At the moment when legal entities or individuals come to bankruptcy, a person must come between them, who will take the place of a special intermediary in this situation - the so-called neutral party. Its task is to minimize the manifestation of possible fraudulent actions of both parties. It is important that this mediator understands the current situation at a professional level. And in the end he managed to take into account the interests of both parties so that they could eventually come to an agreement. The main goal of this outsider is to help the debtor get out of the debt hole and fully pay off all his creditors. In legal circles, the position of such an intermediary is called an arbitration manager.

Arbitration manager: who is he?

It is unlikely that in a bankruptcy situation there is a great opportunity to completely independently achieve acceptable results that would satisfy everyone. In the event that the parties would resolve this issue on their own. This is why there is a need for an outsider, a neutral one. The responsibilities of the arbitration manager are distributed in a bankruptcy situation as follows:

First and foremost, he is the bankrupt’s defender and, in essence, his conditional employee. The manager is the representative of the interests of the bankrupt, and tries to direct all his own efforts to trying to get the “victim” out of the debt hole. The arbitration manager is appointed by the judge. This means that he must also take into account the interests of the debtor's creditors.

And finally, every action of a person holding this position must be performed exclusively within the framework of the law and his chosen profession. This means that the manager is just as interested in their correctness of personal actions and their own impartiality. After all, in this situation he also protects his personal interests.

To obtain the position of manager, you must first of all:

- Higher specialized education;

- Knowledge of the specifics of the activities of an assistant manager;

- Knowledge of the specifics of management positions;

- Mandatory insurance;

- Absence of criminal or administrative penalties;

- Russian citizenship;

- Theoretical certification.

Since at the very beginning all or most of the creditors have not yet received information about the start of the bankruptcy process, any of them, even with small claims, can file a petition. It is worth noting that in this case the manager begins to act specifically in the interests of the creditor who appointed him. But not a debtor.

In practice, however, such a turn of events can lead to various abuses of power. It is worth considering that the observation procedure lasts at least three months. Sometimes up to six months. Thus, this is exactly how long the activity of this arbitration manager lasts. It is for this reason that it is so important to appoint a manager faster than others, so that he acts in your interests.

About choosing a financial manager

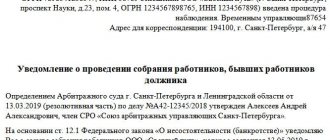

Based on legislative provisions, a citizen has the right to choose a manager. In reality, the matter looks like this: the bankruptcy application contains an instruction by the debtor to a self-regulatory organization (SRO) of insolvency practitioners. It is this organization that appoints the arbitration manager.

It is worth noting that he must be a member of this self-regulatory organization and meet all the requirements for insolvency practitioners. There is one more mandatory factor - the financial manager cannot be personally interested in helping the debtor or creditor (he also cannot depend on either party to the case).

So, the debtor independently selects a self-regulatory organization and (perhaps in a theoretical sense) can enter into an agreement with it on a specific arbitration manager. The court then approves the proposed candidacy - if it meets the established requirements.

What to pay the bankruptcy trustee for

During the process of declaring the defendant bankrupt, the arbitration manager is part of the contingent employees of the bankrupt company and provides services that are aimed at the rehabilitation of financial resources. Legislatively, he may well demand a material reward for his services. This is his payment, as in the case of any other employee.

The responsibilities of this judicial representative include:

- An adequate approach to attracting outside specialists, with the expectation that the debtor undertakes to pay for their services;

- Maintaining reports on transactions, with their subsequent demonstration to creditors;

- Protection of the property of a bankrupt company;

- Disclosure of the fact of fictitious or deliberate bankruptcy to all participants in the case, including government agencies;

- Contacting the relevant authorities if the debtor has committed any administrative violation;

- Detailed analysis of all types of activities of the debtor;

- Involvement of auxiliary management persons if necessary;

- Drawing up a list of creditors, which will also indicate their requirements for the debtor.

Legislative payments to the arbitration manager

Payment for the services of the arbitration manager must be accrued regularly. More specifically, monthly, while he is listed as a conditional (or auxiliary) employee of the supposed bankrupt company. Work with him proceeds according to the following scheme: the beginning of joint cooperation, the adoption of a court ruling, the end of joint cooperation.

But the end of cooperation can be marked not only by the completion of production. The arbitration manager may be released or simply removed from his activities. Yes, this happens too. The manager also ceases to operate if the parties have signed a peace agreement or if the auction proceedings have been completed.

Let's say a representative of the arbitration court began to deal with the assigned bankruptcy case. If the beginning and end of his work activity do not occur at the beginning and end of the month, then the amount of payment for an incomplete calendar month is calculated on the basis of the proportional ratio of days in the months worked.

If, during the bankruptcy proceedings, a completely different or even several other arbitration managers were brought in, the remuneration of workers should also be calculated proportionally for each individual day, separately for each of the mentioned employees. If it has been proven (and such cases have happened) that one of the managers made a much greater contribution to the matter in question, then his pay can be fairly increased.

What exactly does a financial manager do?

The activities of the financial manager, his powers and responsibilities relate to the repayment of debt to the creditor. For example, he:

- Engaged in the identification and sale of property and other property of a bankrupt individual. Also involved in ensuring its safety.

- Manages the debtor's funds.

- In accordance with the established procedure, publishes all information related to the bankruptcy case.

- Provides written reports on the results of its activities to the arbitration court.

In addition to the above, the powers of the arbitration manager also include the following: establishing signs of deliberate or fictitious bankruptcy (if any), monitoring the progress of debt restructuring.

He must also represent the interests of a bankrupt individual in court - challenge transactions, seeking to invalidate them, object to creditors' claims, submit petitions for measures to preserve the debtor's property, and much more.

How is the reward for AU calculated?

In those moments when legal entities or individuals are faced with bankruptcy proceedings, an uninterested, impartial intermediary must necessarily stand between the potential bankrupt and his creditor. As has already been mentioned, and this is really important to understand, the main task of the arbitration manager is to minimize fraudulent actions that can be performed by representatives of the opposing parties. He must be a professional in his field, take into account the interests of each party and bring the matter to a “common denominator”. That is, an agreement that will satisfy everyone: creditors are obliged to get their money back, and the bankrupt must leave the debt hole. This is exactly the kind of person an arbitration manager is in a court of law.

This position is really very responsible and only at first glance may seem simple. But without this person, the issue of bankruptcy would have been resolved in no way. That is, in other words, neither party would have achieved the result, since each would have taken certain actions specifically in its own interests. This is why in such cases there is a need for an unbiased third party.

And for the services provided, the manager is always entitled to a material reward. Payment in a certain amount, which consists of two components - an established stable monthly rate and interest charges. Typically, the final award amount differs depending on the case at hand. And it is influenced by a large number of specific factors. For example, this could be a special reimbursement to the specialist for money that he spent during the consideration of the case. They are also included in the payments due to the manager.

The category of the arbitration manager is the basis from which it is worth starting to calculate the amount of remuneration for a third party:

- Administrative – 15 thousand rubles/month;

- External – 45 thousand rubles/month;

- Temporary – 30 thousand rubles/month;

- Financial – about 10 thousand rubles/month.

It must be said that calculating interest is much more difficult. And the calculations completely depend on the resulting situation. Here it is worth taking into account the category of the arbitration manager, the balance sheet price category of the company, and so on, and so on.

For example, for a financial manager, the additional interest to the rate is 7% of the money that was paid to creditors. In the event that the court has decided to sell off the debtor’s property, then the manager has every right to also receive about the same amount of interest from the money received from the sale of the property of the bankrupt company.

The mentioned amounts must be paid to the insolvency administrator no later than ten days after the completion of the bankruptcy proceedings is officially confirmed by documents.

Use of a bank account during the surveillance process

During the conclusion of transactions, financial settlement is also provided in accordance with established conditions. Thus, the debtor, either independently or through the “hands” of his authorized representatives, subject to legislative restrictions, has every right to send an order to the bank to carry out certain operations on his account.

The above conclusion is fully confirmed by the standards of Art. 63 of Federal Law No. 127. In accordance with which claims of creditors for financial obligations and for mandatory payments, excluding current ones, can be provided to the debtor only in compliance with the legislative procedure for their provision. It is noted that, in accordance with Article 5 of the above-mentioned law, current payments are financial obligations and mandatory payments that arose after the acceptance of the application for declaring the debtor insolvent.

What is the bankruptcy estate used for in bankruptcy?

There are several categories of expenses that must be paid in bankruptcy proceedings.

- Obligatory payments.

- Payments out of turn.

- Satisfying the requirements of the secured creditor.

- Repayment of debt claims of creditors of the first, second, third priority, as well as victims of transactions declared invalid.

Let's look at these categories in order.

Obligatory payments

These include:

- Alimony.

Awarded for the maintenance of children until they reach adulthood, disabled spouses and parents. Fortunately, alimony cannot be written off in bankruptcy, so the trustee must allocate funds from the bankruptcy estate to support the debtor’s relatives. - Court expenses.

These are publications that will definitely be required in bankruptcy, state duty and other expenses. - Financial manager services.

Funds must be deposited before the first court hearing; but the manager receives them only after the procedure is completed.

Payments out of turn

This includes monthly and periodic mandatory expenses that arise for a person regardless of the bankruptcy procedure:

- payment of utility bills;

- rent, if the debtor rents an apartment, and other expenses.

They are not written off at the end of bankruptcy. If there is nothing to pay, the court may offer restructuring or some other benefits. The debt will remain in force.

Satisfying the requirements of the secured creditor

If, for example, a borrower or co-borrower on a mortgage goes bankrupt, the collateral is included in the bankruptcy estate and is subject to sale. In this case, the bank that issued the mortgage receives 80% of the proceeds from the sale of the apartment.

That is, the secured creditor is not included in the register of third-priority creditors. He has the right to count on this compensation outside of the priority standards.

Repayment of creditors' claims according to priority

First of all

includes persons who are entitled to receive compensation by a court decision as a result of:

- malicious damage to their property;

- causing harm to health or life.

Second stage

- these are former employees of an individual entrepreneur who is going through bankruptcy proceedings along with other individuals. Their claims are also not written off (like alimony and compensation to first-priority creditors).

Third stage

- these are collectors, banks and microfinance organizations that issued loans, credits, and who have in their hands confirmation of debt in the form of loan agreements (or similar evidence). Also included in this category are the requirements of the Federal Tax Service, traffic police fines and promissory notes of individuals.

The remaining obligations include the claims of the parties to transactions declared invalid at the initiative of the financial manager.

Article 134. Order of satisfaction of creditors’ claims

- Creditors' claims for current payments are satisfied in the following order:

- first of all, claims for current payments related to legal expenses in the bankruptcy case, payment of remuneration to the arbitration manager, collection of debts for the payment of remuneration to persons who performed the duties of the arbitration manager in the bankruptcy case, requirements for current payments related to payment for the activities of persons are satisfied, the involvement of whom by the arbitration manager to perform the duties assigned to him in a bankruptcy case in accordance with this Federal Law is mandatory, including the collection of debts to pay for the activities of these persons;

in the second place, demands for payment of wages of persons working or who worked (after the date of acceptance of the application for declaring the debtor bankrupt) under an employment contract, demands for payment of severance pay are satisfied;

- in the third place, demands for payment for the activities of persons engaged by the arbitration manager to ensure the fulfillment of the duties assigned to him in the bankruptcy case are satisfied, including the collection of debts for payment for the activities of these persons, with the exception of the persons specified in paragraph two of this paragraph;

- fourthly, requirements for operational payments (utility payments, payments under energy supply contracts and other similar payments) are satisfied; (as amended by Federal Law dated June 23, 2016 N 222-FZ)

- fifthly, requirements for other current payments are satisfied.

Claims of creditors for current payments related to one queue are satisfied in calendar order. (clause 2 as amended by Federal Law dated June 29, 2015 N 186-FZ)

Federal Law of October 26, 2002 N 127-FZ (as amended on December 30, 2020) “On Insolvency (Bankruptcy)” (as amended and supplemented, entered into force on January 2, 2021)

Read completely

Source

How is the bankruptcy estate distributed to creditors?

After the property has been sold at auction and acquired a “cash form,” the manager begins distribution:

- Mandatory payments are paid first. Alimony arrears, legal expenses and remuneration for the manager are paid (for the sale of property he is additionally entitled to 7% of the amount sold).

- Next, the claims of first-priority creditors are paid, if they are included in the register. If there is enough money, their claims are closed 100%, and the manager moves on to the second stage (if there is one).

- The remaining funds are used to pay off the claims of former employees. If there are assets left after settlements, the manager passes to the remaining creditors.

In practice, funds are often insufficient. Usually, only 2-3 banks and a couple of microfinance organizations are listed in the register. Sometimes the requirements amount to 900,000 - 1.5 million rubles, and the bankruptcy estate barely reaches 300,000 - 400,000 rubles. In this case, repayment is carried out in proportion to the requirements.

Example:

- the bankruptcy estate amounted to 300,000 rubles;

- There are 2 banks in the register: one is owed 500,000 rubles, the second - 1 million rubles.

Each creditor within the queue receives an equal percentage of compensation according to debt claims. As a result, a bank with a million-dollar debt will receive 200,000 rubles; with half a million - 100,000 rubles.

Who pays the cash reward?

In nine out of ten cases, the payment is made by the debtor company. In the event that, according to the law, no other sources of payment for this proceeding are provided.

If a company is permanently declared bankrupt and no longer has any property left to pay expenses (including the manager's salary), then the applicant must pay this expense item. For example, it could be the creditor who submitted the application. But in this case, we are talking only about a fixed rate, without paying additional interest.

If it so happens that the debtor himself filed an application to declare the company bankrupt, the obligation to pay the insolvency administrator his award will most likely fall heavily on the shoulders of the founders of the debtor company. Most often, it happens that legal proceedings are stopped at the moment when it becomes clear in court that the debtor does not have enough material resources and finances to repay all debts and cover all expenses. Including manager's remuneration. The latter in this case must be very careful. If the bankruptcy manager does not carefully study the current situation of a potential bankrupt company, he may not notice an insufficient amount of funds. And if he notices this, but does not make any statements, then he simply will not be able to demand remuneration for his labors in the future. Or he will not be able to recover, at least, the amounts that he himself invested.

In some cases, upon successful fulfillment of obligations towards creditors, it is they who can decide whether or not to accrue interest on the money received. If the manager fails to properly carry out the stage of auction production, in this case he will be able to count only on the minimum remuneration, which is equal to 25 thousand rubles.

How are payments made to the arbitration manager?

Since, in the course of his professional activities, the arbitration manager becomes a temporary employee of a bankrupt company, his reward is not considered to be a salary. This category of payments is recorded in accounting as a standard expense.

When calculating the company's expense items, including taxes, payments for the arbitration manager are classified as other expense items. That is, the money that goes directly to managing the company. It follows that the principles for calculating the insolvency administrator’s remuneration correspond to those used for creditors.

In the process of liquidating a company declared bankrupt during the proceedings, the auction manager sends a request to complete the production case. A certain amount of time must pass before it is recorded in the register that the company has been liquidated. The manager may not be paid for the mentioned period if during this period the manager did not participate in court hearings regarding an appeal against the decision to liquidate the company.

In this particular case, it is from the appellants that a fixed amount will be collected, according to the complexity and volume of work performed by the auction manager. If the manager takes an active part in restoring monetary stability or plays the role of an observer in the company, then he has the right to demand that the debtor pay a fixed amount.

What is the priority of the arbitration manager?

If the previously appointed manager was removed from work, or the case moved to a new level, and the manager was replaced by a court decision, then the previous manager should apply to the court with a request for payment of a material award.

As mentioned earlier, after completing work on a specific case, payment of remuneration to the manager’s account should be received within ten days. It is worth mentioning that, in the conditions of the proceedings itself, the arbitration manager has special privileges. After all, payments are received into his account regardless of the priority assigned to creditors.

Cost of a financial manager

In case of bankruptcy, unnecessary expenses are unacceptable. Therefore, it is necessary to determine the cost of the manager’s services at the beginning of the process.

Previously, prices were significantly lower, and each intermediary received no more than ten thousand. In the latest price revisions, the cost of servants has been increased, and now the lump sum payment is equal to twenty-five thousand rubles. When the bankruptcy procedure is divided into several processes, the manager receives his fee for each part carried out:

- organization of tenders and sale of property;

- carrying out financial restructuring;

- conclusion of a settlement agreement between the parties to the case.

In this case, the payment is made not for a month, but for the entire period required to carry out all processes. Among other things, the financial manager can legally count on a commission amounting to seven percent of the total amount of the sale of the debtor’s property. The work done by a specialist is quite painstaking and complex - the payment must correspond to it.

If one of the parties to the bankruptcy process assumes that the amounts received by the manager are inflated, and the work performed by him does not meet expectations, he has the right to go to court. In any case, the bankruptcy procedure is a rather complex process and contacting a specialist to facilitate its implementation is the right action.

Let us recall that the financial manager in bankruptcy is an intermediary between the debtor and creditors, who is appointed by the judicial authorities.

What is the minimum income of an Arbitration Manager

Currently, domestic legislation does not provide clear boundaries regarding the amount of material reward for a judicial representative. Successful completion of the proceedings is an undoubted guarantee of payment of the full award. In other words, the arbitration manager will be able to receive both a fixed amount and a certain amount of interest.

However, to date there are no clear guarantees that payments will be made if the manager is unable to adequately cope with his responsibilities. This category even includes amounts that the manager spent out of his own pocket in the process. It is only stated that the manager’s salary should not be less than 25 thousand rubles. But this may not include all the costs and amounts of money equivalent to the effort expended on the consideration of ship proceedings.

Some nuances

It is also worth considering the fact that the amount of the award may well be increased in accordance with the court's decision. For example, this may be due to some merit or special difficulties in work (when the result exceeded all expectations). But this only applies to a fixed payment amount. Among other things, creditors can also independently increase the amount of payments to the manager at the expense of creditor contributions. This is taken into account in calculating the interest rate, which is paid after the bankruptcy proceedings are completed and completely closed.

In the same case, if the judicial representative behaved inappropriately or incompetently, the court can also reduce the amount of payments that are due to a person in this position. The amount of reduction is directly proportional to the severity of the offense. Among other things, it is also necessary to prove that the manager is incompetent or behaves incorrectly. This matter should be dealt with directly by the one who pointed out all the mistakes and mistakes in the work of the judicial representative.

Additionally, during the consideration of a bankruptcy case, costs or activities that are initially recognized as illegal are taken into account. In other words, what exactly entailed the unsupported costs of the debtor company. And what has now ended with the bankruptcy recognition procedure. Attention is also drawn to the periodization when the SRO representative for some reason did not fulfill his direct obligations.

It follows that for the work performed in the course of the case under discussion, the judicial representative, who is the arbitration manager, receives a material reward. The size of which depends on the specific situation, his personal significance for this matter and the value of the shares of the bankrupt company.

How to choose a competent financial manager?

In a situation where the manager fails to cope with his responsibilities, the bankrupt needs to select another specialist.

There are several factors to consider:

- a specialist who has been working for a long time, has many effectively performed procedures under his belt, has the necessary experience and knowledge, but requires high payment;

- a younger financial manager in bankruptcy requires lower commissions, but may carry out the procedure more slowly and may not take into account all the situations that may arise during the process;

- It is best to make a choice through a federal register, which contains all the information about specialists;

- It wouldn’t hurt to look through the file of judicial cases involving managers - you can find out about the possibility of administrative violations by specialists.

Finally, one of the most important questions is the amount that needs to be spent on the services of a bankruptcy specialist.