The duration of the collective agreement is limited to three years, and when it comes to an end, there is a need to extend the agreement. The workforce and the employer can enter into a new collective agreement or extend an existing one. In this case, all points of the document must be reconsidered and agreed upon.

The extension of the collective agreement is carried out only after reaching agreement between the participants in the labor relations. The number of document extensions is not limited; if necessary, it can be extended several times.

Collective agreement

As a rule, all labor relations between an employee and an employer are fixed by an employment contract. But if there are rights and obligations that apply to all employees or to a certain group, then a collective agreement is concluded in the organization. This agreement is very convenient when the number of employees is large, since there is no need to sign several documents with each employee. Thus, a collective agreement is a document that regulates labor relations between several employees and the employer (

Protocol Details

There is no special form for the protocol. But if you follow the general rules for drawing up a document, the protocol should contain the following:

- document number, date of approval of the protocol and additional agreement;

- name of the document (act);

- for what purpose is this document on the extension of the collective agreement drawn up (the name of the organization, the number of employees for whom the rules of the agreement apply, the new validity period of the document when the agreement is extended should be indicated);

- positions, full names and signatures of all participants;

- employer's stamp.

name of the organization; duration of the collective agreement; registration number and date of registration; period for which the collective agreement is extended.

Protocol*

on the extension of the Collective Security Treaty

dated May 15, 1992

The states parties to the Collective Security Treaty (hereinafter referred to as the Treaty), signed in Tashkent on May 15, 1992 and entered into force on April 20, 1994,

Considering that the period of validity specified in Article 11 of the Treaty expires on April 20, 1999,

based on the desire to continue cooperation within the framework of the Treaty and ensure the continuity of its operation,

1. The Agreement is extended for five years.

[/su_box]

This Protocol, which is an integral part of the Treaty, extends the validity of the Treaty from April 21, 1999 and comes into force on the date of receipt by the depositary of the fifth written notification that the signatory states have completed the internal procedures necessary for its entry into force.

Done in Moscow on April 2, 1999 in one original copy in Russian. The original copy is kept in the Secretariat of the Collective Security Council, which will send a certified copy to the states that have signed this Protocol.

________________

* Signed by the Heads of State of the Republic of Armenia, the Republic of Belarus, the Republic of Kazakhstan, the Kyrgyz Republic, the Russian Federation, the Republic of Tajikistan.

The Protocol has been ratified by all of the above states.

PROTOCOL No. 3

trade union meeting of the municipal educational institution Ryazanovskaya secondary school

PRESENT: 32 people

HEARD: Bolshakova T.I. chairman of the trade union committee on extending the validity of the Collective Agreement for the 2008-2011 academic year.

1. Extend until December 3, 2014 the validity of the Collective Agreement of the Municipal Educational Institution of the Ryazanovskaya Secondary School dated December 3, 2008 with all its annexes, amendments and additions as of the date of signing of this Decision.

2. Changes and additions to the current Collective Agreement shall be made by agreement of the parties in the manner established by clause 1.11. Collective Agreement of the Municipal Educational Institution Ryazanovskaya Secondary School dated December 3, 2008.

The total number of team members is 9 people.

There were 9 people present.

We invite you to familiarize yourself with the sample specification for the supply contract 2020

There is a quorum, the meeting is competent to make decisions.

A.A. Petrova was elected chairman of the meeting. Secretary of the meeting Sidorov V.V.

1. Participation in collective bargaining.

2. Conclusion of a collective agreement.

Election of a representative on behalf of employees to sign a collective agreement.

The first issue on the agenda was addressed by the chairman of the meeting A.A. Petrova. which reported that the collective of workers and the administration of the company had developed a draft collective agreement, and proposed concluding a collective agreement in the proposed wording.

They voted: openly - “for” (unanimously).

conclude a collective agreement in the proposed wording.

Chairman of the meeting A.A. Petrova spoke on the second item on the agenda. who proposed to elect Lyudmila Mikhailovna Kashina as a representative on behalf of the workers and entrust her with signing a collective agreement on behalf of the workers.

elect Lyudmila Mikhailovna Kashina as a representative on behalf of the workers and entrust her with signing the collective agreement on behalf of the workers.

The agenda is exhausted and the meeting is considered closed.

The form was prepared using legal acts as of 08/23/2010.

How the collective agreement is renewed

Any process that requires a number of approvals requires the implementation of certain actions:

- coordinate the relevance of an expired document (the possibility of making changes is considered, additions or exceptions to some conditions from the collective agreement are agreed upon);

- formalize the results of negotiations (the result is documented in a protocol, or a new local act is developed);

- the contract extension or the new text of the document is registered.

Methods for extending the collective agreement

The legislation provides two ways to extend the collective agreement:

- drawing up a new collective agreement;

- drawing up an additional agreement to an existing contract.

Usually, the most convenient way to extend a collective agreement is to draw up an additional agreement. This document states the following:

- The period for which the collective agreement is extended. This period can be no more than 36 months.

- Information contained in the collective agreement (full name, passport data, job titles of participants, etc.).

- Date of registration of the additional agreement.

- Date of acquisition of legal significance.

The preparation of an additional agreement for the extension of the collective agreement occurs in accordance with the rules of the organization. This agreement is also subject to registration, like the collective agreement itself . The additional agreement may also contain some additional conditions, and not just information about the extension of the contract. Moreover, all new conditions must be agreed upon by all parties to the agreement. And if one of the participants does not agree with the new conditions, then the act will need to be reviewed and only then reissued.

Important! A collective agreement acquires legal significance at the moment the document is signed by all participants.

Automatic renewal and early signing options

The issue of automatic prolongation of an employment contract is not considered in the Labor Code and other normative acts regulating the scope of labor relations, which allows us to say that this action is not prohibited for participants in these legal relations.

However, in order for this rule to begin to work and be used, it must be fixed in the text of the collective labor agreement itself, which will avoid discrepancies in resolving disputes about the validity period of such a legal act.

In the case of automatic prolongation, the contract is extended without “crossing the validity period” of the document. In the same case, if a new collective agreement or additional agreement is signed early, the old legal act ceases to be valid on the day the new one is signed, or the validity period of the document is reduced by the period that the parties did not wait to sign the new contract or agreement.

Thus, it is possible to carry out the early signing of an additional agreement with the subsequent issuance of an order to extend the term of the employment contract, but the existing features of such a procedure should be taken into account.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call :

Or on the website. It's fast and free!

In accordance with legal norms, collective agreements are concluded for a specific period. The period of legal validity of the agreement is indicated in the text of the documentation. Acts of law stipulate that the maximum validity period of a collective agreement cannot be more than 36 months. However, there is the possibility of extending cooperation on the deal. How the collective agreement can be extended will be described in the material.

How is the relevance of a collective agreement agreed upon?

Important! In order to evaluate and re-agreed the content of the collective agreement, the organization holds a meeting of representatives of the parties to the labor relationship.

Each provision of the previously valid collective agreement is subject to revision and re-approval . The decision is made by a majority vote. After the meeting, a written protocol is drawn up, in which the final results obtained are recorded (

What is the duration of the collective agreement and is it possible to extend it?

Therefore, even during reorganization, termination of a collective agreement does not relieve one from the obligation to fulfill its terms. In Part 6 of Art.

43 of the Labor Code of the Russian Federation provides that if the form of ownership of an organization changes, the collective agreement remains in effect for three months from the date of transfer of ownership, i.e. until the state registration of ownership.

After three months from the date of the appearance of a new owner of the organization, the collective agreement ceases to be valid.

However, termination of a collective agreement does not relieve the person from the obligation to fulfill the conditions contained therein that were not fulfilled by the new owner within three months. And in this case, the principle of mandatory conditions of the collective agreement applies, due to which the termination of the collective agreement does not relieve one from the obligation to fulfill the conditions contained in it.

Labor Code of the Russian Federation. In addition, in Part 2 of Art. 36 states that representatives of a party, having received a written proposal to launch collective negotiations, are obliged to begin them within a week. This means that the party receiving the proposal must provide the initiator with a response no later than 7 days from the moment of familiarization with it.

Attention

Registration of a legal act is voluntary. IMPORTANT. Russian legislation does not provide for liability for companies and individual entrepreneurs for the absence of collective agreements.

The purposes of the adoption of such acts are also not established.

Collective agreement: for what period is it concluded?

The grounds for refusal to comply with the terms of a collective agreement are the conclusion of an appropriate agreement on exemption from their execution between authorized representatives of employees and the employer, as well as the recognition of these conditions as invalid or invalid in court. Introduction of amendments and additions to the collective agreement, including the abolition of part of its provisions, on the basis of Art.

44

The Labor Code of the Russian Federation requires going through the procedures provided for concluding a collective agreement. In other words, in order to make these changes, it is necessary to properly formalize again the powers of representatives of workers and employers to make changes to the current collective agreement.

In accordance with Part 4 of Art. 43 of the Labor Code of the Russian Federation, the collective agreement remains in force if the name of the organization is changed or the employment contract with the head of the organization is terminated.

How are minutes drawn up following a meeting?

There is no special form for the protocol. But if you follow the general rules for drawing up a document, the protocol should contain the following:

- document number, date of approval of the protocol and additional agreement;

- name of the document (act);

- for what purpose is this document on the extension of the collective agreement drawn up (the name of the organization, the number of employees for whom the rules of the agreement apply, the new validity period of the document when the agreement is extended should be indicated);

- positions, full names and signatures of all participants;

- employer's stamp.

You can extend the contract using an additional agreement

When concluding the main contract, the parties to the transaction may not indicate in what order the terms should be extended. Then the contract can be extended by agreement of the parties. The execution of such an additional agreement is subject to general rules. It should be clear from the text that the counterparties have agreed to increase the term of the transaction. In the document:

- list the details of the parties;

- indicate the number of the main agreement and other data;

- include in the text wording about the duration of the contract with extension.

In this case, a specific extension period can be specified in the additional agreement. Then they fix the date until which the agreement will be valid. But sometimes, when prolonging the contract, the validity period of the contract is not specified. In this case, you can use the same language as for the terms of renewal in the main contract. Please note that if the contract is being extended in relation to a major or related party transaction, corporate law approval may be required for such action.

In some cases, the contract extension is considered to be the actions of the parties aimed at executing the transaction, even if the contract does not contain conditions for increasing the terms and the parties did not sign special documents on the extension. However, this method may provoke a dispute between counterparties. To avoid this, it is better to enter into an agreement.

Procedure for registering a collective agreement

The accepted agreement must be registered by analogy with the primary document. That is, registration consists of submitting documents to the regional labor department. The agreement comes into force from the date of its signing, regardless of how long it takes to register the document. Documents for registration must be submitted within 7 days from the date of signing the agreement . This registration is for informational purposes only. Notification of labor authorities is carried out in order to check the contents of the contract for contradictions with labor legislation. If they are identified, this will be reported to the state labor inspectorate. However, this does not mean that changes will need to be made to the contract. It may be applied without modification, except for inconsistent provisions.

Important renewal details

The right to extend the agreement for a period of no more than three years is secured by the forty-third article of the Labor Code of the Russian Federation.

According to the thirty-sixth article of the Labor Code of the Russian Federation, those representatives of the party who received a written proposal to begin negotiations are obliged to enter into them within the period established by law.

If the term of the agreement is not extended, all issues that were settled by the agreement cease to apply.

According to the fiftieth article of the Labor Code of the Russian Federation, the agreement must be sent by the employer or his representative for notification registration to the relevant authority within seven days from the date of signing. It is worth noting that the agreement comes into force regardless of the above registration. The Labor Code of the Russian Federation does not oblige the employer to register the extension of the collective agreement with notice.

Order to extend the collective agreement

Any actions that occur between employees and management must be documented. In this case, it will be necessary to draw up an order from the manager to extend the collective agreement. The order must contain the following information:

- document name, number, date of preparation;

- reasons for extending the collective agreement;

- the essence of the order (including the date of its extension, as well as the employees with whom cooperation will continue);

- signature of the manager, company seal.

Sample order to extend a collective agreement

Sample additional agreement

The legislator did not approve the sample document. We will consider one of the options for drawing up an agreement.

ADDITIONAL AGREEMENT

to the collective agreement of LLC “Wind of Changes” dated 02/01/2014

About extending the validity period

The employer represented by the director of Wind of Change LLC Kirovtsev P.R., who acts on the basis of the Charter, on the one hand, and the employees represented by the chairman of the primary trade union organization Petrenko I.I., who acts on the basis of the decision of the meeting dated January 21, 2017, with the other party on the basis of Art. 44 of the Labor Code of the Russian Federation and clause 1.5 of the Collective Agreement dated 02/01/2014 decided:

- Extend the validity period of the Collective Agreement of Wind of Change LLC for 3 years - until 02/01/2021.

- The additional agreement comes into force from the moment it is signed by the parties and is an integral part of the Collective Agreement.

Signatures and seals of the parties

***

Thus, it is possible to extend the agreement, but it is important to follow the negotiation procedure between the parties to the social partnership.

The collective agreement is valid for the time specified in the document. According to the legislation of the Russian Federation, a collective agreement cannot be valid for longer than 36 months. What should I do if it expires?

The parties have the right to enter into a new agreement or extend the existing one for another 36 months. To renew a current contract before its expiration, you need to understand the nuances. Please note that when the collective agreement is extended, all points of the document are re-reviewed and agreed upon.

Answers to common questions

Question: Is there any liability for the employer if he does not submit the collective agreement for registration to the labor authorities?

Answer: According to the legislation, there is no direct responsibility for the employer’s failure to submit a collective agreement to the labor authorities. However, if during an inspection of the company this fact is revealed, it will be regarded as a violation of labor laws and fines will be imposed in the following amounts:

- 30,000 – 50,000 rubles – for organization;

- 1,000 – 5,000 rubles – per manager.

Question: Is it possible to provide for the possibility of automatic renewal in a collective agreement?

Answer: The legislation does not contain a direct prohibition on these actions. But in this case, it may not be possible to avoid claims from labor representatives consisting of untimely notification of the expiration of the document and its automatic extension.

Collective agreement. What to do if it is not renewed

The organization’s collective agreement has expired and missed the deadline for its extension.

What will happen to us for this? Will the tax office have questions regarding bonuses provided for in the collective agreement? What does notification registration of a collective agreement mean?

In accordance with Art.

22 of the Labor Code of the Russian Federation, the employer has the right

to conduct collective negotiations and

conclude collective agreements

.

The employer

is obliged

to conduct collective negotiations, as well as conclude a collective agreement in the manner established by the Labor Code of the Russian Federation.

At the same time, in order to conclude a collective agreement, it is necessary to comply with the collective bargaining procedure

.

Take the initiative

Both representatives of employees and representatives of employers can

conduct such negotiations .

Art. 40 Labor Code of the Russian Federation

It has been established that

a collective agreement

is a legal act that regulates social and labor relations of an individual entrepreneur and is concluded by employees and the employer represented by their representatives.

If no agreement is reached between the parties

according to certain provisions of the draft collective agreement, within three months from the date of the start of collective negotiations, the parties must sign a collective agreement on the agreed terms and simultaneously draw up a protocol of disagreements.

Unsettled disagreements may be the subject of further collective negotiations or resolved in accordance with the Labor Code of the Russian Federation.

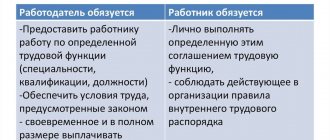

As a general rule, content and structure

collective agreement

are determined by the parties

.

In Art. 41 Labor Code of the Russian Federation

lists

the obligations of employees and the employer, which may be included in a collective agreement

, on the following issues:

– forms, systems and amounts of remuneration;

– payment of benefits, compensation;

– a mechanism for regulating wages taking into account rising prices, inflation levels, and fulfillment of indicators determined by the collective agreement;

– employment, retraining, conditions for releasing workers;

– working time and rest time, including issues of granting and duration of vacations;

– improving the working conditions and safety of workers, including women and youth;

– respect for the interests of workers during the privatization of state and municipal property;

– environmental safety and health protection of workers at work;

– guarantees and benefits for employees combining work with training;

– health improvement and recreation for employees and members of their families;

– partial or full payment for employees’ meals;

– control over the implementation of the collective agreement, the procedure for making changes and additions to it, the responsibility of the parties, ensuring normal conditions for the activities of employee representatives, the procedure for informing employees about the implementation of the collective agreement;

– refusal to strike if the relevant conditions of the collective agreement are met;

– other issues determined by the parties.

In the collective agreement

taking into account the financial and economic situation of the employer,

benefits and advantages for employees, working conditions

that are more favorable in comparison with those established by laws, other regulations, and agreements can be established

The collective agreement must be signed by the employer

(his representative) and

employee representatives

.

The collective agreement is concluded for a period of no more than three years

and comes into force on the day it is signed by the parties or on the date established by the collective agreement.

In this case, the parties have the right to extend

the collective agreement is valid for a period

of no more than three years

(

Article 43 of the Labor Code of the Russian Federation

).

That is, if the validity period of the collective agreement is not extended, all issues regulated by the agreement cease to apply

.

According to Art.

50 of the Labor Code of the Russian Federation,

must be

sent

by the employer or the employer’s representative

for notification registration to the relevant labor authority

within seven days from the date of signing .

In this case, the collective agreement comes into force regardless of the fact of its notification registration

.

The Labor Code does not establish the employer’s obligation to register an extension of the deadline by notification

validity of the collective agreement and refusal to extend the validity of the collective agreement.

According to Art. 36 Labor Code of the Russian Federation

Representatives of a party who have received a proposal

in writing

to begin collective bargaining are required to enter into negotiations

within seven calendar days

from the date of receipt of the proposal by sending a response to the initiator of collective bargaining indicating representatives from their side to participate in the work of the collective bargaining commission and their powers.

The start date for collective bargaining is

the day following the day the initiator of collective bargaining received the specified response.

It follows that if employees did not take the initiative

Upon conclusion of a collective agreement,

the employer is not obliged to independently initiate collective negotiations

.

If the offer

the start of collective negotiations

has been received from employees

,

the employer does not have the right to refuse

to conduct such negotiations.

The same applies to the extension of the collective agreement.

.

Let us note that for

Failure

to carry out notification registration of a collective agreement

of administrative responsibility of the Code of Administrative Offenses of the Russian Federation

is not provided for

.

And for the employer’s evasion

or the person representing him,

from participating in negotiations

on the conclusion, amendment or addition of a collective agreement, agreement, or violation of the deadline established by law for negotiations, as well as

failure to ensure the work of the commission for concluding a collective agreement

, agreement within the time limits determined by the parties,

Art.

5.28 of the Code of Administrative Offenses of the Russian Federation provides for a warning or

the imposition of an administrative fine in the amount of 1,000 to 3,000 rubles

.

Unreasonable refusal by the employer

or the person representing him,

the conclusion of a collective agreement

or agreement entails a warning or the imposition of an administrative fine

in the amount of 3,000 to 5,000 rubles

(

Article 5.30 of the Code of Administrative Offenses of the Russian Federation

).

Art. 255 Tax Code of the Russian Federation

It has been established that

the taxpayer’s

expenses for wages include any accruals

to employees in cash and (or) in kind, incentive accruals and allowances, compensation accruals related to working hours or working conditions,

bonuses and one-time incentive accruals

, expenses associated with the maintenance of these employees, provided for by the norms of the legislation of the Russian Federation, labor agreements (contracts) and (or) collective agreements.

Thus, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, labor costs include any types of expenses

, meeting the requirements

of Art.

252 of the Tax Code of the Russian Federation , made in favor of the employee,

if they are provided for by the employment contract and (or) collective agreement, with the exception

of the expenses specified in

Art.

270 Tax Code of the Russian Federation .

In accordance with paragraph 2 of Art. 255 Tax Code of the Russian Federation

Labor costs for the purposes of Chapter 25 of the Tax Code of the Russian Federation include, in particular, accruals of an incentive nature, including

bonuses for production results

, bonuses to tariff rates and salaries for professional excellence, high achievements in work and other similar indicators.

Clause 25 Art. 255 Tax Code of the Russian Federation

It has been established that labor costs

also include other types of expenses incurred in favor of the employee, provided for by the employment contract and (or) collective agreement

.

In accordance with paragraph 21 of Art. 270 Tax Code of the Russian Federation

When determining the tax base for income tax,

expenses for any types of remuneration

provided to management or employees

in addition to remunerations paid on the basis of employment agreements

(contracts) are not taken into account

But at the same time Art.

255 of the Tax Code of the Russian Federation directly allows

taxpayers to take into account bonuses provided for

in the collective

agreement.

Thus, taking into account paragraph 7 of Art. 3 Tax Code of the Russian Federation

, which prescribes the interpretation of all irremovable doubts, contradictions and ambiguities of acts of legislation on taxes and fees in favor of the taxpayer,

the terms of bonuses can be specified

both

only in the collective

agreement, and

only in employment

contracts,

or in both the collective agreement and employment contracts at the same time

.

If the term of the collective agreement has expired, the agreement has not been extended, a new agreement has not been concluded

, and

the bonuses

provided for by the previously valid collective agreement

continue to be paid

, then for profit tax purposes these bonuses can be

taken into account as expenses only if they are provided for in employment contracts with employees

.

If in your organization bonuses are provided for in employment contracts

, then the absence of a collective agreement will not affect the accounting of bonuses for profit tax purposes.

If in employment contracts regarding bonuses there is only a reference to the collective agreement

, then it will not be possible to take bonuses into account in expenses, since the collective agreement has lost force.

In your situation, you need to “retroactively” (from the day following the day of termination of the collective agreement) to draw up additional agreements to employment contracts with employees

.

Additional agreements must be stated in a new version

clauses of the employment contract relating to remuneration

and bonus systems

.

You can outline the bonus system in each specific employment contract.

At the same time, you can reduce the amount of work and adopt a local regulatory act of the organization

.

According to Art. 8 Labor Code of the Russian Federation employers

, with the exception of employers - individuals who are not individual entrepreneurs,

adopt local regulations

containing labor law norms, within their competence in accordance with labor legislation and other normative legal acts containing labor law norms, collective agreements, and agreements.

Pay systems

, including the size of tariff rates, salaries (official salaries), additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal conditions, systems of additional payments and incentive allowances and

bonus systems, are established by collective agreements, agreements, local regulations

in in accordance with labor legislation and other regulatory legal acts containing labor law standards (

Article 135 of the Labor Code of the Russian Federation

).

That is, if the parties to the labor relationship have not entered into a collective agreement

, then

the employer must adopt a local regulatory act that will establish a remuneration system

.

These may be Internal Labor Regulations, Regulations on Bonuses, etc.

In a letter dated September 22, 2010 No. 03-03-06/1/606, the Ministry of Finance of the Russian Federation indicated that the conditions for establishing a specific premium amount

employment contracts

do not contain

.

Therefore, the cost of paying bonuses to employees can be taken into account

for profit tax purposes

on the basis of the provision on bonus payments to employees, provided

that

in the employment contracts

concluded with employees,

a reference is made to this provision

and these payments comply with the provisions of

paragraph 1 of Art.

252 Tax Code of the Russian Federation .

If, according to the bonus regulations, bonuses are issued on the basis and in the amounts provided for by order of the company management, the costs of paying such bonuses can be taken into account

for profit tax purposes, provided that such expenses comply with the requirements

of Art.

252 of the Tax Code of the Russian Federation and are associated with the production results of employees.

That is, the provision on bonuses

it may be stipulated that the grounds for bonuses and the specific amounts of bonuses

are determined

each time directly

by the head of

the company.

And if in employment contracts

With employees there will be a corresponding

reference to the provision on bonuses

, then the paid bonuses can be safely taken into account as expenses for profit tax purposes.

The Federal Tax Service of the Russian Federation, in a letter dated April 1, 2011 No. KE-4-3/5165, also reported that in order to take into account the amounts of bonuses as part of labor costs for profit tax purposes, it is necessary

:

– availability of documents

, confirming

the relationship of payments in the form of bonuses to the remuneration system

in the organization.

To do this, payments must be established in employment contracts.

with employees

or employment contracts must contain a reference

to a local regulatory act regulating the employer’s responsibilities in terms of payment and (or) incentives for employees.

At the same time, tax officials point out, wage relations can be considered established

if the terms of the employment contract or local regulations,

the amount of payments due to the employee can be unambiguously determined from the agreed conditions

.

In other words, a set of documents

, defining the employer’s obligation to pay and stimulate labor,

must clearly define the system of relations for the payment of bonuses for labor

, that is,

an unambiguous procedure for calculating

mandatory bonuses for payment by the employer, which are based on

specific indicators for assessing the work

of employees (work time, volume of labor, quality of work (if it is possible to formalize it), other indicators characterizing the results of work).

Otherwise, if the terms of employment contracts

or local regulations

do not make it possible to unambiguously determine the amount due to be paid to the employee

based on the labor assessment indicators achieved by him (or the work collective), then

the rights and obligations of the employee and the employer in this part should be considered not established

;

– documents confirming that employees have achieved specific performance assessment indicators

(actually hours worked, the amount of material assets created by labor, the amount of income received through labor, etc.);

– primary documents on the calculation of specific payment amounts

in favor of employees according to the current remuneration system in the organization, formalized in accordance with the law.

In the event that the employment contract stipulates

If the employee

is entitled to a cash bonus within the framework of the remuneration system

, that is, all of the above conditions are met, then

such a bonus is taken into account as part of labor costs

for profit tax purposes.

If the bonus is not part of the salary

, but is paid

for other reasons

, then such payments

do not reduce the tax base

for income tax.

Tax officials, as well as the Ministry of Finance, believe that if the payment of bonus

for the main results of economic activities

is provided for by the collective agreement

of the organization, the conditions for its payment are determined in

the Regulations on bonuses

to personnel, in accordance with this Regulation,

bonus indicators are established by the head

, then in fact the payment of bonuses for the main results of economic activities

is regulated by a local regulatory act

adopted in accordance with the provisions of the Labor Code RF.

Therefore, the specified premium

in accordance with

Art. 129 of the Labor Code of the Russian Federation is an integral part of the employee’s salary

.

For income tax purposes, this means that bonus payments

for the main results of economic activity,

which

in accordance with the requirements of the Labor Code of the Russian Federation

, are an integral part of wages, are taken into account as part of labor costs on the basis of Art.

255 Tax Code of the Russian Federation .