Concept of legal expenses

In accordance with Article 101 of the Arbitration Procedure Code, court costs consist of state fees and legal costs associated with the consideration of the case in the arbitration court.

In turn, legal costs (Article 106 of the APC) are:

- expenses for the services of lawyers and other representatives,

- sums of money to be paid to experts, specialists, witnesses, translators,

- costs associated with on-site inspection of evidence,

- all other expenses incurred by the persons participating in the case in connection with the consideration of the case in the arbitration court (for example, costs of travel to the city where the court is located, payment for a hotel, etc.).

Amount of costs

As part of the process, you have to pay for the services of representatives, the preparation of examinations, etc. However, if you win, not everything will be compensated.

In order for the company to replenish these amounts, it will have to prove the reasonableness of the payments and the fact that the money was transferred. In addition, the court must accept that the costs are costs.

What are legal costs is stated in Article 106 of the Arbitration Procedure Code of the Russian Federation. In accordance with this, the courts recognize the following costs as costs:

- For specialists: experts, translators, other specialists. This also includes payments to witnesses.

- For the inspection required to identify evidence on site.

- For representatives, including not only payment for services, but also expenses for accommodation, travel, etc. At the same time, the courts do not consider “success fees” as costs.

- For notification of a corporate dispute, if the participant in the dispute is obliged to notify about it by force of law.

- To receive extracts from the Unified State Register of Legal Entities and Unified State Register of Individual Entrepreneurs.

- To collect evidence.

- To comply with the pre-trial procedure for resolving a dispute, if required by law or the terms of the contract.

- To consider an application for compensation of legal costs and expenses.

- By virtue of an agreement between the parties to the dispute on the distribution of legal costs.

- At the stage of execution of the court decision. For example, the debtor asked for a postponement or installment plan, and the participation of the claimant in the meetings entailed expenses. The debtor will have to compensate them.

- For other purposes, if required during the process.

This is also important to know:

How to return loan insurance after closing a loan

It is important to consider which costs are not considered expenses. However, in some cases, third parties have the right to demand reimbursement of their expenses.

Definition

Legal expenses are financial losses of the parties and other entities participating in the meeting associated with the consideration of a dispute in civil proceedings, aimed at an objective study of the circumstances of the case and making an informed decision.

Legal regulation of legal expenses is carried out at the federal level.

The following legislation applies:

- Civil Procedure Code of the Russian Federation (Civil Procedure Code of the Russian Federation). This law in Chapter 7 establishes a group of rules defining the types of expenses under consideration, the procedure and conditions for their collection.

- Tax Code of the Russian Federation (Tax Code of the Russian Federation) - articles 333.18, 333.19. The application of these rules is required to establish the amount of a specific type of legal costs - state fees.

How are legal costs distributed?

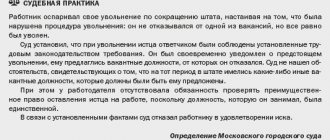

The rules for the distribution of costs between the parties to the case are established by Article 110 of the Arbitration Procedure Code. Thus, in accordance with the general rule, the losing party must reimburse its opponent for all legal expenses - both state fees and expenses.

There are several exceptions to this rule:

- Representative expenses are charged within reasonable limits. About reasonableness - I once again refer you to the previous article on this topic. It should be additionally noted that the court may, on its own initiative, reduce the amount of compensation if it is not provided with evidence of the validity of the expenses incurred (for example, prices of similar law firms).

- If the winning person abused his procedural rights (delayed the process), then legal costs may be borne by the winner.

If the claim is not fully satisfied, the loser is charged expenses in proportion to the amount of satisfied claims.

Distribution of legal costs between the parties and their compensation to the parties and the court

According to Art. 98 of the Code of Civil Procedure of the Russian Federation, the distribution of costs in civil proceedings presupposes the advantage of the party that wins the case. For example, if the claim is satisfied in full, then the applicant is compensated for all expenses incurred, and if partially, then in proportion to the requirements fulfilled. The parties can also reach an agreement by drawing up a settlement agreement. Such an agreement also involves designating the order of distribution of costs.

According to the resolution of the Plenum of the Supreme Court of the Russian Federation No. 1, types of legal disputes are established in which procedural costs are assigned to the parties who incurred them. In this case, the satisfaction or rejection of the claim will not affect the reimbursement of funds.

We invite you to familiarize yourself with: Sample petition to summon an expert to court

Exceptions are disputes related to:

- establishing legal facts;

- determining the legal status of a citizen or property;

- other situations that are not of a material and legal nature.

What needs to be proven

As a general rule, the costs of paying for the services of a representative incurred by the winning party in the case are recovered by the court from the losing party within reasonable limits (Part 2 of Article 110 of the Arbitration Procedure Code of the Russian Federation). In this case, the court may reduce the amount of compensation at the request of the person from whom legal costs are being recovered if he provides evidence of their excessiveness (Part 3 of Article 111 of the Arbitration Procedure Code of the Russian Federation).

In fact, when considering the recovery of representative costs, consideration is given to whether they were actually incurred (the validity of the costs), the relationship of the costs to the matter in question and the reasonableness of their amount. The Supreme Court of the Russian Federation emphasized that the person collecting costs must prove the first two criteria, and the party from whom it is intended to collect legal costs has the right to prove their excessiveness (clause 10, clause 11 of Resolution No. 1).

This is also important to know:

How to file a claim based on a receipt for debt collection, how to collect a debt?

At the same time, the court does not have the right to reduce the amount of legal costs if the party from whom the costs are recovered does not raise objections and does not provide evidence of their excessiveness, the Supreme Court of the Russian Federation indicated. The exception is cases when the court, having studied the case materials, comes to the conclusion that the amount declared for collection is clearly unreasonable (excessive) in nature (paragraph 2, paragraph 11 of Resolution No. 1).

The leading lawyer of Pepelyaev Group, Konstantin Sasov, . He noted that the practice of collecting legal costs in full, for example, from the Russian Ministry of Finance, as was the case in the case of an energy company appealing the ministry’s letter on documentary confirmation of the taxpayer’s right to receive a social tax deduction (determination of the Supreme Arbitration Court of the Russian Federation dated June 19, 2013 No. VAS-13840/12), will improve the quality of explanations of tax legislation provided by the Ministry.

By the way, the Federal Tax Service of Russia recommends that tax authorities, when deciding whether to initiate legal proceedings with taxpayers, be guided by established judicial practice in similar cases, especially acts of higher courts, in order to reduce the number of lost disputes and save the budget (letter of the Federal Tax Service of Russia dated September 14, 2007 No. ShS -6-18/ [email protected] , letter of the Federal Tax Service of Russia dated May 11, 2007 No. ShS-6-14/ [email protected] , letter of the Federal Tax Service of Russia dated November 26, 2013 No. GD-4-3/21097, order Federal Tax Service of Russia dated 02/09/2011 No. ММВ-7-7/ [email protected] ).

Confirmation of the validity of legal costs involves the provision of evidence that they were incurred by the time the application for recovery of costs is considered, no later. Thus, if there is an agreement for the provision of legal services and a report on the work performed by the lawyer under the specified agreement, but there is no receipt for payment for these services, the court may recognize the fact of incurring legal expenses in the declared amount as unproven and refuse to collect them (resolution of the Arbitration Court of the Moscow District dated 1 March 2021 in case No. A41-8865/2015).

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Moreover, cash documents are considered by the courts as evidence of expenses even if they are executed incorrectly, emphasizes senior lawyer of Incor Alliance Kristina Valakhovich (resolution of the Arbitration Court of the Volga-Vyatka District dated October 27, 2021 in case No. A38-4739/2015, resolution of the Seventeenth Arbitration Court of Appeal dated March 27, 2021 in case No. A50-15661/2015).

Collection procedure

A person claiming legal costs must prove:

- the fact of their carrying, as well as

- the connection between the costs incurred by the specified person and the case being considered in court with his participation.

Failure to prove these circumstances is grounds for refusal to reimburse legal costs.

Sums of money to be paid to witnesses, experts and specialists, or other expenses related to the consideration of the case, recognized by the court as necessary, are paid in advance

- the party making the corresponding request or

- parties in equal parts, if the request is mutual.

Funds are deposited into a bank account in the manner established by the budget legislation of the Russian Federation (Article 96 of the Code of Civil Procedure of the Russian Federation).

If calling witnesses, appointing experts, engaging specialists and other actions subject to payment are carried out

- on the initiative of the court, the corresponding expenses are reimbursed from the federal budget;

- on the initiative of a magistrate - at the expense of the budget of the constituent entity of the Russian Federation on the territory of which the magistrate operates (Article 96 of the Code of Civil Procedure of the Russian Federation).

We suggest you read: Refund of money by receipt, judicial practice

The court, as well as the magistrate, may exempt a citizen, taking into account his property status, from paying expenses associated with the payment of sums of money by witnesses, experts and specialists, or other expenses recognized by the court as necessary. The court and magistrate may also reduce the amount of these costs. In this case, expenses are reimbursed from the corresponding budget (Article 96 of the Code of Civil Procedure of the Russian Federation).

The return to the parties of unspent sums of money contributed by them towards the upcoming legal expenses is made on the basis of a court order. The procedure for returning unspent amounts of money to the parties is established by the Government of the Russian Federation.

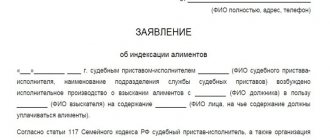

To recover legal costs, they must be documented. If you need to pay for representative offices, you will need to submit a concluded agreement or act reflecting the provision of services. Payment orders are attached to it. These documents must indicate who transferred the money and to whom. Details are considered a mandatory element of the order.

Costs are subject to division between the parties to the process. Regardless of the type of expenses, you need to confirm them with documentation. If there is no evidence of payment, it will not be possible to recover expenses. The division is carried out on the basis of a court decision.

The services of a lawyer who participates in the process are subject to compensation. In this case, it is mandatory to draw up an agreement between the client and the lawyer. The obligations assumed by the parties are reflected in the act. To put it simply, a lawyer provides services in court, and the citizen pays him for it. The agreement specifies the nature of the payment. Payment may be made on a piece-rate or hourly basis. There is a mixed type of payment.

If the document is not drawn up according to the rules, the lawyer may lose payment for his work. Costs for legal services are paid according to general rules. To support expenses, the parties must have documentary evidence. The main requirement is that the lawyer is not an entrepreneur. If so, the judge rejects the petition.