authorities about the termination of the contract;

- fine 30,000-100,000 rubles. for the company and 10,000-20,000 rubles. for the manager for not sending a writ of execution on time with a note about withheld funds.

Bailiffs can analyze and check the work of the accounting department, as well as monitor the fulfillment of obligations to pay funds. Being aware of the rules for dismissing alimony payers and the deadlines for fulfilling obligations to provide documentation to executive authorities, you don’t have to worry about problems with the law.

Retroactive notice

It often happens that an employee introduces ambiguity into the process of employment, dismissal from a position, or continuation of work in his place. For example, he periodically decides to write a letter of resignation, and then changes his mind. The management of the organization faces a difficult question regarding what can be done when dismissing an employee retroactively. Since this is a violation of the law in the form of failure to comply with deadlines.

For documents not sent on time and certain other inconsistencies, the employer may be punished in the form of penalties.

Therefore, in this case, it is important to explain the reasons for the untimely submission of notice to the bailiffs. If regular absenteeism was noted, the employee failed to cope with his job obligations, or periodically committed unlawful actions, the employer will be able to dismiss the employee on his own initiative, indicating the appropriate article. In this case, the retroactive dismissal of the alimony payer is not a violation of the law.

How to dismiss a child support worker and prepare a letter to bailiffs

According to the norms of Russian legislation, it is the employer who is responsible for the timely transfer of alimony to the recipient (Article 111 of the RF IC). But it so happened that the alimony worker submitted his resignation. What does the employer's accounting department do in this case?

- Firstly, on the day of termination of the employment relationship with the employee, he sends a letter to the bailiff by mail about the dismissal of the alimony provider;

- Secondly, the letter of execution itself and the order of dismissal are attached to the letter.

Thus, bailiffs must receive information about the termination of employment of a person in a particular company on the day of the official termination of the employment contract.

There is no official sample of a notice of dismissal of an alimony worker in Russia. However, you can find many approximate options on the Internet. At the same time, a letter written in free form should contain such aspects as:

- The period of deduction of alimony from the employee’s income;

- The total amount of funds withheld for the entire period of employment;

- The outstanding balance of alimony payments;

- The name of the enterprise to which the employee is transferred (if any) and its address;

- The address where the employee lived before his dismissal from the organization.

In addition to the requirements for the notification letter, there are a number of rules on how to return the writ of execution to the bailiffs upon dismissal.

- Since the letter is an official document and has legal force, it is drawn up on the company’s letterhead with its name and details;

- Since the document covers financial issues, it is signed by the head of the organization and its chief accountant;

- The letter is affixed with the seal of the enterprise (this requirement applies to legal entities).

The letter, dismissal order and writ of execution are sent to the bailiff service by registered mail. In this case, an inventory of documents is compiled at the post office, which is certified by the date the letter was sent.

Who notifies the recipient of alimony? This responsibility also falls on the employer's accounting department. The second registered letter also contains a notice drawn up in free form, an order of dismissal and a copy of the writ of execution.

What if the company does not have the address of the alimony recipient? In this situation, the second package of documents is also transferred to the bailiff service, after which its employees contact the recipient of the payments.

Since the letter indicates the amount of the employee’s income and the percentage of alimony withheld from him, it is important to understand exactly what cash receipts are included in. The norms of Russian legislation determine that alimony is paid from two types of income:

- Employee salary. In 2021, recovery of a fixed amount and interest was allowed. Moreover, the latter should be no more than 25% for one child, 33% for two children and 50% for three or more children.

- Vacation payments. They are involved if the employee’s salary is too low. In their respect, the withholding is carried out in a fixed amount.

The specific amount of deductions (in a fixed form or as a percentage) in favor of alimony payments is prescribed in the writ of execution, therefore, without it, the accounting department should not make any deductions from the employee’s salary.

It should be added that the employer is only responsible for withholding child support in favor of minor children. In cases where we are talking about disabled children and incapacitated citizens, bailiffs do not impose such obligations on the company.

Dismissal procedure

Regardless of what was the reason for terminating the employment relationship between the employee and the employer - failure to fulfill labor obligations or the personal desire of the person to leave his position - the procedure for dismissing the alimony payer must be followed. For example, when removing a person from a position for absenteeism, the procedure will be as follows:

- identification of the fact of absenteeism and documentary evidence (memo, act, etc.);

- determining the reason for absenteeism - the presence or absence of valid reasons;

- registration of dismissal under the relevant article with making a note in the work book and personal file.

Because the presence of minor children who are entitled to monthly payments is not a “mitigating circumstance,” an employee can be dismissed according to the same scheme and on the same grounds as other employees. The only nuance can be considered an increase in bureaucratic procedures and mandatory compliance with the following formalities:

- drawing up and sending notices and writs of execution to bailiffs;

- sending a corresponding notice to the second parent receiving child support.

The employer is responsible for the timely provision of the specified documentation to the authorities.

Payment of alimony upon dismissal of an employee calculation in 2019

These documents are handed over to the bailiff, who opens proceedings to enforce the court decision. All documents on the basis of which alimony payments are made are transferred to the accounting department of the enterprise. Government Resolution No. 841, the draft of which was approved on June 18, 1996. The legislative act clearly defines the list of employee income from which alimony is calculated:

- bonus payments;

- additional payments, including those paid for difficult working conditions;

- other types of income specified by law.

- wage;

- fee;

Note!

The above is a non-exhaustive list of income for collecting alimony. The list includes business income, deposit interest, scholarships, pensions, and social benefits.

But since deductions from this list are carried out by other authorities, we will not discuss them in this article.

Procedure for dismissing an employee

Termination of an employment contract with an alimony provider can be done in two ways:

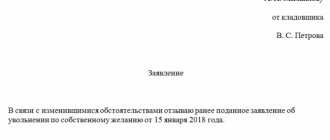

- On his initiative. In this case, the employee must submit an application himself, indicating a valid reason (for example, dismissal for health reasons).

- At the initiative of management. Such a development of events is possible in the event of serious disciplinary offenses on the part of the employee, liquidation or reorganization of enterprises, or reduction of the workforce.

It should be noted that persons obligated in court to pay monthly alimony payments to their children can be both women and men.

And the procedure for terminating employment contracts is carried out for them on a general basis. At the same time, as mentioned above, the status of alimony worker does not eliminate possible dismissal.

Its specific values for each individual alimony holder are indicated in the writ of execution (sheet). Without this document, both the withholding of funds and the dismissal of an employee cannot be carried out.

The procedure is as follows:

- The employee submits an application to the management of the organization or enterprise with a notification indicating the desired date of termination of the employment contract. An employer can also be the initiator. By sending a written notice to the employee, management informs him of the upcoming dismissal.

- At the next stage, the personnel department prepares a corresponding order, which is signed by the manager. The dismissed employee must be familiarized with the document (he signs).

- Then, notes are made in the employee’s work book and personal file, recording the reasons and grounds for termination of the contract (a reference is given to the manager’s order and labor legislation).

- All payments required by law are calculated. These funds are paid on the last day of work at a particular enterprise. If an employee leaves on his own initiative, severance pay is not accrued.

The accountant is required to include the following documents in the employee’s personal file (they are stored in the archive in case of inspection by bailiffs):

- the document on the basis of which alimony amounts were withheld (writ of execution);

- the order that served as the basis for terminating the contract with the employee;

- a copy of the letter sent to the bailiff service;

- a description of all documents included in this letter;

- notifications received by the company about the delivery of letters (to the bailiffs and the recipient).

Nominal and real wages - understand this issue.

If you want to find out how long you will be paid maternity benefits, then our information will be useful to you.

Find out more about the state pension for disabled people here.

How to return a writ of execution to bailiffs upon dismissal

Relevant as of: April 4 Notification of employee dismissal Sometimes organizations have employees from whose salaries the accounting department regularly makes deductions and transfers them to claimants. Alimony or other amounts are withheld from the employee’s income on the basis of a writ of execution.

Notifying bailiffs about the dismissal of an employee Returning a writ of execution to bailiffs Below we will describe in detail the procedure for returning a writ of execution for each of the above cases. Let's consider typical cases: The defendant repaid the amount of debt. Let us assume that, on the basis of a writ of execution, the employer made penalties for compensation for damage caused, while the amount of compensation in the document is indicated in a fixed monetary amount. In this case, the organization returns the writ of execution upon full repayment of the debt. The collection period has been terminated. In general, the employer withholds child support until the child turns 10 years old. If the text of the writ of execution contains this wording of the retention order, then upon the child’s birthday, the plaintiff’s demands are considered fulfilled, which means that the employer can return the writ of execution to the bailiff. Deadline for returning the writ of execution to the bailiffs Based on the provisions of the RF IC, the employer is obliged to return the writ of execution to the bailiffs before the expiration of 3 days from the moment the payer fully repays the claims.

Below we will describe in detail the procedure for returning a writ of execution for each of the above cases. Let's consider typical cases: The defendant repaid the amount of debt. Let us assume that, on the basis of a writ of execution, the employer made penalties for compensation for damage caused, while the amount of compensation in the document is indicated in a fixed monetary amount.

USEFUL INFORMATION: Sample petition for reconciliation of the parties in a divorce

Below we will describe in detail the procedure for returning a writ of execution for each of the above cases. Let's consider typical cases: The defendant repaid the amount of debt. Let us assume that, on the basis of a writ of execution, the employer made penalties for compensation for damage caused, while the amount of compensation in the document is indicated in a fixed monetary amount. In this case, the organization returns the writ of execution upon full repayment of the debt. The collection period has been terminated. In general, the employer withholds child support until the child turns 10 years old. If the text of the writ of execution contains this wording of the retention order, then upon the child’s birthday, the plaintiff’s demands are considered fulfilled, which means that the employer can return the writ of execution to the bailiff. Deadline for returning the writ of execution to the bailiffs Based on the provisions of the RF IC, the employer is obliged to return the writ of execution to the bailiffs before the expiration of 3 days from the moment the payer fully repays the claims.

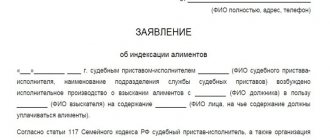

Dear professionals, tell me about the situation: A writ of execution at the previous place of work. Actually, as far as I understand, his former employer is obliged to inform the bailiff about the dismissal of this employee and return the writ of execution. And he, in turn, will redirect it to you. Sorry for the stupid questions, this is just my first time encountering this, but is an employee supposed to notify bailiffs about a new place of work? And you are waiting for it to be sent to you. To speed up the process and not accumulate debt, which will still have to be paid, you can advise the employee to contact the bailiffs themselves and hurry up the transfer of the document. In this application, it is recommended to necessarily reflect the following provisions: - last name, first name, patronymic and address of the alimony payer; - last name, first name, patronymic and address of the person to whom alimony should be paid or transferred; - last name, first name, patronymic, day, month and year of birth of children or other persons for whose maintenance alimony should be withheld; - the amount of alimony for the maintenance of minor children in a fixed sum of money or in the amount of a share of earnings; the given amount of deductions should not be less than the amount established by law; - the amount of alimony for the maintenance of parents, spouses, and other persons in need of financial assistance - in a fixed amount; — the date from which deductions should be made; — period of production of alimony deductions. In the absence of this information, it is not recommended to accept the application for execution. Applications must be stored in the organization in the manner established for executive documents.

Notification to bailiffs

After the dismissal of an employee who paid alimony, the bailiffs must be informed about this. To do this, the employer draws up a letter containing the following information:

- The period during which the employer withheld and transferred alimony;

- Child support debt, if any, as well as the reasons why this debt arose;

- Information about the new employer, if the employee is dismissed by transfer;

- Employee's residence address.

The letter is signed by the manager or an authorized employee, and a writ of execution is attached to it, as well as the amount that was withheld from the employee. The fact that the employer informs the bailiffs about the dismissal of the alimony worker must also be reported to the recipient of alimony payments. To do this, a notice is also drawn up for him, which is sent to the former employee by mail. The period within which notifications must be sent to bailiffs is given differently in different legislative acts. According to the Family Code, it is 3 days, and Law No. 229-FZ states that the notice must be sent on the day the alimony provider is dismissed. In this regard, it is better to do this earlier than three days, that is, on the day of dismissal.

If the withholding and transfer of alimony was carried out not according to a writ of execution, but according to an agreement certified by a notary, then there is no need to send a notification to the bailiffs. In this case, only the recipient of alimony payments needs to be notified.

I pay child support and quit my job.

Calculation of alimony Alimony upon dismissal If an enterprise dismisses an employee from whose income alimony was withheld, the administration must take several mandatory steps provided for by the Federal Law “On Enforcement Proceedings” and the Family Code of the Russian Federation. In addition, it is extremely important for the company’s accounting department to correctly determine the amounts from which to deduct in the final settlement with its employee. And here the basis on which the accruals and their recipient are assigned plays an important role. If alimony upon dismissal from work is paid to a minor child by court decision or on the basis of a notarial agreement, then when determining the withholding base, it is necessary to be guided by the provisions of Government Decree No. 841 of the Russian Federation, which approves the list of income from which such payments can be made. Soldatkina Maria Valerievna Yes, it is advisable to register with the Central Employment Service, because if alimony is collected as a percentage and you do not work, then the bailiff will calculate the arrears of alimony based on the average salary in Russia, and if you register with the Central Employment Service, then alimony will be deducted from unemployment benefits. lawyer Khokhryakova Lyubov Vladimirovna Hello! You don’t have to get up, then the court has the right to recalculate alimony in a fixed amount based on your ex-wife. Read (2 answers) This is the situation. I was fired from my job at the end of my contract. I pay child support. I joined the labor exchange. When we were married, I took out a loan in the amount of 268 thousand rubles and 115 thousand rubles. Now I pay alone. And pay for another 3 years. Can I divide these loans between two people or stop alimony or what? what advantages do I have? Thank you.

- Send the properly completed writ of execution to the bailiffs.

- Inform the bailiff service about the employee’s new place of work and residence, if such information is available at the enterprise.

- When carrying out these procedures, within the framework of Article 111 of the Family Code of the Russian Federation, the accounting department must enter the following data in the executive document:

- about the amounts withheld from the parent’s income;

- about the period of time for which alimony was calculated;

- on the amounts of outstanding indexation and debt.

At the same time, it is necessary to take into account that failure to comply with these legal requirements on the part of the enterprise or its individual employees may entail administrative liability for specific employees in the form of a fine, the amount of which can reach 10 thousand rubles.

What are the difficulties?

In fact, there is not much difference between the dismissal of an ordinary employee and a child support worker. From the point of view of documentation (orders, entries in the work book), everything is identical. But the main question remains: what should an accountant do? The confusion is due to the fact that after the dismissal of an employee, a writ of execution is left in hand, on the basis of which alimony is withheld.

The Family Code of the Russian Federation and other legislative acts state that the employer is responsible for calculating alimony. And if the amounts from wages are not withheld on time, then it is he who will bear responsibility, and not the alimony payer himself.

Of course, when an employee is fired, there is no longer any need to send money from his salary - after all, there is no income in the company. However, the employer also has other responsibilities. If, in the event of dismissal, the employer or accountant of the enterprise does not promptly submit a writ of execution to higher authorities, then this can result in serious consequences for several parties at once:

- the alimony recipient himself will automatically be considered a debtor, although at the time of payments he may not have a job or salary to pay alimony to the child;

- the company may be held administratively liable.

Read more: How to receive the pension savings of a deceased husband

If the company wants to avoid any possible penalties, then the accountant must promptly notify the enforcement authorities about the dismissal. This is done in writing.

Payment of alimony upon dismissal

Grounds: the parent obligated to pay child support has irregular, changing earnings and (or) other income, or if this parent receives earnings and (or) other income in full or partly in kind or in foreign currency, or if he has no earnings and ( or) other income, also in other cases, if the collection of alimony in proportion to the earnings and (or) other income of the parent is unrealistic, problematic or significantly violates the interests of one of the parties. The sequence of actions for collecting alimony debts: Does not pay alimony, what to do ? Question: My husband is ordered to pay alimony in the monthly amount of 8,000 rubles. And he pays 300-500 rubles.

What to do with alimony after dismissal? Sergey! Your former employer is obliged to send the writ of execution with explanations to the bailiff service. where enforcement proceedings for the collection of alimony have been opened. In turn, it is advisable for you to take a certificate from the labor exchange, where it will be clearly written and certified by their seal on what basis they are not registering you right now, there are still 2 weeks until the new year and you can miss the deadline for registering with the labor exchange ( find out this question). What should an employer do when dismissing a child support payer? An employee who pays child support according to a writ of execution leaves the company.

Legislation

If a manager needs to part with an employee, from whose salary

If alimony payments are withheld, you will have to take into account several legislative norms at once.

The obligation to promptly and in writing notify bailiffs about a change in the alimony worker’s workplace is assigned to employers by the Family Code in Article 111.

In this case, only the legal grounds for termination of the employment contract specified in Article 81 of the Labor Code should be taken into account.

And Article 77 of the labor legislation specifies the procedure for transferring such workers to another enterprise or another organization.

Federal Law No. 229 (Article 98), concerning enforcement proceedings, is also taken into account. All violations in this area committed by employers are punishable in accordance with the Code of Administrative Offenses (the norms are reflected in article number 17.14).

How to pay child support if I was fired under the article

When the alimony worker is dismissed, the accounting department is faced with the question: what to do with the writ of execution provided by the executive authorities? After all, according to Art. 111 IC RF and Art. 5 No. 229-FZ, it is not the parent, but the employer, who is responsible for calculating child support. Failure to comply with formalities may result in administrative liability.

If the employer’s company does not take appropriate measures after the employee’s dismissal and does not submit a writ of execution to the relevant authorities on time, the consequences can be disastrous:

- the alimony automatically becomes a debtor;

- The employer's company, according to the law, is found guilty of failure to fulfill its obligations.

To avoid misunderstandings, after the dismissal of the alimony worker, the company accountant notifies the enforcement authorities about this.

Law on dismissal of alimony worker

The procedure for the employer's actions in the event of dismissal of the alimony worker is regulated by Art. 111 IC RF and Art. 5 No. 229-FZ. According to this article, a company that withholds alimony on the basis of a court decision or a certificate certified by a notary is obliged to report the dismissal of an employee to the executive authorities. The deadline for this is three working days. Also, the person receiving alimony - the second parent - is notified of the dismissal of the alimony provider. If the employer has information about the subsequent place of work of the alimony payer, he must provide this information too.

When moving from one place of work to another, the parent involved in paying child support does not have the right to hide the new place of employment. He must inform the bailiff and the person receiving alimony about the change of employer. Notification of additional earnings, if any, is also required. Failure to comply with these requirements may result in the responsible persons being subject to administrative liability.