In order to be able to collect old debts from an enterprise that is already at the stage of bankruptcy, it is important to follow the legal procedure for entering claims for unfulfilled obligations into the register of creditors' claims . If the situation is such that this is not done on time or the application is completed incorrectly or untimely, then there is a risk of not receiving the required amount of money. So, let’s look at what a register of claims is, what information is entered into it, who does it and how, the procedure for filing an application and collecting the debt itself. And what, in essence, does this register provide, does it help to recover the debt from a bankrupt counterparty.

What is the register of creditors, and why is it important for a creditor to get into it?

A register of claims that displays all the company's debts. It is a document that has legal force for the legal fulfillment of claims in favor of creditors by the debtor. The practice of maintaining a register of creditors is not new, and is successfully used in different countries. In its form and essence, this is a list of all debts that a bankrupt legal entity has, and which it could not independently fulfill within the time limits established in the contract. Because of this, bankruptcy proceedings were initiated. Satisfaction of creditors' claims is carried out according to the stipulated priority. Data such as the amount and priority of claims are also recorded in the register.

The registry document in the bankruptcy case displays information about the creditor himself and the presence of confirmed obligations on the part of the enterprise. If there is no recording of the debt in the debt register, then the possibility of repaying the overdue debt in the future is negligible for such a creditor. He cannot claim compensation for losses if this amount is not recorded in the register. That is why inclusion in the register of creditors’ claims is a mandatory procedure for a creditor to receive an outstanding financial obligation from a bankrupt legal entity.

Rules for submitting an application to the register of creditors

To record information about a debt in the registry, you must fulfill certain requirements related to the execution and submission of the application. These requirements are established by procedural legislation. An application for inclusion in the register of creditors' claims may be submitted by a representative authorized by the legal entity of the creditor. His credentials must be properly certified.

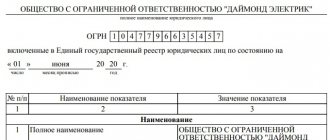

A package of documents - an application and attachments - must be sent to the arbitration court. There are basic requirements for the content of the creditor's application. Thus, the application must indicate the full name, address and details of the creditor’s enterprise. It is important not to forget to indicate the case number and name of the debtor.

There are clearly defined deadlines for the creditor, following which he can declare inclusion in the register of the creditor's claims against the debtor. This period is calculated from the date of publication in a specialized publication of information about the introduction of supervision in the bankruptcy procedure. This period is 30 calendar days (not business days). It is important for the lender to know this so as not to miss it, since it cannot be restored for any reason. Even if the reason for missing is very valid. Why is it so important to provide information within this deadline? After the applications are accepted, the first meeting of all creditors is scheduled and a committee is created. Those who managed to get there will be able to vote and thereby influence the course of the bankruptcy process.

If the creditor did not have time to file a claim against the debtor before this moment, then certain negative legal consequences arise for them. They will be able to receive their money only after a full settlement has been made with the bankruptcy creditors, information about which is available in the register. Accordingly, there is practically no chance that a hundred will remain after these mutual settlements.

It should be noted that you can get into the register later, only without the opportunity to take part in the bankruptcy case in the creditors’ committee. The registry is closed at the end of two calendar months, from the date of recognition as bankrupt, and the corresponding publication of this information. In relation to this enterprise, another procedure is already being applied, which is called bankruptcy proceedings . After this, applications for the introduction of requirements are not accepted, although they are considered in the general manner.

The creditor indicates the date the debt arose, the circumstances of the case, and what documents confirm the unfulfilled obligations. Inclusion in the register is carried out after the court makes a ruling. It is worth noting that, according to the practice of higher courts, debt collection by filing a claim against a legal entity is not allowed if it is at the stage of insolvency proceedings. Such a claim remains without consideration by the court.

The difference between current requirements in a bankruptcy case and registry requirements

Home / Articles / The difference between current requirements in a bankruptcy case and registry ones

Published: November 13, 2015

Bankruptcy cases sometimes look like this: the bankruptcy estate has been formed, but the registry claims are not being paid. This happens due to the fact that the entire mass is spent on paying off current claims. Creditors are increasingly expressing the opinion that their participation in bankruptcy proceedings is, in fact, a mere formality. In view of all of the above, creditors with current payments need to know the order of repayment of such payments, and registered creditors must learn to determine a reasonable limit for the debtor’s current expenses, including studying ways to combat abuse.

What are the differences between the registry and current requirements?

The Bankruptcy Law recognizes as current payment monetary obligations and obligatory payments that appear after the date of acceptance of the application for declaring the debtor bankrupt. From the norms of the Civil Code of the Russian Federation and the resolution of the Plenum of the Supreme Arbitration Court, we can conclude that current payments serve to maintain the viability of a bankrupt debtor at a very acceptable level.

So, the current requirements can be easily distinguished from the registry ones:

- By the date of appearance of monetary obligations of creditors;

- By the date of the court's ruling that the application for declaring the debtor bankrupt has been accepted for proceedings.

If during bankruptcy proceedings it is determined that it is absolutely impossible to restore the solvency of a bankrupt debtor, then it is current payments that will contribute to the effective formation of the debtor’s bankruptcy estate and thereby more complete repayment of register claims. Thus, current requirements should be minimal (for example, auction organizers, lawyers, utility bills, specialists preparing documents for archiving). If current payments, on the contrary, can bring the debtor out of bankruptcy, then they will naturally always be desirable (for example, the purchase of raw materials used for the manufacture of products subject to very profitable sale).

The bankruptcy law does not name creditors for current payments as persons participating in a bankruptcy case. In view of this, they do not have the right to actively manage the bankruptcy procedure of the debtor, however, they have the power to appeal the actions (inaction) of the arbitration manager, but only if their rights and interests are affected. Current creditors have priority in repaying debts over registered creditors. Accordingly, claims for current payments are not subject to inclusion in the register of creditors by law.

With current payments, everything is more or less clear.

What are registry requirements? Register requirements

are those requirements that arose before the initiation of bankruptcy proceedings against the debtor. These creditors are directly involved in the bankruptcy case of their debtor and may well, for example, cast their vote at a meeting of creditors, and this is very important for the creditor. Essentially, the goal of a bankruptcy case is to satisfy all registry claims. Achieving this goal without the availability of current payments is impossible. After all, in order to carry out the bankruptcy procedure properly, in any case it is necessary to incur some costs for its implementation. Back to articles

Similar articles:

Exemption from debts applies only to bona fide bankrupt debtors

In our country, only citizens registered as individual entrepreneurs (IP) can go bankrupt, and accordingly, only they can be freed from debt. What should ordinary citizens without individual entrepreneur status do if things go wrong in their lives?

More details

Precautions in a bankruptcy case

In case of bankruptcy, after the introduction of a monitoring procedure, the management bodies of the debtor company do not have the right to make a decision on its reorganization or liquidation.

More details

Some current issues in bankruptcy of citizens

In the near future (presumably from October 1 of this year), rules on bankruptcy of citizens will come into force. These rules will be included in the bankruptcy (insolvency) law, which previously included...

More details

The procedure for collecting debt from a bankrupt

According to the rules specified in the Federal Law on Bankruptcy , there is a sequence of requirements for a bankrupt debtor. There are also current and registered payments by the debtor. Current are those claims for the obligations of a legal entity, the occurrence of which occurred after the opening of bankruptcy proceedings. Debt that arose as a result of unfulfilled obligations by the debtor before the onset of bankruptcy is called registry debt.

The Plenum of the Supreme Arbitration Court of the Russian Federation gave its explanation on how it is necessary to apply the rules on the distribution of current payments in bankruptcy cases.

You can read more about debt collection at the link: https://svbankrotstvo.ru/vzyskanie-dolga-cherez-bankrotstvo/

Priority of creditors' claims

So, the court classified the following as extraordinary, urgent current payments:

- payment for the services of establishing a bank or other financial institution, for conducting transactions on the current accounts of the debtor’s company, and servicing the account;

- legal costs;

- payment of fees and remuneration to the arbitration manager.

In the opinion of the Supreme Arbitration Court, the second stage of current payments includes debts to pay employees wages and benefits that the company incurred after the start of the insolvency process. In the event that the debt for unpaid wages and mandatory deductions from it towards enforcement proceedings is included in the register, such debt is considered a registered debt of the second priority.

The law establishes five priorities for current payments. The first includes the above-mentioned expenses for payment of fees, legal costs and payments for servicing the debtor by the bank. The second includes remuneration of individuals and the withholding of personal income tax from their salary income, payment of severance pay associated with dismissal. Further, the third in line are satisfied with current payments for the activities of specialists involved in the case to provide them with qualified assistance and assessment. The fourth is payment for utilities and operating payments. Fifthly, other current payments not specified in the clear list of Art. 134 of the Law.

It is noteworthy that a bankruptcy creditor who has registry claims against the debtor is not limited to the possibility of also having current claims against him for the debt. All claims have their own legally established order, the so-called order in which payment occurs.

What are the requirements for banks?

In the event of bankruptcy of a credit institution, clients and depositors also have the right to submit claims to the register. When a temporary administration is introduced into a bank, it may happen that the depositor is not included in the register of creditors. Therefore, bank clients are concerned with the question of how to include claims in the register of creditors’ claims , even at the stage of normal operation. After all, they are unlikely to know about the bankruptcy of the bank in advance. This can be done by submitting an application to the bankruptcy trustee. Information is entered into the form either on the basis of a court decision, or according to data on the availability of current and deposit accounts of a given client.

Thus, inclusion of confirmed claims in the register is necessary to increase the chance of returning your money to a depositor or creditor of a legal entity declared bankrupt. Refund of funds when a counterparty is at the stage of bankruptcy is an extremely important and complex procedure. Therefore, you can successfully complete it only with the support of professionals.

What requirements can be entered into the register of creditors?

What requirements can be included in the register? It all depends on the stage at which the bankruptcy case is.

During observation, monetary claims from obligations that arose before the court accepted applications to declare the debtor bankrupt are entered into the register.

If debts arose from obligations after the application was accepted, they are current and are not recorded in the register of creditors.

Claims for non-monetary obligations (for example, a requirement to transfer property into ownership) are considered by the court separately from the bankruptcy case according to general rules.

At the stage of bankruptcy proceedings, not only monetary claims (with the exception of current claims), but also non-monetary claims can be included in the register. The latter require a monetary valuation.